Struggling with overwhelming debt can be a daunting experience, leaving you feeling trapped and uncertain about your financial future. One potential solution to manage and consolidate your debts is by taking out a loan designed to pay off existing obligations, offering a way to regain control over your finances. But is this the right move for you?

Key Takeaways

- Evaluate Your Finances

Assess your total debt load by listing all your debts with their details and calculating your debt-to-income (DTI) ratio. This will help you understand your financial situation and determine how much you need to borrow. - Explore Loan Options

Consider various debt consolidation options such as personal loans, home equity loans, and credit card balance transfers. Each option has its pros and cons, so choose the one that best fits your needs. - Qualify and Manage the Loan

Maintain a good credit score and stable income to qualify for a debt consolidation loan. Once approved, use the funds to pay off existing debts and focus on making timely payments on the new loan. This will help simplify your finances and improve your debt management.

Assess Your Debt Situation

Before considering a loan to pay off your debts, it’s essential to have a clear understanding of your current financial situation. Here’s how to start:

Identify Your Debts

Begin by listing all your debts, including credit card balances, personal loans, student loans, car loans, and mortgages. Note the creditor, outstanding balance, interest rate, and minimum monthly payment for each. This detailed list will help you understand where your money is going each month and identify which debts are the most costly.

Calculate Your Total Debt Load

Sum up the outstanding balances on all your debts to determine your total debt load. This figure is crucial as it provides a clear picture of your financial challenge and helps you gauge how much you might need to borrow for consolidation.

To ensure you’re getting the most cost-effective solution when taking out a loan, consider strategies on how to reduce the total cost of your loan.

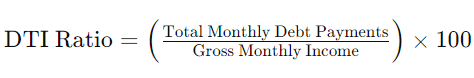

Assess Your Debt-to-Income (DTI) Ratio

The DTI ratio indicates the proportion of your monthly earnings that is dedicated to repaying debts. A high DTI ratio can make it more difficult to qualify for a loan, as it suggests you might be overextended. To determine your debt-to-income ratio, you need to divide your total monthly debt payments by your gross monthly income. Afterwards, multiply the result by 100 to convert it into a percentage.

Explore Your Loan Options

When considering how to consolidate your debts, it’s crucial to explore the various loan options available. Each type has its own benefits and potential drawbacks, so understanding these can help you choose the best solution for your situation.

Personal Loans

Personal loans are often used for debt consolidation and are typically unsecured, meaning you don’t need to provide collateral. They usually have fixed interest rates and monthly payments, which can simplify budgeting. These loans are available from banks, credit unions, and online lenders.

Pros

- Predictable Payments: Fixed interest rates offer consistent monthly payments.

- No Collateral Needed: Unsecured loans don’t require you to risk any assets.

Cons

- Higher Rates for Poor Credit: Those with lower credit scores may face higher interest rates.

- Limited Loan Amounts: May not provide as much money as secured loans.

Home Equity Loans

Home equity loans allow you to borrow against the equity in your home. They generally come with lower interest rates because they are secured by your property. However, defaulting on the loan could result in losing your home. These loans can provide a substantial sum, making them suitable for significant debt consolidation.

Pros

- Lower Interest Rates: Secured by your home, resulting in typically lower rates.

- Possible Tax Benefits: Interest may be tax-deductible.

Cons

- Risk to Property: Your home is at risk if you fail to repay the loan.

- Longer Approval Process: May take more time to get approved compared to unsecured loans.

Credit Card Balance Transfers

This option involves transferring your high-interest credit card debt to a new credit card with a lower interest rate, often an introductory 0% APR. This can help save on interest and expedite debt repayment. However, balance transfer cards usually come with a transfer fee, and the low rate is often temporary.

Pros

- Interest Savings: 0% introductory APR reduces interest costs.

- Simplified Payments: Combines multiple debts into one credit card.

Cons

- Transfer Fees: Fees can add to your total debt.

- Higher Rates Later: Interest rates can increase significantly after the introductory period.

Debt Consolidation Loans

These loans are specifically designed to combine multiple debts into a single loan, typically with a fixed interest rate and repayment term. This can simplify your finances by reducing multiple payments to a single monthly payment, often at a lower rate than your existing debts.

Pros

- Simplified Payments: One payment each month instead of multiple.

- Potentially Lower Rates: May offer lower interest rates than your current debts.

Cons

- Credit Requirements: May require good credit to qualify.

- Origination Fees: Fees can increase the overall cost of the loan.

For self-employed individuals, securing a loan to manage or consolidate debt might come with unique challenges. Explore our guide on loans for self-employed in South Africa to understand your options and how to enhance your loan approval chances.

Qualifying for a Debt Consolidation Loan

Your credit score plays a pivotal role in determining your eligibility for a debt consolidation loan. Lenders use your credit score to gauge your creditworthiness and to set the terms of the loan, including the interest rate. Generally:

- Higher Credit Score: With a good credit score, you’re more likely to secure a loan with favorable terms and lower interest rates.

- Lower Credit Score: A lower credit score can restrict your options and lead to higher interest rates or even rejection of your application.

Before applying, it’s wise to check your credit report for errors and work on improving your credit score if needed. This can involve paying down existing debt, making payments on time, and correcting any inaccuracies on your credit report.

Income and Employment Criteria

Lenders need to ensure that you have a stable income to support the loan repayments. They will typically require:

- Proof of Employment: Recent pay slips and possibly a verification letter from your employer.

- Self-Employed Individuals: Additional documentation such as tax returns, business financial statements, or profit and loss statements.

Having a consistent and sufficient income can enhance your chances of approval and potentially help you secure better loan terms.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is another critical factor in loan applications. It is calculated as:

- Lower DTI Ratio: Indicates that you maintain a manageable level of debt relative to your income. Most lenders favour a DTI ratio of 40% or lower.

- Higher DTI Ratio: If your DTI ratio is too high, you may need to reduce your existing debt or increase your income to improve your loan eligibility.

Understanding these criteria and preparing accordingly can help you present a strong application and increase your chances of securing a debt consolidation loan with favorable terms.

Paying off debt with your bonus can lighten your financial load and improve your credit health. Find out if this approach aligns with your financial goals.

About Arcadia Finance

Experience hassle-free loan securing with Arcadia Finance. There are no application fees, and you can choose from 19 esteemed lenders, each fully compliant with South Africa’s National Credit Regulator standards. Enjoy a simplified process and trustworthy options suited to your financial needs.

Steps to Apply for a Debt Consolidation Loan

Applying for a debt consolidation loan can simplify your finances and potentially reduce your debt burden. Here’s a structured approach to guide you through the process:

1. Assess Your Financial Situation

- List Your Debts: Compile all your debts, including amounts owed, interest rates, and monthly payments.

- Calculate Total Debt: Determine the total amount of debt you need to consolidate.

- Evaluate Your Needs: Decide how much you need to borrow to effectively consolidate your debts.

2. Check Your Credit Score

- Obtain Your Credit Report: Get a copy of your credit report from major credit bureaus.

- Review Your Score: Check your credit score and identify any issues.

- Improve Your Score: If your score is low, consider steps to improve it, such as paying down existing debt or correcting errors on your report.

3. Research Lenders

- Compare Options: Look for lenders that offer debt consolidation loans. This includes traditional banks, credit unions, and online lenders.

- Evaluate Terms: Compare interest rates, fees, loan terms, and eligibility requirements.

- Seek Advice: Use comparison tools and consult with financial advisors to find the best lender for your needs.

4. Gather Necessary Documentation

- Prepare Documents: Collect required documents such as proof of income (pay slips, tax returns), identification, details of your debts, and possibly bank statements.

- Ensure Accuracy: Verify that all documentation is accurate and up-to-date.

5. Apply for the Loan

- Submit Application: Complete and submit your loan application either online or in person.

- Provide Information: Ensure all information is accurate and complete.

- Respond Promptly: Be prepared to answer any additional questions the lender may have.

6. Review Loan Offers

- Receive Offers: Evaluate the loan offers you receive.

- Compare Terms: Look at interest rates, repayment periods, monthly payments, and fees.

- Choose the Best Option: Select the loan that best fits your financial needs and goals.

7. Accept the Loan and Pay Off Debts

- Accept Terms: Finalize the loan by accepting the terms and completing any required steps.

- Disbursement: Use the loan funds to pay off your existing debts.

- Confirm Closures: Ensure all debts are fully paid and confirm the closures with your creditors.

8. Manage Your New Loan

- Make Timely Payments: Ensure you make payments on time each month.

- Pay More Than Minimum: If possible, pay more than the minimum amount to reduce the principal faster.

- Create a Budget: Create a budget to manage your finances effectively and prevent the accumulation of new debt.

By following these steps, you can simplify your debt management, improve your financial stability, and take control of your financial future.

Many consumers consider taking out loans to manage existing debt, but is this really a sustainable solution? Understanding the broader landscape of borrowing and repayment strategies is key to making informed financial decisions. What Increased Credit Demand Means for Consumers in South Africa provides insights into the rising credit trend and its impact on consumers.

Finding the Right Lender

Comparing Lenders and Loan Offers

Different lenders can offer varying interest rates, terms, fees, and eligibility requirements. To find the best deal, use online comparison tools and seek advice from financial experts. Evaluate the total cost of the loan, including any fees and the repayment period.

Checking Interest Rates and Fees

Interest rates and fees play a significant role in determining the total cost of your loan. Lower interest rates can result in savings, whereas higher fees can add to your expenses. Common fees include origination, application, and prepayment penalties. Be sure to understand all associated costs and whether the interest rate is fixed or variable, as this will affect your monthly payments and long-term expenses.

Evaluating Customer Reviews and Reputation

Before making a commitment, research the reputations of South African lenders and read customer reviews. Pay attention to feedback on customer service, the loan application process, and the overall experience. Reliable lenders generally have positive reviews and a solid reputation. Check with organisations like the National Credit Regulator (NCR) for any complaints. A lender with good reviews is likely to provide a smoother loan experience.

From personal loans to mortgages, our article on Facts About Loans provides critical insights that will guide you through the complexities of each option, ensuring you choose wisely based on your financial goals.

How to Apply for a Loan with Arcadia Finance

Applying for a loan at Arcadia Finance is straightforward and accessible. Start your application by visiting our website, where our dedicated and experienced team is available to assist you with any inquiries you might have throughout the process. We will require some basic information from you, including details about your income and expenses, as well as your desired loan amount and preferred repayment term. After submitting your application, our team will promptly review the details and respond with a decision as soon as possible.

Conclusion

Taking out a loan to consolidate your debts can be a practical way to streamline your finances and take control of your financial future. However, keep in mind that debt consolidation is not a complete fix. It’s important to address the root causes of your debt and implement effective financial practices moving forward. Setting up a budget, avoiding additional debt, and seeking financial advice can help you stay on track and work towards long-term financial stability.

Frequently Asked Questions

Yes, you can use a debt consolidation loan to pay off all your debts. This type of loan lets you combine multiple debts into a single loan with one monthly payment, often at a lower interest rate. To qualify, you’ll need to meet the lender’s requirements for credit score, income, and debt-to-income ratio. It’s important to compare different loan options and choose the one that best suits your financial situation.

Consolidating your debts into one loan can make managing your finances easier by reducing multiple payments to just one monthly payment. It can also lower your overall interest rate, which may save you money, and it could improve your credit score over time by ensuring you make consistent, on-time payments.

To qualify for a debt consolidation loan, lenders usually require a good credit score, a stable income, and a reasonable debt-to-income ratio. You’ll need to provide documents such as pay slips, tax returns, and a list of your current debts.

Yes, there are risks involved. If you miss payments on the new loan, you could face penalties, increased interest rates, and damage to your credit score. Additionally, using secured loans like home equity loans could put your property at risk if you default.

It can be more difficult to consolidate debts with a low credit score, but it’s still possible. Some lenders offer loans specifically for individuals with poor credit, though these loans may come with higher interest rates and fees. Improving your credit score before applying can increase your chances of qualifying for better terms.