Mashonisa Loans

Why settle for Mashonisa? Arcadia Finance gives you better options, better rates, and better service!

Arcadia Finance helps you in the search of loans from different banks and lenders. Fill in a free application and get loan offers from up to 16 lenders. We work with well-known, trusted, and NCR-licensed lenders in South Africa.

Many individuals seek Mashonisa loans—informal, community-based cash loans that require no formal documentation or credit checks—due to the difficulties associated with accessing traditional bank loans. While Mashonisas can provide quick financial relief for urgent needs, these loans come with significant risks, such as high-interest rates, aggressive collection practices, and limited borrower protections, which can result in long-term financial strain.

Who Are the Mashonisas?

Mashonisas are informal money lenders who operate outside the formal banking system, providing quick, no-paperwork loans to individuals who may not qualify for traditional financial services. Their lending practices are deeply rooted in local communities, making them easily accessible to those in urgent need. Unlike banks or regulated financial institutions, Mashonisas do not require extensive paperwork, background checks, or credit histories. They typically operate on a cash-based system, relying on word of mouth and personal connections within the community to build their client base.

Characteristics of Mashonisa Lenders

The Mashonisa model is characterized by a lack of regulation. Operating outside formal financial frameworks, Mashonisas can circumvent government oversight and lending restrictions, allowing them to set their own terms regarding interest rates, fees, and collection practices. Their transactions are cash-based, meaning that neither the Mashonisa nor the borrower typically maintains formal records of the loan. This can be advantageous for clients needing immediate cash, but it poses challenges if disputes arise, as there is often little recourse for borrowers.

Personal relationships play a central role in the Mashonisa lending approach. Most Mashonisas know their clients personally or are acquainted through community networks, fostering a level of trust uncommon in formal lending. However, this familiarity can also enable Mashonisas to enforce repayments through informal but often aggressive methods that would be illegal in regulated lending environments.

Profile of Typical Mashonisa Clients

Mashonisa clients are usually individuals facing urgent financial needs with limited access to formal credit. They may have poor credit histories, unstable employment, or no formal income documentation, making it difficult to secure loans from banks or microfinance institutions. Many clients live paycheck to paycheck, dealing with emergencies or trying to cover basic expenses, and they often feel they have no choice but to accept these high-risk loans.

The accessibility of Mashonisas serves a significant portion of South Africans who are otherwise underserved by the formal financial system. However, the lack of legal and financial protections leaves these borrowers vulnerable to exploitation, unmanageable debt, and aggressive repayment methods.

About Arcadia Finance

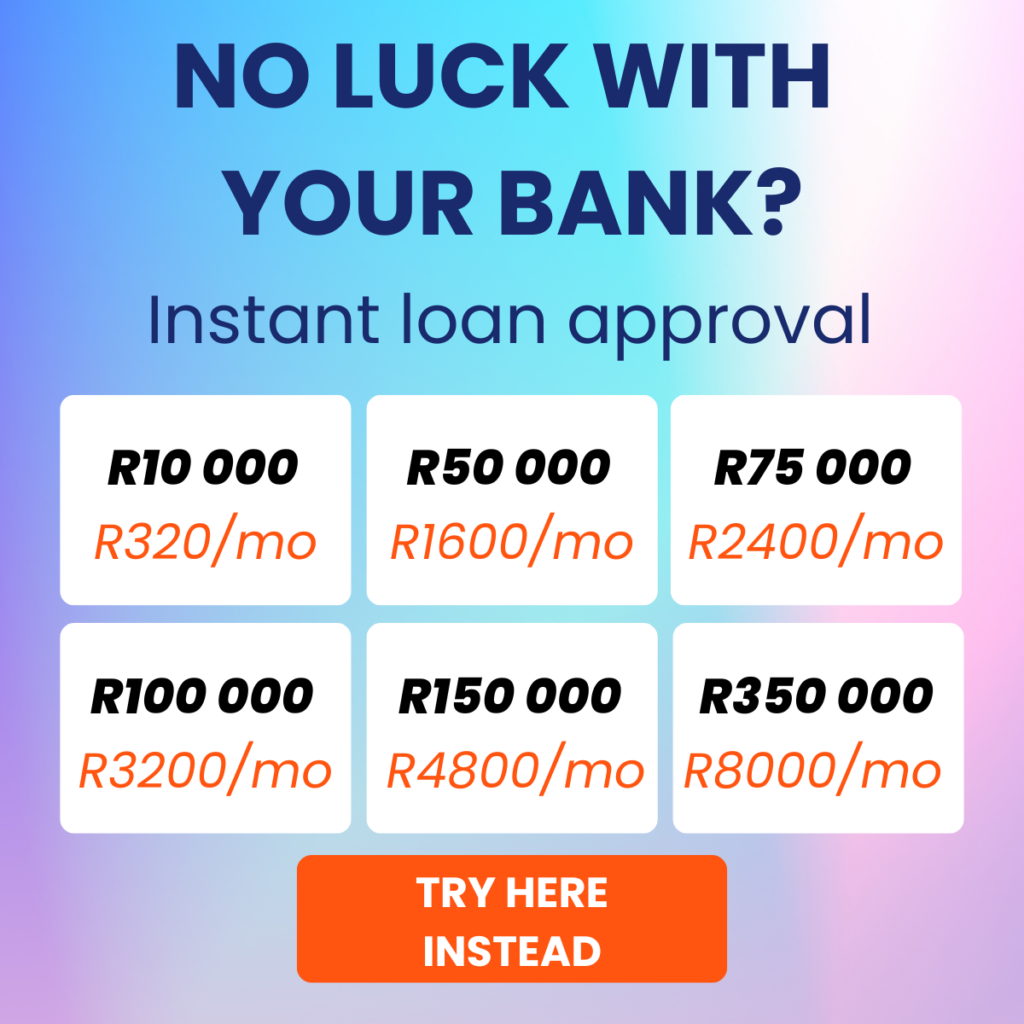

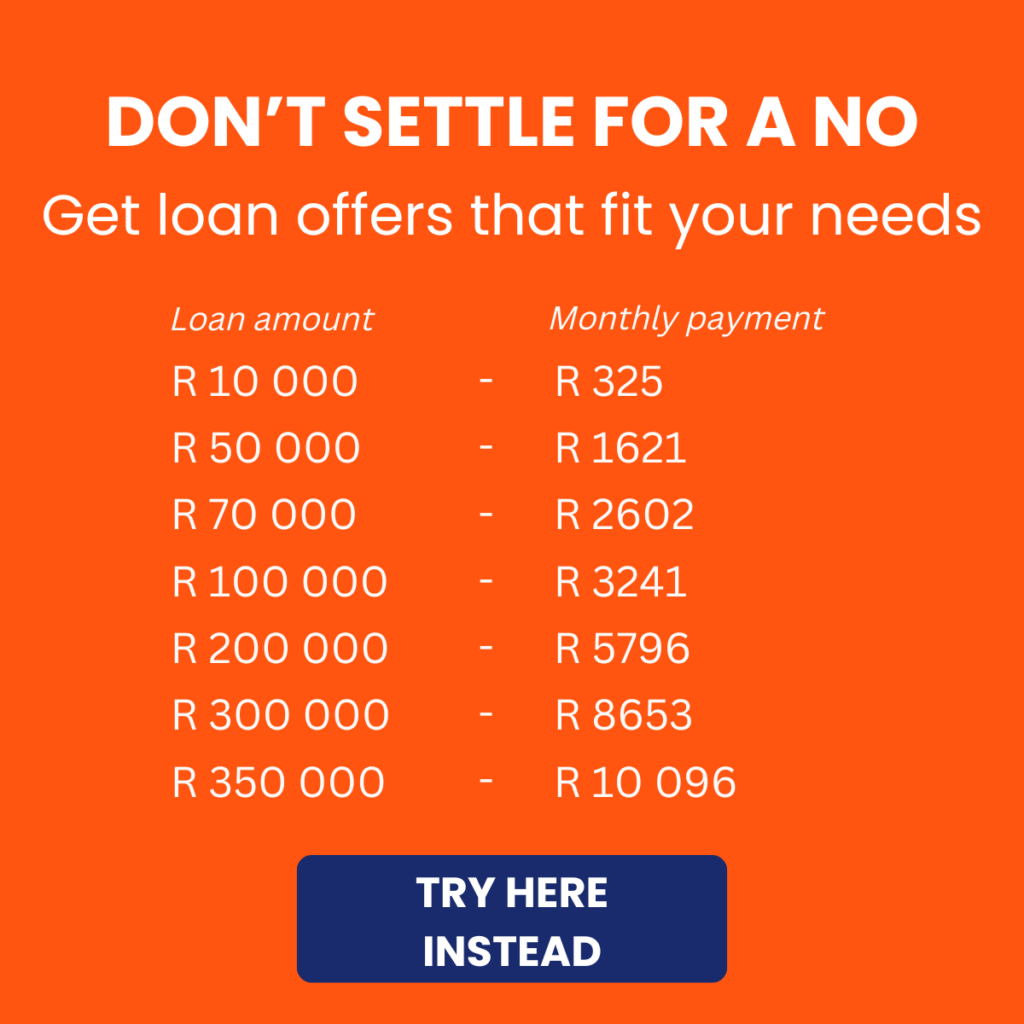

Arcadia Finance makes loan access seamless and fee-free. Pick from 16 top lenders, all fully regulated by South Africa’s NCR. Experience a quick, reliable, and tailored borrowing solution.

Understanding the Appeal of Mashonisa Loans

Mashonisa loans attract many South Africans due to their immediate access to cash and the minimal requirements compared to traditional banks or credit providers. Unlike formal lenders, Mashonisas do not demand documentation such as credit checks, proof of income, or extensive paperwork. This simplicity and speed in the loan process make it particularly appealing for borrowers who may not qualify for conventional bank loans.

Ease of Access

Mashonisas provide cash without the need for formal requirements, such as credit checks or proof of income, making the process easier for those who may not qualify for bank loans.

Personal Relationships

Loan approval and disbursement are typically immediate, with funds often provided within hours, unlike banks that may take days or weeks to process applications.

Community Trust

Many Mashonisas are familiar, local figures within the community, building trust and comfort that can make borrowing feel more approachable than dealing with a formal lender.

Advantages

Borrowers may feel more at ease working with a Mashonisa, as they often have personal or community ties with the lender, which adds to a sense of familiarity and support.

Flexibility

Mashonisas often offer flexible repayment terms tailored to the borrower’s financial situation, providing options not typically available with formal lenders.

Criticism of Mashonisa Loans

Mashonisa loans, while providing quick financial relief, have significant drawbacks that often overshadow their advantages. Below are the main criticisms associated with these informal lending practices:

High-Interest Rates and Unregulated Fees: Mashonisas typically charge very high interest rates, significantly exceeding those of regulated lenders. Operating without oversight, they set arbitrary interest rates and fees that can rapidly escalate the amount owed. Borrowers may face unpredictable costs and encounter unexpected fees, leaving little room for negotiation or recourse.

Harsh Collection Methods: Mashonisas frequently employ aggressive collection tactics, including harassment, intimidation, and sometimes even threats. Without legal protections, borrowers are vulnerable to coercive practices that instil fear and pressure for repayment. This situation can leave borrowers feeling trapped, with few alternative options for financial assistance.

Absence of Borrower Rights: Borrowers who engage with Mashonisas often lack formal rights or protections in their agreements. When contracts exist, they are usually non-transparent, with vague terms regarding interest, fees, and repayment. Many loans are made verbally, which leaves clients without documented terms, increasing the risk of exploitation.

Debt Trap and Long-Term Financial Harm: High interest rates and ongoing fees can create a cycle of debt, making it challenging for borrowers to escape their repayments. A short-term loan from a Mashonisa can escalate into a significant financial burden, negatively affecting family stability and future planning. These consequences can extend across generations, hindering borrowers’ ability to regain financial control.

Legal Framework and Regulatory Challenges

The informal nature of Mashonisa lending presents significant challenges for South African regulators, as Mashonisas operate outside the established financial and credit framework. While South Africa has laws like the National Credit Act aimed at protecting borrowers from exploitative lending practices, these laws primarily apply to registered credit providers, leaving Mashonisas largely unregulated. This gap exposes borrowers to higher risks due to limited standards governing interest rates, repayment terms, or acceptable collection practices.

Limited Legal Oversight

Mashonisas exist in a grey area within South African law, complicating the enforcement of borrower protections. As they are not officially recognised as credit providers, there are few legal mechanisms to address issues such as high interest rates, lack of transparency, and aggressive collection tactics. This absence of oversight hinders authorities’ ability to hold Mashonisas accountable or regulate their practices effectively.

Regulatory Efforts to Curb Exploitation

South African authorities have attempted to tackle the exploitation often associated with Mashonisa loans, although enforcement remains challenging. Initiatives have included educational campaigns aimed at increasing awareness of borrower rights and discouraging reliance on informal lending. However, due to the community-based, informal nature of Mashonisa loans, implementing widespread regulatory changes that effectively protect borrowers remains difficult.

Comparing Mashonisa Loans with Other High-Risk Loans

Mashonisa loans are among several high-risk lending options available to individuals in financial need, particularly those who find it difficult to access traditional credit. Other prevalent high-interest lending options include payday loans, pawn loans, and informal community savings schemes. While each of these alternatives has its unique characteristics, they all carry inherent risks that can affect borrowers’ financial stability. Below is a comparison of Mashonisa loans with these other high-risk options.

| Loan Type | Similarities | Differences |

|---|---|---|

| Mashonisa Loans vs. Payday Loans | Both offer quick, short-term cash with minimal documentation or credit checks. Accessible to those with poor or no credit history. | Mashonisas are unregulated; payday lenders are licensed and subject to some regulations. Payday loans require full repayment by next payday; Mashonisas may offer flexible but aggressively enforced repayment. |

| Mashonisa Loans vs. Pawn Loans | Both provide fast cash access without credit checks. Typically used by people who can’t access traditional loans. | Pawn loans require collateral (e.g., jewellery), which can be seized if unpaid; Mashonisa loans are unsecured but may involve aggressive repayment methods. |

| Mashonisa Loans vs. Community Savings Schemes | Both operate within local communities and are based on trust and personal connections.Cater to people underserved by formal institutions. | Community schemes like stokvels are collaborative and may offer low or no-interest loans; Mashonisas charge high interest. Savings schemes focus on mutual support, while Mashonisas operate for profit. |

Safer Alternatives to Mashonisa Loans

While Mashonisa loans may seem like an easy option, there are safer, regulated alternatives available that can provide necessary financial assistance without the same risks. Here are some of the most viable options:

Microloans from Regulated Financial Institutions

Pros

- Regulated, with transparent terms and fixed interest rates.

- Provides better borrower protections.Flexible repayment options.

Cons

- Application process may be more complex than Mashonisa loans.

- Limited to those who meet eligibility requirements.

Government Assistance Programmes

Pros

- No or low interest, reducing financial burden.

- Supports essential needs without long-term debt.

Cons

- Eligibility requirements can be strict.

- May have limited funds or availability for all in need.

NGO and Community Support Options

Pros

- Often free or low-cost financial assistance.Tailored advice to prevent predatory lending.

- Non-profit, prioritising borrower welfare.

Cons

- Limited funding may mean smaller loans or financial aid.

- Availability can vary by region.

Debt Counselling and Financial Literacy Programmes

Pros

- Helps borrowers restructure debt and create sustainable budgets.

- Builds financial knowledge to avoid debt traps.

Cons

- Not a direct source of financial aid; doesn’t provide immediate cash.

- Requires time and commitment to see benefits.

Conclusion

While Mashonisa loans may offer immediate financial relief to individuals unable to access traditional credit, they carry significant risks that can lead to severe long-term debt and financial hardship. With high-interest rates, aggressive repayment practices, and a lack of borrower protections, Mashonisa loans often worsen financial strain rather than alleviate it.

Exploring safer, regulated alternatives—such as microloans, government assistance programmes, and support from NGOs—can provide essential financial support without the hidden dangers associated with informal lending. By opting for these alternatives, individuals can pursue a path to financial stability and steer clear of the pitfalls of unregulated, high-risk lending practices.

Frequently Asked Questions

A Mashonisa loan is an informal cash loan provided by unregulated, community-based lenders, often without the need for formal documentation, credit checks, or bank approvals. These loans are typically short-term, high-interest, and operate outside formal financial regulations.

Individuals turn to Mashonisa loans because they offer quick access to cash without the strict requirements imposed by banks or formal lenders. Many borrowers rely on Mashonisas when facing urgent financial needs or when they do not qualify for traditional loans due to poor credit or insufficient income documentation.

Mashonisa loans involve several risks, including high-interest rates, aggressive collection methods, and minimal legal protections for borrowers. Since these loans are unregulated, lenders can set arbitrary fees, and borrowers often have no recourse if terms change or repayment becomes unmanageable.

No, Mashonisa loans operate outside of South Africa’s formal financial regulations, meaning borrowers have limited legal protection. This lack of oversight leaves them vulnerable to exploitative terms, unexpected fees, and potentially harmful collection practices.

Safer alternatives include microloans from regulated financial institutions, government assistance programmes, and support from NGOs, which offer financial aid with greater protections and fairer terms. Additionally, debt counselling and financial literacy programmes can serve as valuable resources for those seeking sustainable financial solutions.