When you make loan payments, a portion goes towards reducing the principal, while the rest covers interest and other charges. But how exactly does the principal impact your overall repayment and financial planning?

Key Takeaways

- Loan Principal: This is the initial amount borrowed or invested. It serves as the foundation for calculating interest and establishing repayment terms for loans and investments.

- Repayment Options: Repayments can be made through monthly instalments or lump-sum payments. Some lenders allow penalty-free extra payments, enabling borrowers to reduce interest costs and shorten the loan term.

- Principal Balance Management: Regularly reviewing your outstanding principal balance is essential. A higher principal balance results in increased interest, which can significantly impact overall repayment costs.

What is a Loan Principal?

The loan principal is the initial amount of money borrowed or invested. This sum serves as the foundation for any loan or investment, as it is the original amount upon which interest or returns are calculated.

In the context of loans, the principal determines the interest you will pay over time, influencing payment schedules and repayment plans, such as amortisation schedules. For investments, the principal represents the amount that generates returns, such as interest income from bonds or other fixed-income securities. If you hold a bond, the principal is also the face value that will be repaid to you once the bond reaches maturity.

Beyond finance, the term “principal” can refer to the primary individual in charge of a company or the main parties involved in a legal contract. Understanding this concept is essential, whether you’re managing a mortgage, considering an investment in bonds, or engaging in any financial agreement, as it directly affects both your costs and potential returns.

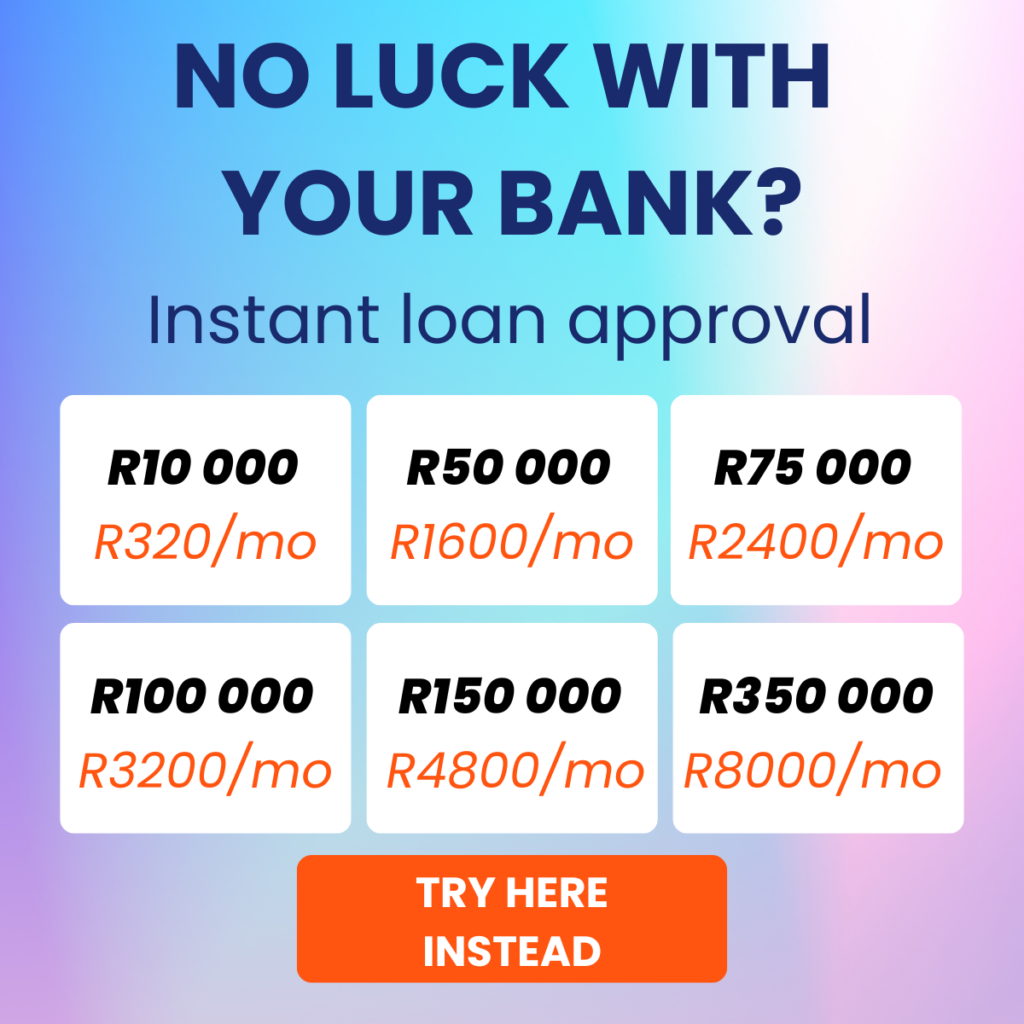

About Arcadia Finance

Effortlessly secure your loan with Arcadia Finance, where no application fees and a selection of 19 reputable lenders await. Each lender complies with South Africa’s National Credit Regulator standards, ensuring a streamlined process and trustworthy solutions tailored to your financial needs.

Understanding the Principal

The principal is the original amount borrowed from a lender, typically for significant purchases such as a car, house, or education expenses. This amount forms the basis upon which interest rates and repayment conditions are calculated. Essentially, it’s the amount provided by the lender that must be repaid over time, along with any interest and applicable fees. The term “principal” can also refer to the remaining balance of the loan as it is gradually paid down.

In the context of loans, there are two primary types of principal balances:

- Initial Principal: This is the amount initially borrowed from the lender, establishing the base for determining both interest and the repayment schedule.

- Outstanding Principal: Over time, as repayments are made, a portion of each payment reduces the principal. The remaining balance, known as the outstanding principal, continues to accrue interest until the loan is fully repaid.

The size of the principal directly impacts the total loan cost. Generally, a higher principal results in increased interest costs throughout the loan term, assuming the interest rate and loan duration remain unchanged.

Role of the National Credit Act (NCA) in Loan Principal Regulation

South Africa’s National Credit Act (NCA) plays a crucial role in regulating loan agreements, including the principal amount. The NCA mandates that all credit providers must practice transparent lending, ensuring that borrowers are well-informed about the principal amount, interest rate, repayment term, and additional fees before entering into a loan agreement.

This transparency enables borrowers to clearly see the principal amount, understand how much they are borrowing, and know their rights regarding early repayment, debt restructuring, and loan affordability assessments. By establishing these standards, the NCA helps protect consumers from exploitative lending practices and ensures that loans remain manageable for South African borrowers.

How Principal Amounts are Set in South African Loans

In South Africa, the principal amount that a borrower can qualify for is primarily determined through the lender’s credit assessment process. This evaluation takes into account several factors, including the borrower’s income, existing debt, credit score, and overall affordability. Based on this assessment, lenders determine the maximum principal amount that a borrower is eligible to receive.

Loan Types and Principal Amounts

Personal Loans: The principal amounts for personal loans depend on the borrower’s income and credit rating. Lenders typically impose caps on these amounts to ensure that repayments remain affordable. The National Credit Act (NCA) mandates an affordability check to verify the borrower’s capacity to repay the loan.

Home Loans: The principal amounts for mortgage loans are influenced by the value of the property and usually require a deposit, which reduces the overall principal. Depending on the borrower’s profile, lenders may offer home loan principals for up to 100% of the property’s value.

Car Financing: For car loans, the principal amount is based on the vehicle’s purchase price and any down payment made by the borrower. Lenders typically require a deposit, which lowers the principal amount to be financed.

Loan Principal vs. Interest Rate

The principal amount of a loan and its interest rate are closely intertwined but serve different roles in the loan structure. The principal refers to the main sum of money that the borrower must repay, excluding any additional charges or fees associated with the loan.

In contrast, interest represents the cost of borrowing that money. This cost is typically expressed as an Annual Percentage Rate (APR), which reflects the interest as a percentage of the principal amount owed.

Interest rates are set independently by banks and other lending institutions, influenced by various economic factors as well as the lender’s policies.

Borrowers are generally encouraged to opt for loans with lower interest rates and shorter repayment terms. This approach can significantly reduce the overall interest paid throughout the life of the loan, ultimately lowering the total repayment amount.

Ever wondered how lenders calculate the interest on your loan? Understanding this process can empower you to make smarter borrowing decisions and even negotiate better terms to minimize your financial burden over time.

The Relationship Between Inflation and Interest Rates

Inflation and interest rates both significantly impact the total amount owed on a loan, and their combined effects can yield outcomes that differ from simply analyzing each factor individually. While interest increases the nominal value of your repayments, inflation can diminish the real burden of your debt over time. Here’s how these forces interact:

Reduction of Debt Burden: As inflation rises, the real value of the debt decreases, effectively lessening the financial impact of what you owe. This can make it comparatively easier to pay off the loan in the future.

Cost of Interest: While interest contributes to your overall debt, in an inflationary environment, the true effect of this interest may be less severe than it initially seems, as inflation reduces the real cost of borrowing.

How Interest Affects Principal

The interest you pay on a loan primarily depends on the size of the principal. A higher principal means greater interest costs.

Interest on loans is typically calculated in one of two ways: simple or compound. Simple interest is calculated solely on the original loan amount, while compound interest applies to both the original principal and any accumulated interest over time.

During the early stages of repaying a loan, a significant portion of your monthly payment goes toward interest, with the remainder reducing the principal. As you pay down the loan balance, a larger share of your payments is applied to the principal. This reduction in the principal balance leads to lower interest charges in subsequent months.

Interest rates can dramatically change a loan repayment. Even a slight change in rates can increase or decrease the total amount you end up paying on your principal. Understanding the impact of interest rates on loans can help you prepare and potentially save thousands over the life of your loan.

Determining the Principal Amount Remaining on Your Loan

If you currently hold a loan and need to determine how much of the original principal amount remains, you have several methods at your disposal:

1. Review Your Loan Account Statement

Most lenders provide monthly or annual statements for your loan account, detailing the original principal, the amount of principal repaid during the period, and the closing principal balance. This document can give you a clear overview of your outstanding principal.

2. Utilize an Online Loan EMI Calculator

Online loan calculators allow you to input details such as the initial loan amount, interest rate, loan term, and monthly repayment (EMI) amount. The calculator can break down each EMI into its principal and interest components. You can then subtract the total principal repaid from the original amount to find the remaining principal.

3. Contact Your Lender

For a direct approach, reach out to your bank or lending institution by phone or email to request information on your current outstanding principal. They can quickly access this information using your account details.

4. Calculate the Principal Manually

You can also calculate the remaining principal manually. Start with the total sanctioned loan amount and subtract the total principal from each EMI paid so far. This calculation will reveal the remaining balance of the original principal that you still owe.

Each of these methods can help you ascertain how much of the principal remains on your loan, enabling you to plan your finances more effectively.

How Can the Principal Amount be Repaid?

To repay the principal amount on an online personal loan, you generally have several options. The most common method involves making regular monthly payments that include both a portion of the principal and the interest accrued. These payments are usually spread over a defined period, which can range from several months to a few years, depending on the specific terms of the loan.

Another repayment option is to make lump-sum payments, allowing you to pay larger amounts towards the principal when possible. This can be advantageous as it may lower the total interest costs and reduce the overall loan term.

Some lenders offer additional flexibility by permitting extra payments on the principal without incurring penalties. This option can help expedite the repayment process, allowing you to settle the loan more quickly.

It is advisable to carefully review your loan agreement to fully understand the repayment conditions, including any prepayment options or fees that may apply.

By consistently meeting these payment obligations and managing your finances with an emphasis on the loan, you can steadily progress towards reducing the principal balance. Regular and responsible repayments not only help decrease debt but also contribute to your journey towards achieving financial stability.

Early Repayment on Loan Principal

South African borrowers have the option to repay their loan principal early to reduce their debt burden. Making additional payments towards the principal can significantly decrease the interest paid over the life of the loan, as interest is generally calculated on the outstanding principal balance.

Under the National Credit Act (NCA), lenders are required to allow early settlement or extra payments, although they may charge a small settlement fee to offset lost interest income. By reducing the principal more quickly, borrowers can shorten the loan term and lower the total interest cost, which is a common strategy for home loans and personal loans.

Conclusion

For borrowers, effectively managing the principal balance can significantly influence the total repayment amount and loan duration, particularly when options like lump-sum payments or penalty-free additional contributions are available. Knowing how principal operates in loans not only aids in making informed decisions but also enhances long-term financial planning by enabling individuals to anticipate costs and minimise unnecessary interest.

Frequently Asked Questions

The principal of a loan is the original amount borrowed, excluding any interest, fees, or additional charges. It represents the core sum that a borrower agrees to repay over the loan term.

The principal directly impacts the amount of interest you will pay. A larger principal leads to higher interest costs over the loan’s term, particularly if the interest rate and loan duration remain unchanged.

Yes, many lenders allow you to make extra payments toward the principal without penalties. Doing so can decrease the total interest paid and shorten the overall loan term, making it a good option for faster debt reduction.

The initial principal is the original amount borrowed at the start of the loan, while the outstanding principal is the remaining balance as you make repayments. Over time, the outstanding principal decreases as regular payments are made.

The concept of principal applies to all loans, but the amount varies depending on the loan type, purpose, and lender’s terms. For instance, a mortgage principal may be significantly larger than that of a personal loan or car loan.