PEP Loans [Pepstores.com] offer a practical financial solution for South Africans who need to manage short-term financial needs. Available through PEP Stores, these loans provide a simple way to cover unexpected expenses or everyday costs without depending on traditional banks. Designed for affordability and ease of access, PEP Loans are ideal for individuals looking for a straightforward borrowing option that suits their budget and lifestyle.

PEP Loans – Loan Overview

| Name | PEP Loans |

| Financial | Independently Managed by Capfin |

| Product | Personal Unsecured Loans |

| Minimum Age | 18 years |

| Minimum Amount | R1,000 |

| Maximum Amount | R50,000 |

| Minimum Term | 6 months |

| Maximum Term | 12 months |

| APR | 17.5% – 24.5% |

| Monthly Interest Rate | 5% (varies with term length) |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Fixed terms, direct debit payments |

| NCR Accredited | Yes |

| Our Opinion | ✅ Tailored for quick financial solutions ✅ Accessible with minimal documentation ⚠️ Higher rates for riskier profiles |

| User Opinion | ✅ Convenient and fast service ⚠️ Concerns over high interest rates |

What Makes PEP Loans Unique?

PEP Loans are designed for ease of access and simplicity, making them an ideal option for South Africans seeking financial assistance without the complexities of traditional loan applications. A key feature of PEP Loans is their integration with PEP Stores’ nationwide network, which allows customers to apply both in-store and online with minimal effort. This accessibility ensures that even individuals without a strong banking history or access to conventional credit can consider this option.

Another notable aspect of PEP Loans is their flexible repayment terms, tailored to suit various financial situations. Borrowers can choose repayment periods that match their income schedules, providing the necessary flexibility. Additionally, PEP Loans are transparent in their terms and conditions, ensuring that customers are fully aware of the costs involved before committing. This combination of convenience, flexibility, and clarity makes PEP Loans a practical solution for many South Africans.

About Arcadia Finance

Effortlessly secure your loan with Arcadia Finance. Choose from 19 reputable lenders, with no application fees and full compliance with South Africa’s National Credit Regulator. Enjoy a simple, reliable process tailored to your financial goals.

Types of Loans Offered by PEP

PEP primarily offers personal loans, which are ideal for addressing short-term financial needs. These loans can be used for various purposes, including paying school fees, managing household expenses, or covering unexpected emergencies. Borrowers can access different loan amounts based on their financial requirements and credit profiles, with repayment options tailored to suit a range of needs.

PEP Loans are particularly beneficial for individuals who may not qualify for traditional loans due to limited credit history. The focus is on providing a straightforward borrowing experience, helping customers manage financial obligations with ease. Whether you’re looking to cover monthly expenses or fund a personal project, PEP’s personal loan options are designed to offer practical and accessible solutions.

Requirements for a PEP Loan

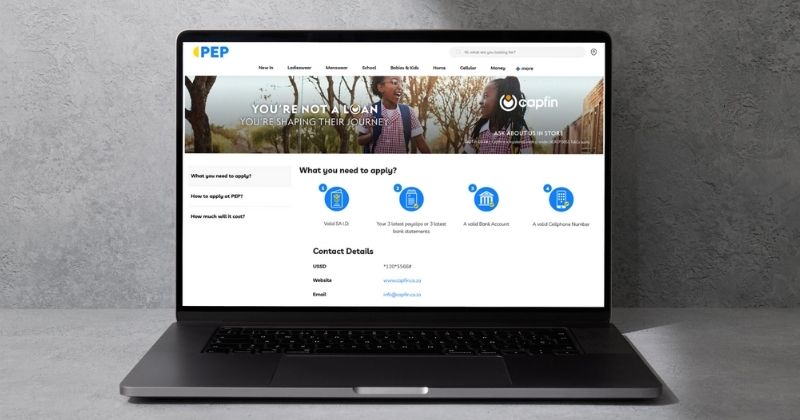

Applying for a PEP Loan requires submitting specific documents and information to ensure a smooth process. Here’s a list of what you’ll need:

- South African ID: A valid South African identity document or Smart ID.

- Proof of Income: Recent payslips or a stamped bank statement showing your income.

- Proof of Residence: A utility bill or another official document with your current address.

- Contact Information: A valid mobile number for communication and loan updates.

How to Apply for a PEP Loan

- Visit Pepstores.com or your nearest PEP Store.

- Complete the loan application form with accurate details.

- Submit the required documents, such as your ID and proof of income.

- Select your loan amount and repayment term.

- Wait for an approval notification via SMS or email.

- Once approved, receive the funds directly into your bank account.

Eligibility Check

PEP Loans provide an easy way to check eligibility before applying. Customers can use the online pre-qualification tool available on the PEP website or seek assistance from in-store representatives. This allows borrowers to assess their potential loan amount and repayment terms before proceeding with the full application process.

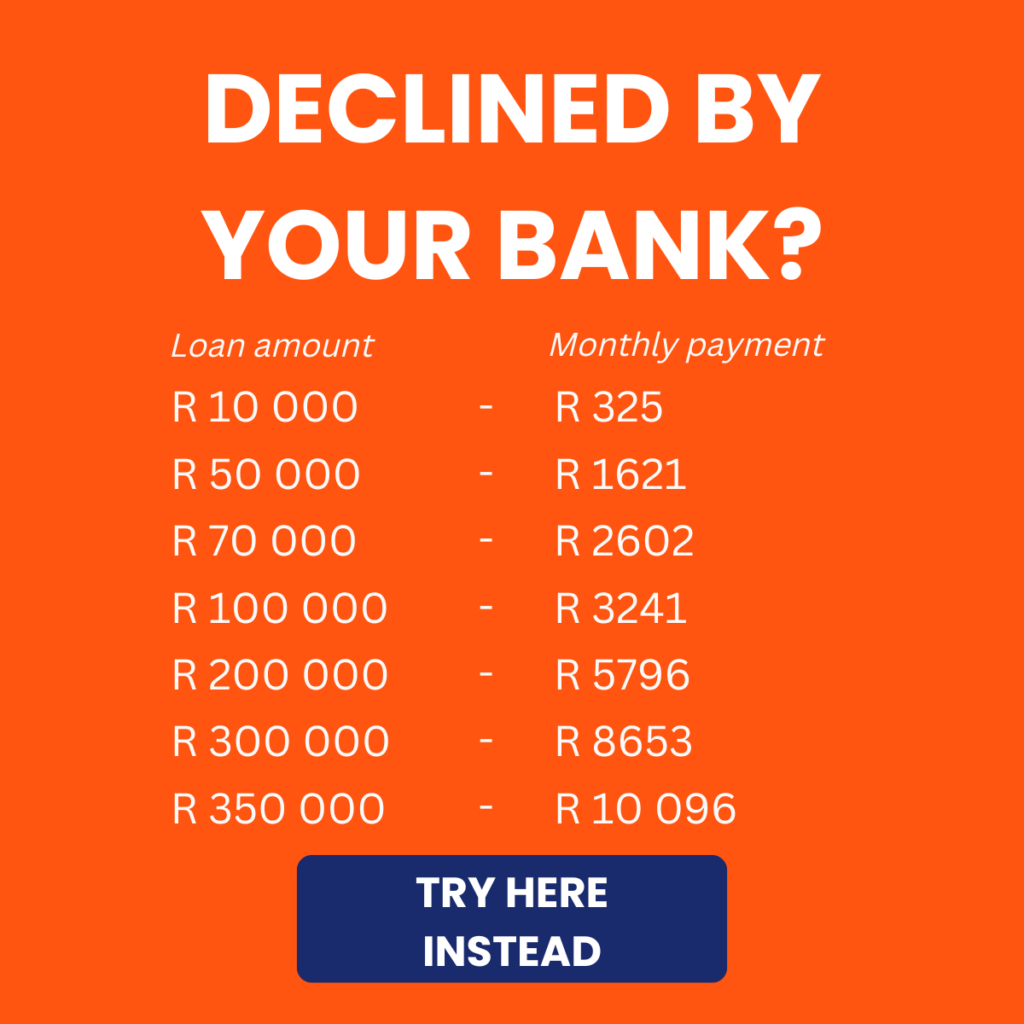

How Much Money Can I Request from PEP?

PEP Loans offer flexible borrowing options to cater to various financial needs. Customers can apply for loan amounts starting from as little as R1 000, with a maximum limit of R50 000. The amount you qualify for depends on factors such as your income, credit profile, and repayment capacity.

This range allows borrowers to access smaller amounts for immediate needs, such as paying bills or school fees, while also providing larger amounts for more significant expenses, like home improvements or personal projects. The flexibility ensures that borrowers can choose a loan size that suits their specific requirements without overcommitting financially.

Receive Offers

Pepstores.com provide personalised loan offers tailored to the applicant’s financial situation. Once you submit your application, the lender evaluates your income, credit history, and repayment ability. This assessment ensures that the loan offer you receive is aligned with your capacity to repay comfortably.

By personalising loan offers, PEP ensures that borrowers only take on loans they can manage, reducing the risk of financial strain. These customised terms also clarify interest rates, repayment amounts, and timelines, helping customers make informed decisions.

How Long Does It Take to Receive My Money from PEP?

PEP Loans are known for their quick processing times, with most approvals completed within 24 to 48 hours. Once your loan is approved, funds are typically disbursed within one business day, ensuring that you can access the money when you need it.

However, the exact timing can vary based on factors such as:

- Submission of all required documents.

- Accuracy of the information provided.

- Banking delays, especially over weekends or public holidays.

To speed up the process, make sure your application is complete and accurate when you submit it.

How Do I Repay My Loan from PEP?

PEP Loans offer several repayment options to make managing your loan easier. Repayments are generally made through monthly debit orders from your bank account, ensuring a smooth and hassle-free process. Borrowers can also choose to settle their loans early without incurring penalties, depending on the terms of their agreement.

It’s important to make repayments on time to avoid additional fees or penalties. Late payments can lead to extra charges, such as interest on overdue amounts, and may negatively affect your credit record. For clarity, borrowers should review the repayment terms and any potential fees during the application process.

By offering flexible repayment options and transparent policies, they aim to make the repayment journey as stress-free as possible.

Pros and Cons of PEP Loans

Pros

- Accessibility: Loans are available to a wide range of South African customers, even those with limited credit history.

- Convenient Application Process: Apply online or in-store at any PEP location across the country, making the process quick and easy.

- Flexible Loan Amounts: Borrow amounts ranging from R1,000 to R20,000, with terms tailored to your specific needs.

- Quick Processing Times: Most applications are processed within 24 to 48 hours, with funds typically disbursed shortly after approval.

- Transparent Terms: Customers are clearly informed about interest rates, repayment plans, and other costs upfront, providing peace of mind.

Cons

- Higher Interest Rates: Interest rates may be higher compared to traditional bank loans, reflecting the ease of access and flexible borrowing criteria.

- Limited Loan Products: PEP primarily offers personal loans, which may not suit those seeking specialized financing options like home or auto loans.

- Strict Documentation Requirements: While the documentation process is straightforward, missing or inaccurate documents can delay approval.

- Repayment Penalties: Late payments can result in additional fees and may negatively impact your credit record.

Customer Service

If you have further questions about PEP Loans, their customer service team is readily available to assist. You can visit any PEP Store to speak directly with in-store representatives who can provide guidance on loan products and the application process. For additional support, you can contact their helpline, where a dedicated team is available to answer queries and provide assistance.

Additionally, Pepstores.com offers a range of online resources, including FAQs and loan calculators, to help you better understand their offerings. Whether your concerns relate to eligibility checks, application steps, or repayment options, PEP’s customer service team is ready to provide the information and support you need.

Contact Channels

If you have further questions about PEP Loans, their customer service team is readily available to assist. You can visit any of their store to speak directly with in-store representatives who can provide guidance on loan products and the application process. For additional support, you can contact their helpline at +27 86 073 7000, where a dedicated team is available to answer queries and provide assistance. Alternatively, their website offers a range of online resources, including FAQs and loan calculators, to help you better understand their offerings.

Whether your concerns relate to eligibility checks, application steps, or repayment options, PEP’s customer service team is prepared to provide the information and support you need.

Online Reviews of PEP Loans

In collaboration with Capfin, this store have received a variety of feedback from South African customers. Many borrowers appreciate the ease of applying for loans at PEP stores across the country, noting the simple application process and quick approval times. The loan’s accessibility is especially beneficial for individuals who may not have a strong credit history, as the eligibility criteria are more flexible compared to traditional banking options.

On the downside, some customers have expressed concerns about the relatively high interest rates associated with PEP Loans. While the loans are accessible, the cost of borrowing may be higher than what traditional banks offer. Additionally, a number of borrowers have reported issues with customer service, including delays in receiving assistance or clarification on loan details.

Alternatives to PEP Loans

South Africans seeking alternatives to PEP Loans have several personal loan options to consider, including Capitec Bank, African Bank, Wonga Loans, and FNB. Each lender has unique benefits and eligibility requirements, so it’s crucial for borrowers to compare options and select the one that aligns with their financial needs and repayment capacity.

Comparison Table

Below is a side-by-side comparison of PEP Loans with top competitors:

| Feature | PEP Loans | Capitec Bank Personal Loans | African Bank Personal Loans | Wonga Loans | EasyPay Loans |

|---|---|---|---|---|---|

| Loan Amount Range | R1 000 – R50 000 | Up to R250 000 | Up to R250 000 | Up to R8 000 | Up to R4 000 |

| Interest Rates | Higher than traditional banks | Competitive rates | Fixed rates | Higher rates for short-term | Competitive rates |

| Repayment Terms | Flexible, up to 12 months | Up to 84 months | Up to 72 months | Up to 6 months | Up to 9 months |

| Application Process | In-store at PEP or online | Online or in-branch | Online or in-branch | Online | Online |

| Approval Time | Within 24 to 48 hours | Quick approval | Quick approval | Within minutes | Quick approval |

| More Info | Capitec Review | African Bank Review | Wonga Review | EasyPay Review |

History and Background of PEP

Established in 1965, PEP is one of South Africa’s most recognised retail brands, known for its commitment to providing affordable clothing, household goods, and financial services to a broad customer base. With an extensive network of stores nationwide, PEP ensures its products and services are accessible to both urban and rural communities. Over the years, PEP has expanded its offerings, including the introduction of financial solutions like PEP Loans, in partnership with Capfin, to meet the evolving needs of its customers.

Their mission is to provide affordable products and services, enabling South Africans to improve their everyday lives. The company’s vision is focused on ensuring that essential goods and financial solutions are available to everyone, promoting greater financial independence and security. This commitment to inclusivity and accessibility has solidified PEP’s reputation as a trusted household name across the country.

Conclusion

PEP Loans provide a practical solution for South Africans seeking accessible and straightforward personal loans. With a focus on quick processing times, flexible repayment terms, and an easy application process, PEP has become a reliable option for meeting short-term financial needs. However, prospective borrowers should take into account the higher interest rates and ensure that the repayment terms suit their financial situation.

Frequently Asked Questions

To qualify, you must be a South African citizen with a valid ID. You need to be employed with a regular income, and you must provide proof of earnings, such as recent payslips or bank statements. Additionally, proof of residence, no older than three months, is required.

PEP Loans allow you to borrow between R1,000 and R20,000, depending on your income and repayment ability. The exact loan amount you qualify for will be determined during the application process based on your financial profile.

PEP Loan applications are typically processed within 24 to 48 hours. Once your loan is approved, funds are usually disbursed to your bank account within one business day. To avoid delays, make sure your application is complete and accurate.

PEP Loans are repaid through monthly debit orders automatically deducted from your bank account. The repayment period varies, usually up to 12 months. Early repayment may be possible, depending on the loan terms.

Yes, you can apply for a PEP Loan online through their website. Alternatively, you can visit a PEP store to apply in person. Both options offer a simple and user-friendly application process, requiring only the necessary documents.