Creditum [Creditum.co.za] is a South African financial services provider offering personal loans tailored to various needs, including debt consolidation, managing unforeseen expenses, or financing major purchases. With a simplified application process, competitive interest rates, and customised loan terms, Creditum provides accessible and flexible borrowing options.

Creditum Loan – Overview

| Name | Creditum |

|---|---|

| Financial | Privately Owned & Registered Credit Provider |

| Product | Personal Loans & Debt Consolidation Loans |

| Minimum Age | >18 years |

| Minimum Amount | R500 |

| Maximum Amount | R350 000 |

| Minimum Term | 12 months |

| Maximum Term | 72 months |

| APR | 15% – 60% |

| Monthly Interest Rate | 1.25% – 5% |

| Early Settlement | Allowed with potential settlement discount |

| Repayment Flexibility | Customised to borrower’s needs |

| NCR Accredited | Yes |

| Our Opinion | ✅ Easy application process ✅ Wide loan range for different needs ⚠️ Higher interest rates for short-term loans |

| User Opinion | ✅ Quick fund disbursement ⚠️ Interest rates vary significantly based on credit score |

About Arcadia Finance

Simplify your loan journey with Arcadia Finance. Choose from 19 trusted lenders, all compliant with South Africa’s National Credit Regulator. With no application fees and a hassle-free process, we offer solutions tailored to your financial goals.

What Makes Creditum Loans Unique?

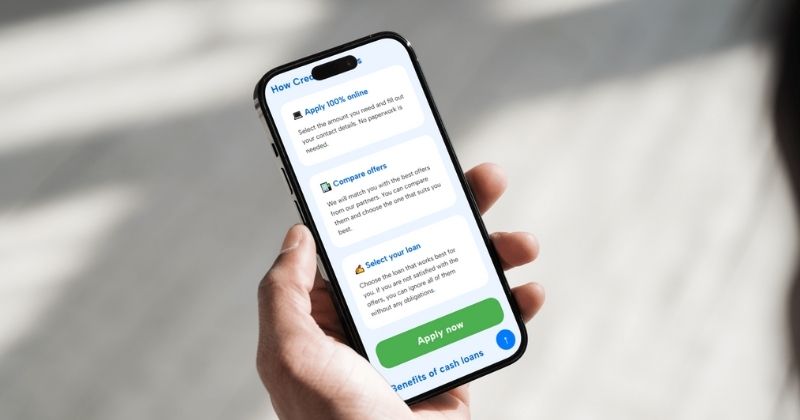

Creditum distinguishes itself in South Africa’s financial sector with an online platform that simplifies the loan application process. Borrowers can complete the entire process online, removing the need for extensive paperwork or in-person visits. This digital service offers a quick and efficient experience, allowing applicants to receive loan offers within seconds and finalise their applications in as little as five minutes.

Creditum also takes an inclusive approach to credit scores, catering to individuals with both strong credit histories and those working to rebuild theirs. By collaborating with a broad network of lenders, the platform provides access to a variety of loan products tailored to each borrower’s financial circumstances.

Types of Loans Offered by Creditum

Creditum provides a range of loan options to suit various financial needs:

Personal Loans: These loans offer flexibility and can be used for unexpected expenses, debt consolidation, or significant purchases.

Debt Consolidation Loans: Designed to merge multiple debts into a single payment, they can simplify financial management and may reduce overall interest rates.

Mini Loans: Suitable for smaller, urgent expenses, these loans provide quick access to funds with shorter repayment terms.

Requirements for a Creditum Loan

To qualify for a loan through Creditum, you must meet the following criteria:

- Be at least 18 years old.

- Possess a valid South African ID.

- Provide proof of income, such as recent payslips or bank statements.

- Have an active bank account for repayments.

- Supply valid contact details, including a phone number and email address.

How to Apply for a Loan with Creditum

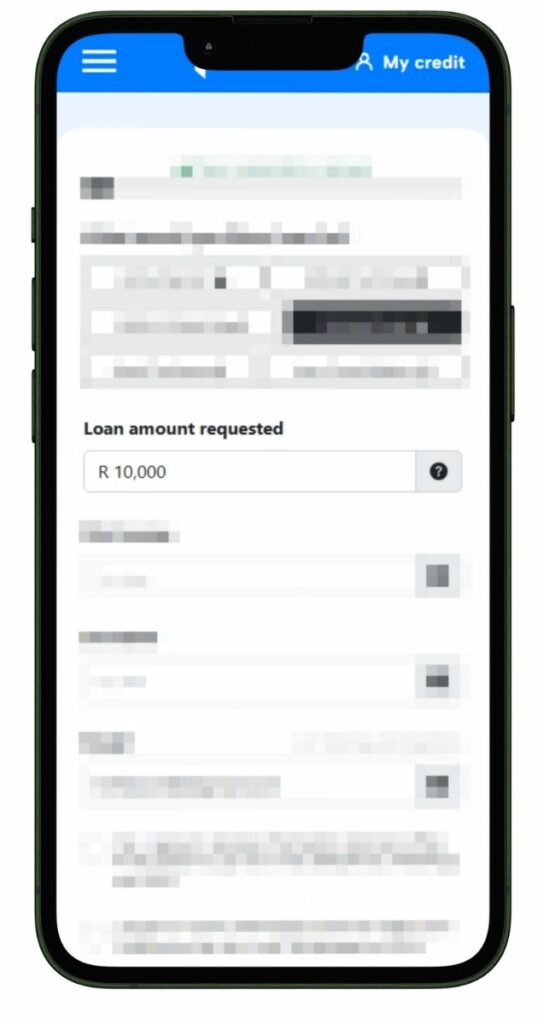

Creditum offers an online loan simulation tool that allows you to input your desired loan amount and repayment period. This feature provides an estimate of your monthly repayments and total costs, enabling you to plan effectively before submitting your application.

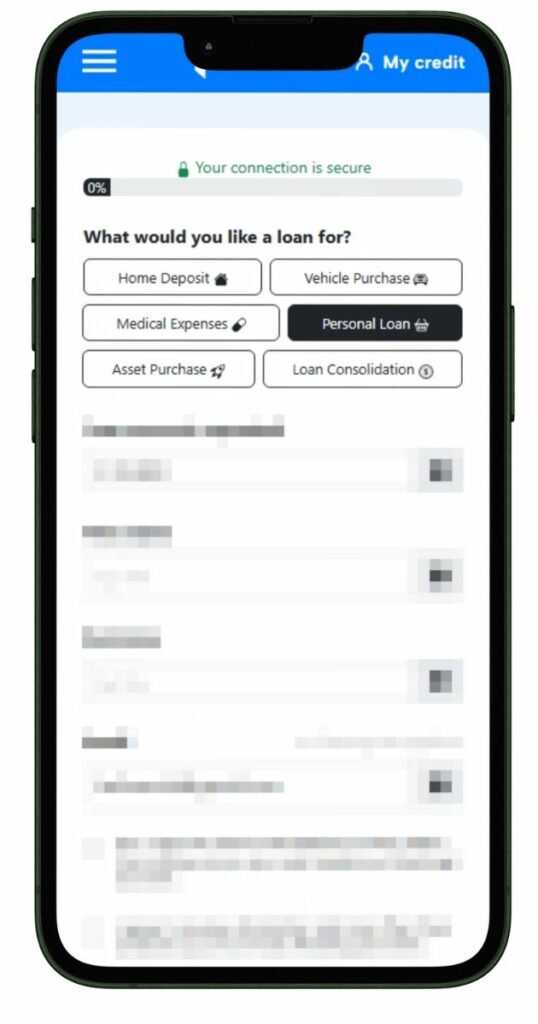

Follow these steps to apply for a loan through Creditum:

Step 1. Visit the Creditum.co.za

Step 2. Adjust the loan amount using the slider and choose your desired amount.

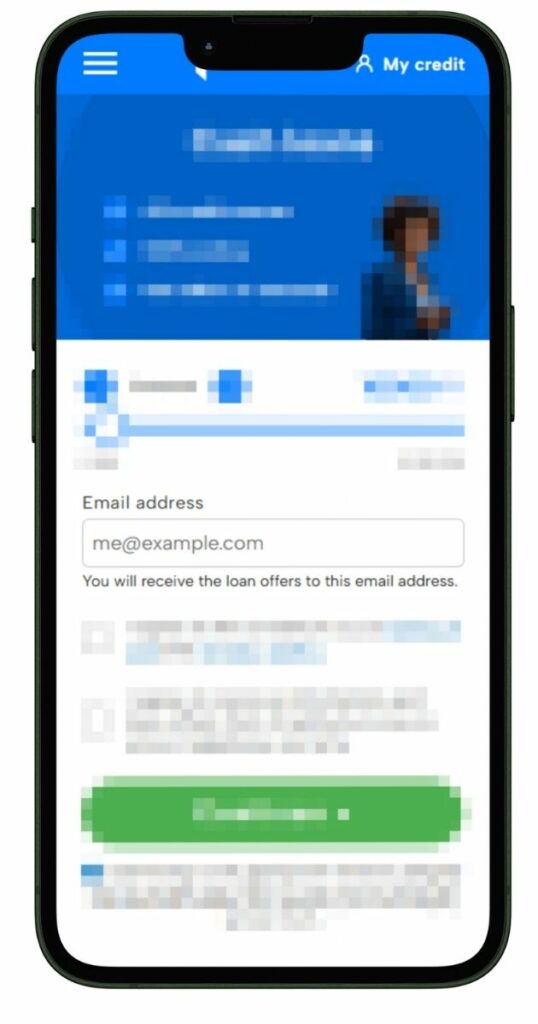

Step 3. Enter your email address to receive loan offers.

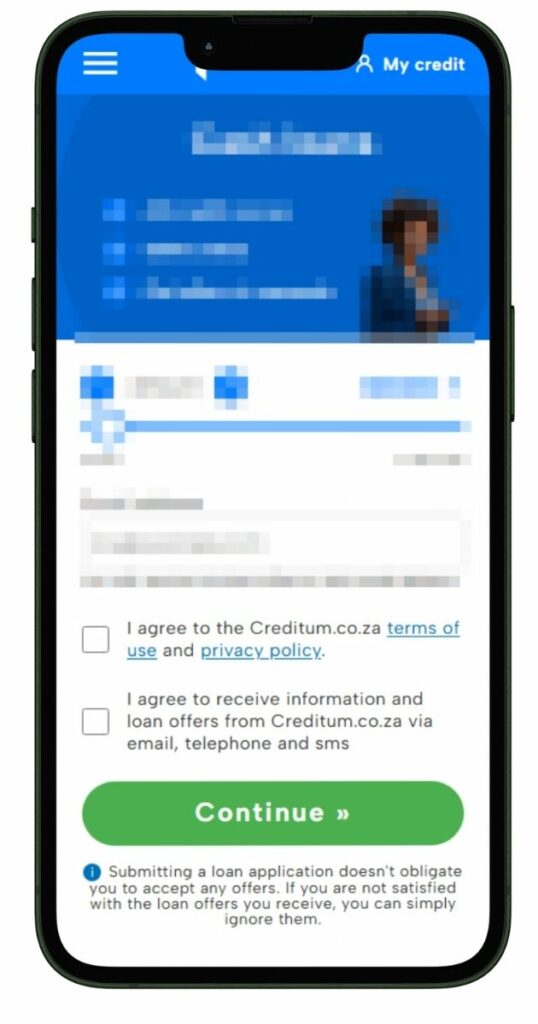

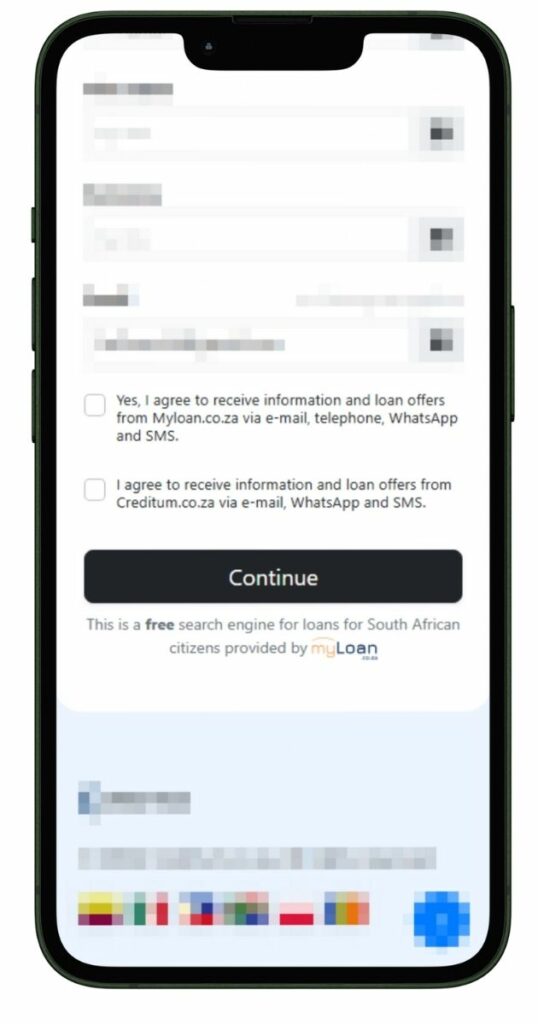

Step 4. Agree to terms and conditions and confirm your consent to receive loan offers.

Step 5. Select the purpose of the loan from the provided options.

Step 6. Confirm your loan amount and fill in additional requested details.

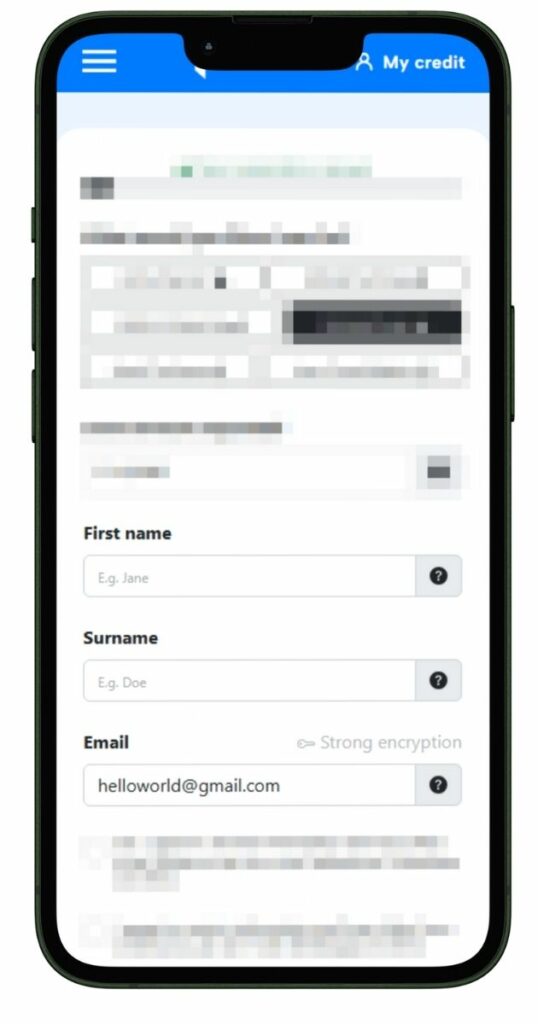

Step 7. Enter personal details like your name, surname, and email for processing.

Step 8. Finalize and confirm your consent to receive loan information through various communication channels.

Step 9. Select your preferred offer and complete the agreement.

Step 10. Once your application is approved, the funds will be transferred to your account.

Eligibility Check

Creditum offers an easy-to-use online tool for borrowers to check their loan eligibility. This quick process requires only basic details such as income level, employment status, and credit history. By entering this information on Creditum’s platform, users can receive a preliminary assessment of their eligibility without affecting their credit score.

The platform also provides personalised loan options based on the financial information submitted, enabling borrowers to compare offers before proceeding. This ensures applicants focus on loans that align with their financial circumstances, saving time and improving the likelihood of approval. For more information, you can access the eligibility tool directly on Creditum’s website.

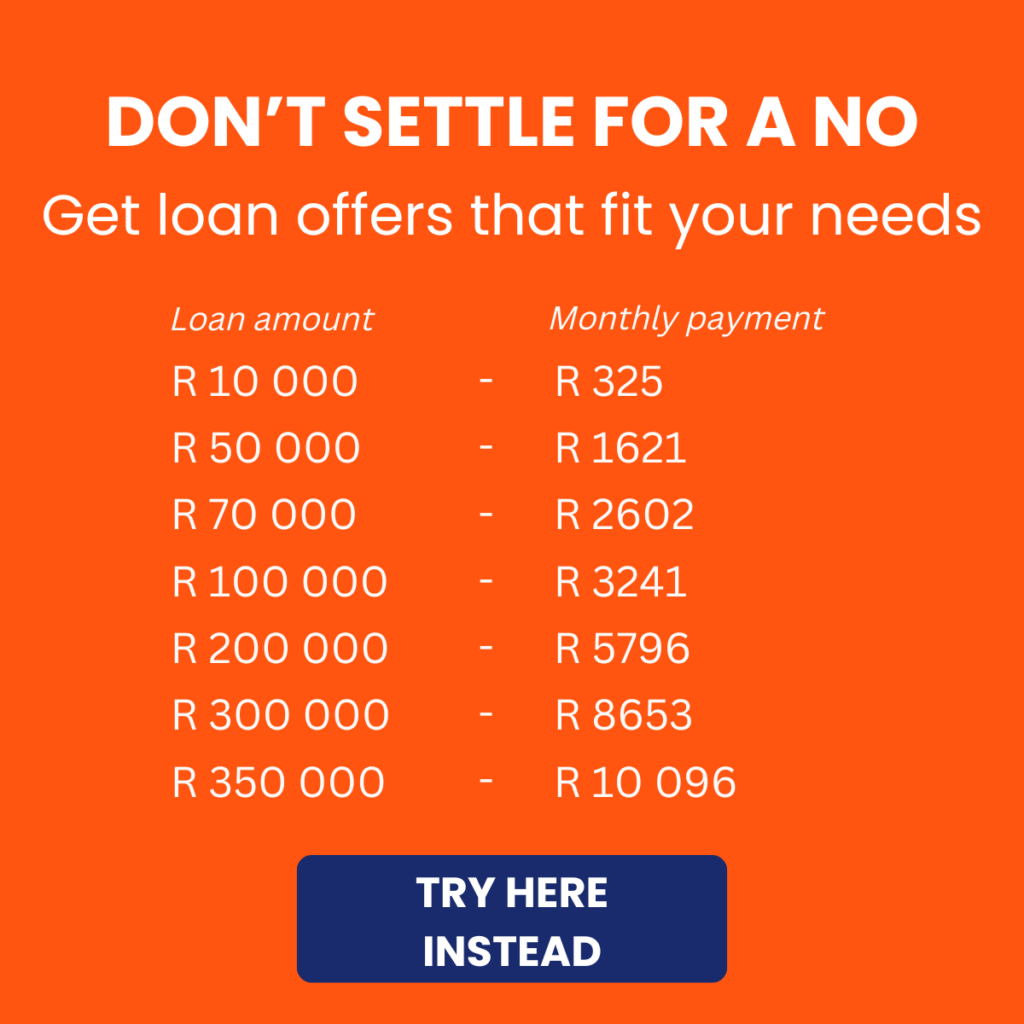

How Much Money Can I Request from Creditum?

Creditum offers flexible loan options to meet a variety of financial needs. Borrowers can request amounts ranging from R500 for smaller expenses to R350 000 for larger requirements, such as home improvements or debt consolidation. These options cater to both minor emergencies and significant financial undertakings.

Receive Offers

Creditum’s platform uses a sophisticated matching system to generate personalised loan offers. Once you complete your application and provide the necessary details, the system evaluates your financial profile and presents loan options tailored to your income, credit score, and repayment capacity. This streamlined approach saves time by filtering out irrelevant offers, ensuring you only receive suitable options from their network of lenders.

How Long Does It Take to Receive Funds?

The processing time for a Creditum loan is typically 24 to 48 hours after approval. This includes application evaluation, lender matching, and fund disbursement. The speed of the process depends on factors such as the completeness of your application, timely submission of required documents, and the lender’s processing timeline. When all documents are in order, funds are often transferred promptly to your account.

Loan Repayment

Repaying a Creditum loan is simple and usually involves monthly instalments that are automatically deducted from your bank account on an agreed date. Creditum works with lenders offering flexible repayment terms tailored to your financial circumstances.

While some lenders may charge fees for late payments or penalties for defaults, Creditum ensures all terms and fees are clearly outlined before you sign the agreement. Additionally, most loans include early settlement options, often without penalties, allowing you to repay the loan sooner if your financial situation improves.

Pros and Cons

Pros

- Streamlined online application: The fully digital application process makes it quick and convenient for borrowers to apply for loans.

- Flexible loan amounts: Loan options range from R500 to R350 000, accommodating a wide array of financial needs.

- Quick processing times: Loans are typically approved and disbursed within 24 to 48 hours, provided all documentation is submitted correctly.

- Personalised loan offers: Borrowers receive tailored loan options based on their financial profiles and repayment capacity.

- Inclusive eligibility: Creditum collaborates with multiple lenders, enabling individuals with various credit scores to find suitable loans.

Cons

- Limited product range: The focus on personal loans and debt consolidation may not address all financial requirements.

- Variable interest rates: Borrowers with lower credit scores may face higher interest rates, depending on the lender.

- Dependence on lender policies: Loan terms, fees, and penalties differ across lenders, which can create uncertainty for borrowers.

Customer Service

If you have additional questions about Creditum’s loan options or require support with the application process, their customer service team is ready to assist. You can contact Creditum via the contact form on their website, email, or phone support. The team provides clear guidance to address your concerns and help ensure a smooth application experience.

For lender-specific enquiries, Creditum facilitates direct communication with the lender, offering clarity on loan terms, interest rates, and repayment conditions. This ensures you have all the information needed to make informed decisions.

Contact Channels

Phone number:

Office:+27 21 123 4567

Email:

info@creditum.co.za

Postal address:

123 Finance Street, Cape Town, South Africa

Online Reviews of Creditum

Online reviews of Creditum present a mixed picture, reflecting a range of customer experiences. While some users praise the company for its straightforward application process and competitive loan options, others have expressed dissatisfaction with certain aspects of the service, such as communication and customer support.

Alternatives to Creditum

If Creditum’s services don’t fully meet your needs, there are other online loan comparison platforms available in South Africa:

Comparison Table

Below is a side-by-side comparison of Creditum with its top competitors:

| Feature | Creditum | SupaSmart Loans | BESTloans | MoMo Qwikloans | FairBanker |

|---|---|---|---|---|---|

| Application Process | 100% online | 100% online | 100% online | 100% online | 100% online |

| Loan Amounts | R500 – R350 000 | R1 000 – R200 000 | R100 – R350,000 | R250 – R10 000 | Up to R350 000 |

| Approval Time | Minutes to hours | Within hours | Instant to 24 hours | Instant, subject to eligibility | Almost instantly after application |

| Customer Support | Email and phone | Email and phone | Email and phone | Email and mobile communication | Email and phone |

| Additional Services | Debt consolidation | Bad credit loans | Short term loans | Early settlement allowed without penalties | Comparison of loans from NCR-licensed lenders |

| More Info | SupaSmartLoans Review | BESTloans Review | MoMo Qwikloans Review | FairBanker Review |

History and Background of Creditum

Creditum is an online loan comparison platform in South Africa that has been helping individuals find suitable loan options for over 8 years. With a strong track record of assisting more than 250,000 satisfied customers, Creditum has become a trusted resource for securing loans that meet a variety of financial needs.

The company’s mission is to offer a user-friendly platform that simplifies the loan application process, ensuring quick and easy access to cash loans in South Africa. Creditum is dedicated to empowering individuals by providing the tools and information they need to make well-informed financial decisions.

Conclusion

Creditum offers a convenient and accessible platform for South African borrowers seeking personal loans. With its user-friendly interface, flexible loan amounts, and quick approval processes, Creditum makes it easier for individuals to access funds. The platform’s personalised loan matching system caters to a wide range of financial needs and credit profiles, making it a viable option for many borrowers.

Frequently Asked Questions

No, it is not a direct lender. It is a loan comparison platform that connects borrowers with a network of lenders to help them find loan options suited to their financial needs.

You can apply for loans ranging from R500 to R350 000, depending on your financial needs and eligibility.

Loan disbursement typically occurs within 24 to 48 hours after approval, provided all required documentation is in order.

Yes, they work with a variety of lenders, some of whom cater to individuals with less-than-perfect credit. Loan terms may vary based on your credit profile.

You will need to provide a valid South African ID, proof of income (such as recent payslips or bank statements), and an active bank account. Additional documents may be requested by specific lenders.