Homeowners could potentially save over R480,000 in interest repayments on a R1.4 million property loan simply by contributing an additional R1,000 to their monthly instalments over a 20-year repayment term. This strategy would not only reduce the total interest paid to the bank but also shorten the repayment period by approximately four years.

Key Takeaways

- Small Extra Payments Save Big: Adding R1 000 to your monthly home loan can save nearly R480 000 in interest and shorten the repayment term by four years. Even smaller amounts, like R200 or R500, can still make a significant impact.

- Repo Rate Cuts Reduce Borrowing Costs: The SARB’s recent 25 basis point rate cut lowers borrowing costs, giving homeowners an opportunity to save by paying off their loans faster.

- Avoid Using Lower Rates for New Debt: Lower interest rates might seem appealing for new debt, but they can lead to financial stress when rates rise. Focus on reducing existing debt instead for better long-term gains.

Although a recent 25 basis point reduction in the interest rate offers some relief, many South Africans, including those with higher incomes, continue to face financial strain and rising levels of debt. However, allocating an extra R1 000 towards a home loan could significantly reduce overall costs in the long term, despite the financial challenges faced by many households.

Tip: Start small if R1 000 feels like too much. Begin with an extra R200 or R500 and gradually work your way up. Over time, even modest amounts can have a significant impact. This approach is especially useful for households working within tight budgets.

Recent Changes to the Interest Rate

On Thursday, the South African Reserve Bank (SARB) implemented its second interest rate reduction of the year, decreasing the repo rate from 8% to 7.75%. Consequently, the prime lending rate dropped from 11.5% to 11.25%. This follows two successive cuts in September and November, totalling a 50 basis point reduction in 2023, after a prolonged period of rate hikes that began in November 2021.

Contributing an extra R1 000 towards a home loan, while challenging for many, could provide significant financial benefits by reducing the overall interest paid over the loan’s duration. For instance, the additional payment could result in total interest savings of nearly R480 000 on a R1.4 million property loan. It would also reduce the repayment term from the standard 20 years to around 16 years and three months.

Wondering how much that 1% drop in interest rate saves you? Learn more about loan interest rate calculations and see how small tweaks make a massive difference in your overall repayment.

Home Loans: A Major Expense for South Africans

Households in South Africa typically spend a significant portion of their income on home loans, making it a key area where even small financial adjustments can yield substantial savings. Using data from Lightstone, the average property price in the country is approximately R1.4 million, which serves as the basis for this illustrative example.

Calculating the Impact of Paying Extra

Based on current interest rates, a home loan of R1.4 million at the new prime lending rate of 11.25% would result in a monthly repayment of approximately R14 690. By adding R1 000 to this monthly instalment, the payment would increase to R15 690, resulting in interest savings of around R480 162 over the loan’s full term.

Tip: Make it automatic. Set up a standing instruction with your bank to transfer the extra R1 000 (or any amount you can manage) every month when your home loan payment is due. This ensures consistency and prevents you from spending the money elsewhere.

A shift in inflation policy could lead to adjustments in home loan rates, impacting both new buyers and existing mortgage holders. Want to understand how interest rates might evolve? Discover key insights in Poll Suggests South Africa Will Reduce Inflation Target in 2026.

The Difference in Total Repayments Over 20 Years

Without the additional R1 000 contribution and assuming the interest rate remains constant at 11.25%, the total repayment to the bank over 20 years would amount to R3.52 million. However, with the extra monthly payment, the total repayment would be reduced to R3 045 338, significantly lowering the total interest paid from over R2 million to R1.645 million.

Moreover, this additional payment would reduce the loan term from 240 months (20 years) to approximately 195 months (16 years and three months). This reduction translates to 45 fewer monthly payments, providing substantial long-term financial relief for the borrower.

Thinking about refinancing or taking a home loan? The SARB’s upcoming announcement could be pivotal. Don’t miss Will January Bring Relief? SARB’s Interest Rate Announcement Awaits, for a closer look at how it could reshape borrowing costs.

Avoid the Temptation to Take on New Debt

While the interest rate reduction may appear to provide an opportunity to take on new debt, financial experts caution against doing so. Taking on additional debt during a period of interest rate relief could lead to significant financial difficulties when rates inevitably rise again. Borrowers who take on new obligations without a solid financial buffer risk becoming overwhelmed by higher repayments in the future.

Instead of using the reduced interest rates to accumulate more debt, South Africans are encouraged to focus on paying down existing liabilities. Allocating the savings from lower instalments towards debt reduction can significantly decrease interest costs and shorten repayment terms, providing a more secure financial foundation over time.

By adopting prudent financial strategies, such as contributing extra funds to loan repayments, South Africans can take advantage of the current interest rate environment to secure long-term savings and improve their financial well-being.

Tip: Prioritise high-interest debt. If you have other debts, such as credit cards or personal loans with higher interest rates than your home loan, consider paying those off first. This will save you even more in the long run. Also, learn how consolidating could save you even more!

Conclusion

For South African homeowners, the current interest rate environment offers a rare chance to save significantly on home loan costs. By contributing just a little extra each month, such as R1 000, borrowers can save hundreds of thousands of rands in interest and reduce their repayment period. While financial challenges remain, taking proactive steps like automating extra payments or prioritising high-interest debt can pave the way for a more secure financial future. In an era of economic uncertainty, these strategies ensure that reduced rates work in favour of long-term financial stability rather than short-term relief.

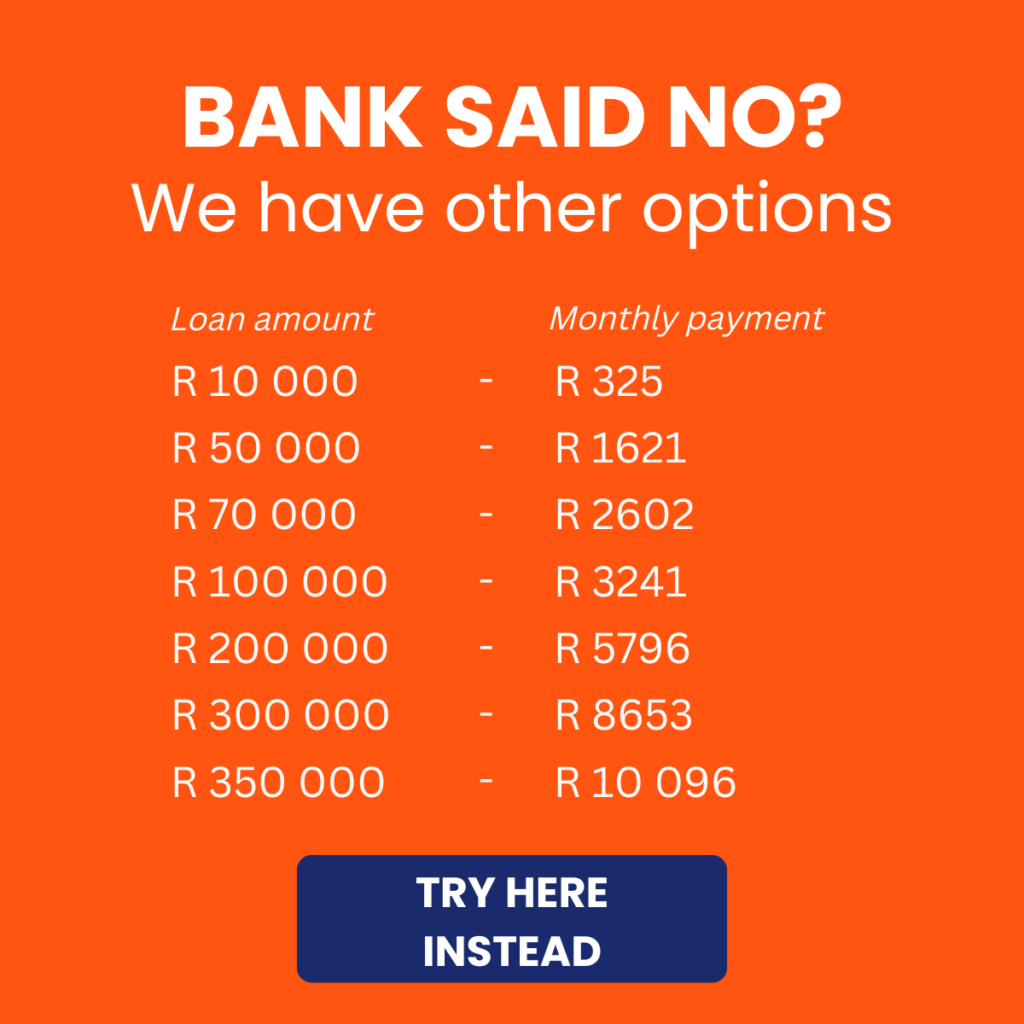

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 16 banks and find the right loan for you.