Absa is one of South Africa’s largest banks, offering a range of financial products, including credit cards tailored for different needs. Whether you want a card for everyday purchases, travel perks, or cashback rewards, Absa provides multiple options. Their credit cards come with benefits such as flexible repayment terms, rewards programmes, and digital banking features. However, choosing the right credit card depends on various factors, including fees, interest rates, and additional perks.

Absa Credit Cards – Overview

| Name | Absa Credit Cards |

|---|---|

| Financial Institution | Absa Bank Limited |

| Product | Credit Cards |

| Minimum Age | 18 years |

| Minimum Income | Varies by card type (e.g. Gold: R7 000/month, Premium: R25 000/month) |

| Credit Limit | Gold: R90 000, Premium: R138 000 |

| Interest-Free Period | Up to 57 days on qualifying purchases |

| Monthly Fees | Gold: R64, Premium: R105 |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Minimum monthly payment of 3% on outstanding balance |

| NCR Accredited | Yes |

| Our Opinion | ✅ Wide range of credit card options tailored to different income levels and needs. ✅ Competitive interest-free period of up to 57 days on purchases. ⚠️ Monthly fees and income requirements vary, which may limit accessibility for some applicants. |

| User Opinion | ✅ Convenient access to funds with global acceptance. ⚠️ Benefits and features differ across card types; higher-tier cards offer more perks but come with higher fees. |

What Makes Absa Credit Cards Unique?

Absa credit cards stand out because they offer a combination of flexible repayment options, competitive interest rates, and value-added benefits. Unlike some banks that provide a one-size-fits-all approach, Absa has multiple credit card options designed for different spending habits and financial needs. Whether you need a card with low fees, premium travel perks, or cashback rewards, Absa provides choices that cater to various lifestyles. Their credit cards integrate seamlessly with digital banking, allowing cardholders to manage transactions, set limits, and track expenses through the Absa Banking App. Additionally, Absa offers an interest-free period of up to up to 57 days on qualifying purchases, giving customers time to pay off their balances without incurring extra costs.

Another key benefit is the security and convenience features that come with every Absa credit card. Cardholders get access to contactless payments, fraud protection, and virtual card options for safer online shopping. For those who travel frequently, certain Absa credit cards provide travel insurance, access to Bidvest airport lounges, and emergency assistance services. The bank also has a rewards programme that allows users to earn cashback or points depending on their card type. With strong customer support and easy application processes, Absa credit cards are designed to be accessible while offering a range of features that compete well with other South African banks.

Exploring different credit card options is key to finding the best fit for your lifestyle. Whether you’re looking for cashback, travel perks, or low-interest rates, South Africa offers a variety of cards tailored to different needs. Check out the Best Credit Cards in South Africa to compare options and make an informed decision.

About Arcadia Finance

Get your loan quickly and hassle-free with Arcadia Finance. With no application fees, you can choose from 19 trusted lenders, all fully regulated by South Africa’s National Credit Regulator. Enjoy a smooth, secure process designed to meet your financial needs.

Types of Credit Cards Offered by Absa

Absa offers a range of credit cards tailored to different financial needs, whether you are looking for affordable credit, premium perks, or rewards on your spending. Below are the different Absa credit cards and their key features:

Absa Flexi Core Credit Card – Best for First-Time Cardholders

Monthly Fee: R64

Minimum Monthly Income: R2 000

The Absa Flexi Core Credit Card is designed for individuals looking for an affordable and entry-level credit card. It comes with a low monthly fee and provides basic credit benefits, including an interest-free period of up to 57 days on qualifying purchases. This card is a good option for those who need a simple and cost-effective way to manage expenses and build a credit history. It also includes basic travel insurance and secure online shopping features.

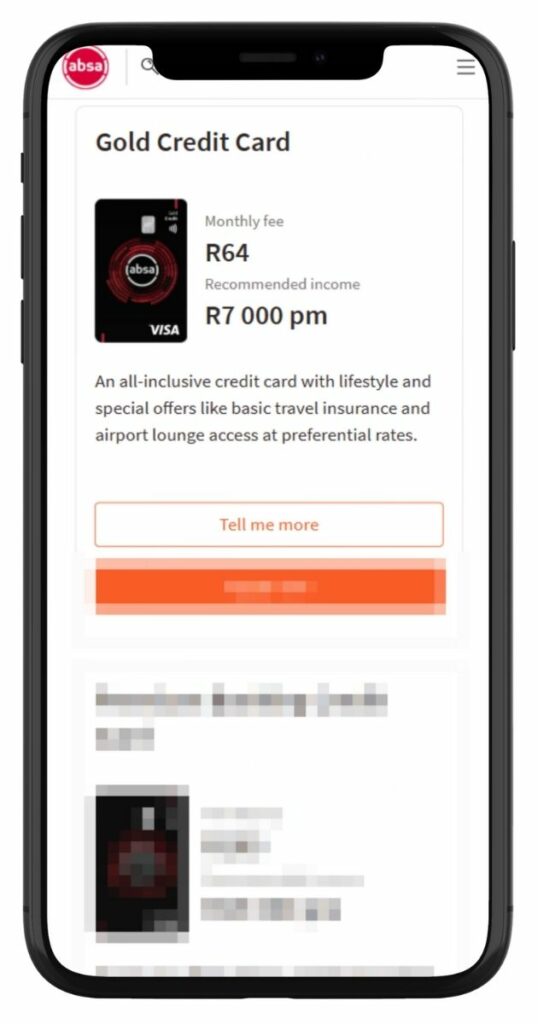

Absa Gold Credit Card – Best for Everyday Spending

Monthly Fee: R64

Minimum Monthly Income: R7 000

The Absa Gold Credit Card is suited for individuals who want a balance between affordability and added benefits. This card provides exclusive deals on entertainment, dining, and travel, making it ideal for those who spend regularly. It offers a higher credit limit than the Flexi Core card, free secondary cards, and rewards through the Absa Rewards programme. Customers can earn cashback on qualifying transactions, which helps save money on everyday purchases.

Absa Premium Banking Credit Card – Best for Higher-Income Earners

Monthly Fee: R105

Minimum Monthly Income: R25 000

The Premium Banking Credit Card is aimed at individuals with a higher income who require premium financial services. It includes benefits such as higher credit limits, extended travel insurance, and complimentary access to Bidvest airport lounges. Cardholders can also enjoy concierge services, dining discounts, and additional fraud protection features. This card is best suited for individuals who travel frequently or require additional financial flexibility.

Absa Private Banking Credit Card – Best for Wealth Management

Monthly Fee: R200

Minimum Monthly Income: R62 500

The Private Banking Credit Card is designed for high-net-worth individuals who require personalised banking services. It provides exclusive rewards, luxury travel perks, priority service, and enhanced security features. Cardholders get higher withdrawal limits, dedicated financial consultants, and 24/7 global assistance. This card is ideal for individuals looking for premium financial solutions and VIP banking services.

Absa Student Credit Card – Best for Students and Young Professionals

Monthly Fee: R0

Minimum Monthly Income: R800

The Absa Student Credit Card is designed for students and young professionals who need an entry-level credit card with low fees and controlled spending options. It provides a low credit limit to encourage responsible spending while still offering fraud protection, contactless payments, and a short-term credit facility. This card is best suited for individuals looking to establish a credit history without high financial commitments.

How does Absa stack up against other credit card providers? Our FNB Credit Cards Review highlights the key features, perks, and drawbacks of FNB cards, giving you a comprehensive comparison to make the best choice.

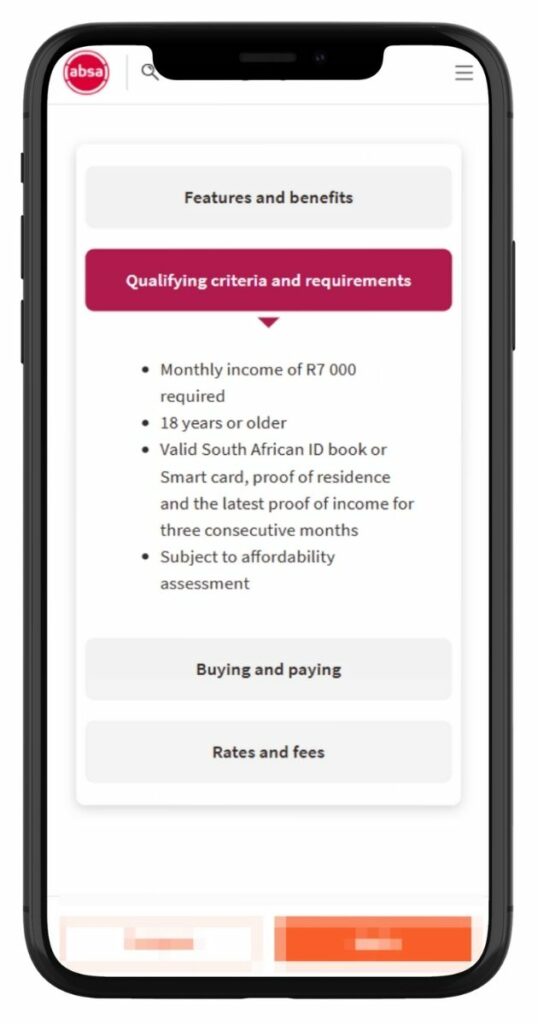

Requirements for an Absa Credit Card

To apply for an Absa credit card, you must meet certain eligibility criteria and provide the necessary documents. Below are the general requirements:

Eligibility Criteria

- Minimum age: 18 years or older

- Minimum income: Varies by card type (e.g. Flexi Core requires a lower income than Premium or Private Banking cards)

- South African residency: Must be a citizen or have a valid residency permit

- Credit history: A good credit record improves approval chances

- Employment status: Must be employed or have a regular income source

Required Documents

- South African ID or valid passport (for non-citizens)

- Latest payslip or proof of income (e.g. three months’ bank statements)

- Proof of residence (utility bill or bank statement not older than three months)

- Completed application form (online or at an Absa branch)

Simulation of a Credit Card at Absa

Applying for an Absa credit card is a simple process. Follow these steps:

Step 1. Compare Absa’s options and select one that fits your needs.

Step 2. Check eligibility criteria and documents needed.

Step 3. Complete the online application by clicking “Apply”.

Step 4. Gather Required Documents: Prepare ID, proof of income, and proof of residence.

Step 5. Wait for Approval: Absa will assess your creditworthiness and provide feedback.

Step 6. Receive Your Card: If approved, collect your card or have it delivered.

Step 7. Activate and Use: Activate via the Absa Banking App or call customer service.

Eligibility Check

Absa provides several ways for applicants to check their eligibility before applying for a credit card. Customers can use the online credit card eligibility checker available on Absa’s website to get an estimate of their approval chances. Those who prefer in-person assistance can visit an Absa branch and speak with a consultant about pre-approval. Another option is to request a credit score assessment, which helps determine whether they meet the bank’s credit requirements. These tools allow customers to assess their suitability in advance, helping them avoid unnecessary applications and potential rejection.

How Much Can I Borrow with an Absa Credit Card?

The credit limit on an Absa credit card depends on the applicant’s income, credit history, and the specific card chosen. The minimum credit limit varies by card type, but generally, entry-level cards such as the Flexi Core Credit Card offer lower limits, while premium cards provide higher spending power. Customers with a good credit score and higher income may qualify for a higher credit limit, which is determined during the application process. For those who need an increase later, Absa allows credit limit adjustments based on affordability assessments.

Receive Offers

Absa creates personalised credit card offers by evaluating an applicant’s financial profile, income, and credit history. When applying, customers are assessed to determine which credit card suits their financial situation. Those with higher earnings and strong credit scores may receive offers for premium cards with exclusive benefits, while individuals with moderate income or limited credit history may be offered more basic options. Existing customers may also receive pre-approved offers based on their banking activity with Absa.

How Long Does It Take to Receive My Credit Card from Absa?

The processing time for an Absa credit card varies, but applications are usually approved within a few business days if all required documents are submitted correctly. Once approved, customers can expect their physical card to be delivered within five to seven working days, depending on their location.

Several factors can affect the processing time. Incomplete applications or missing documents may cause delays, as Absa will need to request additional information. Creditworthiness assessments and affordability checks also influence how long it takes to get a decision. Customers who apply online and meet all criteria are likely to receive faster approval than those who apply in-branch with manual verification.

How Do I Repay My Absa Credit Card?

Absa provides multiple repayment options to ensure cardholders can manage their balances effectively. Customers can set up a debit order to automate monthly payments, helping to avoid missed deadlines. Manual payments can be made via online banking, the Absa Banking App, ATM deposits, or direct transfers from an Absa or external bank account.

Repayments are subject to minimum monthly payments, which must be settled to keep the account in good standing. Customers who do not pay their full outstanding balance will incur interest charges on the remaining amount. Late or missed payments may lead to penalty fees and a negative impact on the customer’s credit score. Absa also allows budget facility options for large purchases, where repayments can be spread over a fixed period with structured interest rates.

Pros and Cons of Absa Credit Cards

Pros

- Variety of options: Absa offers different credit cards suited for various financial needs, from entry-level to premium banking.

- Interest-free period: Customers can benefit from up to 57 days of interest-free purchases if balances are settled in full.

- Rewards and cashback: Certain cards offer Absa Rewards, allowing cardholders to earn cashback or points on qualifying transactions.

- Security features: Cards come with fraud protection, contactless payments, and virtual card options for safer transactions.

- Travel benefits: Premium cardholders receive free travel insurance, airport lounge access, and concierge services.

- Flexible repayments: Multiple repayment options, including debit orders, manual payments, and budget facility plans.

- Easy digital management: The Absa Banking App allows users to track expenses, manage limits, and freeze/unfreeze cards.

Cons

- Interest rates can be high: If the balance is not paid in full, interest charges on outstanding amounts can add up quickly.

- Monthly fees apply: Even for basic cards, a monthly service fee is charged, which can add to costs.

- Strict credit approval process: Those with low credit scores or irregular income may find it harder to qualify.

- Foreign transaction fees: Using an Absa credit card abroad incurs additional charges on international purchases.

- Late payment penalties: Missing a payment can lead to penalty fees and a negative impact on credit scores.

Customer Service

If you have further questions about Absa credit cards, there are multiple ways to contact their customer service team. Customers can visit an Absa branch for in-person assistance, call the Absa Credit Card Helpline, or use live chat and support features on the Absa Banking App. The bank also provides detailed FAQs on its website, covering common enquiries about card usage, fees, and repayment options. For urgent matters, customers can contact the 24/7 fraud and lost card helpline to report stolen or compromised cards.

Absa Credit Card Services Contact Channels

If you have further questions about Absa credit cards, you can reach their customer service through various channels:

Phone number:

Phone: 0861 462 273

Email: contactcard@absa.co.za

Lost or Stolen Cards:

Phone: 0800 111 155 or +27 (0) 11 501 5050 (International)

Hours of operation:

Hours: 7 days a week, 08:00 – 17:00

Online Reviews of Absa

Customer feedback on Absa’s credit card services is mixed. On platforms like Hellopeter, Absa holds a rating of 2.9 out of 5, based on over 40,000 reviews. Some customers express dissatisfaction with aspects such as service quality and fee structures. For instance, a user reported challenges when attempting to increase their credit limit, highlighting communication issues within the credit card division.

Conversely, discussions on forums like Reddit reveal that some users find value in Absa’s offerings, though opinions vary widely. One user mentioned paying R170 per month for their Gold debit and credit accounts and questioned the bank’s reputation, while others shared their experiences with different banks for comparison.

Alternatives to Absa

For those exploring other credit card options in South Africa, several banks offer competitive products:

Comparison Table

Below is a side-by-side comparison of Absa’s Premium Banking Credit Card with top competitors:

| Feature | Absa Premium Banking Credit Card | Capitec GlobalOne Credit Card | FNB Gold Credit Card | Standard Bank Titanium Credit Card |

|---|---|---|---|---|

| Initiation Fee | R166.45 | R100 | R175 | R180 |

| Monthly Fee | R59 | R40 | From R89 | R74 |

| Interest Rate | Up to 17.5% | 7% to 17.5% | Personalised | Personalised |

| Interest-Free Period | Up to 57 days | Up to 55 days | Up to 55 days | Up to 55 days |

| Rewards Program | Cashback rewards | None | eBucks Rewards | Discounts on various services |

| Travel Benefits | Travel insurance, lounge access | None | Travel insurance | Travel insurance, discounts |

History and Background of Absa

Absa Group Limited, formerly known as the Amalgamated Banks of South Africa, was established in 1991 through the merger of UBS Holdings, the Allied and Volkskas Groups, and certain interests of the Sage Group. In 1992, Absa expanded by acquiring the Bankorp Group, which included TrustBank, Senbank, and Bankfin. The name was changed to Absa Group Limited in 1997. In 2005, Barclays acquired a majority stake in Absa, leading to a rebranding as Barclays Africa Group. However, by 2018, Barclays had reduced its shareholding, and the group rebranded back to Absa Group Limited. Today, Absa operates in 12 countries across Africa, offering a range of financial services.

Absa’s mission is to be a customer-focused financial services group in targeted market segments. The company’s vision is to be a leading Pan-African bank delivering sustainable outperformance. Absa is committed to empowering Africa’s tomorrow by making a positive contribution to the world around them, putting their purpose at the core of everything they do.

Conclusion

Absa offers a diverse range of credit cards tailored to meet various financial needs, from entry-level options to premium services. While the bank provides numerous benefits, including rewards programs and flexible repayment options, it’s essential for potential customers to carefully consider the associated fees and terms. By evaluating individual financial situations and comparing alternatives, consumers can make informed decisions that best suit their needs.

Frequently Asked Questions

Absa provides a range of credit cards suited for different financial needs, including entry-level, gold, platinum, and premium options. Each card comes with unique benefits such as cashback rewards, travel perks, and purchase protection.

To qualify for an Absa credit card, you typically need to meet certain income requirements, have a good credit history, and provide necessary documents such as proof of income, bank statements, and a valid ID. The eligibility criteria may vary depending on the specific card you apply for.

Your credit limit is determined based on factors such as your income, credit score, and financial history. Absa assesses your affordability before assigning a limit, and you may request an increase after demonstrating responsible usage over time.

Yes, Absa credit cards offer various rewards and benefits, including Absa Rewards points, travel insurance, fuel discounts, and exclusive shopping deals. Higher-tier cards typically offer more perks, such as VIP airport lounge access and concierge services.

You can apply online through the Absa website, visit a branch, or contact customer service. The application process involves submitting personal and financial details, after which Absa will review your eligibility and provide feedback on approval.