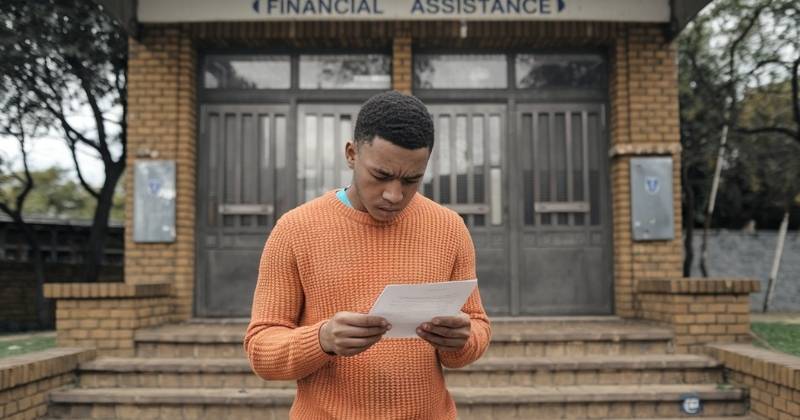

The South African Social Security Agency (SASSA) has taken decisive action to address concerns over fraudulent activities linked to the Covid-19 Social Relief of Distress (SRD) grant. The agency has temporarily suspended payments to accounts flagged as suspicious, requiring affected beneficiaries to verify their details before payments can resume. This move aims to safeguard public funds and ensure that only eligible individuals receive financial assistance.

Key Takeaways

- SASSA has suspended SRD grant payments to flagged accounts: The agency has halted payments to suspected fraudulent recipients, requiring them to verify their details before funds can be released. This step aims to prevent unauthorised claims and ensure financial assistance reaches legitimate beneficiaries.

- An investigation confirmed security vulnerabilities in SASSA’s online system: Findings from Stellenbosch University students exposed weaknesses in the SRD grant application platform, prompting a parliamentary probe. The investigation validated concerns that these flaws could be exploited for fraudulent activities.

- Authorities suspect organised fraud syndicates are involved: Officials believe that a significant portion of flagged applications may be linked to coordinated fraud rings using stolen identity details to claim grants unlawfully. While SASSA urges vigilance, critics warn that some genuine applicants are being unfairly impacted by the crackdown.

About Arcadia Finance

Need a hassle-free loan? Arcadia Finance connects you with 19 reputable lenders—fully compliant with South Africa’s National Credit Regulator—without any application fees. Quick, secure, and designed to suit your financial needs.

Verification Process to Prevent Fraud

SASSA spokesperson Paseka Letsatsi stated that the suspension is a necessary step to maintain the integrity of the grant system. By temporarily halting payments to questionable accounts, the agency seeks to prevent unauthorised individuals from exploiting the relief fund. Letsatsi emphasised the importance of beneficiaries taking responsibility for safeguarding their personal information, particularly their identity numbers, to prevent fraudulent use by third parties.

He urged recipients to remain vigilant and avoid sharing their identity details with strangers, as doing so could inadvertently enable criminal activities. SASSA officials suspect that criminal syndicates may be behind a significant portion of these fraudulent claims, using stolen identity numbers to siphon off grant payments meant for those in genuine need. According to SASSA, fraudsters often exploit unsuspecting grant recipients by unlawfully using their credentials to claim funds to which they are not entitled.

Grant fraud is a growing concern, and SASSA has been tightening security to combat unauthorised claims. Read about Fraud in SASSA Grants to understand the various schemes that have led to benefit suspensions and how authorities are cracking down on abuse.

Action Required for ‘Referred’ Cases

Letsatsi further advised that beneficiaries whose SRD grant application status is marked as “referred” should act immediately by contacting the agency for assistance. The “referred” status indicates that SASSA’s verification system has detected potential fraudulent activity linked to the applicant’s profile, prompting further investigation before any payments can be processed.

Affected individuals are encouraged to reach out to SASSA as soon as possible to resolve any issues and provide any necessary verification documents. Failure to do so may result in prolonged delays or even permanent suspension of the grant. Some affected beneficiaries have expressed frustration over the process, claiming that their applications were flagged incorrectly, leaving them without crucial financial support. Critics argue that SASSA’s fraud detection system, while necessary, may be inadvertently penalising genuine applicants in need of urgent assistance.

Banking Details Should Not Be Changed

As part of the agency’s measures to streamline payments and avoid unnecessary delays, Letsatsi advised beneficiaries against making changes to their banking details unless absolutely necessary. He explained that altering banking information within the system could lead to processing delays, further complicating the disbursement of funds.

Grant recipients were urged to maintain their current banking details to facilitate smooth transactions and avoid disruptions to their financial assistance.

This advisory comes amid growing concerns that fraudsters are targeting vulnerable beneficiaries, coercing them into changing banking details so that the funds are redirected to illicit accounts. Authorities have warned grant recipients to be cautious of individuals offering “help” with SASSA applications, as these scammers often have ulterior motives.

Your SASSA grant could be delayed if your banking details aren’t correctly submitted. Ensure you receive your SRD grant on time by following this guide on Submit Banking Details to SASSA. Avoid payment disruptions and get the financial support you need without unnecessary hassle.

Stellenbosch Students Expose System Vulnerability

Concerns over fraudulent activities in SASSA’s grant distribution system are not new. In October, two first-year students from Stellenbosch University raised alarms about security vulnerabilities in the agency’s online application system. Their findings suggested that weaknesses in the system could be exploited, potentially allowing unauthorised individuals to access and manipulate grant applications.

Following these allegations, Parliament instructed the Minister of Social Development, Sisisi Tolashe, to conduct a thorough investigation within 30 days. Tolashe’s department complied, submitting a detailed report a month later. The findings sent shockwaves through government circles, raising questions about how long these vulnerabilities had existed and whether past fraudulent activities had slipped through undetected. Calls for urgent reforms within SASSA’s digital infrastructure have since intensified.

Investigation Confirms Security Weaknesses

In her report to Parliament, Tolashe confirmed that the students’ concerns were valid. The department’s investigation team found that weaknesses within the SRD grant web application posed risks to both the security and functionality of the system. These vulnerabilities, if left unaddressed, could have made the platform susceptible to fraudulent activities, further compromising the integrity of the grant disbursement process.

SASSA has since committed to addressing these security concerns while reinforcing its fraud detection measures. The agency continues to urge beneficiaries to remain cautious and report any suspicious activities related to their grant payments. Despite these assurances, scepticism remains high, with critics questioning whether SASSA has the capacity to fully secure its systems against sophisticated fraud operations. Some believe that unless drastic changes are implemented, the risk of exploitation will persist, leaving both the agency and rightful beneficiaries vulnerable to further financial losses.

Conclusion

SASSA’s decision to suspend potentially fraudulent SRD grant payments highlights the growing concern over social grant fraud in South Africa. While the agency insists that these measures are necessary to protect public funds, the move has also sparked frustration among some beneficiaries who claim to be wrongly affected. The revelation of security weaknesses in SASSA’s digital platform has only added to the controversy, raising questions about how effectively the agency can safeguard grant payments in the future. As investigations continue and security upgrades are promised, the challenge remains to strike a balance between preventing fraud and ensuring that those in genuine need do not suffer unnecessary delays.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.