Woolworths Financial Services (WFS) offers credit cards designed to provide exclusive shopping benefits, rewards, and flexible repayment options for South African consumers. Whether you frequently shop at Woolworths or want a credit card with added perks, the Woolworths Credit Card comes with a range of features, including cashback rewards, in-store discounts, and interest-free periods. However, understanding the fees, interest rates, and overall value is essential before applying.

Woolworths Credit Card – Overview

| Name | Woolworths Credit Card |

|---|---|

| Financial Institution | Woolworths Financial Services (WFS), backed by Absa |

| Product | Credit Card with Rewards and Shopping Benefits |

| Minimum Age | 18 years |

| Minimum Credit Limit | Subject to affordability assessment |

| Maximum Credit Limit | Determined based on income and creditworthiness |

| Minimum Term | Revolving credit, with monthly repayments required |

| Maximum Term | Ongoing, with budget facility for extended repayment terms |

| APR (Annual Percentage Rate) | Varies based on credit profile and card type |

| Monthly Interest Rate | Subject to National Credit Act (NCA) regulations, varies per applicant |

| Early Settlement | Full balance can be paid at any time without penalties |

| Repayment Flexibility | Options include full monthly settlement, minimum payment, or budget instalments |

| NCR Accredited | Yes |

| Our Opinion | ✅ Exclusive Woolworths rewards and cashback benefits ✅ Flexible repayment options with interest-free periods ⚠️ Best suited for frequent Woolworths shoppers due to reward structure |

| User Opinion | ✅ Good for earning cashback on Woolworths purchases ⚠️ Interest rates may be higher compared to some traditional bank credit cards |

What Makes the Woolworths Credit Card Unique?

The Woolworths Credit Card stands out because of its exclusive shopping rewards and tailored benefits for Woolworths customers in South Africa. Unlike standard bank-issued credit cards, this card is integrated with the Woolworths WRewards programme, allowing cardholders to earn cashback, discounts, and special offers on groceries, fashion, homeware, and beauty products. This means frequent shoppers at Woolworths can save money on everyday purchases while enjoying additional perks such as extended interest-free periods and exclusive promotions. The card also offers budget-friendly repayment options, making it suitable for those who want flexibility in managing their spending.

Another unique aspect of the Woolworths Credit Card is its affordable fee structure compared to many retail credit cards. With competitive interest rates and low monthly account fees, it provides good value for those who primarily shop at Woolworths and its partner stores. Cardholders also benefit from free additional cards for family members, secure online shopping features, and access to lifestyle perks such as travel insurance and dining discounts. Woolworths Financial Services has made the application process simple and quick, with online and in-store options available, ensuring accessibility for a wide range of customers.

Retail credit cards often come with unique perks, but how do they compare? Our RCS Group Credit Card Review breaks down another popular store-linked credit card, helping you decide which offers the most value.

About Arcadia Finance

Finding the right loan has never been easier with Arcadia Finance. We connect you with 19 reputable lenders—each compliant with South Africa’s National Credit Regulator—without charging any application fees. Trust us for a smooth and secure borrowing experience.

Types of Woolworths Credit Cards

Woolworths Financial Services provides different credit card options tailored to various spending habits and financial needs. Each card comes with exclusive benefits designed for regular Woolworths shoppers who want to maximise their savings.

Woolworths Gold Credit Card

Monthly fee: R65

Minimum monthly income: R3 000

The Woolworths Gold Credit Card is the entry-level option, ideal for those looking for a basic credit card with Woolworths-specific rewards. Cardholders can earn cashback on Woolworths purchases through the WRewards programme, making everyday shopping more rewarding. Discounts on selected items and exclusive in-store promotions provide additional savings, allowing customers to spend less on essential goods. The card also offers interest-free credit for a set period, making short-term purchases more affordable and manageable.

This credit card is well-suited for first-time credit card users or individuals who prefer a straightforward, low-maintenance card for everyday spending at Woolworths. It provides a simple way to benefit from Woolworths rewards without complex terms or high fees.

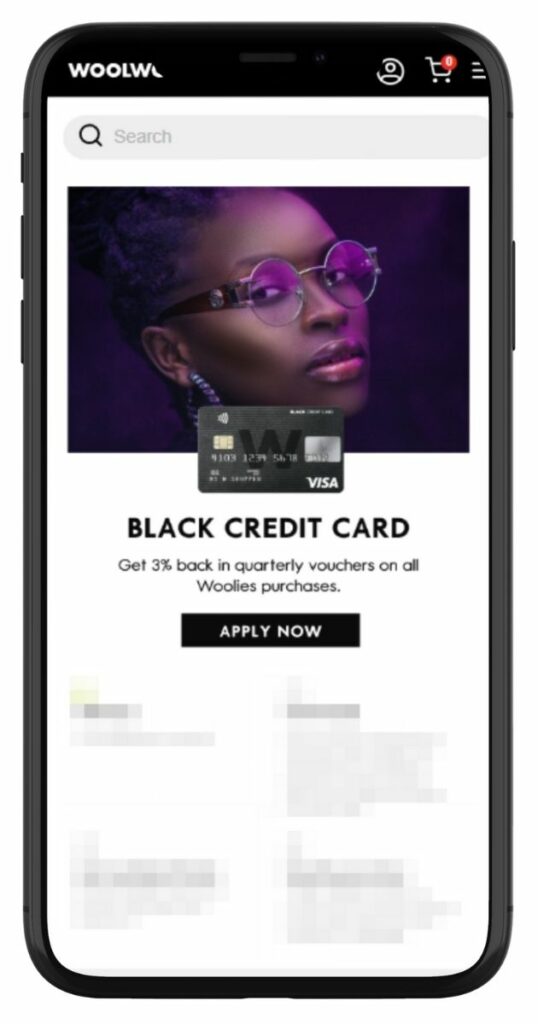

Woolworths Black Credit Card

Monthly fee: R69

Minimum monthly income: R41 666

The Woolworths Black Credit Card is a premium option that provides higher rewards and additional perks. Customers who use this card can access increased cashback rates on Woolworths and partner store purchases, allowing them to save more with every transaction. Exclusive discounts on fashion, beauty, and homeware add further value for frequent shoppers. This card also includes extended interest-free periods and lower interest rates on outstanding balances, offering greater financial flexibility.

In addition to retail savings, the Black Credit Card includes travel benefits such as travel insurance and access to airport lounges, making it a suitable choice for those who travel frequently. This card is best suited for frequent shoppers who want enhanced savings and premium perks, as well as individuals who enjoy travel and dining benefits.

Both Woolworths credit cards come with secure online payment options, budget-friendly repayment plans, and additional features such as balance protection cover. The right choice depends on individual spending habits, lifestyle, and how often the card is used for Woolworths purchases.

Not sure if a Woolworths credit card is your best option? South Africa offers a variety of competitive credit cards tailored to different needs, from cashback rewards to travel perks. Our detailed guide on the best credit cards in South Africa will help you compare Woolworths’ offerings with other top-rated cards to make an informed decision.

Requirements for a Woolworths Credit Card

To apply for a Woolworths Credit Card, applicants must meet specific criteria. The minimum age requirement is 18 years old, and applicants must be South African citizens or permanent residents. A stable income is necessary, with proof of employment or self-employment required during the application process. Woolworths Financial Services also conducts a credit check to assess financial stability and determine eligibility.

Documents and Information Needed

Applicants must provide a valid South African ID or passport (if a foreign national with residency status). Proof of income, such as recent payslips or bank statements, is required to verify financial capacity. A proof of residence, not older than three months, must also be submitted to confirm the applicant’s physical address. For self-employed individuals, additional documents such as business registration papers or tax clearance certificates may be needed.

Simulation of a Woolworths Credit Card

Woolworths Financial Services provides an online credit calculator that allows potential applicants to estimate their monthly instalments and repayment terms based on the requested credit limit. This tool helps in understanding the affordability of the credit card before applying.

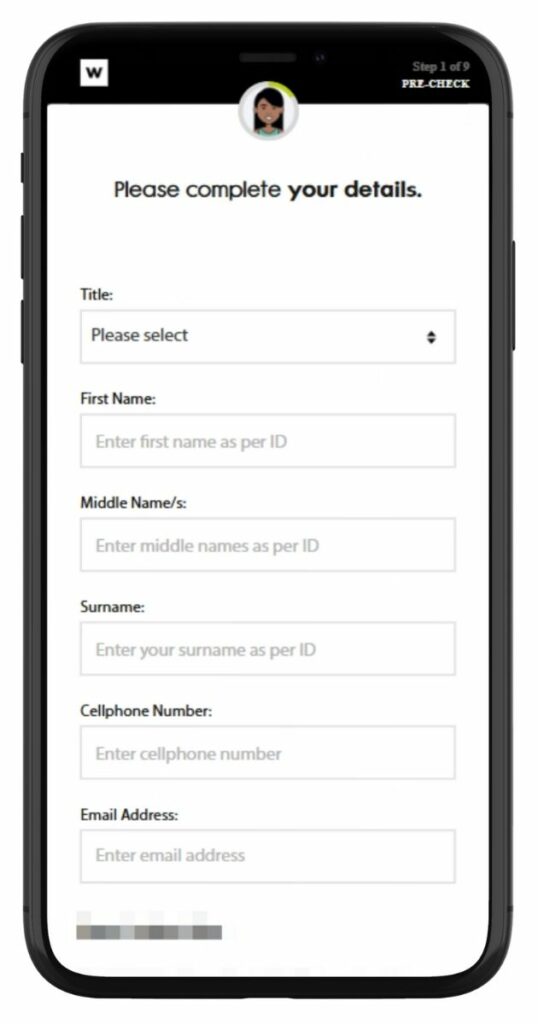

How to Apply for a Woolworths Credit Card

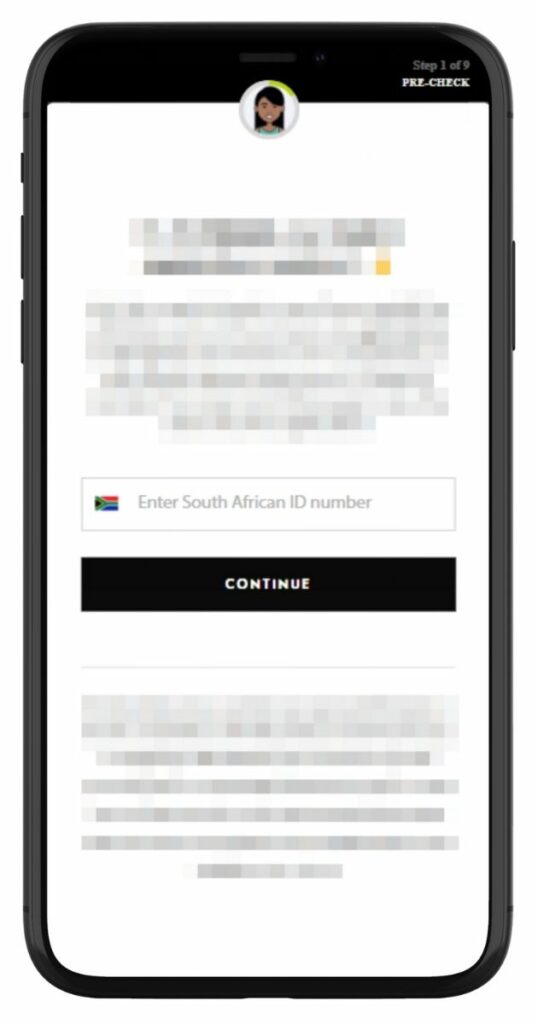

Step 1. Visit the Woolworths website.

Step 2. Click “Apply Now” to start your application.

Step 3. Input South African ID number to proceed.

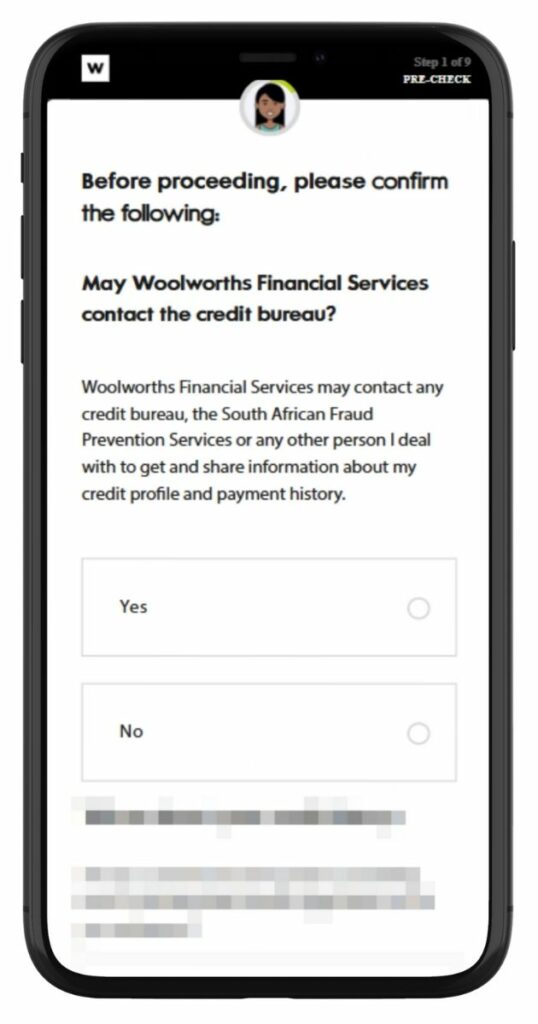

Step 4. Consent to Woolworths contacting the credit bureau.

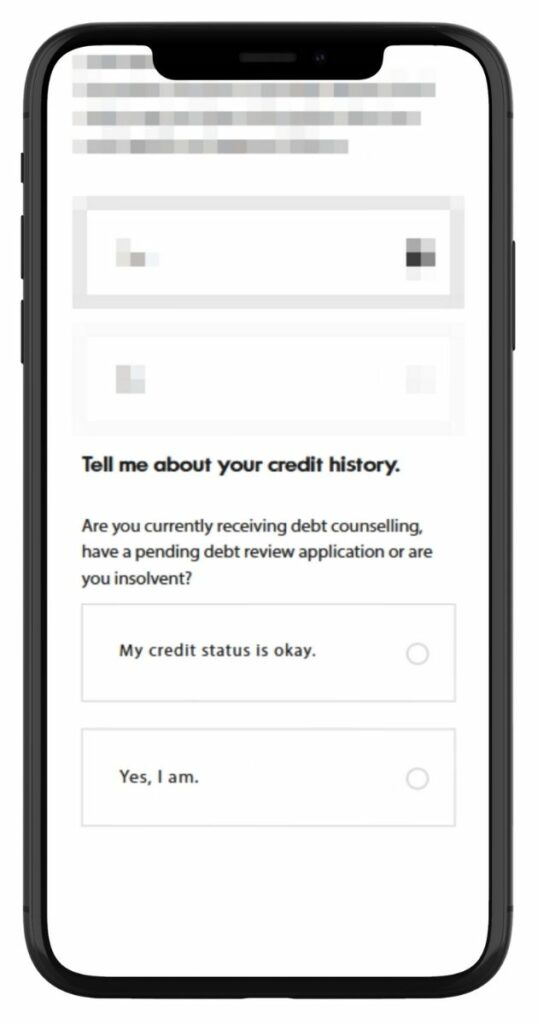

Step 5. Confirm if you are under debt review or financially stable.

Step 6. Choose whether to enroll in Woolworths’ rewards program.

Step 7. Fill in your title, name, phone number, and email.

Step 8. Woolworths will assess your credit profile to determine approval.

Step 9. If approved, you will receive your credit limit and repayment terms.

Step 10. Accept the terms and conditions before activating the card.

Step 11. Activate Your Card – Once activated, the card is ready for use.

Eligibility Check

Woolworths Financial Services provides a pre-qualification tool that allows applicants to check whether they meet the minimum requirements without affecting their credit score. This tool gives an indication of potential approval before formally submitting an application. Customers can also visit Woolworths branches to speak to a consultant for a manual eligibility check based on their financial details.

Wondering how Woolworths Credit Cards compare to others in the market? Our Sanlam Credit Card Review breaks down features, fees, and benefits to help you decide which card suits your lifestyle best.

How Much Credit Can I Request from Woolworths Credit Card?

Woolworths Credit Card limits vary based on income, credit history, and affordability assessment. The minimum credit limit is typically set at a lower amount to accommodate first-time cardholders or those with moderate income levels. The maximum credit limit is determined by Woolworths Financial Services based on the applicant’s financial profile, ensuring responsible lending. Customers with a strong credit score and stable income may qualify for a higher credit limit, subject to approval.

Woolworths offers more than just credit cards—their retail finance also includes store loans. If you’re curious about their lending services, dive into our full Woolworths Lender Review for everything you need to know, from repayment terms to approval criteria.

How Woolworths Creates Personalised Credit Card Offers

Woolworths Financial Services assesses each applicant individually to determine a suitable credit limit and interest rate. The evaluation includes income verification, credit score analysis, and spending patterns. Based on these factors, Woolworths tailors personalised offers that align with the customer’s financial situation, ensuring affordability. Approved applicants receive their credit limit, repayment terms, and applicable interest rates as part of their offer.

How Long Does It Take to Receive a Woolworths Credit Card?

The approval and card issuance process typically takes a few working days. Online applications are processed faster, with applicants receiving an initial response within 24 to 48 hours. If additional verification is required, such as income or address confirmation, processing may take longer. Once approved, card delivery and activation generally occur within 5 to 7 business days.

Several factors can affect processing times, including the accuracy of submitted documents, credit profile verification, and application volume. Applicants who apply in-store may experience slightly quicker processing, depending on document submission and assessment speed.

How to Repay a Woolworths Credit Card

Woolworths provides flexible repayment options to suit different financial needs. Cardholders can repay their balance in full each month to avoid interest charges or opt for a budget repayment plan to spread payments over several months. Monthly instalments can be paid via debit order, EFT, direct deposit, or at Woolworths stores.

Failure to make minimum monthly payments on time may result in late payment penalties and additional interest charges. If an account remains unpaid for an extended period, Woolworths Financial Services may impose collection fees or take further action. Exceeding the assigned credit limit may also result in over-limit fees. It is recommended that cardholders monitor their spending and choose a repayment plan that suits their budget to avoid unnecessary costs.

If you’re struggling with high-interest credit card debt, you may be wondering whether a personal loan could be a better solution. Taking out a loan to consolidate credit card debt can sometimes lower your interest rate and simplify payments. Learn more about the pros and cons in our article Should I Pay Off My Debt with a Loan?.

Pros and Cons of a Woolworths Credit Card

Pros

- Exclusive Woolworths Rewards: Cardholders earn cashback and discounts through the WRewards programme, making everyday shopping more affordable.

- Interest-Free Period: Offers an interest-free period for qualifying purchases, helping manage short-term expenses.

- Affordable Fees: Monthly account fees are lower compared to some other retail credit cards in South Africa.

- Flexible Repayment Options: Customers can choose between full monthly payments or budget plans to spread costs over time.

- Secure Transactions: Includes chip-and-PIN technology, virtual card options, and fraud protection for safer spending.

- Free Additional Cards: Secondary cards for family members can be issued at no extra cost.

Cons

- Limited Usability: Best suited for Woolworths shoppers, as rewards and benefits are primarily tied to Woolworths purchases.

- Potentially High Interest Rates: Interest rates may be higher compared to traditional bank-issued credit cards, especially for cash withdrawals.

- Fees for Late Payments: Missing payments results in penalty fees and additional interest charges.

- Limited Premium Benefits: Compared to premium bank credit cards, travel and lifestyle perks are not as extensive.

Customer Service

For any questions or assistance with a Woolworths Credit Card, customers can contact Woolworths Financial Services through multiple support channels. The customer service team is available via phone, email, and in-store consultations for queries related to applications, payments, interest rates, and credit limits. Woolworths also provides online account management, allowing cardholders to check balances, make payments, and monitor transactions through a secure digital platform.

For direct assistance, customers can visit their nearest Woolworths store or contact Woolworths Financial Services through their official website.

Contact Channel

Phone number:

Woolworths Online: 0860 100 987

In-Store Card: 0861 50 20 20

Credit Card: 0861 50 20 05

Email Addresses:

Woolworths Online: shop@woolworths.co.za

Financial Services: queries@woolworths.co.za

General Enquiries: custserv@woolworths.co.za

Postal address:

Woolworths House, 93 Longmarket Street, Cape Town, 8001, South Africa

Online Reviews of Woolworths Credit Cards

Customer feedback on Woolworths Credit Cards presents a mix of positive and negative experiences. On platforms like HelloPeter, some users have expressed dissatisfaction with the financial services, citing issues such as poor service and incorrect settlement amounts.

Additionally, reviews.io reports an average rating of 1.5 out of 5 for Woolworths SA, with only 11% of reviewers recommending their services.

Conversely, discussions on Reddit highlight some benefits of the Woolworths Black Credit Card, including a 17.5% interest rate, 55 days interest-free period, quarterly cashback vouchers, and complimentary monthly coffee vouchers.

These mixed reviews suggest that while some customers appreciate the rewards and benefits, others have concerns regarding service quality and fees.

Alternatives to Woolworths Credit Cards

Several other banks in South Africa offer credit cards with competitive features. Here are some notable alternatives:

Comparison Table

| Feature | Woolworths Gold Credit Card | Capitec Credit Card | Sanlam Money Saver Credit Card | Discovery Bank Gold Credit Card | FNB Aspire Credit Card | Standard Bank Gold Credit Card |

|---|---|---|---|---|---|---|

| Monthly Fee | R50.50 | Low | Low | R30 | R45 | R23 |

| Interest Rate | 21% | Not specified | Not specified | From 2% | Personalised | From 11.75% |

| Cashback Rewards | 2% on Woolworths purchases | 1% on all purchases | 2.5% effective rate | Up to 75% on healthy groceries | Not specified | Not specified |

| Interest-Free Period | Not specified | Not specified | Not specified | Up to 55 days | Not specified | Not specified |

| Additional Benefits | WRewards discounts | No frills | No loyalty tiers | Travel insurance, Discovery Miles | Debt protection | Free travel insurance |

| More Info | Capitec Credit Card Review | Discovery Credit Card Review | FNB Credit Card Review | Standard Bank Credit Card Review |

History and Background of Woolworths

Woolworths Holdings Limited, established in 1931, is a prominent South African retail company known for offering high-quality clothing, food, and homeware. Over the decades, Woolworths has expanded its footprint, becoming a household name synonymous with quality and innovation in retail.

In 2000, Woolworths Financial Services was founded as a joint venture between Woolworths Holdings and Absa Group, aiming to provide tailored financial products to its customers. This collaboration has enabled Woolworths to offer a range of credit solutions, including the Gold and Black Credit Cards, designed to enhance customer loyalty and provide added value through exclusive rewards and benefits.

The company’s mission is to deliver sustainable value to its stakeholders by offering superior products and services while maintaining a commitment to ethical practices and social responsibility. Woolworths envisions being a leading retailer in the southern hemisphere, renowned for setting standards of excellence in quality, style, and value.

Conclusion

The Woolworths Credit Card offers exclusive shopping benefits, cashback rewards, and flexible repayment options, making it a practical choice for frequent Woolworths shoppers in South Africa. While it provides good value through discounts and interest-free periods, its benefits are most useful for those who primarily shop at Woolworths and partner stores. Customers considering this card should compare it with other credit card options to determine if it aligns with their financial needs. With affordable fees, secure transactions, and easy application processes, the Woolworths Credit Card remains a competitive option in the retail credit sector.

Frequently Asked Questions

Yes, the Woolworths Credit Card can be used at any retailer that accepts Mastercard, both locally and internationally. However, the best cashback and rewards are earned on purchases made at Woolworths stores.

Missed payments result in late payment fees and additional interest charges. If payments continue to be missed, Woolworths Financial Services may take further action, such as restricting the account or reporting to credit bureaus.

Cardholders can check their balance and recent transactions through the Woolworths Financial Services online portal, mobile app, or by contacting customer support.

Yes, customers can request a credit limit increase. Woolworths Financial Services will review the request based on income, credit history, and account repayment behaviour before approving a higher limit.

To cancel the card, customers must contact Woolworths Financial Services and request account closure. Any outstanding balance must be settled before the cancellation is processed.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.