Woolworths is a well-known name in South Africa, mainly recognised for its high-quality food, clothing, and home goods. However, Woolworths Financial Services (WFS) [Woolworths.wfs.co.za] also offers personal loans to help customers manage their short-term and long-term financial needs. Whether you’re dealing with unexpected expenses, planning a big purchase, or just looking for some breathing space in your budget, a personal loan can offer some relief. Woolworths Personal Loans are designed to be straightforward, with a focus on affordability and convenience.

Woolworths, through Woolworths Financial Services, offers personal loans with flexible repayment terms of up to 60 months. The loan amount and interest rate are based on your individual credit profile and affordability. If you’re looking for a reliable loan option with a quick and convenient application process, keep reading to see if a Woolworths Personal Loan is the right fit for your needs.

Woolworths Personal Loans: Quick Overview

Loan Amount: Up to R75 000

Loan Term: Up to 60 months

Interest Rate: Personalised rate based on credit profile (regulated by the National Credit Act)

Fees: Initiation fee and monthly service fee apply (amount varies by applicant)

Loan Types: Personal loans with a revolving credit option

About Arcadia Finance

Get your loan the easy way with Arcadia Finance. No application fees, access to 10 trusted lenders, and full compliance with South Africa’s National Credit Regulator. Fast, secure, and tailored to fit your financial goals.

Woolworths Personal Loans Full Review

What Makes Woolworths Personal Loans Unique?

Woolworths Personal Loans stand out due to their quick access to funds, with approved applicants receiving money within 48 hours. This speed is beneficial for those needing to address urgent financial needs promptly. Additionally, they offer flexible repayment terms, allowing borrowers to choose a schedule that aligns with their financial situation, making it easier to manage monthly budgets.

Another distinctive feature is the option to apply for additional funds on an existing loan, subject to credit approval. This flexibility is advantageous for borrowers who may require extra financial support during the loan term. Furthermore, they provide electronic statements, enabling customers to monitor their loan accounts conveniently.

Types of Loans Offered by Woolworths Financial Services

Revolving Personl Loans

Woolworths Financial Services offers a Revolving Personal Loan, designed to provide financial assistance for various needs. This loan is suitable for covering unexpected expenses such as medical bills, car repairs, or home maintenance. It can also be used for planned expenditures like funding a holiday or consolidating existing debts.

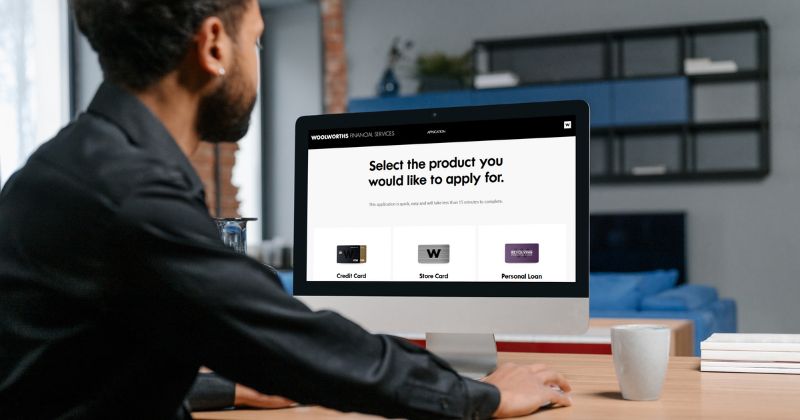

Credit Cards

In addition to personal loans, they offer Store Cards and Credit Cards. The Store Card allows customers to charge purchases directly to their account, with flexible repayment options. The Credit Card functions like standard credit cards, offering the convenience of cashless transactions and the benefit of earning Woolworths vouchers through spending.

Requirements for a Woolworths Personal Loan

To apply for a Woolworths Personal Loan, you need to meet the following criteria:

- Age: Be at least 18 years old.

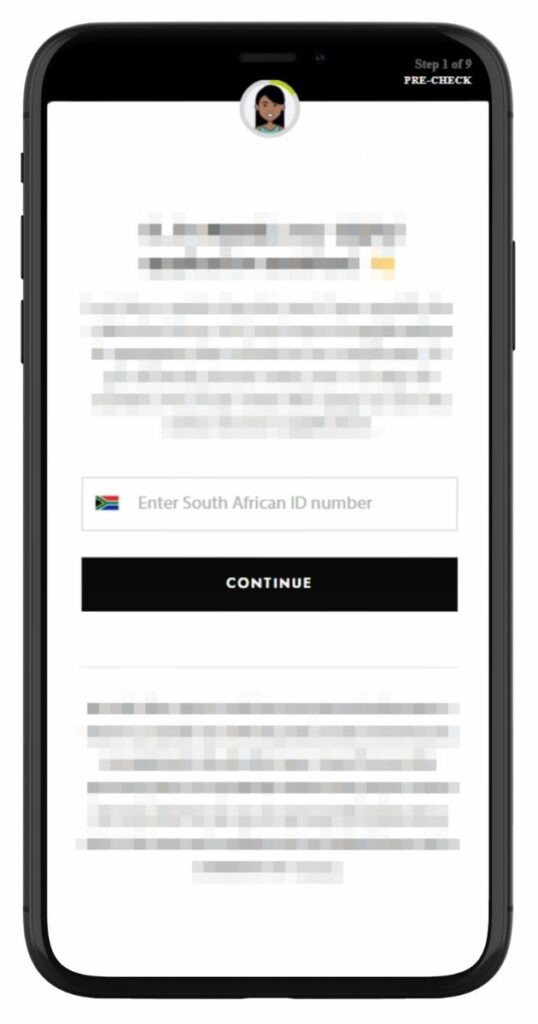

- Identification: Possess a valid South African ID.

- Income: Earn a minimum monthly income of R2 000.

- Proof of Income: Your latest three payslips or bank statements from the last three months.

These requirements ensure that applicants have a stable income and are capable of managing loan repayments.

Simulation of a Loan at Woolworths

Applying for a Woolworths Personal Loan at Woolworths.wfs.co.za involves the following steps:

Step 1. Choose ‘Personal Loan’ on the application page.

Step 2. Input your South African ID number to start the application.

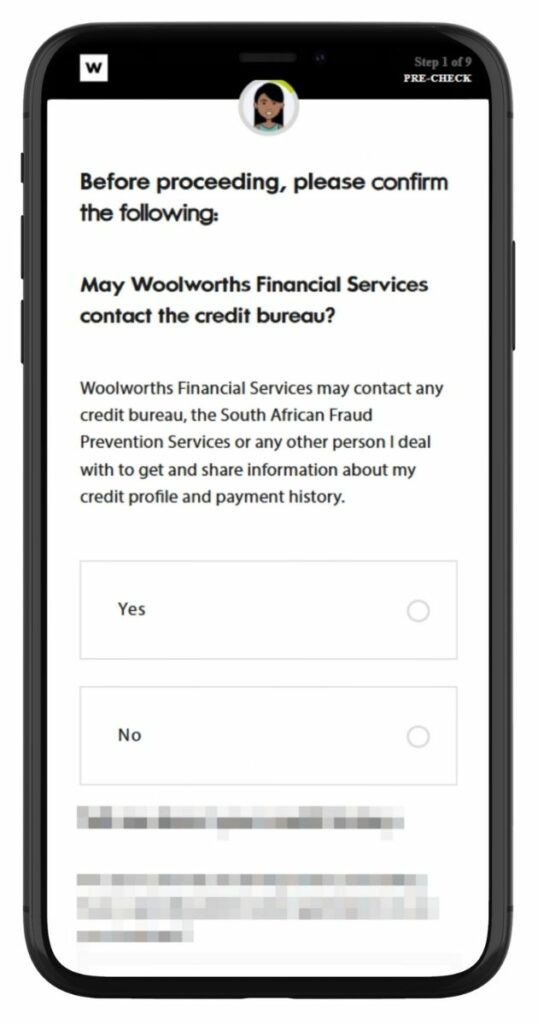

Step 3. Grant them permission to contact the credit bureau.

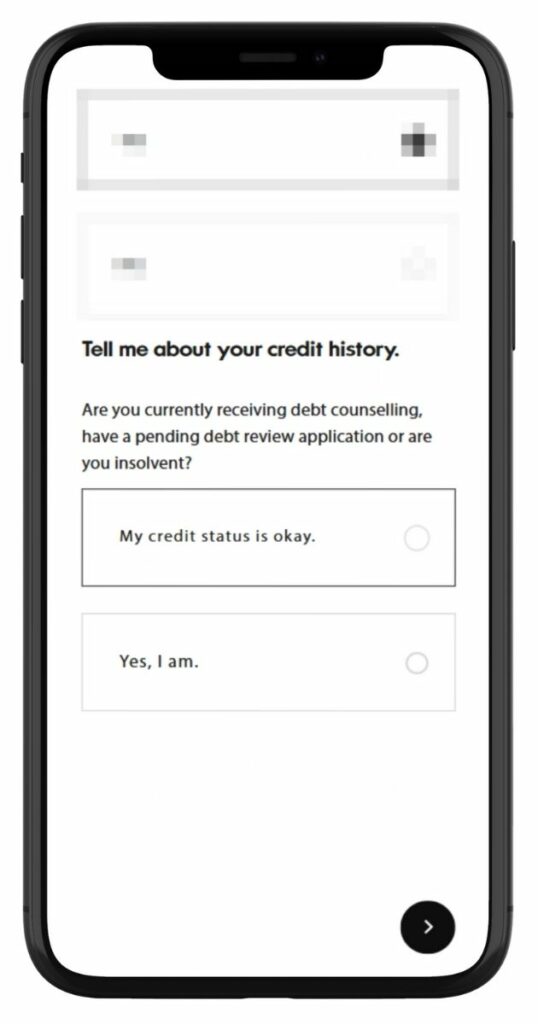

Step 4. Declare if you’re under debt review or if your credit status is okay.

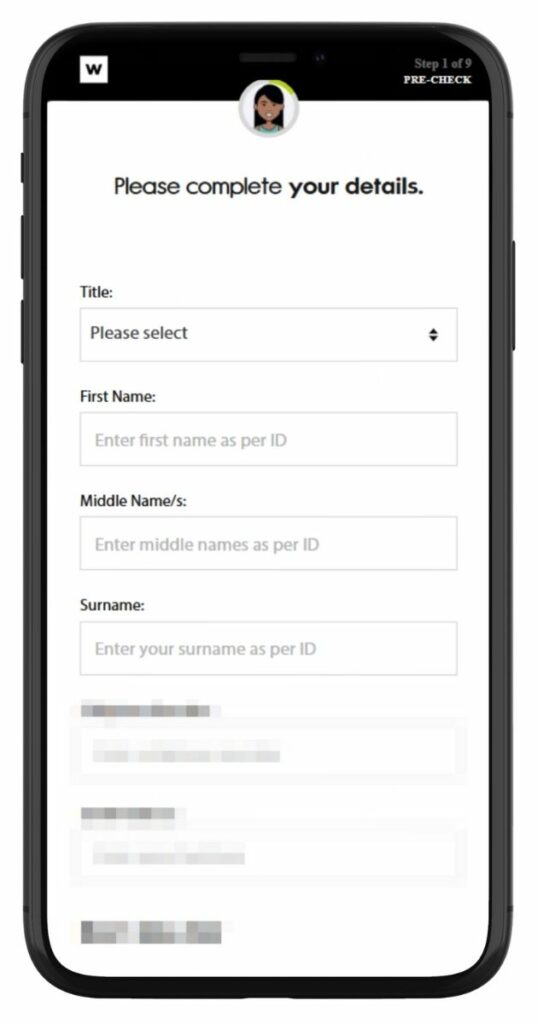

Step 5. Provide your title, full name, and ID-aligned personal info.

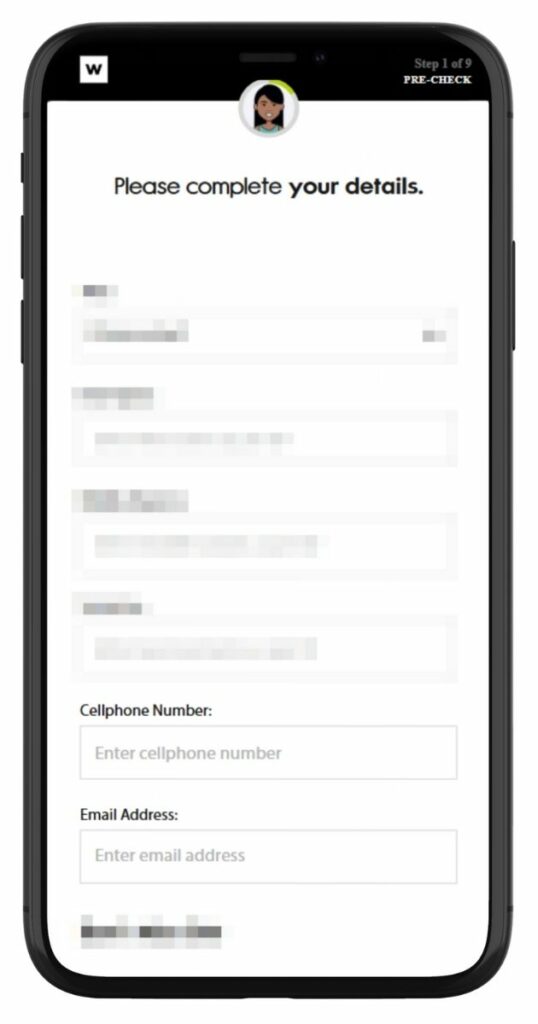

Step 6. Enter your address, contact number, and email address.

Step 6. Submit your proof of income as specified.

Step 7. Review all information and send in your application.

Eligibility Check

Woolworths does not explicitly mention an online tool for pre-checking loan eligibility. However, by reviewing the stated requirements—age, valid South African ID, and minimum income—you can self-assess your eligibility before applying. Ensuring you meet these criteria and have the necessary documentation ready can facilitate a smoother application process.

Who Are Woolworths Personal Loans Best Suited For?

Their Personal Loans are well-suited for individuals in South Africa who:

- Need a personal loan to cover planned or unexpected expenses

- Are permanently employed and earn a regular income

- Prefer a quick and convenient online application process

- Want access to additional funds during the loan term (subject to approval)

- Require flexible repayment terms of up to 60 months

Is Woolworths a Safe and Good Option for Personal Loans?

Woolworths Personal Loans, offered through Woolworths Financial Services (WFS), are fully regulated by the National Credit Regulator (NCR), making them a legitimate and reliable lending option in South Africa. These loans are tailored to meet a range of personal financial needs, with flexible repayment terms of up to 60 months. The application process is straightforward and can be completed online, with the main requirements being a valid South African ID, recent proof of income, and a bank account.

Woolworths aims to provide clear and responsible lending, with all applications subject to an affordability assessment. Interest rates and fees comply with the National Credit Act and are personalised based on the applicant’s financial profile. Once approved, loan funds are usually paid out within 48 hours, making this a practical choice for customers who need access to money relatively quickly. For those seeking a trusted, branded lender with a simple application process and flexible repayment structure, Woolworths Personal Loans present a suitable option.

How Much Money Can I Request from Woolworths?

You can request a personal loan from Woolworths South Africa ranging from R2 000 to R75 000, with flexible repayment terms between 12 and 60 months. The amount you qualify for will depend on your credit profile, income, and affordability assessment. They ensure all loans comply with the National Credit Act, offering a secure and transparent borrowing experience.

Receive Offers

Woolworths Financial Services creates personalised loan offers by assessing your individual financial profile. This includes evaluating your credit history, income, and existing financial commitments. By understanding your unique circumstances, they can offer loan terms that align with your ability to repay, ensuring responsible lending practices.

How Long Does It Take to Receive My Money from Woolworths?

Once your loan application is approved, Woolworths Financial Services strives to disburse funds promptly. The exact time frame can vary based on factors such as verification of provided documents and bank processing times. To facilitate a quicker process, ensure that all required documents are accurate and submitted promptly.

Woolworths Personal Loan – Overview in Detail

| Name | Woolworths Personal Loan |

|---|---|

| Financial Institution | Woolworths Financial Services (WFS) |

| Product | Personal Loan with Flexible Terms |

| Minimum Age | 18 years |

| Minimum Loan Amount | Not specified (subject to affordability assessment) |

| Maximum Loan Amount | R75 000 |

| Loan Term | Up to 60 months |

| APR (Annual Percentage Rate) | Varies based on credit profile; follows National Credit Act regulations |

| Monthly Interest Rate | Subject to NCA regulations; varies per applicant |

| Early Settlement | Can repay full balance at any time without penalties |

| Repayment Flexibility | Choose repayment term up to 60 months |

| NCR Accredited | Yes |

| Our Opinion | ✅ Flexible repayment terms ✅ Fast payout once approved ⚠️ Limited upfront info on loan amounts |

| User Opinion | ✅ Easy to apply online ⚠️ Interest rates depend on credit profile |

How Do I Repay My Loan from Woolworths?

Woolworths offers flexible repayment options to accommodate different financial situations. You can choose repayment terms of up to 60 months, allowing you to select a period that suits your budget. Repayments can typically be made via debit order, ensuring timely and convenient payments.

It’s essential to be aware of potential fees and penalties associated with your loan:

- Missed Payment Fees: If you miss one or more payments, they will notify you and charge a fee each time they must contact you regarding the missed payment.

- Initiation and Monthly Service Fees: They charge low initiation and monthly service fees for their personal loans.

Pros and Cons of Woolworths Personal Loans

Pros of Woolworths Loans

- Flexible Repayment Terms: Woolworths offers repayment periods of up to 60 months, allowing borrowers to select a term that suits their financial situation.

- Quick Access to Funds: Approved applicants can receive funds within 48 hours, which is beneficial for urgent financial needs.

- Revolving Credit Facility: Borrowers have the option to reuse funds that have been repaid, providing ongoing access to credit without reapplying.

- Low Fees: The loans come with low initiation and monthly service fees, making them more affordable over time.

- Early Settlement Flexibility: There are no penalties for early repayment, allowing borrowers to settle their loans ahead of schedule without extra costs.

Cons of Woolworths Loans

- Limited Loan Products: Woolworths primarily offers revolving personal loans, which may not suit borrowers seeking other types of credit, such as home or auto loans.

- Customer Service Concerns: Some customers have reported dissatisfaction with Woolworths’ loan department, citing issues with service quality and management responsiveness.

- High-Interest Rates: Depending on the borrower’s credit profile, the interest rates may be higher compared to other financial institutions.

Customer Service

If you still have questions about their Personal Loans, you can get in touch with Woolworths Financial Services directly. They also provide help with loan account queries, statements, repayment issues, or updating your contact details. Their support is available both online and telephonically, so you can reach them in a way that suits you.

Contact Channels

Phone number:

Office: 0861 50 20 20

Hours of operation:

Monday to Saturday: 7:30 am – 9:00 pm

Sunday: 8:00 am – 6:00 pm

Postal address:

Woolworths Financial Services 1st Floor, Block F Boulevard Office Park Searle Street Woodstock 7925

For inquiries related to Woolworths Personal Loans, you can reach Woolworths Financial Services through the following contact details:

Online Reviews of Woolworths Financial Services

Customer feedback on Woolworths Financial Services (WFS) is mixed, with some clients expressing dissatisfaction, particularly regarding loan products. On platforms like HelloPeter, a consumer review website, there are instances where customers have reported issues. For example, one customer described the customer service from the loan department as “pathetic” and advised against taking a revolving loan from Woolworths. Another review mentioned incorrect settlement amounts and poor customer service.

It’s worth noting that online reviews often represent individual experiences and may not reflect the overall customer satisfaction. Prospective borrowers should consider these reviews alongside other factors when evaluating WFS as a potential lender.

A bank will offer you a much lower settlement figure regardless of how much you owe, because you are settling with the financial institution. But Woolworths wants to suck a person dry and on top of that offer the worst customer service ever.

I will not advise anybody to take a revolving loan from Woolworths! The customer service from the loan department and the management is pathetic!

Alternatives to Woolworths Financial Services

When exploring personal loan options in South Africa, several other financial institutions offer competitive products:

- Capitec Bank: Known for its simplified banking solutions, Capitec offers personal loans with flexible repayment terms and competitive interest rates.

- African Bank: Provides a range of loan products tailored to individual needs, with transparent terms and conditions.

- Absa Bank: Offers personal loans with fixed repayments, allowing for better financial planning.

- First National Bank (FNB): Provides various loan options, including personal loans with flexible repayment periods.

When comparing loan offers, it’s essential to evaluate interest rates, repayment terms, fees, and customer service to determine the best fit for your financial situation.

Comparison Table

| Feature | Woolworths Financial Services | Capitec Bank | African Bank | Absa Bank | FNB |

|---|---|---|---|---|---|

| Loan Types | Personal Loans | Personal Loans | Personal Loans | Personal Loans | Personal Loans |

| Interest Rates | Personalised rates | Competitive rates | Transparent rates | Fixed rates | Flexible rates |

| Repayment Terms | Up to 60 months | Flexible terms | Tailored terms | Fixed repayments | Flexible periods |

| Application Process | Online and in-store | Online and in-branch | Online and in-branch | Online and in-branch | Online and in-branch |

| Customer Service Feedback | Mixed reviews | Generally positive | Generally positive | Mixed reviews | Generally positive |

| Additional Benefits | Top-up facility, electronic statements | Simplified banking | Transparent terms | Fixed repayments | Flexible options |

| More Info | Capitec Bank Review | African Bank Review | Absa Bank Review | FNB Review |

History and Background of Woolworths Financial Services

Woolworths Financial Services (WFS) was incorporated in 2000 as a joint venture between Woolworths Holdings Limited and Barclays Bank. This collaboration aimed to provide customers with focused financial products and services. Over the years, WFS has expanded its offerings to include store cards, credit cards, personal loans, and various insurance products, catering to the diverse financial needs of its clientele.

The mission of Woolworths Holdings Limited, the parent company, is to be the first choice for customers who care about value, innovation, and sustainability. Their vision is to be one of the world’s most responsible retailers, reflecting a commitment to ethical business practices and quality.

WFS aligns with this mission by offering financial solutions that emphasise customer-centricity, responsibility, and quality service.

Conclusion

Woolworths Financial Services offers a practical and flexible loan option for South Africans who need access to credit for personal expenses. With an easy online application process, personalised loan terms, and quick fund disbursement, it can be a suitable choice for individuals looking for convenience and reliability. While the loan offering is limited to personal loans and lacks clear upfront information on loan amounts and rates, Woolworths still appeals to existing customers and those seeking a straightforward lending solution. As with any financial commitment, comparing alternatives and reviewing all fees and repayment terms carefully is recommended before proceeding.

Frequently Asked Questions

You can apply online through the Woolworths Financial Services website or by visiting selected stores that offer financial services support.

Up to R75 000 but the amount you qualify for depends on your income, credit record, and affordability assessment.

Yes, you can request a settlement quote and repay the loan early. This may save on interest, but always check if there are any early settlement fees.

You will need a valid South African ID, recent payslips or bank statements (usually from the last 3 months), and proof of income.

If your application is approved and all documents are in order, funds are typically paid into your account within 48 hours.