Challenor Finance [Challenorfinance.co.za] offers varying financial solutions to its clients. They are registered through the NCR (National Credit Regulator). Partnered with various Furniture and Hardware outlets to assist with housing finance and other lifestyle or home improvements. They offer tailored loans to suit the needs of their clients with a strong emphasis on customer service.

As a private lender, they offer a wide variety of loans, namely student loans, through their online web application. Student loans through Challenor have competitively low-interest rates. Those enrolled in some form of tertiary education, be it an undergraduate or postgraduate degree, may apply for such a loan based on an affordability analysis.

Challenor Finance provides borrowers with loan amounts ranging from R2 000 to R80 000, with repayment terms of up to 24 months. If this seems like a suitable option, read on to learn more about this lender and whether they meet your needs.

Challenor Finance: Quick Overview

Loan Amount: R2 000 – R80 000

Loan Term: Up to 24 months

Interest Rate: Minimum 10.25% APR for student loans (personal loan rates not specified)

Fees: Information on fees not explicitly provided

Loan Types: Personal loans, student loans

About Arcadia Finance

Arcadia Finance facilitates a simplified and efficient loan acquisition process. Submit a complimentary application and receive loan proposals from up to 19 lenders. Trust in the credibility and compliance of all our lending partners with the regulations of the National Credit Regulator in South Africa.

Challenor Finance Full Review

Can I only find Payday loans at Challenor?

Challenor offers a variety of loans; however, these are mainly personal loans as well as student loans. They additionally provide instant personal loans that typically range between R2 000 and R80 000 on their online platform.

Personal Loans

Challenor loan amounts typically range from R2 000 to R80 000. However, this is mainly dependent on the affordability analysis of the client. Regarding their repayable terms, they vary between 3 to 24 months. However, these terms are based on their client’s financial needs and circumstances.

Student Loans

This lender offers student loans for tertiary education. Lending amounts typically range from the value of R3 000 to R80 000. Usually, this is only for recognized higher education institutions within South Africa. Interest rates are very favourable with competitively low-interest rates. Clients can expect a minimum interest rate of as little as 10.25% APR(annual percentage rate). The repayment term length of the student loan ranges from up to 24 months. Their repayment terms are solely based on a budget of their client’s ability to repay. However, student loans are based on the applicant’s income and have more flexibility, such as a 3-month minimum repayment period.

How do I know if Challenor Loan is Legit?

For any lending company in South Africa to qualify as a legitimate lender, the company must be registered under the NCR(National Credit Regulator). They ensure the proper lending practices that are fair and transparent. Upon review of Challenor loans, you will find they are registered under the NCR as a legitimate lender.

Who Is Challenor Finance Best For?

It is best for borrowers who:

- Need Personal or Student Loans

- Are Formally Employed

- Prefer a Streamlined Application Process

- Want Flexible Repayment Terms

- Seek NCR-Registered Lending

Is Challenor Finance a Safe and Good Option?

Challenor Finance is a registered credit provider offering personal and student loans to individuals in South Africa. As an NCR-registered lender, it adheres to regulated lending practices, ensuring transparency and compliance. With a streamlined online application process, borrowers can apply for loan amounts ranging from R2 000 to R80 000, with repayment terms of up to 24 months. Loan approvals are typically processed within 24 hours, with funds disbursed shortly after.

While this lender offers competitive interest rates, particularly on student loans, personal loan interest rates may vary based on affordability assessments. The lender provides clear terms and repayment structures, making it a practical option for those seeking flexible financing solutions. For borrowers looking for quick and legitimate loan options, this company is a trustworthy choice.

Simulation of a Loan at Challenor

Step-by-step Guide to Applying for a Loan with Challenor

Applying for a loan at Challenor Finance is a streamlined process designed for efficiency and convenience.

Step 1. Start by navigating to Challenorfinance.co.za

Step 2. tart your loan application by clicking “APPLY FOR A LOAN NOW!”

Step 3. Fill in your personal details including name and contact information.

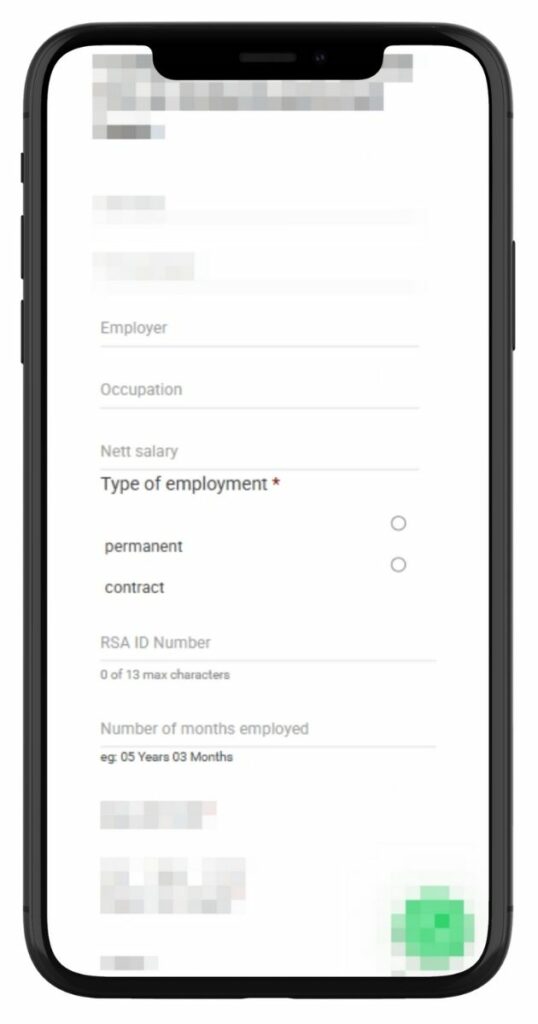

Step 4. Provide your employment information and indicate your type of employment.

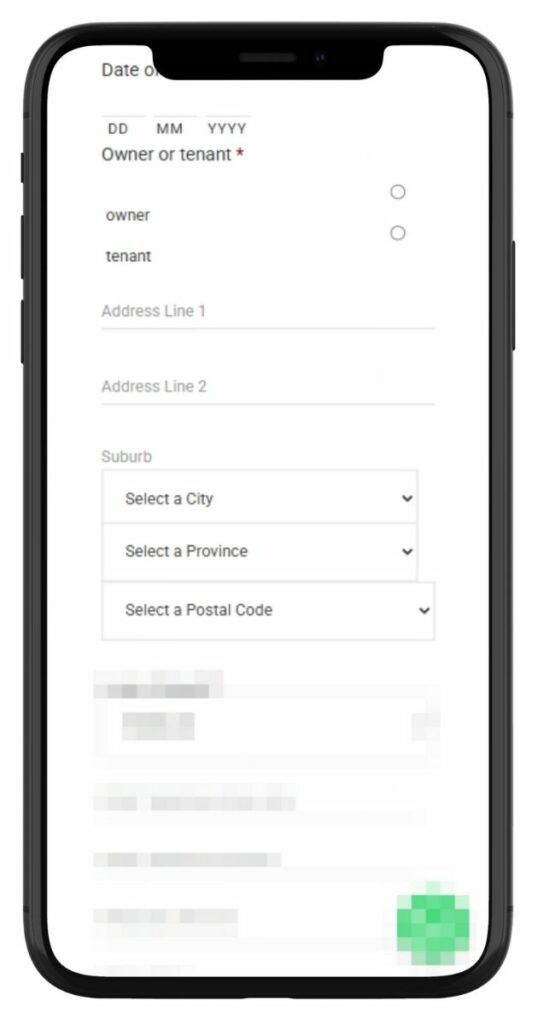

Step 5. Enter your residential details, including ownership status and address.

Step 6. Review your information and click “SEND APPLICATION” to complete the process.

Step 7. Wait for Confirmation: You’ll receive a confirmation via SMS or email once your application is submitted successfully.

Step 8. Application Review: Challenor Finance will assess your details and verify your documents.

Step 9. Loan Approval & Payout: If approved, your loan amount will be disbursed directly into your bank account.

Special Requirements of the Challenor Loan Application

To apply for a loan through Challenor Finance, the application process entails that potential clients are over the age of 18. A South African citizen with a valid South African ID. Additionally, they will need to provide proof of residence and income with their most recent payslip and three months’ bank statements.

Eligibility Check

Challenor Finance offers potential borrowers the ability to gauge their eligibility through initial inquiries. While there isn’t a specific tool mentioned for eligibility checking on Challenorfinance.co.za, applicants can contact them directly to discuss their circumstances and loan requirements. This direct interaction allows applicants to receive guidance and information that can help ascertain their eligibility and the likelihood of loan approval, ensuring that applicants have a preliminary understanding before formally initiating the application process.

Security and Privacy

Challenor Finance demonstrates a commitment to safeguarding customer data through robust security measures and responsible data-handling practices. The company ensures that the personal and financial information shared by applicants during the loan application process is protected against unauthorized access and misuse.

Challenorfinance.co.za and online application portal are likely fortified with secure sockets layer (SSL) encryption, a standard security technology that ensures data transmitted between the web server and browser remains private. This encryption helps safeguard sensitive information such as identity details, bank account information, and other financial particulars shared during the loan application and approval processes.

Challenor Finance’s privacy policies play a crucial role in defining how customer data is handled, used, and stored. These policies are instrumental in establishing the frameworks within which customer information is managed, ensuring that data is handled with the utmost confidentiality and integrity. The privacy policies likely outline the types of information collected, the purposes for which it is used, and the measures in place to protect the information from unauthorized access and disclosure.

How Much Money Can I Request from Challenor?

Challenor Finance provides a variety of loan amounts to meet diverse financial needs, allowing borrowers to request a minimum of R2 000, scaling up to a maximum of R80 000. This flexibility accommodates a range of financial requirements, including emergency expenses, debt consolidation, or significant purchases.

Challenor Finance distinguishes itself by offering personalized loan packages. By assessing each applicant’s financial profile, the company tailors loan offers to align with the borrower’s repayment capabilities and financial health. This customization ensures that the loan terms, including interest rates, are as favorable and manageable as possible for the borrower.

How Long Does It Take to Receive My Money from Challenor?

The speed at which Challenor Finance processes loan applications is a standout feature. On average, once all necessary information and documents are submitted, this lender promises a decision within 24 hours. Following approval, the loan amount is swiftly deposited into the borrower’s bank account, typically within another 24 hours. This efficiency ensures that borrowers can access the funds they need with minimal delay.

How Do I Repay My Loan from Challenor?

Repayment with Challenor Finance is structured for clarity and consistency. Borrowers are presented with fixed monthly payments, ensuring that there are no unexpected fluctuations throughout the repayment period. This approach facilitates easier budgeting and financial planning for borrowers.

While specific details regarding fees and penalties are not explicitly mentioned, it’s always advisable to be aware of any additional costs that might be incurred due to late or missed payments, ensuring a smooth and transparent repayment journey.

Challenor Finance – Loan Overview in Detail

| Field | Details |

|---|---|

| Name | Challenor Finance |

| Financial | Privately owned, operating in South Africa |

| Product | Personal Loans, Student Loans |

| Minimum Age | 18 years |

| Minimum Amount | R2 000 |

| Maximum Amount | R80 000 |

| Minimum Term | 3 months |

| Maximum Term | 24 months |

| APR | Customized based on client profile; student loans from 10.25% APR |

| Monthly Interest Rate | Fixed rates (exact rate not disclosed publicly) |

| Early Settlement | Not specified; contact Challenor Finance directly |

| Repayment Flexibility | Fixed monthly repayments; terms tailored to affordability |

| NCR Accredited | Yes (NCRCP 314) |

| Our Opinion | ✅ Quick approval and online application process ✅ Offers both personal and student loans with flexible terms ✅ Suitable for short to mid-term needs |

| User Opinion | ✅ Customers appreciate fast service and fixed repayment terms ⚠️ Some concerns over settlement amounts and customer service |

How can Challenor Finance’s Loan interest rate change loan payments?

As with changes in interest rates, Challenor Loan’s monthly repayments are fixed each month. This is ideal for those worried about future changes on their initial loan. Subsequentially this is ideal as there are no hidden costs or needs to change your budget in the event of a potential economic downturn regarding your repayments.

Do Challenor Loans let me use an online loan calculator?

Upon review of their official site, they do not have an online loan calculator to estimate the amounts of a potential loan. However, this is solely due to the personalization of loans tailored to their client’s budget, credit score, and choice in repayment terms.

Are Challenor Finance’s Loan Reviews Positive?

Upon review, a Challenor loan is mixed with relatively few complaints compared to other lenders. However, it is important to note that there is always some form of bias in any review, namely in the case where the customer has had a bad experience or has been denied their potential loan. This is where they will be more inclined to review negatively. However, as a lending company, there are fewer bad reviews than other lenders.

Their interest rate is very reasonable. I give them thumbs up, try them you won’t regret.

Great service. Very helpful. Non complicated. Quick and easy. Highly recommended.

Doesn’t even deserve 1 star. Terrible customer service. You must phone them to ask for docs to apply for loans.

These people are greedy!!! They debited their premium on not agreed dates, and when I desputed it, they claim it was a mistake.

What are Challenor Loans’ Contact Details?

Challenor Finance emphasizes the importance of customer service in their loan offerings. If you find yourself with further questions or in need of clarification at any point during the loan application or repayment process, this lender encourages direct contact. They offer the option to call their office for immediate assistance, ensuring that potential borrowers have access to timely and helpful responses to their queries. This approach underscores Challenor Finance’s commitment to service excellence and customer satisfaction, ensuring that every borrower has the support and guidance they need throughout their loan journey.

Contact Channels

Phone number:

Office: 031 303 2647

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: By appointment only

Postal address:

45 McKenzie Road, Morningside

Durban, 4001

KwaZulu-Natal, South Africa

Alternatives to Challenor

While Challenor Finance offers a compelling suite of loan services, it’s always beneficial to be aware of alternatives in the market. Several other credit comparison portals and lenders provide a range of loan products, interest rates, and terms, allowing borrowers to find the most suitable option for their needs.

Comparison Table

| Lender | Loan Amounts | Interest Rates | Repayment Terms | Special Features |

|---|---|---|---|---|

| Challenor Finance | R2 000 – R80 000 | Customized; min 10.25% annually for student loans | Up to 24 months | Flexible repayment for student loans |

| ABSA Personal Loan | R250 – R350 000 | Competitive rates with price guarantee | 12 to 84 months | Flexible loan amounts and terms |

| African Bank Loan | R2 000 – R250 000 | Low interest rate of 12% on loans up to R50 000 | 7 to 72 months | Fixed repayments; special terms for certain loans |

| FNB Personal Loan | Up to R300 000 | As low as 12.75% per annum | Up to 60 months | Break from payment in January; no penalty for early settlement |

This side-by-side comparison provides an overview of features, including loan amounts, interest rates, and repayment terms offered by Challenor Finance and its competitors. Prospective borrowers can use this table to make informed decisions based on their specific financial needs and preferences. It’s important to note that the information provided here is subject to change, and borrowers should verify the latest details directly from the lenders’ official sources.

Pros and Cons of Challenor Loans

Pros of Challenor Finance

- The loan requirements are minimal as they only require a monthly income to apply for a potential loan. This is also true for those who are full or part-time students.

- Loan amounts are relatively large, capped at R80 000. This is ideal for a wide array of financial goals of a client, especially in the case of tertiary education or further studies.

- The time frame for receiving your loan amount will be within three days upon submitting a simple yet quick application.

- Students in the final year of their studies are still eligible to apply for a student loan.

- Interest rates for student loans are competitively low. This is ideal for those with a respectable credit score to attain an even lower or the most minimal interest rate of 10.25%.

Cons of Challenor Finance

- The term period of loans typically ranges up to 24 months. Regarding other lenders, this is a brief short repayment period, especially for more significant amounts.

- Student fees are typically quite large. Establishing the cost of tertiary education indicates that the tuition costs may be well over the capped loan amount of R80 000. Costs can range well over R100 000.00; hence, it is essential to note that the initial loan may not cover the entire costs of the associated student fees.

Related Post: Wonga Loan Review

Conclusion

Challenor Finance offer competitive student loan rates for those seeking or pursuing tertiary education with somewhat flexible repayment terms. However, Challenor Finance has shorter repayment periods than other lenders of only 24 months. Those in need of a loan can expect to receive their funds within less than a week but can be deposited sooner, as early as three days. Despite not having an online calculator, they offer personalized and tailored repayment plans for their clients, as a loan offer is typically based solely on affordability analysis.

Frequently Asked Questions

You can borrow up to R80 000. The specific amount you are eligible for will depend on various factors, including your financial profile and creditworthiness.

Challenor Finance aims to deposit the funds into your bank account within 24 hours following the approval of your loan application. This ensures that you can access the necessary financial support swiftly.

It’s essential to discuss and clarify all potential fees and charges with Challenor Finance during the application process. Understanding the full cost of the loan, including any additional fees, is crucial for transparent and manageable repayments.

While there isn’t a specific online tool for this, you can contact Challenor Finance directly to discuss your circumstances and receive preliminary guidance regarding your eligibility and potential loan terms.

Typically, you would need to provide proof of identity, proof of income, and bank statements. These documents help them assess your eligibility and tailor the loan terms to your financial profile.