FASTA [Fasta.co.za] is a Fintech company in South Africa situated in the Western Cape. The business has been operating since 2017. This company offers quick loan solutions for online as well as for in-store items. A loan from FASTA is typically between R500 to R8 000 with an interest rate of 3% per month. FASTA is a secure digital lending platform that makes use of innovative and scalable technology. They offer financial solutions to a wide variety of merchants as well as online.

This lender is registered and regulated through the NCA (National Credit Authority). This entails they follow and adhere to the proper fair, just, and secure lending practices within South Africa.

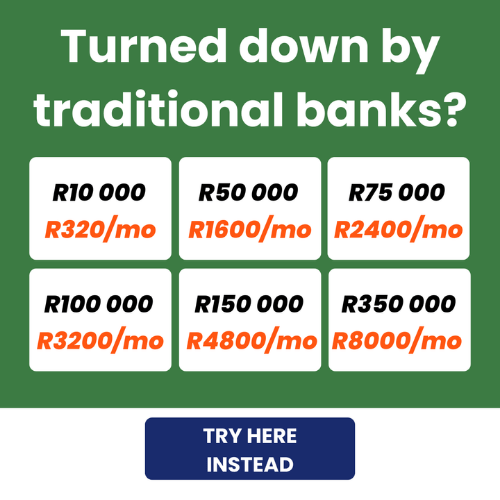

Looking for a fast and flexible loan? Fasta.co.za offers R500 to R8 000 with repayment terms of one, two, or three months—giving you the financial breathing room you need. But is it the right choice for you? Let’s break down everything you should know before you borrow.

FASTA: Quick Overview

Loan Amount: R500 – R8 000

Loan Term: 1 to 3 months

Interest Rate: Approximately 3% per month, varying based on the loan amount and individual credit profile

Fees:

- Initiation Fee: R86

- Monthly Service Fee: R69

- Credit Protection Insurance: R6.33

Loan Types: Short-term personal loans

About Arcadia Finance

Arcadia Finance offers a hassle-free solution for securing loans from a variety of banks and lenders. Just complete a no-cost application and be presented with options from up to ten different lenders. Our lending partners are all reputable, operating under the strict guidelines of South Africa’s National Credit Regulator.

FASTA Full Lender Review

FASTA provides a range of flexible credit solutions to meet various financial needs. Whether you’re looking for a short-term personal loan, a digital credit facility, or a virtual card for online purchases, it has an option tailored for you.

FASTA Card (Cash Bank Credit Facility)

The FASTA Card is a virtual credit card that enables users to make online purchases with ease. Once approved, credit is deposited into the card, offering a revolving credit option with structured repayment plans. This ensures that customers can access funds instantly when shopping online without needing to withdraw cash.

FASTA Once-Off Loans

They also offer short-term personal loans ranging from R500 to R8 000, with flexible repayment terms of 1, 2, or 3 months. The application process is straightforward—users simply need to register by providing basic personal details, income, expenses, and supporting documents such as payslips. FASTA then assesses this information and offers a loan amount and interest rate based on the applicant’s financial profile. Once approved, the funds are deposited directly into the specified bank account, typically within minutes.

FASTA Account Credit (Online & In-Store Credit)

This company also functions as a credit checkout facility for online shopping. Customers can use their Account Credit at partnered retailers, making purchases instantly and repaying the amount over flexible instalments.

- In-Store Credit: Available via Fasta.co.za, where customers can receive a credit voucher upon approval, which can be used immediately at designated merchants.

- Online Credit: At participating online merchant stores, customers can select the Instant Credit option during checkout. Instead of waiting for a loan disbursement, funds are sent directly to the merchant, ensuring a seamless purchase experience.

Can I Only Find Payday Loans at FASTA?

This lender offer Payday loans with a repayment period of 1 to 3 monthly instalments. This is ideal for those seeking more affordable Payday loans. Most credit providers do not offer more than two months to repay. This is ideal for those seeking fast access to affordable emergency funds.

Who is FASTA Best For?

FASTA is ideal for individuals who need quick, short-term financial support. It’s best suited for:

- Those needing fast cash – Get approved and receive funds in as little as 5 minutes.

- Online shoppers – Use their instant credit at partnered retailers for buy now, pay later convenience.

- Short-term borrowers – Borrow between R500 and R8 000, with flexible repayment over 1 to 3 months.

- People with a steady income – Proof of income is required to qualify.

- Tech-savvy users – A fully online application makes it quick and hassle-free.

Understanding the difference between secured and unsecured loans can help you choose the right financing option for your needs—learn more about how they work and which one suits you best!

Is FASTA a Safe and Good Option?

FASTA is a legitimate and NCR-registered lender, offering a secure and fully online loan process. It provides fast access to credit, with applications taking just minutes and funds available almost instantly. The platform uses encrypted technology to protect personal and financial information, ensuring a safe borrowing experience.

With flexible repayment terms and a straightforward approval process, this company is a good option for those needing short-term financial support. Its transparent lending practices and convenient credit solutions make it a reliable choice for eligible borrowers.

Who can apply for a FASTA Loan?

Criteria for Potential Borrowers

FASTA’s loans are accessible to a wide range of individuals, but there are basic criteria that one must meet to be eligible. Firstly, applicants must possess a valid RSA ID number, ensuring that they are legally recognized residents or citizens of South Africa. Additionally, applicants must be 18 years or older, aligning with the legal age of contractual accountability.

Another crucial criterion is having a verifiable income for the last 90 days. This income verification is a standard procedure that helps the lender determine your ability to repay the loan. Lastly, applicants must have access to internet banking, as the entire application process, including the disbursement of funds, is conducted online.

Differences from Other Loan Providers

This lender distinguishes itself through its emphasis on speed and convenience. Unlike traditional loan providers that may require physical meetings or a plethora of documents, FASTA simplifies this process by making it entirely online and minimizing paperwork. Their system is designed to facilitate quick decision-making, allowing for instant loan approvals and immediate fund disbursements upon acceptance.

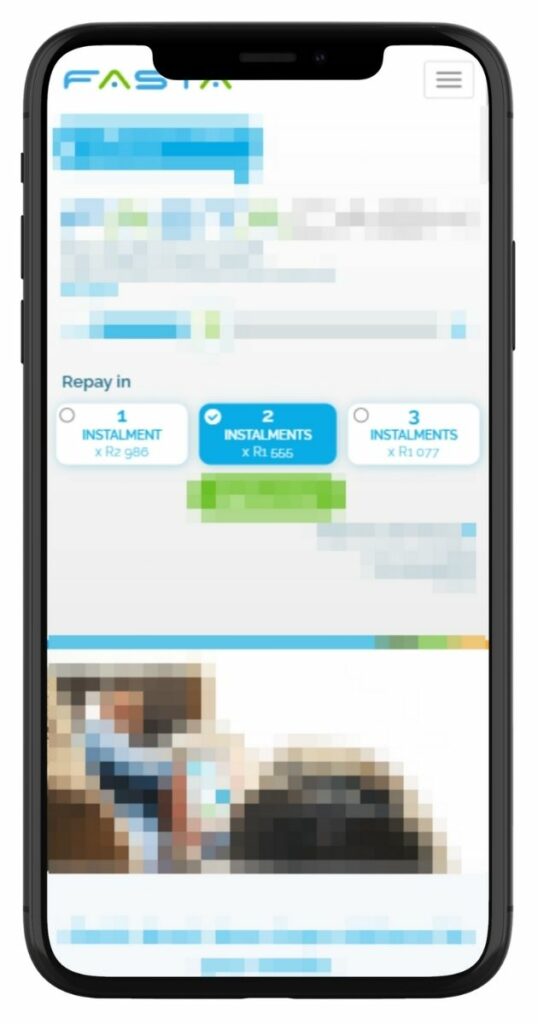

Another notable difference is the flexibility in repayment terms. Borrowers can choose to repay their loans in one, two, or three instalments, providing some level of flexibility based on their financial capability and planning. This approach offers customers a certain degree of autonomy and adaptability in managing their loans and financial obligations.

Requirements of the FASTA Loan Application

Before you apply for your potential loan, you may require the following.

- South African ID

- Access to online banking

- 3 months’ payslips

- You are over the age of 18.

Once you have submitted the above information, they will then begin their online assessment. Where they will assess your financial position and your ability to afford the repayments. This is solely based on your income, additional debts, as well as expenses. This assessment verifies if you can afford any additional credit instalments. If in the case where an application is denied, this is due to them only offering responsible loans. Additionally, they will not offer loans to individuals that cannot afford to repay or cause themselves financial hardship.

Looking for a reliable loan option? Find out if Hoopla is worth considering in our detailed Hoopla Lender Review!

Simulation of a Loan at FASTA

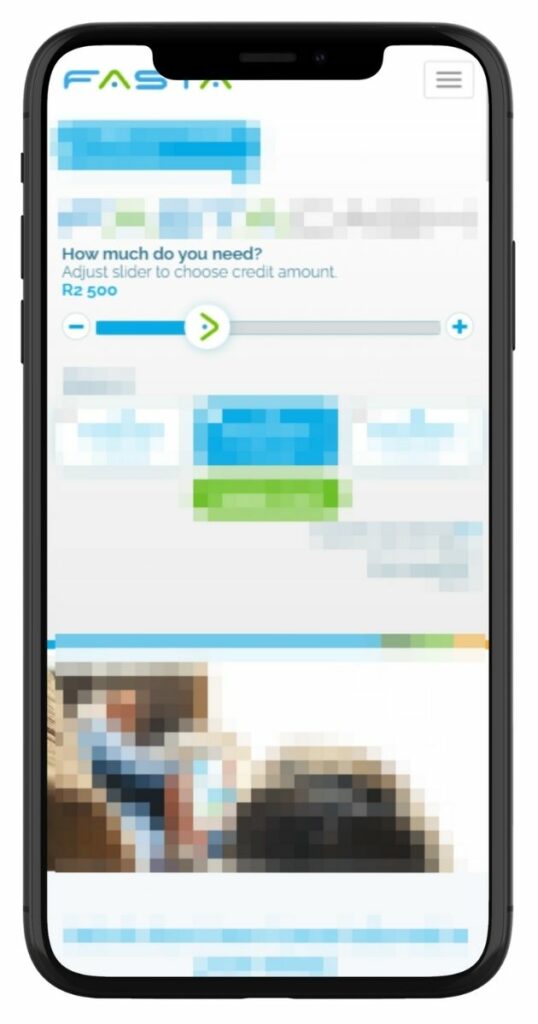

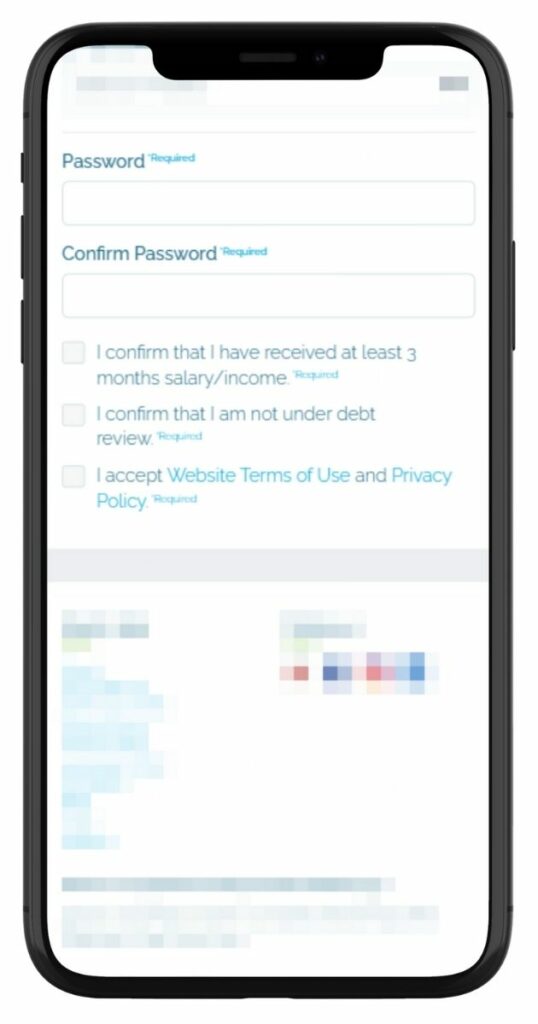

Step 1. Start by accessing Fasta.co.za.

Step 2. Select loan amount using the slider.

Step 3. Choose repayment terms between 1, 2, or 3 instalments.

Step 4. Review the total repayment details and click “apply now”.

Step 5. Start the application by entering your ID number.

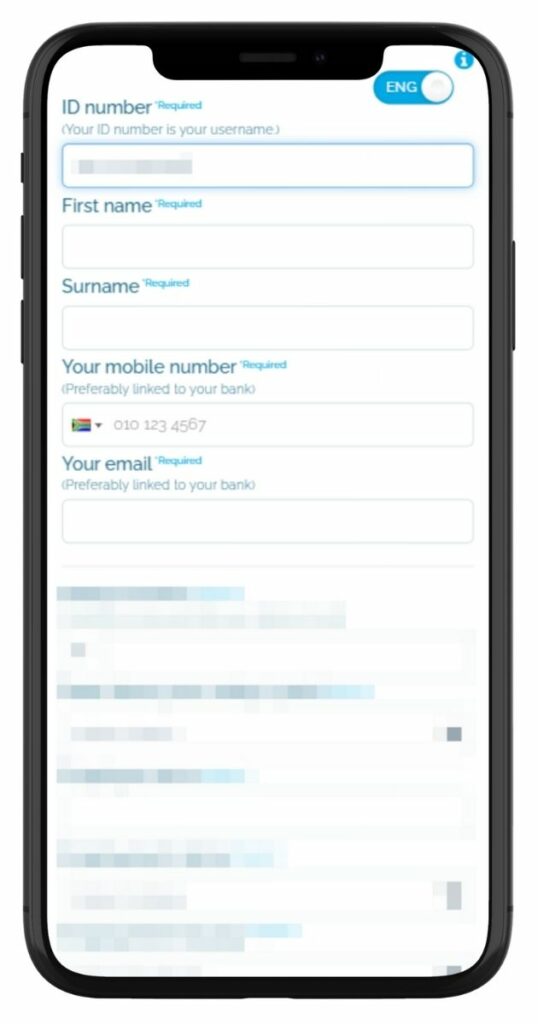

Step 6. Provide personal details including name, mobile number, and email.

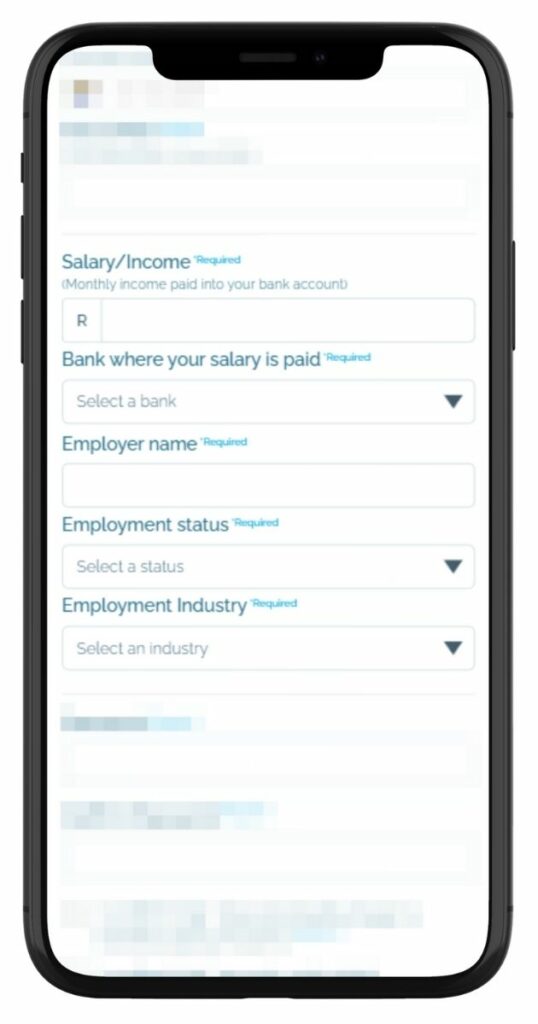

Step 7. Enter financial information such as income, employer details, and bank account.

Step 8. Set a password, confirm details, and agree to the terms to finalise the application.

Step 9. They will conduct credit checks and verify the details provided.

Step 10. If approved, you will receive a loan offer detailing the terms and conditions.

Step 11. If you agree to the terms, accept the offer.

Step 12. Once accepted, the loan amount will be deposited into your bank account.

Eligibility Check

FASTA aims to make the loan application process as seamless as possible. To assist potential borrowers, they offer tools to pre-check eligibility. Before diving deep into the application process, users can utilize these tools to get an idea of their chances of approval. This preliminary check is based on basic information and does not guarantee loan approval but provides a general

How Much Money Can I Request from FASTA?

When applying for a loan, the amount of money you can request varies based on certain factors, but there are established minimum and maximum thresholds. You can apply for a loan starting from a minimum amount, which is relatively low, making it accessible for minor financial needs or emergencies. On the other end of the spectrum, FASTA offers loans up to a maximum amount of R8 000. This cap is set to ensure that loans remain manageable for borrowers and align with responsible lending practices.

This lender also provides personalized loan offers. This means that the loan amount and terms you are offered are tailored based on your financial situation and creditworthiness. This personalized approach ensures that the loan aligns with your financial capacity and repayment ability.

FASTA – Loan Overview in Detail

| Name | FASTA |

|---|---|

| Financial | Privately owned, operating in South Africa |

| Product | Unsecured Personal Loans |

| Minimum Age | 18 years and older; must be a South African citizen |

| Minimum Amount | R500 |

| Maximum Amount | R8 000 |

| Minimum Term | 1 month |

| Maximum Term | 3 months |

| APR | Varies based on credit profile and loan amount |

| Monthly Interest Rate | Around 3% per month, subject to approval |

| Early Settlement | Information not specified |

| Repayment Flexibility | Fixed repayment terms of 1, 2, or 3 months |

| NCR Accredited | Yes |

| Our Opinion | ✅ Fast approval and online application process ✅ Flexible repayment terms ⚠️ Short repayment period of up to 3 months only |

| User Opinion | ✅ Suitable for emergency short-term borrowing ⚠️ Interest rates may be higher than traditional lenders |

How Long Does It Take to Receive My Money from FASTA?

Fasta.co.za prides itself on its quick processing times. Once your application is approved, the disbursement of funds is quite prompt. In many cases, borrowers receive their money almost immediately after accepting the loan offer. However, the actual time may vary based on certain factors such as the time of approval and the operational hours of your bank.

How Do I Repay My Loan from FASTA?

Repaying a loan is designed to be as straightforward as the application process. Borrowers are presented with repayment plans that align with their loan terms, allowing for repayments in one, two, or three instalments. These options provide some flexibility, enabling borrowers to choose a plan that suits their financial situation.

Additionally, it’s essential to be aware of fees and penalties that may apply. For instance, late payments or failure to meet repayment obligations could incur additional costs. Ensuring that repayments are made according to the agreed terms is crucial to avoid any extra charges and maintain a healthy credit profile.

Does FASTA Let me Use an Online Loan Calculator?

Yes, they make use of an online calculator where clients can calculate potential loan fees. This is a free service that requires minimal documentation. They offer an immediate deposit of funds, with the option to choose up to 1 to 3 instalments. They offer a second option to deposit funds as cash on a digital card.

How can FASTA’s interest rate change loan payments?

Interest rates are fixed. You can expect a rate between 0% to 5%. However, this rate will be subject to factors such as your credit profile.

Are FASTA Reviews Positive?

Upon review of previous clients, testimonials regarding their services are mixed. However, this is expected with any review. Though, those who have reviewed positively praise their simplicity and access to potential loan amounts. Amounts can reflect within a few hours of submitting their application. Additionally, clients reviewed positively regarding their instalment options, where they can choose their instalment plan from 1 to 3 months. This instalment option makes their repayment plans more flexible and affordable.

Easy to get approved, but they don’t give out much. Repayment is easy, they even give you a grace period of a few days (without negative reflection on your credit).

Willing to help before I even had a credit score and now thanks to fasta loans I was able to get my score right up there

They never respond to their “support” messages it has been 7 days till today I received no help.

Still haven’t got my money back after being Debited twice by FASTA

Customer Service

Customer service is a crucial aspect of any financial service, and this lender provides avenues for customers to seek assistance and ask questions. If you have further queries or need clarification on any aspect of the loan process, their customer service team is available to assist.

Having access to reliable customer support ensures that any uncertainties or issues you encounter can be promptly addressed, enhancing your overall experience and confidence in the service. It’s always advisable to reach out and seek professional guidance if you have any uncertainties or questions regarding your loan or the application process.

What are FASTA’s Contact Details?

Since they are mainly an online lending platform, there is currently no direct phone number for client queries. However, queries can be made on the official site through their help desk. Those that require an email address may use the following email address support@fasta.co.za. Their offices are located at Dock Road Junction, Cnr. Stanley & Dock Road on the 3rd Floor, Spaces in Cape Town.

Alternatives to FASTA

While FASTA offers a unique blend of convenience and speed in the loan application process, there are other credit comparison portals available for those looking to explore alternative options. These platforms provide a range of offers from various lenders, allowing borrowers to compare and choose the best fit for their needs.

Comparison Table

| Lender Name | Loan Amount Range | Interest Rate | Repayment Term | Additional Fees | Special Features |

|---|---|---|---|---|---|

| FASTA | R500.00 to R8 000.00 | 3% | Up to 4 months | Monthly service fee: R69.00 | Instant online issuance, various credit types |

| Absa Personal Loans | R250 to R350 000 | Variable | 12 to 84 months | Service and initiation fees | Flexible for personal and business needs |

| African Bank Personal Loans | Up to R250 000 | 15% to 27.75% | 7 to 72 months | Insurance rates: 5.04% to 5.4% | Fixed monthly instalments, online application |

| Capitec Personal Loans | Up to R250 000 | 12.9% to 24.5% | 1 to 84 months | Initiation fee, monthly service fee | Online estimates, personalised offers |

Pros and Cons of FASTA

Pros of FASTA

- Speed and Convenience: Their online platform is designed for quick and easy loan applications, making funds accessible almost immediately after approval.

- Transparency: All fees, charges, and interest rates are clearly outlined, ensuring borrowers are not caught off guard by unexpected costs.

- Flexible Repayment Terms: Borrowers have the option to choose their repayment plans, allowing for better financial planning and management.

Cons of FASTA

- Loan Amount Limit: The maximum loan amount offered is R8 000, which might not be sufficient for borrowers with more substantial financial needs.

- Short-term Focus: Loans are more suited for immediate or emergency financial needs, and might not be the best fit for long-term financial planning or larger investments.

- Online Dependence: Since all transactions, including the application and fund disbursement, are conducted online, those without reliable internet access or online banking facilities might find it challenging to access their services.

Conclusion

FASTA are ideal for borrowers who need affordable short-term loan solutions. For those seeking a fast loan, online purchases, or affordable emergency funds. The online application process requires minimal documentation. With an expected loan deposit within a few hours.

This lender provides several instant credit options. They offer loan deposits directly into your bank account or loaded onto a virtual credit card for later use. Lastly, clients can pay directly to their desired online merchant. However, there are limitations regarding the amounts as they may not fully cover some purchases from designated merchants. Their repayment plan offers the choice of between 1, 2, or 3 instalments each month. This gives more flexibility and affordability to their clients.

Frequently Asked Questions

After your loan application is approved, they will disburse the funds almost immediately. However, the actual receipt of funds may depend on your bank’s operational hours and processing times.

Their application process is entirely online, and you typically won’t need to upload documents. However, you should be prepared to provide details such as your RSA ID number and have access to internet banking for verification purposes.

This lender conducts credit checks as part of their responsible lending policy. While a poor credit history may affect your application, it doesn’t necessarily mean you will be ineligible. Each application is assessed on an individual basis.

Yes, early repayment is usually possible, and it might save you some money on interest and fees. It’s advisable to contact their customer service for specific guidance based on your loan agreement.

Missing a repayment could result in additional charges or fees. It’s essential to contact FASTA as soon as possible if you’re having trouble making a repayment, as they may be able to offer assistance or advice.