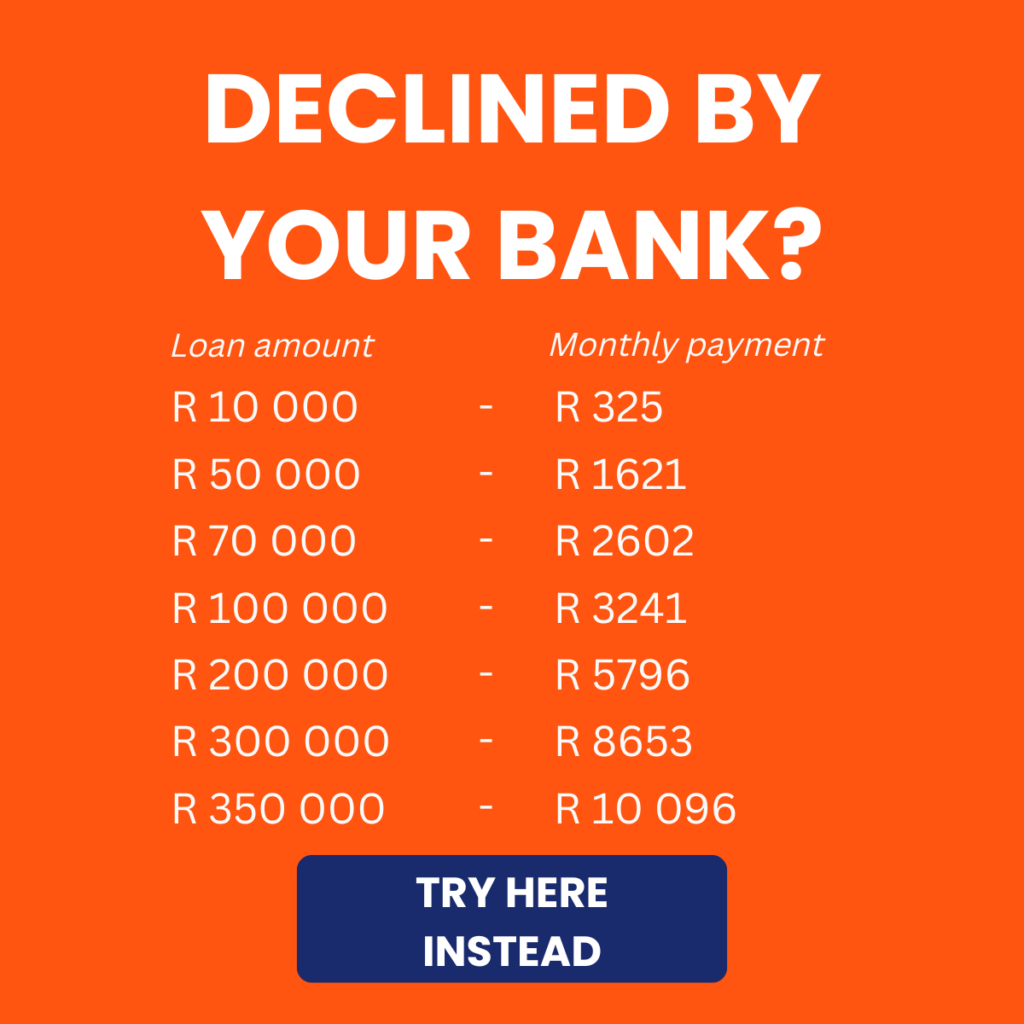

Save More with Low-Interest Loans!

Don’t Let High Rates Hold You Back! Discover low-interest loans designed for smarter borrowing.

Arcadia Finance helps you in the search of loans from different banks and lenders. Fill in a free application and get loan offers from up to 16 lenders. We work with well-known, trusted, and NCR-licensed lenders in South Africa.

What Are Low-Interest Loans?

Low-interest loans are financing options that feature a lower interest rate than standard loans, making them more affordable for borrowers in the long run. The interest rate, expressed as a percentage, determines the additional amount you’ll pay on top of the principal amount borrowed. For example, if you take out a loan with a 10% annual interest rate, you’ll pay less in interest compared to a loan with a 20% rate. These loans are typically offered by banks, credit unions, alternative lenders, and government programmes.

The interest rate offered often depends on factors such as your credit score, income, and repayment history. Lenders view borrowers with a strong financial profile as lower risk, which allows them to offer reduced rates.

About Arcadia Finance

Arcadia Finance makes securing your loan easy and hassle-free. Choose from 16 reputable lenders regulated by South Africa’s National Credit Regulator, with no application fees. Our smooth process ensures the perfect financial solution for your needs.

Types of Low-Interest Loans

Home Loans: Also known as mortgages, these loans often come with competitive interest rates, especially when secured by a property.

Car Loans: Vehicle finance loans typically offer low rates when the car is used as collateral.

Personal Loans: Although unsecured, personal loans may still feature low rates for borrowers with an excellent credit history.

Student Loans: Government-backed student loans in South Africa often offer lower interest rates to make education more affordable.

Debt Consolidation Loans: Consolidation loans combine multiple debts into one, often with a reduced interest rate to make repayments more manageable.

Benefits of Low-Interest Loans

Low-interest loans offer several benefits that make them an appealing option for borrowers in South Africa. They not only save money but also provide financial flexibility to help achieve various goals.

- Reduced Monthly Repayment Obligations: A lower interest rate directly affects your monthly instalments, making them more affordable. This is especially helpful for South Africans managing tight budgets. For instance, a home loan with a reduced interest rate can significantly lower your monthly payment, allowing you to allocate funds towards other essentials or savings.

- Lower Overall Borrowing Costs: The total cost of a loan consists of the principal amount borrowed and the interest charged over the loan term. With a low-interest loan, the interest portion is smaller, meaning you save thousands of rands over the life of the loan. This is particularly beneficial for long-term loans like home or car finance.

- Accessibility to Various Financial Goals: Low-interest loans make it easier to finance significant life goals without putting undue financial pressure on yourself. Whether you are buying a home, starting a business, or funding your education, affordable interest rates ensure you can reach these goals while maintaining financial stability.

By understanding how these loans work and the benefits they offer, South Africans can fully take advantage of the opportunities they present—whether reducing debt or investing in the future.

Factors That Determine Loan Interest Rates

The interest rate on a loan is influenced by several factors, many of which are directly tied to your financial profile and the broader economic climate. Understanding these factors can help you plan effectively when applying for a loan.

Credit Score

Your credit score is one of the most important factors lenders use to determine your interest rate. A high credit score suggests that you have a history of managing credit responsibly, making you a lower-risk borrower. South Africans with strong credit scores are more likely to qualify for loans with lower interest rates, while those with poor credit scores may face higher rates or difficulty securing a loan.

Loan Amount and Repayment Terms

The amount you borrow and the length of time you take to repay it also impact the interest rate. Larger loans or longer repayment periods may come with higher interest rates, as they represent a greater risk to the lender. On the other hand, smaller loan amounts and shorter repayment terms generally come with lower rates, as lenders recover their money faster.

Economic Factors in South Africa

The broader economic environment plays a key role in determining interest rates. Factors such as inflation and the South African Reserve Bank’s repo rate significantly influence lending rates. For example, if the repo rate increases to curb inflation, banks may pass these higher costs onto borrowers by raising their loan interest rates. Staying informed about economic trends can help you time your loan applications for better rates.

How to Qualify for Lower Interest Rates

Qualifying for a lower interest rate typically involves presenting yourself as a low-risk borrower. Here are some actionable steps:

- Improve Your Creditworthiness: Pay your bills on time, reduce your existing debt, and regularly check your credit report for errors. Over time, these actions will boost your credit score.

- Provide Collateral: Secured loans often come with lower interest rates because they reduce the lender’s risk. Offering assets like property or a vehicle as security can help you secure better terms.

- Negotiate with Lenders: Don’t hesitate to discuss interest rates with your lender. If you have a strong credit history or are an existing customer, you may have leverage to negotiate more favourable rates.

- Shop Around: Compare offers from different lenders, including banks, credit unions, and online platforms. Different institutions often offer varying rates, so exploring your options helps you find the most affordable loan.

Types of Low-Interest Loans in South Africa

Secured Loans

Secured loans require borrowers to provide an asset, such as property or a vehicle, as collateral. This reduces the lender’s risk, often resulting in lower interest rates and higher borrowing limits. Common examples include home loans, where the property acts as security, and vehicle finance, where the car is used as collateral. These loans are suited to larger purchases due to their favourable terms but come with the risk of losing the asset if repayments are not made. As a result, they represent a substantial long-term commitment that calls for careful financial planning.

Unsecured Loans

Unsecured loans do not require collateral; instead, they are based on the borrower’s creditworthiness. Common examples include personal loans and student loans. Personal loans can be used for a variety of needs, such as debt consolidation or medical expenses, while student loans are intended to cover educational costs. These loans are easier to access for individuals who may not have substantial assets and often have quicker approval processes. However, they typically come with higher interest rates and stricter qualification criteria, such as a good credit score and stable income.

Government-Subsidised Loans

Government programmes in South Africa offer low-interest loans to support specific groups. For example, the National Student Financial Aid Scheme (NSFAS) provides affordable loans for students, while the Small Enterprise Finance Agency (SEFA) assists entrepreneurs with funding. Eligibility for these loans depends on factors such as income, citizenship, and the viability of a business. Applicants must provide supporting documents and apply through the relevant agency. These loans often have lower interest rates than traditional options and are targeted at individuals or businesses that may struggle to secure financing through other channels.

Steps to Apply for a Low-Interest Loan

Before applying for a low-interest loan, it’s important to gather the necessary documentation and confirm that you meet the lender’s eligibility criteria. Commonly required documents include proof of identity (ID or passport), recent payslips, bank statements (typically covering the past three months), and proof of address. For business loans, additional documents such as a business plan or financial statements may be required.

Checking your eligibility in advance can save you time and effort. Factors such as your credit score, income level, and debt-to-income ratio often determine whether you qualify for a loan. You can use online tools to check your credit score and review the lender’s specific requirements to avoid unnecessary rejections.

The Application Process

The process of applying for a low-interest loan in South Africa typically involves several key steps:

- Research Loan Options: Compare interest rates, terms, and fees across multiple lenders to find the best option for your needs.

- Submit an Application: Complete the lender’s application form, either online or in person, and provide the required documentation.

- Await Approval: The lender will review your application and assess your financial situation to determine your eligibility.

- Loan Agreement and Disbursement: Once approved, you will need to sign a loan agreement outlining the terms, after which the loan amount is disbursed to your account.

Challenges during the process can include delays due to missing documentation or low credit scores. To address these, ensure that all documents are accurate and up-to-date, and consider improving your credit profile if needed before applying.

Top Lenders Offering Low-Interest Loans in South Africa

| Category | Examples | Features | Considerations |

|---|---|---|---|

| Banks | Standard Bank, ABSA, Nedbank, FNB | Offer a range of secured and unsecured loans, including home loans, vehicle finance, and personal loans. Competitive interest rates, flexible repayment terms, and reliable customer support. | Lending criteria vary by bank. Review terms carefully to select the most suitable option for your financial needs. |

| Alternative Lenders | Wonga, Lulalend, TymeBank | Faster loan approval, flexible repayment structures, and online convenience. Ideal for borrowers with non-standard income or smaller loan amounts. | Interest rates may be higher than banks, and additional fees may apply. Read terms and conditions thoroughly. |

| Government and NGOs | NSFAS, SEFA, Industrial Development Corporation (IDC) | Provide affordable loans for specific groups, such as students and small business owners. Reduced interest rates and lenient repayment terms. | Applicants must meet specific criteria, such as South African citizenship or business viability, and provide required documentation. |

Conclusion

Low-interest loans offer South Africans an affordable way to achieve important financial goals, whether it’s purchasing a home, funding education, or consolidating debt. By understanding the various types of low-interest loans, comparing lenders, and managing repayments carefully, borrowers can reduce costs and avoid financial strain. It’s important to review loan terms thoroughly, stay informed about eligibility criteria, and be aware of any hidden fees to ensure a smooth borrowing experience. With the right preparation, low-interest loans can be a valuable tool for achieving financial success.

Frequently Asked Questions

A low-interest loan is a type of financing where the borrower pays a lower interest rate compared to standard loans. This reduces the total cost of borrowing and is often available for home loans, car finance, personal loans, and government-supported options.

Qualifying typically requires a good credit score, stable income, and a low debt-to-income ratio. Providing collateral for secured loans or applying for government-subsidised options can also improve your chances of approval.

Yes, additional fees can apply, such as admin charges, early repayment penalties, and insurance costs. Always review the loan agreement carefully to identify and understand all associated fees before signing.

In South Africa, you can access secured loans (e.g., home loans and vehicle finance), unsecured loans (e.g., personal and student loans), and government-subsidised loans for education or small business funding.

Compare interest rates, loan terms, fees, and eligibility requirements across multiple lenders. Use online comparison tools and calculators to estimate total loan costs and choose the most affordable and suitable option for your needs.