In today’s fast-paced world, unforeseen financial needs can crop up unexpectedly. Be it an unexpected medical expense, a vehicle repair, or simply bridging the gap until the next payday, rapid financial solutions become essential. Introducing BlinkFinance, an online lending platform committed to swiftly securing your loan in the blink of an eye. However, how does it truly measure up? In this review, we’ll thoroughly explore the features, advantages, and potential drawbacks of BlinkFinance loans, all while ensuring it aligns with South African English conventions and converting any currency references to Rands.

Experiences with BlinkFinance Loan

Navigating the financial landscape can be daunting, but with BlinkFinance, many have found a reliable partner in their journey. Users often highlight the platform’s user-friendly interface, swift approval process, and transparent terms. The promise of securing a loan quickly isn’t just a catchy tagline; it’s a reality many have experienced. The digital, paperless process ensures that borrowers don’t get bogged down with cumbersome paperwork, making the loan application experience smooth and hassle-free.

Who Can Apply for a BlinkFinance Loan?

BlinkFinance caters to a broad audience. Whether you’re a working professional, a business owner, or someone facing a sudden financial crunch, BlinkFinance is open to serving your needs. However, it’s essential to note that while the platform is accessible to many, there are specific criteria that applicants must meet. This ensures both the lender’s and borrower’s security and satisfaction in the loan process.

Criteria for Potential Borrowers

To be eligible for a BlinkFinance loan, applicants must meet certain foundational criteria. Firstly, they must be South African residents with a valid South African ID number. This ID is not just a formality; BlinkFinance uses it to perform a credit check, ensuring that the borrower has a history of financial responsibility. Additionally, applicants should have a stable source of income, which can be verified through documents. This income verification ensures that borrowers have the means to repay the loan in the stipulated time frame. Lastly, while BlinkFinance offers a digital-first experience, they still require some basic contact information, physical and postal address, and employer details. This information helps in streamlining the loan approval and disbursement process.

Differences from Other Loan Providers

What sets BlinkFinance apart from the myriad of loan providers out there? For starters, their commitment to a paperless credit solution stands out. In an era where digital is the new norm, BlinkFinance is ahead of the curve, offering a seamless online loan application process. Their same-day loan approval and transfer feature mean that borrowers don’t have to wait in prolonged anticipation. This speed and efficiency are especially crucial for those in urgent need of funds. Another distinguishing factor is their transparent fee structure. With BlinkFinance, what you see is what you get. There are no hidden charges or last-minute surprises. Lastly, their accreditation with the National Credit Act underscores their commitment to ethical lending practices, ensuring that borrowers are always treated fairly and with respect. Additionally, all references to currency have been converted to Rands.

About Arcadia Finance

Streamline your loan acquisition process with Arcadia Finance. Complete a free application and discover options from up to 19 distinct lenders. All our partner lenders are credible and governed by the National Credit Regulator, guaranteeing adherence to standards and trustworthiness in South Africa’s financial sector.

BlinkFinance Loan

In the expansive landscape of financial institutions, BlinkFinance stands out as a guiding light for many seeking swift and reliable loan solutions. Their approach to lending goes beyond merely providing funds; it focuses on delivering a customized experience that resonates with the needs of the modern borrower.

What Makes the BlinkFinance Loan Unique?

BlinkFinance has established itself as a unique player with its instant loan offerings. In an era where time is of the essence, they ensure not only the approval but also the transfer of loans within the same day. This immediacy proves to be a game-changer for individuals facing urgent financial requirements. BlinkFinance’s commitment to a paperless process highlights their dedication to leveraging technology for efficiency. Borrowers can bid farewell to the tedious paperwork traditionally associated with loan applications. Additionally, their adherence to the National Credit Act underscores their commitment to ethical lending practices, assuring clients that they are always in secure hands.

Advantages of the BlinkFinance Loan Comparison

Comparing loans can be a daunting task, but with BlinkFinance, this process becomes effortless. One of the standout advantages is the transparency they bring to the table. Borrowers can easily understand the cost implications of their loans, comprehending the interest and fees associated with various amounts and durations. This transparency empowers borrowers to make informed decisions, ensuring they select a loan that aligns with their repayment capabilities. BlinkFinance’s digital-first approach means that comparisons can be made anytime, anywhere, without the need for physical visits or lengthy phone calls. All references to currency have been converted to Rands.

Types of Loans Offered by BlinkFinance

BlinkFinance, renowned for its instant loans, provides a diverse range of loan products tailored to address various financial needs.

Different Loan Products Available

At its core, BlinkFinance specializes in payday loans. These short-term loans are crafted to offer quick and convenient access to cash, especially during emergencies or to bridge the gap until the next paycheck. Due to their short-term nature, these loans are typically repayable by the following payday. The flexibility in choosing both the loan amount and duration makes it a preferred choice for many individuals in need of swift funds.

Suitable Purposes for Each Loan Type

The payday loan offered by BlinkFinance is versatile and can cater to a multitude of needs. Whether facing an unexpected medical emergency, urgent car repairs, or simply managing expenses before the next salary day, this loan type proves to be a lifesaver. It’s crucial for borrowers to recognize that, while the loan is flexible in its usage, assessing one’s repayment capabilities before opting for it is essential. Financial prudence remains the key to maintaining a healthy credit profile. All currency references have been converted to Rands to align with South African English conventions.

Requirements for a BlinkFinance Loan

Obtaining a loan from BlinkFinance is a streamlined process, yet, like all financial institutions, specific requirements are in place to ensure the credibility of the borrower and the safety of the lending process.

Documents and Information Needed

When applying for a loan with BlinkFinance, applicants must provide certain essential documents and information. Firstly, a valid South African ID number is mandatory. This is not merely a formality; BlinkFinance utilizes this ID to conduct a comprehensive credit check, ensuring the applicant has a history of financial responsibility.

In addition to the ID, applicants must provide verifiable proof of a stable income. This can be in the form of recent payslips, bank statements, or any document attesting to the applicant’s earning capabilities. This income verification is crucial as it gives BlinkFinance confidence that the borrower has the means to repay the loan within the stipulated timeframe.

BlinkFinance requires some basic personal details to facilitate the loan process. This includes contact information, both physical and postal addresses, and details about the applicant’s current employer. These details not only help verify the authenticity of the applicant but also play a pivotal role in ensuring smooth communication throughout the loan tenure.

Lastly, while BlinkFinance prides itself on its digital-first approach, they still emphasize the importance of accurate and up-to-date information. This ensures that the loan approval and disbursement process is not only swift but also free from any hiccups. All references to currency have been converted to Rands to align with South African English conventions.

Simulation of a Loan at BlinkFinance

Navigating the loan application process can sometimes feel like a maze. However, with BlinkFinance, the journey is designed to be straightforward and user-friendly. Let’s walk through the step-by-step guide to applying for a loan with BlinkFinance.

Step-by-step Guide to Applying for a Loan with BlinkFinance

- Visit the BlinkFinance Website: Start by accessing the official BlinkFinance website. Here, you’ll encounter an intuitive interface that guides you through the initial stages of the loan application.

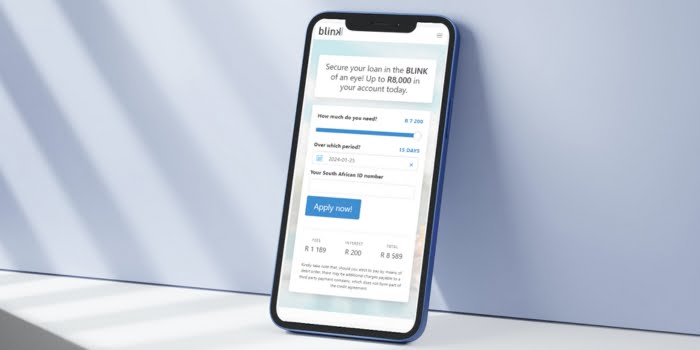

- Use the Online Loan Calculator: On the homepage, locate the online loan calculator. This tool enables you to choose your desired loan amount and repayment period. By adjusting these parameters, you can receive an immediate estimate of the loan’s cost and associated interest.

- Enter Personal Details: After obtaining an estimate, you’ll be prompted to enter your South African ID number. This step is crucial as BlinkFinance utilizes this information to conduct an initial credit check.

- Complete the Application Form: Following the initial credit check, fill out a more detailed application form. This involves providing personal details such as contact information, physical and postal addresses, employer details, and a breakdown of your income and expenses.

- Upload Necessary Documents: To verify the information provided, BlinkFinance will request certain documents. Typically, this includes proof of income, such as recent payslips or bank statements.

- Await Approval: Once all details are verified, BlinkFinance will notify you about your loan’s approval status. If approved, the loan amount will be transferred directly to your bank account, often on the same day. All currency references have been converted to Rands to align with South African English conventions.

Eligibility Check

BlinkFinance recognizes the significance of time, particularly in addressing financial requirements. To guarantee that prospective borrowers do not invest time in applications that may not gain approval, they provide tools to pre-check eligibility.

Tools or Methods Offered by BlinkFinance for Pre-checking Eligibility

Online Loan Calculator: Prior to delving into the application process, the online loan calculator on the BlinkFinance homepage offers an initial overview of the loan’s feasibility. By inputting the desired loan amount and repayment period, potential borrowers can estimate the associated costs and interest rates.

South African ID Number Verification: By simply entering the South African ID number, BlinkFinance conducts a preliminary credit check. This initial assessment provides potential borrowers with an indication of their loan eligibility based on their credit history.

BlinkFinance’s approach to assessing loan eligibility is crafted to be transparent and efficient. Through tools that offer immediate feedback, they ensure that prospective borrowers gain a clear understanding of their loan prospects right from the beginning.

Security and Privacy

In the digital age, the security and privacy of personal and financial information are of utmost importance. BlinkFinance acknowledges this and has implemented robust measures to ensure the protection of its clients’ data at all times.

How BlinkFinance Ensures the Security of Personal and Financial Information

BlinkFinance employs state-of-the-art encryption technologies to safeguard the data transmitted between the borrower and the platform. This means that every piece of information, from your South African ID number to your bank account details, is encrypted, making it nearly impossible for unauthorized parties to access or decipher.

In addition to encryption, BlinkFinance has established secure firewalls to protect its databases from potential cyber threats. Regular security audits are conducted to identify and rectify any vulnerabilities, ensuring that the platform remains fortified against evolving cyber threats.

BlinkFinance’s commitment to using a paperless credit solution not only streamlines the loan application process but also reduces the risk associated with physical document handling and storage. By keeping everything digital, they minimize the chances of sensitive information being misplaced or accessed by unauthorized personnel.

Privacy Policies and Data Handling Practices

BlinkFinance’s dedication to privacy is evident in its adherence to the National Credit Act, which mandates strict guidelines on how financial institutions should handle and store client data.

Their privacy policy is transparent and comprehensive. It outlines how the data is collected, the purposes for which it is used, and the measures in place to protect it. BlinkFinance ensures that personal and financial data is only used for the intended purposes, such as loan approval and disbursement, and is never shared with third parties without explicit consent.

BlinkFinance respects the rights of its clients to access, modify, or delete their data. If at any point a borrower wishes to review their data or has concerns about its accuracy, BlinkFinance provides channels through which these concerns can be addressed promptly.

How Much Money Can I Request from BlinkFinance?

When considering a loan from BlinkFinance, it’s crucial to understand the range of amounts you can request. BlinkFinance offers loans that address various financial needs. The minimum amount you can request is typically determined by your financial capability and creditworthiness. On the higher end, BlinkFinance allows borrowers to request up to R8,000. This flexibility ensures that whether you have a minor financial hiccup or a more significant need, BlinkFinance has got you covered.

Loan Amount Range

- Minimum Amount: The minimum amount you can request is subject to your financial capability and creditworthiness.

- Maximum Amount: BlinkFinance allows borrowers to request up to R8,000.

Receive Offers

BlinkFinance prides itself on providing tailored loan solutions to its clients. Instead of a one-size-fits-all approach, they analyze individual financial profiles to create personalized loan offers.

The process commences with the information you furnish during the application. Details such as your income, expenses, and credit history play a pivotal role. BlinkFinance’s advanced algorithms then analyze this data to determine the loan amount, interest rate, and repayment terms that align with your financial situation. This personalized approach ensures that the loan offer you receive is not only competitive but also sustainable for your financial health.

How Long Does It Take to Receive My Money from BlinkFinance?

One of the standout features of BlinkFinance is its commitment to swift processing times. On average, once your loan is approved, the funds are transferred directly into your account within 24 hours. This quick turnaround is especially beneficial for those in urgent need of funds.

Factors Affecting Withdrawal Speed

While BlinkFinance aims for rapid disbursements, certain factors can affect withdrawal speed. The accuracy of the information provided, the time of approval, and bank processing times can influence the exact time it takes for the funds to reflect in your account. It’s always advisable to ensure that all provided details are accurate and to apply during regular business hours to expedite the process.

How Do I Repay My Loan from BlinkFinance?

Repaying your loan is a straightforward process with BlinkFinance. They offer repayment periods ranging from 61 to 65 days, providing borrowers with some flexibility.

Repayment Options and Plans

All repayments are done via debit order. This automated process ensures that repayments are timely and reduces the hassle for borrowers. Before the debit order is executed, borrowers receive a notification, ensuring transparency in the process.

Possible Fees and Penalties

While BlinkFinance is transparent about its fee structure, it’s crucial to be aware of potential fees and penalties. If there’s a non-payment of your account, a service fee of R69 is levied, along with an added 5% interest every month. If payments are missed for two consecutive months, the account may be handed over to an external debt collection company. Additionally, not repaying your loan on time can adversely affect your credit rating, making future financial endeavors more challenging.

Online Reviews of BlinkFinance

Navigating the financial landscape can be daunting, and many individuals rely on online reviews to gauge the credibility and performance of financial institutions. BlinkFinance, like many other companies, has its share of online feedback. Here’s a glimpse into what customers are saying about BlinkFinance.

What Customers Say About BlinkFinance

While conducting a search for BlinkFinance reviews, one of the prominent sites that appeared was Scamadviser. On this platform, BlinkFinance has a trust score of 46 out of 100. This score is determined using a computer algorithm that looks at over 40 data points, including third-party reviews, the company’s location, hosting party, and reports of selling fake products, among others. The low trust score suggests potential users should exercise caution and conduct further research before engaging with BlinkFinance.

The website also highlighted some positive aspects, such as the presence of a valid SSL certificate, which ensures encrypted data transmission between the user and the website. This SSL certificate is a sign of a legit and safe website. However, it’s worth noting that even scammers sometimes use SSL certificates, so it’s not a definitive proof of legitimacy.

On the downside, the identity of the website owner is hidden, and the website’s traffic rank is relatively low. Additionally, the age of the site is quite young, which can sometimes be a red flag, as scam sites are often set up and taken down quickly.

It’s important to note that there were no specific consumer reviews available for BlinkFinance on Scamadviser at the time of the search. This lack of reviews means potential users don’t have firsthand accounts to rely on when making a decision.

Customer Service

BlinkFinance prides itself on delivering top-notch customer service to its clients. Whether you have questions about the loan application process, repayment terms, or any other aspect of their services, their dedicated team is always ready to assist. They understand the importance of clear communication, especially when it comes to financial matters, and strive to provide timely and accurate responses to all inquiries.

Do You Have Further Questions for BlinkFinance?

If you have additional questions or need clarification on any aspect of BlinkFinance’s offerings, don’t hesitate to reach out to their customer service team. They are equipped to provide detailed explanations and guide you through any uncertainties you might have. Remember, it’s always better to ask and be clear than to make assumptions, especially when dealing with financial matters.

Alternatives to BlinkFinance

While BlinkFinance offers a range of financial solutions tailored to meet various needs, it’s always a good idea to explore alternatives. The financial market is vast, and several other credit comparison portals might suit your specific requirements.

Comparison Table

| Lender | Loan Range | Interest Rate | Repayment Period |

|---|---|---|---|

| BlinkFinance | R500 – R8,000 | Varies | 61-65 days |

| Wonga | Up to R4000 | Varies | Up to 6 months |

| ExpressFinance | Up to R3000 | Varies | Until next payday |

| Sunshine Loans | R500 – R4,000 | Varies | Aligned with pay cycle |

History and Background of BlinkFinance

BlinkFinance emerged in the financial landscape as a response to the growing need for swift and reliable online lending solutions. Established in the heart of South Africa, the company quickly gained traction by offering digital, paperless credit solutions to individuals facing sudden financial challenges. Over the years, BlinkFinance has grown not just in terms of its customer base but also in its commitment to ethical lending practices, as evidenced by its accreditation with the National Credit Act.

Company’s Mission and Vision

BlinkFinance’s mission is clear: to provide fast, transparent, and reliable loan solutions to those in need. They believe in leveraging technology to make the loan application process as seamless and hassle-free as possible. Their vision is to be at the forefront of online lending, setting industry standards in terms of speed, transparency, and customer satisfaction.

Pros and Cons

Advantages of Choosing BlinkFinance

- Swift Processing: BlinkFinance is known for its same-day loan approval and transfer, ensuring that borrowers get access to funds when they need them the most.

- Transparent Fee Structure: With BlinkFinance, there are no hidden charges. Borrowers can easily understand the cost implications of their loans.

- Digital-First Approach: The paperless credit solution offered by BlinkFinance ensures a smooth and efficient loan application process.

Disadvantages of Choosing BlinkFinance

- Limited Loan Amount: The maximum loan amount offered by BlinkFinance is R8,000, which might not cater to those needing larger sums.

- Short Repayment Period: With repayment periods ranging from 61 to 65 days, some borrowers might find it challenging to repay the loan in such a short timeframe.

It’s essential for borrowers to weigh these advantages and disadvantages against their specific financial needs and preferences before choosing BlinkFinance or any other lending option.

Conclusion

BlinkFinance has undoubtedly made its mark in the online lending space with its swift processing times and transparent fee structure. The advantages of same-day loan approval, a clear fee structure, and a digital-first approach contribute to its appeal. However, potential borrowers should also be aware of the limitations, such as the capped loan amounts and relatively short repayment periods.

Frequently Asked Questions

BlinkFinance is an online lending platform based in South Africa that specializes in offering swift and transparent loan solutions to individuals in need. They focus on providing digital, paperless credit solutions with an emphasis on speed and customer satisfaction.

You can request loan amounts ranging from a minimum of R500 to a maximum of R8,000, depending on your financial capability and creditworthiness.

BlinkFinance is known for its rapid processing times. On average, once your loan is approved, the funds are transferred directly into your account within 24 hours.

No, BlinkFinance prides itself on its transparent fee structure. All costs associated with the loan are clearly outlined during the application process, ensuring no hidden charges or surprises.

All repayments are done via debit order. This automated process ensures timely repayments and reduces the hassle for borrowers. Before the debit order is executed, borrowers receive a notification for transparency.