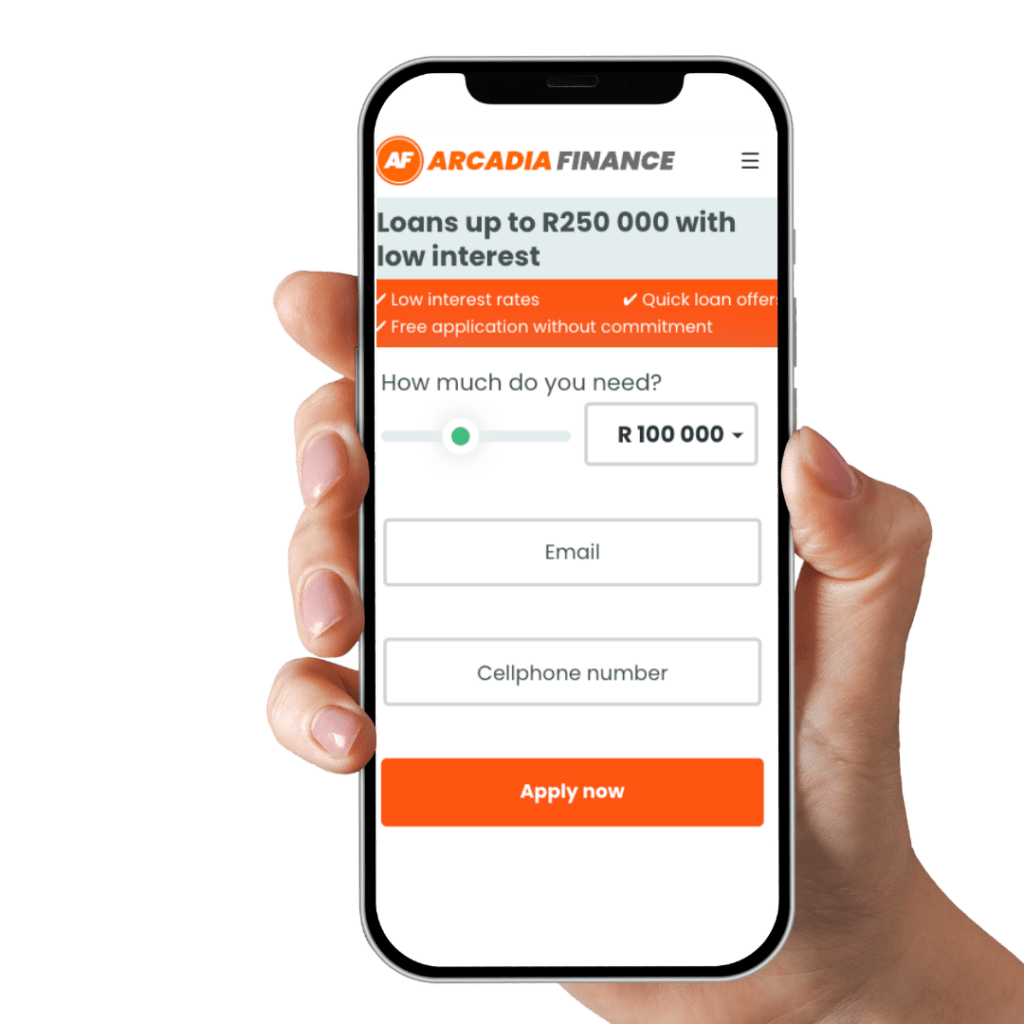

Personal loans up to R250 000

- Loan offers from over 10 banks

- Quick application and payment

- Offers are non-binding and free of charge

10+ NCR certified banks and lenders

Examples of compared loans

Male, 32

Loan Amount

R49,000

Loan Time

5 years

Interest Rate

15%

Monthly Repayment

R1165.71

Female, 49

Loan Amount

R22,000

Loan Time

15 years

Interest Rate

8%

Monthly Repayment

R210.24

Male, 35

Loan Amount

R15,000

Loan Time

8 years

Interest Rate

11%

Monthly Repayment

R235.63

Female, 41

Loan Amount

R30,000

Loan Time

6 years

Interest Rate

12.5%

Monthly Repayment

R594.34

How to apply for a loan?

1.

Fill in our short loan application in minutes. Just enter your details and choose your desired loan amount.

2.

We will send your application over to a number of different banks and lenders for review.

3.

You’ll receive personalized offers based on your responses, giving you a variety of choices. You are free to accept or decline the offers as you please.

Who can apply for a loan?

- You are over 18 years old

- You are employed and employment has lasted for more than 6 months

- Your loan should not be more than 8 times larger than your monthly income

Why use Arcadia Finance?

- 100% online: The whole application process is done online.

- Fast: Apply and get approved within minutes.

- Convenient: Compare over 10 banks with one application.

- Non-binding: You decide if you want to accept or decline your offers.

- Safe: Your personal data is safe with us – read more here.

About Arcadia Finance

Get your loan hassle-free with Arcadia Finance. There’s no application fee, and you can choose from a range of 10 trusted lenders. Each lender abides by the regulations set by the National Credit Regulator in South Africa.

Frequently Asked Questions

Arcadia Finance is an online loan broker and not a lender. We help you to find loans from various banks and lenders, offering a service that connects users to multiple lenders with one application, enabling you to compare and select the most suitable loan offers.

Most banks and lenders only offer loans to full-time employed people whose employment has lasted at least 3 (three) months. You should also take into consideration that your loan should not be more than 8 times larger than your monthly income. You are required to have a South African ID to apply and you should not be under any debt review.

Loan amount R100 – R250,000. Repayment terms can range from 3 – 72 months. Minimum APR is 5% and maximum APR is 60%.

This totally depends on the lenders. If you have a good credit history and earn enough to cover the repayment terms, there shouldn’t be any problem getting a loan. The interest rate offered depends on the applicants’ credit score and other factors at the lender’s discretion. Interest rates charged by lenders can start as low as 20% APR, including an initiation and service fee determined by the lender.

Unfortunately, you cannot apply if under debt review and we do not provide loans to clients who are blacklisted at any place.

Yes, pensioners can qualify for a loan. Each decision is, however, made individually. Please fill in the loan application to see your personal loan possibilities.

Instead of applying for a loan in several banks, we help you compare them with one quick application. We only partner with trustworthy NCR certified banks and lenders. If you are not satisfied with our loan offers, you can decide not to accept the offers free of charge.

How comparing loans work?

After submitting your loan application to us, we will send it over to a number of different banks and lenders for review.

Within minutes, you’ll receive a variety of loan options that are available for you. Select the one that best fits your needs.

Remember, all offers are no-binding, so if you don’t find what you’re looking for, you’re free to decline.