Load shedding, a term now deeply ingrained in the daily lives of South Africans, no longer sparks as much surprise as it once did. What was once met with frustration has gradually turned into resigned acceptance for many. However, the far-reaching consequences of these power outages cannot be overlooked. South Africa’s economy continues to bear the brunt, with significant disruptions across various industries. Since load shedding became a recurring issue, the country’s economic stability has been noticeably weakened. So, what are the broader effects of load shedding on the economy?

Key Takeaways

- Economic Disruptions: Load shedding significantly impacts businesses across all sectors, leading to reduced productivity, higher operational costs, and financial losses, particularly for SMEs and large corporations.

- Sector-Specific Challenges: Industries like manufacturing and hospitality experience severe setbacks, including production delays and diminished service quality, with many facing the threat of closure due to unsustainable costs.

- Mitigation Strategies: Businesses can reduce financial risks by investing in backup power solutions, creating contingency plans for financial operations, and improving energy efficiency to maintain resilience during load shedding.

About Arcadia Finance

Simplify your loan application with Arcadia Finance. Take advantage of no application fees and choose from 19 trusted lenders, all compliant with South Africa’s National Credit Regulator standards. Enjoy a seamless process and reliable solutions tailored to meet your financial goals.

What is Load Shedding?

Load shedding refers to the controlled distribution of electricity demand across multiple power sources. This approach is implemented to alleviate pressure on the primary power grid when the demand for electricity exceeds what the main energy supply can provide.

The purpose of load shedding is to prevent the primary power grid or supply from becoming overloaded, which could result in widespread blackouts. This method is a form of demand management that often involves rotating power outages or temporarily reducing electricity usage from primary sources. These measures continue until demand decreases or the system regains sufficient capacity to meet electricity needs. During such periods, facilities like data centres typically depend on backup power systems to maintain operations and prevent interruptions.

Load shedding is commonly planned in advance as part of routine energy management. However, it is also employed as an emergency response following natural disasters or extreme weather conditions. The duration of these power interruptions can range from several minutes to a few hours. This can cause significant disruptions to businesses and essential services, negatively affect productivity, and lead to dissatisfaction among customers and clients.

Understanding the financial implications of load shedding starts with knowing its timing and frequency. Eskom load shedding schedules provide critical insights for individuals and businesses to plan around disruptions. By minimizing uncertainty, you can reduce the cost of downtime and prepare effectively.

Causes of Load Shedding

Load shedding occurs due to various factors, which include the following:

- High electricity demand exceeding available supply, often during peak usage periods.

- Insufficient generation capacity at power stations, leading to an inability to meet the required demand.

- Unreliable energy sources, such as inconsistent fuel supply or renewable energy production issues.

- Equipment failures, including malfunctioning transmission lines or power distribution units (PDUs).

- Outdated or inadequate infrastructure, such as reliance on older PDUs instead of more advanced smart PDUs.

- Energy crises, where a region or country struggles to generate or import enough electricity to meet its needs.

- Damage from extreme weather conditions, such as storms or heatwaves, which can disrupt the power grid, damage transformers, or sever transmission lines.

As South Africans grapple with rolling blackouts, fuel price hikes further strain household budgets. Read on: Petrol Costs Set to Climb Higher.

How Does Load Shedding Work?

In many cases, load shedding is carefully planned and coordinated with property owners and other stakeholders. Electricity providers monitor the grid to assess when demand surpasses available supply or approaches critical capacity levels. Based on these evaluations, a plan is developed that typically includes scheduled power cuts, temporary disconnections, or even incentives for businesses and property owners to participate in reducing usage. Once the electricity demand stabilises or additional supply becomes available, power is restored to the affected areas.

Unplanned load shedding can also occur, often without prior notice. This situation arises when electricity providers are forced to rapidly lower or stop electricity supply in certain regions to prevent the entire grid from failing. Such scenarios are commonly referred to as rolling blackouts, where power outages are rotated among different areas to minimise disruption. Alternatively, a brownout may occur, where the electricity provider reduces voltage levels during periods of high demand to prevent a complete blackout while maintaining some level of power supply.

When you’re assessing the full cost of blackouts, it’s vital to understand exactly what each stage involves. Our guide to Loadshedding Stages breaks down the levels, so you can see how they escalate and what that means for your pocket.

Power Outages vs Load Shedding

While power outages and load shedding both result in electricity interruptions, they differ significantly in nature and cause.

- Load shedding is a planned and controlled measure to reduce electricity demand. It follows pre-arranged schedules and involves agreements between power stations and property owners to temporarily cut power as a preventative step.

- Power outages, on the other hand, are unplanned interruptions caused by factors such as severe weather, natural disasters, or equipment breakdowns. They occur suddenly and are not controlled by utility providers.

Another key distinction is duration. Load shedding is typically a temporary measure with a fixed duration, while power outages can persist until the issue is resolved, which could take hours, days, or even weeks. In both cases, buildings equipped with automatic transfer switches can transition to backup power sources, ensuring continued operations during disruptions.

Homeowners dealing with load shedding can significantly benefit from installing backup power systems like generators or solar panels. Financing home improvements offers an accessible pathway to mitigate frequent power cuts while potentially increasing property value.

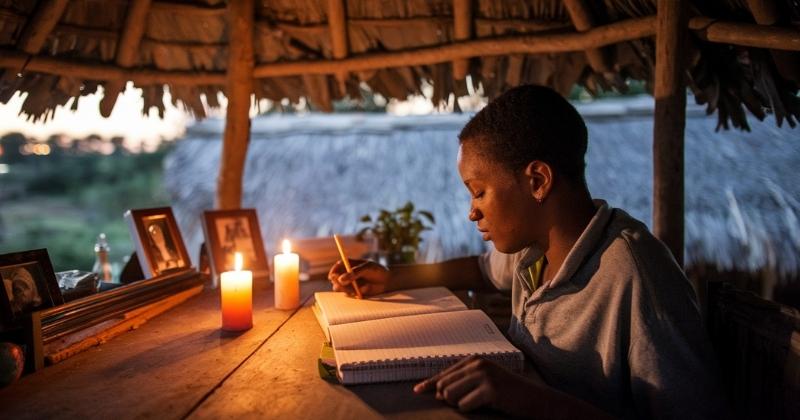

Impact of Load shedding in South Africa

In 2022, South Africa endured more than 200 days of loadshedding, which placed a significant financial burden on businesses across all industries. Organisations of all sizes faced the challenge of maintaining operations amidst persistent power disruptions, often resorting to expensive contingency measures to mitigate the effects.

Large corporations, including The Foschini Group (TFG) and Shoprite, reported financial losses amounting to millions of rands. These losses were largely attributed to heightened expenses for diesel generators and other emergency power solutions required to sustain business activities during frequent outages.

Small and medium enterprises (SMEs) were equally impacted, with surveys indicating average monthly losses of around R8 000. These losses were primarily driven by the cost of alternative energy solutions and the expenses associated with repairing damage caused by inconsistent power supply.

Load shedding is driving more South Africans towards solar energy, but rushing into an installation without proper research could cost you dearly. A bad solar installer might leave you with inefficient panels, unapproved wiring, or even voided warranties. Don’t fall for costly mistakes. Read Experts Warn That Picking the Wrong Solar Installer Could Cost You before you invest.

Challenges Across Industries

Manufacturing Sector

Manufacturers have experienced up to a 50% drop in productivity, primarily due to disruptions in workflows and extended periods of machine downtime. The increasing expenses associated with maintaining operations and handling wasted materials have placed further pressure on profit margins, making it harder for businesses to remain sustainable.

Hospitality Sector

The hospitality industry, including establishments like guesthouses and restaurants, has been heavily impacted by reduced operational capacity during power outages. This has not only degraded the quality of service provided to customers but has also led to substantial financial losses, with some businesses facing the possibility of permanent closure.

Other Sectors

A variety of other industries, such as furniture manufacturing and armament production, are grappling with escalating operational costs brought on by loadshedding. Lower output levels combined with unsustainable expenses are pushing many businesses toward potential shutdowns, leaving these sectors in a precarious position.

Like the economic toll of load shedding, tariffs on Shein and Temu impact consumers and industries in unexpected ways. Understand how such policies weigh on household budgets and the local market.

Ways That Load Shedding Affects The Economy

Reduced Productivity

Load shedding forces businesses to pause operations or work below full capacity, which directly reduces productivity and slows economic growth. Power outages can cause equipment failures, data loss, and incomplete tasks. Employees may struggle to meet deadlines, while delayed deliveries and disrupted communication harm customer satisfaction.

Increased Costs

Frequent power cuts have compelled businesses to invest in alternative energy sources, which often come at a higher cost. The upfront expense of solutions like solar power systems is significant, making them unaffordable for many businesses, particularly those with reduced profit margins. These financial strains impact operational budgets and long-term growth.

Job Losses

As companies face operational challenges, some are forced to downsize or close entirely, resulting in job losses and higher unemployment. This compounds financial hardship for many families already under pressure, exacerbated by recent challenges like the pandemic.

Reduced Foreign Investment

Unreliable power supply undermines South Africa’s reputation for dependable infrastructure, deterring foreign investors and slowing economic progress. This also discourages potential visitors and expatriates, reducing South Africa’s global appeal.

Reduced Tax Revenue

Lower economic activity and shrinking profits reduce tax revenues for the government. This shortfall limits funding for infrastructure improvements, public services, and support for vulnerable citizens.

Reduction in Consumer Spending

With decreased disposable income, South Africans spend less, weakening the economy. The financial strain also motivates many citizens to emigrate in search of better opportunities, further reducing local economic participation.

Supply Chain Disruptions

Power outages disrupt supply chains, delaying the delivery of goods and services and causing stock shortages. Many customers shift to competitors who can maintain operations, often disadvantaging smaller businesses with limited resources.

Increased Reliance on Fossil Fuels

For businesses unable to afford cleaner energy options, generators become a necessity. This increases the use of fossil fuels, contributing to pollution. Generator noise is also a persistent nuisance in residential areas.

Reduced Access to Essential Services

Load shedding affects critical services like healthcare, education, and public safety. This limits access to essential resources, negatively impacting citizens’ quality of life and well-being.

Managing Financial Risks During Load Shedding

Using Backup Power Solutions

Installing reliable backup power systems can reduce financial risks during load shedding. Options include generators, UPS systems, and solar power. These solutions help businesses maintain operations and reduce downtime during outages, ensuring productivity remains steady.

Preparing Contingency Plans for Financial Operations

Power outages can disrupt payroll, invoicing, and reporting. To maintain financial processes, businesses should create contingency plans. These could involve remote work setups, using cloud-based accounting tools, or training staff to handle tasks manually if needed.

Protecting Data During Power Cuts

Load shedding increases the risk of data loss or breaches. Regularly backing up critical financial data to secure offsite locations is essential. Encryption and access controls further protect sensitive information from unauthorised access during outages.

Improving Energy Efficiency

To rely less on the grid, businesses can adopt energy-efficient practices. This includes using LED lighting, upgrading to efficient appliances, and conducting energy audits to identify cost-saving opportunities while reducing power consumption.

Conclusion

Load shedding continues to pose significant challenges for South Africa’s economy, affecting productivity, increasing costs, and hindering growth across various sectors. From job losses and reduced foreign investment to disruptions in essential services and consumer spending, the ripple effects are far-reaching. However, businesses can mitigate the impact by implementing strategic solutions, such as investing in backup power, adopting energy-efficient practices, and strengthening supply chains. While the problem persists, proactive measures can help minimise financial risks and ensure greater resilience during these challenging periods.

Frequently Asked Questions

Load shedding is a planned and controlled reduction of electricity supply to prevent the power grid from becoming overloaded. It occurs when electricity demand exceeds available supply due to factors such as high usage, insufficient generation capacity, or infrastructure failures.

Businesses face reduced productivity, higher operational costs, and potential financial losses during load shedding. Smaller businesses are particularly vulnerable due to their limited resources to invest in alternative power solutions.

Load shedding undermines economic growth by discouraging foreign investment, reducing tax revenues, and decreasing consumer spending. It also impacts South Africa’s competitiveness in global markets.

Businesses can invest in backup power solutions like generators and solar systems, create contingency plans for financial operations, and adopt energy-efficient practices to reduce reliance on the national grid.

Yes, load shedding disrupts essential services such as healthcare, education, and public safety. These interruptions compromise access to critical resources, affecting citizens’ quality of life and well-being.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.