The African Bank Credit Card is a flexible financial tool designed for South Africans looking for a convenient way to manage everyday spending while enjoying additional benefits. This credit card offers a competitive credit limit, an interest-free period, and access to exclusive perks, making it a practical choice for those who need financial flexibility. Whether you are looking to make secure online purchases, pay for daily expenses, or build a positive credit record, this card provides a reliable option.

African Bank Credit Card – Overview

| Name | African Bank Credit Card |

|---|---|

| Financial Institution | African Bank |

| Product | Credit Card with Global Acceptance and Flexible Benefits |

| Minimum Age | 18 years |

| Minimum Credit Limit | Subject to affordability assessment |

| Maximum Credit Limit | Determined based on income and creditworthiness |

| Minimum Term | Revolving credit, with monthly repayments required |

| Maximum Term | Ongoing, with a budget facility for extended repayment terms |

| APR (Annual Percentage Rate) | Varies based on credit profile and prevailing interest rates |

| Monthly Interest Rate | Subject to National Credit Act (NCA) regulations, varies per applicant |

| Early Settlement | Full balance can be paid at any time without penalties |

| Repayment Flexibility | Options include full monthly settlement, minimum payment, or budget instalments |

| NCR Accredited | Yes |

| Our Opinion | ✅ Global acceptance at merchants and ATMs displaying the Visa logo ✅ Flexible repayment options with interest-free periods ⚠️ Interest rates may vary based on individual credit profiles |

| User Opinion | ✅ Convenient for international transactions due to Visa affiliation ⚠️ Interest rates may be higher compared to some traditional bank credit cards |

What Makes the African Bank Credit Card Unique?

The African Bank Credit Card stands out for its competitive interest rates, flexible repayment options, and easy accessibility. Unlike many credit cards that come with complicated fee structures, this card offers transparent pricing, so users know exactly what they are paying for. It includes up to 62 days of interest-free purchases, giving cardholders extra time to manage their finances before incurring interest. Additionally, the card is equipped with contactless payment features and can be linked to digital wallets like Apple Pay, Samsung Pay, and Google Pay, making transactions faster and more secure.

Another key advantage of the African Bank Credit Card is its accessibility to a wider range of applicants. Many banks require strict credit scores or high income levels, but African Bank offers a more inclusive approach. The bank allows customers to apply with a minimum income of R5 000, making it a good option for individuals looking to improve their financial standing. No annual card fees further enhance its appeal, reducing long-term costs. The card also provides travel benefits such as global ATM withdrawals and security features like 24/7 fraud monitoring, ensuring safe and convenient spending whether at home or abroad.

About Arcadia Finance

Get the loan you need effortlessly with Arcadia Finance. With no application fees and access to 19 trusted lenders regulated by South Africa’s National Credit Regulator, you can secure a loan quickly and confidently—tailored to your financial needs.

Types of Credit Cards Offered by African Bank

African Bank currently offers one primary credit card, designed to suit a variety of financial needs.

African Bank Black Credit Card

This is a general-purpose credit card that offers a competitive credit limit, interest-free purchases for up to 62 days, and flexible repayment options. It is suitable for individuals who need a reliable spending tool for everyday purchases, online transactions, or managing monthly expenses. The card also includes fraud protection, digital wallet compatibility, and no annual fees, making it an affordable option for those who want a straightforward and cost-effective credit solution.

Currently, African Bank does not offer multiple tiers of credit cards, such as premium or platinum options. However, their single credit card is designed to be versatile enough for most users, whether they are looking for short-term financing, convenience, or a way to build their credit profile.

Requirements for an African Bank Credit Card

To apply for an African Bank Credit Card, applicants must meet certain requirements and provide the necessary documents. The bank aims to make the process straightforward while ensuring responsible lending practices.

Eligibility Criteria

- Minimum income: R5 000 per month

- Age requirement: 18 years or older

- South African residency: Valid South African ID or passport with a work permit

- Employment status: Must be employed or have a regular income

- Credit history: Subject to a credit check to assess financial responsibility

Simulation of a Credit Card Application at African Bank

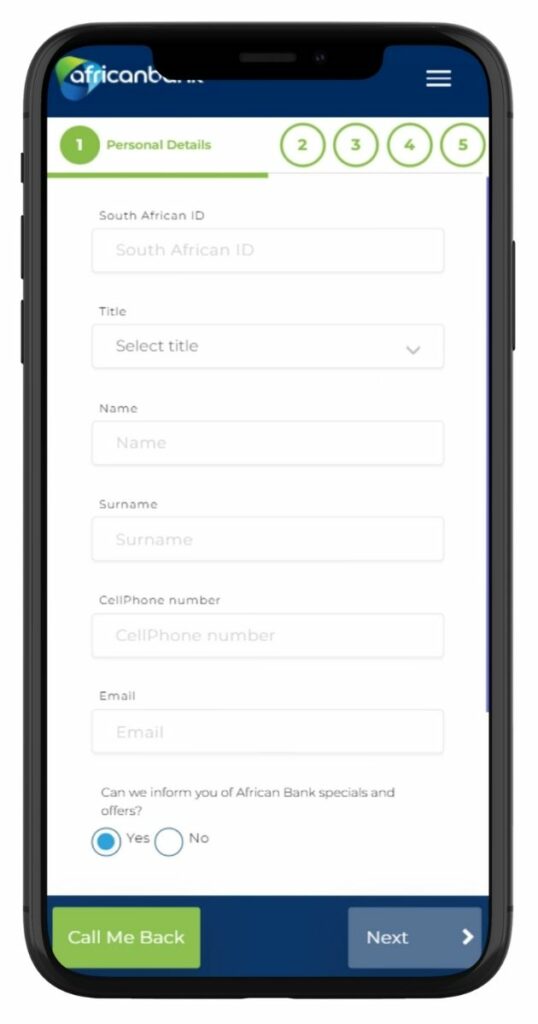

Applying for an African Bank Credit Card is a simple process that can be done online or in a branch. Follow these steps:

Step 1. Visit the African Bank website or go to a branch.

Step 2. Click “Apply Now” to start your credit card application.

Step 3. Fill in your South African ID, name, contact details, and email.

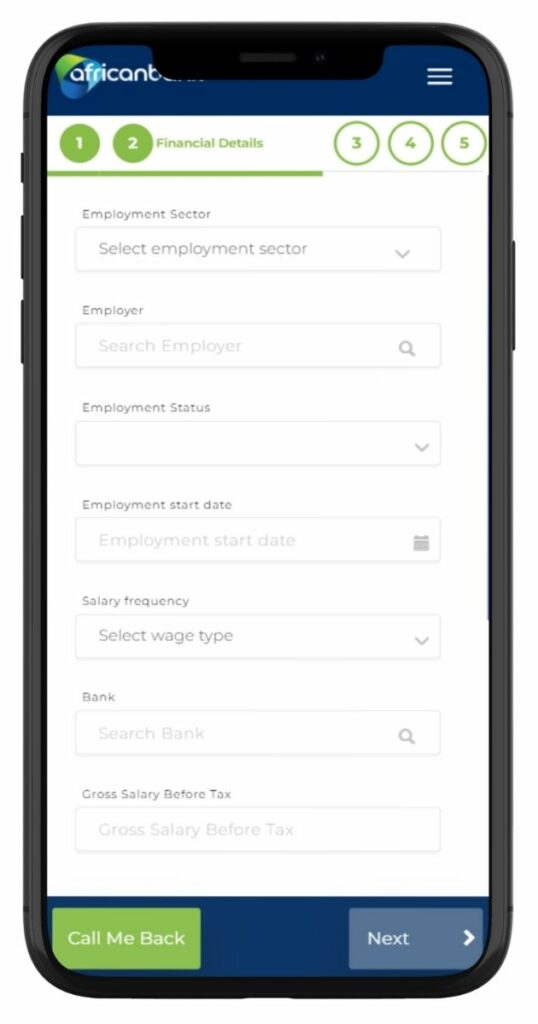

Step 4. Select your employment sector, employer, salary details, and bank

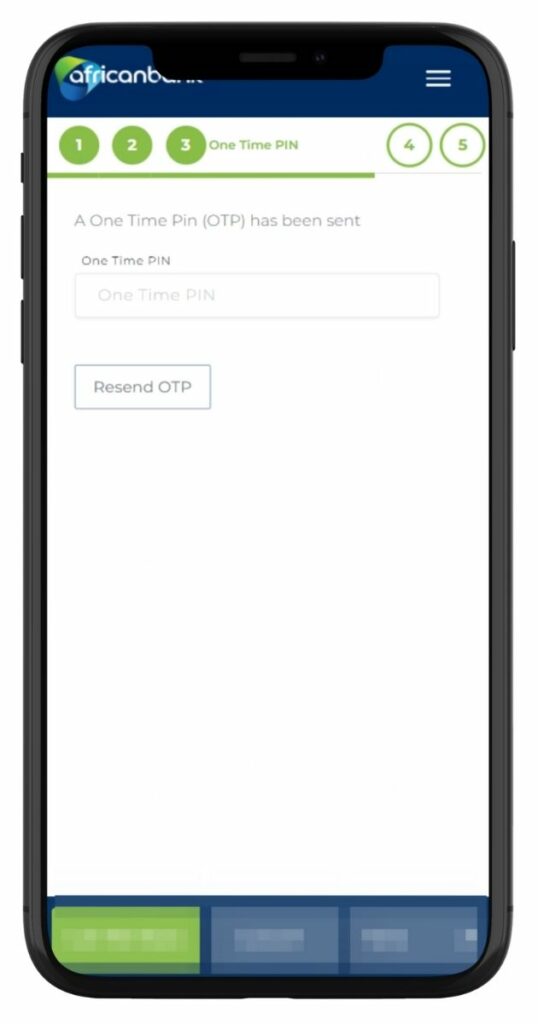

Step 5. Enter the One-Time PIN (OTP) sent to your phone for security verification.

Step 6. Upload required documents for verification.

Step 7. Submit the application and wait for approval.

Step 8. Receive approval status via SMS or email.

Step 9. Collect your card at a branch or have it delivered, depending on the process chosen.

Step 10. Activate the card and set up online banking access.

Eligibility Check

African Bank offers tools to help applicants check if they qualify before applying:

- Online credit assessment tool: A quick check on the African Bank website to estimate approval chances.

- In-branch pre-qualification: Customers can visit a branch for an eligibility check before submitting an application.

- Call centre support: Applicants can contact African Bank to discuss their eligibility based on income and credit history.

These tools allow potential applicants to gauge their likelihood of approval without affecting their credit score.

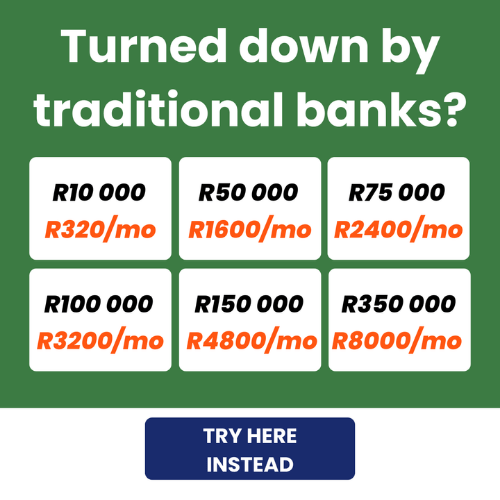

How Much Credit LImit Can I Request from African Bank?

African Bank offers a credit limit ranging from R2 000 to R250 000, depending on the applicant’s income, credit score, and affordability assessment. Higher credit limits are available to those with strong credit profiles and stable incomes, while first-time credit users or individuals with lower income levels may start with a smaller limit. Customers can request a credit limit increase over time by demonstrating responsible usage and making regular, on-time payments.

Receive Offers

African Bank provides personalised credit card offers based on an applicant’s financial profile. The bank evaluates income, credit history, and affordability to determine a suitable credit limit and interest rate. Some customers may pre-qualify for offers before applying, while others will receive a custom credit limit upon approval. The bank also reviews accounts periodically, allowing eligible users to apply for higher limits.

How Long Does It Take to Receive My Credit Card?

The application process is quick, with most approvals completed within 24 to 48 hours. Online applications are usually processed within one to two days, while in-branch applications may be approved immediately if all documents are provided. Once approved, the card can be collected at a branch or delivered within 5 to 7 working days. Delays may occur if additional credit checks are required or if documents are incomplete.

How Do I Repay My African Bank Credit Card?

Customers can repay their credit card through various methods, including monthly minimum payments, full balance payments, or structured instalments. Payments can be made via debit order, online banking, EFT, or at African Bank branches. To avoid penalties, cardholders should ensure at least the minimum repayment is made on time to prevent late fees, interest charges, and a negative impact on their credit score.

If you’re struggling with high credit card interest rates, you may consider using a personal loan to pay off credit card debt. This can help you consolidate your balances into a single, lower-interest payment, making it easier to manage your finances and reduce long-term costs.

Pros and Cons of African Bank Credit Card

Pros of African Bank Credit Card

- No annual card fees, making it a cost-effective option.

- Up to 62 days of interest-free purchases when paying off the full balance on time.

- Competitive credit limits ranging from R2 000 to R250 000.

- Contactless payments and digital wallet compatibility (Apple Pay, Google Pay, Samsung Pay).

- Flexible repayment options, including fixed instalments and debit orders.

- Available to a wider range of applicants, with a minimum income requirement of R5 000.

Cons of African Bank Credit Card

- Late payment penalties for missed or overdue instalments.

- Limited card options, as African Bank offers only one credit card.

- Branch-based collection for some customers, as home delivery may not always be available.

Before making a decision, it’s wise to explore multiple credit card options. The RCS Group Credit Card Review highlights a strong alternative for everyday spending and rewards, making it easier to compare the best fit for your financial needs.

Customer Service

African Bank provides multiple customer support channels for cardholders who need assistance. Customers can contact the bank via phone, email, or by visiting a branch for help with applications, repayments, or account-related queries. The African Bank website also offers an FAQ section with answers to common questions about credit cards, fees, and repayment terms.

Contact Channels

Phone number:

Customer Service Centre: 0861 111 011

Alternative Contact: 011 207 4500

Hours of operation:

Monday to Friday: 7:00 AM to 7:00 PM

Saturday: 8:00 AM to 12:00 PM

Postal address:

Private Bag X170, Midrand, 1685, Johannesburg

Online Reviews of African Bank

Customer feedback on African Bank’s credit card is mixed, with some users praising its affordable fees, easy approval process, and flexible repayment terms, while others highlight concerns about customer service response times and high interest rates for overdue balances. Many customers appreciate the no annual fees and interest-free period, making it a budget-friendly option compared to other credit cards.

However, some users have reported delays in card delivery and challenges with limit increases. Overall, reviews suggest that the card is best suited for individuals looking for a simple, cost-effective credit option but may not offer the premium benefits of high-end credit cards from larger banks.

Alternatives to African Bank

For those looking at other credit card options in South Africa, several banks offer competitive alternatives. Capitec, FNB, Standard Bank, Nedbank, and Absa all have different credit card products with varying benefits.

Comparison Table

| Feature | African Bank Credit Card | Capitec Global One Credit Card | FNB Aspire Credit Card | Standard Bank Gold Credit Card | Nedbank Gold Credit Card | Absa Flexi Core Credit Card |

|---|---|---|---|---|---|---|

| Minimum Income | R5 000 | R5 000 | R7 000 | R7 500 | R5 000 | R2 000 |

| Credit Limit | Up to R250 000 | Up to R500 000 | Up to R300 000 | Based on affordability | Based on affordability | Up to R90 000 |

| Annual Fee | None | R50 per month | R29 per month | R27 per month | R40 per month | R23 per month |

| Interest-Free Days | Up to 62 | Up to 55 | Up to 55 | Up to 55 | Up to 55 | Up to 57 |

| Rewards & Cashback | No rewards programme | No formal rewards | eBucks Rewards | UCount Rewards | Greenbacks Rewards | Absa Rewards |

| Digital Wallets | Yes | Yes | Yes | Yes | Yes | Yes |

| More Info | Capitec Credit Cards Review | FNB Credit Cards Review | Standard Bank Credit Cards Review | Nedbank Credit Cards Review | Absa Credit Cards Review |

History and Background of African Bank

African Bank was established in 1975 and has since grown into a well-known financial services provider in South Africa. It focuses on offering accessible credit solutions, savings accounts, and insurance products to a wide range of consumers. The bank has undergone several transformations over the years, including a restructuring process in 2016 after being placed under curatorship, which led to the creation of a stronger, more customer-focused institution.

African Bank’s mission is to provide affordable financial services to South Africans, empowering individuals through responsible lending. The bank aims to offer accessible credit solutions while promoting financial education and sustainable borrowing habits. Its vision is to be a trusted and customer-centric financial institution, ensuring that banking services remain simple, transparent, and inclusive for all South Africans.

Conclusion

The African Bank Credit Card is a practical and affordable option for South Africans who need a reliable credit solution without high fees. With no annual card fees, an interest-free period of up to 62 days, and flexible repayment options, it provides a cost-effective way to manage daily expenses and build credit. While it may not offer premium rewards like some competitor cards, it remains a strong choice for those looking for straightforward credit access with transparent pricing. Customers who value simplicity, security, and accessibility will find this card a suitable fit for their financial needs.

Frequently Asked Questions

To qualify for the African Bank Credit Card, applicants must have a minimum monthly income of R5 000. This ensures that cardholders have sufficient financial capacity to manage their repayments and use the credit facility responsibly.

The approval process for an African Bank Credit Card is generally quick and efficient. Online applications are typically processed within 24 to 48 hours, while in-branch applications can sometimes be approved on the same day, provided all the required documents are submitted correctly. Delays may occur if additional credit checks are needed.

No, African Bank does not charge an annual card fee, making it a more affordable option compared to many competitor credit cards. However, cardholders should still be aware of other costs, such as interest on outstanding balances, late payment fees, and transaction charges for cash withdrawals.

Yes, the African Bank Credit Card is enabled for international transactions, allowing you to make purchases at overseas merchants and withdraw cash from ATMs worldwide. However, foreign currency conversion fees may apply when transacting outside South Africa, so it’s advisable to check the applicable rates before travelling.

If a cardholder misses a payment, they may incur a late payment fee, and interest will be charged on the overdue amount. Continued missed payments can negatively impact your credit score, making it harder to qualify for future credit. To avoid penalties, it’s best to set up a debit order or reminder to ensure payments are made on time.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 16 banks and find the right loan for you.