The Capitec Credit Card is a widely used credit solution in South Africa, offering competitive fees, straightforward eligibility criteria, and easy management through Capitec’s banking app. With a focus on affordability and accessibility, the card provides a flexible credit limit, interest-free repayment periods, and various spending benefits. Whether you need a credit card for everyday expenses, online shopping, or travel, Capitec’s offering aims to meet different financial needs.

Capitec Credit Card Overview

| Name | Capitec Credit Card |

|---|---|

| Financial Institution | Capitec Bank |

| Product | Credit Card |

| Minimum Age | 18 years |

| Minimum Credit Limit | R1 000 |

| Maximum Credit Limit | Up to R500 000 (based on affordability and credit profile) |

| Interest Rate | Starting from the prime lending rate, personalised based on credit profile |

| Interest-Free Period | Up to 55 days on purchases if the balance is paid in full by the due date |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Minimum 5% repayment per month; budget facility available for extended repayment terms up to 48 months |

| NCR Accredited | Yes |

| Our Opinion | ✅ Efficient and user-friendly application process ✅ Competitive interest rates with flexible repayment options ⚠️ Lacks a rewards or cashback programme |

| User Opinion | ✅ Convenient access to funds with global acceptance ✅ Appreciation for the interest-free period and low fees ⚠️ Desire for additional perks like rewards or cashback |

What Makes the Capitec Credit Card Unique?

The Capitec Credit Card stands out for its affordability and accessibility, making it a practical choice for South Africans looking for a cost-effective credit solution. Unlike many traditional credit cards, it offers a competitive interest rate starting from 9.75% per annum, which is lower than what many other banks provide. Additionally, Capitec provides an interest-free period of up to 55 days, allowing users to avoid interest charges if they settle their balance within this timeframe. The card also features a simple fee structure, with a low monthly service fee and no unnecessary hidden costs, making it easy to manage without unexpected charges.

Another key feature that sets the Capitec Credit Card apart is its integration with Capitec’s user-friendly mobile banking app. Cardholders can manage their credit limit, track spending, and make repayments directly through the app without visiting a branch. The tap-to-pay functionality and worldwide Mastercard acceptance make it suitable for both local and international use. Additionally, Capitec offers free basic travel insurance for cardholders using the credit card to book flights, providing extra value without additional fees. These features, combined with the bank’s focus on transparency and low costs, make the Capitec Credit Card a strong contender for those seeking a straightforward and affordable credit option.

About Arcadia Finance

Arcadia Finance makes borrowing simple! No application fees, a smooth process, and a selection of 19 reliable lenders—fully compliant with South Africa’s National Credit Regulator. Secure the right loan for your financial goals with ease.

Credit Cards Offered by Capitec

Capitec keeps its credit card offering simple and accessible by providing a single standard credit card with flexible terms and a straightforward fee structure. Unlike some banks that offer multiple tiers of credit cards, Capitec focuses on affordability and ease of use.

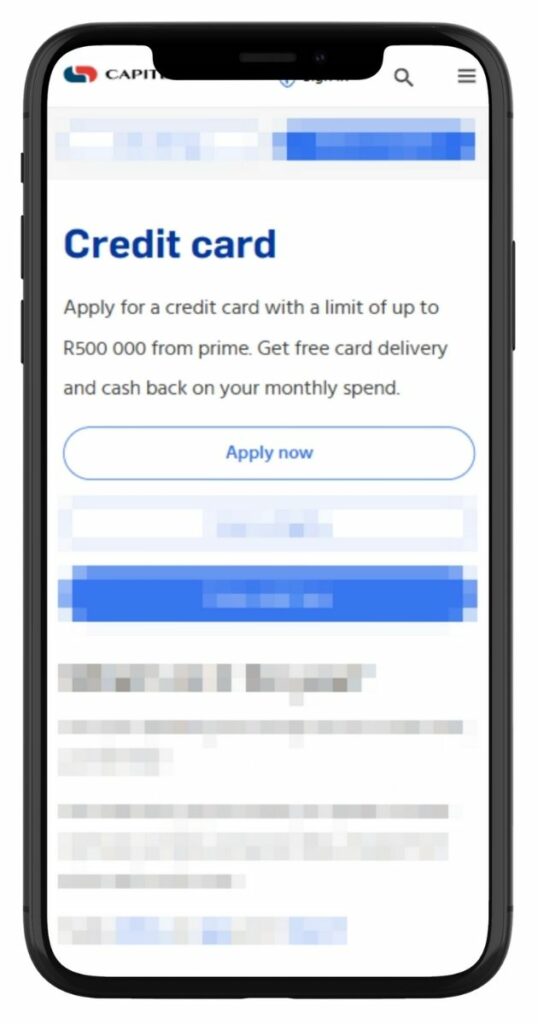

Capitec Credit Card

Monthly fee: R50

Minimum monthly income: R5 000

The Capitec Credit Card is the only credit card option offered by the bank, designed to cater to a wide range of financial needs. It provides credit limits of up to R500 000, depending on affordability and credit profile. Interest rates start from 9.75% per annum, making it one of the more cost-effective options in the market. Cardholders can benefit from up to 55 days interest-free on purchases if the balance is paid in full by the due date. Free basic travel insurance is included when the card is used to purchase flights. The card also features tap-to-pay functionality and enhanced online shopping security, ensuring safe and convenient transactions.

Who Is the Capitec Credit Card Best For?

This credit card is well-suited for a variety of users. Everyday spenders can use it for regular purchases, bill payments, and unexpected expenses. It is also ideal for online shoppers, as Mastercard’s global acceptance ensures it can be used for both local and international online transactions. Travellers may find it useful due to the included free basic travel insurance and the ability to use the card abroad. Budget-conscious individuals who prefer a credit card with low service fees and competitive interest rates may also find this option appealing.

Since Capitec focuses on keeping banking simple, it does not offer multiple credit card tiers such as gold, platinum, or black cards. Instead, it provides one credit card with flexible terms that can be adjusted based on income and spending behaviour. This approach ensures that customers of all income levels have access to a credit solution that meets their financial needs without unnecessary complexities.

If you’re considering the Capitec credit card, it’s essential to compare it with other options available in South Africa. Check out this guide on the best credit cards in South Africa to see how it stacks up against the competition in terms of rewards, interest rates, and perks.

Requirements for a Capitec Credit Card

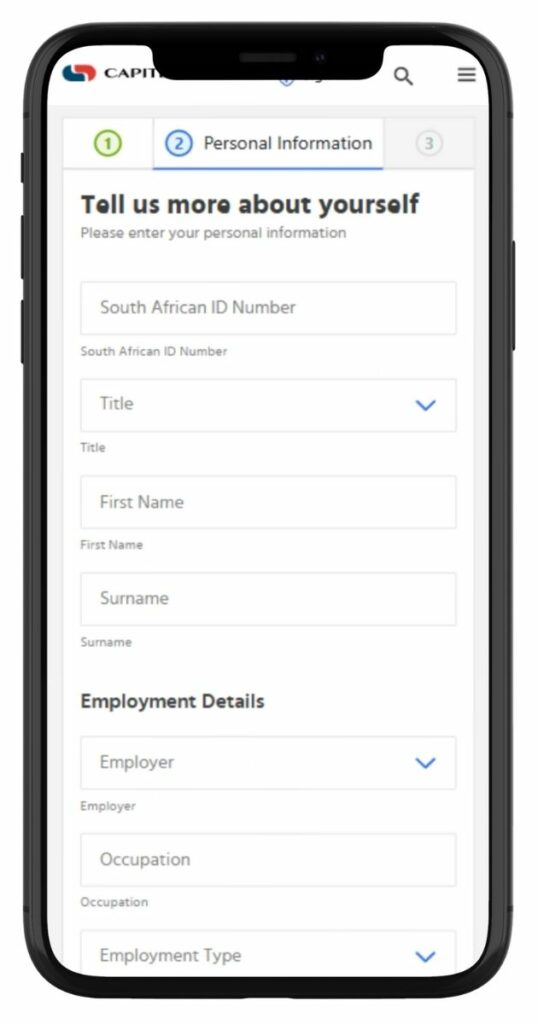

To apply for a Capitec Credit Card, applicants must meet specific requirements. The minimum age for eligibility is 18 years, and the applicant must be a South African citizen or hold a valid South African work permit. A minimum monthly income of R5 000 is required, which must be proven through recent bank statements or payslips. Capitec also conducts a credit assessment to determine affordability and responsible credit usage.

Applicants must provide a valid South African ID, along with their latest three months’ bank statements if their salary is not paid into a Capitec account. Those with a Capitec account can apply more easily as their income and banking history are already on record. A recent proof of residence (not older than three months) is also required. Self-employed applicants may need to provide additional financial documents to verify their income stability.

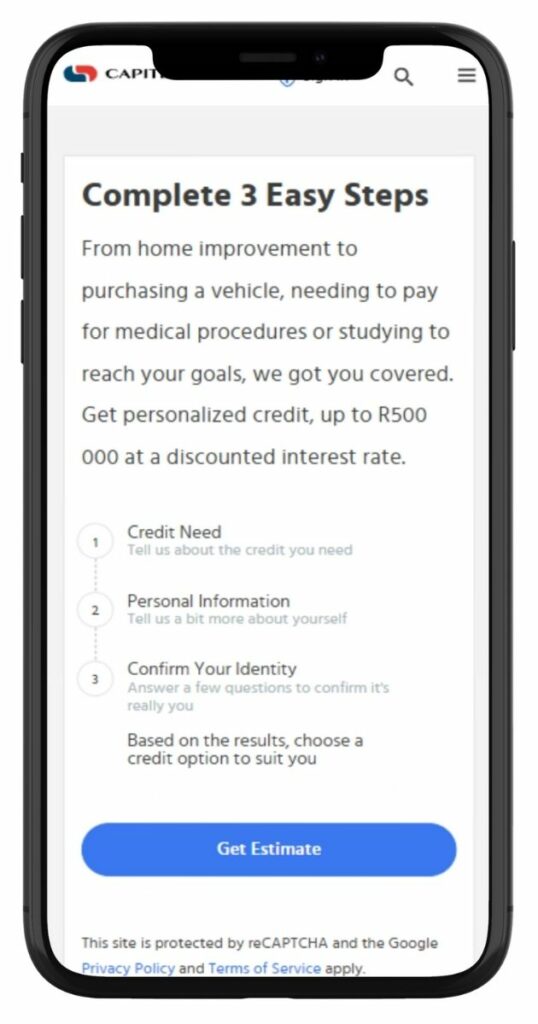

Simulation of a Capitec Credit Card Application

Step 1. Visit the Capitec website or open the Capitec app, then navigate to the Credit Cards section.

Step 2. Select “Credit Card” and click Apply Now.

Step 3. Select “Get Estimate”

Step 4. Select “Credit Card” and Choose your desired credit limit (up to R500 000).

Step 5. Fill in personal details, including ID and employment information, then submit.

Step 6. Complete the application via the Capitec app, website, or visit a branch.

Step 7. Capitec reviews your financial profile to determine affordability.

Step 9. If approved, collect your card at a branch or request delivery where applicable.

Step 10. Activate the card via the app or at a branch and start using it.

Eligibility Check

Capitec provides tools to help customers check if they qualify for a credit card before applying. The Capitec app and online banking platform allow users to check their credit score and affordability assessment in real time. Customers with a Capitec account may receive a pre-approved credit limit based on their income and spending behaviour. Those who do not have an account can visit a branch for an assessment or use Capitec’s affordability calculator to estimate their qualification.

How Much Credit Limit Can I Request on a Capitec Credit Card?

The Capitec Credit Card offers a minimum credit limit of R1 000 and a maximum limit of up to R500 000, depending on the applicant’s financial profile. The credit limit is determined based on income, credit score, and overall affordability. Higher earners with a strong credit history may qualify for the maximum amount, while those with lower income or limited credit history may start with a smaller limit. Capitec periodically reviews credit limits and may offer increases to eligible customers based on their repayment behaviour and financial stability.

Receive Offers

Capitec personalises its credit card offers by assessing an applicant’s income, banking behaviour, and credit history. Customers who already bank with Capitec may receive pre-approved credit limits based on their salary deposits and spending habits. Those applying for the first time go through a credit risk assessment, where Capitec evaluates their ability to manage credit responsibly. Offers may vary depending on the applicant’s financial history, with some customers qualifying for lower interest rates or higher credit limits. Capitec may also adjust offers over time, increasing or decreasing limits based on usage and repayment behaviour.

How Long Does It Take to Receive Credit from Capitec?

Once a Capitec Credit Card is approved, customers can access their credit limit immediately. The physical card is issued on the same day for in-branch applications, allowing customers to use it right away. Online applications may take a bit longer, as identity and income verification need to be completed before approval. Once the card is activated, customers can withdraw funds from an ATM or transfer available credit to their Capitec transactional account.

Processing times depend on several factors, including application completeness, credit assessment, and verification speed. Those who bank with Capitec may experience faster approval since their financial data is already accessible. Applicants from other banks may need to wait one to three business days for document verification before receiving their card. Delays can also occur if additional income proof is required or if the credit assessment process takes longer than expected.

How Do I Repay My Capitec Credit Card?

Capitec offers several repayment options, making it convenient for customers to manage their credit. Cardholders can repay their balance through debit orders, EFT payments, or direct deposits via the Capitec app or online banking. Customers can also pay at a Capitec branch if they prefer an in-person transaction.

Repayments can be made in full or in monthly instalments, with a minimum repayment required each month. If the full balance is paid within 55 days of the statement date, no interest is charged on purchases. However, if a balance is carried over, interest accrues based on the outstanding amount. Late payments result in penalty fees and may negatively affect the customer’s credit score. Capitec also charges a monthly service fee for maintaining the account, which is deducted automatically. To avoid unnecessary costs, customers are encouraged to make timely repayments and use their credit responsibly.

If you’re interested in a credit card that offers low fees and competitive interest rates, don’t miss our African Bank Credit Card Review. Compare it with Capitec’s credit card to see which one fits your spending habits best.

Pros and Cons of the Capitec Credit Card

Pros

- Competitive interest rates starting from 9.75% per annum, lower than many traditional banks.

- Up to 55 days interest-free on purchases when the full balance is repaid on time.

- Low monthly service fee, making it a cost-effective credit option.

- Credit limits up to R500 000, depending on affordability and credit history.

- Free basic travel insurance when using the card to book flights.

- Tap-to-pay and secure online payment features for convenience and safety.

Cons

- No rewards or cashback programme, making it less attractive for those looking for loyalty benefits.

- Strict eligibility requirements, including a minimum monthly income of R5 000.

- Limited premium benefits, as Capitec does not offer gold, platinum, or black card options.

- Foreign transaction fees apply, which may increase costs for international purchases.

Customer Service

For any queries about the Capitec Credit Card, customers can contact Capitec’s customer service team through multiple channels. The Capitec banking app provides direct access to support, allowing users to chat with an agent or request assistance. Customers can also call the Capitec Client Care Centre at 0860 10 20 43, available for general enquiries, lost or stolen card reports, and dispute resolution.

For in-person assistance, customers can visit their nearest Capitec branch, where consultants can help with credit card applications, limit increases, or repayment queries. Additional support is available through Capitec’s website, where FAQs and self-service tools can provide quick solutions.

Capitec Bank Contact Information

Phone number:

Client Care Centre: 0860 10 20 43 (24/7)

Business Banking: 0860 30 92 50 (24/7)

International Calls: +27 21 941 1377

Other Support:

Report Fraud: Call 0860 10 20 43 or visit a branch

Credit Enquiries via SMS: Send your 13-digit ID number to 30679

Postal address:

Capitec Bank Limited

P.O. Box 12451, Die Boord, Stellenbosch, 7613

Online Reviews of Capitec Bank

Customer experiences with Capitec Bank vary. Many clients appreciate the bank’s commitment to simplicity, affordability, and accessibility. Positive reviews often mention friendly and efficient service, both in-branch and through customer care channels. For instance, clients have expressed satisfaction with prompt assistance in resolving account issues and commendable service from specific branch staff.

On the other hand, some customers have reported challenges such as delays in transaction processing and difficulties in communication. These mixed reviews suggest that while many clients value Capitec’s approach to banking, there are areas where the bank could enhance its service delivery.

Alternatives to Capitec Bank

For individuals exploring other credit options in South Africa, several banks offer competitive credit card products:

Comparison Table

| Feature | Capitec Bank | First National Bank (FNB) | Standard Bank | Absa | Nedbank |

|---|---|---|---|---|---|

| Credit Card Options | Single standard credit card | Multiple tiers | Multiple tiers | Multiple tiers | Multiple tiers |

| Rewards Program | Not available | eBucks | UCount Rewards | Cash Rewards | Greenbacks Rewards |

| Interest Rates | Starting from 9.75% per annum | Varies | Varies | Varies | Varies |

| Annual Fees | Low monthly service fee | Varies | Varies | Varies | Varies |

| Additional Benefits | Free basic travel insurance | Travel insurance, eBucks | Travel insurance | Access to exclusive events | Budget facility options |

| More Info | FNB Credit Cards Review | Absa Credit Cards Review | Nedbank Credit Cards Review |

History and Background of Capitec Bank

Capitec Bank was established on 1 March 2001 with a focus on simplifying banking for South Africans. Its mission is to provide transparent, affordable, and accessible financial services that improve everyday lives.

Since its launch, Capitec has introduced several innovations, including Global One in 2003, which allows customers to link multiple savings accounts to their main account. By 2008, it expanded into internet and mobile banking, and later pioneered biometric verification for enhanced security.

As of 2023, Capitec serves over 20 million clients, demonstrating its rapid growth. The bank’s vision is to empower individuals and communities with straightforward and cost-effective banking solutions, positioning itself as a leading retail bank in South Africa.

Conclusion

The Capitec Credit Card offers a simple, affordable, and accessible credit solution for South Africans. With low fees, competitive interest rates, and up to 55 days interest-free on purchases, it is a practical option for everyday spending, online shopping, and travel. While it lacks a rewards programme, it compensates with straightforward management through the Capitec app and free basic travel insurance. For those seeking a no-frills credit card with transparent costs and flexible repayment options, Capitec provides a reliable choice.

Frequently Asked Questions

The minimum income requirement is R5 000 per month, with proof of earnings needed for approval.

Approval can be instant for Capitec account holders, while non-Capitec customers may wait one to three business days for verification.

No, Capitec does not provide a rewards or cashback programme with its credit card.

Yes, the card is a Mastercard, accepted worldwide for online and in-store transactions.

You can request a limit increase via the Capitec app, online banking, or at a branch, subject to affordability and credit assessment.