Discovery Bank offers a range of credit cards designed for South African consumers looking for rewards, financial flexibility, and seamless banking integration. With options ranging from Gold to Purple, Discovery credit cards provide benefits such as Discovery Miles, fuel savings, and travel perks, particularly for Discovery Vitality members. These cards cater to different income levels and spending habits, making them a suitable choice for individuals who want to earn rewards on everyday purchases while managing their finances efficiently.

Discovery Bank – Overview

| Name | Discovery Bank |

|---|---|

| Financial Institution | Discovery Bank |

| Products | Credit Cards, Overdrafts, Revolving Credit Facilities |

| Minimum Age | 18 years |

| Credit Limit | Varies based on individual assessment |

| Terms | Flexible, depending on the product and agreement |

| APR | Dynamic, influenced by the client’s Vitality Money status |

| Monthly Interest Rate | Variable, with potential reductions up to 7% for managing money well |

| Early Settlement | Permitted without penalties |

| Repayment Flexibility | Options to allocate credit across accounts via the Discovery Bank app |

| NCR Accredited | Yes |

| Our Opinion | ✅ Efficient, fully digital application process ✅ Dynamic interest rates reward responsible financial behaviour ⚠️ Requires active engagement with the Vitality Money programme for maximum benefits |

| User Opinion | ✅ Convenient management of credit through the app ⚠️ Interest rates are competitive, especially for clients with a high Vitality Money status |

What Makes the Discovery Credit Card Unique?

Discovery credit cards stand out due to their integrated rewards system and health-focused benefits. Unlike traditional credit cards that only offer cashback or travel perks, Discovery cards reward users based on their lifestyle choices, particularly through the Vitality programme. Cardholders can earn Discovery Miles, which can be redeemed for travel, shopping, and fuel discounts, making it ideal for those who want to maximise savings on everyday purchases. Additionally, Discovery’s dynamic interest rate model incentivises good financial behaviour by offering lower interest rates to those who manage their spending responsibly.

Another key feature is enhanced digital banking. Discovery credit cards come with robust security features, including biometric authentication, virtual cards, and real-time spending insights via the Discovery Bank app. The app helps users track expenses, set budgets, and receive personalised financial advice. For frequent travellers, Discovery’s international lounge access and travel insurance benefits add extra value. These features, combined with flexible repayment options and seamless integration with Discovery’s insurance and investment products, make Discovery credit cards a competitive choice in the South African market.

About Arcadia Finance

Get the loan you need—hassle-free! Arcadia Finance connects you with 19 trusted lenders, all fully compliant with South Africa’s National Credit Regulator standards. No application fees, just a smooth, secure process designed for your financial needs.

Types of Credit Cards Offered by Discovery

Discovery offers several credit card options to suit different income levels and spending habits. Each card comes with specific benefits tailored to different types of users, from everyday spenders to premium clients looking for exclusive perks.

Discovery Gold Credit Card

Monthly Fee: R110

Minimum Yearly Income: R100 000 to R350 000

This entry-level card is ideal for individuals looking for basic credit facilities with added rewards. It offers Discovery Miles on eligible purchases, fuel savings, and discounts at partner retailers. Suitable for students, young professionals, or those new to credit cards.

Discovery Platinum Credit Card

Monthly Fee: R165

Minimum Yearly Income: R350 000 to R850 000

Designed for middle-income earners, this card provides enhanced benefits, including higher Discovery Miles earning rates, travel insurance, and lower interest rates for responsible spending. It suits individuals who want more value from their everyday transactions.

Discovery Black Credit Card

Monthly Fee: R250

Minimum Yearly Income: R850 000 to R2.5 million

Aimed at high-income earners, the Black card offers premium benefits such as VIP airport lounge access, higher credit limits, and exclusive travel and lifestyle perks. It is suitable for professionals and business owners who travel frequently or make high-value transactions.

Discovery Purple Credit Card

Monthly Fee: R679

Minimum Yearly Income: more than R2.5 million a year

This top-tier card is for Discovery’s wealthiest clients, providing ultra-premium benefits such as concierge services, personalised investment opportunities, and luxury travel privileges. It is best suited for individuals with a high net worth who require bespoke financial solutions.

From cashback rewards to travel perks, credit cards vary widely. See how Discovery’s credit cards compare by checking out our Sanlam Credit Card Review to make an informed choice.

Requirements for a Discovery Credit Card

To qualify for a Discovery credit card, applicants must meet certain income and credit requirements. The eligibility criteria varies depending on the specific card type, with higher-tier cards requiring a higher monthly income and a strong credit history. Applicants must be at least 18 years old and either a South African citizen or a permanent resident.

The minimum annual income required depends on the card type, with the Gold card requiring R100 000, the Platinum card requiring R350 000, the Black card requiring R850 000, and the Purple card requiring R2.5 million. A good credit score and financial history are necessary, and applicants should not have any adverse credit listings or defaults.

Documents and Information Needed

When applying for a Discovery credit card, you must provide:

- Valid South African ID or passport (for permanent residents)

- Proof of income (latest payslip or three months’ bank statements)

- Proof of residence (utility bill or bank statement not older than three months)

- Employer details (if applicable)

- Banking details (for debit order setup)

Simulation of a Discovery Credit Card Application

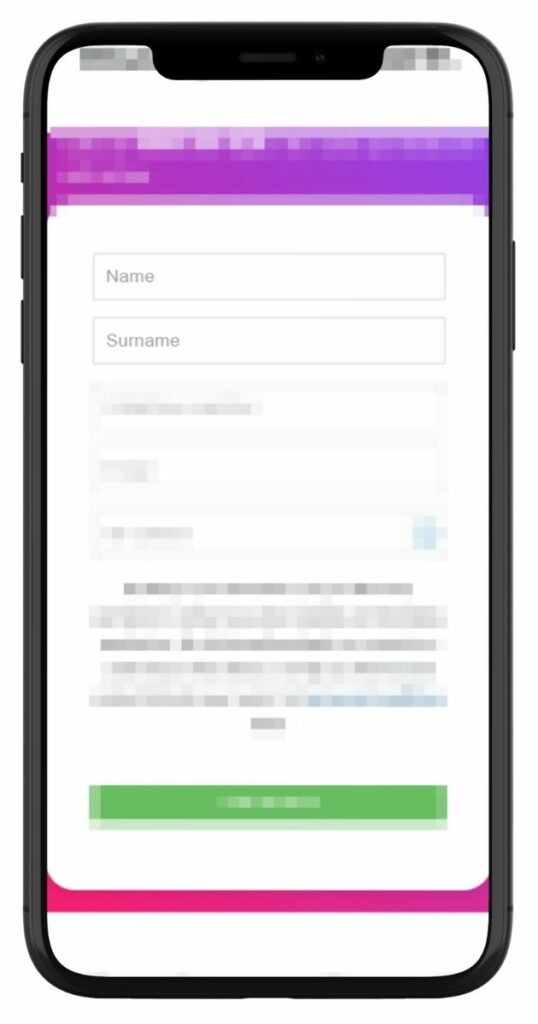

Applying for a Discovery credit card is a straightforward process:

Step 1. Visit Discovery Bank’s website or download the Discovery Bank app.

Step 2. Enter your Name and Surname in the provided fields.

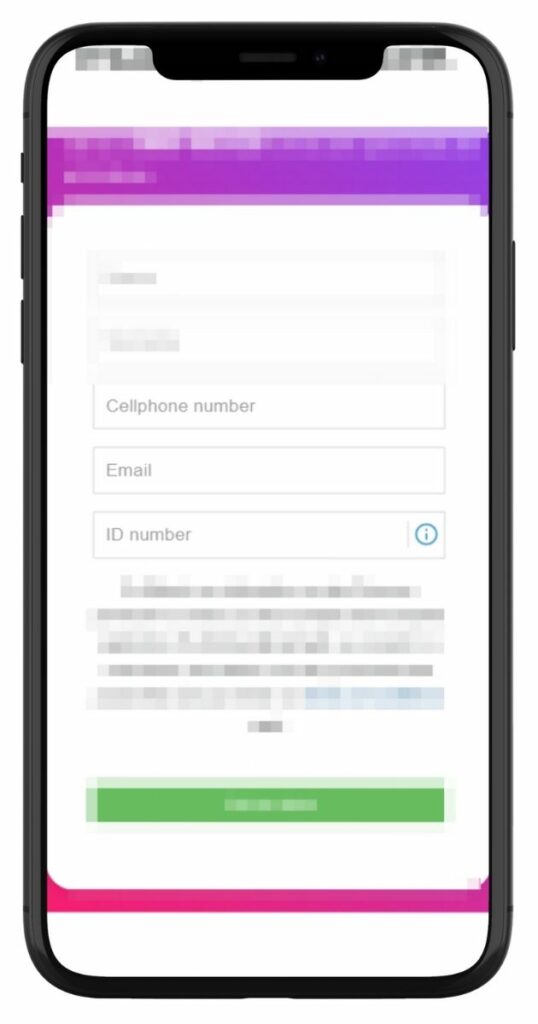

Step 3. Provide your Cellphone Number, Email, and ID Number for verification.

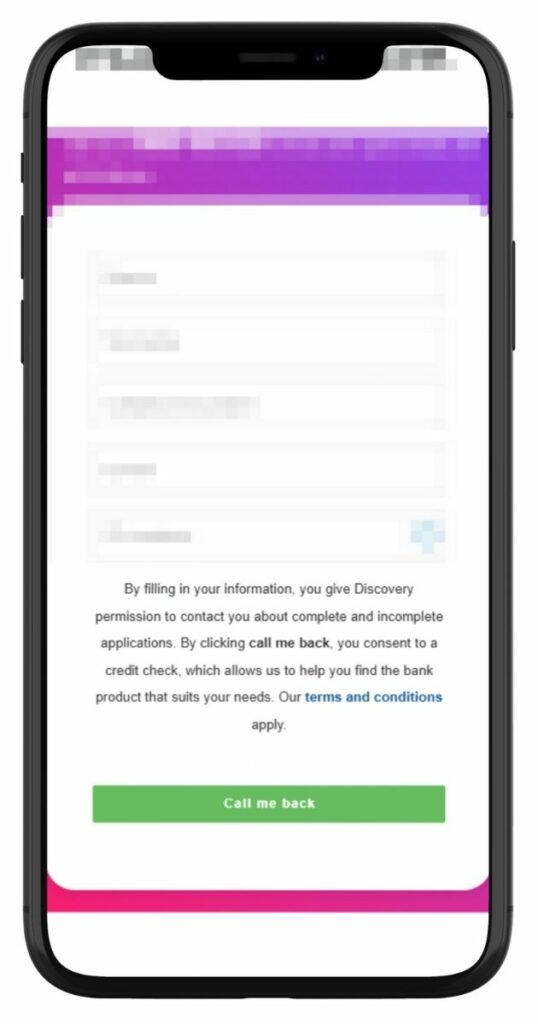

Step 4. Review and click “Call me back” to submit your application request.

Step 4. Verification Call: Discovery contacts you for confirmation.

Step 5. Submit Documents: Provide ID, proof of income, and bank statements.

Step 6. Wait for credit assessment and approval.

Step 7. Get your physical card delivered to your address if approved.

Eligibility Check

Discovery Bank offers online eligibility tools to help potential applicants determine whether they qualify before applying. The Discovery Bank app and website allow users to enter their income and expenses to estimate eligibility. Additionally, Discovery may offer pre-approval checks through its existing customer database, ensuring a smoother application process without affecting credit scores.

How Much Money Can I Request from a Discovery Credit Card?

Discovery credit cards offer flexible credit limits based on the applicant’s income, credit history, and spending behaviour. The minimum credit limit for a Discovery credit card starts at R5 000, while higher-tier cards, such as the Discovery Black and Purple cards, offer significantly higher limits. The maximum credit limit varies per customer and is determined through a personalised credit assessment. Discovery evaluates the applicant’s affordability and financial stability before assigning a limit that ensures responsible borrowing.

Receive Offers

Discovery creates personalised credit card offers based on an applicant’s income, spending habits, and financial profile. When applying, Discovery evaluates banking behaviour, credit history, and existing debt obligations to determine the most suitable card and credit limit. Customers who are part of Discovery’s banking or insurance ecosystem may receive pre-approved offers based on their financial activity. Discovery also adjusts credit limits over time, offering limit increases to eligible customers who maintain a good repayment history and responsible spending habits.

Not sure if the Discovery Credit Card is your perfect financial match? There are plenty of competitive options in the market! Check out our roundup of the best credit cards in South Africa to see how Discovery stacks up against other top contenders, whether you prioritise rewards, low fees, or exclusive perks.

How Long Does It Take to Receive My Credit Card from Discovery?

Discovery aims to process credit card applications within a few business days, with many applicants receiving approval within 48 hours. Once approved, customers receive a virtual credit card immediately, which can be used for online purchases and digital payments. The physical card is typically delivered within 5 to 7 business days, depending on the applicant’s location.

Several factors can affect processing times, including the accuracy of the information provided, document verification delays, and credit assessment procedures. Customers who apply with all required documents and meet the credit criteria typically experience faster approvals and card issuance.

How Do I Repay My Discovery Credit Card?

Repaying a Discovery credit card is straightforward, with multiple payment options available. Customers can set up a debit order, ensuring that payments are deducted automatically from their bank account each month. Alternatively, they can make manual payments through Discovery’s banking app, EFT, or direct deposit. Discovery also allows customers to pay off their outstanding balance in full or make minimum payments, depending on their financial situation.

Late or missed payments may result in penalty fees and increased interest rates. Discovery charges interest on outstanding balances, and customers who fail to make the required payments may incur additional fees. It is advisable to pay more than the minimum amount to reduce interest charges and avoid falling into long-term debt.

Pros and Cons of Discovery Credit Cards

Pros

- Reward System: Earn Discovery Miles on eligible transactions, which can be redeemed for travel, shopping, and fuel discounts.

- Vitality Benefits: Additional savings and discounts for Discovery Vitality members.

- Flexible Credit Limits: Offers personalised credit limits based on income and financial history.

- Advanced Security Features: Includes biometric authentication, virtual cards, and real-time transaction monitoring.

- Immediate Access to Funds: Virtual credit card is issued instantly upon approval.

- International Perks: Lounge access and travel insurance benefits for higher-tier cardholders.

- Integrated Digital Banking: Discovery Bank app provides budgeting tools and spending insights.

Cons

- Interest Rates Can Be High: Depending on spending behaviour, interest rates may be higher than competitors.

- Limited Lounge Access for Lower Tiers: Only premium cardholders get full international lounge benefits.

Customer Service

Discovery provides multiple customer support channels for credit card queries. Customers can reach out through the Discovery Bank app, website chat, or call centre. The bank also offers in-branch assistance at selected locations for those who prefer face-to-face support.

For quick answers, Discovery’s online FAQ section and banking app provide solutions to common questions, such as managing card limits, checking transaction history, and reporting lost or stolen cards. Customers can also access live chat support via the Discovery website or app for real-time assistance.

Discovery Bank Contact Channels

Phone number:

General Enquiries: 0800 07 96 97 (24/7)

International Calls: +27 11 324 5000

Fraud & Stolen Cards: 011 324 4444

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: By appointment only

Postal address:

PO Box 786722, Sandton, 2196, South Africa

Online Reviews of Discovery Bank

Discovery Bank has garnered a mix of feedback from its customers. Many users appreciate the bank’s innovative approach to integrating health and financial wellness through its Vitality Money program. The Discovery Bank app is often praised for its user-friendly interface and comprehensive features, allowing clients to manage their finances efficiently.

However, some customers have reported challenges, particularly concerning the bank’s fee structures and the complexity of certain account features. As with any financial institution, experiences vary, and potential clients are encouraged to review the bank’s offerings in detail to determine alignment with their personal financial needs.

Alternatives to Discovery Bank

For those considering alternatives to Discovery Bank, several other South African banks offer competitive credit card options:

Comparison Table

| Feature | Discovery Bank | FNB | Standard Bank | Absa | Nedbank |

|---|---|---|---|---|---|

| Rewards Program | Vitality Money: Rewards for healthy financial behavior | eBucks: Cash back on purchases, travel, and entertainment discounts | UCount Rewards: Points on spending redeemable across various partners | Cash Rewards: Cash back on selected purchases and exclusive deals | Greenbacks: Points convertible into cash or for purchases |

| Annual Fees | Varies by card tier; higher-tier cards have higher fees | Varies by card type; generally competitive | Competitive fees across different card offerings | Range of fees depending on card selection | Fees vary by card type; options available for different income levels |

| Interest Rates | Competitive rates; influenced by client’s financial behavior | Competitive rates; varies by card and client profile | Varies by card type; generally competitive | Competitive rates tailored to different card offerings | Rates vary; tailored to client’s credit profile |

| Additional Benefits | Integration with Discovery’s health and insurance products; personalised insights | Access to SLOW lounges, travel insurance, and device protection | Travel insurance, purchase protection, and access to airport lounges | Travel benefits, purchase protection, and access to exclusive events | Access to airport lounges, travel insurance, and concierge services |

| More Info | FNB Credit Cards Review | Absa Credit Cards Review |

History and Background of Discovery Bank

Discovery Bank, a subsidiary of the Discovery Group, was established to revolutionise the banking sector by integrating financial services with wellness incentives. Building upon Discovery’s success in health and life insurance, the bank aims to encourage positive financial behaviours among its clients.

The bank’s mission is to enhance the financial health of its customers by rewarding responsible financial management and promoting overall well-being. Its vision is to create a sustainable banking model that aligns the interests of the bank with those of its clients, fostering a community of financially healthy individuals.

Conclusion

Discovery Bank offers a range of credit cards tailored to different income levels, with features designed to reward responsible financial behaviour. The integration of Discovery Miles, Vitality benefits, and a digital-first approach makes these credit cards appealing to those who already use Discovery’s ecosystem. While higher-tier cards provide excellent travel perks and rewards, eligibility requirements and interest rates should be considered before applying. For South Africans looking for a smart, rewards-driven credit card, Discovery is a competitive option, especially for Vitality members who want to maximise savings and benefits.

Frequently Asked Questions

You can apply online through the Discovery website or via the Discovery Bank app by submitting your personal and financial details along with the required documents.

The minimum monthly income requirement varies by card type, starting at R5 000 for the Gold card and up to R250 000 for the Purple card.

Discovery Miles are earned on eligible transactions and can be redeemed for travel, shopping, fuel discounts, and partner rewards.

Yes, Discovery Bank reviews credit limits periodically. You can request an increase via the Discovery Bank app, subject to affordability checks.

Late payments may result in penalty fees, interest charges, and potential impacts on your credit score. Setting up a debit order can help avoid missed payments.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.