First National Bank (FNB) offers a range of credit cards designed to suit different financial needs, from everyday transactions to premium banking benefits. Whether you need a basic credit card for convenience or a high-tier card with travel and lifestyle rewards, FNB provides several options. Each card comes with different features, interest rates, and fees, making it essential to understand which one best fits your needs.

FNB Credit Cards — Overview

| Name | FNB Credit Cards |

|---|---|

| Financial Institution | First National Bank (FNB) |

| Product Range | Aspire, Premier, Private Clients, and Private Wealth |

| Minimum Age | 18 years |

| Minimum Credit Limit | Varies by card type; Aspire Credit Card starts at approximately R5 000 |

| Maximum Credit Limit | Dependent on individual credit assessments; Private Wealth Credit Card can exceed R250 000 |

| Interest Rate | Variable, based on prime rate plus a margin (e.g., budget facility purchases at Prime +2%) |

| Annual Percentage Rate (APR) | Variable, depending on credit profile and card type |

| Early Settlement | Allowed without penalties; outstanding balances can be paid off at any time |

| Repayment Flexibility | Full balance repayment monthly or budget facilities for larger purchases |

| NCR Accredited | Yes, FNB is registered with the National Credit Regulator |

| Our Opinion | ✅ Wide range of credit card options for different income levels ✅ Comprehensive eBucks rewards program ⚠️ Interest rates and fees vary; checking terms is necessary |

| User Opinion | ✅ Convenient digital banking features and virtual card options ⚠️ Some users report challenges with customer service responsiveness |

What Makes the FNB Credit Card Unique?

FNB credit cards stand out because they offer a combination of rewards, convenience, and flexible financial management tools. One of the key features is the eBucks Rewards Programme, which allows cardholders to earn points on everyday spending. These points can be used for travel, fuel, shopping, and even investments. Unlike many other banks, FNB categorises spending and offers higher rewards on specific purchases, such as groceries, fuel, and online shopping. The bank also provides access to exclusive lifestyle benefits, including travel discounts, airport lounge access, and entertainment perks. Additionally, FNB integrates its credit cards with secure digital banking tools, allowing users to monitor their spending, set limits, and manage their accounts easily through the FNB mobile app and online banking.

Another standout feature is FNB’s approach to credit card flexibility and security. Customers can choose between different repayment options, including straight or budget facilities, to spread out payments for larger purchases. The cards come with advanced security features, such as virtual cards for safer online transactions, tap-to-pay functionality, and transaction notifications. FNB also provides additional financial services like credit protection plans that help cover outstanding balances in case of unexpected financial difficulties. These features make FNB credit cards more than just a payment tool—they offer a complete financial management solution that adapts to different customer needs.

Wondering how FNB credit cards stack up against other options? Check out our guide on the Best Credit Cards in South Africa to compare rewards, fees, and benefits before making a decision.

About Arcadia Finance

Arcadia Finance simplifies your loan journey. With no application fees and access to 19 trusted, NCR-compliant lenders, you can secure the right financing with confidence. Reliable, transparent, and tailored to your financial success.

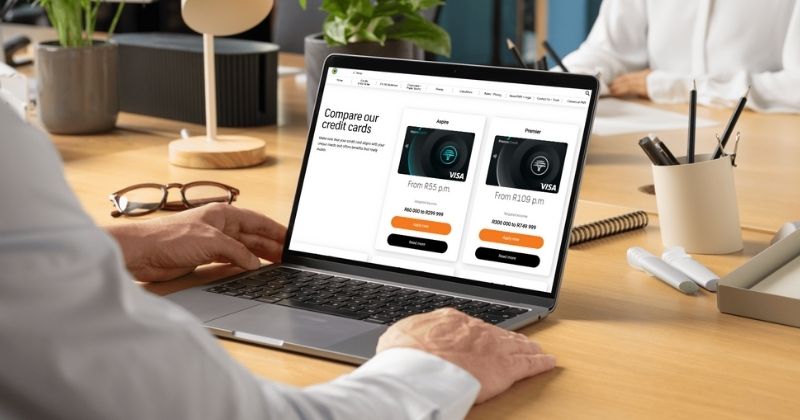

Types of Credit Cards Offered by FNB

FNB provides a variety of credit cards to meet different financial needs, ranging from entry-level options for everyday transactions to premium cards with exclusive benefits. Each card is tailored to a specific income bracket and spending lifestyle, ensuring that customers can find a suitable option.

FNB Aspire Credit Card (Previously Gold Credit Card) – Best for Everyday Spending

The FNB Aspire Credit Card is designed for individuals with a monthly income between R84 000 and R449 999 per year. It offers essential credit card features with added benefits such as the eBucks Rewards Programme, where customers can earn points on daily transactions. Cardholders also receive basic travel perks, including discounts on domestic flights, and access to exclusive Aspire benefits, such as special shopping deals and partner discounts.

FNB Premier Credit Card – Best for Middle-Income Professionals

The FNB Premier Credit Card is aimed at individuals earning between R240 000 and R849 999 per year, offering enhanced rewards and lifestyle benefits. It provides a higher eBucks earning rate, particularly on fuel and grocery purchases, making it ideal for those who spend frequently in these categories. Travel perks include complimentary travel insurance when flights are booked using the card, as well as limited access to SLOW domestic airport lounges. Customers also benefit from a budget facility, allowing them to spread the cost of larger purchases over an extended period.

FNB Private Clients Credit Card – Best for Affluent Individuals

The FNB Private Clients Credit Card caters to individuals with an annual income of R750 000 to R1 799 999, offering premium financial services, lifestyle perks, and tailored rewards. Cardholders earn increased eBucks Rewards on high-value transactions, particularly on travel and entertainment. Travel benefits include access to SLOW domestic and international airport lounges, ensuring a more comfortable experience for frequent travellers. Additional perks include comprehensive travel insurance covering medical emergencies and trip cancellations, as well as wealth management services for financial planning and investment guidance.

FNB Private Wealth Credit Card – Best for High-Net-Worth Individuals

Designed for individuals with an annual income of R1.8 million or more, the FNB Private Wealth Credit Card provides exclusive financial services and elite privileges. Cardholders benefit from maximum eBucks rewards on luxury spending, international purchases, and travel bookings, making it highly rewarding for those who frequently spend in these categories. Travel benefits include unlimited SLOW Lounge access, both locally and internationally, along with access to partner lounges across the globe. Additional premium services include bespoke concierge assistance, providing tailored travel and lifestyle support, as well as access to FNB’s Private Wealth advisory team for expert financial and investment guidance.

High-interest credit card debt can be overwhelming. In some cases, a personal loan may offer a lower interest rate and a structured repayment plan. Learn more about When to Use a Personal Loan to Pay Off Credit Card Debt and decide if it’s the right move for you.

Requirements for an FNB Credit Card

To qualify for an FNB credit card, applicants must meet certain income and creditworthiness criteria. Each credit card has a specific minimum income requirement, ranging from R84 000 per year for the Aspire Credit Card to over R1.8 million for the Private Wealth Credit Card. Applicants must also be 18 years or older, hold a valid South African ID or passport, and have a good credit score.

If applying as a new FNB customer, a South African bank account statement showing three months’ transactions is required to verify income. Proof of employment or income—such as a payslip or employment contract—is also needed. Self-employed individuals must submit business financial statements and bank statements covering at least six months.

Simulation of a Credit Card at FNB

Applying for an FNB credit card is a simple online or in-branch process. Follow these steps:

Step 1. Visit the FNB website, log into the mobile banking app or go to an FNB branch.

Step 2. Select the credit card that suits your financial needs.

Step 3. Click “Apply Now”.

Step 4. Complete the online application form with personal and financial details.

Step 5. Upload required documents such as ID, proof of income, and bank statements.

Step 6. FNB performs a credit check to assess eligibility.

Step 7. If approved, accept the terms and conditions.

Step 8. Receive your credit card via courier or collect it from an FNB branch.

Step 9. Activate the card using the FNB app or online banking.

Eligibility Check

FNB provides various tools to pre-check eligibility before applying. Customers can use the FNB Credit Card Calculator, available on the bank’s website, to estimate their credit limit and assess affordability. Additionally, FNB account holders can use online banking or the mobile app to check pre-approved credit offers based on their banking history. If unsure, visiting an FNB branch allows customers to consult with a financial advisor for a personalised credit assessment before applying.

How Much Money Can I Request from FNB Credit Cards?

The credit limit on an FNB credit card depends on the applicant’s income, credit score, and financial standing. The minimum credit limit varies by card type, with the FNB Aspire Credit Card starting at around R5 000, while higher-tier cards like the FNB Private Wealth Credit Card can exceed R250 000 or more, depending on the applicant’s affordability assessment. Customers with a strong credit profile and higher income may qualify for larger credit limits, while new customers or those with lower earnings may receive a smaller initial limit, which can be increased over time based on responsible card usage.

Receive Offers

FNB personalises credit card offers based on a customer’s banking history, income, and creditworthiness. Existing FNB account holders may receive pre-approved credit card offers, which are visible in FNB online banking, the mobile app, or via SMS and email notifications. These offers consider the applicant’s current account balance, transactional history, and previous credit performance. New customers undergo an affordability check, and FNB may tailor their credit card limit and interest rate based on their risk profile. In some cases, customers can negotiate credit limits or request an increase once they have established a repayment history with FNB.

How Long Does It Take to Receive My Credit Card from FNB?

The time it takes to receive and activate an FNB credit card depends on several factors. Once approved, customers typically receive their credit card within 5 to 7 working days if opting for home delivery, while collection from an FNB branch may be faster. Activation can be done immediately via the FNB mobile app or online banking. The speed of fund availability depends on whether a customer already has an FNB credit account—existing customers may access their credit limit instantly, whereas new applicants might experience a short delay while their account is finalised. Factors such as document verification, credit checks, and public holidays may extend the processing time.

How Do I Repay My Card from FNB?

FNB offers multiple repayment options to ensure flexibility for credit cardholders. Customers can set up a debit order, ensuring that their monthly credit card repayment is deducted automatically from their bank account. Manual payments can be made via online banking, the FNB mobile app, or direct deposit at an FNB branch or ATM. Cardholders can choose between a straight payment option, where purchases are repaid in full on the due date, or a budget facility, which allows larger purchases to be repaid in fixed instalments over 6 to 60 months.

Late or missed payments may result in penalty fees, higher interest rates, and a negative impact on the credit score. FNB also charges an interest rate on outstanding balances, which varies based on the type of credit card and the cardholder’s risk profile. Customers should ensure that minimum monthly repayments are made on time to avoid additional charges.

Pros and Cons of FNB Credit Cards

Pros

- Wide range of credit card options to suit different income levels and financial needs.

- eBucks Rewards Programme, allowing cardholders to earn cashback and discounts on purchases.

- Competitive travel benefits, including lounge access, travel insurance, and flight discounts.

- Flexible repayment options, including straight and budget facilities.

- Secure digital banking features, such as virtual cards, transaction notifications, and biometric authentication.

- Pre-approved credit card offers for existing FNB account holders, simplifying the application process.

- Integration with FNB’s digital banking app, allowing users to manage their card, track spending, and set limits.

Cons

- High-income requirements for premium credit cards, limiting access for lower earners.

- eBucks rewards are tiered, meaning lower spending or not meeting FNB’s banking criteria may result in fewer rewards.

Customer Service

For any queries or support regarding FNB credit cards, customers can contact FNB’s customer service through multiple channels. The FNB contact centre is available via phone for assistance with credit card applications, account management, and dispute resolution. Customers can also visit an FNB branch for in-person support or use the FNB mobile app and online banking for self-service options such as card activation, transaction monitoring, and setting spending limits. Live chat support and secure messaging are also available for quick responses to common queries.

FNB Credit Card Services Contact Channels

For assistance with your FNB credit card, you can reach out through the following channels:

General Inquiries

087 575 1111

Report a Lost or Stolen Credit Card

087 575 9444

+27 11 352 5910

Postal address:

FNB Credit Card Division, P.O. Box 1153, Johannesburg, 2000, South Africa.

Online Reviews of FNB

Customer feedback for First National Bank (FNB) in South Africa presents a mixed picture. On platforms like Hellopeter, FNB has garnered a variety of reviews, reflecting diverse customer experiences.

Some customers appreciate the bank’s comprehensive range of services and the benefits of the eBucks Rewards Programme. For instance, users on Reddit have highlighted the substantial rewards earned through eBucks, especially when reaching higher reward levels.

However, there are also criticisms, particularly concerning customer service responsiveness and the complexity of qualifying for higher reward tiers. Some users have expressed dissatisfaction with the bank’s handling of specific issues, leading to frustration. Overall, while many customers find value in FNB’s offerings, others feel there is room for improvement in service delivery and support.

Alternatives to FNB

Several other banks in South Africa offer competitive credit card options that serve as alternatives to FNB. Discovery Bank provides a range of credit cards with unique rewards structures, including the Discovery Miles program. Nedbank offers various credit cards, each with its own set of benefits and rewards. Investec caters to high-net-worth individuals with tailored banking solutions. Standard Bank and Absa also present diverse credit card offerings, each with distinct features and benefits.

Comparison Table

Below is a side-by-side comparison of FNB’s credit card offerings with those of its top competitors:

| Bank | Credit Card Tier | Minimum Annual Income | Monthly Fee | Key Benefits |

|---|---|---|---|---|

| FNB | Aspire | R84 000 | R25 | eBucks Rewards, basic travel perks, digital banking tools |

| Premier | R240 000 | R92 | Higher eBucks earning rates, travel insurance, SLOW Lounge access | |

| Private Clients | R750 000 | R133 | Increased eBucks rewards, comprehensive travel insurance, wealth management, SLOW lounge access | |

| Private Wealth | R1.8 million | R258 | Maximum eBucks rewards, unlimited lounge access, bespoke concierge services, SLOW lounge access | |

| Discovery Bank | Gold | R100 000 | R80 | Discovery Miles rewards, dynamic interest rates, health-related benefits |

| Platinum | R350 000 | R130 | Enhanced rewards, travel benefits, lifestyle discounts | |

| Black | R850 000 | R465 | Premium rewards, extensive travel perks, concierge services | |

| Nedbank | Gold | R60 000 | R40 | Greenbacks rewards, basic travel insurance, budget facility |

| Platinum | R350 000 | R90 | Higher rewards earn rate, comprehensive travel insurance, lifestyle benefits | |

| Private Wealth | R2 million | R530 | Exclusive rewards, personalized banking services, global travel benefits | |

| Investec | Private Banking | R800 000 | R635 | Tailored rewards, dedicated private banker, international travel perks |

| Standard Bank | Titanium | R300 000 | R82 | UCount rewards, travel insurance, lifestyle benefits |

| Platinum | R600 000 | R103 | Enhanced rewards, comprehensive travel insurance, concierge services | |

| Absa | Gold | R84 000 | R55 | Cash rewards, basic travel insurance, purchase protection |

| Platinum | R300 000 | R92 | Higher cash rewards, travel benefits, lifestyle offers | |

| Private Banking | R750 000 | R185 | Exclusive rewards, personalized services, global travel perks |

History and Background of FNB

Founded as the Eastern Province Bank, FNB is the oldest financial institution in South Africa, with a history that spans generations, which was formed in Grahamstown in 1838. Over the years, FNB has evolved into a leading financial institution, offering a comprehensive range of banking services to individuals, businesses, and corporations.

The bank’s mission is to provide innovative financial solutions that meet the needs of its customers, while its vision focuses on being a trusted partner in financial growth and prosperity. FNB is committed to leveraging technology and customer-centric strategies to enhance the banking experience and contribute positively to the South African economy.

Conclusion

FNB offers a diverse range of credit cards tailored to different income levels and financial needs. With benefits such as eBucks Rewards, travel perks, and flexible repayment options, FNB credit cards provide value for both everyday transactions and premium banking clients. However, eligibility criteria, fees, and interest rates vary, making it essential for applicants to choose a card that aligns with their financial situation. While FNB’s digital banking features and rewards programme are strong selling points, customer service and qualifying for higher reward tiers remain areas where experiences may differ. If you’re considering an FNB credit card, reviewing your spending habits and financial goals will help you determine the best option.

Frequently Asked Questions

The minimum income requirement depends on the specific credit card. The FNB Aspire Credit Card requires an annual income of at least R84 000, while the Private Wealth Credit Card is for individuals earning over R1.8 million per year.

You can apply online through FNB’s website or mobile app, visit an FNB branch, or call their credit card division. You’ll need a valid South African ID, proof of income, and recent bank statements if you’re not an existing FNB customer.

FNB cardholders earn eBucks on qualifying purchases, with higher rewards for spending on fuel, groceries, and online transactions. Rewards depend on your account tier and banking behaviour, and points can be redeemed for travel, shopping, or savings.

Once approved, delivery takes between 5 to 7 working days for courier delivery. Collection from an FNB branch may be faster, and activation can be done immediately via the FNB app or online banking.

Missed payments may incur penalty fees, higher interest rates, and negatively impact your credit score. FNB recommends setting up debit orders or reminders to avoid late payments and potential financial penalties.