Nedbank is one of South Africa’s leading banks, offering a variety of credit cards tailored to different financial needs. Whether you need a basic credit card for everyday spending, a premium card with travel perks, or a rewards-focused option, Nedbank has several choices. Each card comes with its own set of benefits, fees, and eligibility requirements, making it essential to understand which one suits your needs best.

Nedbank Credit Card – Overview

| Name | Nedbank Credit Cards |

|---|---|

| Financial Institution | Nedbank Group Limited |

| Product | Credit Cards with Various Benefits and Rewards |

| Minimum Age | 18 years |

| Minimum Income Requirement | Varies by card type (starting from R5 000 per month for the Gold Credit Card) |

| Credit Limit | Determined based on individual affordability assessments |

| Interest-Free Period | Up to 55 days on eligible purchases |

| Annual Percentage Rate (APR) | Personalised based on credit profile and card type |

| Repayment Flexibility | Options include full monthly settlement, minimum payment (as low as 5% of the outstanding balance), or budget instalments |

| National Credit Regulator (NCR) Accredited | Yes |

| Our Opinion | ✅Diverse range of credit cards ✅Attractive rewards programs ⚠️Interest rates and fees may be higher compared to some competitors |

| User Opinion | ✅Rewards programs and travel benefits are well-rated ⚠️Some customers report issues with customer service and account management |

What Makes Nedbank Credit Cards Unique?

Nedbank credit cards stand out due to their diverse range of options, catering to different income levels and financial needs. Whether you’re looking for a basic credit card for everyday transactions or a premium card with exclusive perks, Nedbank has a variety of choices. One key feature is the Greenbacks Rewards Programme, which allows cardholders to earn rewards on qualifying purchases, redeemable for cash, travel, and shopping discounts. Additionally, many Nedbank credit cards come with built-in security features, such as free card protection, 3D Secure online shopping verification, and optional travel insurance. This makes them a secure and flexible option for everyday spending and international transactions.

Another aspect that sets Nedbank apart is its customised credit solutions and interest-free repayment periods. Most Nedbank credit cards offer up to 55 days of interest-free credit, giving cardholders time to manage their finances before being charged interest. Nedbank also provides digital banking services, including online and app-based account management, which allows customers to track their spending, make payments, and adjust their credit limits easily. With competitive fees, added security, and a range of benefits, Nedbank credit cards provide a balance between affordability and premium features.

About Arcadia Finance

Get your loan hassle-free with Arcadia Finance! No application fees, 19 trusted lenders, and full compliance with South Africa’s National Credit Regulator. Fast, secure, and tailored to you.

Types of Credit Cards Offered by Nedbank

Nedbank offers several credit card options tailored to different financial needs. Below is a breakdown of the available credit cards and their purposes:

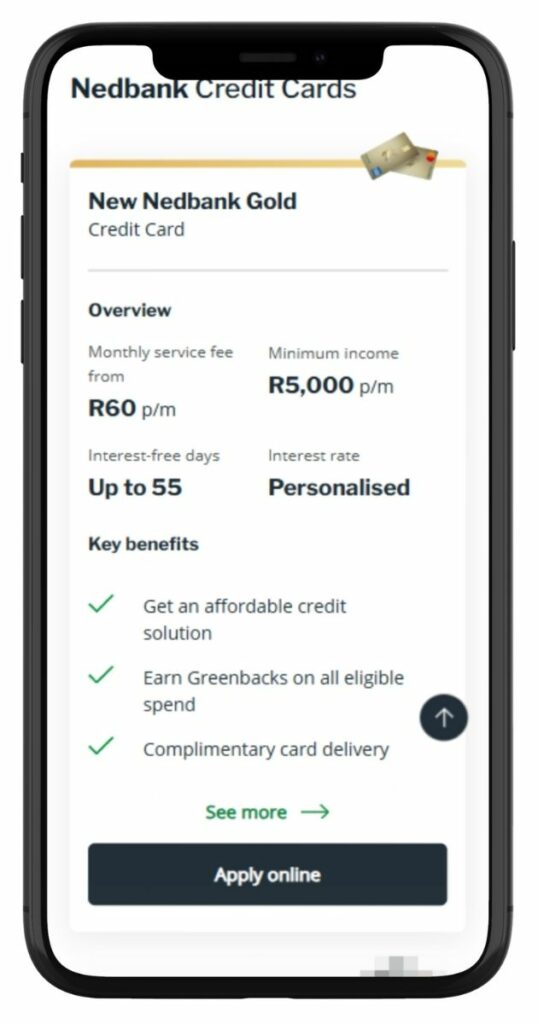

Nedbank Gold Credit Card

Minimum income requirement: R5 000 per month

The Nedbank Gold Credit Card is ideal for individuals looking for a simple yet rewarding credit solution. It is designed for those with a stable income and provides access to the Greenbacks Rewards Programme, allowing users to earn points on everyday transactions. The card includes up to 55 days of interest-free credit, helping cardholders manage their finances efficiently. There is also an optional budget facility for larger purchases, making it a flexible choice for those who need short-term financing options. To qualify, applicants must earn at least R5 000 per month.

Nedbank Platinum Credit Card

Minimum income requirement: R25 000 per month

The Platinum Credit Card is aimed at higher earners who want more than just standard credit card benefits. It includes all the features of the Gold Credit Card but with added advantages, particularly for travel. Cardholders receive free basic travel insurance, making it a suitable option for frequent travellers. There is also access to exclusive lifestyle and entertainment offers, providing additional value beyond daily spending. The minimum income requirement for this card is R25 000 per month.

Nedbank SAA Voyager Credit Cards (Gold and Premium)

Minimum income requirement: R6 600 per month (Gold) / R25 000 per month (Premium)

For individuals who travel frequently and want to maximise their spending on flights and travel-related expenses, the Nedbank SAA Voyager Credit Cards offer a valuable solution. These cards allow users to earn SAA Voyager miles on every purchase, which can be redeemed for flights, upgrades, and other travel rewards. The Premium version of this card includes free comprehensive travel insurance and access to airport lounges, enhancing the overall travel experience. The minimum income requirement for the Gold card is R6 600 per month, while the Premium version requires a monthly income of at least R25 000.

Nedbank American Express® Credit Cards (Gold and Platinum)

Minimum income requirement: R17 600 per month (Gold) / R62 500 per month (Platinum)

For those who prefer American Express benefits and want to maximise rewards, the Nedbank American Express Credit Cards provide a strong alternative to traditional Visa and Mastercard options. These cards earn American Express Membership Rewards points on qualifying purchases, offering higher reward potential than standard credit cards. They also include travel insurance, lifestyle perks, and exclusive discounts that add value to everyday transactions. The income requirement for these cards varies depending on the card type.

Choosing the right credit card can be daunting, with so many options promising perks and benefits. If you’re exploring your choices beyond Nedbank, check out our comprehensive guide to the best credit cards in South Africa. Whether you want travel rewards, cashback, or low-interest rates, this list will help you compare top providers to find the perfect fit.

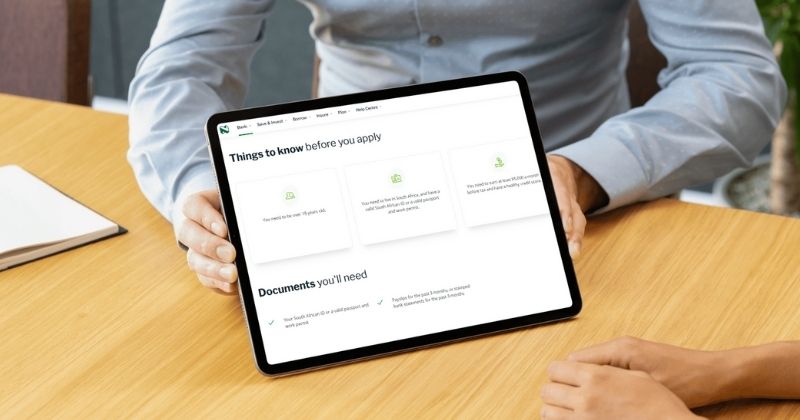

Requirements for a Nedbank Credit Card

To apply for a Nedbank credit card, you must meet specific eligibility criteria. These requirements vary depending on the type of card but generally include:

- Age: Applicants must be 18 years or older.

- Income Requirements: Each card has a minimum income requirement, ranging from entry-level to premium cards.

- South African Citizenship or Residency: You must be a South African citizen or hold a valid permanent residency permit.

- Credit History: A good credit score increases the chances of approval. Nedbank may reject applications if the applicant has adverse listings on their credit profile.

- Employment Status: Salaried or self-employed individuals can apply, but proof of stable income is required.

Documents and Information Needed

When applying for a Nedbank credit card, you will need to provide the following documents:

- A valid South African ID or passport (for non-citizens with permanent residency).

- Latest payslips or bank statements (usually for the last three months).

- Proof of residence (a utility bill or official document not older than three months).

- Income Tax Number (if applicable).

If your credit score isn’t quite where you’d like it to be, don’t worry—you can take steps to turn it around. From paying bills on time to managing credit utilisation, our expert guide on how to improve your credit record will help you build a strong financial foundation and qualify for better credit card deals.

Simulation of a Credit Card at Nedbank

Nedbank offers an online credit card simulator that allows potential applicants to estimate their credit limit, monthly repayments, and interest rates. This tool helps determine affordability before applying. Customers can access the simulator on the Nedbank website or through the Nedbank Money app.

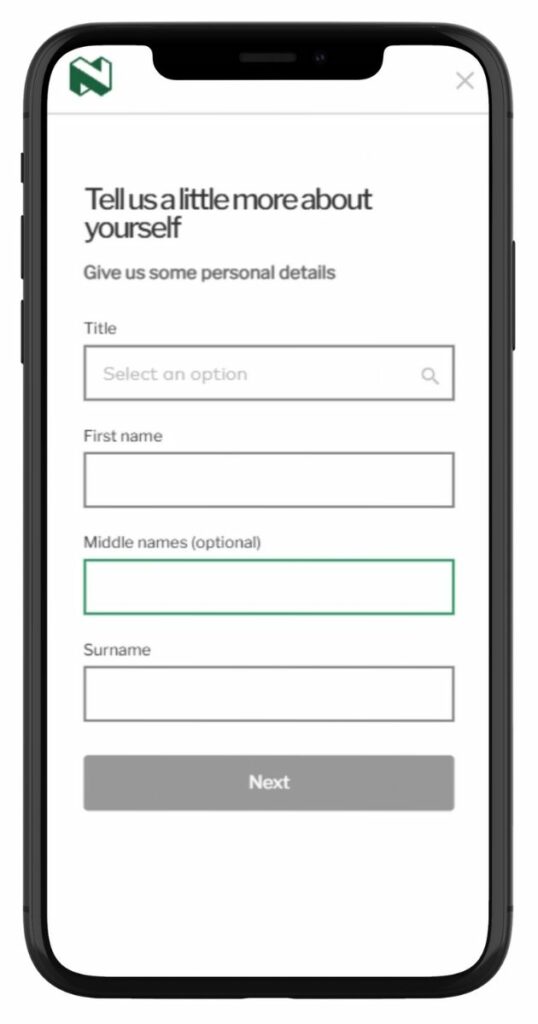

Applying for a Nedbank credit card is a simple process that can be done online or in-branch. Follow these steps:

Step 1. Compare available options.

Step 2. Select Your Prefferd Card and click “Apply online.”

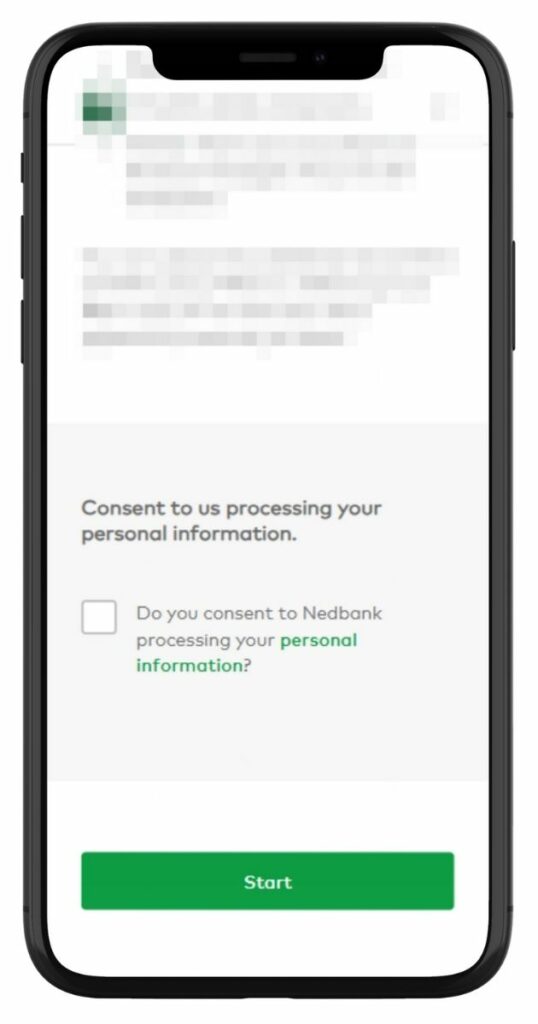

Step 3. Consent to Nedbank processing your personal information, then click “Start”.

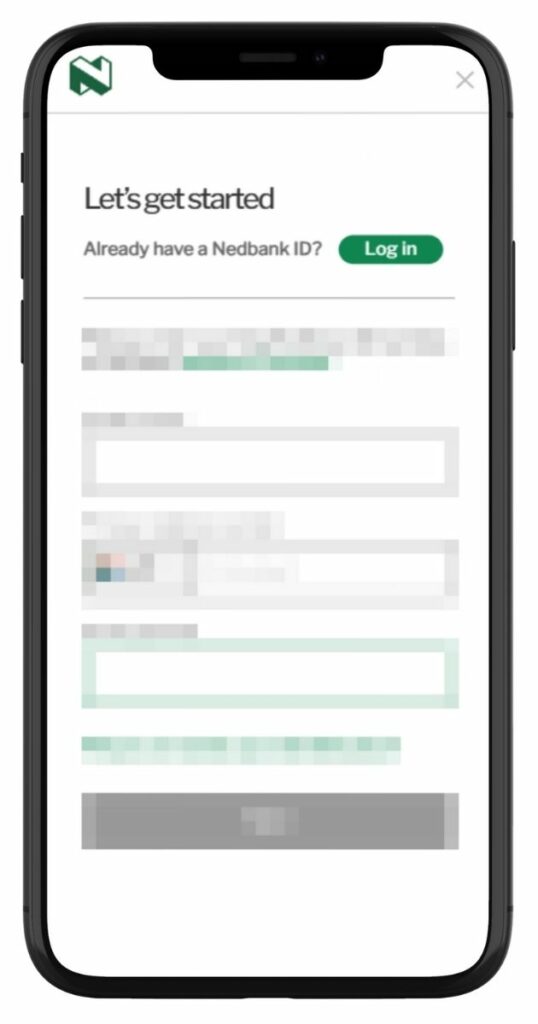

Step 4. If you already have a Nedbank ID, log in; otherwise, proceed as a new applicant.

Step 5. Provide your South African ID number or passport, phone number, and optional email.

Step 6. Fill in your personal details (name, surname, and title) and click “Next.”

Step 7. Follow the next steps to submit financial details, review terms, and finalise your application.

Step 8. Submit your application via the Nedbank website or visit a Nedbank branch.

Step 9. Nedbank will review your application and perform a credit check.

Step 10. If approved, you will receive your credit card via courier or pick it up at a branch.

Step 11. Activate it through the Nedbank Money app, internet banking, or by calling the customer service number.

Eligibility Check

Nedbank provides several tools to help potential applicants check their eligibility before applying for a credit card. The Online Pre-Qualification Tool allows users to see if they qualify without affecting their credit score. For those who prefer mobile banking, the Nedbank Money App offers a personalised credit assessment based on financial information. Customers who prefer in-person assistance can visit a Nedbank branch or contact the call centre for a pre-assessment and guidance on available credit card options.

How Much Credit Can I Get from a Nedbank Credit Card?

The credit limit on a Nedbank credit card depends on several factors, including income, credit score, and financial history. Each card has different minimum and maximum limits, which are assessed individually for each applicant.

For entry-level credit cards, the credit limit usually starts at a lower amount, making them more accessible for those with moderate incomes. Premium credit cards offer significantly higher limits, catering to high-income individuals who require greater financial flexibility. The final approved limit is determined based on an affordability assessment conducted by Nedbank during the application process.

Receiving Offers from Nedbank

Nedbank creates personalised credit card offers by analysing an applicant’s financial profile, including their income, credit history, and spending habits. Customers who already have an account with Nedbank may receive pre-approved credit card offers based on their existing banking relationship. These offers are typically sent via email, SMS, or through the Nedbank Money App.

For new customers, Nedbank conducts an initial credit assessment during the application process to determine eligibility. If approved, applicants receive an offer outlining their credit limit, interest rate, and applicable benefits. In some cases, Nedbank may provide a range of options, allowing the customer to choose a credit limit that best suits their needs.

How Long Does It Take to Receive My Nedbank Credit Card?

The time it takes to receive a Nedbank credit card depends on the application process and approval speed. Online applications are generally faster, with pre-qualification results available within minutes. If all required documents are submitted correctly, Nedbank usually processes and approves applications within two to five business days.

Once approved, customers can expect to receive their physical credit card via courier within five to seven business days. The process may take longer if additional documentation or verification is required.

Several factors can affect how quickly a customer receives their credit card, including the accuracy of submitted documents, the applicant’s credit profile, and the chosen delivery method. Those applying in-branch may experience slightly longer processing times, depending on bank operations.

How Do I Repay My Nedbank Credit Card?

Nedbank offers several repayment options to make it easy for customers to manage their credit card balances. Cardholders can choose between full monthly repayments to avoid interest charges or minimum payments to maintain account activity. Payments can be made via debit order, EFT, Nedbank ATMs, or in-branch deposits.

Customers who opt for automatic debit orders ensure that their payments are made on time, reducing the risk of late fees. Online banking and the Nedbank Money App also provide an easy way to schedule manual payments whenever necessary.

Failing to make payments on time may result in penalty fees and increased interest charges. Late payments can lead to a negative impact on credit scores, making it harder to qualify for future credit. If payments remain overdue for an extended period, Nedbank may take further action, including collections and legal proceedings. To avoid penalties, customers should ensure they meet the minimum monthly repayment requirement and keep track of their due dates through their credit card statements or online banking portal.

Pros and Cons of Nedbank Credit Cards

Pros

- Rewards Programme: Cardholders can earn Greenbacks Rewards, which can be redeemed for discounts, travel perks, and cashback.

- Travel Benefits: Select credit cards come with travel insurance, airport lounge access, and exclusive travel discounts.

- Interest-Free Period: Customers can enjoy up to 55 days of interest-free purchases, provided the balance is paid in full by the due date.

- Strong Security Features: Includes fraud protection, card freezing via the Nedbank Money App, and secure online transaction verification.

- Pre-Qualification Tool: Potential applicants can check their eligibility before applying, helping them understand their chances of approval without affecting their credit score.

Cons

- High Interest Rates on Outstanding Balances: If customers do not pay their balance in full, interest charges can be high, particularly for premium credit cards.

- Monthly and Annual Fees: Some credit cards come with monthly maintenance fees and annual service charges, which can add up over time.

- Strict Eligibility Criteria: Some Nedbank credit cards require higher income levels, limiting access for lower-income applicants.

- Foreign Transaction Fees: International purchases may come with additional fees, which can be costly for frequent travellers.

Customer Service and Support

For those who need assistance, Nedbank offers multiple ways to contact customer service. Customers can visit a Nedbank branch for in-person support, call the Nedbank Contact Centre, or use the Nedbank Money App for account management and inquiries. The bank also provides a live chat service on its website, where customers can get real-time support from a representative.

For urgent queries, Nedbank’s 24/7 fraud and lost card hotline ensures customers can block their cards immediately in case of theft or unauthorised transactions. Nedbank also has a presence on social media platforms, where customers can reach out for assistance.

Contact Channels

Phone number:

Nedbank Contact Centre: 0800 555 111 (toll-free within South Africa, available 24/7)

International Calls: +27 11 294 4444

Lost and Stolen Cards: 0800 110 929 (toll-free within South Africa) or +27 10 249 0100 (international)

Hours of operation:

Nedbank Contact Centre: 24 hours a day, 7 days a week

Head Office: Monday to Friday, 08:00 to 16:30

Postal address:

Nedbank Group Limited, 135 Rivonia Road, Sandown, Sandton, Gauteng, 2196, South Africa

Online Reviews of Nedbank

Customer feedback for Nedbank presents a mix of positive and negative experiences. Some customers have expressed dissatisfaction with the bank’s services. For instance, a reviewer on Reviews.io described an incident where their account was debited twice in one month, leading to frustration and a delay in refund processing.

Similarly, a complaint on Hellopeter detailed a prolonged delay in receiving a refund from the credit card department, highlighting issues with customer service efficiency.

Conversely, discussions on platforms like Reddit indicate that some customers find value in Nedbank’s offerings, especially concerning wealth and travel benefits. One user noted that while Nedbank excels in these areas, other banks might offer better loyalty rewards.

Overall, while Nedbank provides a range of financial products and services, customer experiences vary, emphasizing the importance of thorough research and consideration of individual banking needs before engagement.

Alternatives to Nedbank

For those exploring alternatives to Nedbank’s credit card offerings, several other South African banks provide competitive options:

Comparison Table

| Bank | Credit Card | Monthly Fee | Interest-Free Period | Rewards Programme | Additional Benefits |

|---|---|---|---|---|---|

| Nedbank | Gold Credit Card | R60 | Up to 55 days | Greenbacks Rewards | Complimentary card delivery, contactless payments, digital wallet integration |

| Standard Bank | Gold Credit Card | R63 | Up to 55 days | UCount Rewards | Discounts on flights, car rentals, and accommodations |

| FNB | Aspire Credit Card | R55 | Up to 55 days | eBucks Rewards | Discounts at major retailers, travel perks, and access to airport lounges |

| Capitec | GlobalOne Credit Card | R50 | Up to 55 days | Cashback on purchases | No foreign transaction fees, interest on positive balances |

| Absa | Gold Credit Card | R57 | Up to 57 days | Cash Rewards | No transaction fees on purchases, travel insurance, and access to airport lounges |

History and Background of Nedbank

Nedbank Group Limited, one of South Africa’s “Big Four” banks, has a rich history dating back to its establishment in 1888 as the Nederlandsche Bank en Credietvereeniging voor Zuid-Afrika in Amsterdam. The bank commenced operations in Pretoria in 1889, primarily financing the mining industry during the Witwatersrand Gold Rush. Over the years, Nedbank expanded its services and underwent several mergers and rebrandings, adopting the name “Nedbank” in 1971.

Today, Nedbank offers a comprehensive range of wholesale and retail banking services, insurance, asset management, and wealth management solutions. The bank’s mission is to use its financial expertise to do good for individuals, families, businesses, and society. Nedbank envisions being the most admired financial services provider in Africa by its staff, clients, shareholders, regulators, and communities.

Conclusion

Nedbank offers a diverse range of credit cards tailored to different financial needs, from entry-level to premium options. With benefits such as Greenbacks Rewards, travel perks, and interest-free periods, these cards provide value to customers who use them responsibly. However, factors like interest rates, fees, and eligibility requirements should be carefully considered before applying. While Nedbank competes well with other major South African banks, alternatives such as FNB, Standard Bank, Capitec, and Absa may offer better rewards or lower fees depending on individual preferences. Choosing the right credit card requires comparing the available options and understanding how each one aligns with your spending habits and financial goals.

Frequently Asked Questions

The minimum income requirement depends on the specific credit card. Some entry-level cards require a salary of around R5 000 per month, while premium cards may require a significantly higher income.

You can check your balance through the Nedbank Money App, online banking, Nedbank ATMs, or by contacting the Nedbank Customer Centre.

Yes, you can request a credit limit increase through the Nedbank Money App, online banking, or by visiting a branch. Approval depends on your credit score, repayment history, and income.

Missing a payment results in penalty fees and increased interest charges. If payments are overdue for an extended period, it may impact your credit score and lead to legal action if left unpaid.

Yes, Nedbank offers the Greenbacks Rewards Programme, allowing cardholders to earn points on purchases that can be redeemed for discounts, travel, or cashback. The availability of rewards depends on the type of credit card.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.