Sanlam is a well-known financial services provider in South Africa, offering a range of banking and credit solutions. The Sanlam Money Saver Credit Card is designed to provide users with a cashback rewards system, competitive fees, and security features that make managing everyday expenses easier. This review will cover the card’s features, benefits, fees, application process, and how it compares to other options in South Africa.

Sanlam Credit Card – Overview

| Name | Sanlam Money Saver Credit Card |

|---|---|

| Financial Institution | Sanlam, in partnership with RCS |

| Product | Platinum Mastercard credit card with cashback and savings benefits |

| Minimum Age | 18 years |

| Minimum Credit Limit | Subject to affordability assessment |

| Maximum Credit Limit | Determined based on income and creditworthiness |

| Minimum Term | Revolving credit with monthly repayments required |

| Maximum Term | Ongoing, with a budget facility for extended repayment terms |

| APR (Annual Percentage Rate) | Varies based on individual credit profiles and prevailing interest rates |

| Monthly Interest Rate | Subject to National Credit Act (NCA) regulations; varies per applicant |

| Early Settlement | Full balance can be paid at any time without penalties |

| Repayment Flexibility | Options include full monthly settlement, minimum payment, or budget instalments |

| NCR Accredited | Yes |

| Our Opinion | ✅Up to 55 days interest-free on purchases if the balance is settled in full ✅Perks via the Sanlam Reality Programme, including discounts on travel and fitness ⚠️Additional 2.5% charge is added to each transaction |

| User Opinion | ✅Users appreciate the cashback benefits and the ability to save while spending ⚠️Issues with card activation and online account management |

What Makes the Sanlam Credit Card Unique?

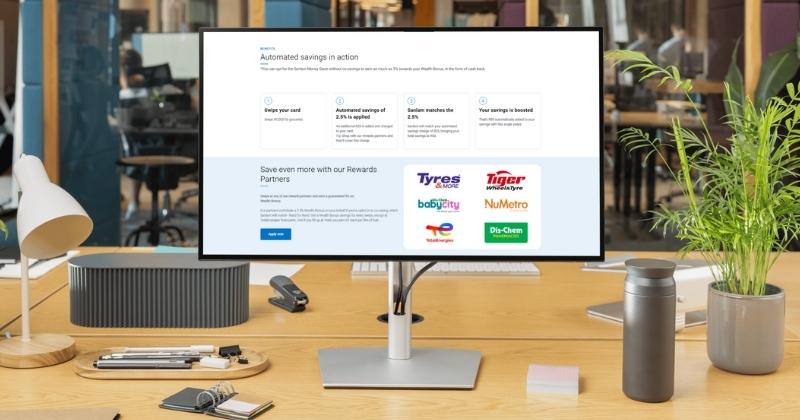

The Sanlam Money Saver Credit Card stands out due to its cashback rewards system, which is different from many other credit cards in South Africa. Instead of offering points that require conversions or specific purchases, this card allows users to earn cashback on everyday transactions. A portion of every purchase goes into a Money Saver account, which grows over time and can be withdrawn as real cash. Unlike typical rewards programmes that limit redemption options, this feature provides direct financial benefits without unnecessary restrictions.

Another unique aspect of this card is its flexibility and low-cost structure. Many credit cards charge high annual fees, but the Sanlam Money Saver Credit Card has a transparent and competitive fee system. Additionally, strong security features such as fraud protection, contactless payments, and virtual card options make it a reliable choice for both online and in-store purchases. The combination of cashback rewards, reasonable fees, and security features makes this card a practical option for South Africans looking for a cost-effective credit solution.

About Arcadia Finance

Secure your loan effortlessly with Arcadia Finance. Enjoy no application fees and select from 19 reputable lenders, each fully compliant with South Africa’s National Credit Regulator standards. Benefit from a streamlined process and trustworthy options tailored to your financial needs.

Types of Credit Cards Offered by Sanlam

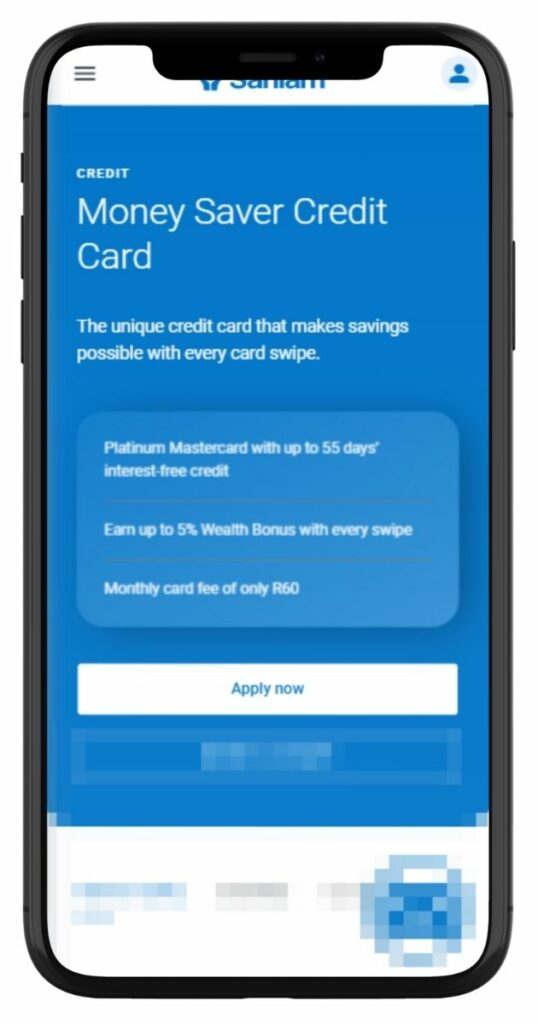

Sanlam Money Saver Credit Card

Monthly fee: R64

Minimum monthly income: R3 000

Sanlam currently focuses on one main credit card, the Sanlam Money Saver Credit Card, which is tailored for users who want to save money while spending. Unlike banks that offer multiple tiers of credit cards, Sanlam simplifies its offering with a single product that provides cashback benefits and flexible spending options.

The Sanlam Money Saver Credit Card is suitable for individuals who want a cost-effective credit card with reward benefits. It is best for everyday expenses, such as groceries, fuel, and online shopping, since it allows cardholders to earn real cashback instead of complicated rewards points. This makes it an ideal choice for those who prefer simplicity, security, and savings when managing their credit.

Not sure if the Sanlam Credit Card is the right fit for you? Discover how it stacks up against the Best Credit Cards in South Africa. From cashback perks to travel rewards, this guide helps you find the perfect plastic to match your spending habits.

Requirements for a Sanlam Credit Card

To apply for the Sanlam Money Saver Credit Card, applicants must meet specific criteria and provide the required documents. The basic requirements include:

- Age: Applicants must be at least 18 years old.

- Income: A minimum monthly income of R3 000 is required.

- Creditworthiness: A good credit record is necessary for approval.

- Residency: Applicants must be South African citizens or permanent residents.

To complete the application, the following documents must be submitted:

- South African ID document or passport (for non-citizens with residency).

- Latest payslip or proof of income (such as a bank statement showing salary deposits).

- Recent three-month bank statements (to verify financial stability).

- Proof of residence (such as a utility bill not older than three months).

Simulation of a Credit Card Application at Sanlam

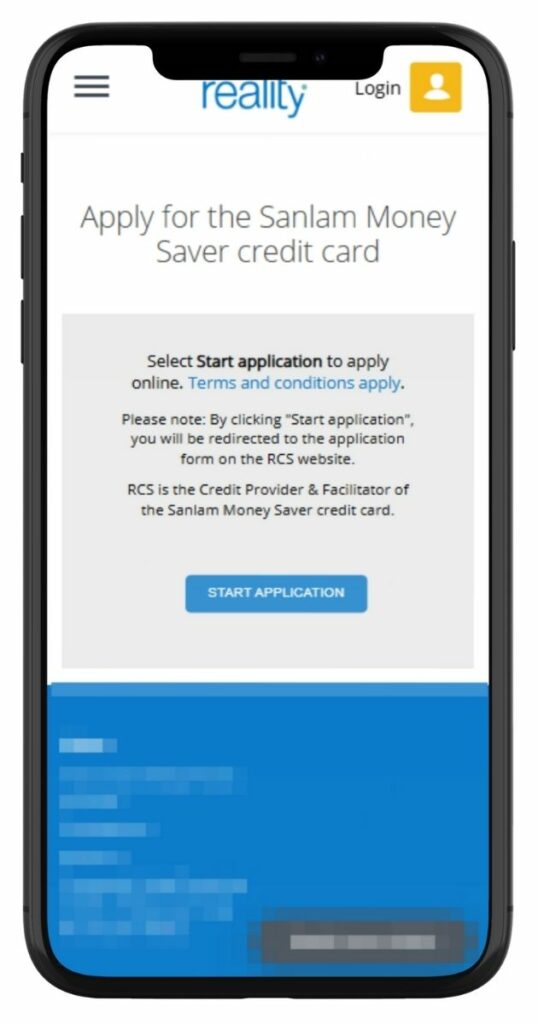

Step 1. Visit the Sanlam website and select the Money Saver Credit Card.

Step 2. Click “Apply Now” and proceed to the Reality website.

Step 3. From the Sanlam Reality website, click “Apply Now” again.

Step 4. Click “Start Application” to be redirected to the RCS application page.

Step 5. Complete the Online Application Form: Fill in your personal and financial details.

Step 6. Upload Supporting Documents: Submit your ID, bank statements, and proof of income.

Step 7. Wait for Approval: Sanlam will review your application and conduct a credit check.

Step 8. Receive Your Card: If approved, your card will be delivered or available for collection.

Step 9. Activate Your Card: Follow the activation instructions and start using your credit card.

Eligibility Check

Sanlam offers an online eligibility tool that allows potential applicants to check if they meet the requirements before applying. This tool helps users determine whether they qualify without affecting their credit score. By entering basic details like income and expenses, applicants can get a preliminary assessment before completing the full application. This ensures that users only proceed if they have a reasonable chance of approval.

How Much Credit Limit Can I Request from Sanlam?

The Sanlam Money Saver Credit Card does not have a fixed loan amount like a personal loan, but rather a credit limit based on the applicant’s income, credit history, and affordability assessment. The minimum credit limit is R5 000, while the maximum is determined based on financial standing. Higher limits may be granted to those with good credit scores, stable income, and low existing debt. Cardholders can also request a credit limit increase after demonstrating responsible repayment behaviour.

Receive Offers

Sanlam provides personalised credit limits and interest rates based on an applicant’s financial profile. During the application process, the company assesses income, expenses, credit history, and debt obligations to determine the most suitable offer. Higher-income earners with strong credit records may receive higher credit limits and better interest rates, while those with lower credit scores may receive more restrictive terms. All offers are tailored to ensure responsible lending and affordability.

How Long Does It Take to Receive My Credit Card from Sanlam?

The Sanlam Money Saver Credit Card application process is fully online, with approvals typically processed within 1 to 2 business days. Once approved, the card is issued within 3 to 7 business days, depending on bank processing times. After activation, funds become available immediately. Processing speed depends on the accuracy of submitted documents, credit assessment, and bank clearance times. To avoid delays, applicants should ensure all required documents are complete and up to date.

How Do I Repay My Card from Sanlam?

Sanlam credit card repayments must be made monthly, with at least the minimum repayment amount required to avoid penalties. Payments can be made via debit order, EFT (electronic funds transfer), or direct bank payments at selected branches. Interest charges apply to outstanding balances beyond the interest-free period, and late payments may result in penalty fees and a negative impact on credit scores. To reduce interest costs, cardholders are encouraged to pay more than the minimum amount whenever possible.

Struggling with high credit card interest rates? It might be time to consider your alternatives. Learn When to Use a Personal Loan to Pay Off Credit Card Debt and whether consolidating your debt could save you thousands in interest payments.

Pros and Cons of the Sanlam Credit Card

Pros

- Cashback Rewards: Earn real cashback on purchases, which can be withdrawn as cash.

- Competitive Fees: Lower monthly and transaction fees compared to some competitors.

- Interest-Free Period: Up to 55 days interest-free on purchases if the full balance is paid on time.

- Strong Security Features: Includes fraud protection, virtual card options, and contactless payments.

- Flexible Credit Limits: Personalised credit limits based on income and affordability assessment.

- Fully Online Application: Quick and convenient online application process.

Cons

- Limited Credit Card Options: Only one credit card product is available, with no premium or business options.

- No Airline or Travel Rewards: Unlike some other banks, Sanlam does not offer frequent flyer miles or travel perks.

- High Interest on Outstanding Balances: Interest rates can be high if balances are not repaid in full each month.

- Cash Withdrawal Fees: ATM withdrawals and cash advances attract additional charges.

Customer Service

Sanlam offers multiple support channels for credit card customers. Queries can be handled through phone support, email, and online assistance via the Sanlam website. For detailed information or assistance with applications, customers can visit the Sanlam Money Saver Credit Card page. If you have further questions about fees, eligibility, repayment options, or cashback benefits, contacting Sanlam’s support team can provide clarification and guidance.

Contact Channels

Phone number:

Office: 0861 44 00 44

Hours of operation:

Monday to Friday: 08:00 – 16:30

Saturday to Sunday: Closed

Postal address:

Sanlam Head Office, 2 Strand Road, Bellville, 7530, South Africa

Online Reviews of Sanlam

Customer feedback on the Sanlam Money Saver Credit Card varies across different platforms. Some users appreciate the swift card delivery, noting experiences like receiving the card within three working days. Others commend the cashback benefits, highlighting the potential to earn up to 5% cashback on purchases.

However, there are criticisms as well. Some customers report challenges with customer service and accessing account information online, with one user expressing difficulties in viewing account details via the Sanlam Reality site. Another user described issues with service responsiveness, stating delays in receiving funds and lack of communication.

Alternatives to Sanlam

When considering alternatives to the Sanlam Money Saver Credit Card, several other South African banks offer competitive credit card options:

Comparison Table

| Feature | Sanlam Money Saver | Capitec Credit Card | FNB Aspire Credit Card | Standard Bank Blue |

|---|---|---|---|---|

| Monthly Fee | R60 | R50 | R55 | R40 |

| Interest-Free Period | Up to 55 days | Up to 55 days | Up to 55 days | Up to 55 days |

| Rewards Program | Up to 5% cashback | 1% cashback | eBucks rewards | UCount Rewards |

| Minimum Income Requirement | R3 000 | R3 000 | R60 000 per annum | R5 000 |

| Additional Benefits | Access to Sanlam Reality program | None | Travel perks, lounge access | Secure online shopping |

| More Info | Capitec Credit Cards Review | FNB Credit Cards Review | Standard Bank Credit Cards Review |

History and Background of Sanlam

Founded in 1918, Sanlam has evolved from a traditional life insurance company into a diversified financial services group in South Africa. Over the decades, Sanlam expanded its offerings to include investment management, asset management, credit solutions, and more, positioning itself as a prominent player in the South African financial landscape.

Sanlam’s mission is to empower individuals and businesses to achieve financial security and prosperity. The company is committed to innovation, customer-centric solutions, and ethical business practices. Its vision is to be the leader in wealth creation and protection, delivering tailored financial solutions that meet the diverse needs of its clientele.

Conclusion

The Sanlam Money Saver Credit Card is a solid choice for South Africans looking for a credit card with real cashback rewards and competitive fees. Its flexible spending options, security features, and straightforward application process make it appealing to a wide range of users. While it lacks travel rewards and premium card options, it remains a cost-effective solution for everyday spending. Potential applicants should compare it with other available credit cards to ensure it meets their financial needs.

Frequently Asked Questions

The Sanlam Money Saver Credit Card allows cardholders to earn up to 5% cashback on eligible purchases. The cashback is automatically deposited into a Money Saver account, which accumulates over time. Unlike some rewards programmes that require specific spending or conversions, this cashback can be withdrawn as real cash, making it a practical benefit for everyday expenses.

Sanlam offers an interest-free period of up to 55 days on purchases, provided that the full outstanding balance is settled before the due date. This means that if you use your card for purchases and pay off the full balance within this period, you will not incur any interest charges. However, if you carry a balance beyond this period, interest will be charged on the remaining amount.

Yes, you can apply for a credit limit increase if you need access to a higher spending amount. Sanlam assesses credit limit increases based on factors such as your repayment history, income stability, and overall creditworthiness. To request an increase, you may need to submit updated proof of income and meet affordability requirements. The decision will be based on whether you can comfortably manage a higher credit limit.

The Sanlam Money Saver Credit Card has a monthly account fee of R60, which covers standard maintenance and access to the cashback rewards programme. Additional fees may apply for certain transactions, including cash withdrawals, foreign currency transactions, and late payments. It is advisable to review the full fee structure before applying to ensure you understand all applicable charges.

Sanlam provides multiple customer support options for credit card users. You can contact their customer service team by calling 0861 44 00 44 during office hours. Alternatively, you can visit their official website to access FAQs, live chat, and email support. If you prefer in-person assistance, you can also visit a Sanlam branch for further inquiries regarding your credit card or application.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.