Standard Bank offers a range of credit cards designed to suit different financial needs, whether for everyday purchases, travel, or business expenses. These credit cards come with various benefits, including rewards programmes, travel perks, and security features. Choosing the right credit card can help you manage expenses effectively while taking advantage of added features such as cashback, purchase protection, and flexible repayment options.

Standard Bank Overview

| Name | Standard Bank Credit Cards |

|---|---|

| Financial Institution | Standard Bank |

| Products | Blue, Gold, Titanium, Platinum, World Citizen, Diners Club Platinum, Diners Club Shari’ah Charge Card |

| Minimum Age | 18 years |

| Minimum Credit Limit | R2 000 |

| Maximum Credit Limit | Up to R250 000 |

| Minimum Income Requirement | Varies by card type (i.e., Platinum Credit Card requires a minimum monthly income of R58 000) |

| Annual Percentage Rate (APR) | Personalised interest rates ranging from prime – 0.25% to the maximum allowable rate under NCA regulations |

| Monthly Interest Rate | Variable, based on personalised APR |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Minimum monthly repayment of 3% of the outstanding balance |

| NCR Accredited | Yes |

| Our Opinion | ✅Efficient and user-friendly application process ✅Flexible repayment options ✅Comprehensive rewards programme |

| User Opinion | ✅Convenient access to funds ⚠️Personalised interest rates may vary based on individual credit profiles |

What Makes Standard Bank Credit Cards Unique?

Standard Bank credit cards stand out due to their diverse range of options tailored to different income levels and financial needs. Whether you need a basic credit card for everyday purchases or a premium option with travel benefits, there is a suitable choice. UCount Rewards, Standard Bank’s loyalty programme, allows cardholders to earn points on qualifying purchases, which can be redeemed for discounts at participating retailers. Additionally, Standard Bank offers competitive interest rates on certain cards, providing flexibility for those who prefer to pay off balances over time. The integration with the Standard Bank Mobile App enhances convenience, allowing users to manage their accounts, make payments, and track spending from anywhere.

Security is another key feature that sets Standard Bank apart. Credit cards come with advanced fraud protection, including real-time transaction alerts, card freezing options, and strong encryption for online transactions. For frequent travellers, selected cards offer travel insurance, airport lounge access, and emergency assistance, making them suitable for both personal and business use. The bank also provides customised credit limits, allowing cardholders to adjust their spending capacity based on their needs and repayment ability. With a strong focus on security, rewards, and flexibility, Standard Bank credit cards are designed to offer both convenience and value.

If you’re comparing Standard Bank credit cards to other options in the market, you might want to check out the best credit cards in South Africa. Whether you’re after travel rewards, cashback, or lower interest rates, this guide breaks down the top contenders to help you find the perfect fit for your financial needs.

About Arcadia Finance

Arcadia Finance makes borrowing simple. Enjoy zero application fees and access 19 vetted lenders, all compliant with South Africa’s credit regulations.

Types of Credit Cards Offered by Standard Bank

Standard Bank offers a variety of credit cards designed to suit different financial needs, spending habits, and lifestyle preferences. Each card provides unique benefits, ranging from basic credit access to exclusive rewards and travel perks.

Blue Credit Card

The Blue Credit Card is ideal for individuals looking for a simple and cost-effective credit facility. It offers a credit limit of up to R250 000 with a monthly fee of R40. This card focuses on essential credit services without additional rewards programmes or luxury perks. Security features include chip-and-PIN technology and 3D Secure verification for safer online shopping. This option is best suited for those who prefer affordability and straightforward credit usage without extra features.

Gold Credit Card

The Gold Credit Card is designed for individuals who want a balance between affordability and added benefits. It includes travel perks such as up to 20% off Emirates flights and automatic basic travel insurance. Cardholders also gain access to lifestyle discounts on dining, leisure activities, and online shopping. Additionally, the Gold Credit Card allows users to earn UCount Rewards Points on qualifying purchases. This card is a great option for those seeking extra value without high monthly fees.

Titanium Credit Card

The Titanium Credit Card is suited for those who require higher credit limits and enhanced benefits. It provides access to increased spending power, making it ideal for individuals with larger financial commitments. This card offers exclusive deals on travel, dining, and entertainment, alongside comprehensive insurance coverage, including travel insurance and purchase protection. It is a strong choice for individuals who want a more premium credit facility with additional lifestyle benefits.

Platinum Credit Card

The Platinum Credit Card is tailored for high-income earners who want premium services and exclusive rewards. It offers higher earning rates on UCount Rewards Points, giving users the ability to accumulate more rewards on their spending. Travel perks include airport lounge access, extended travel insurance, and discounts on premium hotels. The card also comes with concierge services and priority customer support, making it ideal for those who travel frequently and require a more personalised banking experience.

World Citizen Credit Card

The World Citizen Credit Card is designed for frequent international travellers who require extensive global benefits. It is widely accepted at international merchants and ATMs, making it convenient for those who travel abroad regularly. The card includes comprehensive travel insurance, covering medical emergencies, trip cancellations, and lost luggage. Additional benefits include discounts on global brands, hotels, and car rentals. This credit card is best suited for individuals who need financial flexibility and security when travelling internationally.

Diners Club Beyond Credit Card

The Diners Club Beyond Credit Card is ideal for individuals who enjoy exclusive dining and lifestyle privileges. Cardholders gain access to premium restaurant offers, special dining events, and invitations to concerts and entertainment shows. The card also includes travel benefits such as insurance coverage and access to select airport lounges. This option is perfect for those who want a high-end credit card that enhances their social and travel experiences.

Diners Club Platinum Credit Card

The Diners Club Platinum Credit Card is designed for customers who want premium lifestyle and travel benefits. It offers discounted flights, hotel accommodation, airport VIP fast-track services, and lounge access. Comprehensive travel insurance is included to provide peace of mind while travelling. Additionally, the card comes with concierge services, allowing users to receive personalised assistance for travel bookings, event reservations, and luxury services. This card is best for individuals who prioritise convenience and exclusive privileges in their banking experience.

Diners Club Shari’ah Charge Card

The Diners Club Shari’ah Charge Card is designed for individuals who prefer banking services that align with Islamic financial principles. It operates without interest, adhering to Shari’ah law, and instead charges a fixed monthly fee on outstanding balances. The card ensures that all transactions comply with ethical and Islamic financial guidelines. This option is suitable for those seeking a credit facility that follows religious banking standards while still offering security and convenience.

Carrying a high credit card balance with steep interest rates? A personal loan might be a smarter way to consolidate and pay off your debt faster. Learn When to Use a Personal Loan to Pay Off Credit Card Debt and how using a personal loan can help you take control of your finances and reduce unnecessary interest payments.

Requirements for a Standard Bank Credit Card

To apply for a Standard Bank credit card, applicants must meet specific income and credit score criteria. The minimum monthly income requirement varies depending on the type of credit card, with entry-level cards requiring a lower income and premium cards requiring a higher salary. A good credit history is essential, as Standard Bank assesses applicants’ credit scores to determine eligibility and credit limits.

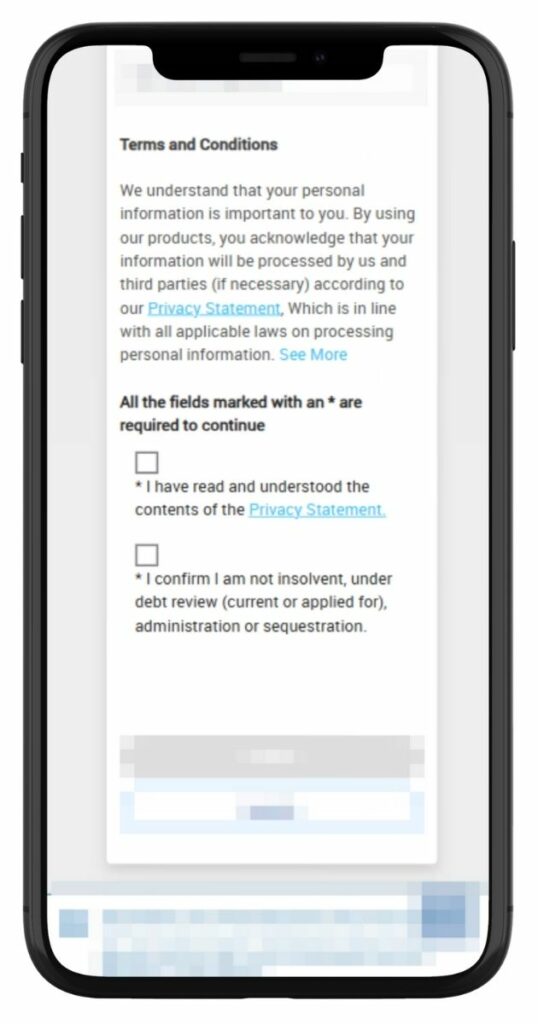

Applicants must be 18 years or older and provide proof of South African residency. Required documents include a valid South African ID or passport, recent proof of income (such as payslips or bank statements for the last three months), and proof of residence (such as a utility bill not older than three months). Self-employed applicants may need to submit additional financial documents, including tax clearance certificates and business financial statements. Providing complete and accurate documentation ensures a smoother application process.

Simulation of a Credit Card at Standard Bank

Step 1. Choose the credit card that suits your needs from Standard Bank’s range.

Step 2. Check Eligibility: Click on “Do I Qualify?” to start the application.

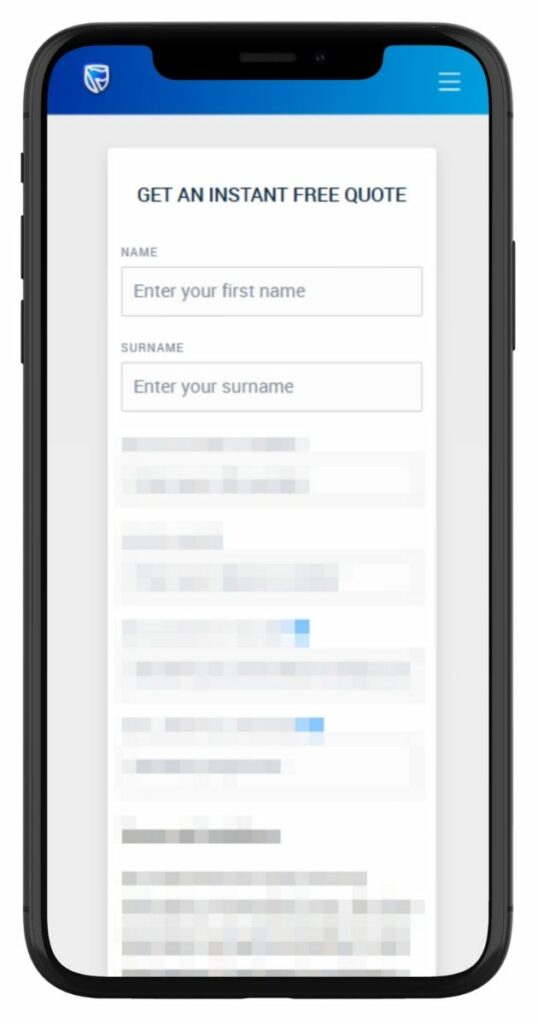

Step 3. Enter Personal Details: Provide your first name and surname.

Step 4. Submit Identification Info: Enter your South African ID number and phone number.

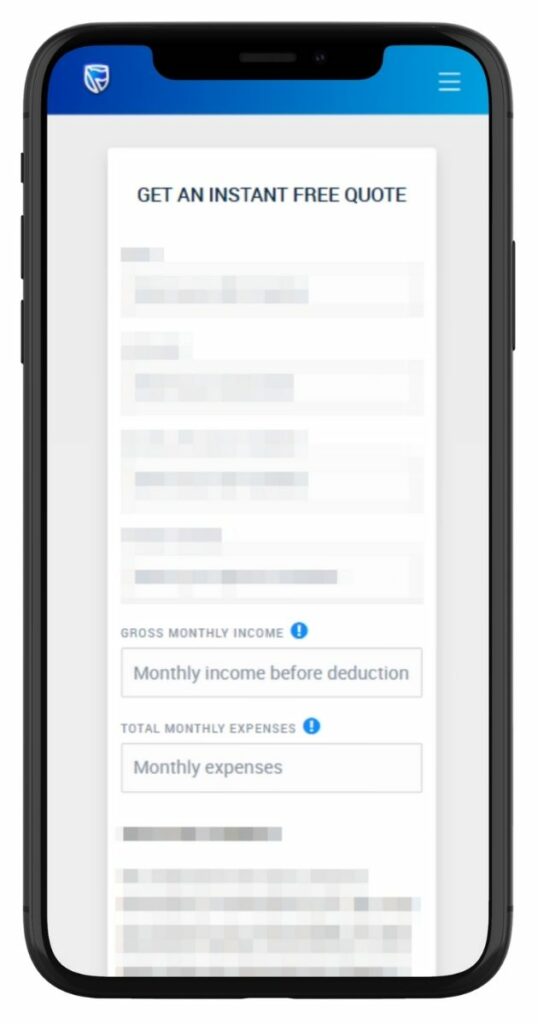

Step 5. Provide Financial Details: Input your gross monthly income and total expenses.

Step 6. Agree to Terms: Read and accept the privacy statement and confirm your financial status.

Step 7. Submit Application: Click “Submit” to complete the process.

Step 8. Await approval: Standard Bank will assess your application and notify you of the outcome.

Step 9. Receive your card: Once approved, collect your card at a branch or have it delivered.

Step 10. Activate and use: Activate your card via the Standard Bank app or customer service before using it.

Eligibility Check

Standard Bank offers tools to help customers pre-check their eligibility before applying. The online credit card eligibility tool allows applicants to input their income and expenses to estimate whether they qualify for a specific credit card. Additionally, Standard Bank’s financial advisors in-branch can assist with manual pre-assessments. Customers with an existing Standard Bank account may also receive pre-approved offers based on their banking history. Checking eligibility before applying helps prevent unnecessary credit score impacts from declined applications.

How Much Money Can I Request from Standard Bank Credit Card?

The minimum and maximum credit limits available depend on the type of Standard Bank credit card and the applicant’s financial profile. Entry-level credit cards, such as the Blue Credit Card, typically offer lower credit limits starting from R2 000, while premium cards like the World Citizen Credit Card or Diners Club Platinum Credit Card provide significantly higher limits, sometimes exceeding R250 000.

The exact credit limit granted is based on several factors, including the applicant’s monthly income, credit score, repayment history, and existing debts. Customers with a strong credit profile and higher income may qualify for larger limits, while those with lower earnings or limited credit history may start with a smaller amount. Standard Bank may also adjust credit limits over time based on the cardholder’s repayment behaviour.

Receive Offers

Standard Bank creates personalised credit card offers by assessing an applicant’s financial history, spending patterns, and income level. Customers with an existing Standard Bank account may receive pre-approved credit card offers based on their banking activity, salary deposits, and overall account behaviour.

For new customers, the bank evaluates creditworthiness using credit bureau reports, employment details, and submitted financial documents. Some applicants may also be eligible for special promotions or reward-based offers, providing better terms, lower fees, or enhanced benefits. Customers can check their eligibility online or speak to a financial advisor to understand their available options.

How Long Does It Take to Receive My Card from Standard Bank?

The time it takes to receive a Standard Bank credit card and access funds depends on the application process, verification steps, and approval speed.

- Application Review: Once an application is submitted, Standard Bank typically processes it within 5 to 7 business days.

- Document Verification: If additional documents are required, the approval process may take longer.

- Card Issuance and Delivery: Once approved, the physical credit card is issued and either collected at a branch or delivered to the applicant within 3 to 5 business days.

- Instant Use for Digital Payments: Some Standard Bank credit cards can be linked to digital wallets (such as Apple Pay or Samsung Pay) for immediate use even before receiving the physical card.

Several factors affect processing times, including credit history checks, income verification, and the accuracy of the submitted information. Existing Standard Bank customers may experience faster approval times, as the bank already has their financial details on record.

How Do I Repay My Card from Standard Bank?

Standard Bank offers multiple repayment options to help cardholders manage their credit card balances effectively. Payments can be made through debit orders, online banking transfers, ATM deposits, or in-branch payments. Customers can choose to pay the full outstanding balance, the minimum monthly repayment, or a custom amount based on their financial situation.

- Debit Order Payments: The most convenient option, allowing automatic monthly payments from a Standard Bank account.

- Online Banking or Mobile App Transfers: Cardholders can manually transfer funds to their credit card using the Standard Bank app or internet banking portal.

- ATM and Branch Payments: Payments can also be made at Standard Bank ATMs or branch tellers for those who prefer in-person transactions.

Possible Fees and Penalties

Failure to make timely repayments can result in late payment fees, increased interest rates, and a negative impact on credit scores. Standard Bank charges a late payment penalty if the minimum repayment amount is not received by the due date. Interest is applied to any outstanding balance, and cash withdrawals from a credit card attract additional charges, including higher interest rates.

To avoid penalties, customers should set up automatic payments or schedule reminders to ensure they meet their monthly repayment deadlines. Paying more than the minimum amount helps reduce interest costs and clear debt faster.

Looking for more credit card choices? Compare how African Bank Credit Card stacks up against Standard Bank’s offerings. Whether you’re after affordability, rewards, or travel perks, knowing your options helps you make the best financial decision.

Pros and Cons of Standard Bank Credit Cards

Pros

- Wide range of credit card options: Offers entry-level, mid-tier, premium, and business credit cards to suit different income levels and needs.

- UCount Rewards Programme: Customers earn rewards on purchases, which can be redeemed for discounts at partner stores.

- Advanced security features: Fraud protection, real-time transaction alerts, card freezing options, and 3D Secure for online purchases.

- Flexible repayment options: Cardholders can choose between paying in full, making minimum payments, or using structured budget plans.

- Pre-approved offers: Existing Standard Bank customers may receive pre-approved credit card offers, simplifying the application process.

Cons

- High-interest rates on outstanding balances: Like most credit cards, unpaid balances accrue interest, which can become expensive over time.

- Additional charges for cash withdrawals: Using a Standard Bank credit card at an ATM incurs cash advance fees and higher interest rates.

- UCount Rewards limitations: Not all purchases earn full rewards points, and some redemptions may be limited to specific partners.

Customer Service

Standard Bank provides multiple ways for customers to get assistance with their credit cards. The bank offers 24/7 customer support through its call centre, where users can report lost or stolen cards, check balances, or request credit limit changes.

Customers can also visit a Standard Bank branch for in-person assistance with their credit card applications or account queries. The Standard Bank mobile app and internet banking platform allow users to manage their credit cards, make payments, and view statements conveniently.

For quick answers, the Standard Bank website features an FAQ section, covering common credit card questions, fees, and repayment options. Customers can also contact Standard Bank via email, live chat, or social media channels for additional support.

Contact Channels

Phone number:

General Enquiries: 0860 123 000 (within South Africa) or +27 11 299 4701 (international)

Lost or Stolen Cards: 0800 020 600 (within South Africa) or +27 10 249 0100 (international)

Fraud Line: 0800 222 050 (within South Africa) or +27 10 824 1515 (international)

Hours of operation:

General Customer Support: Monday to Sunday, 8:00 AM to 10:00 PM

Lost or Stolen Cards and Fraud Line: 24 hours a day, 7 days a week

Postal address:

Standard Bank Group Ltd, 5 Simmonds Street, Johannesburg, 2001, Gauteng, South Africa

Online Reviews of Standard Bank

Customer feedback for Standard Bank’s credit card services presents a mix of positive and negative experiences. Some users have expressed frustration, particularly regarding customer service and unmet expectations. Some criticise the bank for failing to deliver on its promises, stating that they were enticed to sign up but later felt misled, ultimately advising others against using the service.

On the other hand, some customers find Standard Bank’s credit cards easy to use and accessible, especially for first-time credit users. They often highlight the simplicity of the application process, noting that qualifying for a Standard Bank credit card is usually straightforward for beginners, making it a convenient option.

Overall, Standard Bank’s credit cards receive mixed reviews. While many appreciate their accessibility and ease of use, others have concerns about service reliability and the consistency of the bank’s commitments.

Alternatives to Standard Bank

Several other banks in South Africa offer competitive credit card options, each with unique benefits and reward structures.

Comparison Table

| Bank | Credit Card | Monthly Fee | Rewards Programme | Unique Features |

|---|---|---|---|---|

| Standard Bank | Titanium Credit Card | R86 | UCount Rewards | Discounts on flights, access to CaféBlue at OR Tambo International Airport. |

| Discovery Bank | Gold Credit Card | Varies by tier | Vitality Money | Cashback on various purchases, integration with health and lifestyle benefits. |

| FNB | Premier Credit Card | R175 | eBucks Rewards | Comprehensive travel insurance, exclusive airport lounge access. |

| Absa | Premium Credit Card | R175 | Absa Rewards | Customizable credit limits, tailored insurance options. |

| Nedbank | Platinum Credit Card | R180 | Greenbacks Rewards | Dedicated relationship banker, lifestyle concierge services. |

| Capitec | Credit Card | Lower than competitors | Simple Rewards | Competitive interest rates, user-friendly digital banking platform. |

History and Background of Standard Bank

Established in 1862 in Port Elizabeth, South Africa, Standard Bank has grown to become one of the continent’s largest financial institutions. With a presence in 20 African countries and key global markets, the bank offers a comprehensive range of financial services, including personal and business banking, corporate and investment banking, and wealth management.

Standard Bank’s mission is to drive Africa’s growth, aiming to make a positive impact on the continent’s economic development. The bank’s vision focuses on delivering superior value to its customers, shareholders, and broader stakeholders by providing innovative financial solutions and maintaining a deep understanding of local markets.

Through its long-standing history, Standard Bank has played a pivotal role in supporting infrastructure projects, facilitating trade, and promoting financial inclusion across Africa.

Conclusion

Standard Bank offers a diverse range of credit cards designed to meet different financial needs, from basic entry-level options to premium cards with travel and lifestyle benefits. With features such as UCount Rewards, flexible repayment options, and strong security measures, these credit cards provide both convenience and value. However, customers should carefully review fees, interest rates, and eligibility requirements before applying. Whether you need a simple credit facility, a card with luxury perks, or a Shari’ah-compliant option, Standard Bank has a variety of choices to suit different financial situations.

Frequently Asked Questions

The minimum income requirement varies depending on the credit card type. Entry-level cards generally require a lower income, while premium cards require a higher monthly salary.

You can check your balance using the Standard Bank mobile app, online banking portal, at an ATM, or by calling customer service.

Yes, credit limit increases are subject to approval based on your financial standing. You can request an increase via online banking, the mobile app, or by visiting a branch.

Report a lost or stolen card immediately by calling Standard Bank’s 24/7 fraud and lost card hotline. You can also block your card temporarily through the mobile app.

Yes, certain Standard Bank credit cards provide complimentary travel insurance. Coverage details depend on the card type and terms of use.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.