Interest in finance literature has surged as more individuals look to improve their understanding of personal finance and investing. With a wide array of books available, it can be overwhelming to know where to start. To assist, we have curated a collection of notable and influential works in the field. These books, written by experts from diverse backgrounds, provide a comprehensive overview while introducing fresh perspectives on the often complex and uncertain economic landscape. Applying the knowledge gained from these resources can empower you to make informed and strategic financial decisions.

Key Takeaways

- Financial literature offers diverse perspectives: These books provide essential insights and practical tools to help readers navigate financial decisions, especially in uncertain economic times.

- Influential books provide enduring insights: Works like A Random Walk Down Wall Street and The Psychology of Money help readers understand market dynamics while offering strategies for managing personal wealth.

- Some books focus on generational wealth: Titles such as The Black Girl’s Guide to Financial Freedom and The Family Bank highlight strategies for preserving and growing family wealth, helping readers avoid common financial pitfalls.

About Arcadia Finance

Secure your loan seamlessly with Arcadia Finance. Choose from 19 trusted lenders, all fully compliant with South Africa’s National Credit Regulator, and enjoy a hassle-free process with zero application fees. Get access to reliable options designed to suit your financial needs.

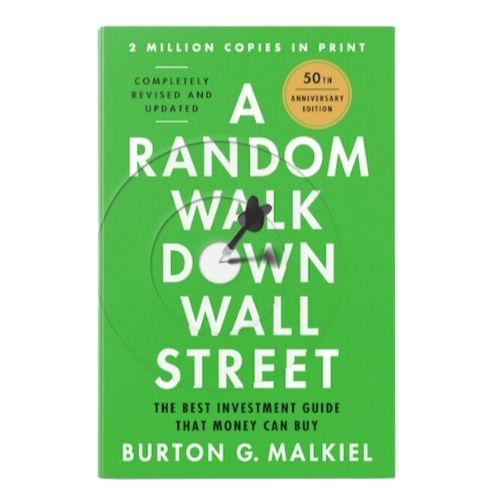

A Random Walk Down Wall Street by Burton G. Malkiel

“Forecasts are difficult to make, particularly those about the future.”

Burton G. Malkiel defines a “random walk” as a scenario where future movements or trends cannot be predicted based on past events. When this concept is applied to the stock market, it implies that short-term fluctuations in stock prices are inherently unpredictable.

Malkiel is a distinguished economist, a former executive at Vanguard, and a former dean of the Yale School of Management. He is best known for his influential book A Random Walk Down Wall Street, first published in 1973. By its 12th edition in 2019, the book had solidified its status as a cornerstone in financial literature, offering readers valuable insights into market behaviour and investment strategies.

Strengths

- Introduces the concept of the efficient market hypothesis, showing that it is hard to consistently beat the market.

- Advocates for low-cost, passive investing through index funds, appealing to both beginners and seasoned investors.

Weakness

- Some may find the book dense and overly detailed for beginners.

- Critics argue that it overlooks exceptions where skilled investors have beaten the market over long periods.

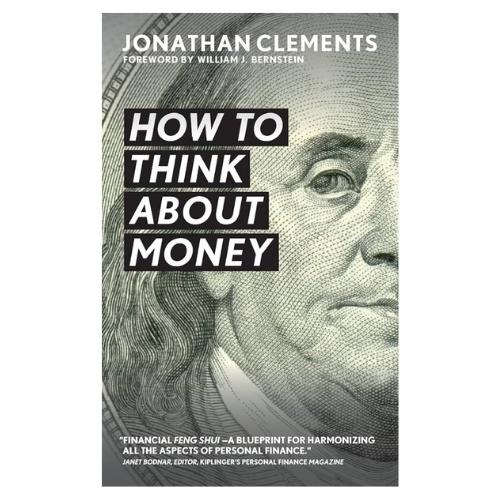

How to Think About Money by Jonathan Clements

“Money’s great ability is to give us peace of mind.”

Many people aim for financial stability and seek to alleviate the stress that often comes with managing money. In his book, How to Think About Money, Jonathan Clements outlines five core principles designed to help individuals achieve this goal. The book serves as a clear and practical guide to understanding and applying these essential concepts.

Clements has received praise from readers and respected financial experts, including Jack Bogle, for its capacity to change how individuals approach financial decisions. With just a few hours of reading, this resource can provide long-term benefits by enhancing financial decision-making skills for a lifetime.

Strengths

- Focuses on the psychology of money, helping readers align financial decisions with personal happiness.

- Simple, actionable advice on savings and investments, making it accessible to beginners.

Weakness

- Some may find it lacks depth for advanced investors.

- Limited focus on more complex investment strategies.

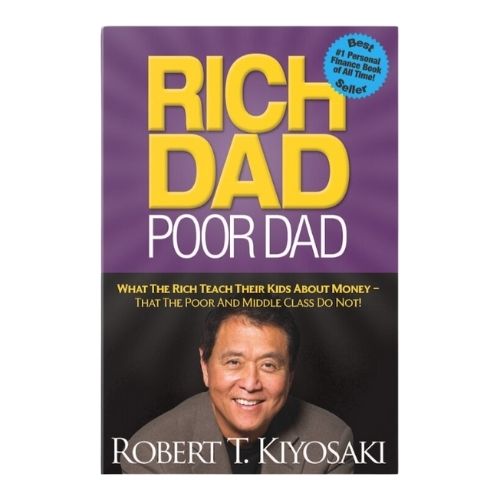

Rich Dad Poor Dad by Robert T. Kiyosaki

“The single most powerful asset we all have is our mind.”

This book is presented in a conversational style and highlights the significance of understanding financial principles as a pathway to building wealth. It contrasts the lessons learned from two father figures. The “rich dad” is a friend’s father who starts with modest means and builds a successful business, exemplifying capitalist ideals. In contrast, the “poor dad” is Robert T. Kiyosaki’s own father, a well-educated government employee who holds socialist views.

Kiyosaki embraced the teachings of the “rich dad” throughout his life, ultimately co-authoring a book that has remained a leading resource on personal finance for over 25 years. The insights shared in this book continue to resonate with readers seeking to enhance their financial literacy and achieve greater financial independence.

Strengths

- Challenges conventional financial wisdom, encouraging entrepreneurship and investment in assets.

- Uses personal anecdotes to make financial concepts relatable and motivational.

Weakness

- Criticized for lacking practical, actionable steps.

- Promotes some ideas that could be risky without proper understanding (e.g., leveraging debt).

For those inspired by strategies in financial books aimed at wealth building, delve deeper with our article on how to become a millionaire in South Africa, offering localized tips for achieving financial freedom.

The Black Girl’s Guide to Financial Freedom by Paris Wood

“Freedom comes from knowing the power of your choices.”

Paris Wood’s insightful book provides valuable guidance on building wealth for future generations, avoiding common financial pitfalls, pursuing education without accumulating debt, and working towards early financial independence. Through real-life examples, including an extreme saver who retired at 30, a woman who spent 25 years in an unsuitable career, and the author’s personal journey to financial independence after being laid off, the book offers clear, actionable advice.

Tailored specifically for Black women, the book is designed to support those who are either just starting their careers or seeking new strategies to take control of their financial futures. Its practical approach empowers readers to make informed decisions that will positively impact their financial well-being for years to come.

Strengths

- Focuses on financial strategies for minorities, promoting empowerment and financial literacy.

- Advocates for debt elimination and thoughtful spending to achieve financial independence..

Weakness

- Geared toward a specific audience, which may limit broader applicability.

- May not cover advanced investment topics in depth.

The Event-Driven Edge in Investing by Asif Suria

“Opportunities arise where uncertainty reigns.”

Investors continually seek methods to outperform the market, and event-driven strategies offer an approach that was once mainly utilized by institutional players. These strategies capitalise on corporate events such as mergers, acquisitions, stock repurchases, and company spin-offs, all of which can significantly influence stock prices.

In The Event-Driven Edge in Investing, Asif Suria discusses how merger arbitrage can yield more favourable risk-adjusted returns compared to traditional bonds. He also explores how tracking insider actions may reveal new investment opportunities, and how stock buybacks can signal a company’s commitment to enhancing shareholder value. Furthermore, spin-offs often provide chances to uncover value in either the new entity or the parent company. Suria’s insights equip investors with the knowledge to navigate and profit from these event-driven opportunities effectively.

Strengths

- Focuses on niche strategies like event-driven investing, which can yield above-average returns.

- Offers insights into mergers, acquisitions, and special situations.

Weakness

- Requires a higher level of financial knowledge to fully grasp.

- The strategies discussed carry significant risk and may not suit all investors.

Supplement your reading on investments with our guide on learning about investment opportunities, focusing on a stable and often overlooked option: buying government bonds.

The Family Bank: The Key to Generational Wealth by John H. Nebeker

“Wealth is a family journey, not an individual sprint.”

In The Family Bank, author John H. Nebeker delves into the factors contributing to the gradual erosion of family wealth over generations. Using a blend of real-world examples and historical analysis, he highlights common mistakes that many families make, leading to the loss of wealth over time.

Conversely, Nebeker showcases the methods and practices employed by families that have successfully preserved and enhanced their wealth for years. The book offers a practical framework aimed at improving financial opportunities while fostering stronger family bonds. By encouraging a collaborative and unified approach to wealth management, The Family Bank seeks to empower families to create lasting legacies.

Strengths

- Emphasizes creating systems for building wealth across generations.

- Practical guidance on setting up family trusts and investment vehicles.

Weakness

- More focused on families with significant wealth or income streams.

- Limited in addressing immediate, short-term financial challenges.

The Great Depression: A Diary by Benjamin Roth

“When prosperity returns, remember this time of hardship.”

Published in 2010, The Diary of a Great Depression by Benjamin Roth offers a detailed personal account of life in an industrial town in Ohio during the Great Depression. Written by Roth, a young lawyer navigating the aftermath of the 1929 stock market crash, the diary captures his real-time observations of the widespread economic challenges of that era.

This work is celebrated not only for its historical narrative but also for its insightful contributions to economics literature. Roth’s perspective resonates with contemporary readers, providing a unique glimpse into how ordinary individuals experienced and responded to a major financial crisis, making it a valuable resource for understanding the social and economic impacts of such events.

Strengths

- Provides a firsthand account of economic hardship and lessons learned during the Great Depression.

- Insightful for understanding economic cycles and the psychology of financial crises.

Weakness

- Primarily historical, with limited direct investment advice for modern markets.

- May not be practical for those looking for step-by-step financial guidance.

The Psychology of Money by Morgan Housel

“Wealth is what you don’t see.”

Published in 2020, The Psychology of Money by Morgan Housel has garnered worldwide attention, selling over four million copies. The book’s success stems from Housel’s skillful storytelling, which fundamentally shifts readers’ perspectives on wealth, greed, and contentment.

Rather than simply viewing money as a medium of exchange, Housel delves into its complexities, portraying it as one of humanity’s most deeply ingrained constructs. He raises thought-provoking questions about how we perceive and interact with money, encouraging readers to reflect on their financial decisions and the emotional factors that influence them. This approach makes the book a compelling read for anyone interested in understanding the deeper implications of personal finance.

Strengths

- Explores how emotions and biases influence financial decisions.

- Engaging storytelling, with practical advice on long-term wealth-building.

Weakness

- Some concepts may feel repetitive for readers familiar with behavioral finance.

- Limited focus on technical investment strategies.

The Simple Path to Wealth by JL Collins

“Spend less than you earn, invest the surplus, avoid debt.”

The Simple Path to Wealth is a widely regarded modern guide that originated as personal letters from JL Collins, a seasoned financial expert, to his daughter. In these letters, Collins shared straightforward methods that, although often overlooked, can lead to financial independence.

The practical steps he outlines empower individuals to take control of their financial future, enabling them to make informed choices about their lifestyles and careers. What began as a series of letters evolved into a popular blog and ultimately into a book that has sold over half a million copies. Its enduring impact continues to resonate with readers around the world, offering clear guidance on achieving financial security.

Strengths

- Offers straightforward advice on achieving financial independence using index funds.

- Written in an accessible and conversational style, ideal for beginners.

Weakness

- Focuses heavily on passive investing, which may not appeal to more active investors.

- Lacks deep insights into non-traditional investments like real estate or cryptocurrency.

The World’s Simplest Guide to the Stock Market by Edward W. Ryan

“In the stock market, simplicity is the ultimate sophistication.”

This book provides a clear and accessible introduction to the fundamentals of the stock market, making it ideal for newcomers to investing or anyone looking for a refresher. Author Edward W. Ryan simplifies crucial concepts by addressing key questions such as what defines a company, how businesses grow and secure funding, and the process for a company to go public.

The book explains what a stock is, the factors that influence stock price movements, and the experiences investors may encounter when holding shares. Drawing on his background as a personal investor and industry expert, Ryan makes these complex topics more understandable, offering readers valuable insights into stocks and the stock market.

Strengths

- Breaks down complex stock market concepts into easy-to-understand language.

- Aimed at beginners, with practical tips for starting investments.

Weakness

- Some advanced investors may find the content too simplistic.

- Limited coverage of more nuanced topics like derivatives or international markets.

Conclusion

The selection of financial education books highlighted here offers valuable insights for readers at any stage of their financial journey. Covering timeless strategies on stock market investing and practical advice on building generational wealth, these works provide guidance that is both relevant and accessible. Whether you want to understand market fluctuations, improve your personal financial management, or explore methods to secure your family’s financial future, these books serve as essential resources for navigating complex financial decisions with confidence.

Frequently Asked Questions

The books discussed cover a broad range of topics related to financial education, aiming to enhance readers’ understanding of stock market behaviour, provide guidance on managing personal finances, and share strategies for accumulating and preserving wealth over time. Each book offers practical knowledge to help individuals make informed financial decisions, whether they are beginning their financial journey or looking to improve their financial literacy.

Yes, many of the books are well-suited for those new to finance. For instance, A Random Walk Down Wall Street and The World’s Simplest Guide to the Stock Market are written in a clear and straightforward manner, making complex financial concepts easier to grasp. The article also highlights books that delve into more advanced topics, ideal for readers seeking to expand their understanding of financial strategies.

How to Think About Money by Jonathan Clements is highly recommended for those looking to improve their personal finance knowledge. It outlines five core principles that can help individuals make better financial decisions, achieve stability, and reduce stress related to money management. This practical guide aims to assist readers in leading a more financially secure life.

Yes, The Black Girl’s Guide to Financial Freedom by Paris Wood is specifically aimed at empowering Black women. It provides actionable steps to build wealth, avoid common financial traps such as debt, and pursue financial independence. The book includes real-life examples that highlight the unique financial challenges faced by Black women and offers tailored solutions.

Certainly. Books like The Family Bank and Rich Dad Poor Dad are particularly useful for those interested in long-term financial planning. They focus on strategies for building wealth that can be sustained across generations, providing insights into how to manage and grow wealth over time. These resources are ideal for those focused on financial planning with a long-term perspective.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.