If you need to consolidate credit card balances, manage unexpected medical expenses, or finance significant life events such as a wedding, a personal loan can provide a practical solution. Personal loans are available to individuals with a range of credit ratings. By taking the right steps, you can secure a loan that meets your financial needs and fits your budget.

Key Takeaways

- Credit Score Review: A perfect credit score is not necessary for personal loans, but higher scores typically result in better interest rates. Improving your credit before applying can enhance your chances of obtaining favourable terms.

- Understanding Loan Terms: In addition to interest rates, borrowers should consider repayment terms, fees (such as origination charges), and any loan restrictions when selecting a personal loan provider in South Africa.

- Prequalification and Lender Comparison: Prequalification allows you to compare rates without affecting your credit score. It’s advisable to check offers from multiple lenders to identify the best option for your financial needs.

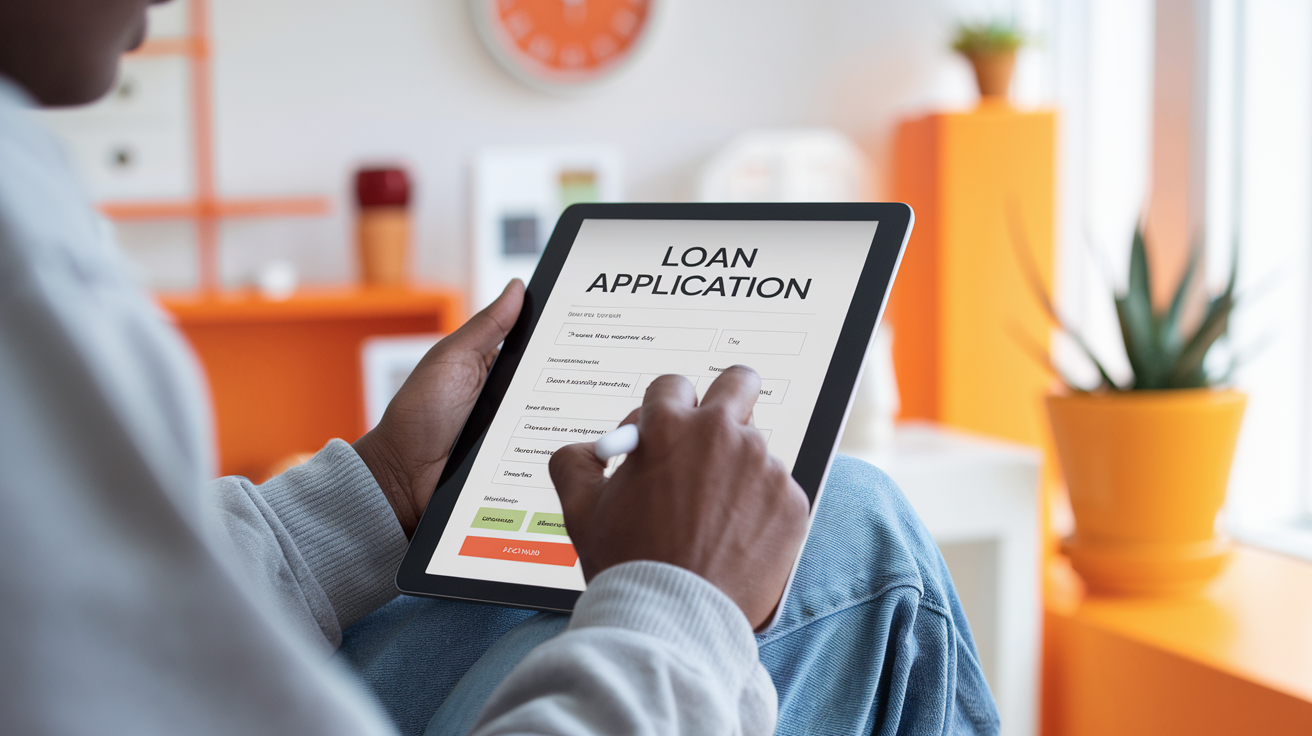

What is a Loan Application?

A loan application is a formal process through which an individual or business requests to borrow money from a financial institution, such as a bank, credit provider, or micro-lender. This process involves submitting personal and financial information to demonstrate eligibility and the ability to repay the loan. The lender uses this information to evaluate the applicant’s creditworthiness and determine whether to approve or deny the request. But how does it work?

Review Your Credit Score

A perfect credit score is not required to secure a personal loan. Some lenders are willing to work with individuals who have poor credit histories. However, the most competitive personal loan interest rates are typically reserved for those with good credit or higher.

If you’re looking to improve your credit before applying for a personal loan, consider the following steps:

- Reduce your credit card debt.

- Bring any overdue accounts up to date.

- Limit new credit applications unless absolutely necessary.

If you find any incorrect information on your credit report, you have the right to challenge it by contacting the relevant credit reporting agencies.

Once approved, borrowers must stick to a repayment schedule that typically involves monthly loan instalments. Understanding how these instalments are structured will help you anticipate your payments and avoid any missed deadlines, which could harm your credit score.

About Arcadia Finance

Get your loan without hassle through Arcadia Finance. No application fees, just access to 19 respected lenders, all certified by South Africa’s National Credit Regulator. Experience a fast, secure process tailored to suit your financial needs.

Determine the Exact Amount You Need to Borrow

It’s important to have a clear understanding of the total amount you need. This can help you avoid requesting too much or too little, which could impact your financial situation. Knowing the exact amount also allows you to filter out lenders who do not offer loan amounts that align with your needs, saving you time and effort.

Additionally, be aware that some lenders charge an origination fee, which is deducted from the loan amount you receive. As a result, you may need to request a slightly higher loan amount to account for these deductions.

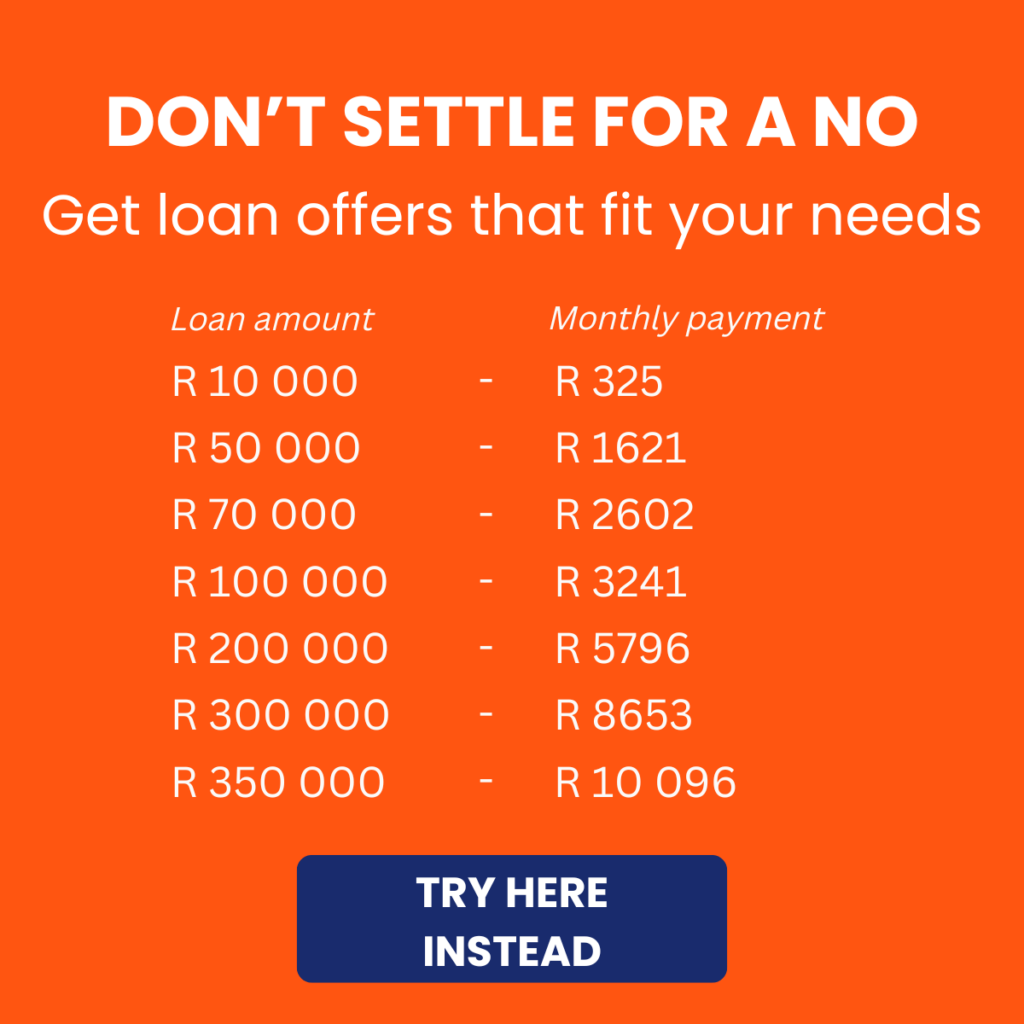

Estimate Your Monthly Repayments

Once you determine the loan amount, it’s advisable to review the interest rates offered by different lenders to get an idea of what you might qualify for based on your credit standing. Use these rates to estimate your monthly repayment amounts as well as the total interest you will pay over the loan period.

By calculating these figures, you can evaluate whether the monthly payments are affordable and gain insight into the overall cost of the loan.

If you’re looking for quick approval without heavy paperwork, it’s worth exploring the easiest personal loans to get in South Africa. These types of loans often come with less stringent credit requirements, making them a great choice if you need fast cash or have a lower credit score.

When Comparing Loan Terms

While the interest rate on a personal loan is a key consideration, it’s important to thoroughly evaluate other terms, such as:

Repayment Terms

Personal loan durations typically range from one to seven years. However, some lenders may offer more flexible options. Extending the repayment period can lower your monthly instalments, but it often results in a higher interest rate, increasing the overall cost of the loan due to additional interest charges.

Fees

Although personal loans usually do not include application fees or prepayment penalties, some lenders do charge origination fees. These fees can be as high as 12% of the total loan amount. Borrowers with strong credit should focus on lenders that do not impose origination fees to minimise upfront costs.

Loan Restrictions

Personal loans can generally be used for a wide range of purposes, although certain restrictions apply. For instance, many lenders do not permit personal loans for educational expenses or investment purchases. Additionally, some lenders specialise in specific uses, such as debt consolidation, so it’s crucial to ensure the loan aligns with your particular needs.

Funding Time

Once your loan is approved, most lenders disburse the funds within a few days. However, if you need funds more urgently, you may prefer lenders that offer next-day or even same-day funding options.

Discounts

Many lenders provide interest rate reductions when you set up automatic payments. Further discounts may be available if you already have an account with the institution. Some lenders include these discounts in the initial quote, so it’s worth verifying your eligibility to ensure you receive an accurate rate estimate.

Select a Lender and Submit Your Application

Once you’ve determined which lender offers the most suitable option for your needs, you can typically complete the application through their website. While the exact process may vary between lenders, you will generally be required to provide the following details:

- Full name

- Date of birth

- South African ID number

- Physical address

- Contact details

- Preferred loan amount and repayment term

- Purpose of the loan

- Employment status and income information

- Residential status and monthly housing payment

- Driver’s license or another valid form of government-issued identification

You may also need to submit proof of income, such as a recent payslip, tax returns, or bank statements. The lender will then conduct a thorough credit check, which will trigger a hard enquiry on your credit record. This enquiry will remain visible on your credit report for up to two years and may slightly lower your credit score for a period of up to a year. After submitting your application, you might receive an immediate decision, although some lenders may take longer to assess your financial situation and credit profile.

Apply With Several Lenders for Prequalification

While it may be convenient to submit a loan application to your current bank or credit union, especially if you already have a financial relationship with them, it’s worth considering that another lender may offer more favourable terms, potentially saving you more money.

Many reputable personal loan providers offer prequalification, which allows you to view and compare interest rates with only a soft credit check. This type of inquiry won’t affect your credit score. The process is usually quick, often completed in just a few minutes. Aim to get prequalified with at least three to five different lenders to ensure a good comparison of offers.

Evaluate the Offer and Confirm the Loan

When applying for a formal loan, a full credit assessment is generally required, which can impact your credit score. This thorough evaluation of your financial standing enables the lender to present a firm offer. The terms provided may differ from any earlier estimates you received.

After approval, carefully assess the offer along with the loan’s terms and conditions to ensure it aligns with your needs. If the conditions do not meet your expectations, you are free to apply with another lender. If the offer meets your satisfaction, sign the loan agreement, and the lender will release the loan funds.

Origination Fees and Administrative Costs in South Africa

When applying for a personal loan in South Africa, it’s important to consider origination fees and administrative charges, which can vary between lenders. Some charge a percentage of the loan amount, typically between 1% and 5%, while others may impose a fixed fee.

These fees are often deducted from the loan before disbursement, meaning you may receive less than the amount you applied for. To plan accordingly, request a detailed breakdown of all fees upfront. Comparing costs across lenders helps ensure you make a well-informed choice, and borrowers with good credit may find options with reduced or no origination fees.

Popular Personal Loan Providers in South Africa

South Africa has a range of reputable lenders offering personal loans, each with their own terms, interest rates, and loan amounts. Some of the most well-known personal loan providers in the country include:

| Bank | Interest Rates | Application Process | Repayment Terms | Additional Features |

|---|---|---|---|---|

| Capitec | Competitive rates | Simple | Flexible | Suitable for various financial needs |

| FNB | Fixed rates | Online available | Predictable payments | Cater to a wide range of needs |

| Nedbank | Personalised rates | Based on credit profile | Flexible options | Credit protection plans |

| Absa | Transparent terms | Online application available | Debt consolidation available | Streamline multiple debts |

| Standard Bank | Secured and unsecured options | Longer repayment periods for larger loans | Longer terms possible | Discounts for good payment history |

| African Bank | Competitive rates | Straightforward | Fixed monthly payments | Tailored to financial circumstances |

Red Flags to Look Out For

When applying for a loan in South Africa, it’s essential to be vigilant to avoid falling prey to fraudulent lenders or misleading practices. Here are some critical red flags to watch for:

Unlicensed Lenders

One of the biggest warning signs is dealing with a lender that is not registered with the National Credit Regulator (NCR). All legitimate lenders in South Africa must comply with the National Credit Act (NCA) and be licensed to operate legally. Unlicensed lenders often operate under the radar and may offer loans without proper checks, leading to unfair practices and exploitation. Always verify the lender’s credentials on the NCR’s official website before proceeding.

Upfront Payment Scams

No reputable lender will require upfront payments or “processing fees” before disbursing a loan. Scammers often request such payments, claiming it’s necessary to release the loan or cover administrative costs. Once the payment is made, the scammer disappears without providing any loan. Genuine lenders typically deduct fees, such as initiation fees, from the loan amount rather than requesting payment in advance.

Too-Good-to-Be-True Loan Offers

If a loan offer sounds unusually generous, such as promising low interest rates for high-risk borrowers or offering instant approval without credit checks, it’s likely a scam. Legitimate lenders carefully assess applicants’ financial profiles, including credit scores and income. If a lender guarantees approval or offers terms far below the market average, it could be a trap to lure unsuspecting borrowers into debt.

Non-transparent Terms and Conditions

Borrowers should be cautious of lenders that do not clearly outline the loan’s terms and conditions. Transparency is crucial, and a trustworthy lender will provide detailed information on interest rates, repayment schedules, and all fees involved. If the lender is vague about these terms or reluctant to provide a written contract, it’s a sign of potential misconduct. Hidden fees or misleading clauses in the loan agreement can lead to unexpected financial burdens.

Rights and Protections under South African Law

South African borrowers benefit from strong legal protections designed to ensure fair lending practices and prevent exploitation. Below is an overview of the key legal frameworks and support systems in place.

National Credit Act (NCA): aims to promote responsible lending and prevent consumers from falling into unsustainable debt. It requires lenders to conduct affordability assessments before granting loans and ensures that borrowers have access to all the necessary information about their credit agreements. The NCA also protects consumers by limiting unfair practices, such as hidden fees and misleading advertising.

Transparency is central to the NCA, as lenders must clearly communicate interest rates, repayment schedules, and any additional charges upfront. This helps borrowers make informed decisions and avoid debt traps.

Credit Ombud and National Credit Regulator (NCR): oversees the credit industry in South Africa, ensuring that lenders comply with the NCA. It regulates credit providers, monitors reckless lending, and handles complaints about unlicensed or unfair practices. Consumers can verify whether a lender is registered by checking the NCR’s database.

The Credit Ombud provides a free service to resolve disputes between borrowers and lenders, as well as issues related to incorrect listings on credit reports. Borrowers can escalate complaints to the Ombud if their issues with lenders remain unresolved, helping them avoid lengthy legal processes.

Conclusion

When applying for a personal loan in South Africa, it is essential to understand key factors such as your credit score, loan amount, repayment terms, and additional fees to make an informed decision. By carefully reviewing your financial situation and comparing offers from multiple lenders, you can secure a loan that meets both your needs and budget. Additionally, prequalification and awareness of the various terms lenders offer, including origination fees and repayment flexibility, will help you avoid unnecessary costs. Taking these steps ultimately ensures a smoother borrowing process and improves your financial outlook.

Frequently Asked Questions

When applying for a personal loan, you will generally need to provide personal identification, such as your South African ID, proof of income (e.g., recent payslips or bank statements), and details about your employment and residential status. Some lenders may also request additional financial information to assess your creditworthiness.

Yes, applying for a loan usually involves a hard credit inquiry, which can slightly lower your credit score. However, many lenders offer prequalification, which triggers only a soft inquiry and does not impact your credit score.

Origination fees are administrative fees charged by some lenders to process your loan. These fees can be a percentage of the loan amount or a fixed cost. Not all lenders charge origination fees, so it is important to compare loan offers to find one with minimal or no additional costs.

You can apply for prequalification with several lenders without affecting your credit score. However, submitting multiple formal loan applications will trigger several hard credit inquiries, which could negatively impact your credit score. It is better to compare prequalified offers before making a final application.

Loan approval times vary by lender. Some lenders may provide a decision within minutes or hours, while others may take a few days to assess your financial situation. Once approved, funds are typically disbursed within a few business days, although some lenders offer same-day or next-day funding options for urgent needs.