Securing a personal loan can be a valuable option for South Africans looking to cover urgent expenses or finance essential purchases. Whether it’s for home improvements, medical costs, or consolidating debt, understanding the approval process and knowing what lenders expect can significantly impact your application outcome. From checking your credit score to comparing lenders and gathering necessary documentation, each step plays a crucial role in improving your chances of approval and ensuring you receive favourable terms that suit your financial situation.

Key Takeaways

- Know Your Credit Score: Checking your credit score beforehand helps you understand your eligibility for favourable loan rates. Higher scores often qualify for better interest rates, while lower scores may lead to higher rates and restricted loan terms.

- Compare Lenders: Research multiple lenders to find the best rates and terms that align with your financial needs. Some banks or credit unions may offer benefits to long-standing customers, so it’s worth enquiring about possible discounts.

- Prepare Required Documentation: Collect essential documents such as proof of identity, income, and address. Having these ready can expedite the application process and reduce potential delays.

How to Obtain a Personal Loan in 9 Steps

Personal loans are a popular option for consumers seeking quick access to funds to address various financial needs. Whether covering unexpected medical expenses, urgent vehicle repairs, or funding essential home improvements, knowing the steps to secure approval can streamline the application process, helping it proceed smoothly and efficiently.

Know Your Credit Score

Begin by thoroughly reviewing your credit score before examining any financial details. In South Africa, personal loan annual percentage rates (APRs) can vary significantly, starting from just below 8% and reaching up to 35.99%, largely influenced by your credit score. Individuals with a score of 800 or above fall into the excellent credit category for personal loans, whereas those with a score of 580 or lower are typically considered to have poor credit.

Obtaining approval for a loan with poor credit can be challenging. Higher APRs result in increased monthly payments, and lenders may limit the loan amount or shorten the repayment period.

Conversely, a strong credit score increases the chances of securing a lower interest rate and a higher loan amount. Additionally, it enhances your likelihood of qualifying for extended repayment terms, possibly up to seven years, compared to the standard five-year term typically offered to borrowers with lower credit scores.

Calculate Carefully

Before applying for a loan, clearly determine the exact amount you need to borrow. This figure directly impacts the interest rate you may receive, your monthly repayment, and the overall origination fees charged by the lender.

Some personal loan providers may charge origination fees exceeding 10% of the borrowed amount. These fees are usually deducted from the loan disbursement itself, which can reduce the amount you receive. Adjusting the loan amount to cover these costs at the outset can help you avoid reapplying later to make up for any shortfall.

Once you’ve identified the loan amount, use a personal loan calculator to explore different repayment scenarios. Consider longer loan terms if you’re aiming for lower monthly payments or shorter terms if you want to clear the balance sooner.

Evaluate Lender Criteria and Collect Necessary Documentation

After determining the loan amount you wish to apply for, it is essential to understand the specific criteria that personal loan providers will use to assess your application. Each lender may have unique standards for approval and may request various documents to evaluate whether offering a loan is feasible.

One of the key concerns for loan approval is financial accessibility. Find out whether having a bank account is mandatory in our guide: Can You Get a Loan Without Bank Account?.

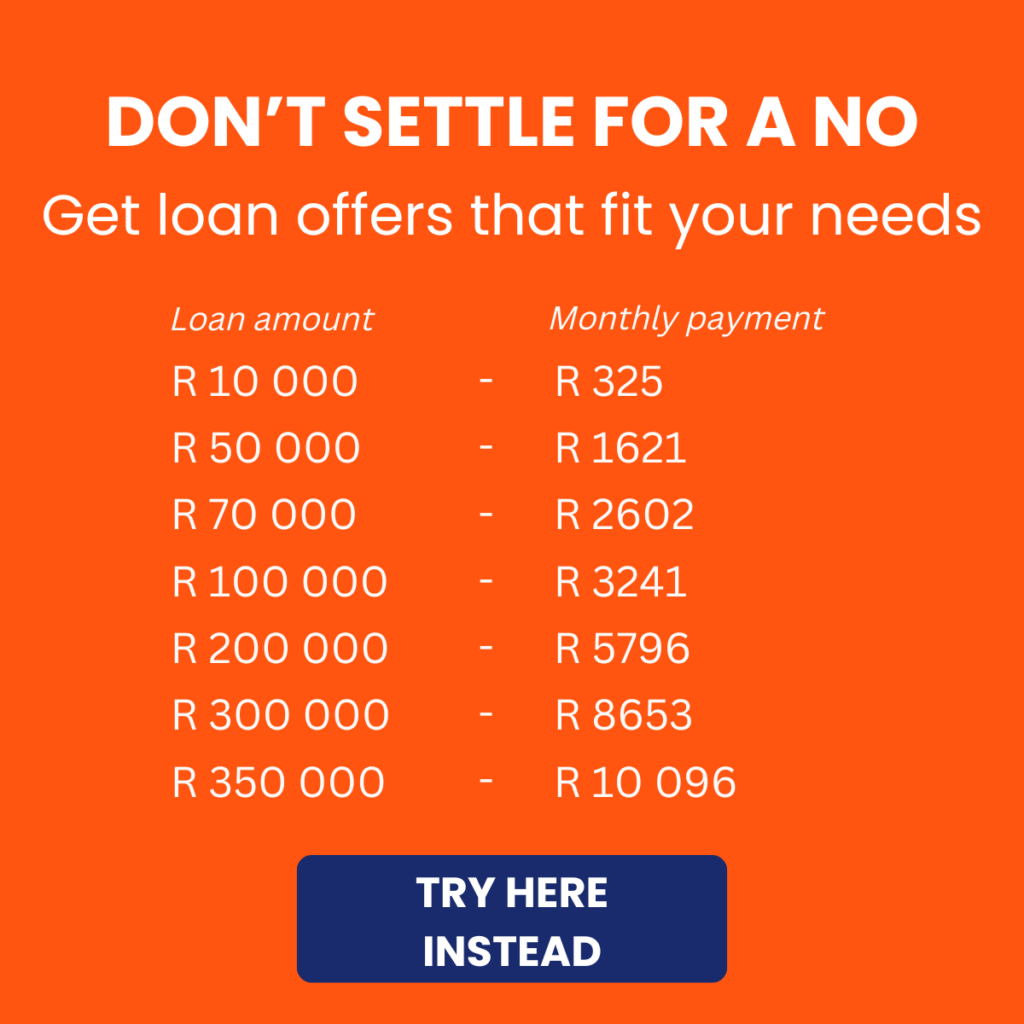

About Arcadia Finance

Simplify your loan process with Arcadia Finance. Enjoy a seamless experience with zero application fees and a network of 19 reputable lenders, all regulated by South Africa’s National Credit Regulator. Find tailored financial solutions designed just for you.

Examine Your Choices

A personal loan provides a valuable option for managing finances or obtaining quick cash for unforeseen expenses. Before exploring different types of personal loans, carefully consider how the funds can support your financial goals or improve your current financial situation.

Select Your Loan Type

Personal loans are available in various types, each designed to meet specific needs. While some lenders allow flexibility in how the loan funds are used, others restrict usage to particular purposes. It is important to check each lender’s conditions beforehand to ensure you can apply the funds as needed.

Additionally, the loan type you select can affect both your terms and interest rates. For example, loans intended for home improvements often feature longer repayment periods compared to emergency loans. Similarly, debt consolidation loans may offer more favourable starting APRs than general-purpose loans.

For the best financial outcome, consider each personal loan type available and align it with your goals.

- Debt Consolidation Loans: Often chosen for their potential to simplify finances, a debt consolidation loan allows you to combine multiple variable-rate debts, such as credit card balances, into a single loan with one payment. This approach can provide a single, possibly lower, interest rate.

- Credit Card Refinancing Loans: Some lenders focus on loans specifically aimed at those seeking to reduce credit card debt. Personal loan interest rates tend to be lower than credit card rates, offering the potential for significant savings in interest over the loan’s term.

- Home Improvement Loans: For those planning significant renovations, a home improvement loan can be a solid choice. It provides a way to finance a project without needing to secure it against home equity.

- Medical Loans: When large medical expenses arise, a personal loan can help manage these costs, spreading payments over several years for more manageable budgeting.

- Emergency Loans: These loans are tailored for urgent expenses, such as unexpected car repairs, minor medical bills, or home repairs like a burst pipe.

- Event Loans: Although not generally recommended as a primary choice, personal loans may also provide an alternative to credit cards for funding events like weddings or holidays, helping to avoid high credit card rates.

Timing plays a crucial role when applying for a loan. February presents unique advantages, such as potential lower interest rates and lenders eager to approve more applications. To maximize your chances of approval, it’s essential to understand the requirements and strategies outlined in Why February Is the Ideal Time to Take Out Your Loan.

Compare Lenders to Find the Most Suitable Personal Loan Rates

Take the time to review and compare multiple lenders and their offerings before applying, ensuring they clearly state personal and financial approval requirements that align with your situation. Evaluating different lenders and loan options will help you better understand what rates and terms you might be eligible for. Avoid committing to the first option presented to you, as exploring other offers may lead to more favourable terms.

If you have been a longstanding customer with your bank or credit union, it may be worthwhile to inquire whether they can offer a reduced rate or if they have any exclusive benefits or discounts available to you.

Choose a Lender and Begin the Application

Once you’ve selected the lender offering the most suitable terms for your financial needs, you can start the application process. Many lenders allow you to complete the application online, although some may require an in-person visit to your local bank or credit union branch. Typically, you’ll need to provide personal details, as well as income and employment information to support your application.

Most lenders also ask that you specify the purpose of your loan during the application. Be aware that the final terms of your loan may adjust based on the documents you submit. Request clarification from the lender if there are any changes to the interest rate or loan amount following your initial application.

Submit Required Documentation

Each lender may have unique requirements for documentation. After you submit your initial application, you might be asked for additional paperwork. Prepare any supporting documents alongside those you initially provided, allowing the lender to verify the information accurately. Providing all necessary documents promptly can help minimise any potential delays in processing.

Finalise the Loan and Begin Payments

Once the lender reviews and approves your application, you will complete the final loan documents by agreeing to the loan terms. After signing the loan agreement, funds are usually disbursed within a week, although some online lenders may provide the funds in as little as one or two business days.

Make sure to track your payment schedule and consider setting up automatic payments to simplify the process. Some lenders may offer interest rate discounts for autopay, providing modest savings on the loan.

Additionally, if possible, try to make extra payments each month, even if they’re small. While personal loans generally offer lower interest rates than credit cards, paying off your loan sooner can reduce your overall interest costs.

Personal loans can be a game-changer when used wisely. Compare the pros and cons of personal loans to make informed financial decisions.

Personal Loan Qualification Requirements

When assessing a personal loan application, lenders generally evaluate several key factors, including your credit score, income, and debt levels. In some cases, they may also consider your employment history or educational background.

Credit Score and Report

Most personal loan providers look for a credit score that meets a fair threshold, although options are available for individuals with poor credit. Beyond just the score, lenders typically check for significant issues in your credit history, such as past bankruptcies or legal judgments. Some lenders may broaden their review to include additional factors, like your education and work history, as part of the application assessment.

Debt-to-Income Ratio

Lenders also consider the balance between your monthly debt obligations and your monthly income, commonly referred to as the debt-to-income (DTI) ratio. A high DTI ratio can limit the loan amount for which you qualify, as it may signal financial strain and a higher risk to the lender.

Income

Your income level provides an indication of your repayment capability. Consistent and higher earnings generally make it easier for lenders to offer favourable loan terms. In some cases, having a co-signer can enhance your application, potentially increasing the approved loan amount.

Collateral

While personal loans are typically unsecured, some lenders offer secured loans that require collateral. This could include assets such as a car, valuable jewellery, or fine art, which provide security for the lender. While secured loans may come with slightly lower interest rates, they carry the risk of losing the asset if payments are missed.

Documents Required for a Personal Loan Application

During the loan approval process, you will need to submit various documents to confirm the information provided in your application. Although some lenders may verify details electronically, most will require the following:

- Proof of Identity: Common documents include a birth certificate, certificate of citizenship, driver’s licence, passport, or a state-issued ID to verify your identity.

- Income Verification: Lenders may ask for evidence of income, which could include pay stubs, bank statements, tax returns.

- Proof of Address: To confirm your residential address and previous places of residence, lenders may request documents such as utility bills, rental agreements, property tax statements, or credit card statements.

Providing accurate and thorough documentation can significantly improve your chances of loan approval and ensure a smoother application process.

Conclusion

Securing a personal loan necessitates careful preparation and an understanding of the factors that lenders consider. By starting with a review of your credit score, calculating the precise loan amount you need, comparing multiple lenders, and gathering essential documentation, you can enhance your chances of approval and potentially secure more favourable terms.

Frequently Asked Questions

Lenders typically look for a credit score of fair standing, generally around 580 or higher, to qualify for a personal loan. However, a higher score can enhance your chances of approval, provide access to lower interest rates, and offer better loan terms. Some lenders also provide options for applicants with lower scores, though these may come with higher APRs.

Yes, it is possible to obtain approval with a lower income, but lenders will likely assess your debt-to-income (DTI) ratio to ensure you can manage monthly payments. Some lenders may also allow a co-signer, which can improve your chances of approval and potentially result in a larger loan amount.

Many lenders charge origination fees, which can range from 1% to over 10% of the loan amount. This fee is often deducted from the loan disbursement. Additional fees may apply for late payments or if you select specific repayment terms, so it’s essential to review each lender’s terms.

Approval times can vary, but many lenders provide decisions within a few days, with funds typically disbursed shortly after approval. Some online lenders offer faster processing, allowing you to receive funds in as little as one to two business days.

Most personal loans offer flexibility in how you use the funds, allowing you to cover various expenses such as home repairs or medical costs. However, some loans are designated for specific purposes, such as debt consolidation or home improvement, so it’s best to confirm usage terms with the lender.