Personal loans have gained popularity as a financing choice for individuals needing to cover various expenses, from debt consolidation to large purchases. Unlike credit cards, personal loans generally offer fixed interest rates and set repayment terms, which can make them simpler to manage. However, they also come with certain drawbacks, such as fees, potential impacts on credit scores, and the risk of accumulating additional debt if not used responsibly. Before committing to a personal loan, it’s worth weighing both the advantages and potential risks.

Key Takeaways

- Personal loans often offer lower interest rates and fixed repayments: This can make them a practical choice for consolidating debt or covering emergency expenses, provided you meet eligibility requirements such as a good credit score and stable income.

- Personal loans may include high fees and rigid repayment terms: These drawbacks could make them less suitable for individuals with variable incomes or smaller borrowing needs.

- Alternative options include stokvels, microfinance loans, and savings accounts: These options may offer a more cost-effective and accessible solution, especially for smaller financial needs or community-based saving goals.

When to Evaluate Taking Out a Personal Loan

Before applying for a personal loan, it’s important to evaluate whether more affordable borrowing options might be available. Situations where a personal loan could be a suitable choice include:

- You’re unable to access or qualify for a low-interest credit card.

- Your current credit card limits don’t meet your borrowing needs.

- A personal loan presents the most cost-effective option compared to other available forms of credit.

- You don’t have assets to use as collateral.

Personal loans may also be useful for borrowing over a defined, relatively short period, typically with terms ranging from 12 to 60 months. For instance, if you’re expecting a lump-sum payment in two years but currently lack sufficient cash flow, a two-year personal loan could help bridge the gap until your funds arrive.

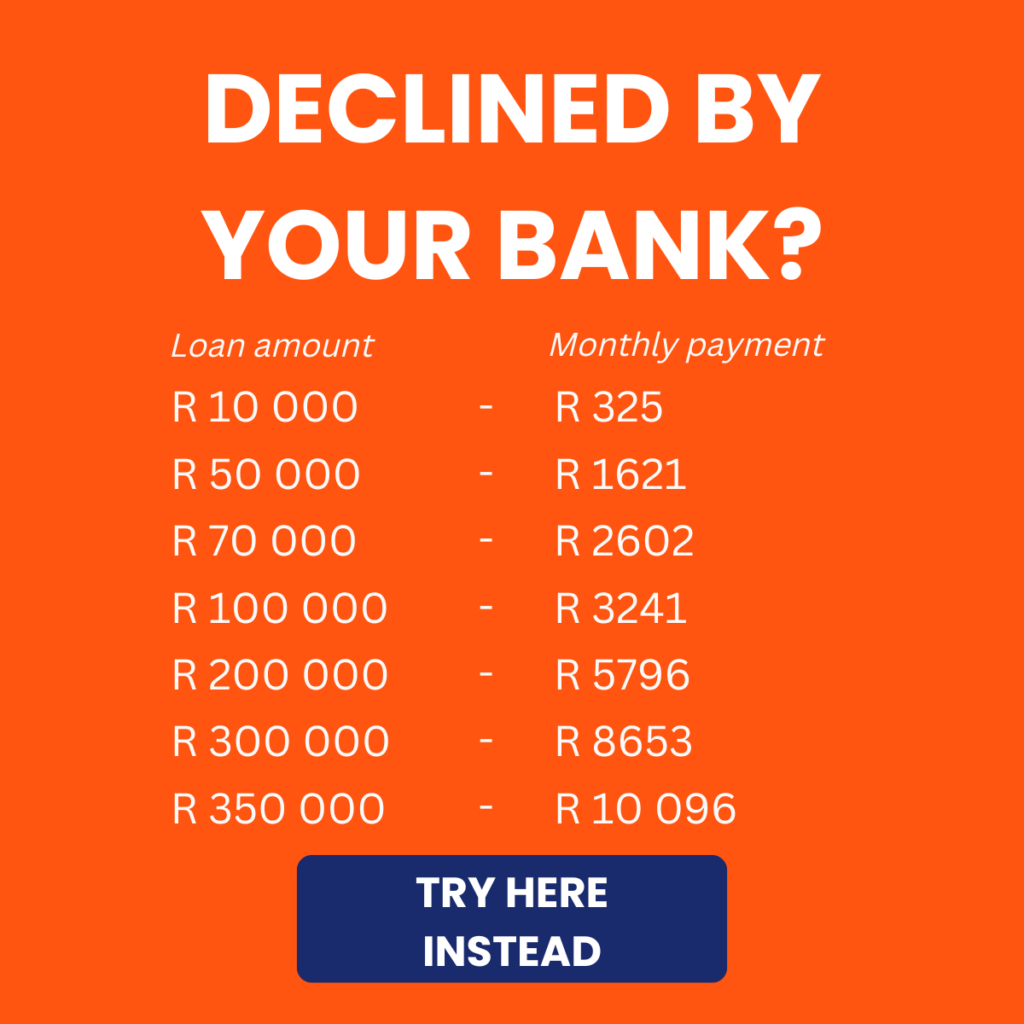

About Arcadia Finance

Arcadia Finance makes securing your loan simple and stress-free. With zero application fees and a selection of 19 reliable lenders adhering to South Africa’s National Credit Regulator guidelines, you get a seamless experience and customized financial solutions you can trust.

When Should a Personal Loan Be Avoided?

Personal loans can provide flexibility for various needs, but there are certain situations where their use is restricted or not advisable. Many lenders do not allow personal loans to be used for:

- Covering educational expenses, such as tuition, accommodation, or student loan repayments.

- Funding a deposit for property purchases.

- Paying for business expenses or start-up costs.

- Investing in stocks, shares, or other financial instruments.

- Financing gambling activities or covering gambling-related losses.

South African Personal Loan Providers

| Provider | Loan Amount | Repayment Terms | Key Features | Application Process |

|---|---|---|---|---|

| FNB | R1,000 to R300,000 | 1 to 60 months | Fixed interest rates, optional credit life insurance, quick approval for pre-qualified clients. | Online, via app, or in branch. |

| Nedbank | Up to R300,000 | Up to 72 months | Transparent fees, early settlement options, online tools for loan management. | Online or in branch. |

| Capitec Bank | Up to R250,000 | 1 to 84 months | Fixed monthly instalments, capped interest rates, same-day approval and disbursement. | Online or in branch. |

| Standard Bank | Up to R300,000 | 12 to 72 months | Competitive personalised rates, loan top-ups available, dedicated customer support. | Via banking app or in branch. |

| African Bank | R500 to R250,000 | Up to 72 months | Flexible repayment schedules, no early repayment penalties, simple online application process. | Online or in branch. |

| Direct Axis | Up to R200,000 | 24 to 72 months | Unsecured loans, tailored interest rates, debt consolidation options, transparent loan agreements. | Online application. |

Understanding the basic eligibility criteria can help you make an informed decision about personal loans. Learn more about what’s typically required in Typical Personal Loan Requirements.

Advantages of Personal Loans

Below are some key benefits of personal loans compared to other types of financing. These points can help you assess whether a personal loan aligns with your borrowing needs.

Single Payment Disbursement

Receiving the entire loan amount at once allows you to manage large expenses, like home renovations or significant life events such as weddings. With structured monthly repayments, your budget remains steady, as payments stay consistent over the loan term. This arrangement provides more predictability than credit card interest rates, which are often variable. Additionally, because personal loans aren’t revolving credit, you avoid accumulating continuous debt, unlike with credit cards.

No Collateral Requirement

Personal loans are unsecured, so you aren’t required to offer assets such as a car or property as security. If you’re unable to repay the loan, your credit score may be affected, but you won’t risk losing essential assets like your vehicle or home through repossession. Approval typically relies on proof of steady employment, consistent income, and a satisfactory credit score. Since no collateral assessment is needed, the process is often faster than with secured loans.

Quick Access to Funds

Many personal loan providers offer fast approval and fund disbursement, often within a single business day. This makes personal loans suitable for emergencies or situations needing immediate funding. In some cases, lenders can transfer the loan amount into your bank account on the same day you apply, provided you meet their criteria.

Lower Interest Rates

Personal loans generally offer lower interest rates than credit cards. As of November 2024, the average interest rate on personal loans is 12.38%, compared to 20.39% for credit cards. Individuals with strong credit scores may secure personal loan rates between 10.73% and 12.50% on average. Additionally, personal loans may allow a higher borrowing amount than your credit card limit.

Flexibility and Versatility

Personal loans can be used for a variety of purposes, such as home renovations, purchasing high-value items like boats, or consolidating multiple debts into a single, manageable payment. Unlike car loans, which are strictly for vehicle purchases, personal loans offer more versatility. Some lenders provide loan amounts up to R1 800 000, offering more borrowing potential than many credit cards.

Fixed Rate and Payment Schedule

Personal loans provide predictability, unlike credit cards. Borrowers know their monthly repayment amount, the interest rate, and the loan term from the outset. Fixed interest rates eliminate concerns about fluctuating payments that come with variable-rate credit cards. Loan terms can extend up to seven years, allowing for manageable instalments, and many lenders permit early repayment without penalties, providing extra flexibility. Keep in mind, however, that longer loan terms mean higher interest costs over time.

Potential to Improve Credit Scores

Using personal loans for debt consolidation is a common strategy, particularly for revolving debt like credit cards. Paying off credit cards can significantly improve your credit utilisation ratio, directly boosting your credit score. Replacing multiple variable-rate credit card payments with one fixed-rate loan also reduces the likelihood of missed payments, making financial management easier and potentially enhancing credit stability.

Not sure which loan type is best for you? Learn the key differences between secured and unsecured loans to make an informed decision.

Disadvantages of Personal Loans

A personal loan may not be the best fit for every financial need. Below are some potential drawbacks that could make it unsuitable for your situation:

Interest Rates Can Be Higher Than Home Equity Options

For homeowners, comparing personal loans with home equity loans or home equity lines of credit (HELOCs) is essential. Home equity options generally offer better interest rates for those with fair to good credit. By contrast, borrowers with poor credit could face rates exceeding 30%, often higher than many credit card rates.

Limited Access to Funds on an As-Needed Basis

If you don’t require the full loan amount right away, a personal line of credit or a HELOC may be more suitable. These options let you borrow only what you need and reuse the credit line, adding convenience and flexibility.

Lack of Payment Flexibility

With a personal loan, you’ll need to make fixed monthly payments, which can be a challenge if you have a fluctuating income, as with tip-based or freelance work. Credit cards, on the other hand, allow for payment flexibility, with minimum payment options based on usage.

Increased Debt Burden

Most personal loans cap repayment terms at five years, which can increase your debt-to-income (DTI) ratio, calculated by dividing total debt by pre-tax income. A higher DTI ratio may limit your ability to secure future credit. Additionally, consistently using personal loans to consolidate debt could indicate a dependency on borrowing, potentially leading to more debt accumulation if budgeting and spending issues aren’t addressed.

Fees and Penalties Can Be Substantial

Personal loan origination fees typically range from 1% to 12% of the loan amount, often deducted from the disbursed funds. Additionally, some lenders may impose prepayment penalties if you settle the balance before the end of the term. Always review these fees and penalties before applying.

Shorter Repayment Terms Compared to Other Options

Personal loans generally have terms of up to seven years, while options like home equity loans, HELOCs, or cash-out refinancing can extend up to 30 years, offering lower monthly payments. If you’re financing home renovations, a home equity loan could also provide tax benefits, as mortgage interest on renovations is often tax-deductible—an advantage not available with personal loans.

While a personal loan can help consolidate high-interest debt, it’s crucial to address underlying financial challenges, such as budgeting, saving, or impulse spending, to avoid worsening your financial situation.

Want to break free from the debt cycle quickly? Learn actionable strategies to fast-track your journey toward financial independence.

Alternatives to Personal Loans in South Africa

South Africans can consider several alternatives to personal loans, each with distinct advantages depending on financial needs:

Savings Accounts

A savings account allows you to prepare for future expenses without going into debt. Regular contributions can cover predictable costs, like school fees or home repairs, and build financial discipline. This option saves on interest payments, although it does require consistent saving over time and may not be ideal for emergencies that need immediate funding.

Microfinance Loans

Microfinance institutions offer small, short-term loans, often to those who may not qualify for traditional loans. These loans are useful for low-income earners or small business owners needing quick cash. Microfinance requirements are typically flexible, but interest rates can be high, so it’s crucial to ensure that the lender is registered with the National Credit Regulator (NCR) to protect against predatory practices.

Other Alternatives

Other borrowing options include:

- Credit Cards: Useful for short-term borrowing with interest-free periods, but interest rates can rise significantly after that period.

- Employer Loans: Some employers offer low-interest or interest-free loans as a benefit, providing a lower-cost option for emergencies.

- Family or Friends: Borrowing from family or friends can be an interest-free option, though it may strain relationships if repayment becomes challenging.

These alternatives each serve specific financial purposes. Weighing the costs and risks of each option can help you choose the most appropriate solution based on your financial situation.

Conclusion

South Africa offers a variety of personal loan options through both traditional banks and alternative lenders to meet different financial needs. Whether you need a loan for debt consolidation, covering unexpected expenses, or making planned purchases, it’s important to understand the terms, interest rates, and features provided by each lender. Comparing factors such as repayment terms, fees, and application processes helps you choose a loan that aligns with your financial goals and ability to repay. By evaluating these options carefully, South African borrowers can find solutions that meet their immediate needs while also supporting long-term financial stability.

Frequently Asked Questions

Personal loans offer several benefits, such as fixed interest rates, predictable monthly repayments, and the flexibility to use the funds for various purposes, like consolidating debt or covering emergency expenses. Additionally, they usually have lower interest rates than credit cards for borrowers with good credit.

Yes, personal loans can be an effective way to consolidate high-interest debt, such as credit card balances. By replacing multiple payments with a single fixed-rate loan, you could save on interest costs and simplify your financial management. However, this strategy is most beneficial if you avoid taking on new debt.

Personal loans can come with some disadvantages, including high fees from certain lenders, fixed monthly repayments that may not be ideal for those with fluctuating incomes, and limited flexibility to access additional funds once the loan is disbursed. Interest rates may also be higher for individuals with poor credit.

To qualify for a personal loan in South Africa, you typically need a steady income, a valid South African ID, and a good credit score. Most lenders will also require proof of residence and recent bank statements to assess your affordability. A strong credit profile improves your chances of securing favourable terms.

Alternatives to personal loans may be more suitable if you have irregular income, require ongoing access to funds, or want to avoid paying interest. Options like stokvels, microfinance loans, savings accounts, or credit cards might be better solutions for specific financial needs.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.