As the festive season unfolds and the New Year approaches, individuals are reminded to plan ahead for impending expenses. The arrival of January often brings increased household premiums and other bills that require careful financial management to avoid unnecessary stress.

Key Takeaways

- Plan and Prioritise: Begin with a thorough review of your budget to cover essential expenses before indulging in holiday spending. Include January’s predictable costs, such as school supplies, in your planning to avoid surprises.

- Shop Smart and Avoid Debt: Take advantage of online shopping, loyalty rewards, and sales to save money. Resist the temptation to borrow for festive spending by sticking to cash or requesting early wage access if necessary.

- Refresh Financial Goals: Use the new year as an opportunity to reassess and update your financial plans. A clear, physical budget can help you visualise your expenses and savings goals, ensuring a strong start to the year ahead.

For those who receive their December paycheque earlier than usual, the wait for the next payday in late January can feel especially lengthy. Planning and prudence during this time are vital to stretching funds and maintaining financial health.

With the challenges of rising household premiums, such as medical aid contributions, and inflation driving up the cost of everyday shopping, it becomes increasingly important to adopt mindful spending habits during the holidays.

To assist in navigating this period successfully, here are 10 tips for holiday budgeting to make your money last longer while avoiding debt traps.

10 Tips for Holiday Budgeting

1. Review and Update Your Budget

Take the time to thoroughly evaluate your income and expenses from the past few months to get a clear understanding of your financial situation. This helps you identify spending patterns and determine areas where you might save. Factor in all upcoming regular bills, loan or credit repayments, and any unavoidable obligations to ensure they are accounted for before allocating funds for festive expenditures. A well-prepared budget serves as a roadmap to avoid overspending and ensures financial stability.

2. Strategise Your Spending

Create a detailed list of your household’s essential purchases, such as groceries, utilities, or necessary gifts, and compare prices across different stores to find the best deals. Prioritise these must-haves over luxury items or non-essentials to ensure your money is spent wisely. Utilise price-comparison tools or apps that allow you to scan barcodes and instantly see where products are cheapest, ensuring you make informed and cost-effective choices. Strategic planning not only saves money but also prevents impulse buys.

The festive season is a time of joy, but overspending can lead to a dreaded case of ‘Januworry.’ Discover how to Protect Your Wallet This Festive Season: Avoid Costly Spending Mistakes, ensuring a financially stress-free start to the new year.

3. Leverage the Benefits of Online Shopping

Opt for online shopping to reduce the temptation of purchasing unnecessary items often encountered in physical stores. Shopping online allows you to focus on your pre-prepared list, saving time and money. Additionally, many online retailers offer free delivery services or exclusive discounts during the festive season, which can further enhance your savings. Look for reliable e-commerce platforms that provide return options, making online shopping both convenient and risk-free.

4. Avoid Last-Minute Shopping

Leaving holiday shopping to the eleventh hour can result in rushed decisions and inflated expenses, as last-minute purchases are often more expensive. Plan your shopping schedule early and take advantage of seasonal sales and promotions to secure items at lower prices. By stocking up on gifts and festive supplies ahead of time, you’ll avoid the stress and financial strain associated with last-minute shopping.

The key to a stress-free January starts with practical holiday planning. You can still create magical moments without stretching your budget by opting for simpler holidays to cope with rising costs.

5. Adopt Thoughtful Gift-Giving Practices

Discuss and establish gifting guidelines within your family to manage expectations and costs. Limiting gift exchanges to children or organising a Secret Santa arrangement, where each participant buys for one person, can significantly reduce the financial burden while still preserving the joy of giving. Additionally, consider homemade or personalised gifts, which often hold more sentimental value and cost less than store-bought alternatives.

6. Maximise Rewards and Loyalty Points

Sign up for and actively use loyalty programmes or rewards schemes offered by retailers to enjoy discounts and other perks. Accumulated points can be redeemed to offset the cost of festive purchases, making your budget go further. Be mindful of expiry dates for loyalty points and take advantage of them before they lapse. Strategically using these rewards ensures you make the most of your existing resources without additional spending.

7. Keep January Expenses in Mind

The post-holiday season often brings additional financial demands, such as school-related expenses, higher utility bills, or annual premiums. Plan for these costs in advance by allocating a portion of your holiday budget to cover them. Preparing for these predictable expenses ensures you start the year without financial strain, even after the festive celebrations.

Worried about post-holiday expenses draining your wallet? It’s not too late to turn things around. Check out these Practical Money-Saving Tips to Survive Januworry and regain control of your finances with actionable advice tailored to keep your budget on track.

8. Refresh Your Financial Plan

As the New Year approaches, use the opportunity to reassess your financial goals and create a more refined budget. A physical or digital budgeting tool can help you visualise income and expenses, making it easier to identify areas where savings can be achieved. Consider adopting the “50/30/20” rule, which allocates 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment. This structured approach promotes long-term financial health.

Make saving fun this holiday season! Join our savings challenge to turn end-of-year celebrations into an opportunity to boost your savings and enter January worry-free.

9. Capitalise on Sales and Promotions

Take advantage of holiday sales and discounts to purchase essential items at reduced prices. However, resist the temptation to overspend on unnecessary products by sticking firmly to your shopping list. Retail promotions can be a great way to save money, but only if approached with discipline and a clear plan. Remember to prioritise quality over quantity to avoid wasting money on items you don’t need or won’t use.

10. Think Long-Term

The festive season provides an excellent opportunity to adopt better financial habits that will benefit you throughout the year. Focus on setting realistic goals for savings, reducing debt, and developing mindful spending behaviours. By integrating these habits into your daily routine, you can build a solid financial foundation that extends beyond the holidays and supports long-term stability.

Conclusion

By carefully planning your spending, prioritising essential expenses, and avoiding unnecessary debt, you can enjoy the festive season without compromising your financial stability. Thoughtful approaches, such as leveraging sales, using loyalty rewards, and setting gift-giving boundaries, can help stretch your budget further. As January approaches, being mindful of upcoming costs and refreshing your financial goals will set the stage for a stress-free start to the new year, ensuring that the holiday cheer doesn’t turn into post-season financial strain.

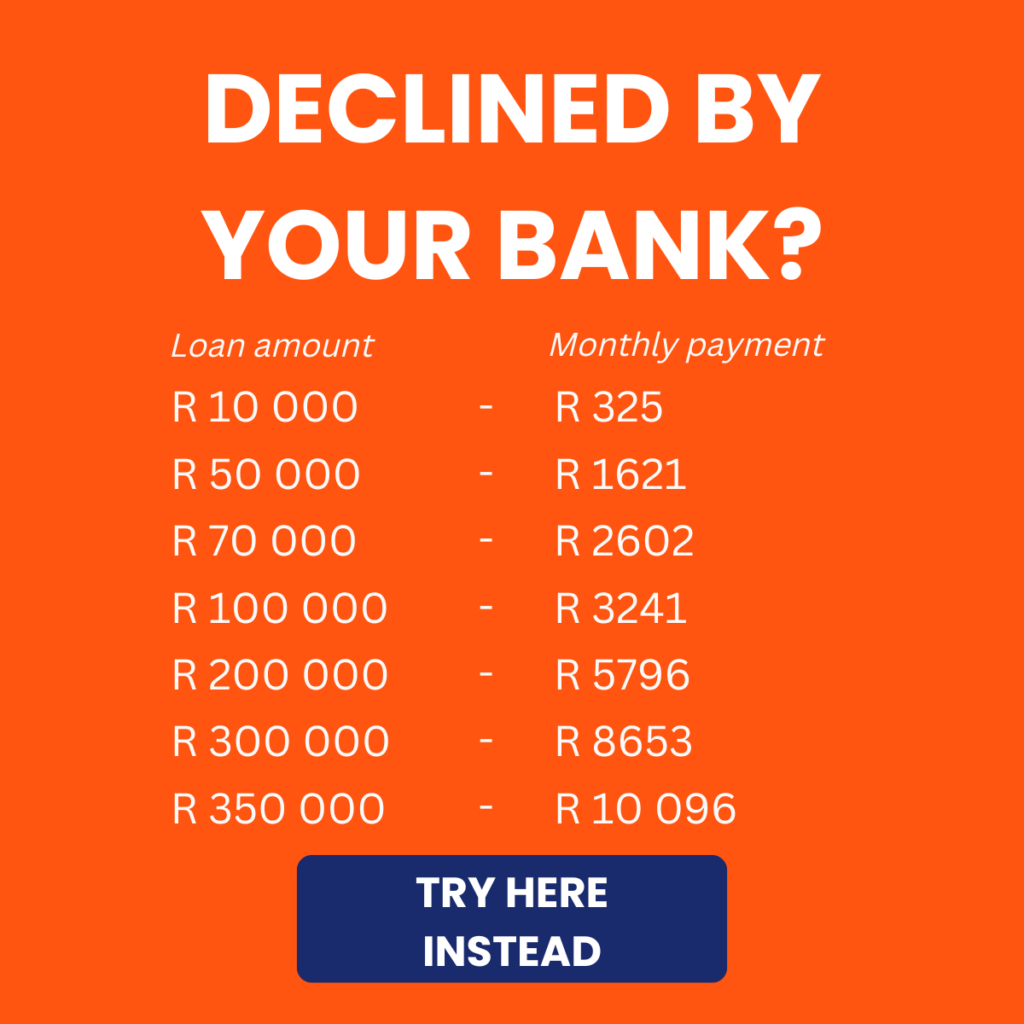

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.