The South African government has officially extended the deadline for recipients of South African Social Security Agency (SASSA) grants to transition from the older gold cards to the new Postbank black cards. The new deadline for completing the card swop process is now set for 31 May 2025. This extension allows additional time for both SASSA and the Department of Social Development to finalise the migration process for all remaining beneficiaries who have yet to collect and activate their new cards.

Key Takeaways

- Extended Deadline to 31 May 2025: SASSA beneficiaries now have until the end of May 2025 to swop their gold cards for the new Postbank black cards, giving more time for a smooth transition.

- Postbank Nears Full Compliance: Postbank has fulfilled eight out of nine South African Reserve Bank requirements, with the final step being the physical rollout of the new cards.

- Improved Features and Accessibility: The new black cards offer stronger security, free basic services, and can be collected at major retail outlets, supported by a USSD tool to find collection points.

About Arcadia Finance

Easily secure a loan with Arcadia Finance, no application fees, a streamlined process, and access to 19 trusted lenders, all NCR-compliant in South Africa.

Briefing Following Cabinet Meeting

This update was shared by the Minister in the Presidency during a media briefing held in Pretoria. The briefing followed a Cabinet meeting that took place the previous day, where the status of the Postbank card migration was discussed. The Minister confirmed that Cabinet had been briefed on the progress made in moving grant recipients over to the new, more secure black Postbank cards. Government sources indicated that the card swop campaign is one of the largest financial logistics operations currently underway in the country, involving coordination between Postbank, SASSA, retail partners, and provincial departments.

Progress on Compliance and Card Roll-Out

Postbank has already satisfied eight out of the nine regulatory conditions set by the South African Reserve Bank (SARB) to facilitate the payment of social grants. The only remaining requirement is the full physical distribution of the new black cards to eligible grant recipients. This task is currently underway and is expected to be completed within the extended deadline. The Reserve Bank’s compliance standards are in place to ensure that only properly vetted financial platforms are used to manage the state’s multi-billion-rand social grants system. As such, the physical roll-out of the new cards is a final but essential step in ensuring beneficiaries are transitioned into a safer, more regulated environment.

Switching from a gold card to a black card is just one part of the transition. You might also need to update your grant payout method. Learn exactly how to change your SASSA pension payment method in 2025, so you don’t miss your money.

Previous Deadlines and Current Status

Initially, the deadline for the migration to Postbank black cards was set for 28 February 2025. However, this was later extended to 20 March 2025 before the most recent extension was announced, pushing the final cut-off to the end of May 2025. The extension ensures that beneficiaries who may have faced delays or logistical challenges will still have the opportunity to swop their old cards without disruptions to their grant payments. Delays were reportedly caused by a combination of high foot traffic at retail outlets, challenges with identity documentation, and limited awareness among rural communities. The government has now ramped up its public communication efforts to avoid a repeat of past confusion.

Where and How to Get the New Postbank Black Card

SASSA beneficiaries can collect their new black cards at selected national retailers, including Checkers, Shoprite, Pick n Pay, Usave, and Boxer. When visiting these outlets to collect the card, individuals must bring along a valid South African ID book, smart ID card, or temporary ID document as proof of identity. These retail partnerships have been crucial in expanding access points nationwide, particularly in remote and underserved areas where SASSA offices or Postbank branches are limited.

Postbank’s Mobile Access Tool for Card Collection Points

To make the process even more convenient, Postbank has launched a mobile service that helps grant beneficiaries locate the nearest card collection points within their respective provinces. Beneficiaries can use their mobile phones to access this service by following these steps:

- Dial *120*355# from a mobile device

- When prompted, press 1 to continue

- Then reply with the number that corresponds to the province of residence

This tool ensures easier access to information on collection locations across South Africa. Postbank’s mobile lookup tool is part of a broader effort to digitise and modernise service delivery, particularly for grant recipients who may not have internet access or smartphones but still need up-to-date information via basic mobile phones.

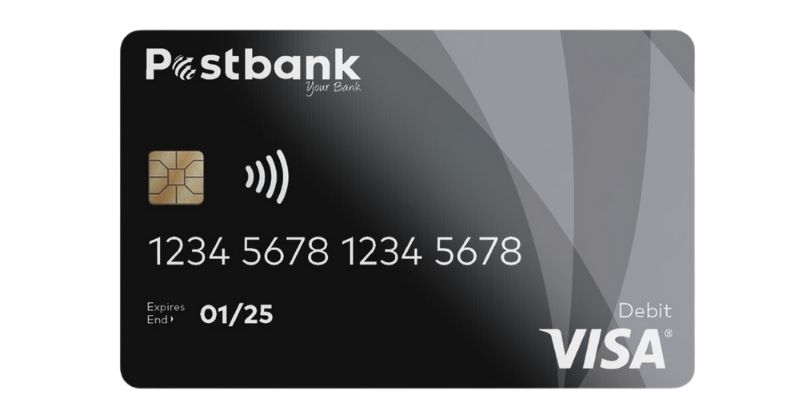

Benefits of the New Postbank Black Cards

The upgraded Postbank black cards come with several enhanced features designed to improve both functionality and security for beneficiaries. These include:

- Advanced security features to reduce the risk of fraud

- One free card replacement per year

- Three free in-store withdrawals each month

- One free over-the-counter monthly statement

These features are aimed at offering beneficiaries greater value, ease of access to their funds, and improved protection of their financial information. Postbank has also emphasised that the black cards are EMV chip-enabled and include enhanced encryption protocols that provide stronger protection against cloning, skimming, and other forms of financial fraud. This is particularly vital in areas where card-related scams have previously targeted grant recipients.

Not sure how to use your new black card to access funds? Here’s everything you need to know about how to receive your grant using the new SASSA payment methods, including cardless withdrawals and updated bank options.

Conclusion

The extension of the swop deadline to May 2025 reflects government’s recognition of the operational challenges involved in a national card replacement effort impacting millions of vulnerable citizens. With enhanced security features and expanded access through retail and mobile support, the Postbank black card initiative aims to provide SASSA beneficiaries with a safer and more reliable way to access their grants. The focus now shifts to completing the distribution efficiently, ensuring no one is left behind during the transition.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.