The quarterly Consumer Pulse Study conducted by TransUnion examines the evolving financial habits, perceptions, and behaviours of South African consumers. It sheds light on how individuals are managing their household budgets, addressing debts, and preparing for future financial challenges. This research delves into various aspects of consumer life, including income dynamics, credit access, and digital security, providing valuable insights that empower consumers while assisting businesses in crafting informed strategies to foster economic growth.

Key Takeaways

- Increased Vigilance Against Digital Fraud: Digital fraud affected 13% of consumers in Q4 2024, with scams like phishing and smishing on the rise. Over half took proactive steps like changing passwords and enabling multi-factor authentication. However, 60% took no action due to lack of guidance, leaving some vulnerable.

- Rising Optimism and Financial Resilience: South African households showed growing optimism in Q4 2024. Only 20% reported a decline in income, while 79% expected future income increases, especially among Gen Z and Millennials. Financial optimism for the next 12 months rose to 76%, with 65% managing to pay bills in full. Inflation eased slightly, and many focused on faster debt repayment and increased savings.

- Slight Dip in Financial Inclusion: Access to credit remains essential for financial goals, but only 38% felt they had sufficient access, particularly Gen Z. Credit demand rose slightly, with 37% planning to seek credit for options like credit cards, personal loans, and ‘buy now, pay later’ services. However, 54% didn’t proceed with applications due to high costs or alternative funding.

Financial Health

Household Income

South African households, having faced significant economic challenges over recent years, appeared to be on a path to recovery, with signs of improvement emerging. In the fourth quarter of 2024, only 20% of households reported a decline in income over the previous three months, a slight improvement from the third quarter, while 38% saw an increase, particularly among younger generations such as Generation Z and Millennials. Easing inflation, which reached a 16-month low of 4.4% in August, and the first interest rate cut in four years in September provided relief to household budgets, with another reduction expected by November. These developments improved financial outlooks, as 79% of respondents anticipated an increase in income over the next year, particularly among younger consumers, where optimism peaked at 86% for Generation Z and 85% for Millennials. Additionally, 76% of households expressed confidence in their finances for the coming year, a notable improvement compared to 2023.

A monthly budget template simplifies the process of managing household finances. Use it to allocate your income effectively, track expenses, and maintain a healthy financial balance.

Spending and Bill Payments

Financial habits showed some improvement in the fourth quarter of 2024, as 65% of consumers reported paying their bills in full, with younger generations such as Generation Z and Millennials leading the way at 68% and 66%, respectively. However, cautious spending patterns persisted, with 52% of respondents, led by Generation X and Baby Boomers, cutting discretionary expenses, 30% cancelling subscriptions, and 26% reducing spending on digital services. Debt repayment remained a priority for 33% of consumers, while 28% increased contributions to emergency funds and 24% allocated more towards retirement savings, with younger generations spearheading these efforts. Looking forward, households planned further adjustments, with 46% intending to reduce discretionary spending, 42% planning to boost retirement savings, and 41% avoiding large purchases, reflecting a strategic approach to managing finances amidst a gradually improving economic environment.

To bridge the gap between Q4 performance and projections for 2025, the government’s fiscal plan is a must-read. The South Africa’s 2025 Budget brings strategic clarity to how South Africa aims to rebound and grow in a tough global climate.

Expanding Financial Access

Consumer Perspectives on Credit

Access to credit remained vital for financial goals, with 93% of consumers viewing it as essential, though only 38% felt they had sufficient access, down slightly from the previous quarter. Younger generations, particularly Generation Z, expressed the greatest concerns, with only 35% feeling adequately served. Credit demand grew modestly, with 37% of consumers planning to seek new credit within the next year, led by Millennials (45%) and Generation Z (41%), driven by needs for education, housing, and lifestyle expenses.

Despite this demand, 54% of potential applicants did not proceed with their credit applications. High borrowing costs, cited by 31%, remained the main deterrent, even after a recent interest rate cut. Others chose alternative funding sources or found credit unnecessary. Preferences for credit products included credit cards (32%), personal loans (27%), and buy now, pay later services (25%), reflecting diverse financing needs across age groups.

Strengthening Financial Awareness

Monitoring Credit Health

The vast majority of consumers (94%) recognised the importance of regularly reviewing their credit reports, with 57% checking them at least monthly to maintain credit health. Younger generations showed the highest engagement, with 63% of Generation Z and 69% of Millennials actively monitoring their reports. However, older generations, such as Generation X (39%) and Baby Boomers (30%), demonstrated lower involvement, highlighting a need for targeted financial education to encourage greater participation.

A growing number of consumers (55%, up five percentage points from Q3 2024) believed that incorporating alternative data into credit reports could enhance their scores. This view was especially prevalent among Generation Z (62%), who often have limited credit histories and could benefit most from broader credit evaluations.

Only 30% of consumers reported conducting the majority of their transactions online, with younger generations, including Generation Z and Millennials, leading the way. Their higher adoption rates likely stem from the convenience of digital payments, greater digital literacy, and a preference for online shopping. In contrast, older generations displayed much lower engagement, suggesting opportunities to promote the benefits of digital financial tools across all age groups.

Protect your finances by building an emergency fund. This safety net is essential for managing unforeseen costs, helping households avoid falling into debt during crises.

Safeguarding Digital Identity

Exposure to Fraud and Identity Risks

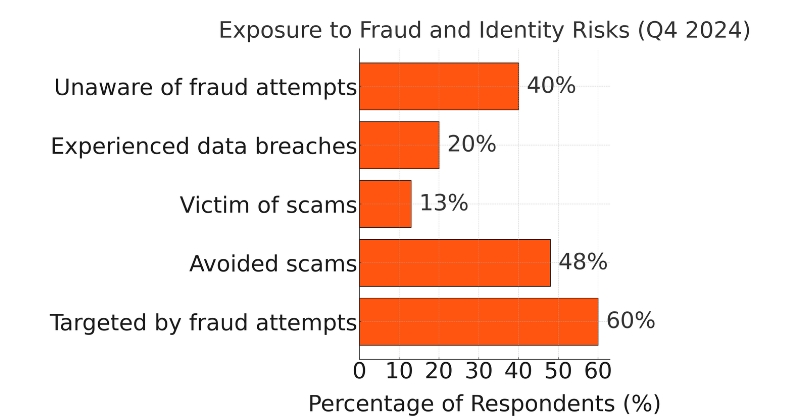

Digital fraud remained a significant concern, with 60% of consumers reporting attempts to target them through online platforms, emails, phone calls, or text messages in the past three months. While the proportion of those targeted but avoiding victimisation fell slightly to 48% in Q4 2024, Generation Z led with a 52% success rate in evading scams. However, the percentage of victims increased to 13%, with Baby Boomers (19%) and Generation X (16%) showing greater vulnerability. Additionally, 20% of respondents experienced identity or account information breaches, while 40% remained unaware of fraud attempts, underscoring the need for better education on recognising and responding to threats.

Common Fraud Types

Money and gift card scams were the most prevalent, affecting 34% of respondents, followed closely by smishing (33%) and phishing (33%). Smishing particularly impacted Generation X (39%), while phishing was most common among Baby Boomers and Generation X (38%). These trends highlight the diverse tactics fraudsters employ and the varying susceptibility of age groups.

Cybersecurity Awareness and Actions

The majority of consumers (88%) expressed concerns about sharing personal information, primarily due to fears of identity theft. Following data breach notifications, 52% updated passwords for compromised accounts, and 41% checked for unauthorised activity. Over the past two months, 63% of respondents changed passwords, 42% reviewed credit reports, and 26% implemented multi-factor or passwordless authentication, reflecting growing vigilance.

Despite these efforts, some consumers lagged in taking protective steps, with 60% unsure how to act and 20% feeling overwhelmed by cybersecurity information. Organisations must address this gap by offering clear, actionable guidance and simplifying cybersecurity concepts through targeted campaigns, empowering consumers to safeguard their digital identities effectively.

Conclusion

In Q4 2024, South African households demonstrated resilience and adaptability amid evolving economic conditions, as highlighted in TransUnion’s Consumer Pulse Study. While financial optimism grew, driven by easing inflation, rising incomes, and a focus on debt repayment, challenges such as limited access to credit and digital fraud persisted. Younger generations, particularly Millennials and Gen Z, showed a proactive approach to managing finances and digital security, leading efforts in savings, credit monitoring, and scam prevention. However, the study also revealed disparities in financial inclusion, cybersecurity awareness, and credit access across age groups, emphasizing the need for targeted education and systemic improvements. By addressing these gaps and supporting informed decision-making, stakeholders can further enhance household financial health and resilience.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.