Old Mutual Loans

- Multiple loan offers

- Get approved today

- Free application – no commitment

Compare top lenders

Together with our partners, we provide access to up to 19 reputable banks and lenders. Explore offers tailored to your needs and choose the most suitable offer. Each lender abides by the regulations outlined by the South African National Credit Regulator (NCR).

What Are Old Mutual Loans?

Old Mutual Loans are financial products offered by Old Mutual, a trusted and established financial services provider with a long-standing history of supporting individuals and businesses. These loans are designed to provide flexible and accessible funding solutions, allowing customers to meet their immediate and long-term financial needs. Whether it’s funding for a personal project, buying a car, or growing a business, Old Mutual Loans aim to offer tailored options that cater to various lifestyles and financial situations.

Why Choose Old Mutual for Your Financial Needs?

Old Mutual stands out as a preferred choice for financial solutions due to its reputation for reliability, transparency, and customer-focused services. With decades of experience in the financial sector, Old Mutual provides not just loans but a relationship built on trust. Customers benefit from competitive interest rates, flexible repayment terms, and a seamless application process, both online and in-branch. Moreover, Old Mutual’s commitment to financial education and empowerment ensures that borrowers are equipped to make informed decisions about their financial futures.

Types of Loans Offered

Personal Loans

Old Mutual’s personal loans are designed to provide financial support for a variety of individual needs. Whether you’re covering unexpected expenses, consolidating debt, or planning a significant purchase, these loans offer flexible amounts and repayment terms tailored to suit your budget. With competitive interest rates and a straightforward application process, personal loans make it easier to manage life’s financial challenges.

Business Loans

For entrepreneurs and business owners, Old Mutual offers business loans to help fund growth opportunities, manage cash flow, or cover operational costs. These loans are specifically tailored for small to medium enterprises (SMEs) and come with competitive rates and repayment structures that align with your business’s financial cycle. Whether you need to purchase equipment or expand your operations, Old Mutual’s business loans are a reliable choice.

Home Loans

Achieving the dream of owning a home is made more accessible with Old Mutual’s home loans. These loans provide the financial support needed to purchase a new property or refinance an existing one. With flexible repayment options and personalised advice, Old Mutual ensures you can confidently take steps toward securing your ideal living space.

Vehicle Finance

Old Mutual’s vehicle finance options help customers purchase their dream cars, whether new or pre-owned. These loans are structured with manageable repayment terms, making it simple to get on the road without straining your finances. With a focus on transparency and affordability, vehicle finance ensures you drive away with peace of mind.

Education Loans

Investing in education has never been easier with Old Mutual’s education loans. These loans are designed to cover tuition fees, textbooks, and other educational expenses for students or parents. By offering affordable repayment plans, Old Mutual supports learners in pursuing their academic goals without unnecessary financial stress.

Who Can Apply for an Old Mutual Loan?

To qualify for an Old Mutual loan, applicants must meet specific eligibility criteria, provide necessary documentation, and undergo assessments of creditworthiness and affordability.

Applicants must:

- Be South African citizens.

- Be between 18 and 60 years old.

- Earn a minimum monthly income of R2 500 before deductions.

- Have been permanently employed with the same employer for at least three months.

You will receive your loan offers immediately after filling up the loan application. Check what kind of loan offers you will get!

Required Documents

Applicants need to submit:

- A valid South African identity document.

- A current payslip not older than one month.

- Bank statements for the last three months, showing consecutive salary deposits, dated within the past seven days.

Creditworthiness and Affordability Assessment

Old Mutual conducts thorough evaluations to ensure applicants can manage loan repayments:

- Credit Check: Reviewing credit history to assess repayment reliability.

- Affordability Assessment: Ensuring the loan amount aligns with the applicant’s financial capacity, in accordance with the Micro-lenders Act 7 of 2018.

How to Apply for an Old Mutual Loan

Online Application Steps

- Visit the Old Mutual Personal Loans Page: Navigate to the Old Mutual Personal Loans section.

- Initiate the Application: Click on the “Apply Now” button to access the online form.

- Complete the Form: Provide accurate personal, employment, and financial details as required.

- Upload Necessary Documents: Attach digital copies of your South African ID, recent payslip, and bank statements.

- Submit the Application: After reviewing your information, submit the form for processing.

In-Branch Assistance

- Locate a Branch: Find your nearest Old Mutual branch using their branch locator.

- Prepare Documentation: Bring along your South African ID, a recent payslip, and the last three months’ bank statements.

- Consult with a Representative: A financial consultant will assist you in completing the application and answer any queries.

This approach allows for face-to-face interaction, ensuring clarity and personalised assistance throughout the process.

Compare Loans in 3 Easy Steps

Fill in our application

Complete our loan application in minutes. Just enter your details and choose your desired loan amount.

Choose a loan offer

Based on your responses, you will receive a variety of personalised offers from up to 19 lenders.

Get your money

You are free to accept or decline the offers as you please. The offers are non-binding.

Loan Amounts Available with Old Mutual

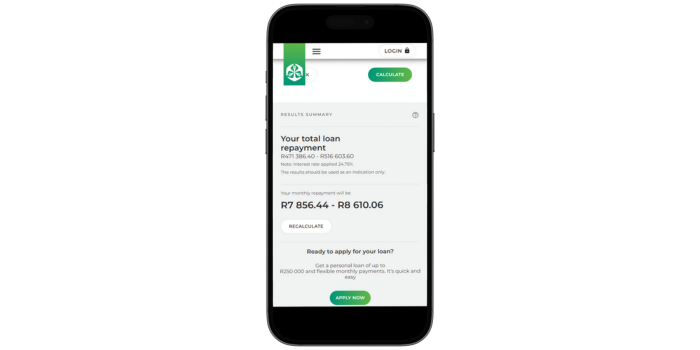

Old Mutual offers personal loans ranging from a minimum of R2 000 to a maximum of R250 000, with repayment terms between 3 and 72 months. The specific loan amount you may qualify for depends on factors such as your income, creditworthiness, and individual financial circumstances. To determine your eligibility and the exact amount you can borrow, you can contact Old Mutual directly or use their online loan calculator for a personalised assessment.

Loan Repayment

| Aspect | Details |

|---|---|

| Repayment Methods | – Debit Orders: Automatic deductions from your bank account. |

| – In-Branch Payments: Pay using a debit card at Old Mutual branches. | |

| Loan Terms | – Repayment Periods: Flexible terms from 3 to 72 months. |

| – Fixed Interest Rates: Interest remains constant throughout the loan term. | |

| – Credit Life Insurance: Required for loans with terms of 12 months or more to cover outstanding balances in case of death, disability, or retrenchment. | |

| Missed Payments | – Proactive Communication: Contact Old Mutual before the payment due date to explore solutions. |

| – Arrears Arrangements: Assistance is available through Old Mutual’s Service Centre. | |

| – Consequences of Default: Missed payments can damage your credit score and lead to legal action. |

Why Use Arcadia Finance?

- 100% free: The application is free and does not include any hidden fees.

- Quick & easy: The whole application process is done online in minutes.

- Convenient: Compare up to 16 banks & lenders with one application.

- Non-binding: You decide if you want to accept or decline your offers.

- Safe: Your personal data is safe with us.

What is Arcadia Finance?

Arcadia Finance helps South Africans in the search for loans from different banks and lenders through our loan broker partners. We provide access to up to 19 reputable banks and lenders. By completing our loan application you will get multiple loan offers, which you can compare and select the most suitable offer. The service we offer is completely free of charge and you will not commit to anything by requesting for loan offers via Arcadia Finance. We only work with trusted loan brokers who collaborate with NCR licensed banks and lenders in South Africa.

Pros and Cons

When considering an Old Mutual personal loan, it’s important to weigh the advantages and potential drawbacks to determine if it aligns with your financial needs.

Pros

- Flexible Loan Amounts and Terms: Borrow between R2 000 and R250 000, with repayment periods ranging from 3 to 72 months, accommodating both short-term and long-term financial requirements.

- Competitive Interest Rates: Offers rates that are competitive within the market, especially for applicants with strong credit profiles.

- Transparent Fee Structure: Provides clear information on fees and interest, allowing borrowers to understand the total cost of their loan upfront.

- Multiple Application Channels: Apply online, over the phone, or in person at a branch, offering convenience and accessibility.

- Early Repayment Options: Allows borrowers to repay their loans early without incurring penalties, potentially saving on interest costs.

Cons

- Monthly Service Fees: A monthly service fee of R69 is applied, which can accumulate over time, increasing the overall cost of the loan.

- Credit Check Requirement: Conducts credit checks as part of the application process, which could affect your credit score if not managed properly.

Contacting Old Mutual for Loan Queries

For loan-related questions, Old Mutual offers multiple contact options:

Phone number:

Office: 0860 50 60 70

Whatsapp: 0860 933 333

Hours of operation:

Monday to Friday: 8:00 AM – 5:00 PM

Postal address:

PO Box 31 Mutual Park, Pinelands 7451 Cape Town, South Africa

Secure your loan effortlessly with Arcadia Finance

The loan application is free, and you can pick from a variety of 19 respected lenders. We only work with trusted loan brokers who collaborate with NCR licensed banks and lenders in South Africa.

After submitting your loan application to us, we will send it through our loan broker partners to a number of different banks and lenders for review. Within minutes, you’ll receive a variety of loan options that are available for you. Select the one that best fits your needs.

Remember, all offers are no-binding, so if you don’t find what you’re looking for, you’re free to decline.

Conclusion

Old Mutual Loans provide a versatile and reliable financial solution for individuals and businesses seeking support to achieve their goals. With flexible loan options, competitive interest rates, and accessible customer support, Old Mutual ensures borrowers have the tools and guidance needed for responsible borrowing. Whether funding personal aspirations, expanding a business, or managing unexpected expenses, their tailored offerings cater to diverse financial needs. By choosing Old Mutual, you’re not just accessing a loan but partnering with a trusted financial institution dedicated to helping you navigate your financial journey with confidence.

Frequently Asked Questions

You can borrow up to R250 000, depending on your income, creditworthiness, and financial circumstances.

Loan applications are typically processed within 24 hours, provided all necessary documents are submitted and the eligibility criteria are met.

Yes, Old Mutual allows early loan repayments without incurring any penalties, helping you save on interest costs.

If you anticipate missing a repayment, it’s important to contact Old Mutual immediately. They can assist with restructuring your loan or setting up arrears arrangements. Missed payments may impact your credit score and lead to additional charges.

Yes, credit life insurance is required for loans with repayment terms of 12 months or more. This insurance covers the outstanding balance in cases of death, disability, or retrenchment.