Managing your finances effectively is crucial for maintaining financial stability and achieving long-term goals. A monthly budget template can be an invaluable tool in helping you track your income, expenses, and savings with precision. Whether you’re saving for a major purchase, reducing debt, or simply ensuring you’re living within your means, a well-structured budget can make all the difference. But how do you create a monthly budget that suits your lifestyle and financial objectives?

Key Takeaways:

- Financial Stability: A monthly budget template helps you track income and expenses, ensuring you live within your means and prepare for unexpected costs.

- Goal Achievement: Incorporating financial goals into your budget keeps you focused and motivated, aiding in systematic saving and debt reduction.

- Spending Awareness: Monitoring expenses with a budget template highlights spending patterns, enabling better financial decisions and accountability.

About Arcadia Finance

Arcadia Finance simplifies loan approval with no application fees. Choose from 19 reliable lenders, all adhering to South Africa’s National Credit Regulator standards.

Why You Need a Monthly Budget

A monthly budget is an essential tool for anyone looking to take control of their finances. It provides a clear framework for managing income, expenses, and savings, ensuring that your financial resources are used efficiently and effectively. Here are three key reasons why you need a monthly budget:

Financial Stability

Financial stability is the cornerstone of a secure and stress-free life. A monthly budget helps you achieve this stability by providing a clear overview of your financial situation. By tracking your income and expenses, you can ensure that you are living within your means and avoiding unnecessary debt. A well-managed budget allows you to anticipate and prepare for future expenses, reducing the risk of financial surprises and providing peace of mind.

Goal Setting

Setting financial goals is crucial for achieving long-term success and fulfillment. Whether you are saving for a home, planning for retirement, or aiming to pay off debt, a monthly budget enables you to allocate funds towards these objectives systematically. By clearly defining your financial goals and incorporating them into your budget, you can make steady progress towards achieving them. A budget helps you stay focused and motivated, ensuring that your financial decisions align with your aspirations.

Track Spending

One of the most significant benefits of a monthly budget is its ability to track your spending. By categorizing and monitoring your expenses, you can identify patterns and areas where you may be overspending. This awareness allows you to make informed decisions about where to cut back and where to allocate more resources. Tracking your spending also helps you stay accountable to your budget, ensuring that you remain on track to meet your financial goals.

For more comprehensive strategies on achieving financial freedom, consider reading our detailed guide on how to be financially free, which offers insights into effective financial planning.

Key Components of a Monthly Budget Template

Creating an effective monthly budget involves breaking down your finances into manageable components. This structure ensures you have a clear understanding of where your money is coming from and how it is being spent. Here are the key components of a monthly budget template:

Income

Your income is the foundation of your budget. This includes all sources of money you receive, such as salaries, wages, bonuses, freelance earnings, and any other form of regular income. It’s crucial to have an accurate record of your total monthly income to plan your expenses and savings effectively. Ensure to consider after-tax income to get a realistic picture of your available funds.

Fixed Expenses

Fixed expenses are those costs that remain constant each month. These can include rent or mortgage payments, utility bills, insurance premiums, car payments, and any other regular monthly obligations. Identifying and listing your fixed expenses helps you understand the essential outflows that must be covered before allocating funds to other areas.

Variable Expenses

Variable expenses fluctuate from month to month and can include groceries, entertainment, dining out, transportation costs, and other discretionary spending. It’s important to estimate these expenses as accurately as possible based on past spending patterns. Keeping track of your variable expenses allows you to adjust your budget dynamically and identify areas where you can potentially save money.

Savings and Investments

Allocating funds towards savings and investments is a crucial component of a healthy financial plan. This section of your budget should include contributions to emergency savings, retirement accounts, investment portfolios, and any other savings goals you have set. Prioritizing savings ensures you are prepared for unexpected expenses and are steadily working towards your long-term financial objectives.

Enhance your budgeting effectiveness with our detailed guide on How to Save Money Monthly, where you’ll find tips to cut costs and optimize your spending patterns.

Debt Repayment

Managing and reducing debt is an important aspect of financial health. Include all your debt repayments in this part of your budget, such as credit card payments, student loans, personal loans, and any other outstanding debts. Clearly outlining your debt repayment commitments helps you stay on top of your obligations and plan strategies for paying off debt faster, ultimately freeing up more of your income for savings and other financial goals.

One of the easiest ways to cut costs is by reducing your utility bills. Discover how to save electricity and make your home more energy-efficient without sacrificing comfort.

How to Create Your Monthly Budget Template

Creating a monthly budget template is a straightforward process that can greatly enhance your financial management. Here are the steps to help you get started:

Step 1: List Your Income Sources

The first step in creating your budget is to list all your income sources. This includes your salary or wages, freelance earnings, rental income, dividends, and any other sources of regular income. Make sure to use your net income (after taxes) to get a clear picture of the money available to you each month. Having an accurate total of your monthly income sets the foundation for the rest of your budget.

Step 2: Identify Your Fixed Expenses

Next, identify your fixed expenses. These are the costs that remain consistent each month and are essential for your daily living. Examples include rent or mortgage payments, utility bills, insurance premiums, car payments, and subscription services. Listing these expenses helps you understand the non-negotiable outflows from your income and ensures that you cover your basic needs first.

Step 3: Estimate Your Variable Expenses

Variable expenses fluctuate from month to month and include items such as groceries, transportation, entertainment, dining out, and other discretionary spending. Look at your past spending patterns to estimate these costs accurately. It’s important to be realistic and honest about your spending habits to ensure your budget reflects your actual lifestyle. Keeping track of these expenses allows you to adjust them as needed to stay within your budget.

Step 4: Plan for Savings and Investments

A crucial part of your budget is planning for savings and investments. Determine how much you want to save each month towards your emergency fund, retirement accounts, and other investment opportunities. Prioritizing savings ensures you are building a financial cushion for unexpected expenses and future goals. Allocate a specific portion of your income to these areas and treat them as non-negotiable, just like your fixed expenses.

Step 5: Allocate Funds for Debt Repayment

Finally, allocate funds for debt repayment. List all your outstanding debts, such as credit card balances, student loans, and personal loans. Determine the minimum payments required for each and then allocate additional funds to pay off high-interest debts faster. Paying down debt should be a priority as it reduces your financial burden and frees up more money for savings and investments in the long run.

Monthly Budget Templates

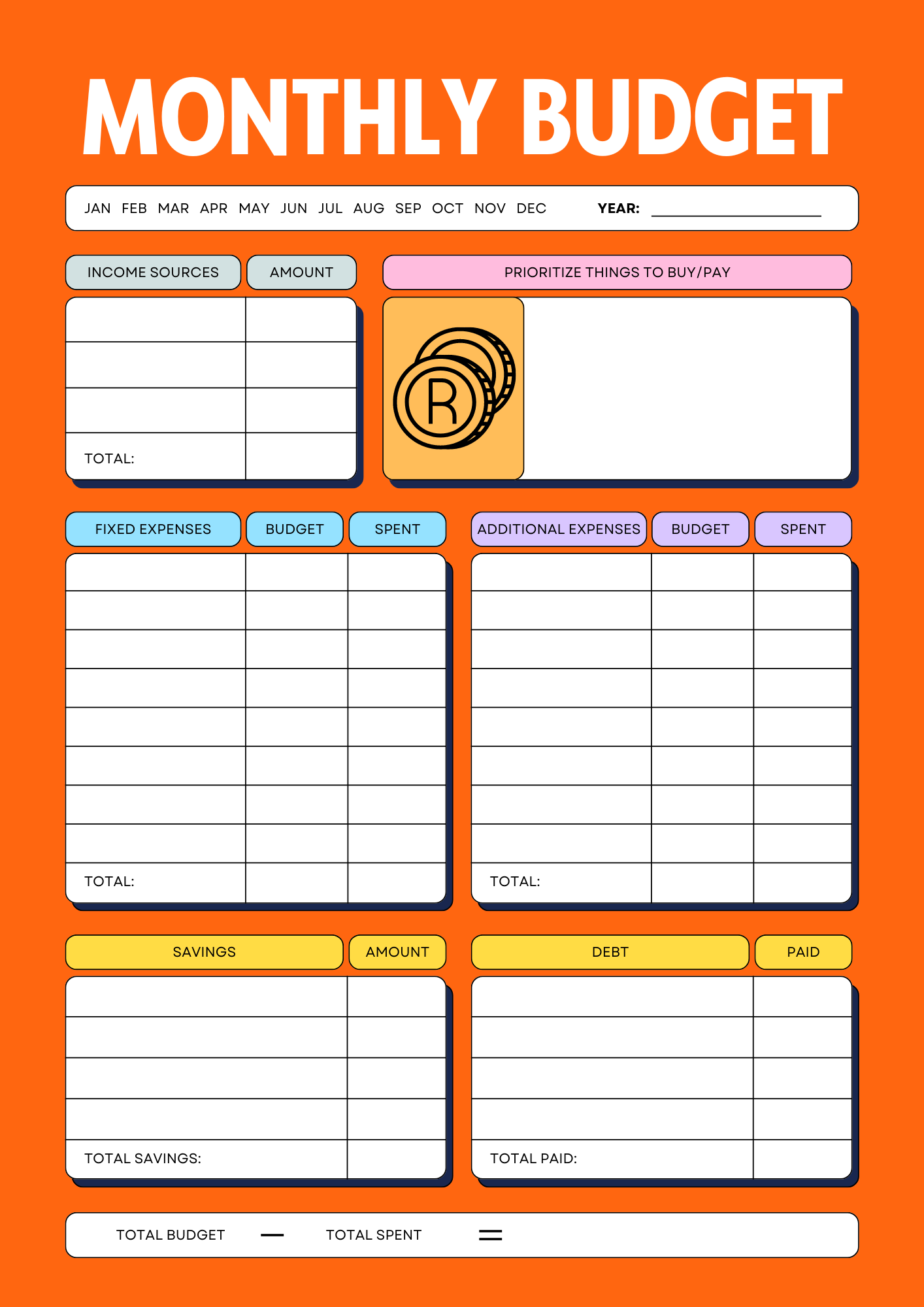

To make your budgeting process even more convenient, we have prepared comprehensive budget templates for you. These templates are designed to help you organize your finances with ease and precision.

Printable Template

Our printable budget template allows you to manually fill in your income, expenses, savings, and debt repayment details. This template is perfect for those who prefer a hands-on approach to budgeting. You can print it out and keep it handy to regularly track your financial progress. With a clear and structured layout, our printable template ensures that you cover all the essential components of your monthly budget.

Use this monthly budget template to include key expenses like the Average Grocery Cost Per Month in South Africa. Planning your grocery budget ensures you maintain control over your monthly finances.

PDF Template

For those seeking additional resources, Consumer.gov offers a free PDF budget template that can be a valuable tool in managing your finances. This template is designed to help you organise your income, expenses, and savings systematically.

Tips for Sticking to Your Budget

Creating a monthly budget is the first step toward financial stability, but sticking to it is where the real challenge lies. Here are some practical tips to help you stay on track and make the most of your budgeting efforts:

Track Your Spending Regularly: Regularly tracking your spending is crucial for maintaining control over your finances. By monitoring your expenditures, you can ensure that you are staying within your budget limits and identify any areas where you might be overspending. Keep receipts, use a spending journal, or leverage mobile apps to record your daily transactions. Regular tracking allows you to compare your actual spending against your budgeted amounts, helping you stay accountable and make informed financial decisions.

Adjust as Necessary: A budget should be flexible and adaptable to your changing financial circumstances. Life is unpredictable, and unexpected expenses can arise at any time. It’s essential to review and adjust your budget regularly to reflect these changes. If you find that certain budget categories consistently exceed their limits, consider reallocating funds from other areas or finding ways to reduce those expenses. Being proactive and willing to make adjustments ensures that your budget remains realistic and effective.

Use Budgeting Tools and Apps: Utilising budgeting tools and apps can make managing your finances easier and more efficient. There are numerous digital tools available that can help you create, track, and adjust your budget with ease. These tools often come with features like expense categorisation, automatic transaction imports, and visual reports, making it simpler to stay on top of your financial situation. Find a tool or app that suits your needs and preferences, and use it consistently to support your budgeting efforts.

For those new to saving, our budgeting tips for first-time savers can provide a solid foundation to get started and maintain financial discipline.

Conclusion

Creating and adhering to a monthly budget is indeed a crucial step towards achieving financial stability and reaching your financial goals. By using a detailed budget template, you can track your income, manage your expenses, and identify areas where you can save. This proactive approach not only helps in avoiding debt but also ensures you are well-prepared for any unexpected financial challenges. Have you started using a monthly budget template to take control of your finances and plan for a secure future? If not, start today!

Frequently Asked Questions

A monthly budget template is a structured tool that assists you in tracking your income and expenses over a month. It enables you to allocate funds for various categories, such as rent, groceries, utilities, and savings, ensuring effective management of your finances.

Utilising a monthly budget template helps you gain better control over your finances, avoid unnecessary expenses, and save for future goals. It offers a clear overview of your monthly expenditure, making it easier to identify areas for improvement and ensure you live within your means.

To create a monthly budget template, begin by listing all sources of income and categorising your expenses (e.g., housing, food, transportation). Allocate a specific amount to each category based on your financial priorities. You can utilise a spreadsheet or budgeting app to streamline this process and tailor it to your needs.

An effective monthly budget should encompass your total income, fixed expenses (like rent and utilities), variable expenses (such as groceries and entertainment), savings goals, and debt payments. Regularly reviewing and adjusting these components ensures that your budget remains accurate and pertinent to your financial circumstances.

It is advisable to review and update your monthly budget at least once a month. This practice assists you in staying on track with your financial objectives, adapting to any changes in income or expenses, and making informed decisions regarding your spending and saving habits. Regular reviews ensure that your budget accurately reflects your current financial situation.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.