Many individuals in South Africa are looking for ways to supplement their income or access funds without the burden of repayment. The concept of “free money” can seem appealing, and understanding how to access it legally is crucial.

Key Takeaways

- Diverse Funding Sources in South Africa: South Africans can access non-repayable aid through government grants, community initiatives, competitions, and cashback programmes tailored to different needs.

- Government Grants: Social grants, child support, and youth grants assist vulnerable groups. Meeting eligibility requirements and following the correct application process can improve approval chances.

- Financial Literacy: Financial education is essential for effective money management. Workshops and online tools support better budgeting, saving, and investing, enabling individuals to leverage financial opportunities.

About Arcadia Finance

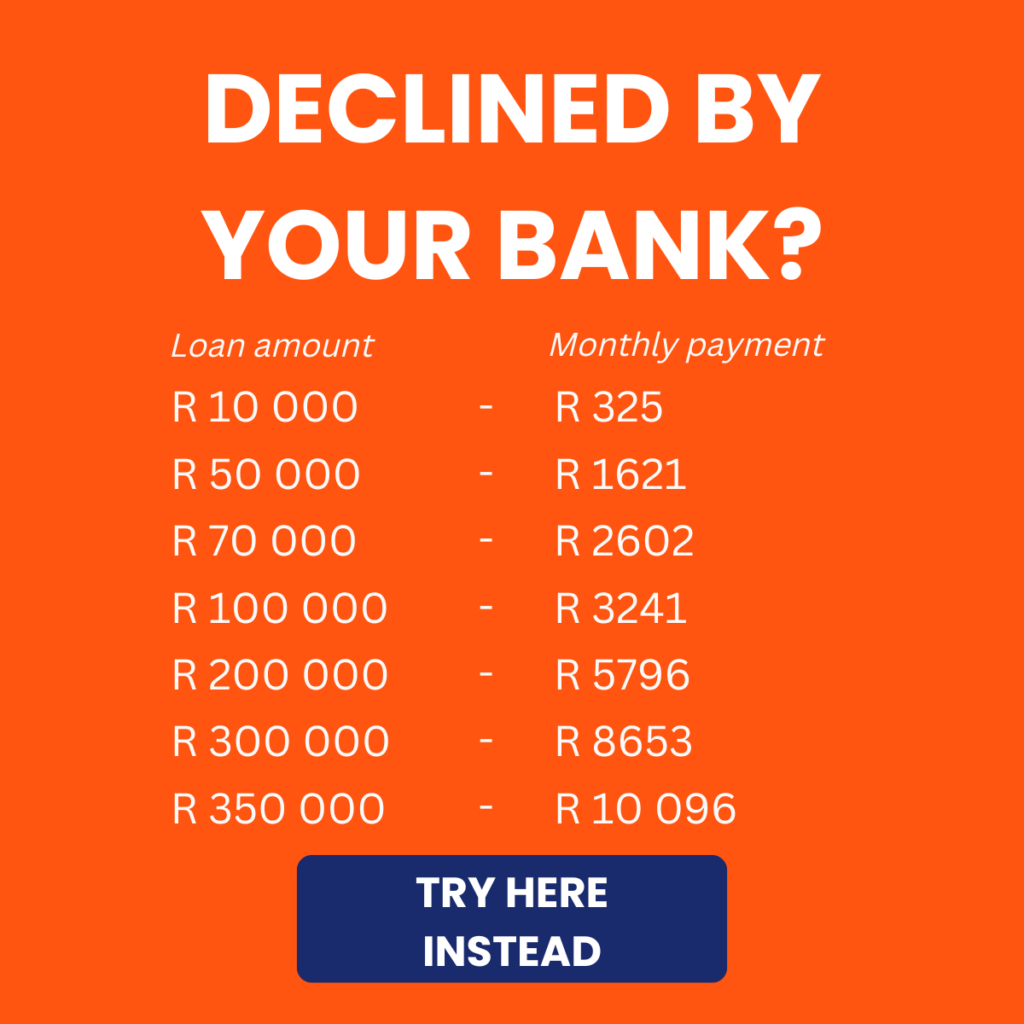

Get your loan easily through Arcadia Finance. We offer zero application fees and access to 19 reliable lenders, all fully compliant with South Africa’s National Credit Regulator. Experience a streamlined process designed for your financial peace of mind.

Government Grants and Subsidies

Government grants and subsidies are financial aid programmes established to support individuals in need, often without the expectation of repayment. In South Africa, these grants aim to assist various demographics, including the elderly, disabled individuals, and youth. Understanding the types of government grants available and the application process can significantly improve your chances of receiving assistance.

Types of Government Grants

There are several types of government grants in South Africa, each catering to specific needs. Here are a few key categories:

Social Grants: These are designed to support vulnerable groups, including older persons, people with disabilities, and children. For example, the Old Age Grant provides financial support to senior citizens, while the Disability Grant assists those unable to work due to a physical or mental impairment.

Child Support Grant: This grant aims to help low-income families by providing financial assistance for the care of children under the age of 18. It helps cover basic needs such as food, clothing, and education.

Foster Care Grant: This financial support is provided to individuals who take care of foster children, helping to cover their living costs and basic needs.

Youth Grants: Various initiatives aim to empower young people, particularly those aged between 15 and 34. These programmes may provide funding for education, skills training, or entrepreneurship.

Eligibility criteria for these grants vary by programme. Generally, applicants must meet specific income thresholds and residency requirements. For instance, social grants typically require proof of South African citizenship or permanent residency, while income levels must fall below a certain limit to qualify for assistance. It is essential to check the specific eligibility criteria for each grant type to determine whether you qualify.

Application Process

Applying for government grants is straightforward if you follow these steps:

- Identify the Grant: Research which government grant suits your needs, considering its benefits and eligibility criteria.

- Gather Required Documents: Collect the necessary documents, which may include:

- Proof of identity (e.g., South African ID or passport)

- Proof of income (payslips, bank statements, or tax documents)

- Proof of residence (utility bill or lease agreement)

- Relevant medical documents (for disability grants)

- Complete the Application Form: Obtain and accurately fill out the application form from the South African Social Security Agency (SASSA) website or your local SASSA office.

- Submit Your Application: Submit your completed form and documents to the appropriate SASSA office. Keep copies of everything for your records.

- Await Response: After submission, SASSA will review your application and inform you of the outcome, which may take several weeks. If approved, you will receive details about the grant amount and payment method.

To make sure you get your money without delays, it’s vital to submit your banking details to SASSA accurately. This step ensures your grant payment is processed smoothly, avoiding any potential financial hiccups.

Community Support Initiatives

In addition to government grants, various community support initiatives can provide financial assistance to those in need. These initiatives often focus on local development and empowerment, offering funding programs tailored to community requirements.

Local Community Grants

Local community grants, typically funded by municipalities or community organisations, are designed to address specific local needs. They focus on projects that improve infrastructure, support local businesses, or assist vulnerable groups. These grants cover various initiatives, including educational programmes, health initiatives, and environmental projects, all aiming to enhance living conditions for residents and foster local development.

To access local community grants, start by contacting your municipality or local government office, which often provides information on available grants and application processes. Community forums and local NGOs can also offer insights into funding opportunities. Additionally, networking with community leaders and attending local meetings can help you learn about grant applications and deadlines.

Non-Governmental Organisations (NGOs)

NGOs play a vital role in providing financial assistance and support to individuals and communities in South Africa. They often focus on specific issues, such as poverty alleviation, education, healthcare, and social justice.

Many NGOs offer direct financial aid, project funding, and educational scholarships while collaborating with communities to identify needs and develop relevant programmes. They also provide guidance on grant applications and help individuals access available resources.

Examples of NGOs that offer grants or assistance include:

- The Solidarity Fund: Provides financial support to those affected by COVID-19, offering grants to individuals and small businesses in financial distress.

- Gift of the Givers: Offers humanitarian aid and disaster relief, including financial assistance to individuals in need.

- The Community Chest: Addresses social issues in South Africa by supporting various initiatives and granting funds to local organisations.

Competitions and Giveaways

Competitions and giveaways are popular ways for individuals to win prizes or financial rewards at no cost. These opportunities can be found online and within local communities, offering various avenues for participation and the chance to receive funds or valuable items.

Online Competitions

Numerous websites and social media platforms host online competitions where participants can enter to win cash, gift cards, or products. Popular platforms include Facebook, Instagram, Twitter, and dedicated competition websites. Brands often use these competitions to promote their products and engage with customers.

To maximise your chances of winning online competitions, consider the following tips:

- Follow the Rules: Carefully read and adhere to the competition rules. Ensure you meet all entry requirements, including age and residency restrictions.

- Enter Multiple Competitions: The more competitions you enter, the greater your chances of winning. Be proactive and participate in various competitions across different platforms.

- Engage with the Brand: Many competitions require participants to like, share, or comment on posts. Engaging with the brand can increase your visibility and improve your chances of being selected.

- Stay Updated: Follow relevant pages or websites that regularly post about competitions. Being informed about new competitions can help you enter promptly.

For those looking to make money from the comfort of their home, exploring legitimate work-from-home opportunities can be game-changing. With flexible hours and diverse roles, you can boost your income stream without spending a cent on commuting.

Community Events

Community events, such as fairs, markets, and festivals, frequently include competitions and giveaways. These events may feature raffle draws, talent shows, or contests, providing participants with the opportunity to win cash or prizes.

To take part in local events, keep an eye on community bulletin boards, local newspapers, and social media pages that promote such activities. Registering for events may require a small fee or simply your attendance. Be prepared to engage with your community and enjoy the experience while competing. Local events are typically well-publicised, so staying informed will help you avoid missing out on these opportunities.

Cashback and Rewards Programs

Cashback and rewards programmes are effective methods for consumers to earn money back on their purchases or receive points that can be redeemed for rewards. These programmes provide financial benefits without any cost to the consumer.

Overview of Cashback Offers

Cashback offers allow consumers to receive a percentage of their purchase back as cash or credit. Retailers partner with cashback platforms to incentivise shopping and attract customers. When shoppers make purchases through these platforms, they can claim a portion of their spending back, often deposited directly into their bank accounts or available as credit for future purchases.

Popular South African retailers offering cashback include:

- Takealot: This online retailer frequently has cashback promotions through partner sites.

- Clicks: Customers can earn cashback on purchases made through specific promotions.

- Checkers: Participates in cashback offers linked to various loyalty programmes.

Loyalty Programmes

Loyalty programmes are designed to encourage repeat business by rewarding customers for their purchases. These programmes typically allow members to earn points for every purchase, which can be redeemed for discounts, free products, or exclusive offers.

To maximise the benefits of loyalty programmes, consider these strategies:

- Sign Up for Multiple Programmes: Joining several loyalty programmes can help you earn rewards across different retailers.

- Understand the Points System: Familiarise yourself with how points are earned and redeemed. Some programmes offer bonus points during promotions or on specific products.

- Use Loyalty Cards: Always present your loyalty card or provide your membership details when making a purchase to ensure you earn points.

- Stay Updated on Promotions: Regularly check for special promotions that allow you to earn additional points or redeem rewards for discounts.

Crowdfunding and Peer-to-Peer Lending

Crowdfunding and peer-to-peer lending are alternative methods for securing financial support. These avenues can help fund personal projects or meet various needs without resorting to traditional loans.

Crowdfunding Platforms

Crowdfunding involves gathering small contributions from a large number of individuals, primarily through online platforms. Participants or organisations showcase their projects, explaining the funding required and offering potential incentives to contributors.

In South Africa, well-known crowdfunding platforms include Backabuddy, Thundafund, and Jumpstarter. These sites cater to a wide range of initiatives, from creative pursuits to community development and personal requirements, facilitating the process of seeking financial assistance.

Peer-to-Peer Lending

Peer-to-peer lending connects borrowers directly with individual lenders, eliminating the need for traditional financial institutions. This approach allows borrowers to obtain loans at potentially lower interest rates, while lenders have the opportunity to earn returns on their investments.

This lending method presents several advantages, such as reduced fees and flexible repayment terms. However, it also poses risks, including the chance of borrower default. Therefore, it is crucial to conduct comprehensive research and understand the terms thoroughly before engaging in peer-to-peer lending.

Conclusion

Although there is no foolproof method to secure “free money” in South Africa, various legitimate opportunities exist for accessing financial support and resources. These include government grants, social relief programmes, scholarships, crowdfunding, competitions, and rewards-based applications. It is crucial to approach these avenues responsibly and remain vigilant against scams or get-rich-quick schemes that may result in financial loss.

Frequently Asked Questions

South Africa provides various government grants, including social grants for the elderly and disabled, child support grants for low-income families, foster care grants for caregivers of foster children, and youth grants aimed at empowering young people. Each grant has specific eligibility criteria.

To apply, first identify the specific grant you need. Then, gather the necessary documents (proof of identity, income, and residence) and complete the application form available on the South African Social Security Agency (SASSA) website or at local offices. Submit the form along with your documents, and keep copies for your records.

Yes, numerous community support initiatives are offered by local municipalities and organisations that provide grants for specific needs, such as infrastructure improvements or support for vulnerable groups. Contact your local government office or community forums for information on available grants.

Online competitions are hosted on platforms like social media and various websites, offering cash or prizes. To participate, carefully follow the rules, engage with the brand, enter multiple competitions, and stay updated on new opportunities by following relevant pages.

Cashback and rewards programmes allow consumers to earn a percentage back on their purchases or accumulate points that can be redeemed for discounts. To maximise your benefits, sign up for multiple programmes, understand how to earn and redeem points, and look out for promotions that enhance your rewards.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.