If your monthly net income is around R15,000, how do you plan to cover accommodation, groceries, insurance, medical expenses, debt repayments, and leisure activities without depleting your funds? Managing all these expenses on a fixed income can be challenging. The solution is to create a budget!

Key Takeaways

- Understanding Budgeting: A budget is a detailed plan that tracks income and expenses, ensuring essential costs are covered and financial goals are within reach.

- Importance of Budgeting: It’s essential for managing finances effectively, especially in uncertain economic times, by preventing overspending and helping achieve financial objectives.

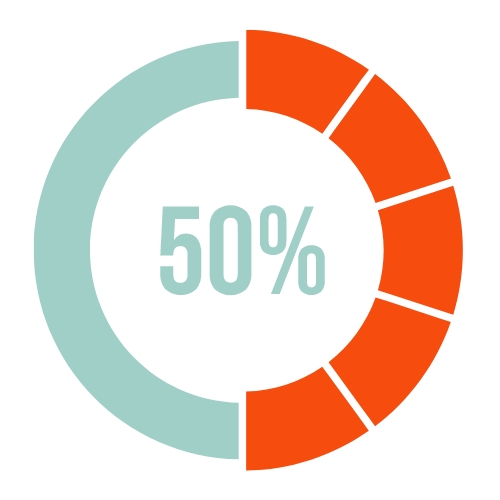

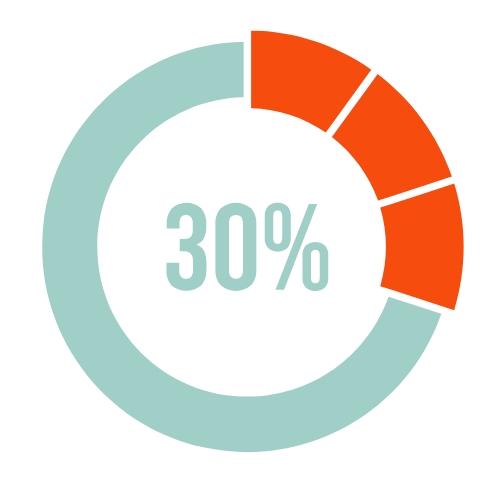

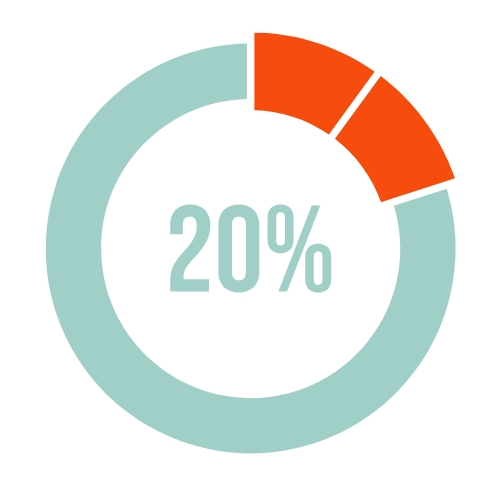

- The 50/30/20 Rule: This approach divides income into essentials (50%), discretionary spending (30%), and savings or debt repayments (20%), encouraging a balanced financial strategy.

About Arcadia Finance

Obtain your loan easily with Arcadia Finance. Experience zero application fees and choose from 19 esteemed lenders, all adhering to the standards set by South Africa’s National Credit Regulator. Enjoy a simplified application process and reliable choices suited to your financial requirements.

What is a Budget?

A budget is a plan that helps you manage your finances by outlining your income and expenses over a set period, usually a month. It helps you decide what’s most important, track where your money is going, and make sure you can pay for necessities like rent, groceries, and utilities. By setting limits on your spending and having savings goals, a budget can help you avoid spending more than you earn and build a stronger financial foundation.

Why Budgeting Matters

In 2018, a survey found that nearly two-thirds of South Africans were cutting back on their monthly spending, even though the economy was growing. As financial conditions change, this trend is likely to continue.

With wages not keeping pace with rising living costs and debts increasing, many South Africans have had to tighten their budgets, regardless of broader economic figures. Just like it’s hard to lose weight without tracking what you eat, managing your finances without a budget can be difficult because it doesn’t show you where your money is really going.

Here are a few reasons why it’s a good idea to have a household budget, no matter your financial situation:

Simple and Effective Debt Management Strategy

Many South Africans face challenges with high interest on credit cards because their monthly expenses exceed their income, making it difficult to pay off their balances. The key advice for budgeting: Ensure your monthly spending stays within your disposable income.

Encouraging Active Financial Participation

Budgeting fosters discipline and motivation, making it easier to manage money responsibly. Studies have shown that people who stick to a budget are more likely to reach their financial goals because they become more engaged in managing their finances.

Achieving Both Short and Long-term Goals

If you’re saving for a car deposit next year, planning to buy a home in five years, or aiming for a comfortable retirement, a budget is essential. It helps you figure out how much to save each month to reach these goals and guides you in allocating your money wisely.

Preparing for Emergencies

With many people living paycheck to paycheck and lacking emergency savings, it’s crucial to build a financial buffer for unexpected costs, such as car repairs, plumbing problems, or sudden job loss.

Wondering how to stretch your paycheque further? The 50/30/20 Rule is a straightforward way to plan your monthly budget and make sure every rand goes where it matters most.

Developing a Budget Strategy

Budgeting can seem complex, but following these five steps can make it easier:

- Determine Your Net Income: Start with the amount on your paycheck. If you have deductions for things like retirement savings or insurance, add these back in to get a true picture of your income. For additional income, such as from freelancing, subtract any related costs like taxes or business expenses.

- Choose a Budgeting Method: Pick a system that fits your financial habits and lifestyle. A good budget should cover necessities, allow for some discretionary spending, and include savings for emergencies and future goals. Examples of budgeting methods are the envelope system, zero-based budgeting, and the 50/30/20 rule.

- Track Your Spending: Record your expenses manually or use digital budgeting tools like 22seven to keep track.

- Automate Savings: Set up automatic transfers to ensure your money goes where it’s intended. If possible, arrange for direct contributions from your salary into savings accounts for emergencies, investments, and retirement. Having a budgeting partner or joining an online group can help keep you on track.

- Review and Adjust Regularly: Update your budget as your financial situation changes, ideally every three months. If sticking to your budget becomes difficult, consider revising your strategies.

Learn how to allocate your salary effectively to cover all your needs and still save, getting closer to understanding how much money you need to live comfortably in South Africa. This guide provides a roadmap for financial stability based on your earnings.

Budgeting Tips

When managing your personal finances, it’s important to distinguish between essential spending and non-essential spending. Below is a table summarizing some key budgeting tips to help you make informed decisions and potentially save money.

| Budgeting Tip | Description | Suggested Action |

|---|---|---|

| Distinguish Between Needs and Wants | Understanding the difference between necessities and luxuries is key. Food is essential, but dining at expensive restaurants is a luxury. | Focus on cutting back on luxury items to save money. |

| Keep an Eye on Small Expenses | Small, frequent purchases can add up quickly. For example, frequent coffee purchases can surprisingly increase your monthly spending. | Calculate monthly spending on small expenses, consider alternatives like homemade coffee. |

| Be Cautious with Salary Increases | Getting a raise is exciting but doesn’t necessarily mean you should increase your spending. | Save a portion or boost your retirement contributions instead of increasing expenses. |

| Use Cash Instead of Cards | Cards are convenient, but using cash can prevent overspending by making you more aware of your spending. | Use the envelope budgeting system to manage cash spending better. |

| Manage Credit Card Debt Proactively | If your credit card balance is growing, addressing it quickly is crucial as it’s an expensive form of debt. | Make paying off credit card debt a priority in your budget. |

| Consider Debt Consolidation | If managing multiple debts becomes overwhelming, consolidating them into a single loan can reduce your interest rates and monthly payments. | Look into debt consolidation options to simplify payments and reduce overall interest. |

Looking to reduce your food expenses while still enjoying tasty meals? Check out our Cheap Dinner Ideas in South Africa guide, packed with delicious, wallet-friendly recipes that keep your budget in check.

Budget Your Salary Using the 50/30/20 Strategy

The 50/30/20 strategy simplifies financial management by dividing your post-tax income into three key areas: essentials, discretionary spending, and savings or debt repayments. This method helps you stay within your budget and control your spending. Here’s how to apply it:

Allocate 50% of Your Income to Essentials

Essentials are the necessary expenses you can’t avoid. Half of your net income should cover these vital costs, which include:

- Rent or mortgage payments

- Utilities like electricity and water

- Transportation

- Essential insurance (health, vehicle, home)

- Minimum debt payments

- Basic groceries

For example, if your monthly income is R20,000, R10,000 should be allocated to these essential items. If your essential costs exceed this amount, consider reducing expenses by switching utility providers, cutting grocery bills, or even moving to more affordable housing.

Spend 30% of Your Income on Non-essentials

Once your basic needs are covered with 50% of your income, allocate 30% to non-essentials. These are items that improve your quality of life but aren’t necessary for survival, such as:

- Dining out

- Clothing and shopping

- Travel and vacations

- Gym memberships

- Entertainment subscriptions like Netflix or Spotify

- Extra groceries beyond the basics

Using the same example, R6,000 from a R20,000 monthly income can be spent on these non-essential pleasures. If this spending category becomes too high, consider cutting back on certain luxuries.

Save 20% of Your Income

The remaining 20% of your income should be dedicated to saving for future goals or paying down debt faster. This includes anything above the minimum debt payments, which helps reduce your debt principal and future interest charges.

By consistently saving 20% of your income each month, you can significantly build your savings. If you’re saving for an emergency fund, a major financial goal, or a property deposit, this approach helps you grow your funds steadily. For example, saving R4,000 each month from a R20,000 income can lead to nearly R48,000 in savings within a year!

Understanding the Minimum Salary to Pay Tax in South Africa is crucial for effective financial planning. Once you know if your income meets the taxable threshold, you can start budgeting smartly to ensure that you not only cover your tax obligations but also manage your living expenses effectively.

Establishing Financial Priorities in Your Budget

Managing your budget can often feel overwhelming, particularly when trying to balance various financial obligations. If you’re dealing with credit card debt, student loan payments, or saving for retirement, the following guide will help you decide what to prioritise first:

Priority No. 1: Start an Emergency Fund

Begin your savings journey with a small emergency fund. Financial advisors generally suggest setting aside enough money to cover minor unexpected expenses or repairs. A good initial goal is at least R7,500, which provides a buffer for small emergencies and forms a base you can build upon.

Having this fund is essential as it prevents further debt by providing a safety net for unforeseen expenses, helping to maintain peace of mind and financial stability.

Not sure what an emergency fund is or why it’s so important? Discover the essentials with our comprehensive guide on What is an Emergency Fund?

Priority No. 2: Maximise Employer Contributions to Your Retirement Fund

Next, focus on securing contributions from your employer to your pension or provident fund. If your employer matches your contributions, make sure you contribute enough to receive the full benefit. This isn’t just about extra money; it also allows you to benefit from tax advantages and the growth that comes from compound interest, helping to build your wealth over time.

The long-term benefits of compound interest are substantial, so it’s important to take full advantage of these employer contributions as early as possible.

Priority No. 3: Pay Off High-Interest Debt

After securing employer matches, concentrate on paying off high-interest debts. This includes credit card debt, personal loans, and other expensive, unsecured debts. These debts often come with such high-interest rates that you could end up repaying double or triple the original amount borrowed.

If your unsecured debt isn’t manageable within five years or makes up half or more of your gross income, consider debt relief options like restructuring or consolidation plans.

Priority No. 4: Save for Retirement

Once your high-interest debt is under control, focus on saving for retirement. A general rule is to aim to save at least 15% of your gross income for retirement, including any employer contributions. For younger people, a retirement annuity could be a good option to maximise your savings before reaching the contribution limit.

Don’t overlook the importance of planning for your retirement. Save for Your Retirement and start planning early to maximize your returns and enjoy your golden years with peace of mind.

Priority No. 5: Grow Your Emergency Fund

Work towards increasing your emergency fund to cover three to six months of essential living expenses. This doesn’t mean your entire budget but should include critical payments. While you may need to dip into this fund from time to time, the aim is to replenish it as needed and gradually build up your safety net.

Priority No. 6: Continue Debt Repayment

With the most pressing debts paid off, focus on settling any remaining debts, such as lower-rate or tax-deductible debts like a mortgage. These can be addressed once your primary financial goals are on track.

Priority No. 7: Focus on Personal Financial Goals

Once you’ve built a strong emergency fund, cleared high-interest debts, and are consistently saving for retirement, you’re well-positioned to think about additional financial goals. This could include saving for major anticipated expenses, like home repairs or a new car, and investing any extra disposable income to boost your wealth.

Transform your next payday into a rock-solid roadmap: punch your take-home pay into our Budget Calculator and discover the ideal split for bills, treats and tomorrow.

Conclusion

A budget is not a miracle worker. It won’t conjure up extra money, make your boss offer you a raise, or control the cost of your next car or holiday. However, its importance in improving your financial well-being is undeniable, often contributing to better emotional and physical health as well. Simply put, a well-planned and carefully managed budget can have a profound impact on your overall quality of life.

Frequently Asked Questions

Creating a budget requires a thorough understanding of your income and expenses. Start by calculating your total monthly income. Then, categorise and list your monthly expenses, beginning with necessities like housing, utilities, and groceries, followed by discretionary spending. Subtract your total expenses from your income to determine if you have a surplus or a shortfall. Adjust as needed by cutting back on non-essential expenses or finding ways to boost your income.

The 50/20/30 budget rule is a straightforward guide for managing your finances. It suggests allocating 50% of your net income to essentials (like rent and groceries), 20% to savings and debt repayment, and the remaining 30% to discretionary spending, such as entertainment and dining out. This rule helps you create a balanced budget that covers necessary expenses, secures your financial future, and leaves room for enjoyment.

Adjusting your budget when your income or expenses change is key to maintaining financial stability. Regularly review your budget and update it with any significant changes, such as a salary increase or a new monthly payment. This helps ensure you continue to meet your financial goals without overspending.

You should review your budget at least once a month. This allows you to identify and correct any deviations from your plan, adjust for unexpected expenses, and stay on track with your financial goals. Regular reviews also give you the chance to reassess your spending habits and make necessary adjustments to save more or reduce non-essential spending.

If you consistently have extra money left over in your budget, consider using it to further your financial goals. You could increase your savings, invest in stocks or unit trusts, pay off debt more quickly, or contribute to a retirement account. Alternatively, you might use some of the surplus for a treat or an upgrade that improves your quality of life, as long as it aligns with your overall financial strategy.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.