Ackermans [Ackermans.co.za], a prominent retail store in South Africa, expands its offerings beyond clothing and home goods by providing financial products, including personal loans. These loans aim to deliver accessible credit to a diverse range of South Africans, particularly those who may not qualify for traditional bank loans. With flexible loan options and a straightforward application process, Ackermans loans have gained popularity among individuals seeking financial assistance for various needs.

Ackermans Loan Overview

| Name | Ackermans |

|---|---|

| Financial | Powered by Capfin |

| Product | Personal Loans |

| Minimum Age | 18+ years |

| Minimum Amount | R1,000 |

| Maximum Amount | R50,000 |

| Minimum Term | 6 months |

| Maximum Term | 12 months |

| APR | Varies based on credit profile |

| Monthly Interest Rate | Up to 5% per month |

| Early Settlement | Allowed, no penalties |

| Repayment Flexibility | Standard monthly repayments |

| NCR Accredited | Yes |

| Our Opinion | ✅ Quick approval process ✅ Convenient store-based application ⚠️ Limited to smaller loan amounts ⚠️ Higher interest rates for longer terms |

| User Opinion | ✅ Easy application through stores ⚠️ Interest rates can be high for certain applicants |

What Makes the Ackermans Loan Unique?

What distinguishes the Ackermans loan is its strong partnership with Capfin, a leading financial services provider in South Africa. This collaboration enables Ackermans to offer quick and accessible personal loans to a broad spectrum of South Africans, with the convenience of applying in-store at any Ackermans outlet. The loan application process is straightforward, requiring only a valid South African ID, proof of income, and three months’ bank statements. For those unfamiliar with online banking or who prefer face-to-face interactions, the in-store application option makes Ackermans loans particularly appealing.

Another key feature that sets Ackermans loans apart is their affordable loan amounts and flexibility in repayment. Borrowers can access loans of up to R50 000, available for repayment over terms ranging from 6 to 12 months. This flexibility, along with an early settlement option that incurs no penalties, makes it an attractive choice for individuals seeking manageable short-term credit solutions. Repayment is also simplified, with various options such as debit orders or in-store payments, providing borrowers with a convenient way to keep their finances on track.

Types of Loans Offered by Ackermans

Ackermans.co.za, through its partnership with Capfin, offers personal loans tailored to meet the various financial needs of South African customers. These loans can be utilised for different purposes based on the borrower’s requirements:

Personal Loan: This flexible loan option is ideal for unexpected expenses, emergency repairs, or educational costs. With loan amounts ranging from R1 000 to R50 000, it is suitable for addressing short-term financial gaps.

Consolidation Loan: While not specifically marketed, some borrowers utilise the personal loan to consolidate debt, simplifying repayment by combining multiple smaller loans into one with more manageable terms.

Store Credit: Ackermans also provides store credit to its customers, allowing shoppers to purchase items on credit and pay them off over time. This option is perfect for individuals who need immediate access to household goods or clothing without the burden of upfront payments.

About Arcadia Finance

Effortlessly obtain a loan via Arcadia Finance, free of application charges, with 19 reliable, NCR-compliant lenders in South Africa, ensuring a streamlined and dependable service for your financial solutions.

Requirements for an Ackermans Loan

To apply for an Ackermans loan, borrowers must provide the following documents:

- A valid South African ID

- The three most recent payslips or bank statements to verify income

- A valid cellphone number for communication and authentication

- Proof of residential address

- If applicable, spousal consent is required for those married in community of property.

Step-by-step Guide to Applying for a Loan at Ackermans

Here’s a straightforward for a loan at Ackermans:

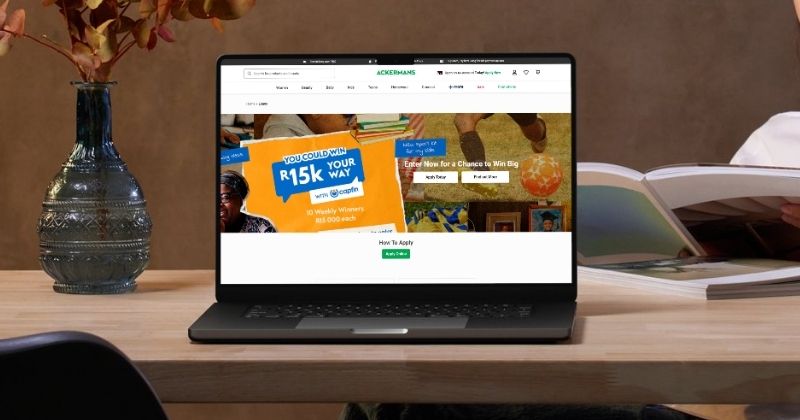

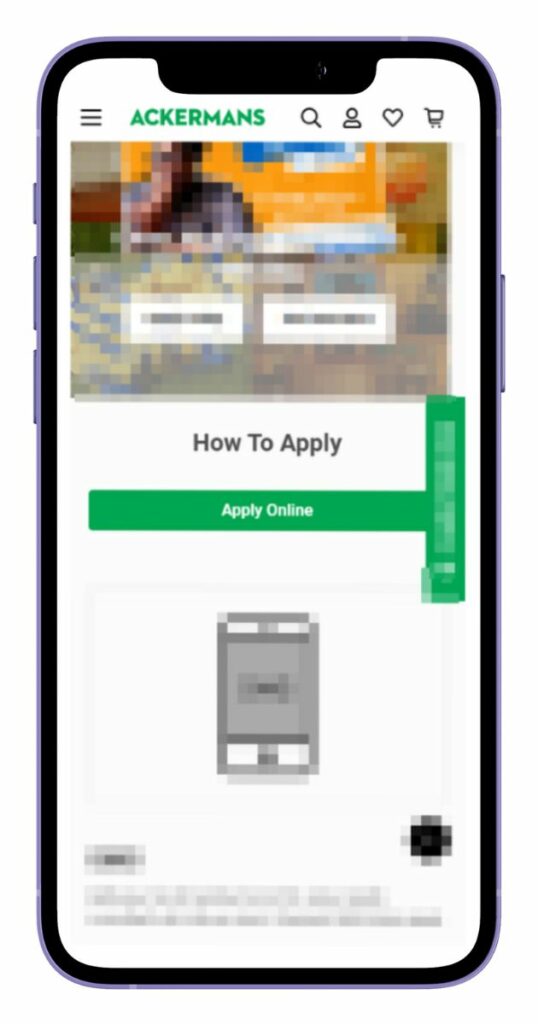

Step 1. Visit your nearest Ackermans store or apply online by visiting Ackermans.co.za.

Step 2. Click “Apply Online”

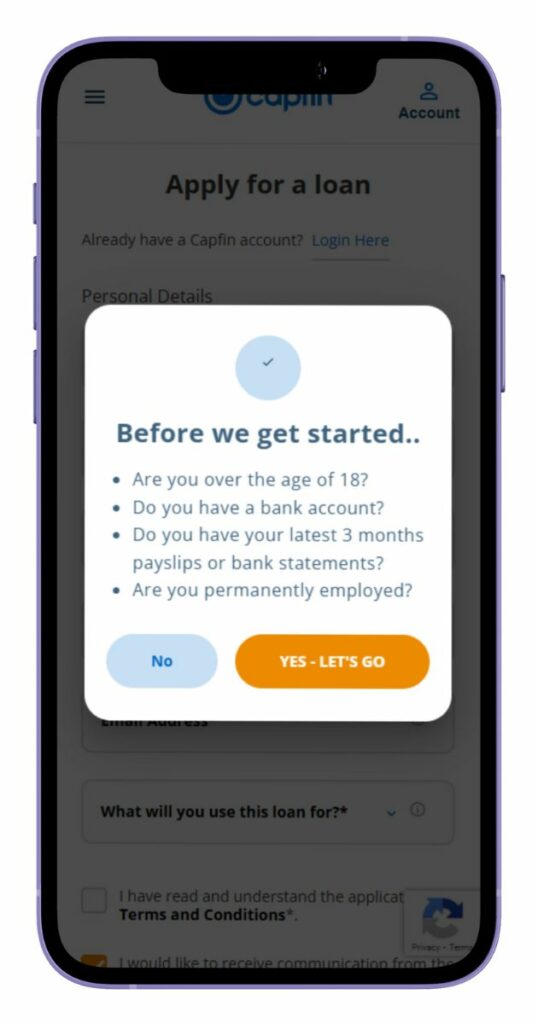

Step 3. Confirm eligibility and click “YES – LET’S GO.”

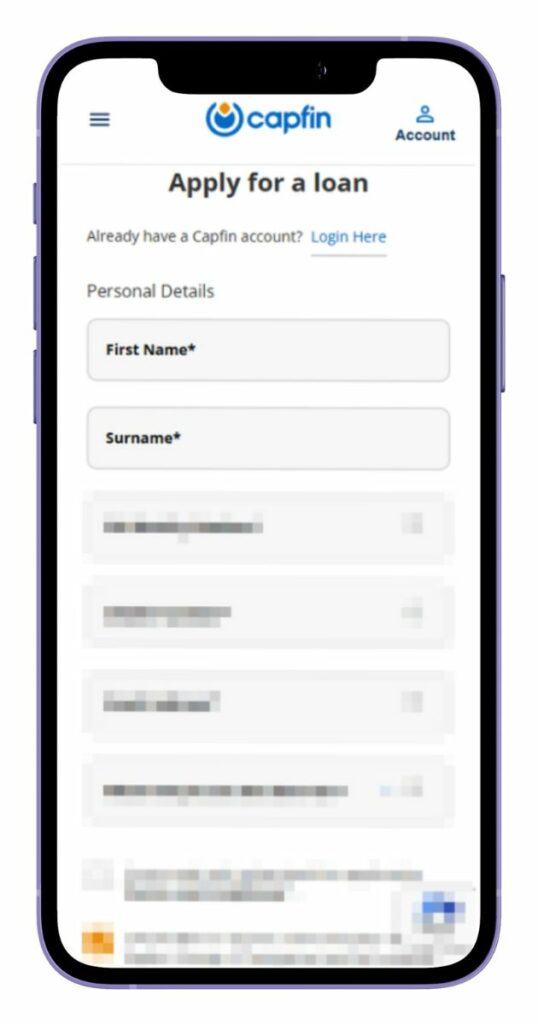

Step 4. Enter your first name and surname.

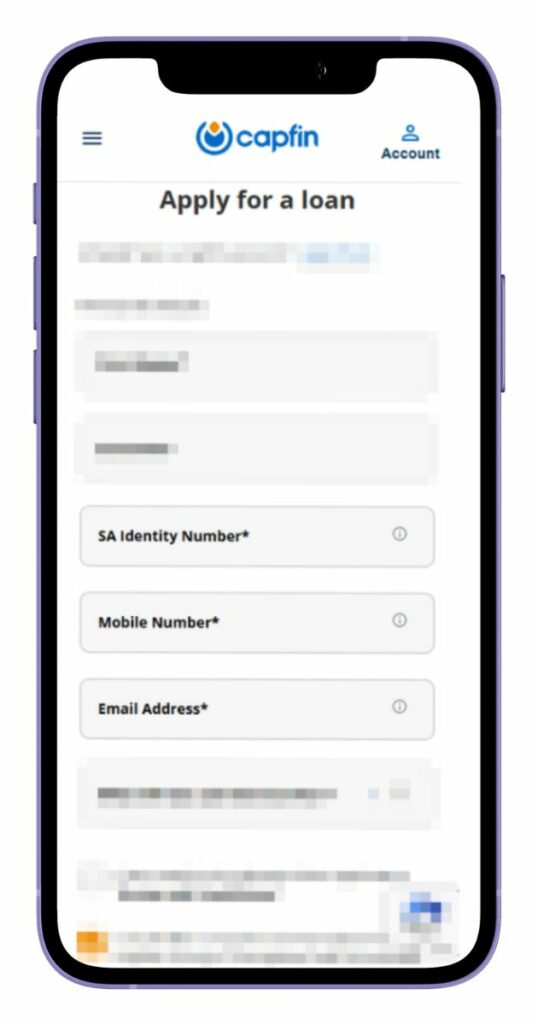

Step 5. Fill in your ID, mobile, and email details.

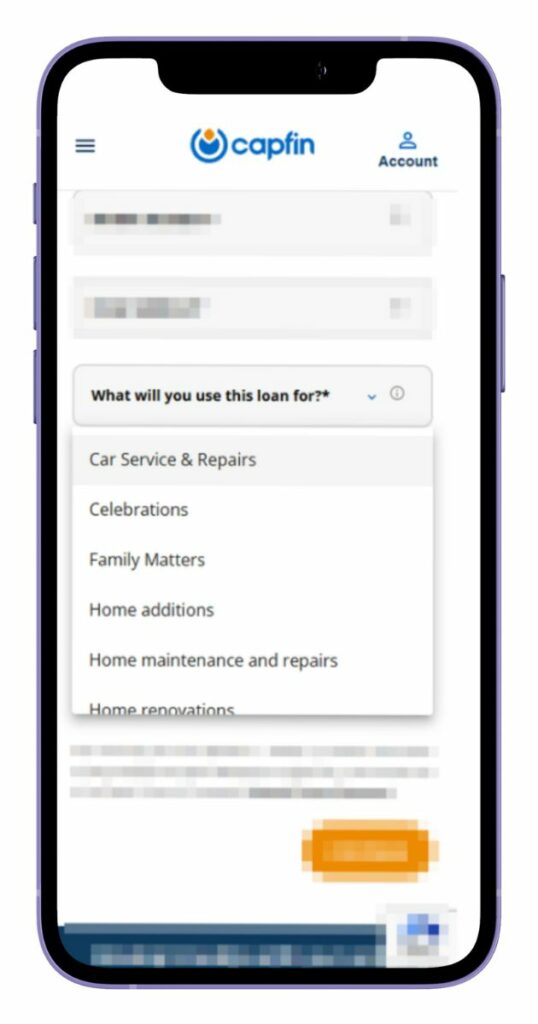

Step 6. Choose the loan purpose from the list.

Step 7. Read and Agree to the terms and click “Continue.

Step 8. Once approved, sign the loan agreement.

Step 9. Receive your funds directly in your bank account.

Eligibility Check

Ackermans.co.za, in partnership with Capfin, provides straightforward tools for potential borrowers to pre-check their loan eligibility, ensuring they meet the basic requirements before submitting a full application. Here’s how applicants can assess their eligibility:

- Online Pre-Check: Customers can visit the Capfin website or use the mobile application to receive an instant status on their loan qualification. By entering basic details such as income information and ID number, applicants can obtain a preliminary response before proceeding with a full application.

- SMS Check: Ackermans customers can also initiate the process by sending an SMS with their ID number to the designated Capfin number (e.g., 33005). This service offers immediate feedback on the customer’s potential loan eligibility.

These tools assist potential borrowers in understanding whether they are likely to meet the lender’s requirements, saving them time and effort before moving forward with a full application.

How Much Money Can I Request from Ackermans?

Ackermans, through its partnership with Capfin, offers personal loans with a minimum loan amount of R1 000 and a maximum of R50 000. These loan amounts cater to various financial needs, ranging from small, short-term expenses to larger financial requirements such as home repairs or educational costs.

Receive Offers

Ackermans creates personalised loan offers through Capfin’s affordability assessment system. When you apply, Capfin evaluates your financial profile, including your income and credit history. Based on this information, a loan amount and repayment terms are tailored to your unique financial situation. This approach ensures that the loan offered aligns with your ability to repay it, promoting responsible lending practices.

How Long Does It Take to Receive My Money from Ackermans?

The average processing time for receiving your loan from them is typically 24 to 48 hours after approval. This quick turnaround is ideal for borrowers needing access to funds promptly. However, certain factors, such as the accuracy of submitted documents and the time required to verify income, can affect the speed of disbursement. Applications submitted online or in-store that include all required documents are processed more quickly.

How Do I Repay My Loan from Ackermans?

Ackermans offers multiple repayment options to accommodate different preferences:

- Debit Order: The most common option is setting up an automatic debit order from your bank account for monthly repayments.

- In-Store Payments: You can make repayments at any of their stores or other Capfin-approved retail locations.

- Electronic Funds Transfer (EFT): You can transfer payments directly to the lender using online banking.

There are no penalties for early settlement, allowing you to repay your loan earlier than the agreed term without incurring additional charges. However, failure to make payments on time may result in late fees or penalty interest, which could negatively impact your credit score.

Pros and Cons of Choosing Ackermans Loans

Pros

- Convenient Application Process: With applications available online, in-store, or via SMS, Ackermans makes it easy for customers to apply for a loan, even for those without regular internet access.

- Quick Approval and Disbursement: Borrowers typically receive loan approval and funds within 24 to 48 hours, making it a suitable option for urgent financial needs.

- Early Settlement Without Penalties: They offer flexibility by allowing borrowers to pay off their loans early without incurring any penalties.

- Accessible Loan Amounts: With loans ranging from R1 000 to R50 000, they cater to various financial needs, from small, short-term expenses to larger obligations.

Cons

- High Interest Rates: Their loans come with relatively high interest rates, particularly for longer repayment terms, which can be costly for some borrowers.

- Limited Loan Types: Unlike traditional banks, they focus on personal loans and does not offer specialised loan products like home or car loans.

- Eligibility Based on Credit Profile: Borrowers with poor credit may face challenges in securing favourable loan terms, and the interest rate can be higher depending on credit history.

Customer Service

If you have more questions about Ackermans loans, there are several ways to get in touch with customer service. You can visit any Ackermans store or call their service line. Additionally, you can manage your loan inquiries through Capfin’s online platform. For help with applications or specific queries, Ackermans encourages customers to take advantage of in-store support or reach out directly to Capfin’s customer support team.

Ackermans.co.za Contact Channels

Phone number:

Office:

0860 900 100 (SA)

+27 21 928 1040 (International)

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: Closed

Postal address:

Ackermans Head Office, 12 Searle Street, Cape Town, South Africa

Online Reviews of Ackermans

Ackermans loans, offered in partnership with Capfin, receive a range of customer feedback. Positive reviews often mention the straightforward application process and accessibility through both in-store and online platforms. Many customers find the short processing time—typically 24 to 48 hours for approvals and disbursements—particularly useful for urgent financial needs.

On the downside, some customers express concerns about high interest rates, especially for those with lower credit scores. There are also occasional complaints about customer service, including delays in issue resolution and limited communication channels. While the loan process is generally efficient, the interest rates may be a drawback for those seeking more affordable long-term credit options.

Alternatives to Ackermans

For those exploring options beyond Ackermans loans, several South African credit providers offer similar or more specialized loan products:

Comparison Table

| Feature | Ackermans | Capitec | Wonga | Nedbank | Vodacom | PEP Loans |

|---|---|---|---|---|---|---|

| Loan Amount | R1 000 – R50 000 | Up to R250 000 | Up to R8 000 | Up to R300 000 | Up to R250 000 | R1 000 – R50 000 |

| Repayment Terms | 6 – 12 months | 1 – 84 months | 4 – 6 months | 6 – 72 months | 3 – 72 months | 6 – 12 months |

| Interest Rate | Varies (up to 5% monthly) | Variable (based on credit) | Varies | Variable | Competitive rates | 5% monthly or 24.5% annually |

| Application Process | Online, In-Store, SMS | Online, In-Branch | Online | Online, In-Branch | Online via VodaPay app | Online, In-Store at PEP locations |

| Early Settlement Penalty | No | No | No | No | No | No |

| NCR Accredited | Yes | Yes | Yes | Yes | Yes | Yes |

| More Info | Capitec Review | Wonga Review | Nedbank Review | Vodacom Review | PEP Loan Review |

History and Background of Ackermans

Ackermans, a prominent South African retail brand founded in 1916 by Gus Ackerman in Wynberg, Cape Town, began as a retailer focused on affordable fashion for all ages. Today, it has grown significantly under the Pepkor group, a subsidiary of Steinhoff International, and is a well-established name in South African households. While its core offerings remain in fashion and home goods, it broadened its services to include financial solutions, such as personal loans in collaboration with Capfin.

Their commitment to providing affordable products and services is central to its mission, prioritizing value for money and accessibility. This mission extends to their financial services, where they seek to offer accessible credit to South Africans who may face barriers to traditional banking options. The company aims to be a reliable and community-focused retailer, continually adapting to meet its customers’ evolving needs with convenience and integrity.

Conclusion

Ackermans loans offer South Africans an accessible option for short-term credit, particularly for those needing quick access to funds. The application process is simple and available both online and in-store, providing convenience for various borrower needs. While interest rates may be higher depending on individual credit profiles, they remain a practical choice with its flexible repayment options and reasonable loan amounts. Prospective borrowers, however, should weigh the total cost of borrowing to ensure it aligns with their financial situation.

Frequently Asked Questions

Through its partnership with Capfin, provides personal loans up to a maximum of R50,000. The actual amount you may qualify for depends on an affordability assessment based on your credit profile and monthly income, making it adaptable for various financial needs, whether small or more significant.

Loan approval generally takes between 24 and 48 hours after all required documents—such as your ID and proof of income—are submitted. This quick processing time aims to give borrowers timely access to funds for urgent needs, though actual times may vary based on how promptly documents are verified.

Yes, their loans can be applied for online via the Capfin website, as well as in-store or through SMS. The online option allows for easy document upload and application completion from home, providing a convenient alternative to visiting a store. For those who prefer face-to-face assistance, any of their branch is available for in-person applications.

No, they do not impose penalties for settling loans early. This means you’re free to repay the loan before the end of the agreed term without extra fees, potentially reducing the total interest paid.

To apply, you’ll need to provide a valid South African ID, the latest three bank statements or recent payslips, and a cellphone number for communication purposes. These documents support the assessment of your income and identity, helping ensure you meet the eligibility criteria.