Atlas Finance [Atlasfinance.co.za] takes pride in its status as an authorized and registered provider of a range of loan services, with a legacy dating back to 1994. With a substantial history and a strong market presence, the company has played a crucial role in aiding thousands of individuals in realizing their financial objectives. This lender adopts an approach that combines traditional values with modern solutions, ensuring that their services are not only reliable but also adapted to meet the changing needs of today’s consumers. This blend of experience and adaptability positions them as a notable player in the financial services sector, committed to assisting individuals on their financial journeys.

Atlas Finance offers short-term personal loans ranging from R500 to R8 000, with repayment terms between 2 and 6 months. If you’re looking for a fast and flexible loan option tailored to smaller financial needs, read on to find out more about Atlas Finance and whether their services are the right fit for your situation.

Atlas Finance: Quick Overview

Loan Amount: R500 – R8 000

Loan Term: 2 to 6 months

Interest Rate: Up to 5% per month (0.17% per day)

Fees: Initiation fee up to R1 050 + VAT; Monthly service fee of R60 + VAT

Loan Types: Personal loans, loan consolidation, domestic worker loans

About Arcadia Finance

Make your loan search easier with Arcadia Finance. Apply for free and browse through up to 19 diverse loan offers. Our lending partners are all reputable and conform to the standards of the National Credit Regulator, providing a safe and compliant financial environment in South Africa.

Atlas Finance Full Review

Experiences with Atlas Finance Loan

Navigating the financial journey with Atlas Finance appears to be a harmonious blend of traditional values and modern financial solutions. Customer testimonials reflect a sense of satisfaction and gratitude towards the services offered by Atlas Finance. Clients depict a compassionate and understanding financial partner that steps in to provide assistance when needed most. The feedback highlights the swift and professional service, emphasizing the ease with which customers could access funds during pressing times.

Atlas Finance seems to transcend the role of a mere credit provider, embodying a partner that comprehends and cares for its clients’ financial well-being. The company appears committed to ensuring that the journey towards achieving financial goals is not only efficient but also supportive, creating an environment where clients feel understood and valued.

Types of Loans Offered by Atlas Finance

Cash Loans

Quick solutions for immediate financial needs, allowing borrowing from R500 to R8 000 with a flexible repayment period of 1 to 6 months.

Domestic Worker Loans

Specially created for domestic workers such as housekeepers and gardeners, this loan allows you to borrow up to R4 000 with repayment terms of up to 4 months. You don’t need a payslip—only three months of bank statements are required, making it more accessible for informal workers.

Each loan type is designed for specific purposes, ensuring customers find products aligning seamlessly with their financial objectives and circumstances.

Requirements for an Atlas Finance Loan

Basic Requirements

- South African ID – You must be a South African citizen with a valid ID.

- 18 years or older – Applicants must be legally of age.

- Proof of income – Typically your latest 3 months’ payslips or bank statements.

- Bank account – You need a South African bank account in your name to receive the loan.

- Cellphone number – A valid contact number for communication and loan updates.

For Domestic Worker Loans

- No payslip required.

- Only 3 months’ bank statements showing regular income.

Credit Check & Affordability Assessment

Loans are only approved if you can afford the repayments without over-indebtedness.

Atlas Finance conducts a credit check and uses the National Credit Act (NCA) guidelines to determine whether you can afford the loan responsibly.

Who Are Atlas Finance Loans Best Suited For?

These loans are designed for individuals who:

- Need Short-Term Financial Assistance for Emergencies or Daily Expenses

- Have a Stable Source of Income and Can Provide Proof of Employment

- Prefer Access to Smaller Loan Amounts Between R500 and R8 000

- Appreciate Fast, Convenient Application Processes – Online or In-Branch

- Require Repayment Terms of Up to 6 Months with Fixed Installments

Is Atlas Finance a Safe and Good Option?

Atlas Finance is a registered credit provider regulated by the National Credit Regulator (NCR CP 3994), making it a legitimate and reliable lender in South Africa. The company offers short-term personal loans ranging from R500 to R8 000, with repayment terms of 2 to 6 months. Borrowers can apply either online or at one of over 250 branch locations nationwide, with basic documentation such as a valid South African ID or passport, proof of income, and three months’ bank statements required.

Atlas Finance focuses on transparent and responsible lending, providing clear information on interest rates, fees, and repayment terms upfront. Loan applications are subject to affordability checks, and funds are typically paid out quickly via a NuCard, which can be used at ATMs and major retailers. With its emphasis on accessibility and customer support, Atlas Finance is a suitable option for individuals seeking fast, short-term financial assistance.

Simulation of a Loan at Atlas Finance

Step 1. Go to Atlasfinance.co.za

Step 2. Open their site and tap “Apply Now”.

Step 3. Fill in the Agent/Referral Code (if available).

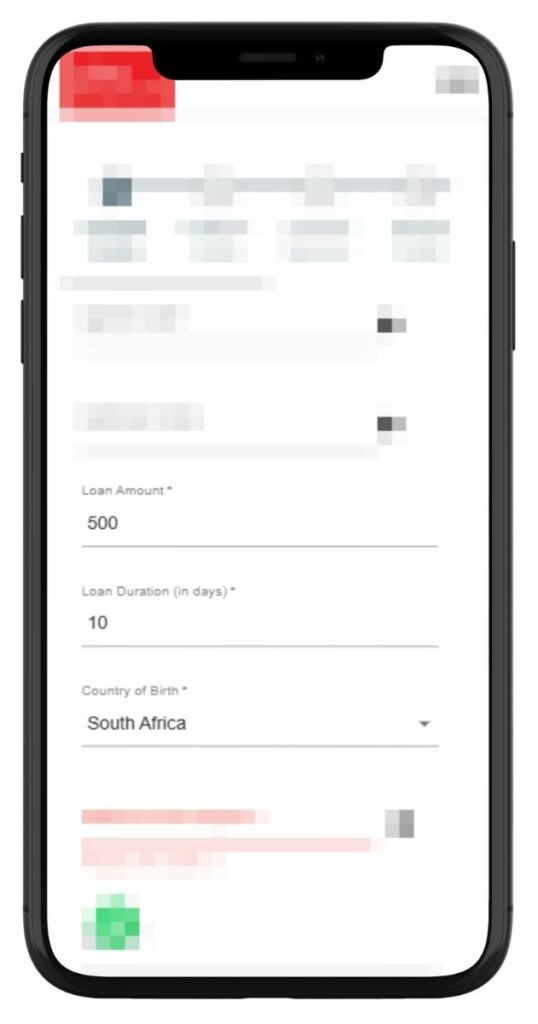

Step 4. Enter your loan amount, loan duration, and country of birth.

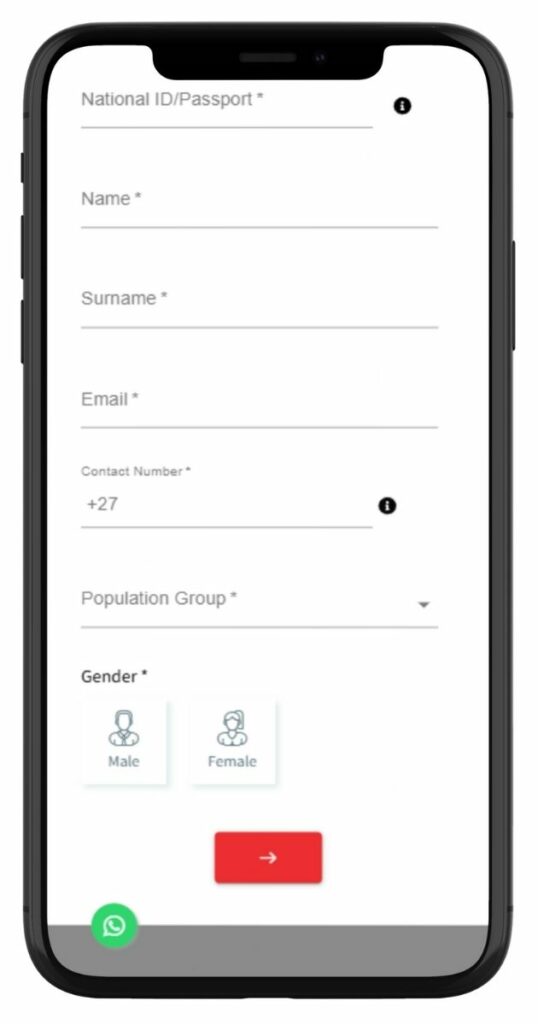

Step 5. Enter your details, select gender, and tap the red arrow to proceed.

Step 6. Submit your application for review and await a decision.

Eligibility Check

Atlas Finance provides tools enabling potential borrowers to assess their eligibility for a loan before the full application process. These tools offer preliminary insights, facilitating a more informed and confident application. By utilizing these tools, applicants can gain a clearer understanding of their likelihood of loan approval, enhancing preparedness and assurance.

Security and Privacy

Atlas Finance employs robust security protocols and technologies to fortify its systems against potential threats. This commitment to security reflects Atlas Finance’s dedication to providing a safe environment where customers can engage in financial transactions with peace of mind.

In addition to security measures, they uphold stringent privacy policies governing the handling and usage of customer data. These policies ensure customer information is managed with utmost discretion and integrity, detailing measures in place for data protection, usage, sharing, and retention.

How Much Money Can I Request from Atlas Finance?

Atlas Finance demonstrates adaptability in its loan offerings, allowing borrowers to request amounts that suit their specific financial needs. The minimum borrowing amount is set at R500, accommodating even modest financial requirements. On the higher end, this lender extends loans up to a maximum of R8 000, providing substantial financial support for more significant expenses or challenges.

What sets Atlas Finance apart is its commitment to offering personalised loan offers. These offers are tailored based on an individual’s unique financial circumstances and repayment capacity, ensuring that each loan is customised to align with the borrower’s specific situation and needs. This personalised approach facilitates a more manageable and sustainable repayment journey, as the loan terms are designed to resonate with the borrower’s financial reality.

How Long Does It Take to Receive Funds from Atlas Finance?

The speed at which borrowers can access funds from Atlas Finance underscores their commitment to providing timely financial support. Processing times are optimized to ensure that borrowers receive the necessary funds with minimal delay. However, the actual time may vary based on factors such as the verification of provided information and documents.

Atlas Finance – Overview in Detail

| Name | Atlas Finance |

|---|---|

| Financial | Privately Owned |

| Product | Personal Unsecured Loans |

| Minimum Age | 18 years |

| Minimum Amount | R500 |

| Maximum Amount | R8 000 |

| Minimum Term | 2 months (61 days) |

| Maximum Term | 6 months (180 days) |

| APR | 36% – 60% |

| Monthly Interest Rate | Up to 5% (0.17% per day) |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Fixed terms, direct debit payments |

| NCR Accredited | Yes (NCR CP 3994) |

| Our Opinion | ✅ Ideal for short-term borrowing needs ✅ Transparent fee structure ⚠️ Limited to smaller loan amounts |

| User Opinion | ✅ Quick and efficient service ⚠️ Loan amounts may not suffice for larger expenses |

How Do I Repay My Loan from Atlas Finance?

Repaying a loan to Atlas Finance is facilitated through a variety of repayment options, offering borrowers flexibility and convenience. The repayment plans are structured to be accommodating, providing support throughout the repayment journey.

While this lender strives to make the repayment process straightforward, borrowers should be mindful of possible fees and penalties that may apply under certain circumstances, such as late or missed payments. Awareness of these potential charges and planning repayments accordingly is crucial for a smooth and hassle-free repayment experience.

Online Reviews of Atlas Finance

Online reviews provide a glimpse into the customer experience, offering valuable insights into what individuals can expect when engaging with Atlas Finance. Customers consistently highlight the company’s commitment to customer satisfaction and their ability to deliver timely and effective financial solutions. The sentiment expressed in reviews emphasizes appreciation for the supportive and understanding approach that Atlas Finance adopts, particularly in situations where customers find themselves in financial distress.

These reviews collectively reinforce Atlas Finance’s reputation as a reliable and empathetic loan provider, showcasing their dedication to fostering positive and supportive customer relationships. The shared experiences often convey a sense of gratitude for the company’s capacity to provide meaningful financial assistance precisely when it is most needed. This positive feedback indicates that Atlas Finance has succeeded in building a reputation for reliability, empathy, and responsiveness in addressing the financial needs of its customers.

I’m happy with the service l got from Atlas finance. I got helped through my rainy days since l didn’t have any savings but Atlas finance came to my rescue and l managed to help my family back home through their service of cross boarder money transfers.

I would like to thank the Atlas team, for their great and fantastic help for a hassle free application, always friendly and ready to assist.

Atlas Finance is NOT help full with clearing one’s name if you are done paying them. Your Credit Record will not be showing you do not owe them. They will tell you they will clear your name but it will not be done.

They are absolutely disappointing. Because why would a person submit an application the Monday today is Wednesday 48hrs later and still nothing has been done. This company is pathetic and unprofessional.

Customer Service

Atlas Finance places a high priority on customer service, ensuring that every interaction is characterized by professionalism, empathy, and a genuine willingness to assist. If you have further questions or need clarification, Atlas Finance provides multiple channels through which you can seek assistance and guidance.

Reaching out to Atlas Finance’s customer service provides an opportunity to engage with a team of knowledgeable and attentive professionals ready to offer the necessary support and information to enhance your experience. Their approach is centered around ensuring that your queries are addressed with accuracy and care, fostering a more informed and confident borrowing experience.

Contact Channels

Phone number:

Customer Care Line: 0800 204 679

WhatsApp Support: 060 070 2440

Hours of operation:

Monday to Friday: 8:00 AM – 4:30 PM

Saturday & Public Holidays: 8:00 AM – 1:00 PM

Sunday: Closed

Postal address:

123 Oxford Road, Corner Cotswold Drive, Saxonwold, Johannesburg, Gauteng, 2196, South Africa

Alternatives to Atlas Finance

While Atlas Finance offers a comprehensive range of loan products tailored to various needs, being aware of alternatives in the market is beneficial. Exploring other credit comparison portals can provide a broader perspective, allowing potential borrowers to make informed decisions based on a wider array of available options.

Comparison Table

| Feature | Atlas Finance | LittleLoans | ExpressFinance | WesBank | Exclusive Loans |

|---|---|---|---|---|---|

| Loan Amounts | R100 to R8 000 | R500 to R8 000 | R500 to R8 000 | R5 000 to R200 000 | Up to R250 000 |

| Repayment Terms | 1 to 6 months | 4 months up to 6 months | 1 to 31 days | 24 to 72 months | Flexible |

| Interest Rates | 0.17% per day, up to 5% per month | Up to 5% per month | 3% per month. | From 22.5% | Not Specified |

| APR | 36% to 60% | Not Specified | Not Specified | Varies, up to 27.50% | Not Specified |

| Fees | Service fee, initiation fee, credit life | 100% free | service fee of R60, initiation fee (varies depending on loan amount), and interest. | Varies, includes initiation and monthly admin fees | Varies |

| Specialization | Personal loans | Payday loans | Payday loans | Personal loans, vehicle finance | Personal loans, bad credit loans |

| More Info | LittleLoans Review | ExpressFinance Review | WesBank Review | Exclusive Loans Review |

History and Background of Atlas Finance

Atlas Finance has solidified its position in the financial industry with a legacy spanning over 29 years. Established in 1994, the company has remained steadfast in its commitment to providing financial solutions that adapt to the evolving needs of individuals. Atlas Finance’s journey is characterized by a harmonious blend of traditional values and a modern approach, ensuring that their services are both reliable and contemporary.

The company’s mission revolves around a customer-centric approach, aiming to offer financial products that are not only accessible but also tailored to meet the unique needs of each customer. Their vision is to be a pillar of support for individuals navigating the financial landscape, providing guidance and solutions that facilitate financial well-being and the achievement of personal goals.

Pros and Cons of Atlas Finance

Pros of Atlas Finance

- Customer-Centric: Atlas Finance prioritizes customer needs, ensuring that their products and services are tailored to provide meaningful financial solutions.

- Diverse Loan Products: The variety of loan products offered allows customers to find options that align with their specific financial circumstances and objectives.

- Experience: With a legacy spanning over 29 years, Atlas Finance brings a wealth of experience and reliability to the table.

Cons of Atlas Finance

- Loan Amounts: The maximum loan amount offered by Atlas Finance is R8 000, which might not be sufficient for individuals seeking higher loan amounts for substantial financial needs.

- Fees and Penalties: Potential fees and penalties in case of late or missed payments could add to the cost of borrowing, making it essential for borrowers to be mindful of the repayment terms and conditions.

Conclusion

Atlas Finance presents a compelling option for individuals seeking a blend of experience, reliability, and customer-focused financial solutions. Their approach, marked by flexibility and support, makes them a noteworthy choice for those navigating the complexities of the financial landscape.

Frequently Asked Questions

You can borrow up to R8 000 from Atlas Finance. The actual amount you are eligible for will depend on various factors, including your financial circumstances and repayment capacity.

Atlas Finance aims to process and approve loans as swiftly as possible. Once your loan is approved, the funds are typically disbursed within 24 hours, allowing you to access the necessary financial support promptly.

Yes, there might be fees or penalties applied if a repayment is missed or delayed. It’s essential to be aware of the terms and conditions related to repayments to avoid any additional charges.

Yes, Atlas Finance offers Loan Consolidation services, which can be a suitable option if you have existing debts. This service allows you to consolidate multiple debts into a single repayment plan, potentially making it easier to manage your financial obligations.

Yes, Atlas Finance provides tools that allow potential borrowers to pre-check their eligibility for a loan. These tools offer preliminary insights into the likelihood of loan approval, helping applicants approach the application process with enhanced confidence and preparedness.