Cash Converters [cashconverters.co.za] is a well-known South African brand that was established in 1994. With several branches across South Africa as well as internationally, they offer the purchase and sale of valued items or pre-owned goods for cash. Additionally, they provide secure and unsecured short-term loan solutions, with the option of securing a loan against certain valued items.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by Cash Converters and is based solely on our research.

Key Takeaways

- Transparent and Ethical: Cash Converters is committed to clear, straightforward loan agreements with no hidden fees, adhering to the National Credit Act.

- Variety of Loan Options: They offer various loan products, including Cash Advance, Pawnbroking, Sell and Borrow Back, Personal Loans, and Instant Cash Loans.

- Inclusive Lending: Cash Converters evaluate applications fairly, requiring proof of income and a valid South African ID, making their loans accessible to many.

How Do I Know if a Cash Converters Loan Is Legit?

There are a few things you can do to check if a loan from this lender is legitimate:

- Check the company’s credentials: Ensure that the company is registered with the appropriate authorities and has a valid license to operate. In most countries, lenders must be licensed by the state or national government.

- Look for reviews: Read customer reviews of the company to get an idea of its service level and reputation. Make sure to read reviews from various sources to get a well-rounded picture.

- Check for contact information: Verify that the company has a valid phone number and email address that you can use to contact them if you have any questions or concerns.

- Check their website: A legitimate loan company should have a professional website with clear information about their products and services. It should also display the proper certificates and licenses.

- Understand the terms and conditions: Make sure you understand the terms and conditions of the loan, including the interest rate, repayment schedule, and any fees.

Who Can Apply for a Cash Converters Loan?

Cash Converters [cashconverters.co.za] welcomes a broad range of individuals to apply for their loans. If you’re an individual seeking a personal loan or someone looking for financial assistance against quality second-hand goods, they have a solution tailored for you. Their inclusive approach ensures that many South Africans have access to the financial support they need, when they need it.

Criteria for Potential Borrowers

While they are inclusive in their approach, there are specific criteria that potential borrowers must meet. Firstly, all applicants must be of legal age and have a valid South African ID. Additionally, proof of a stable income is essential, ensuring that borrowers have the means to repay their loan. Documentation, such as recent payslips or bank statements, may be required during the application process. Lastly, a good credit history can be beneficial, although this credit provider evaluates each application on its individual merits, ensuring a fair assessment for all.

Differences from Other Loan Providers

What sets Cash Converters apart from other loan providers is their commitment to transparency and ethical lending. While many lenders might have hidden fees or complicated terms, Cash Converters prides itself on clear and straightforward loan agreements. Their differentiated interest rates for first-time and repeat borrowers within a calendar year showcase their commitment to rewarding customer loyalty. Additionally, their adherence to the National Credit Act ensures that all their practices are above board, providing borrowers with added peace of mind. In a market flooded with options, they stand out for its integrity, transparency, and commitment to its borrowers.

About Arcadia Finance

Arcadia Finance helps you easily find a loan without costing you anything. You can fill out an application and look at options from up to 19 lenders. Each lender is checked and approved by the National Credit Regulator, so you can trust them as they legally operate in South Africa.

Cash Converters Loan

What Makes the Cash Converters Loan Unique?

When it comes to securing a loan, they have become a go-to choice for many individuals. But what exactly makes a their loan stand out in a crowded market?

Unique Features of Cash Converters Loan

Cash Converters [cashconverters.co.za] is not just another lender in the market. Their approach to lending is rooted in transparency, fairness, and a genuine understanding of their customers’ needs. Unlike many other lenders who might have a one-size-fits-all approach, this loan provider tailors its loan offerings based on individual requirements. Their adherence to the National Credit Act ensures that all their lending practices are ethical and above board. This commitment to transparency means borrowers are always in the know, with no hidden surprises or terms.

Advantages of the Cash Converters Loan Comparison

Comparing them with other loan providers highlights several advantages. Firstly, their clear breakdown of loan fees and charges ensures borrowers are never caught off guard. The differentiated interest rates for first-time borrowers and those taking subsequent loans within a calendar year are another feather in their cap, making it more appealing for repeat borrowers. Their inclusive approach, coupled with a broad range of loan products, ensures that a wide array of individuals can access the financial support they need.

Types of Loans Offered by Cash Converters

Cash Converters [cashconverters.co.za] South Africa offers a range of loan products designed to meet different financial needs. Here’s an overview of the main types of loans available:

Cash Advance Loans

Cash Advance Loans are short-term loans designed to help individuals cover unexpected expenses or manage cash flow until their next payday. These loans are typically small, unsecured, and have a short repayment period, often due within a month.

Key Features:

- Quick approval process

- No collateral required

- Ideal for emergency expenses

Sell and Borrow Back

The Sell and Borrow Back option allows individuals to sell their valuable items to them and then borrow money against the same items. This offers flexibility for those who need quick cash but wish to retain ownership of their items in the long term.

Key Features:

- Option to repurchase items

- Flexible repayment terms

- Suitable for high-value items

Pawnbroking Loans

Pawnbroking Loans involve borrowing money against the value of a personal item, such as jewellery, electronics, or other valuables. The item is used as collateral, and the loan amount is based on its appraised value.

Key Features:

- No credit checks required

- Immediate access to cash

- The item can be reclaimed upon loan repayment

Personal Loans

Personal Loans from them are unsecured loans intended for various personal needs, such as home improvements, medical expenses, or education costs. These loans typically offer fixed interest rates and repayment terms.

Key Features:

- Fixed interest rates

- Flexible loan amounts and terms

- Can be used for various purposes

Instant Cash Loans

Instant Cash Loans provide immediate cash based on the value of items you wish to sell. This service is quick and convenient, offering a fast solution for those in urgent need of funds.

Key Features:

- Immediate cash based on item value

- No lengthy application process

- Convenient for urgent financial needs

Step-by-Step Guide to Applying for a Loan with Cash Converters

- Initial Research: Before starting the application, it’s wise to familiarise yourself with the different loan products offered by them. If you’re interested in a personal loan or a loan against second-hand goods, understanding the specifics will help you make an informed decision.

- Visit the Official Website or Store: They are a user-friendly website where potential borrowers can find detailed information about the loan application process. Alternatively, visiting a physical store can provide a more hands-on experience, with staff available to answer any queries.

- Eligibility Check: Before the formal application, make sure you meet the basic eligibility criteria. This typically includes being of legal age, having a valid South African ID, and proof of a stable income.

- Fill Out the Application Form: Whether online or in-store, you’ll need to complete an application form. This form will ask for personal details, income information, and the desired loan amount.

- Submit Necessary Documents: Along with the application form, you’ll need to provide supporting documents such as your ID, recent payslips, or bank statements.

- Loan Assessment: Once your application and documents are submitted, they will assess your eligibility, creditworthiness, and the loan amount you qualify for.

- Loan Approval: If everything is in order, they will approve your loan. The approval time can vary, but Cash Converters aims to process applications promptly.

- Loan Disbursement: Upon approval, the loan amount will be disbursed. The mode of disbursement can vary, but it’s typically done through a bank transfer or in cash if processed in-store.

- Repayment Schedule: After receiving the loan, you’ll be given a clear repayment schedule. It’s important to follow this schedule to maintain a good credit history and avoid any additional charges.

Eligibility Check

Cash Converters understands the importance of efficiency and may offer tools or methods for potential borrowers to check their eligibility in advance. This could include an online eligibility calculator or a quick assessment tool on their website. By entering basic information, these tools can provide a preliminary estimate of the loan amount you might qualify for. This helps borrowers have a clear understanding before starting the formal application process.

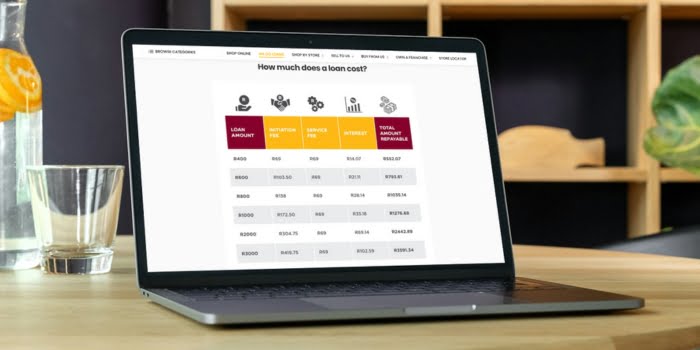

How Much Money Can I Request from Cash Converters?

When considering a loan from Cash Converters [cashconverters.co.za], a common question borrowers have is about the amount they can request. This lender offers a range of loan amounts to cater to the diverse needs of its customers. While the exact minimum and maximum amounts can depend on individual circumstances and the specific loan product, they ensure their offerings are competitive and align with market standards.

Receive Offers

This lender takes pride in creating personalised loan offers for its customers. Rather than a standard approach, they assess each application on its own merits. Factors such as the borrower’s credit history, income level, and the value of collateral (for loans against goods) influence the loan amount and terms. This approach ensures that borrowers receive offers tailored to their unique financial situation.

How Long Does It Take to Receive My Money from Cash Converters?

The time it takes to receive funds from them can vary based on several factors. On average, once a loan is approved, disbursement is prompt, often within a business day. However, this can change depending on the loan type, the method of disbursement, and other factors.

Factors Affecting Withdrawal Speed

Several factors can influence how quickly you receive your loan amount from them. The completeness and accuracy of the provided documentation can play a significant role. If there are discrepancies or missing documents, it might lead to delays. Additionally, the method of disbursement, whether it’s a bank transfer or cash pickup from a store, can also affect the speed. Lastly, the volume of applications being processed at a given time might impact the processing speed.

How Do I Repay My Loan from Cash Converters?

Repaying a loan from them is designed to be straightforward and convenient. Borrowers receive a clear repayment schedule that outlines the amount due and the due dates. There are various repayment options available, including bank transfers, in-store payments, or automated deductions, providing flexibility for the borrower.

Possible Fees and Penalties

While Cash Converters is open about its loan terms and fees, it’s important for borrowers to be aware of any potential fees and penalties. Late or missed payments might result in additional charges. It’s advisable to thoroughly review the loan agreement and contact them for any clarifications. Taking these steps ensures that borrowers are well-informed and can manage their loans effectively, avoiding any unexpected charges.

Are Cash Converters Loan Reviews Positive?

Reviews can vary based on an individual’s personal experience with the company. It’s advisable to research multiple sources and read a range of reviews to gain a balanced understanding of a company and its services. Positive reviews for credit lending companies can be hard to find, as people are often more vocal about negative experiences. Satisfied customers may not leave feedback as frequently, making it appear that criticism outweighs praise. Some individuals might express frustration when denied a loan, not realising that the denial is due to not meeting the eligibility criteria. This frustration often leads to negative comments in online forums or on the company’s social media pages.

What are Cash Converters Loans contact details?

You can visit any of their nearby stores to make an inquiry, or you can contact them by phone at +27 (0) 87 820 4758 or email customercare@cashconverters.co.za.

This credit provider is dedicated to providing excellent customer support. They aim to ensure customer satisfaction by offering multiple communication channels. You can email them at customercare@cashconverters.co.za with any questions or concerns. Additionally, you can use the question-and-answer form provided below if you prefer.

Alternatives to Cash Converters

While they offer a range of loan products tailored to meet various needs, it’s always a good idea to explore alternatives. The lending market is vast, with numerous credit providers offering competitive products. Some other credit comparison portals can provide insights into various loan offers available in the market.

Side-by-Side Comparison of Cash Converters with its Top Competitors

| Bank Name | Loan Product Name | Interest Rate | Loan Term | Max Loan Amount | Fees | Requirements |

|---|---|---|---|---|---|---|

| Cash Converters | Payday Loan | Varies | 1 month | R4,000 | Varies | SA ID, proof of income |

| Absa Bank | Express Loan | 24% p.a. | 12 months | R50,000 | R600 initiation fee | SA ID, proof of income, credit check |

| Standard Bank | Personal Loan | 22% p.a. | 24 months | R100,000 | R1,200 initiation fee | SA ID, proof of income, credit check |

| Nedbank | Unsecured Loan | 25% p.a. | 3 months | R10,000 | R500 service fee | SA ID, proof of income |

| First National Bank (FNB) | Revolving Loan | 23% p.a. | Indefinite | R80,000 | R850 initiation fee | SA ID, proof of income, credit check |

History and Background of Cash Converters

Cash Converters, established in the 1980s, began its journey in Perth, Australia. Initially set up as a platform for individuals to sell their second-hand goods, the company expanded its services over the years. It entered the pawnbroking industry and eventually diversified into personal finance. Today, this credit provider in several countries, including South Africa, offering a variety of financial services alongside its original retail focus.

Company’s Mission and Vision

Their mission is to provide customers with a range of financial solutions tailored to their individual needs, ensuring transparency, fairness, and ethical practices. Their vision is to be a global leader in the personal finance sector, known for their commitment to customer satisfaction and adherence to industry best practices.

Pros and Cons of Cash Converters Loans

Strengths

- Simple Application Process: Applying for a loan is straightforward and quick, making it an option for those who need funds urgently.

- Varied Loan Options: They offers different types of loans, such as personal loans, pawnbroking loans, and buyback loans, allowing you to select one that suits your needs.

- No Credit Check: Typically, they do not require a credit check, making it accessible even for those with poor credit or no credit history.

- Short-Term Financing:They generally provides short-term loans with repayment periods of a few months, useful for covering expenses until your next paycheck.

- Convenient Locations: With physical branches available worldwide, Cash Converters offers the advantage of applying for loans in person and accessing your funds directly.

Weakness

- High Interest Rates: Their loans often come with higher interest rates and fees compared to other loan types, potentially increasing the overall cost.

- Short-Term Loans: While the short-term nature of these loans can be advantageous for temporary needs, it may not be suitable for those requiring longer-term financing.

- Limited Loan Amounts: The maximum loan amounts offered might be relatively low, which could be insufficient for borrowers needing larger sums.

- Risk of Debt Cycle: There is a risk that borrowers might take out additional loans to repay existing ones, leading to a potential cycle of debt if not managed carefully.

- Risk of Predatory Practices: As Cash Converters loans often cater to those with poor credit, there is a risk of encountering predatory lending practices.

Conclusion

Cash Converters has established a distinct position in the personal finance sector. Their focus on clear communication, ethical lending practices, and prioritising customer needs has garnered the confidence of many borrowers globally. Although they offer several benefits, as with any organisation, there are aspects where improvements could be made.

Frequently Asked Questions about Cash Converters

Cash Converters is an international company offering a range of financial services, including personal loans and loans secured against second-hand goods. Established in Australia, it has since expanded to various countries, including South Africa.

They provide personal loans for various needs and loans secured by quality second-hand items. This allows individuals to use their valuable goods as collateral to obtain a loan.

You can apply for a loan with Cash Converters either online via their official website or by visiting one of their physical branches. The process involves completing an application form and submitting the required documents.

To be eligible, applicants must be of legal age, hold a valid South African ID, and provide proof of a stable income. Additional criteria may apply depending on the specific loan product.

Once a loan is approved, Cash Converters usually disburses the funds quickly, often within a business day. The exact timeframe can vary depending on the type of loan and other factors.