Having carved out a solid reputation in the financial services sector, Debt Busters [debtbusters.co.za] has committed its resources to helping South Africans tackle financial challenges with a range of loan products. Whether you’re wrestling with mounting debts or seeking funds for significant expenses, knowing what Debt Busters provides can help inform your decision-making process.

Debt Busters Loan Overview

Debt Busters [debtbusters.co.za] distinguishes itself in the South African loan market by prioritizing debt management and restructuring. Unlike traditional lenders that mainly offer standard loan products, they deliver solutions crafted to ease financial strain. This distinctive approach involves personalized guidance and financial planning, aiming to assist borrowers not only in handling their debts but also potentially decreasing them over time.

Types of Loans Offered by Debt Busters

Debt Busters offers a variety of loan types, each tailored to meet different financial needs and objectives. Below is an in-depth description of each loan product and its suitable purposes:

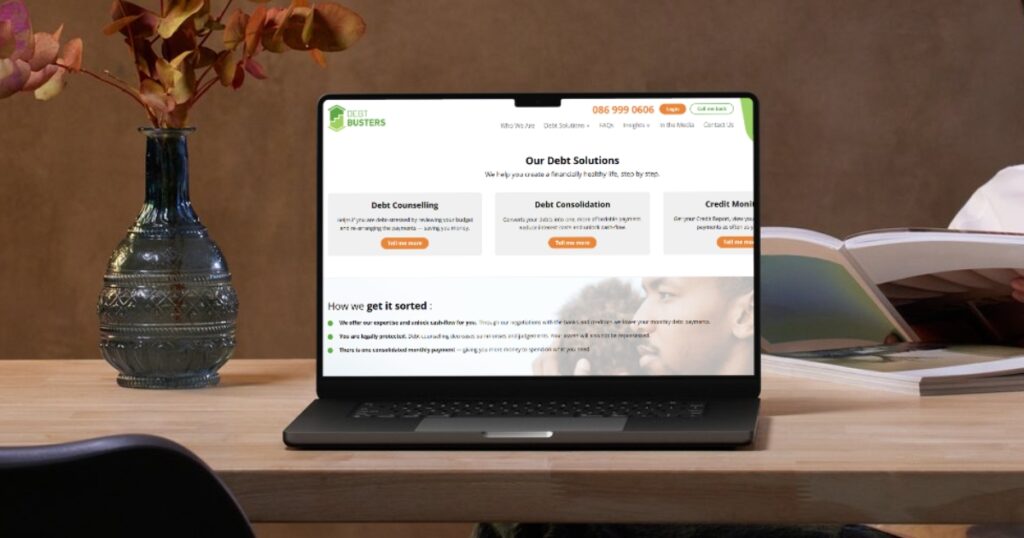

Debt Consolidation Loans

These loans are perfect for individuals contending with multiple debts. This lender’s consolidation loans enable borrowers to merge various debts into a single loan featuring potentially lower interest rates and simpler payment terms. This consolidation can lead to reduced monthly payments and a clearer path to debt freedom.

Suitable purposes:

- Combining credit card debts, store card debts, and other high-interest loans.

- Streamlining finances by consolidating multiple repayments into one monthly payment.

- Potentially decreasing the total monthly payment and interest rate.

Personal Loans

Personal loans from them are versatile and can be utilized for various purposes, from handling unforeseen expenses to financing significant purchases or home improvements. These loans are typically unsecured, meaning no collateral is required, and they offer flexible repayment terms.

Suitable purposes:

- Covering emergency expenses like medical bills or urgent home repairs.

- Financing major life events such as weddings or educational fees.

- Undertaking home renovations or acquiring high-cost appliances.

Home Loans

For those aiming to buy a home or refinance an existing mortgage, Debt Busters provides home loans with competitive rates and terms. These loans are secured, with the property serving as collateral, often resulting in lower interest rates compared to unsecured loans.

Suitable purposes:

- Purchasing a new home.

- Refinancing an existing mortgage to secure better interest rates and terms.

- Investing in property to diversify personal assets.

About Arcadia Finance

Streamline the process of securing a loan with Arcadia Finance. Apply at no cost and review options from as many as 19 different lenders. Every lending affiliate we collaborate with is credible and regulated by the National Credit Regulator, ensuring both compliance and reliability in the South African financial sector.

Requirements for a Debt Busters Loan

To secure a loan with this lender, you must meet specific eligibility criteria and submit various documents to support your application. This process ensures that loans are extended to individuals who can feasibly manage and repay their borrowed amounts, adhering to responsible lending standards.

Eligibility Criteria

- Age Requirement: Applicants must be over the age of 18, legally recognized as adults.

- Stable Income: Proof of income is essential to demonstrate the ability to repay the loan.

- Citizenship or Residency: Applicants must be South African citizens or permanent residents, verified through valid identification.

- Credit History: While they may consider applicants with less-than-perfect credit, a positive credit history improves approval chances and may lead to better terms.

- Bank Account Details: A South African bank account is required for loan deposit and repayment withdrawals.

Documents and Information Needed

- South African ID: To verify identity and legal age, applicants must provide their ID book or Smart ID card.

- Recent Payslips: Typically, payslips from the last three months are required to validate income.

- Bank Statements: Statements from the past three months showing income and expenses assist in assessing financial behavior and repayment capability.

- Proof of Residence: A recent utility bill or similar document confirms the residential address.

- Credit Report: Occasionally, applicants may need to provide a credit report, or Debt Busters will obtain one with permission to verify credit history.

- Existing Debts Details: For debt consolidation loans, information on current debts to be consolidated must be provided.

Collecting these documents beforehand can expedite approval and simplify the process. Debt Busters utilizes this information to customize loan products to your financial situation, enhancing your ability to manage the loan effectively.

Stay updated with the best loan providers in South Africa today by checking out our latest list. This resource is invaluable for anyone seeking to compare rates and terms across different lenders efficiently.

Simulation of a Loan at Debt Busters

- Initial Research: Get acquainted with Debt Busters’ loan options by visiting their website [debtbusters.co.za] or reaching out to customer service.

- Eligibility Check: Utilize their online tools to verify if you meet basic eligibility criteria such as age, income, and residency.

- Document Preparation: Gather essential documents like your ID, recent payslips, bank statements, and proof of address.

- Application Submission: Complete the application form on their website, providing/uploading required documents and information.

- Loan Assessment: They will review your application and conduct a credit assessment to assess your suitability for the loan.

- Approval and Disbursement: If approved, you’ll receive a loan agreement to sign. Once signed, the loan amount will be deposited into your account.

- Repayment: Adhere to the agreed repayment schedule. Setting up automated payments can help ensure you never miss a payment.

If you’re seeking a platform that simplifies financial decision-making and debt management alike, our JustMoney Review showcases a reliable comparison tool for budgeting, saving, and borrowing smarter.

Tools or Methods Offered by Debt Busters to Pre-check Eligibility

Debt Busters offers several tools to assist potential borrowers in pre-checking their eligibility:

Online Eligibility Calculator: Available on their website, this online tool enables you to input your financial details, such as income and existing debt obligations, to evaluate your eligibility for a loan.

Preliminary Online Assessment: Certain stages of the application process may entail a soft credit check, which does not impact your credit score but provides an initial indication of your loan eligibility.

Customer Service Consultation: For individuals who prefer personalized assistance, you can directly communicate with their customer service representative. They can conduct a preliminary eligibility assessment over the phone, offering guidance tailored to your specific circumstances.

Security and Privacy

Debt Busters prioritizes the security and privacy of its clients’ personal and financial information. Recognizing the critical nature of safeguarding such sensitive data, they have implemented a robust framework of security measures and adhere to strict privacy policies.

Ensuring the Security of Personal and Financial Information

To prevent unauthorized access, use, or disclosure of client information, Debt Busters employs advanced security technologies and stringent procedures. They utilize Secure Socket Layer (SSL) technology to encrypt all data transmitted between clients’ browsers and their servers, ensuring confidentiality during transmission. Additionally, advanced firewall technology and security protocols are in place to protect internal networks and databases from cyber threats. Regular security audits further strengthen their defense systems by promptly identifying and addressing potential vulnerabilities.

Privacy Policies and Data Handling Practices

Debt Busters is committed to maintaining client privacy. Their privacy policies clearly outline how personal information is collected, used, and shared, ensuring transparency. Information is collected only to the extent necessary for processing loan applications, providing financial advice, and offering tailored services. This includes personal details and financial data required for effective service provision.

The use of collected information is limited to assessing loan eligibility, managing accounts, and facilitating client communication. This lender ensures that information is used solely for its intended purposes and does not sell or rent it to third parties. Information sharing is restricted to what is necessary for transaction completion, legal compliance, or with explicit client consent.

Information retention practices comply with legal requirements, retaining data only for necessary periods. Once no longer needed, personal information is securely disposed of. Clients have rights regarding their personal information, including access, correction, or deletion requests, with clear instructions provided in the privacy policy on how to exercise these rights.

How Much Money Can I Request From Debt Busters?

Debt Busters offers a variety of loan amounts to cater to diverse financial needs. The minimum loan request usually starts at R1,000, suitable for addressing small, immediate expenses. On the higher end, borrowers may be eligible for a maximum loan amount of up to R250,000. However, these figures are indicative and subject to variation. Therefore, it’s advisable to verify the latest details directly from them.

Personalized Loan Offers

Debt Busters tailors loan offers by assessing each applicant’s individual financial profile. This involves evaluating credit history, existing financial commitments, income stability, and overall repayment capability. Through this comprehensive approach, they ensure that loan offers align with the borrower’s financial circumstances, enhancing affordability and minimizing financial strain.

Receiving Your Funds

Upon approval of a loan application, the time it takes to receive the funds can vary. Typically, processing times range from 24 to 48 hours. However, several factors may influence this timeline:

- Verification Speed: Providing required documentation promptly expedites the verification process.

- Bank Processing Times: The speed at which your bank processes incoming transfers affects fund availability.

- Application Accuracy: Ensuring that all application information is accurate and complete helps prevent processing delays.

Repaying Your Loan from Debt Busters

Repayment Options and Plans

Debt Busters provides flexible repayment plans to ensure borrowers can effectively manage their loans alongside other financial commitments. Repayments are typically structured on a monthly basis, with the flexibility to choose the repayment duration. This period can range from a few months to several years, depending on the loan amount and agreement terms.

Possible Fees and Penalties

Understanding potential fees and penalties associated with your loan is essential. This credit provider may charge initiation fees, service fees, and in some cases, early repayment fees if you settle your loan before the scheduled term. Late payment penalties may also apply if repayments are not made on time. These fees and penalties are outlined in the loan agreement, so it’s crucial to review these terms carefully to avoid surprises during the loan tenure.

Online Reviews of Debt Busters

Customer feedback serves as a valuable tool for assessing the performance and reliability of a company like Debt Busters. Online reviews often highlight several key aspects of their service.

Customer Service: Many reviewers commend them for their professional and supportive customer service. Customers appreciate the staff’s responsiveness and willingness to address queries and concerns, which enhances their overall experience. The advice provided is often described as helpful and tailored to individual financial situations, making debt management more approachable for many.

Efficiency: Reviews frequently praise them for the efficiency of their loan processing. Customers value the quick turnaround times from application to receipt of funds, particularly crucial for those in need of urgent financial assistance.

Transparency: Transparency in terms and conditions, fees, and repayment expectations is another positive aspect commonly highlighted in reviews. Customers feel well-informed about their loans, which fosters trust and confidence in this lender as a financial partner.

Further Questions for Debt Busters

If you have further inquiries or need specific advice regarding Debt Busters’ services, there are several communication channels available:

- Debt Busters maintains a dedicated customer service line where you can directly speak with a representative who can provide detailed information and assist with any queries you may have.

- Email and Online Contact Forms: For less urgent queries or when seeking detailed documentation, contacting them via email or their online contact form is a practical option. This method also allows for a record of communication, which can be useful for future reference.

- Visit Their Website: Their website offers comprehensive information about their services, including frequently asked questions (FAQs) that might address your concerns immediately.

- Social Media Channels: They also utilize social media platforms, which often provide updates and serve as another means to contact their customer service teams. Interaction through social media can sometimes yield quicker responses to straightforward questions.

Engaging with them through these communication channels can provide you with more clarity regarding their loan products, terms, and services. It ensures that all your concerns are addressed before making any financial commitments.

Alternatives to Debt Busters

When you’re thinking about managing debt or seeking loan services, it’s helpful to look at different options to find the one that fits your financial situation best.

Comparison Table

| Feature | Debt Busters | Wonga | Capitec Bank |

|---|---|---|---|

| Products Offered | Debt consolidation loans, personal loans, home loans | Short-term personal loans | Personal loans, Multi loans |

| Loan Amounts | R1,000 to R250,000 | R500 to R8,000 (up to R4000 for new customers) | up to R500,000 |

| Loan Term | Up to 5 years | From 4 days to 6 months | Up to 84 months |

| More Info | Wonga Review | Capitec Bank Review |

History and Background of Debt Busters

Debt Busters was founded to meet the increasing demand in South Africa for efficient debt management and financial recovery solutions. Since its establishment, the company has concentrated on assisting individuals in overcoming financial challenges through personalized debt counseling and consolidation services. Over time, they developed into one of South Africa’s premier debt management firms, renowned for offering trustworthy and ethical financial solutions.

Company’s Mission and Vision

Mission: Their mission is to empower individuals to regain control of their finances by providing comprehensive debt solutions and expert financial advice. The company aims to alleviate the financial stress of its clients by offering services tailored to each individual’s unique financial situation. This mission is grounded in a commitment to transparency, integrity, and customer-centric practices.

Vision: Debt Busters aspires to lead and redefine the debt management industry in South Africa. They aim to pioneer financial innovation, offering solutions that not only address immediate financial challenges but also foster long-term financial health and stability for their clients. The company envisions a future where every South African has access to the resources and support necessary to effectively manage debt and achieve financial independence.

Debt Busters remains focused on its mission and vision, adapting to the changing economic landscape and evolving consumer needs. This approach has enabled them to maintain their status as a trusted leader in the debt management sector, dedicated to positively impacting the financial well-being of individuals throughout South Africa.

Pros and Cons of Choosing Debt Busters

When considering this lender for your financial needs, it’s crucial to evaluate both the advantages and disadvantages. This balanced perspective can assist you in making an informed decision based on your specific circumstances.

Advantages

- Comprehensive Debt Solutions: They provide a range of services, including debt consolidation, personal loans, and home loans, tailored to help clients effectively manage and reduce their debt.

- Personalized Service: Each client receives customized financial advice and solutions tailored to their unique financial situations, enhancing the effectiveness of the services offered.

- Educational Resources: They are is committed to financial education, offering clients resources and advice to help them understand and improve their financial situations.

- Strong Customer Support: The company is renowned for its excellent customer service, boasting a responsive and supportive team that assists clients throughout their journey to financial recovery.

- Flexible Repayment Options: Offers flexible repayment terms that can be adjusted to accommodate the financial circumstances of different clients, simplifying the management of loan repayments.

Disadvantages

- Limited to South African Residents: Services are restricted to residents of South Africa, excluding potential international clients who could benefit from their services.

- Dependence on Creditworthiness: While Debt Busters aims to assist individuals with varying credit histories, those with poor credit may encounter higher interest rates or may not qualify for certain loan products, limiting their options.

- Potential Fees: Despite their transparency about its fees, clients may still face charges such as initiation fees, service fees, or penalties for late payments, which can accumulate over time.

- Risk of Over-Indebtedness: As with any debt management or loan service, there is a risk that clients may become overly reliant on financial solutions like loans, potentially exacerbating financial strain if not managed properly.

- Documentation and Processing Times: The requirement for comprehensive documentation and the processing times for loan approval may be cumbersome or slow for some clients, especially those urgently in need of financial assistance.

Conclusion

Debt Busters is highly esteemed for its comprehensive range of debt management services and personal loans, tailored to meet the diverse needs of South Africans grappling with debt. The company receives a strong overall rating for its personalized service, dedication to customer education, and effective financial solutions. Clients particularly appreciate the supportive customer service and the practical, actionable advice offered. However, prospective clients should also consider potential fees and the need for thorough documentation, which could impact their overall experience.

Frequently Asked Questions

Debt Busters provides a variety of loans, including debt consolidation loans, personal loans, and home loans. Each is tailored to meet different financial needs, ranging from consolidating high-interest debts to financing significant purchases or investments.

Loan eligibility is determined based on various factors, including the applicant’s credit history, current financial situation, income stability, and overall ability to repay the loan. Debt Busters utilizes this information to customize loan offers that align with the client’s needs and financial capacity.

Yes, there are fees associated with their loans, which may encompass initiation fees, service fees, and, in some instances, penalties for late payments or early loan repayments. These fees are clearly outlined in the loan agreement and transparently communicated to clients.

Once a loan is approved, funds are typically disbursed within 24 to 48 hours, subject to document verification and the processing times of the relevant banks.

Yes, you can settle your Debt Busters loan ahead of schedule. The company supports flexible repayment options, and generally, there are no penalties for early repayment. However, it’s advisable to confirm this, as terms may vary based on the specific loan product.