Discovery Bank is one of South Africa’s newer banking options, launched by the well-known Discovery Group. It operates fully online and offers a mix of everyday banking features, digital tools, and rewards aimed at individuals who already use Discovery’s health, life, or insurance products. The bank promotes better financial behaviour by linking rewards and interest rates to how you manage your money.

At a glance, Discovery Bank offers South Africans a fully digital banking experience, including transaction accounts, credit cards, savings tools, and rewards through Vitality Money. Whether you’re managing daily spending, accessing flexible credit, or earning rewards for smart financial habits, Discovery Bank provides personalised features via its mobile app. If you’re thinking about switching banks or exploring better options, keep reading to see what Discovery Bank has to offer.

Discovery Bank: Quick Overview

Service Type: Digital banking services including transaction accounts, credit cards, loans, savings tools, and personalised rewards

Access: Available through the Discovery Bank mobile app and online platform

Eligibility: South African ID; must be 18 years or older; must hold a qualifying Discovery product

Fees: Monthly account fees vary based on account type; additional charges may apply

Additional Services: Vitality Money rewards programme, Discovery Miles, travel and lifestyle benefits, financial health tracking, and integrated services for existing Discovery clients

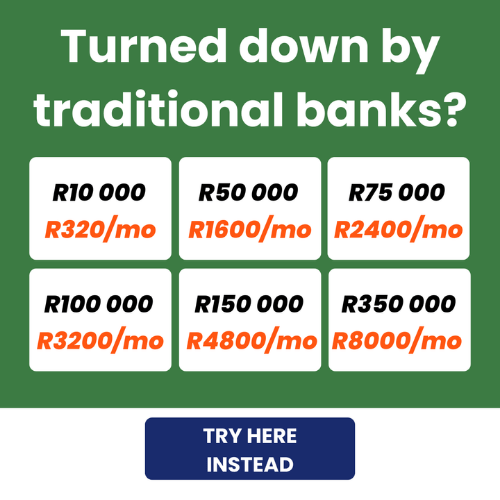

About Arcadia Finance

Get the Loan You Need—Quickly and Securely with Arcadia Finance. Choose from 19 trusted lenders, all registered with South Africa’s National Credit Regulator. No application fees, no hassles—just a fast, secure, and compliant loan process tailored to your needs.

Discovery Bank Full Review

What Makes Discovery Bank Unique?

Discovery Bank stands out from traditional banks in South Africa because of how it combines banking with rewards for healthy financial habits. It uses a behaviour-based system called Vitality Money, which tracks how well you manage your money. If you stick to a budget, save regularly, and maintain a healthy credit record, the bank rewards you with better interest rates, lower banking fees, and Discovery Miles (which can be used at partner stores or for travel). This approach is different from most banks, where benefits are mainly based on how much money you have. Discovery Bank focuses more on how you manage your money, not just how much you earn.

Another key feature that makes Discovery Bank different is that it’s 100% digital. You can open an account, apply for a credit card, and manage your finances using only the Discovery Bank app. There are no physical branches, which means all customer service is done through the app or online platforms. The app includes budgeting tools, financial health tracking, and real-time support. For customers who already use other Discovery products, such as medical aid or life insurance, there are extra rewards and discounts through integrated services, which makes Discovery Bank an appealing option for existing Discovery members.

Types of Services Offered by Discovery Bank

Discovery Bank provides a range of digital banking products designed for different income levels and financial needs. All services are managed through the Discovery Bank app, allowing customers to track spending, earn rewards, and access smart financial tools.

Banking Suites

Discovery Bank offers four tiered banking suites that combine transaction accounts with credit cards, tailored to different income brackets:

- Gold Suite – For annual incomes between R100,000 and R350,000

- Platinum Suite – For incomes between R350,000 and R850,000

- Black Suite – For incomes between R850,000 and R2.5 million

- Purple Suite – For those earning above R2.5 million annually

Each suite includes benefits such as enhanced credit cards, premium transaction accounts, unlimited savings accounts, and access to real-time forex.

Transaction Accounts

Discovery Bank offers:

- Bundled Fee Accounts – A monthly fee that covers a range of free transactions

- Pay-as-you-Transact Accounts – A flexible option with charges based only on what you use

These are available in various tiers including Gold, Platinum, and Black.

Savings Accounts

Discovery Bank provides multiple savings options to help customers grow their money:

- Demand Savings Accounts

- Notice Savings Accounts

- Tax-Free Savings Accounts

- Fixed Deposit Accounts

Each account type offers competitive interest rates and flexible access.

Credit Products

Credit offerings include:

- Credit Cards – With lifestyle rewards and benefits across different tiers

- Revolving Credit Facility – Offers approved access to flexible, ongoing credit

Designed to provide convenience and financial freedom.

Forex Accounts

Clients can open and manage real-time forex accounts in currencies such as British Pounds, Euros, and US Dollars. These accounts support currency conversions, savings, and international payments—accessible 24/7 through the mobile app.

Digital Banking Features

The Discovery Bank app includes:

- Vitality Money Financial Analyser – Helps monitor and improve financial health

- Discovery Pay – For instant transfers to other Discovery clients

- Mobile Wallet Integration – Supports Apple Pay, Google Pay, Samsung Pay, and more

These features ensure a seamless digital banking experience.

Rewards and Benefits

Through the Vitality Money programme, clients earn Discovery Miles by maintaining good financial habits. These can be redeemed for travel, groceries, personal care items, and more. Higher-tier clients may also enjoy travel perks and airport lounge access.

Requirements for a Discovery Bank Service

To open an account with Discovery Bank, you need to meet the following criteria:

- Age: You must be 18 years or older.

- Identification: Possess a valid South African ID number.

- Existing Discovery Product: Have a qualifying Discovery product.

Please note that foreigners and foreign nationals are currently not eligible to activate a Discovery Account or join Discovery Bank.

Simulation of a Service at Discovery Bank

Applying for a service with Discovery Bank is straightforward. Here’s a simple step-by-step guide:

- Download the Discovery Bank App: Available on your device’s app store.

- Select ‘Join the Bank’: Open the app and tap on ‘Join the Bank’.

- Confirm Personal Details: Enter and verify your personal information.

- Verify Mobile Number: Confirm your cellphone number through the app.

- Set Up Facial ID: Scan your face to establish your unique Facial ID and security features.

- Choose Account Type: Select the account that best suits your needs.

- Complete Application: Follow the prompts to finalise your application.

- Await Confirmation: You’ll receive confirmation once your account is active.

Eligibility Check

Discovery Bank provides a few tools that help you check whether you’re eligible for their banking services. One of the main tools is the Product Comparison Tool, which allows you to compare your existing bank account with what Discovery Bank offers. This helps you see which product matches your needs more closely.

Another useful feature is the Financial Analyser, available through the Discovery Bank app. This tool gives you an overview of your financial habits and status, such as how you spend, save, and manage debt. Based on this information, you can see which Discovery Bank products you might qualify for. These tools are designed to help you make better choices by giving you a clearer picture of which account or service suits your situation best.

Who Is Discovery Bank Best For?

Discovery Bank is best suited for individuals who:

- Prefer a fully digital banking experience managed through a mobile app

- Want to earn rewards and better interest rates based on financial behaviour

- Already use other Discovery products like medical aid, insurance, or Vitality

- Are looking for flexible credit options with no early repayment penalties

- Value personalised financial insights, budgeting tools, and spending alerts

Is Discovery Bank a Safe and Reliable Option?

Yes. Discovery Bank is a registered South African financial institution and operates under the regulations of the South African Reserve Bank and the National Credit Regulator (NCR). It complies with the National Credit Act and banking industry standards to ensure that client information is managed securely and responsibly. While Discovery Bank offers financial products such as transaction accounts and credit facilities, it also encourages responsible banking through its behaviour-based rewards system.

To keep your information safe, Discovery Bank’s digital platform uses advanced security features, including encryption, biometric login, and strict identity verification. Access to your account and personal details is only granted once your identity has been confirmed, helping to protect your data and maintain your privacy.

How Many Services Can I Request from Discovery Bank?

Discovery Bank offers a range of digital banking services tailored for individuals with varying financial needs. These include transaction accounts, credit cards, bundled account suites, a basic Discovery Account, and a Revolving Credit Facility. Additionally, all clients gain access to Vitality Money, a behaviour-linked rewards programme, and Discovery Miles, a loyalty system used for spending or saving. Services are structured across different account tiers—Gold, Platinum, and Black—each offering tailored features, such as travel benefits, budgeting tools, and spending analytics.

How Discovery Bank Creates Personalised Services

Discovery Bank uses the Vitality Money programme to customise services and rewards based on each client’s financial behaviour. The platform tracks five key areas—credit usage, savings habits, insurance coverage, spending efficiency, and asset protection—to assign a financial status ranging from Blue to Diamond. This status directly influences the interest rates, fees, and rewards a customer receives. In addition, tools like the Financial Analyser and Product Comparison Tool within the app help tailor account suggestions and financial tips based on real-time behaviour.

Discovery Bank Loan – Overview in Detail

| Name | Discovery Bank |

|---|---|

| Financial Institution | Discovery Bank Limited |

| Product | Revolving Credit Facility with Flexible Terms |

| Minimum Age | 18 years |

| Minimum Loan Amount | R20 000 |

| Maximum Loan Amount | R1 000 000 |

| Loan Term | Flexible (no fixed term) |

| APR (Annual Percentage Rate) | Varies based on credit profile and Vitality Money status |

| Monthly Interest Rate | Based on applicant profile; reductions up to 7% via Vitality Money |

| Early Settlement | No penalties for settling the full balance early |

| Repayment Flexibility | Monthly instalments from as low as 2.5% of the balance |

| NCR Accredited | Yes (NCRCP9997) |

| Our Opinion | ✅ Immediate access to funds ✅ Interest rate rewards ⚠️ Must actively manage benefits |

| User Opinion | ✅ Easy digital application ⚠️ May not suit those needing branch support |

How Long Does It Take to Complete a Service from Discovery Bank?

Most Discovery Bank services, such as opening a new account or applying for credit, can be completed within 5 to 10 minutes via the mobile app. However, funds access and application approvals may take longer depending on several factors. These include credit assessment, identity verification, and transaction clearance times. EFTs to other banks are subject to interbank processing windows, while in-app payments and card transactions are typically processed instantly. Account upgrades or switching between suites may take a bit longer due to internal eligibility checks.

How Do I Pay for My Service from Discovery Bank?

Clients can manage repayments and make payments directly through the Discovery Bank app, using options such as inter-account transfers, EFTs, or scheduled debit orders. For credit facilities, the minimum monthly repayment starts from 2.5% of the outstanding balance. Fees may apply, including R2.50 per digital transaction and real-time payment charges ranging from R1 to R30, depending on the amount. Penalty fees may be charged for late or missed payments, which can also negatively impact your credit score. Setting up automatic payments is recommended to avoid penalties and maintain a healthy payment profile.

Pros and Cons of Choosing Discovery Bank

Pros of Discovery Bank

- Innovative Rewards Programme: Discovery Bank integrates the Vitality Money programme, which rewards clients for healthy financial behaviour with better interest rates and discounts on various services.

- Comprehensive Digital Banking: As a fully digital bank, clients can manage their accounts, make payments, and monitor their financial health through a user-friendly mobile app.

- Integrated Services: Clients who use other Discovery products, such as medical aid or insurance, can benefit from additional rewards and seamless integration between services.

Cons of Discovery Bank

- Limited Physical Presence: Being a digital-only bank, Discovery Bank lacks physical branches, which may be a drawback for clients who prefer in-person banking services.

- Complex Fee Structure: Some clients may find the bank’s fee structure and rewards system complex and challenging to navigate.

- Eligibility Restrictions: Certain products and rewards are only available to clients who hold other Discovery products, potentially limiting access for new customers.

Customer Service

If you have more questions or need direct assistance, Discovery Bank provides several contact options through the app and online platform. You can chat to a consultant via the Discovery Bank app, call the customer care line, or visit the Discovery Contact Page for specific departments and service hours. The app also includes an in-app help centre with frequently asked questions, product guides, and step-by-step instructions.

For any further details or personalised queries, it’s best to use the chat function within the Discovery Bank app, where your account details can be verified securely.

Contact Channels

Phone number:

General Enquiries: 0800 07 96 97

International Calls: +27 11 324 5000

Fraud or Stolen Card Reporting: 011 324 4444

Hours of operation:

Discovery Bank’s customer service is available 24 hours a day, 7 days a week, 365 days a year.

Postal address:

PO Box 786722, Sandton, 2196

Online Reviews of Discovery Bank

Customer feedback for Discovery Bank is mixed. On Hellopeter, a South African consumer review platform, Discovery Bank holds a TrustIndex score of 2.5 out of 5. Some customers have expressed dissatisfaction with issues such as delayed assistance and communication challenges.

Conversely, on platforms like Reddit, users have shared positive experiences, highlighting the bank’s 24/7 customer support and the benefits of the Vitality Money programme. One user noted an increased awareness of their spending habits due to the programme.

These varied reviews suggest that while some customers appreciate Discovery Bank’s innovative features and customer service, others have encountered challenges that impacted their banking experience.

It is just easy, fast and efficient. From ordering banking card delivered to your door, to the self-service banking on the app. It works, always supports and can be trusted. I moved to Discovery Bank and I recommend it.

Called Discovery Bank a few minutes to retrieve my ATM Bank PIN & the swift, professional service was absolutely amazing.

I am extremely frustrated with the delay in processing my refund. It’s been 7 days since the transaction was initiated and still stuck under pending transactions. I need a clear explanation and better service communication for this delay as this is a critical transaction.

“I am extremely disappointed in Discovery Bank’s lack of interest in assisting me to recall an incorrect payment I made to another bank. After spending over 2 hours on calls with their consultants, I have been told to resolve the issue myself with the other bank.

Alternatives to Discovery Bank

In South Africa’s evolving banking landscape, several digital and traditional banks offer services comparable to Discovery Bank:

- TymeBank: A fully digital bank known for its zero-fee transactional accounts and high-interest savings options. It has rapidly grown its customer base since its launch.

- Capitec Bank: A well-established bank offering simplified banking solutions with low fees and competitive interest rates, catering to a broad market segment.

- First National Bank (FNB): A traditional bank that has embraced digital innovation, providing a comprehensive suite of banking products and a robust online platform.

- Nedbank: Offers a range of personal and business banking services with a focus on sustainability and green banking initiatives.

Comparison Table

| Feature/Bank | Discovery Bank | TymeBank | Capitec Bank | First National Bank (FNB) | Nedbank |

|---|---|---|---|---|---|

| Bank Type | Digital | Digital | Traditional with digital offerings | Traditional with digital offerings | Traditional with digital offerings |

| Monthly Fees | Varies based on account type | Zero | Low | Varies based on account type | Varies based on account type |

| Interest Rates | Behaviour-based rates via Vitality Money | Competitive savings interest rates | Competitive savings interest rates | Standard interest rates | Standard interest rates |

| Rewards Program | Vitality Money and Discovery Miles | None | None | eBucks rewards | Greenbacks rewards |

| Customer Support | 24/7 via app and online | Limited hours via online platforms | Branches and online support | Branches and online support | Branches and online support |

| Physical Branches | None | Kiosks in retail stores | Extensive branch network | Extensive branch network | Extensive branch network |

History and Background of Discovery Bank

Discovery Bank is a subsidiary of Discovery Limited, a South African financial services group founded in 1992 by Adrian Gore and Barry Swartzberg. The parent company initially focused on health insurance, guided by the core purpose of making people healthier and enhancing and protecting their lives.

Leveraging its success in the insurance sector, Discovery Limited expanded into banking, officially launching Discovery Bank in 2019. The bank introduced a unique behavioural banking model, rewarding customers for managing their finances responsibly through the Vitality Money programme. This approach aligns with Discovery’s overarching mission to promote healthier behaviours, extending it into the financial realm.

Discovery Bank’s vision is to be the best bank for its clients by sharing the value that they create. This vision reflects the bank’s commitment to integrating financial services with behavioural incentives, aiming to foster a banking experience that benefits both the customer and the institution.

Conclusion

Discovery Bank is a modern, fully digital bank that offers a unique approach to personal finance in South Africa. It rewards responsible financial behaviour, offers flexible products, and provides useful tools for money management through the Discovery Bank app. While it works best for individuals who already use other Discovery services, it is still a strong option for anyone seeking a data-driven, tech-forward banking experience. However, its fee structure and digital-only service model may not suit everyone, so it’s worth comparing it with other banks before making a decision.

Frequently Asked Questions

To open an account, you must be 18 years or older, have a valid South African ID, and own at least one qualifying Discovery product.

No, Discovery Bank accounts are currently only available to South African citizens with valid South African ID numbers.

You earn Discovery Miles by using your Discovery Bank card and managing your finances responsibly through the Vitality Money programme.

You can freeze your card immediately using the Discovery Bank app or call 011 324 4444 to report it and request a replacement.

No, Discovery Bank operates fully online. All services and support are handled through the Discovery Bank app and online platforms.