When financial needs arise unexpectedly, finding a reliable lender with straightforward terms can make all the difference. EasyPay Loans [Epe-online.co.za] has established itself as a practical option for South Africans looking for flexible, accessible loan solutions. This company offers a simple application process and clear repayment options tailored to suit your needs.

EasyPay offers personal loans ranging from R500 to R4 000, with flexible repayment terms of 3, 6, or 9 months. The application process is quick and straightforward, featuring instant credit checks and affordability assessments for immediate access.

EasyPay: Quick Overview

Loan Amount: R500 – R4 000

Loan Term: 3, 6, or 9 months

Interest Rate: 0% for 3- and 6-month loans; approx. 1% per month for 9-month loans

Fees: Initiation fee – R86, Service fee – R69/month, Credit protection fee – R6.33/month

Loan Types: Short– to medium-term personal loans

About Arcadia Finance

Choose Arcadia Finance for a hassle-free loan process. With zero application fees and 19 compliant lenders, find trustworthy options suited to your needs. Confidence and convenience in one place.

EasyPay Lender Full Review

EasyPay Loans stands out by offering a convenient, fully digital application process, allowing South Africans to apply for loans from the comfort of their homes. Unlike many traditional lenders, EasyPay does not require extensive paperwork or long waiting periods, making it an appealing option for individuals who need quick access to funds. The platform is designed to prioritise user experience, ensuring that borrowers can navigate the loan process with ease. This simplicity is complemented by competitive interest rates and flexible repayment terms, tailored to accommodate varying financial needs and circumstances.

Another unique feature is its focus on accessibility. By offering smaller loan amounts alongside personalised repayment schedules, the service caters to borrowers who might otherwise struggle to qualify for loans through conventional banks. Their dedication to transparency further distinguishes it, with clear breakdowns of fees and repayment obligations provided upfront. This approach ensures borrowers can fully understand their commitments before proceeding, fostering trust and reliability in their services.

Types of Loans Offered by EasyPay

EasyPay Loans provides a range of financial products designed to meet diverse borrowing needs. Personal loans are the most versatile option, suitable for covering unexpected medical expenses, consolidating debt, or funding personal projects. These loans are typically smaller in size and come with manageable repayment terms, making them ideal for individuals requiring quick financial assistance without committing to long-term obligations.

For borrowers looking to manage cash flow or handle short-term financial needs, EasyPay also offers micro-loans. These loans are tailored for urgent expenses such as utility bills, school fees, or small-scale purchases. The application process is straightforward, and funds are disbursed quickly to ensure borrowers can address their immediate requirements without delay. Regardless of the loan type, this company aims to provide financial solutions that are both practical and accessible, supporting South Africans in meeting their goals effectively.

Who Is EasyPay Loans Best For?

EasyPay Loans is best suited for South African borrowers who:

- Need small, short-term personal or micro-loans

- Are formally employed with a regular income

- Prefer a quick and fully online application process

- Want fixed repayment terms of 3, 6, or 9 months

- Are seeking accessible credit without extensive paperwork

Is EasyPay Loans a Safe and Good Option?

EasyPay Loans is a financial service offered through Epe-online.co.za, providing short-term personal loans to individuals in South Africa. Backed by Lesaka Technologies, it offers a secure online platform with a quick and straightforward application process. Borrowers can apply for loan amounts ranging from R500 to R4,000, with repayment terms of 3, 6, or 9 months. Applications are typically reviewed within hours, and approved loans are usually disbursed within 24 to 48 hours.

EasyPay Loans features transparent fees and repayment terms, including 0% interest on 3- and 6-month loans, with a low monthly interest rate for 9-month terms. All fees—such as initiation, service, and credit protection—are clearly outlined upfront. This lender is particularly suitable for those needing smaller, short-term financial assistance with fast turnaround and minimal paperwork. For South Africans looking for a convenient and legitimate loan option, EasyPay Loans is a practical and trustworthy choice.

Requirements for an EasyPay Loan

To apply for a loan, you must meet the following requirements:

- Age: Applicants must be 18 years or older.

- Income: A regular and verifiable source of income is required.

- Bank Account: You need an active South African bank account.

- Residency: Must be a South African citizen or hold permanent residency.

Documents and Information Needed

Prepare the following documents and information before applying:

- A valid South African ID or passport.

- Proof of income, such as recent payslips or bank statements.

- Proof of residence not older than three months (e.g., utility bill).

- Contact details, including a valid phone number and email address.

Step-by-Step Guide to Applying for an EasyPay Loan

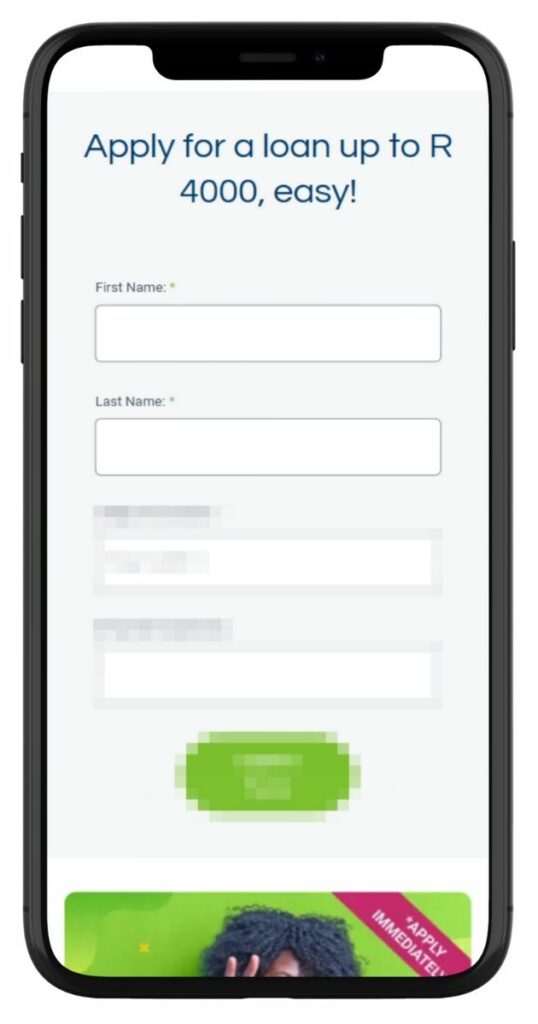

Step 1. Visit the Epe-online.co.za

Step 2. Fill in your personal details, including your first and last name, to start the loan application process.

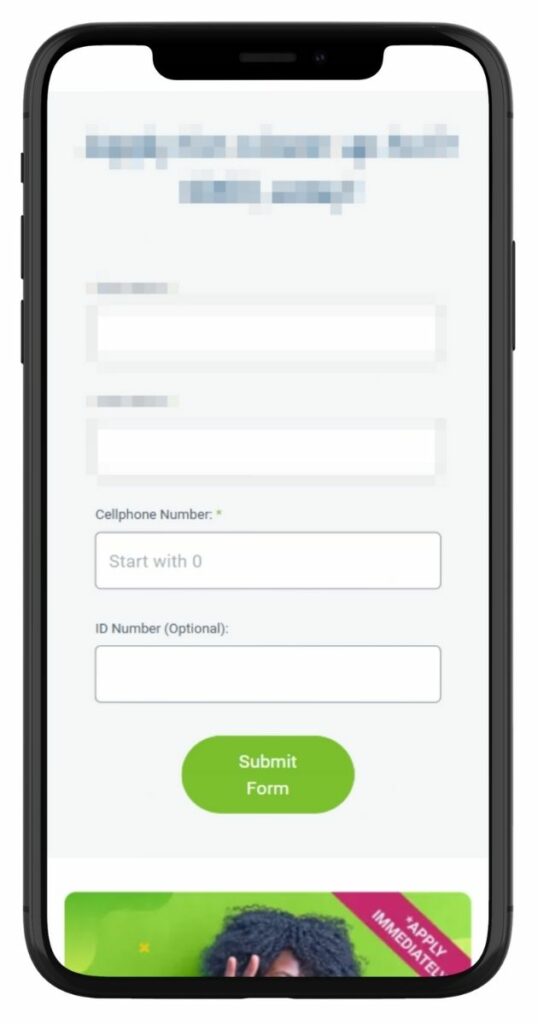

Step 3. Enter your cellphone number and optional ID number, then click “Submit Form.”

Step 4. Receive confirmation that your loan request has been successfully submitted and will be reviewed shortly.

Step 4. Wait for them to review your application and contact you with further details or requirements.

Step 5. Once approved, review and sign the loan agreement to finalise the process and access your funds.

Eligibility Check

To help borrowers determine if they qualify, Epe-online.co.za provides several tools and resources. The loan calculator gives an estimate of costs, ensuring the loan is affordable for your circumstances. A pre-approval check allows you to input basic financial details for a quick eligibility assessment. For further clarity, EasyPay’s customer support team can assist by manually reviewing your information and advising you on your eligibility.

How Much Money Can I Request from EasyPay Loans?

EasyPay Loans offers borrowers a range of loan amounts to cater to various financial needs. The minimum loan amount you can request is typically R500, making it an accessible option for smaller, short-term financial obligations. For those requiring larger sums, the maximum loan amount available is generally R4 000, depending on your credit profile and ability to repay.

The exact loan amount you qualify for will depend on factors such as your monthly income, credit history, and affordability. This lender aims to provide flexible options that align with your financial situation, ensuring you don’t borrow more than you can comfortably repay.

Receive Offers

EasyPay Loans takes a streamlined and customer-focused approach to provide tailored loan offers. Once you submit your application, the platform evaluates your financial profile, including your income, expenses, and credit score. Using this data, EasyPay Loans creates a personalised loan offer that balances your needs with what you can reasonably afford.

Borrowers are presented with clear terms, including the loan amount, repayment schedule, and interest rates. This personalised approach ensures you understand your loan terms upfront, helping you make an informed choice. The automated system speeds up the process, reducing wait times and eliminating unnecessary paperwork.

How Long Does It Take to Receive My Money from EasyPay Loans?

One of the standout features of Epe-online.co.za is its fast processing times. Once your application is approved, funds are typically disbursed within 24 to 48 hours, making it a convenient option for urgent financial needs. In some cases, you may even receive the money on the same day, especially if all required documents are submitted promptly.

EasyPay Loans – Loan Overview in Details

| Name | EasyPay Loans |

|---|---|

| Financial | Not publicly traded; part of Lesaka Technologies |

| Product | Unsecured Personal Loans |

| Minimum Age | 18 years and older; must be a South African citizen |

| Minimum Amount | R1 000 |

| Maximum Amount | R4 000 |

| Minimum Term | 3 months |

| Maximum Term | 9 months |

| APR | 0% for 3-month and 6-month loans; 12% per annum for 9-month loans |

| Monthly Interest Rate | 0% for 3-month and 6-month loans; approximately 1% per month for 9-month loans |

| Early Settlement | Information not specified |

| Repayment Flexibility | Fixed terms of 3, 6, or 9 months; tailored to suit customer needs |

| NCR Accredited | Information not specified |

| Our Opinion | ✅ Quick and simple application process ✅ No interest on shorter-term loans ⚠️ Limited loan amounts up to R4 000 |

| User Opinion | ✅ Convenient for small, short-term financial needs ⚠️ Requires an EasyPay Everywhere account with a 3-month history |

How Do I Repay My Loan from EasyPay Loans?

EasyPay Loans offers flexible repayment options to suit different financial situations. Most borrowers are required to repay their loans through monthly instalments over a period agreed upon during the application process. Repayment terms vary but typically range between 1 and 12 months, depending on the loan amount and agreement.

Repayments can usually be made via:

- Debit orders: Payments are automatically deducted from your bank account on agreed-upon dates.

- Electronic funds transfer (EFT): You can manually transfer payments through your banking app.

- EasyPay platform: Some borrowers may have the option to pay directly on the lender’s platform.

It’s important to meet repayment deadlines to avoid extra charges. They may impose penalty fees for late or missed payments, which can increase your total repayment amount. Defaulting on payments may negatively impact your credit score, making it harder to qualify for future loans.

Pros and Cons

Pros of EasyPay

- Simple Application Process: EasyPay Loans provides a user-friendly online application system that is quick and hassle-free.

- Fast Approval and Disbursement: Funds are typically transferred within 24 to 48 hours after approval, making it a great option for urgent financial needs.

- Flexible Loan Amounts: Borrowers can access amounts ranging from R500 to R4 000, catering to both small and medium financial requirements.

- Transparent Terms: Loan agreements clearly outline interest rates, fees, and repayment schedules, reducing the risk of hidden costs.

- Customised Offers: Borrowers receive personalised loan terms based on their financial profile, ensuring affordability.

Cons of EasyPay

- Higher Interest Rates for Short-Term Loans: Like many short-term lending solutions, EasyPay Loans may charge higher interest rates compared to traditional bank loans.

- Penalties for Late Payments: Missing a repayment can lead to additional fees, which can add up if payments are delayed.

- Limited Loan Amounts: The maximum loan amount of R15 000 may not be sufficient for borrowers with larger financial needs.

- Dependence on Internet Access: The online application process may be challenging for those without reliable internet or digital literacy.

Customer Service

If you need assistance or have additional questions about EasyPay Loans, their customer service team is ready to help. They offer support for various needs, including loan applications, repayment queries, and resolving any issues related to your borrowing experience. You can contact them through their helpline for real-time assistance, send queries via email for detailed responses, or use the contact forms available on their official website for a quick reply. They are committed to providing prompt and reliable support, ensuring that borrowers enjoy a smooth experience. To resolve your concerns faster, ensure you have your loan reference number or account details ready when reaching out.

Contact Information for EasyPay

If you have questions or need assistance regarding EasyPay Loans, their customer service team is available to help. They offer support for loan applications, repayment queries, and any concerns related to your borrowing experience. You can reach EasyPay Loans through various channels:

Phone number:

Helpline: 0801111880

Hours of operation:

Monday to Friday: 07:00-21:00

Saturday: 08:00-13:00

Physical address:

4th Floor President Place, Cnr. Jan Smuts Avenue & Bolton Road, Rosebank, Johannesburg, South Africa, 2196

Online Reviews of EasyPay Loans

Customer feedback is an essential indicator of any lending service’s reliability, and EasyPay Loans has received a variety of reviews from South African borrowers. Many customers commend EasyPay Loans for its fast application process and prompt disbursement of funds, which are particularly helpful in emergencies. The transparent loan terms and accessible platform have also been highlighted as positives by satisfied users.

However, there are occasional complaints regarding higher interest rates for short-term loans. These reviews indicate that while this lender meets the needs of many, borrowers should carefully assess the terms to ensure they align with their financial situation.

When you need help from easypay u must be patient because there system it’s lower little bit than the other companies systems

They had a bad service i waited for an hour and still they did not help

Whoever updates the credit bureau at your place needs another job! Due to him/her I’m unable to apply for any loans

Alternatives to EasyPay Loans

While EasyPay Loans is a convenient option, South Africa has several other credit providers worth considering.

Comparison Table

| Feature | EasyPay Loans | Wonga | Capitec | RCS | Oloan | FASTA |

|---|---|---|---|---|---|---|

| Loan Amounts | R500 – R4 000 | R500 – R8 000 | Up to R250 000 | Up to R150 000 | Up to R350 000 | Up to R8 000 |

| Interest Rates | Higher for short-term | Moderate | Competitive | Competitive | Competitive | Competitive |

| Processing Time | 24 – 48 hours | Within 24 hours | 1 – 3 business days | 1 – 3 business days | 1 – 3 business days | Within 24 hours |

| Repayment Period | 1 – 12 months | 1 – 6 months | Up to 84 months | Up to 60 months | Up to 72 months | Up to 3 months |

| Accessibility | Online application | Online application | Branch or online | Online application | Online application | Online application |

| More Info | Wonga Review | Capitec Review | RCS Review | Oloan Review | FASTA Review |

History and Background of EasyPay Loans

EasyPay Loans is a product offered by Lesaka Technologies, a company with a well-established presence in South Africa’s financial sector. Lesaka has a strong focus on empowering communities through accessible financial solutions, ensuring inclusivity and convenience. The company created EasyPay Loans to provide South Africans with a secure and straightforward way to access credit.

Their mission is to offer flexible and transparent lending options that meet the diverse needs of individuals and families. Their vision is to create a platform that promotes financial inclusion, helping customers manage unexpected expenses while maintaining financial stability. By leveraging technology and customer-centric policies, EasyPay Loans continues to expand its reach and improve the borrowing experience.

Check your eligibility for FREE!

Conclusion

EasyPay Loans is a reliable option for South Africans seeking quick and accessible credit. The platform’s user-friendly application process, transparent loan terms, and fast disbursement make it ideal for addressing short-term financial needs. However, borrowers should carefully review the interest rates and penalties to ensure they are comfortable with the repayment terms. Overall, EasyPay Loans earns a solid rating as a trustworthy lender for smaller, short-term loans, particularly for those who value convenience and speed. By comparing its offerings with other providers and considering customer reviews, you can make a well-informed decision to meet your financial needs.

Frequently Asked Questions

To apply, visit the official website at epe-online.co.za and complete the online application form. You’ll need to provide personal details, proof of income, and a copy of your South African ID. The application process is quick and user-friendly.

Approval times are typically within a few hours, provided all your documents are submitted correctly. Once approved, you can expect the funds to be transferred to your account within 24 to 48 hours.

This lender offers flexible repayment plans, usually spread across 1 to 12 months. Repayments are made via debit orders, EFT, or other methods agreed upon during the loan application process.

Yes, they may allow you to apply for an additional loan, depending on your financial profile and repayment history. However, this is subject to the lender’s affordability assessments and approval criteria.

Yes, late or missed payments may result in penalty fees, which could increase the total repayment amount. It’s advised to stay on top of your repayment schedule to avoid these additional charges and protect your credit score.