With so many options available, borrowers are constantly seeking lending solutions that stand out from the rest. That’s where Exclusive Loans [Exclusiveloans.co.za] enters the picture, promising tailor-made financial products designed to meet unique needs. But does this lender really live up to its claims, or are there hidden terms borrowers need to be aware of?

Exclusive Loans – Loan Overview

| Name | Exclusive Loans |

|---|---|

| Financial | Privately Owned & Registered Credit Provider |

| Product | Diverse Loan Products |

| Minimum age | 18 years |

| Minimum amount | Varies by loan type; typically starts from small short-term loans |

| Maximum amount | Up to R250,000 for certain loan types |

| Minimum term | Varies by product |

| Maximum term | Flexible, depending on the loan type and customer’s profile |

| APR | Specific rates not disclosed; varies by loan type and customer circumstances |

| Monthly Interest Rate | Not specifically disclosed; dependent on loan terms |

| Early Settlement | Allowed; terms may vary |

| Repayment Flexibility | Tailored to meet specific customer requirements |

| NCR Accredited | Yes |

| Our Opinion | ✅ Efficient and fast approval process |

| ✅ Flexible loan terms based on customer needs | |

| ⚠️ Specific rates not readily available | |

| ⚠️ Limited to certain types of loans | |

| User Opinion | ✅ High approval rates (92% reported) |

| ✅ Useful loan comparison service | |

| ⚠️ High-interest rates for certain short-term loan options |

Experiences with Exclusive Loans

Navigating the loan application process is often marked by uncertainty and confusion, but Exclusive Loans aims to make this journey as smooth as possible. The company boasts an impressive 92% approval rate, signaling flexibility and understanding towards various financial situations, including those with less-than-perfect credit scores.

Exclusiveloans.co.za offers a diverse range of loan products, including payday loans, short-term loans, personal loans, and consolidation loans. This variety allows potential borrowers to choose a loan that aligns with their immediate needs and financial circumstances. The application process is simplified, providing options for both online and in-person applications, catering to individuals with different preferences and needs.

Who Can Apply for an Exclusive Loans Loan?

Criteria for Potential Borrowers

Exclusive Loans aims to be accessible to a diverse range of individuals seeking financial assistance. The eligibility criteria are designed to be inclusive, accommodating a broader spectrum of applicants, including those with less-than-perfect credit scores. Applicants are required to submit standard documents such as payslips, a copy of ID, and bank statements, adhering to typical requirements in the loan application process.

Differences from Other Loan Providers

Exclusive Loans distinguishes itself through its flexible repayment terms and a diverse array of loan products. Unlike providers with rigid repayment structures, this loan provider tailors repayment terms based on the borrower’s needs and budget. This approach ensures that the repayment process is manageable and not overly burdensome.

The company’s willingness to offer loans to individuals with bad credit scores demonstrates a level of inclusivity and understanding that might not always be present in other loan providers. This approach positions this lender as a more accessible and considerate option for potential borrowers navigating the complexities of financial borrowing.

About Arcadia Finance

Facilitate your journey to securing a loan through Arcadia Finance. There is no charge to apply, and you can evaluate proposals from as many as 19 varied lenders. Our affiliated lenders are all respected and regulated by the National Credit Regulator, assuring adherence to South Africa’s financial regulations.

Exclusive Loans Loan

Exclusive Loans provides a diverse array of loan services tailored to meet the varied needs of its customers. What sets Exclusiveloans.co.za apart is its commitment to delivering swift and dependable loan services, ensuring that customers can access funds precisely when they need them. With an impressive 92% approval rate, the majority of applicants are likely to secure the financial assistance they are seeking.

Another distinctive aspect is Exclusive Loans’ loan comparison service. Beyond merely offering loans, this lender acts as a guiding partner, helping customers navigate through the various loan options in the market. This comparison service empowers customers to make informed decisions, selecting loans that best suit their financial needs and circumstances, preventing them from ending up with burdensome or unsuitable loans.

This loan provider offers a range of loan products designed to address various financial needs and situations. Each loan type is carefully crafted with a specific purpose in mind, ensuring customers can find a loan that aligns with their financial objectives.

This lender provides a diverse range of loan products tailored to meet various financial needs. Payday Loans are short-term solutions designed for immediate financial relief, ideal for covering unexpected expenses or emergencies until the next payday. Short-Term Loans offer a quick financial boost with slightly extended repayment flexibility, suitable for managing unforeseen expenses.

Personal Loans are versatile, offering larger amounts for a range of purposes such as home renovations or education, coupled with flexible repayment terms for effective financial management. Lastly, Consolidation Loans are crafted to help customers manage multiple debts by consolidating various obligations into a single loan, streamlining repayments, and potentially reducing overall interest. Each loan type is meticulously designed to offer specific benefits, ensuring that customers find suitable and manageable financial solutions.

Each loan product offered by them is designed with the customer’s convenience and financial well-being in mind, ensuring that borrowers have access to funds in a manner that is sustainable and manageable.

Requirements for an Exclusive Loans Loan

When contemplating applying for a loan with this lender, it’s crucial to be well-prepared with the necessary documents and information.

- Proof of Income: Applicants need to provide recent payslips or bank statements to demonstrate their financial stability and ability to repay the loan.

- Valid Identification: A government-issued ID is necessary to confirm the applicant’s identity and legal status.

- Proof of Residence: A utility bill or lease agreement is typically required to verify the applicant’s current address.

- Current and Readily Available Documents: Ensuring all documents are up-to-date can streamline the application process and improve the chances of loan approval.

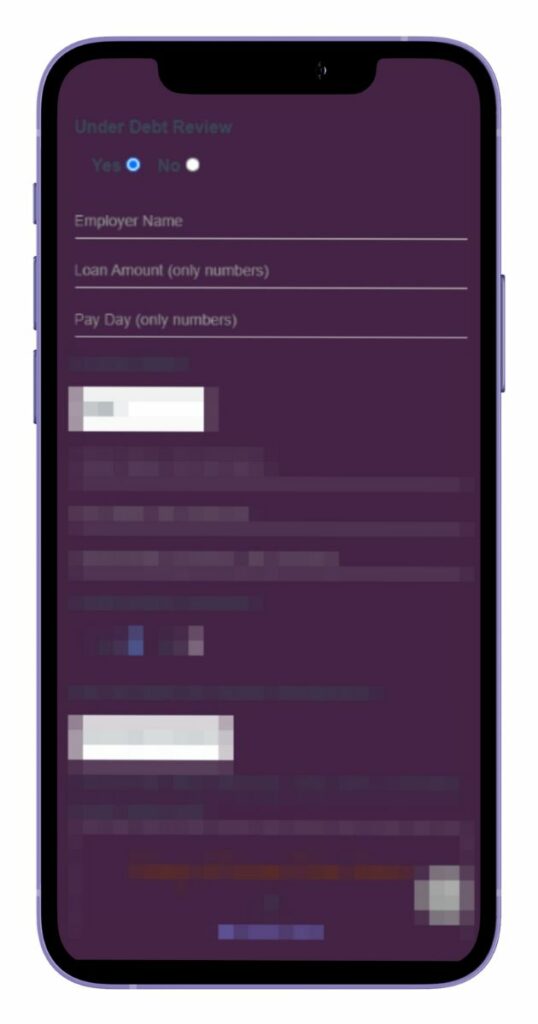

Step-by-step Guide to Applying for a Loan with Exclusive Loans

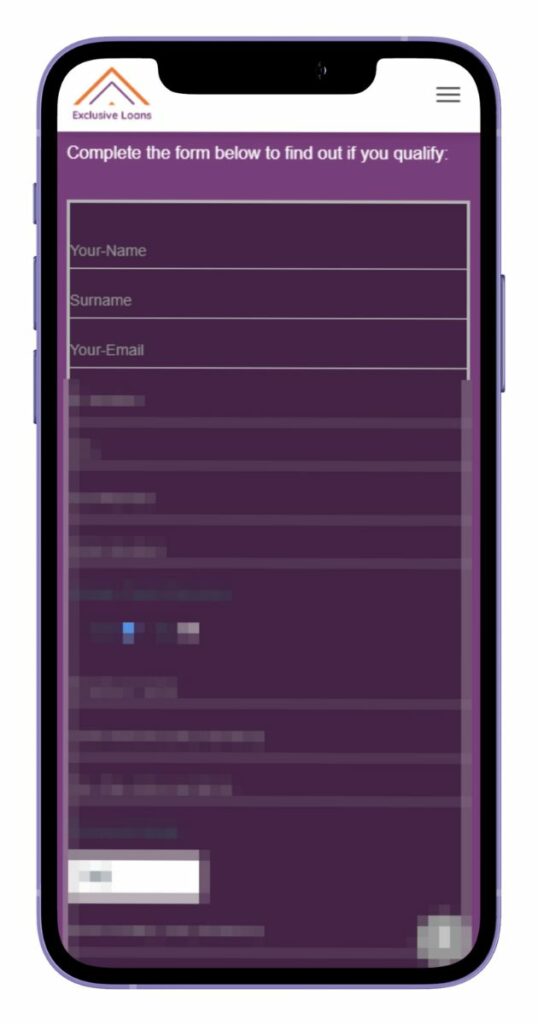

Step 1. Begin by visiting Exclusiveloans.co.za and navigating to the loan application section.

Step 2. Enter your personal information, including name, surname, and email.

Step 3. Provide your contact details, such as city, cell number, and work number.

Step 4. Indicate whether you are under debt review and fill in employer information and loan amount.

Step 5. Enter your financial details, including gross salary, net salary, and expenses.

Step 6. Provide credit check consent, select insurance type, and upload required documents (payslip, ID, bank statement).

Step 7. Double-check all the provided information for accuracy and then submit the application.

Step 8. They will review the application, and if all criteria are met, they will provide a loan offer.

Step 9. Once approved, the loan amount will be transferred to the specified bank account.

Eligibility Check

Exclusive Loans understands the importance of time and the need to avoid unnecessary credit checks. To assist potential borrowers, they offer an online eligibility checker. This tool allows applicants to input basic information, and within moments, they receive feedback on their potential eligibility for a loan. It’s a hassle-free way to gauge the likelihood of loan approval before diving deep into the application process.

Security and Privacy

Exclusive Loans prioritizes the security and privacy of customers’ personal and financial information, establishing itself as a trustworthy loan service provider. The company has instituted robust security protocols, including advanced encryption technologies, to safeguard customer data during various stages such as loan application and repayment.

Their website is meticulously designed to be a secure platform, ensuring that customers can confidently share sensitive information. The encryption of data transmitted through their website acts as a formidable barrier against unauthorized access, enhancing the overall security framework.

Complementing its security measures, this lender also upholds transparency and integrity in its data handling practices. A comprehensive privacy policy is in place, detailing the nuances of how customer information is collected, utilized, and protected. This policy underscores the company’s commitment to maintaining transparency, keeping customers informed and assured about the confidentiality of their data.

By fostering a secure and transparent environment, Exclusive Loans enhances customer confidence, bolstering its reliability and integrity as a notable loan service provider in the online domain.

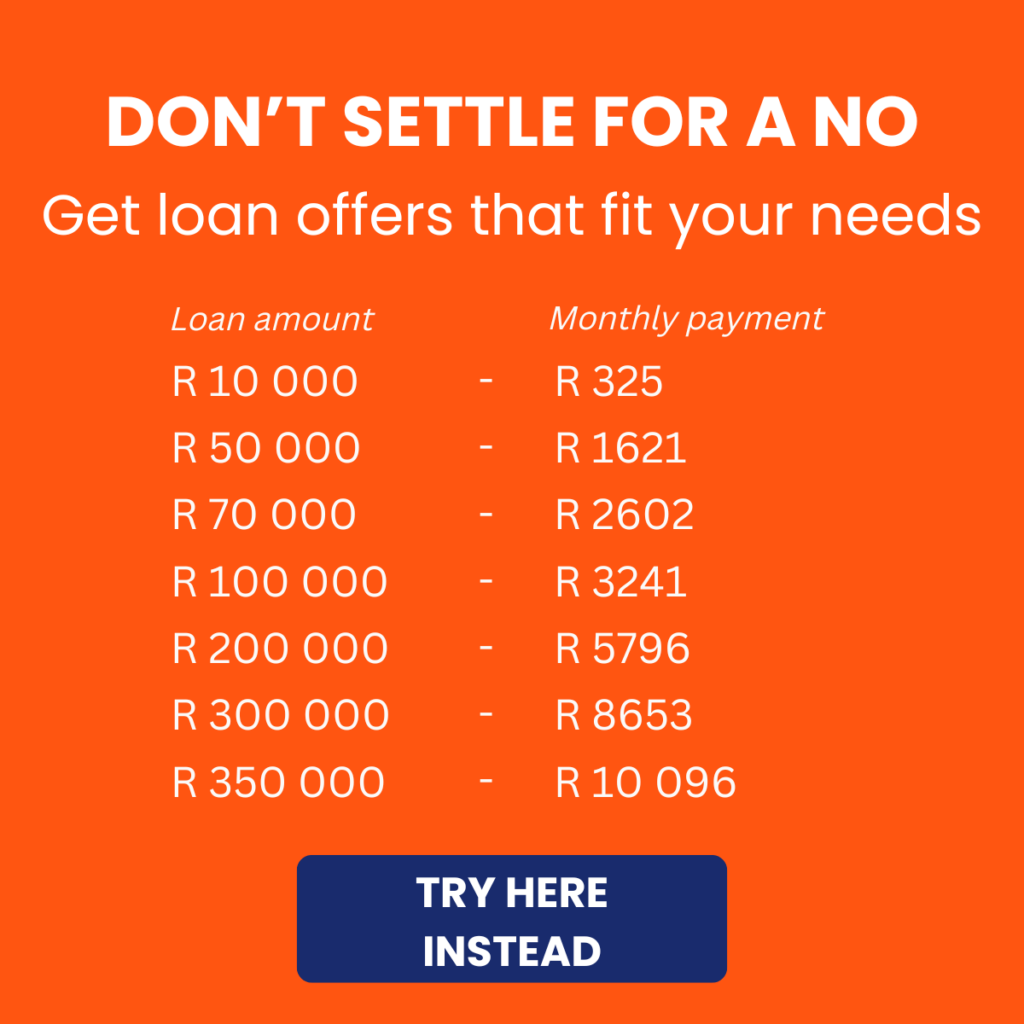

How Much Money Can I Request from Exclusive Loans?

Exclusive Loans provides a variety of personal and consolidation loans. Loan amounts range from as little as R1 000 up to R250 000. The amount you are eligible to borrow will depend on factors such as your credit rating, income stability, and existing financial commitments. They personalise loan offers based on your financial situation to ensure the repayment terms are manageable and suited to your ability to repay comfortably.

Customers have the opportunity to receive multiple offers based on the information provided during the application process. These offers are customized to meet the specific needs and financial circumstances of each applicant, ensuring that the loan terms, including the amount, are suitable and manageable. This loan provider takes into account factors such as the applicant’s credit score, income, and existing financial obligations to determine appropriate loan amounts and terms.

How Long Does it Take to Receive My Money from Exclusive Loans?

The speed at which customers can access funds after approval is a critical aspect of the loan service. Exclusive Loans strives to ensure that the loan disbursement process is swift and efficient. On average, processing times are relatively quick, allowing customers to receive the funds they need promptly. However, it’s important to note that various factors, such as the type of loan and the verification process, can influence the withdrawal speed.

How Do I Repay My Loan from Exclusive Loans?

Repaying a loan from Exclusiveloans.co.za is designed to be a straightforward process. The company offers various repayment options, allowing customers to choose a plan that aligns with their financial capabilities.They provide flexible repayment terms, ensuring that borrowers can manage their loan repayments alongside other financial commitments.

While the repayment process is made to be as convenient as possible, it’s also essential for customers to be aware of any potential fees and penalties associated with late or missed payments. Understanding these aspects is crucial in managing repayments effectively and avoiding any additional costs that may arise due to non-compliance with the repayment terms.

Online Reviews of Exclusive Loans

Online reviews of Exclusive Loans reflect mixed opinions, with many users sharing positive experiences while some remain cautious. According to customer feedback on platforms like HelloPeter, the company has been praised for fast and efficient service. Borrowers often highlight the professionalism of the staff, quick loan approvals, and the willingness to assist customers even if they have poor credit histories. This has earned the lender favorable ratings for accessibility and support.

However, some cautionary sources urge potential borrowers to be vigilant about online lending services. Scam Detector points out the importance of scrutinizing the legitimacy of lending websites, as there have been instances where fraudulent loan providers operate under similar models. As a result, it is essential to verify loan offers and ensure that any communication with Exclusive Loans adheres to their official procedures and domain.

For borrowers considering Exclusive Loans, it’s advisable to review customer feedback carefully and follow best practices to avoid scams or misunderstandings about terms. Additional insight can be found through customer reviews on HelloPeter and related sources.

Customer Service

Customer service is a pivotal aspect of the loan process, providing applicants and borrowers with a point of contact for queries, clarifications, and support. Exclusiveloans.co.za offers various channels through which customers can seek assistance or information. Whether you have questions regarding the application process, loan terms, or repayment schedules, Exclusive Loans’ customer service is available to provide timely and helpful responses.

Accessible and responsive customer service enhances the overall customer experience, ensuring that borrowers have the necessary support and guidance throughout the loan process. It reflects the company’s commitment to customer satisfaction and its dedication to offering services that meet the needs and expectations of its clientele.

Exclusive Loans Contact Channels

Phone number:

+27 76 352 0765

+27 65 881 7293

Email:

Info@exclusiveloans.co.za

Postal address:

37 Wolroy Building, Buitekant Street

Cape Town, Western Cape, 8001

Alternatives to Exclusive Loans

While Exclusive Loans provides a comprehensive range of loan products and services, there are other credit comparison portals available in the market that borrowers might consider. These platforms also offer various loan products, each with its unique features and benefits.

| Lender | Exclusive Loans | Unifi | Atlas Finance |

|---|---|---|---|

| Loan Types | Payday, Personal, Consolidation | Short-term Microfinance | Personal loans |

| Max Loan Amount | R250 000 | R8 000 | R8 000 |

| Approval Rate | 92% | Not Specified | Not Specified |

| Interest Rates | Not Specified | 3% | 0.17% per day, up to 5% per month |

| Repayment Terms | Flexible | Up to 6 months | 1 to 6 months |

| Special Features | Bad Credit Loans Available | Fast, 5-minute application; Instant cash transfer | Service fee, initiation fee, credit life |

| More Info | Unifi Review | Atlas Finance Review |

Keep in mind that specific details, such as interest rates and loan amounts, may vary based on individual circumstances and the lender’s policies. It’s crucial for potential borrowers to review each lender’s terms and conditions thoroughly before making a decision.

History and Background of Exclusive Loans

Exclusive Loans has solidified its position as a dependable loan service provider in South Africa, dedicated to delivering a diverse range of loan products tailored to address various financial needs. Since its establishment, the company has prioritized the creation of loan solutions that are both accessible and manageable, ensuring that customers can obtain the financial assistance they need with terms that are sustainable. This lender operates with a mission to provide fast, reliable, and customer-centric loan services, aiming to make the application process as seamless as possible and ensuring prompt fund disbursement.

The vision of Exclusive Loans extends to becoming a trusted partner in assisting customers throughout their financial journeys. The company aspires to offer services that not only provide immediate financial relief but also contribute to the overall financial well-being of their customers. This is exemplified through products like consolidation loans, which aid in managing and reducing debt, aligning with the vision of being a supportive and beneficial presence in their customers’ financial lives.

Pros and Cons

Pros

- Variety of Loan Products: Offers a diverse range of loan products, catering to different financial needs, including payday loans, short-term loans, personal loans, and consolidation loans.

- High Approval Rate: With an impressive 92% approval rate, this lender stands out for its likelihood to approve loan applications for a broad spectrum of customers, even those with less-than-perfect credit histories.

- Customer-Centric Approach: Exclusive Loans places emphasis on simplifying and expediting the loan application process, demonstrating a commitment to ensuring that customers receive funds promptly and efficiently.

Cons

- Limited Physical Presence: Exclusive Loans primarily operates online, which may be a drawback for customers who prefer or rely on in-person services for their financial transactions and interactions.

- Fees and Penalties: Customers should be mindful of potential fees and penalties associated with late or missed payments, as these could add to the overall cost of the loan and impact the borrower’s financial obligations.

Conclusion

Exclusive Loans emerges as a robust and reliable option for individuals seeking various types of loans in South Africa. The company’s standout features include a high approval rate and a comprehensive range of loan offerings, encompassing payday loans, short-term loans, personal loans, and consolidation loans. The flexibility in repayment terms and the commitment to providing personalized loan offers further contribute to this lender’s appeal to potential borrowers. However, individuals should be aware of the online-centric nature of the service and the importance of adhering to repayment terms to avoid additional costs.

Frequently Asked Questions

Exclusive Loans offers a variety of loans, including Payday Loans, Short-Term Loans, Personal Loans, and Consolidation Loans. Each loan type is designed to address different financial needs, ranging from immediate short-term assistance to larger, long-term financial objectives.

The disbursement of funds is generally prompt. However, the exact timing can vary based on the type of loan and the verification process. The company aims to ensure that customers have access to the funds they need as quickly and efficiently as possible.

Exclusive Loans employs advanced security measures to protect customers’ personal and financial information. The company ensures that data transmitted through their website is encrypted, safeguarding it from unauthorized access or leakage.

Exclusive Loans provides a loan comparison service that assists customers in navigating through various loan options available in the market. This service enables borrowers to make informed decisions by choosing loans that best suit their financial circumstances and needs.

The maximum loan amount offered depends on various factors, such as the type of loan, the borrower’s credit score, income, and existing financial obligations. Exclusive Loans focuses on providing personalized loan amounts that align with the borrower’s repayment capacity and financial situation.