FinChoice [Finchoice.co.za] offers a range of financial solutions tailored to meet the needs of individuals seeking quick and convenient loan options. This review aims to provide a comprehensive and unbiased look at what FinChoice brings to the table in terms of loan offerings, customer service, and overall reliability.

FinChoice – Loan Overview

| Name | FinChoice |

|---|---|

| Financial | Registered Credit Provider (NCRCP 8162) |

| Product | Personal Loans & MobiMoney™ Facility |

| Minimum age | Not specified |

| Minimum amount | Personal Loans: Up to R8,000 (initially), up to R40,000 upon qualification MobiMoney™: Up to R10,000 |

| Maximum amount | Personal Loans: R40,000 MobiMoney™: R10,000 |

| Minimum term | Personal Loans: Up to 6 months MobiMoney™: 1 month |

| Maximum term | MobiMoney™: 3 months |

| APR | Not specified |

| Monthly Interest Rate | Not specified |

| Early Settlement | Not specified |

| Repayment Flexibility | Yes, with MobiMoney™ allowing repayment over 1, 2, or 3 months. |

| NCR Accredited | Yes |

| Our Opinion | ✅ Flexible loan options with MobiMoney™ offering immediate access to funds. ⚠️ Limited to specified loan amounts and terms. |

| User Opinion | ✅ Secure interaction with KwikServe®. ⚠️ Interest rates and terms are dependent on the loan type selected. |

Experiences with FinChoice Loan

Navigating through the loan application process can often feel like a tumultuous journey. With FinChoice, the experience seems to be designed with the customer’s ease in mind. From the initial application stages to the final loan approval, this lender appears to prioritize simplicity and clarity. Customers have access to a variety of loan options, each tailored to meet different financial needs and circumstances. The feedback from customers illustrates a level of satisfaction that speaks volumes about the company’s dedication to customer service. Testimonials often highlight the ease of the application process, the responsiveness of customer service, and the overall reliability of the loan services provided.

Who Can Apply for a FinChoice Loan?

Criteria for Potential Borrowers

FinChoice is quite inclusive with its eligibility criteria, ensuring that a broad spectrum of individuals can access their loan products. To apply for a loan, an applicant must be 18 years or older and a resident of South Africa. A consistent source of income is also a prerequisite, ensuring that the borrower has the means to repay the loan. Documentation such as proof of income, identification, and details of a valid bank account are necessary to facilitate the application process. The emphasis here is on accessibility, ensuring that the loans are not just limited to a specific demographic but are available to a wider audience who may need financial assistance.

Differences from Other Loan Providers

When comparing Finchoice.co.za to other loan providers, certain distinctions come to the forefront. One notable difference is the flexibility in their loan offerings. FinChoice provides a range of loan options with various repayment terms, allowing borrowers to choose a loan that aligns with their financial circumstances. Additionally, the application process is streamlined and user-friendly, enabling customers to apply and receive feedback with minimal hassle. The company also places a significant emphasis on customer service, ensuring that customers receive the necessary support and guidance throughout the loan application and repayment process. This customer-centric approach appears to be a defining feature that sets FinChoice apart from other lenders in the financial landscape.

About Arcadia Finance

Arcadia Finance facilitates the process of securing loans from a range of banks and lenders. Fill out a free application and get loan offers from up to 19 different lenders. We collaborate with well-established, trustworthy lenders who are licensed by the National Credit Regulator (NCR) in South Africa.

FinChoice Loan

What Makes the FinChoice Loan Unique?

In the crowded marketplace of loan services, this lender carves out its uniqueness through a blend of customer-centric features and flexible loan offerings. The company’s approach seems to be rooted in understanding the diverse financial needs of customers and offering solutions that are both practical and accessible. They don’t just offer loans; they provide a variety of options that can be tailored to meet specific financial objectives, whether it’s navigating through a short-term financial crunch or managing a significant expenditure.

Comparing Finchoice.co.za loans with other options in the market reveals several advantages. The flexibility in repayment terms, the variety of loan options, and the user-friendly application process collectively enhance the borrowing experience. The company’s commitment to transparency ensures that borrowers are well-informed about the terms of their loans, fostering a sense of trust and reliability. This comparative advantage positions FinChoice as a lender that prioritizes the needs and experiences of its customers, making it a noteworthy option for potential borrowers.

Types of Loans Offered by FinChoice

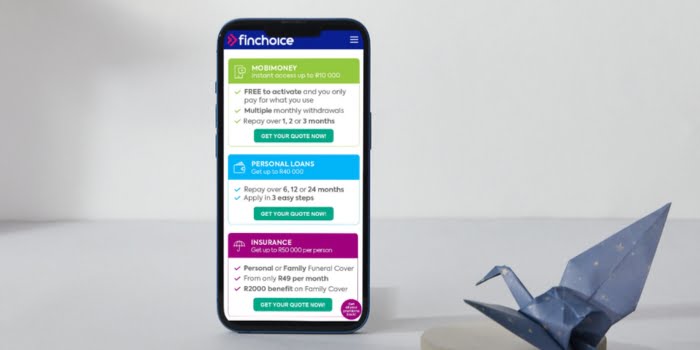

FinChoice offers the following types of loans:

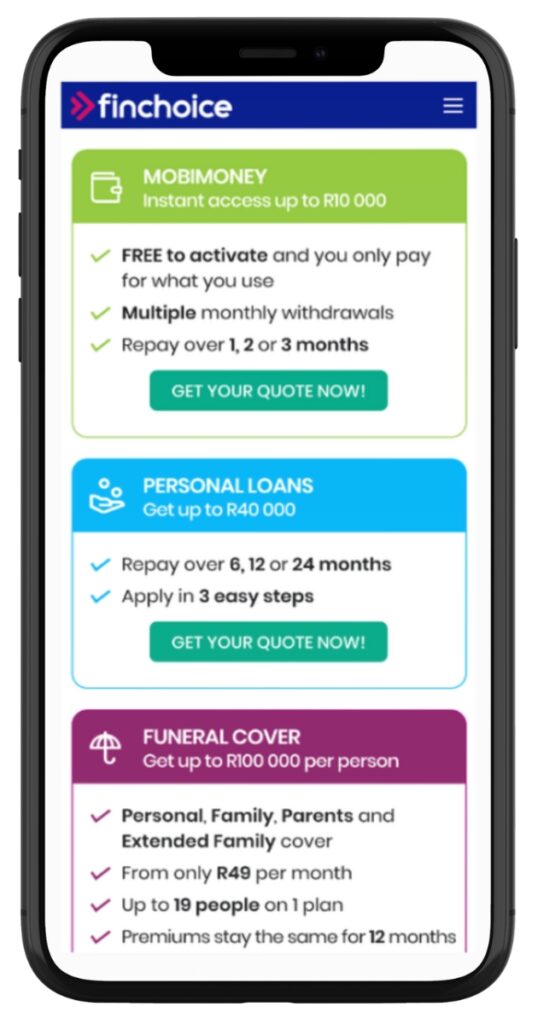

Personal / Flexi Loan

- This loan allows you to qualify for up to R8,000, repayable within 6 months. If you complete your repayment, you may qualify for up to R40,000. The loan is designed to be a simple solution for immediate financial needs.

- Comes with a Personal Protection Plan for cover in case of loss of job, disability, or death).

MobiMoney™ Facility

- Offers access to up to R10,000, with the flexibility to repay over 1, 2, or 3 months. The unique feature of this facility is that you only pay for what you use.

- Provides same-day withdrawals of between R100 and R10,000, and allows for the purchase of airtime, data, and electricity 24/7

Requirements for a FinChoice Loan

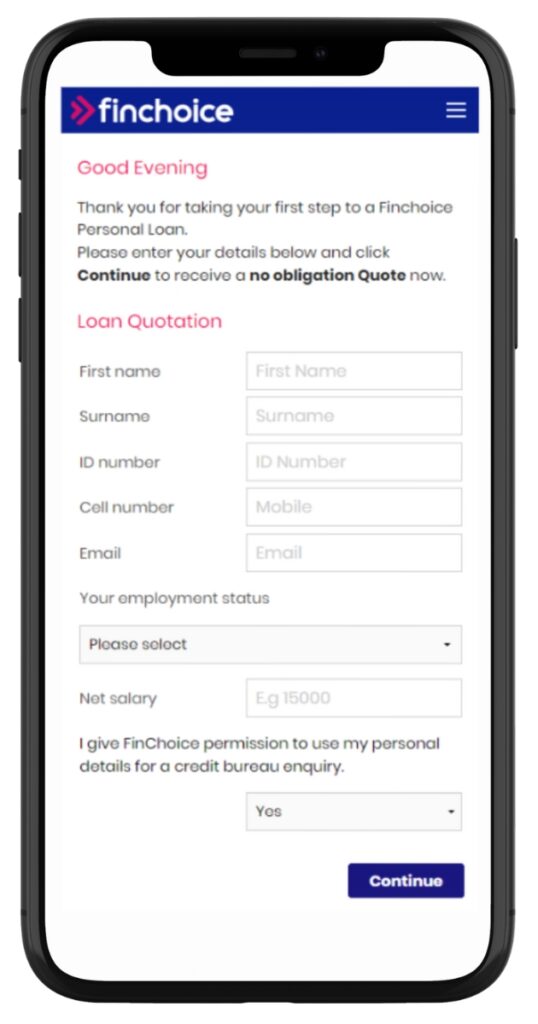

Getting a loan from this lender involves a process that requires applicants to provide certain documents and information. The necessary documentation primarily includes a valid South African ID and proof of income to validate the applicant’s ability to repay the loan. Additionally, applicants must provide details of a valid bank account where the loan amount can be deposited.

More:

- Affordability Assessment: FinChoice conducts an affordability assessment as per the National Credit Act (NCA) guidelines. This assessment ensures they lend you only what you can afford to repay. During this process, they will ask questions about your income and expenses.

- Proof of Income: To complete the loan application, you need to provide proof of income. This can be in the form of:

- The 3 most recent payslips

- Bank statements

- Pension slips

- Documentation Submission: You are encouraged to submit your proof of income documents monthly, even if you are not planning on taking another loan. This allows for instant approval when you do need a loan.

- Bank Statements: If you bank with ABSA, Nedbank, or Standard Bank, FinChoice can request your bank statements directly with your permission.

- Mobile Number: KwikServe® services are accessed with your registered cell phone, indicating the need for a mobile number during the application process

Step-by-Step Guide to Applying for a Loan with FinChoice

To apply for a loan at FinChoice, follow these steps:

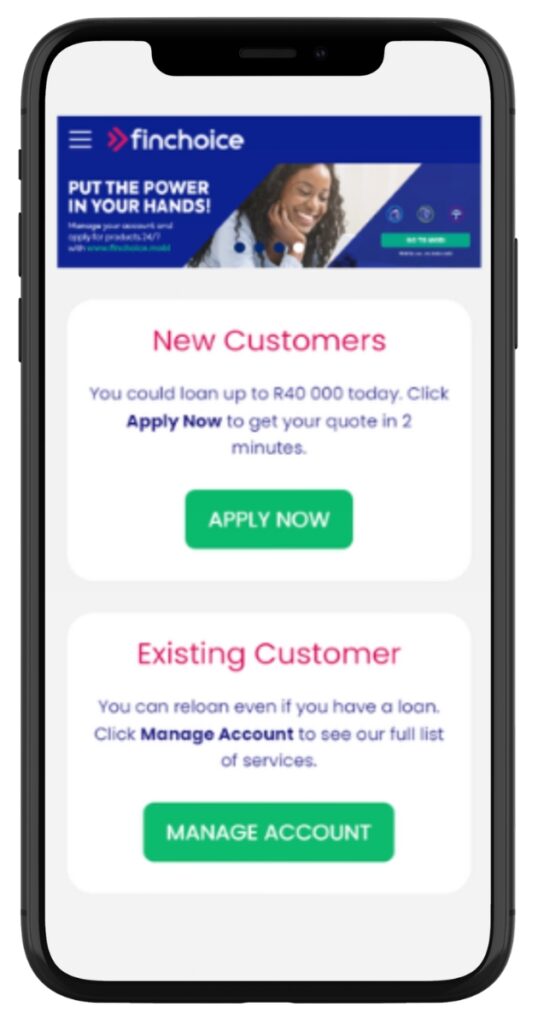

Step 1. Visit Finchoice.co.za

Step 2. Apply up to R40,000 instantly or Reapply via “Manage Account.”

Step 3. Choose between MobiMoney and Personal Loans.

Step 4. Provide personal and employment details for a quote.

Step 5. Submit the required documents, such as proof of income.

Step 6. Wait for the approval decision, which may include an affordability assessment.

Step 7. Once approved, the loan amount will be disbursed to your account.

Eligibility Check

FinChoice offers tools that allow potential borrowers to pre-check their eligibility for a loan. These tools are designed to provide applicants with preliminary insights into their loan options, helping them understand what to expect in terms of loan amounts and repayment terms. Utilizing these tools can be a valuable first step in the loan application process, enabling applicants to gauge their eligibility before proceeding with the formal application. This approach enhances the transparency of the process, allowing applicants to make informed decisions based on their eligibility status.

Security and Privacy

In the realm of financial transactions, security, and privacy hold paramount importance. FinChoice appears to be acutely aware of this, implementing robust measures to safeguard customers’ personal and financial information. The company utilizes secure technologies and practices to ensure that the data shared by customers during the loan application and management processes remains protected against unauthorized access and breaches.

This lender’s privacy policies further reinforce its commitment to data security. These policies delineate how customer information is handled, used, and protected, ensuring that customers have clarity and confidence in the company’s data management practices. The policies are crafted to comply with legal regulations and standards, ensuring that data handling practices align with established norms and expectations.

The emphasis on security and privacy reflects this lender’s dedication to creating a safe and trustworthy environment for customers. It underscores the company’s effort to foster trust and reliability, ensuring that customers can engage with their services with assurance and peace of mind. In a digital age where data vulnerabilities are a significant concern, such measures play a crucial role in enhancing the overall customer experience and confidence in the company’s services.

How Much Money Can I Request from FinChoice?

When considering a loan from Finchoice.co.za, applicants have the flexibility to request various loan amounts based on their individual needs and repayment capabilities. The company offers loans that range from smaller, short-term amounts to more substantial sums, allowing for adaptability based on the borrower’s requirements. FinChoice also provides personalized loan offers, tailoring the loan terms to align with the borrower’s financial situation, ensuring that the loan is both manageable and practical for the applicant.

How FinChoice Creates Personalised Loan Offers

FinChoice takes a personalized approach to loan offerings. The company assesses each application on an individual basis, considering various factors such as the applicant’s income, credit history, and repayment capacity. This detailed evaluation allows them to create loan offers that are customized to meet the specific needs and financial circumstances of each borrower, enhancing the likelihood of loan approval and successful repayment.

How Long Does It Take to Receive My Money from FinChoice?

The processing time for receiving money from them is relatively efficient. The company aims to facilitate a swift and smooth transaction process, ensuring that approved loans are disbursed promptly. However, the actual time may vary based on several factors, including the verification of provided information and documents, as well as banking processes.

How Do I Repay My Loan from FinChoice?

Repaying a loan from them is facilitated through various repayment options, allowing borrowers to choose a method that is most convenient for them. The company provides detailed information on the repayment terms, ensuring that borrowers are well-informed about their obligations. Additionally, it’s essential to be aware of any potential fees or penalties that may apply, such as those associated with late or missed payments, to manage the repayment process effectively and avoid any unnecessary costs.

Online Reviews of FinChoice

Online reviews offer a window into the customer experiences with FinChoice. These reviews, often a mix of positive and negative, provide insights into various aspects such as the application process, customer service, and the overall satisfaction levels of the borrowers. Customers commonly highlight the ease of application and the responsiveness of the lender’s team. These reviews can be a valuable resource for potential borrowers, offering a more nuanced understanding of what to expect when considering FinChoice as a loan provider.

Customer Service

Customer service is a pivotal aspect of the borrowing experience, and FinChoice appears to place a significant emphasis on ensuring that customers receive the necessary support and assistance. If there are further questions or if any clarification is needed, they provide various channels:

Finchoice Contact Channels

Phone number:

Office: 0861 346 246

Hours of operation:

Monday to Friday: 07:30 – 19:00

Saturday: 08:00 – 17:00

Sunday: 09:00 – 14:00

Public Holidays: 08:30 – 15:00

Closed: Christmas Day, New Year’s Day, Good Friday

Alternatives to FinChoice

Alternatives in the South African lending market include Sunshine Loans, SEFA, RCS, and ShowTime Finance. These competitors vary in their loan offerings, interest rates, and terms. These variety in the lending landscape offers potential borrowers diverse options to meet their financial needs, each with its unique features and benefits.

Comparison Table

Here’s a comparison table of FinChoice and four other lenders in South Africa:

| Criteria | FinChoice | Sunshine Loans | SEFA | RCS | ShowTime Finance |

|---|---|---|---|---|---|

| Loan Amount | R500 – R40,000 | R500 – R4,000 | R500 – R5,000,000 | R2,000 – R250,000 | R1,000 – R250,000 |

| Interest Rate | 5% | 10% | Not specified | 15% | Varies |

| Loan Term | 1 – 24 months | 4 – 49 days | 1 – 5 years | 12 – 60 months | 6 – 84 months |

| More Info | Sunshine Loans Review | RCS Review | ShowTime Finance Review |

History and Background of FinChoice

FinChoice has established itself as a reputable financial services provider, carving a niche in the competitive landscape of personal loans. The company’s inception was rooted in a vision to offer flexible and accessible financial solutions tailored to meet the diverse needs of customers. Over the years, this credit provider has cultivated a commitment to delivering quality services, fostering a relationship of trust and reliability with its customers. The company’s mission revolves around providing financial products that resonate with the individual needs and circumstances of its borrowers, ensuring that they receive solutions that are both practical and manageable.

Pros and Cons

Navigating through the world of loans and financial services often involves weighing the benefits against the drawbacks. With FinChoice, there are several pros and cons to consider when evaluating their loan offerings.

Pros

- Flexibility: FinChoice offers a variety of loan products with different repayment terms, allowing borrowers to choose options that align with their financial situations.

- Customer Service: The company prioritizes customer satisfaction, ensuring that borrowers receive adequate support and guidance throughout the loan process.

- Ease of Application: The application process is streamlined and user-friendly, facilitating a smooth and efficient experience for applicants.

Cons

- Loan Amounts: The maximum loan amount offered by FinChoice might not be sufficient for borrowers looking for substantial financial assistance.

- Interest Rates: While competitive, the interest rates can vary, and borrowers need to assess whether the rates align with their repayment capabilities.

- Eligibility: The eligibility criteria, while inclusive, might still limit access for some potential borrowers, particularly those without a consistent source of income.

Conclusion

Taking into consideration various aspects such as loan offerings, customer service, and overall user experience, FinChoice deserves a commendable rating. Their dedication to providing tailored loan solutions that meet individual needs and circumstances is a significant strength. The positive customer testimonials and the company’s focus on transparency and integrity further bolster its standing as a reliable lender.

Their customer-focused approach, paired with their flexible and diverse loan options, positions them as a lender that potential borrowers can consider with confidence.

Frequently Asked Questions

FinChoice offers a variety of loans to cater to different financial needs. These range from short-term loans for immediate financial requirements to more substantial loans for significant expenses or investments. The diversity in loan offerings ensures that borrowers can find a loan that aligns with their specific financial needs and repayment capabilities.

This lender aims to process and approve loans promptly. Once a loan is approved, the funds are disbursed efficiently, ensuring that borrowers have access to the funds within a reasonable timeframe. However, the actual disbursement time may vary based on various factors such as verification processes and banking procedures.

The maximum loan amount offered by them varies based on the borrower’s financial assessment and the type of loan chosen. Borrowers can access loan amounts that align with their repayment capabilities and financial needs, ensuring that the loan terms are manageable and practical.

FinChoice provides tools and resources that allow potential borrowers to pre-check their eligibility for a loan. These tools offer preliminary insights into the loan options available based on the borrower’s financial circumstances, enabling them to gauge their eligibility before proceeding with the formal application process.

Applying for a loan with FinChoice requires various documents such as proof of identity, proof of income, and bank account details. These documents facilitate the application process, enabling a smooth and efficient loan approval journey.