Finsa [Finsa.co.za] has established its reputation by providing customised loan solutions designed to meet the specific needs of South Africans. Whether you’re consolidating debt, financing a large purchase, or seeking support for your business, Finsa may offer a suitable option.

Finsa – Loan Overview

| Name | Finsa |

|---|---|

| Financial | Privately Owned & Registered Credit Provider |

| Product | Personal and Business Loans |

| Minimum age | 18 years |

| Minimum amount | R5,000 |

| Maximum amount | R300,000 |

| Minimum term | 3 months |

| Maximum term | 60 months |

| APR | 18% – 28% |

| Monthly Interest Rate | Starts from 1.5% |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Tailored to meet specific requirements |

| NCR Accredited | Yes |

| Our Opinion | ✅ Competitive interest rates for personal and business loans ✅ Flexible repayment terms that can be adjusted to your financial situation ✅ Quick application process with minimal documentation required |

| User Opinion | ✅ Users appreciate the straightforward application process ✅ Many have highlighted the helpful customer service ⚠️ Some concerns about the clarity of terms for longer loan periods |

Unique Features of Finsa Loans

Finsa offers a range of loan solutions specifically tailored to address a wide variety of financial needs, standing out with its flexible and customer-focused policies. What differentiates this lender is its dedication to providing personalised loan options that accommodate the diverse financial situations of its clients. For example, loans can be customised with repayment terms ranging from a few months to several years, allowing borrowers to match their repayment plans with their financial circumstances. This flexibility is particularly helpful for borrowers who need structured payments aligned with their income, reducing financial pressure and making timely repayments more manageable.

Additionally, their loan approval and disbursement processes are streamlined, ensuring that clients receive their funds quickly. This is especially beneficial for those requiring urgent financial assistance, whether for emergency expenses, business cash flow, or immediate personal needs. Unlike traditional lenders that often involve extensive paperwork and lengthy approval times, Finsa.co.za employs a faster process, reducing the wait for applicants. Coupled with competitive interest rates and no penalties for early settlement, Finsa has become a preferred option for many South Africans seeking reliable and efficient financial services.

Types of Loans Offered by Finsa

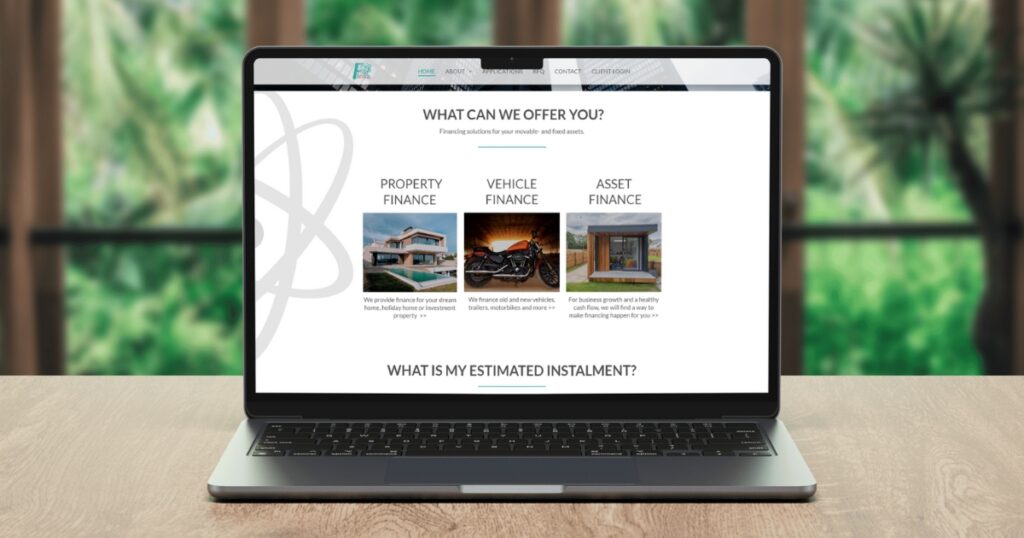

Finsa offers a variety of loan products designed to meet the specific financial needs of its clients, with each option tailored to different purposes:

Property Finance

Ideal for individuals looking to purchase residential properties, holiday homes, or make property investments. It provides flexible financing options to help you secure the property of your dreams.

Asset Finance

Tailored for businesses and individuals seeking to acquire movable and fixed assets, providing the necessary funding for equipment or machinery essential for operations.

School Finance

Designed for educational institutions, allowing schools to enter into lease agreements for acquiring assets like computers, sports equipment, or other educational tools.

Vehicle Finance

For those looking to purchase new or used vehicles, Finsa offers auto loans with flexible terms to fit the borrower’s budget and repayment capacity, ensuring affordability for both the purchase and maintenance of the vehicle.

Requirements for a Finsa Loan

To apply for a loan with Finsa, applicants must meet certain criteria and provide specific documentation to support their application:

- Valid South African ID or Smart ID Card

- Recent payslips (from the past three months) to verify income

- Proof of residence (such as a recent utility bill)

- Bank statements for the last three months, showing income and expenses

- For business loans, additional documents may be required, such as business registration papers and financial statements

General Requirements:

- Applicants must be at least 18 years old

- A regular income from employment or a verifiable source is necessary

- Credit history and score will be assessed to determine eligibility and applicable interest rates

- For auto loans, the vehicle must be insured

About Arcadia Finance

Get your loan easily with Arcadia Finance. Choose from 19 trusted lenders, fully compliant with South Africa’s National Credit Regulator, with zero application fees.

Simulation of a Loan at Finsa

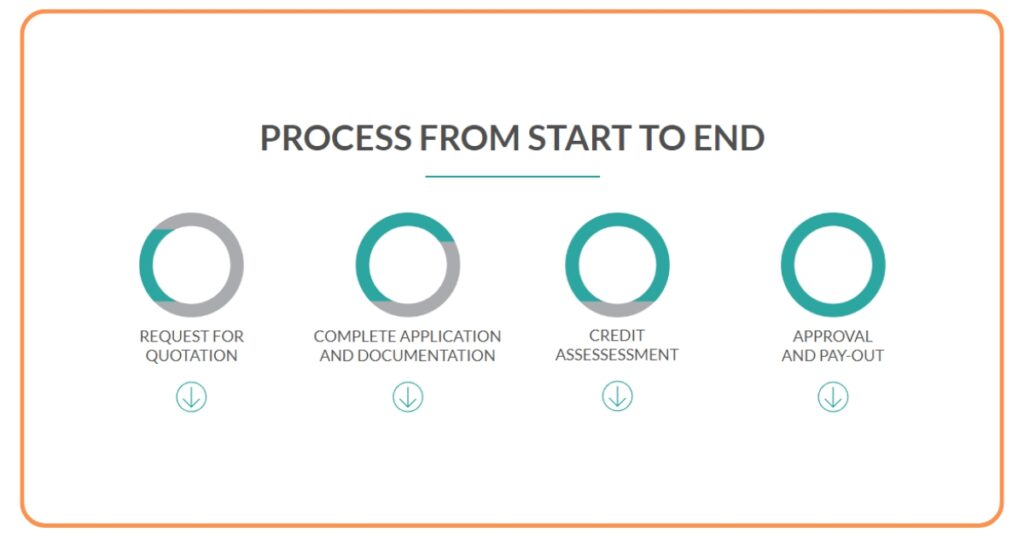

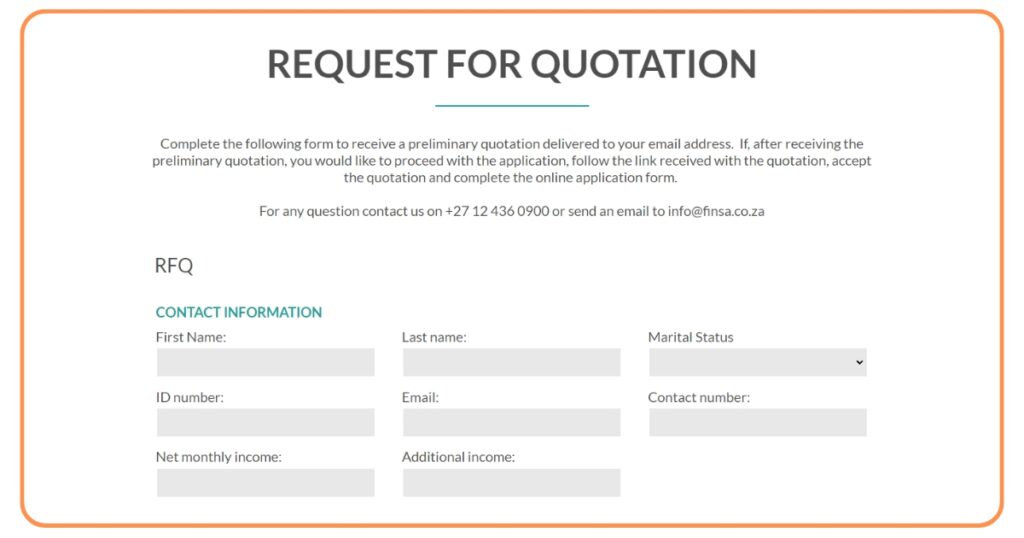

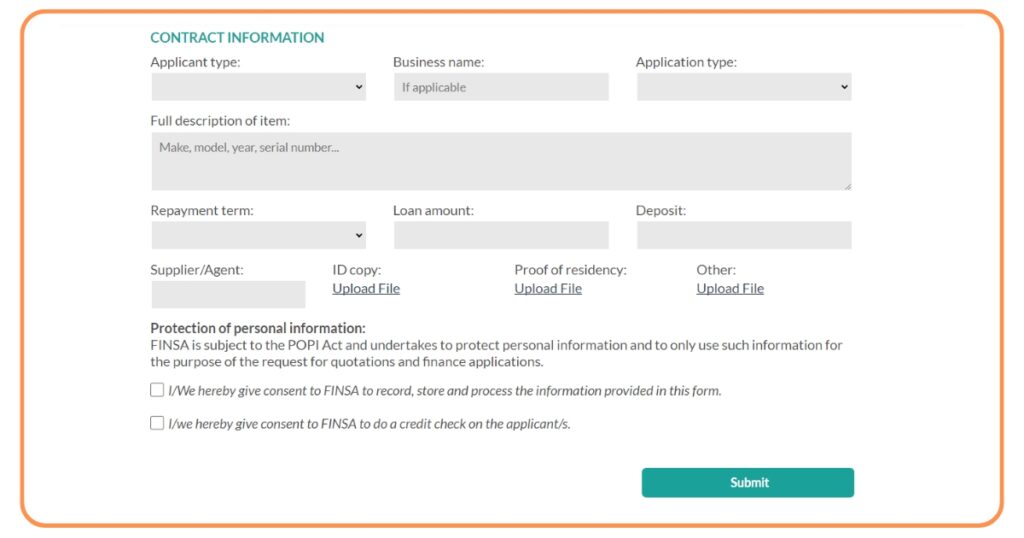

Applying for a loan with Finsa is designed to be straightforward and easy to navigate. Here’s a simple step-by-step guide to help you through the process:

Step 1. Go to Finsa.co.za

Step 2. Select “Applications”

Step 3. Click “Request a quotation”

Step 4. Complete the request for quotation form with your personal and contact information to receive a preliminary quote.

Step 5. Provide detailed information about the loan, including the item description, repayment terms, and required documents.

Step 6. Double-check your details for accuracy and submit your application.

Step 7. They will review your application and conduct a credit check.

Step 8. If approved, you’ll receive an offer outlining your loan amount, interest rate, and terms.

Step 9. If you’re satisfied with the terms, accept the loan agreement.

Step 10. Once you’ve signed the agreement, the funds will be deposited into your bank account.

Eligibility Check at Finsa

Finsa provides several tools and methods to help potential borrowers assess their eligibility before formally applying for a loan. This proactive approach helps applicants gauge their chances of approval and better understand the terms they might receive. Here are the main ways this credit provider allows you to check your eligibility:

- Online Eligibility Calculator: On their website, you can input details like your income, employment status, and desired loan amount. The calculator provides a preliminary assessment of your eligibility and an estimate of the loan amount you could qualify for.

- Pre-Application Query Form: Prospective applicants can fill out a simple query form online, providing basic personal and financial information. Their customer service team will contact you to discuss your eligibility based on the details submitted.

- Soft Credit Inquiry: They can conduct a soft credit check, which does not affect your credit score. This gives a preliminary indication of whether your credit profile meets their loan criteria.

- Direct Consultation: You can also consult with their loan advisor either over the phone or in person. This allows you to discuss your financial situation and receive personalised advice on your eligibility.

How Much Money Can I Request from Finsa?

Finsa offers loan amounts that cater to a variety of financial needs. For personal and auto loans, you can request between R5,000 and R300,000, depending on your financial situation and creditworthiness. Business loans often have higher maximum limits, designed to meet the specific scale and requirements of your business operations.

Receive Offers

Finsa creates personalised loan offers by evaluating each applicant’s financial status, credit history, and loan purpose. Through a detailed analysis that combines credit scoring with personal financial data, Finsa tailors the loan amounts, terms, and interest rates to ensure the offers are in line with the borrower’s repayment capacity.

How Long Does It Take to Receive My Money from Finsa?

The time to receive funds from Finsa after applying is generally quick. The approval process typically takes 24 to 48 hours once all necessary documents are submitted correctly. After approval, the funds are usually disbursed within one business day. The total time may vary depending on how quickly the applicant provides the required documents or if any additional information or clarification is needed.

How Do I Repay My Loan from Finsa?

Finsa offers several flexible repayment options, including monthly instalments that can be set to coincide with your payday. This lender also allows for early repayment without penalties, helping to reduce interest costs. While there are no hidden charges, late payments may incur fees, and standard fees such as account management or transaction costs may apply. These charges are communicated upfront during the loan agreement process.

Pros and Cons of Choosing Finsa

When considering them for your loan needs, it’s helpful to review both the benefits and limitations of their services. Here’s a summary of the key pros and cons:

Pros

- Competitive Interest Rates: Offers attractive interest rates, particularly for personal and business loans, making their products affordable to a wide range of customers.

- Flexible Repayment Terms: Borrowers can choose repayment terms that suit their financial situation, with the added benefit of early repayment without penalties.

- Quick Processing and Disbursement: Loan approval process is efficient, with funds usually disbursed within one business day after approval. This is ideal for those needing quick financial assistance.

- Personalized Loan Offers: Customizes loan offers based on each applicant’s financial profile, ensuring manageable repayments that align with individual needs.

- Minimal Documentation: The loan application process is straightforward, requiring minimal paperwork, which reduces the time and hassle for applicants.

Cons

- Strict Credit Requirements: Credit requirements may exclude individuals with a poor or limited credit history, limiting access to those in need of loans.

- Limited Loan Amounts for Higher Needs: For individuals or businesses needing large sums, their maximum loan amounts may not be sufficient to meet their needs.

- Potential for Additional Fees: While this lender is transparent with most fees, there may be extra charges related to late payments or account management that may not be fully apparent upfront.

- Service Availability: The availability of their services may not be equally accessible across all regions, potentially restricting access for some clients.

- Limited In-person Services: In certain areas, customers may not have access to physical branches for in-person consultations, which could be inconvenient for those who prefer face-to-face service.

Customer Service at Finsa

Finsa is dedicated to offering excellent customer service to ensure a seamless experience for all clients. Whether you’re applying for a loan, managing repayments, or have other queries, Finsa provides various support channels:

- Online Support: They feature an extensive online support system, including a comprehensive FAQ section for common questions. There’s also an online chat option on their website where you can interact directly with a customer service representative.

- Contact Center: For detailed inquiries or immediate assistance, they have a dedicated contact centre. You can call during business hours to speak with a support agent who can provide guidance and resolve any issues you may encounter.

- Email Communication: If your query is not urgent, you can email their support team. They are known for their prompt responses and aim to reply to all emails within 24 hours.

Do You Have Further Questions for Finsa?

If you have any additional questions about their loan products, application processes, or anything else, feel free to reach out to their customer service team. They are well-equipped to provide the information and support you need to ensure a smooth and positive borrowing experience. Whether you need assistance before applying, during the loan term, or after repayment, Finsa’s customer service is available to help you throughout the entire process.

Contact Channels

Phone number:

Call Centre: 012 023 1333

General Contact Number: 012 436 0900.

Email: info@finsa.co.za

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: By appointment only

Postal address:

Office 2, DGE Building, 90 Sovereign Drive, Route 21 Corporate Park, Irene, South Africa

What Customers Say About Finsa

Customer feedback on Finsa.co.za, based on online reviews, presents a range of opinions. Here’s a summary:

Positive Feedback

- Quick and Easy Application: Many reviewers appreciate Finsa’s streamlined application process, which facilitates rapid fund disbursement—particularly valuable for those needing urgent financial help.

- Flexible Repayment Terms: The flexibility in repayment options is often praised. Customers find it beneficial to have adaptable repayment schedules that align with their financial situations.

Negative Reviews

- Fee Transparency Issues: Some customers have raised concerns about the transparency of fees. They feel that initial positive impressions were overshadowed by problems with fee disclosures.

- Customer Service Experience: There have been reports of dissatisfaction with customer service, including instances where customers felt unresponsive support or were misled during the loan process.

Alternatives to Finsa for loans in South Africa

| Provider | Loan Types Offered | Interest Rates (Approx.) | Loan Amount Range | Special Features |

|---|---|---|---|---|

| Finsa | Personal, Business, Educational, Auto | 18% – 28% APR | R5,000 to R300,000 | Flexible repayment terms, minimal documentation |

| MyLoan | Personal | Starting from 16% APR | R5,000 to R250,000 | Compares multiple lenders, quick application |

| Capitec Bank | Personal, Multi Loan | Competitive rates | Up to R250,000 | Accessible in branches, straightforward application |

| African Bank | Personal, Consolidation | Custom rates | Up to R250,000 | Break from payments option, high approval rate |

| Nedbank | Personal, Home, Vehicle | Market-related rates | Varies by product | Customisable loans, easy online management |

| Loan4Debt | Debt Consolidation, Short-Term, Personal | Starting from 36% APR | R1,000 to R1,000,000 | Customisable loan |

| YourLoan24 | Personal, Short-Term, Debt Consolidation, Easy Loans | Starting from 19.25% APR | R2,000 to R200,000 | Quick approvals, flexible repayment, online process |

History and Background of Finsa

Finsa.co.za was founded with the goal of offering flexible and accessible financial solutions to individuals and businesses throughout South Africa. Since its establishment, the company has experienced considerable growth, continuously adapting to meet the changing financial needs of its clients. Throughout its development, they maintained a strong commitment to customer satisfaction and ethical lending practices.

Mission: To empower its clients by offering financial solutions that are both practical and adaptable, helping them achieve their personal and business goals.

Vision: Aims to be a leading financial services provider in South Africa, known for its dedication to client empowerment, innovation in financial solutions, and integrity in service delivery.

Conclusion

Based on a thorough review of Finsa’s services, including their loan offerings, customer service, and client feedback, Finsa comes highly recommended. Their focus on tailored financial solutions and prompt service delivery establishes them as a dependable option for those seeking financial assistance.

Frequently Asked Questions

They provides a range of loan types to meet different financial needs, including personal loans, business loans, educational loans, and auto loans. Each type is designed to address specific requirements for individuals or businesses.

To apply for a loan with them, visit their website, select the loan type you need, complete the online application form with your personal and financial details, and upload the required documents for verification.

The minimum loan amount offered by them is R5,000, with the maximum amount available up to R300,000, depending on the loan type and your eligibility.

They typically process loan applications within 24 to 48 hours after all required documents have been submitted and verified.

They provide flexible repayment options that can be adjusted to align with the borrower’s pay cycle. Borrowers can choose from various repayment plans, and early repayment is permitted without penalties, allowing for better management of interest costs.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 16 banks and find the right loan for you.