Hoopla Loans [Hooplaloans.co.za] is an online platform and loan matching service in South Africa. They make comparisons between lenders, so you don’t have to. They handle Payday and Personal loans and, in addition, don’t charge any fees for their services. They promise to keep your information only between creditors processing your application. Additionally, they offer repayment terms that best suit your needs. In this article, we review Hoopla Loans’ loan options.

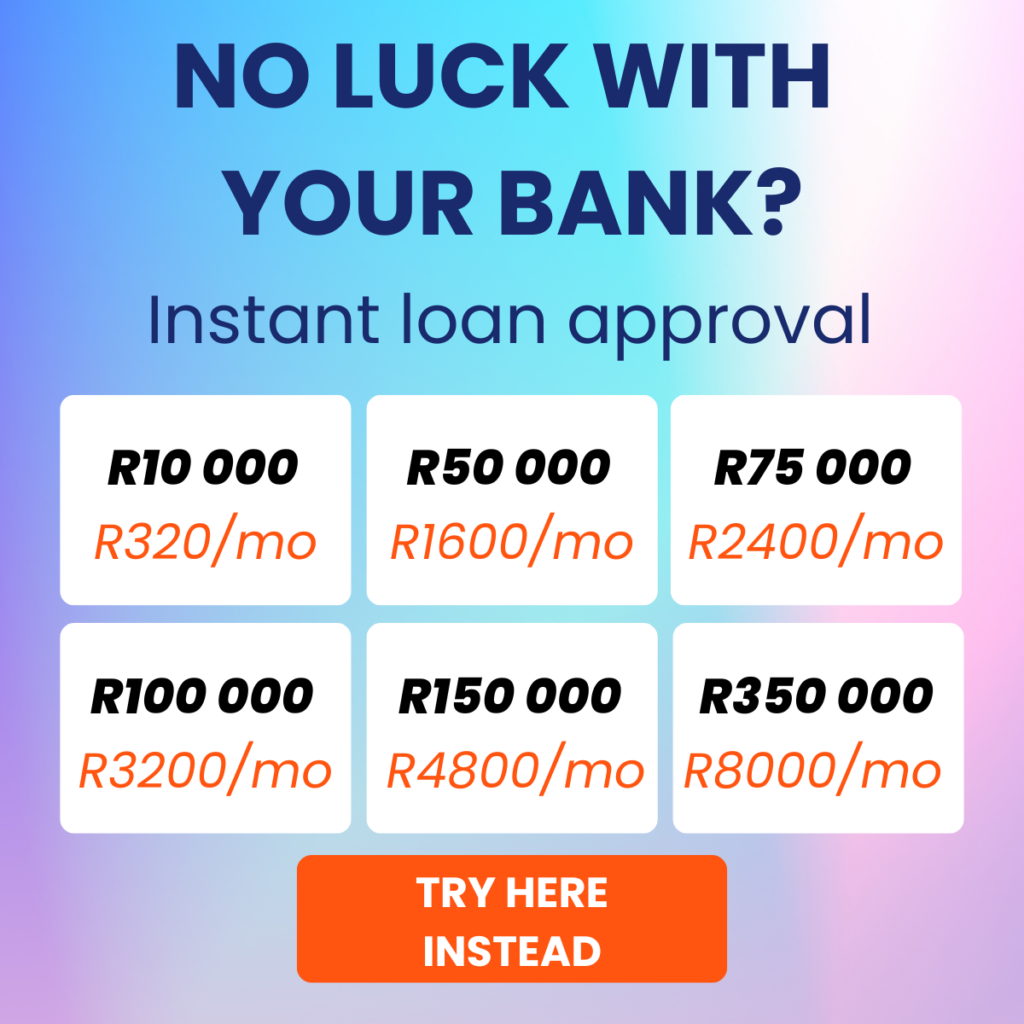

Hoopla Loans provide borrowers with loan amounts ranging from R100 to R250 000, with repayment terms between 2 and 60 months. If this seems like a suitable option, read on to learn more about this lender and whether they meet your needs.

Hoopla Loans: Quick overview

Loan amount: R100 – R250 000

Loan term: 2 to 60 months

Interest rate: 5% per month

Fees: Does not charge borrowers any fees for its loan-matching services

Loan types: Online loan broker

About Arcadia Finance

With Arcadia Finance, securing a loan is made easy. Our platform connects you to a range of banks and lenders upon completion of a free application. Up to 19 different lenders will present their offers to you. Rest assured, all our lending partners are vetted and licensed by South Africa’s National Credit Regulator (NCR).

Hoopla Loans Full Review

What Makes the Hoopla Loans Unique?

What sets Hoopla Loans apart is its streamlined approach to personal lending tailored specifically for South African customers. Unlike many lenders, this loan provider focuses on providing a simple and fast application process with minimal paperwork, making it an attractive option for those needing quick access to funds. The company emphasises flexibility in loan amounts and repayment terms, allowing customers to find a loan option that aligns with their financial needs and repayment capacities. This tailored structure aims to reduce the typical loan barriers, supporting a more accessible path to borrowing for various financial situations.

Furthermore, this broker prioritises transparent fees and competitive interest rates, ensuring that applicants are fully aware of costs from the beginning. This transparency is especially beneficial for those looking to manage their finances responsibly without hidden surprises. Their customer service is also designed to provide support through every step of the process, giving borrowers the confidence to make well-informed decisions. This combination of efficiency, clarity, and support makes this broker a distinctive option in the South African lending market.

Loan options you can expect from Hoopla Loans

This broker has several loan options available to its clients. These offers can amount to up to R250 000. However, regarding a payday loan, they won’t loan amounts up to this amount. In this instance, applications for such a loan should be through a personal loan instead of a payday loan. Those seeking lower amounts may apply for amounts as little as R100 for payday loans.

Payday Loans

These are short-term loans designed to help individuals bridge the gap between paydays. They’re ideal for emergencies or unexpected expenses that arise before your next salary. With quick approval times, they ensure that you have the funds you need without delay.

Personal Loans

A step above payday loans in terms of loan amount and duration, personal loans are versatile. Whether you’re planning a holiday, need to pay for a course, or are considering a small home renovation, a personal loan from this broker might be the answer.

Long-Term Loans

For more significant financial needs, long-term loans come into play. These loans offer larger amounts and extended repayment durations. They’re suitable for more substantial investments, such as buying property or starting a business.

Specialized Loans

Hoopla Loans also caters to specific regional needs with options like Gauteng Payday Loans and Western Cape Payday Loans. Additionally, they offer solutions for those with a rocky credit history through their bad credit loans.

This broker stands out not just for its range of products but also for its approach to lending. By prioritizing the needs of the borrower and offering a transparent, efficient process, it’s paving the way for a new era of online lending in South Africa.

Related Post: Finance27 Loan Review

Is Hoopla Loans Legit?

Any lender should be registered through the National Credit Regulator(NCR) —any registered lender offers regulated rates and terms. Hoopla Loans are brokers and only serve as a bridge between you and the credit provider. Though not official lenders, they only operate with lenders registered through the NCR.

Who is Hoopla Loans best for?

Best for borrowers who:

- Require Small, Short-Term Loans

- Seek Larger Personal Loans

- Have Less-Than-Perfect Credit Histories

- Desire a Fully Online Application Process

- Need Quick Access to Funds

Is Hoopla Loans a Safe and Good Option?

Hoopla Loans is a loan-matching platform connecting borrowers with NCR-registered lenders in South Africa. While not a direct lender, it ensures compliance with regulated loan terms. The fully online application process uses encrypted technology for security, offering instant lending decisions and potential same-day funding. Loan amounts range from R100 to R250 000, with repayment terms of 3 to 60 months.

Offering personal, payday, and debt consolidation loans, this comparison website caters to various financial needs, including those with bad credit. The platform is transparent about fees and interest rates, making it a fast, secure, and reliable option for borrowers seeking quick financial assistance.

Who Can Apply for a Hoopla Loans Loan?

Hooplaloans.co.za is inclusive and aims to cater to a broad spectrum of South Africans. Whether you’re a young professional just starting, a seasoned worker, or someone looking to consolidate debts, this broker is open to you. The primary criteria are that applicants must be South African citizens, living and working within the country. It’s a platform that believes in second chances, understanding that everyone’s financial journey is unique.

Requirements for Hoopla Loans Application

Credit providers, banks, and lending companies have requirements to avoid high-risk applicants for loans. However, as a broker, they may only require that the applicant is a South African citizen. The exception is when the borrower is foreign; they will need a work permit to apply.

Additional Requirements

They will enquire, namely, about your income each month. Information such as your ID, cellphone number, and proof of residence address. Lastly, the required amount and term to be repaid.

With the required information, Hoopla Loans will assess the associated risk for the applicant online. Once you qualify after your assessment, they review your information to other lenders for potential offers. As a loan broker, the probability of qualifying is respectably high.

Simulation of a Loan at Hoopla Loans

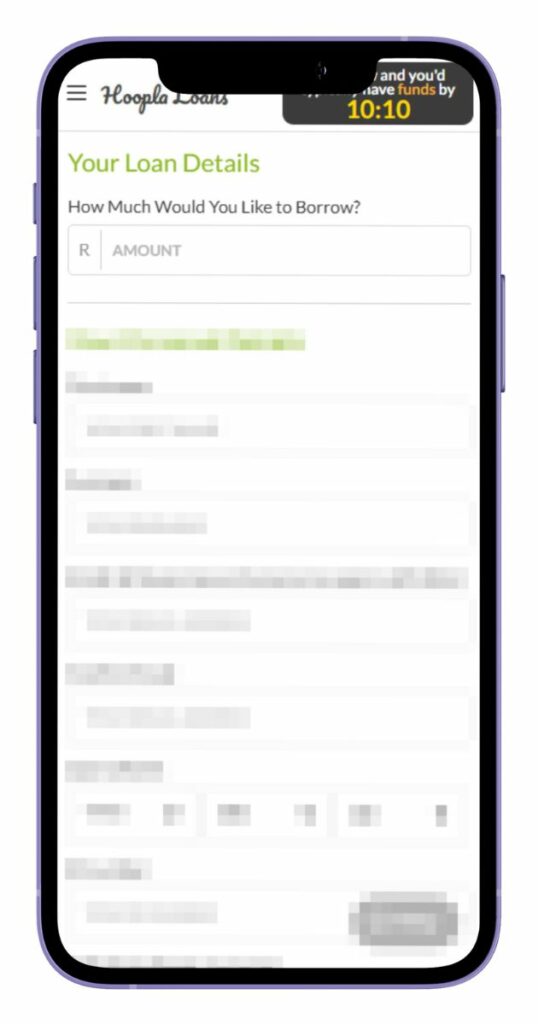

Here’s a step-by-step guide to help you navigate it:

Step 1. Start by accessing the official website Hooplaloans.co.za

Step 2. Click “Get My Loan”

Step 3. Enter the loan amount you wish to borrow.

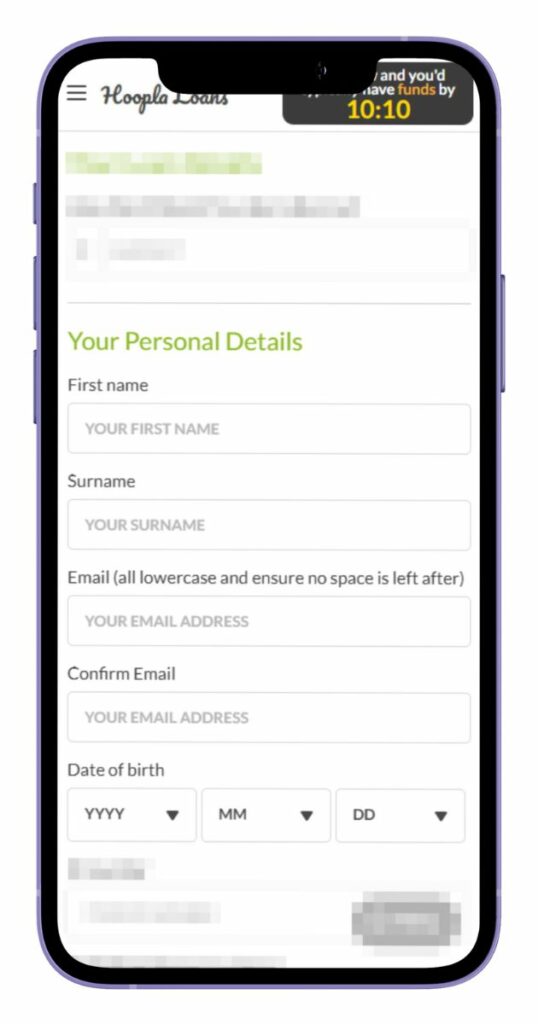

Step 4. Fill in your personal details including name, email, and date of birth.

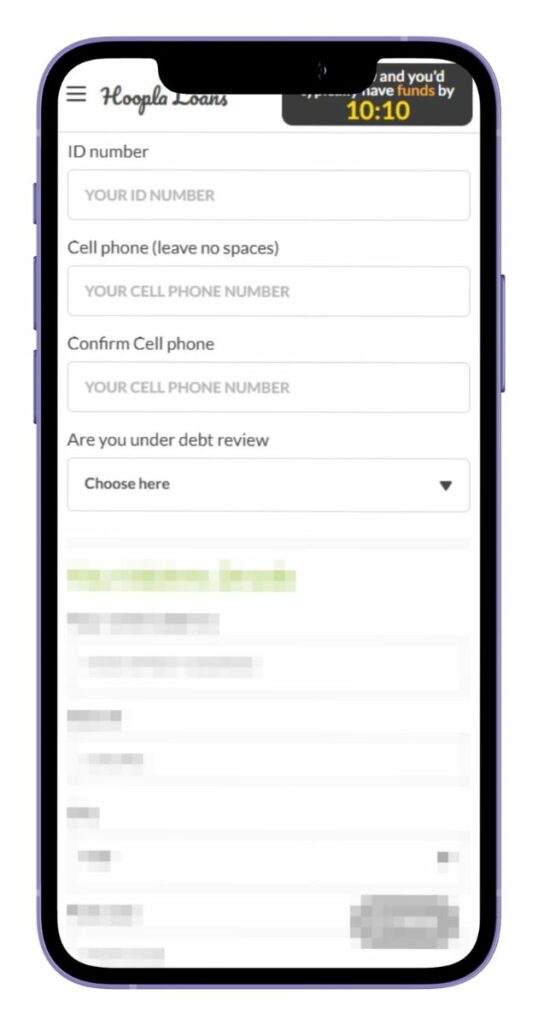

Step 5. Provide your ID number and confirm your cell phone number.

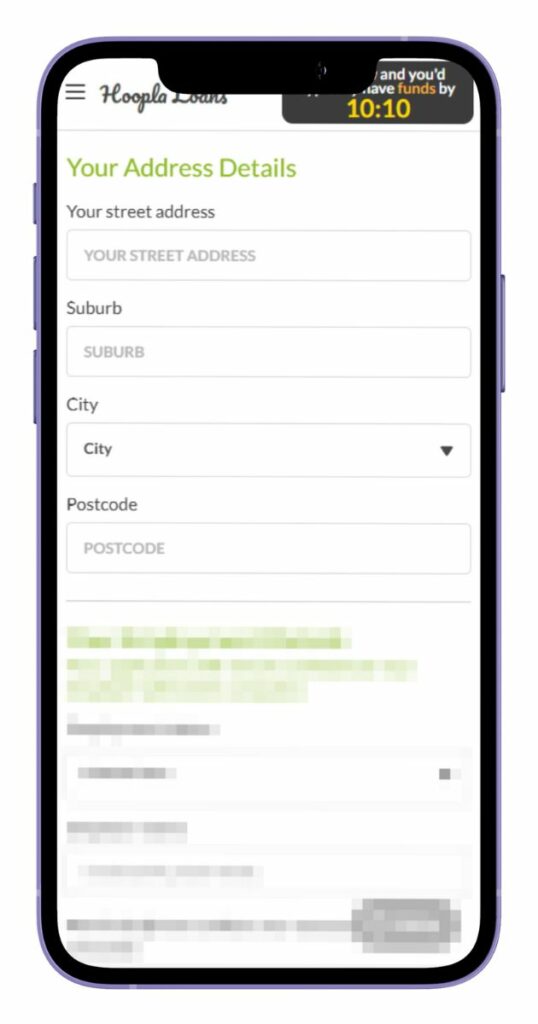

Step 6. Enter your address details such as street address, suburb, city, and postcode.

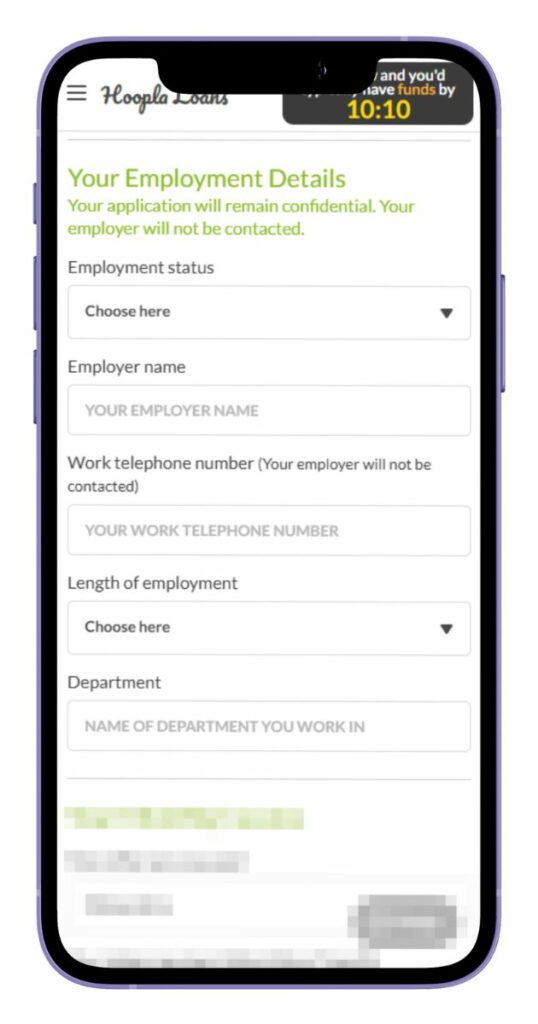

Step 7. Fill in your employment information, including status, employer, and length of employment.

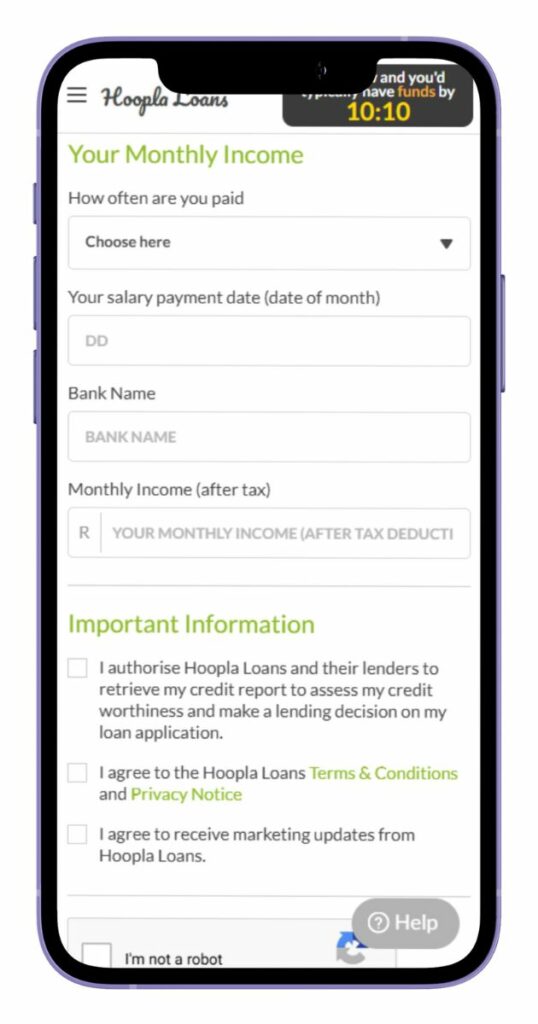

Step 8. Provide your monthly income details and agree to the terms and conditions before submitting.

Step 9. Once all details are filled in, submit your application.

Step 10. Lender will review your application and match you with suitable lenders. You’ll typically receive feedback quickly.

Step 11. If approved, you’ll receive a loan offer. Ensure you read the terms and conditions carefully.

Step 12. If you’re satisfied with the offer, accept it. The loan amount will then be transferred to your bank account.

Eligibility Check

Hooplaloans.co.za is designed with user convenience in mind. One of its standout features is the eligibility checker, which allows potential borrowers to gauge their chances of loan approval before formally applying. By inputting basic information such as income level, employment status, and desired loan amount, users can get a preliminary idea of whether they qualify for a loan. This tool not only saves time but also reduces the potential negative impact on one’s credit score from multiple loan applications.

This company offers a transparent and user-friendly approach to online lending. With clear requirements, an efficient application process, and tools to pre-check eligibility, it ensures that borrowers have a seamless experience from start to finish.

How Much Money Can I Request from Hoopla Loans?

This comparison website offers a diverse range of loan products to cater to varied financial needs. The minimum amount you can request is typically as low as R100, making it accessible even for minor financial hiccups. On the other end of the spectrum, they provides loans up to R250 000 for more substantial financial requirements. The exact amount you can borrow will depend on several factors, including your credit profile, income level, and the specific loan product you choose.

- Payday Loans: R100 – R8 000

- Personal Loans: R8 001 – R20 000

- Long-Term Loans: R20 001 – R250 000

How Hoopla Loans Creates Personalised Loan Offers

When you apply for a loan, their intelligent system reviews the details you provide, such as your income, employment status, and credit history. Based on this information, the platform then compares multiple lenders to find those that are most likely to approve your loan request. This tailored matching process ensures that the loan offers you receive are not only competitive but also realistic in terms of approval chances.

How Long Does It Take to Receive My Money from Hoopla Loans ?

One of the standout features of their loans is its efficiency. On average, after your loan application is approved, you can expect the funds to be disbursed into your bank account on the same day. This quick turnaround is particularly beneficial for those in urgent need of funds.

Hoopla Loans – Loan Overview

| Attribute | Details |

|---|---|

| Financial Name | Hoopla Loans |

| Product | Various loan types including personal and payday loans |

| Minimum Age | 18 years |

| Minimum Amount | R100 |

| Maximum Amount | R250 000 |

| Minimum Term | 2 months |

| Maximum Term | 60 months |

| APR | Varies, starting from 20% to 112% per annum |

| Monthly Interest Rate | Starts from 5% per month |

| Early Settlement | Not specified |

| Repayment Flexibility | Customizable based on borrower’s needs |

| NCR Accredited | Yes |

| Our Opinion | ✅ Offers a wide range of loan amounts and terms |

| ✅ Quick application and disbursement process | |

| ⚠️ High-interest rates for certain loans | |

| User Opinion | ✅ Convenient and quick financial solution |

| ⚠️ Interest rates can be high depending on the loan package |

How can Hoopla Loan’s interest rate change loan payments?

As we know, an interest rate through any lending company that the NCR regulates is to ensure that the rates are fair and justified. Hoopla loans offer fixed interest rates and will state if the interest rate will change during the period of the loan. This loan provider will stipulate at the start the interest rate to be paid each month till your final instalment. They reach out to several lenders, which is excellent for looking at fixed interest rates or additional options to suit your needs.

Do Hoopla Loans let me use an online loan calculator?

Unfortunately, their official website has no loan calculator. However, please use our loan calculator for a total cost analysis of your potential loan.

How Do I Repay My Loan from Hoopla Loans?

Hoopla Loans typically offers a direct debit option, where monthly repayments are automatically deducted from your bank account on a specified date. This ensures timely payments and reduces the risk of missing a due date.

When you accept a loan offer, the repayment schedule, including the amount and frequency, will be clearly outlined. Depending on the loan type and amount, you might have the flexibility to choose between different repayment plans, such as monthly, fortnightly, or even weekly installments.

Possible Fees and Penalties

Transparency is a hallmark of this broker. Any fees associated with your loan will be detailed in your loan agreement. This can include:

- Initiation Fee: A one-time fee that covers the cost of initiating the loan.

- Service Fee: A monthly fee for the ongoing administration of the loan.

Late or missed payments can result in additional fees or penalties. It’s crucial to review the loan agreement thoroughly and ensure you’re aware of any potential charges. If you anticipate difficulty in making a repayment, it’

Review of Hoopla Loans are They Positive?

Those who have taken a loan through Hooplaloans.co.za need to understand that with any loan taken out, there are risks to both parties. However, their aim to grant their clients quick access to loans tailored to their financial circumstance. As loan brokers, there are many benefits, namely the ability to lend and screen multiple lenders for suitable loan options. As with any loan, it’s best to review your possible lending options and make calculated comparisons.

I used Hoopla Loans when I was in need of emergency cash. Their loan application was super easy and I received an instant response. It is free to use and I got my loan the same day. With all the loan scams around, Hoopla is the go to place.

Easy, simple, fast, got my money right away with no surprises, helped me out big time when i needed it. I would recommend Hoopla Loans in a heartbeat.

I tried applying bit to kept asking me to redo the application. Not impressed.

They say they do offer loans for bad credit but when you apply they don’t approve why say they do offer but they never approve not impressed.

What are Hoopla Loan’s Contact and Location Details?

As an online broker, they often refer their clients to their online platform/site. Their site enables users to have their process their applications. However, no number is listed to reach out to on their official site. They stipulate that they only operate online and, in addition, do not make use of call centres. They handle communication through email or messaging through the comment box at the bottom of their contact page. You can expect a response within 1 to 2 days. This is the same for their application process for their loans. This broker is located at Manhattan Corner, Office 2 in Capetown. However, they only process applications and loans online.

Phone number:

Office: 012 941 1572

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday: 09:00 – 13:00

Sunday: Closed

Postal address:

Office 2 Manhattan Corner, Century Way, Century City, Milnerton, Cape Town, Western Cape 7441, South Africa

Alternatives to Hoopla Loans

While this broker offers a comprehensive range of services, it’s always wise to be aware of other players in the market. There are several other credit portals available, each with its unique offerings.

Comparison Table

| Criteria | Hoopla Loans | Capfin Loans | Bayport Financial Services | YourLoan24 |

|---|---|---|---|---|

| Maximum Loan Amount | R250 000 | R50 000 | R250 000 | R200 000 |

| Loan Term | Up to 60 months | Up to 12 months | 3 to 84 months | 2 to 72 months |

| Interest Rate | Up to 28% | Up to 29.25% | Personalised, fixed rate | Starting from 19.25%, varies by applicant |

| More Info | Capfin Loan Review | Bayport Financial Services Review | YourLoan24 Review |

History and Background of Hoopla Loans

Hoopla Loans was established with a vision to simplify and transform personal lending for South African borrowers, focusing on creating a fast, transparent, and accessible loan experience. Founded to address the challenges many face in securing reliable and flexible financing, This broker set out to streamline the loan application process, providing a much-needed alternative to traditional, often cumbersome lending options. Over the years, this broker has developed a strong presence in the South African financial sector by prioritising customer needs and adapting to the evolving demands of the market.

The company’s mission is to make borrowing straightforward and fair, offering accessible financial solutions to individuals across South Africa. This company envisions a lending landscape where customers feel empowered by the clarity and flexibility of their loan options, promoting responsible borrowing while supporting a wide range of financial needs. This mission drives their continuous efforts to enhance its services, keeping customer satisfaction and financial empowerment at the forefront.

Pros and Cons of Choosing Hoopla Loans

When considering an online lending platform, it’s essential to weigh both the advantages and disadvantages to make an informed decision.

Advantages of Hoopla Loans

- Tailored Loan Matches: Their system is designed to connect borrowers with lenders that align with their specific needs and financial profiles.

- User-Friendly Platform: The online interface is intuitive, making the loan application process smooth and straightforward.

- Transparency: They are committed to ensuring that all terms, conditions, and fees are clear, reducing the risk of surprises.

- Diverse Loan Offerings: Catering to a wide range of financial needs, from short-term payday loans to more substantial long-term loans, they offer versatility to its users.

- Quick Turnaround: For those in urgent need of funds, their efficient system often ensures same-day loan approvals and disbursements.

Disadvantages of Hoopla Loans

- Brokerage Model: Since they act as a broker rather than a direct lender, some users might prefer more direct interaction with their loan provider.

- Variable Experiences: Given that this broker connects users with third-party lenders, experiences can vary based on the specific lender’s practices and terms.

- Potential for Multiple Credit Checks: As they try to match users with multiple lenders, there might be multiple credit checks, which could impact one’s credit score.

Conclusion

Hoopla Loans, with its focus on user experience, transparency, and efficiency, has established itself as a notable player in the online lending space in South Africa. While it offers numerous advantages, potential borrowers should be aware of its brokerage model and the implications thereof. As with any financial decision, it’s crucial to conduct thorough research and understand the platform’s workings before committing.

Frequently Asked Questions

No, they act as a broker, connecting borrowers with suitable third-party lenders.

Typically, once approved, borrowers can expect to receive funds on the same day.

Hoopla Loans prides itself on transparency. All fees and terms are clearly outlined during the application process.

Yes, they connect borrowers with a range of lenders, some of whom cater to those with less-than-perfect credit profiles.

Their customer service can be reached via their official website, where they provide contact details and a dedicated support section.