LendPlus [Lendplus.co.za] provides a variety of financial solutions designed to meet the diverse needs of South Africans seeking financial support. Whether you need to cover unexpected expenses, finance a project, or consolidate debt, this credit provider offers options that cater to different personal finance needs.

LendPlus offers short-term personal loans ranging from R500 to R4 000, with repayment terms of 5 to 41 days. If you’re in need of a fast and convenient loan to manage urgent expenses, keep reading to find out whether LendPlus is the right fit for your financial situation.

LendPlus: Quick Overview

Loan Amount: R500 – R4 000

Loan Term: 5 – 41 days

Interest Rate: Varies; determined by individual credit profile

Fees: Transparent fee structure; all costs disclosed upfront

Loan Types: Short-term and personal loans

About Arcadia Finance

Obtain your loan easily through Arcadia Finance, featuring no application fees and a choice of 16 credible lenders compliant with South Africa’s National Credit Regulator. Enjoy a smooth, reliable service tailored to meet your financial requirements.

LendPlus Full Review

What Makes the LendPlus Loan Unique?

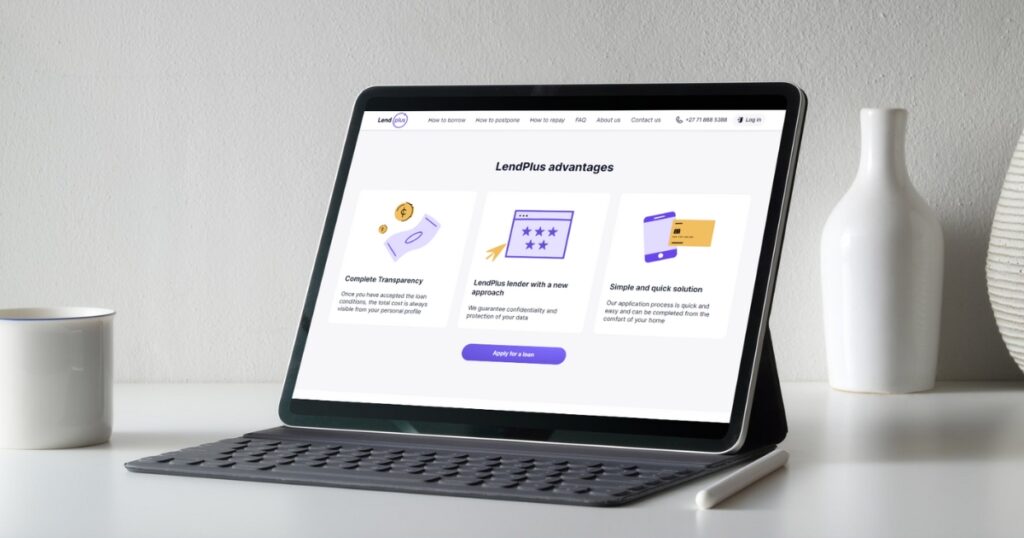

Lendplus.co.za distinguishes itself in the competitive short-term lending market by emphasising speed and accessibility, making it a preferred option for many South Africans seeking prompt financial assistance. Unlike traditional loan processes that can be slow and cumbersome, this lender leverages technology like TruID to quickly verify applicant details, significantly accelerating the approval process. Loans can be disbursed within an hour of approval directly to the borrower’s bank account, which is especially advantageous for urgent financial needs. The fully online application process further enhances convenience, allowing customers to apply from anywhere without needing to visit a physical branch.

Additionally, they are noted for their transparency and emphasis on customer control. Each loan includes clear, upfront information about terms and fees, and borrowers can manage their loans and repayments through a straightforward online dashboard. This approach not only simplifies loan management but also fosters trust and confidence among users. The incorporation of DebiCheck in the repayment process adds an extra layer of security and control, enabling customers to authorise debit orders with full knowledge and consent, reducing the risk of unauthorised deductions and enhancing protection in financial transactions.

Types of Loans Offered by LendPlus

LendPlus provides a focused range of loan products designed to address specific and immediate financial needs, rather than offering a wide array of financial services. Here is a description of the different loan products available and their intended purposes:

Personal Loans

Personal loans from this lender are intended for general use, making them a flexible option for covering unexpected expenses such as medical bills, emergency repairs, or urgent cash needs. These loans are unsecured, meaning they do not require collateral and are based on the borrower’s creditworthiness.

Amounts and Terms: These loans generally range from R500 to R4 000, with repayment terms from 5 days up to 41 days, addressing short-term financial needs.

Short-term Loans

Short-term loans are designed to bridge a temporary cash gap until the next payday. They are ideal for managing small, urgent financial needs, such as paying overdue bills or covering unexpected costs before payday.

Features: A notable feature is the rapid disbursement of funds, typically within an hour after approval, with the entire application process available online for added convenience.

Who Are LendPlus Loans Best Suited For?

LendPlus loans are well-suited for South Africans who:

- Need short-term personal loans to cover urgent expenses

- Prefer a fully online loan application process

- Are employed and can provide recent bank statements

- Require small loan amounts, typically between R500 and R4 000

- Are comfortable with short repayment periods, ranging from 5 to 41 days

Is LendPlus a Safe and Reliable Option?

LendPlus is a registered credit provider in South Africa, operating under Lendplus Technology (Pty) Ltd and regulated by the National Credit Regulator (NCR). The company offers short-term personal loans ranging from R500 to R4 000, with repayment terms between 5 and 41 days. Applications are completed entirely online, and applicants must be South African residents aged 18 or older, with a valid SA ID, active cellphone number, bank account, and three months’ bank statements showing income.

LendPlus is known for its transparent loan terms and efficient service. The lender uses tools such as TruID for instant verification and DebiCheck for secure debit order authorisation, helping ensure safe and fast transactions. Loan decisions are typically made within 30 minutes, and once approved, funds are often disbursed within an hour, making it a convenient option for those needing quick access to short-term credit.

Requirements for a LendPlus Loan

Applying for a loan from them is designed to be straightforward, but you’ll need to provide specific documents and information to ensure a smooth application process. Here’s what you’ll need:

- Valid South African ID: Proof of identity is essential to confirm your citizenship and eligibility to apply for a loan in South Africa – A valid South African ID for this purpose.

- Latest 3 Months’ Bank Statements: These statements are used to evaluate your financial stability and ability to repay the loan. They provide an overview of your income, expenses, and overall financial health. This credit provider uses this information to assess your creditworthiness and decide on your loan application.

- Valid Cell Phone Number: A valid cell phone number is necessary for communication. They use this number to update you on your application status, loan approval, and any required follow-ups. It is also used for verification during the application process.

- Proof of Income: Proof of income, usually reflected in your bank statements, is required to confirm that you have a regular income source. This helps them ensure that you can meet the repayment terms of the loan.

- Online Profile Creation: You’ll need to create an online profile on their website to start your application. This profile allows you to submit your loan application, track its progress, and manage your loan once approved.

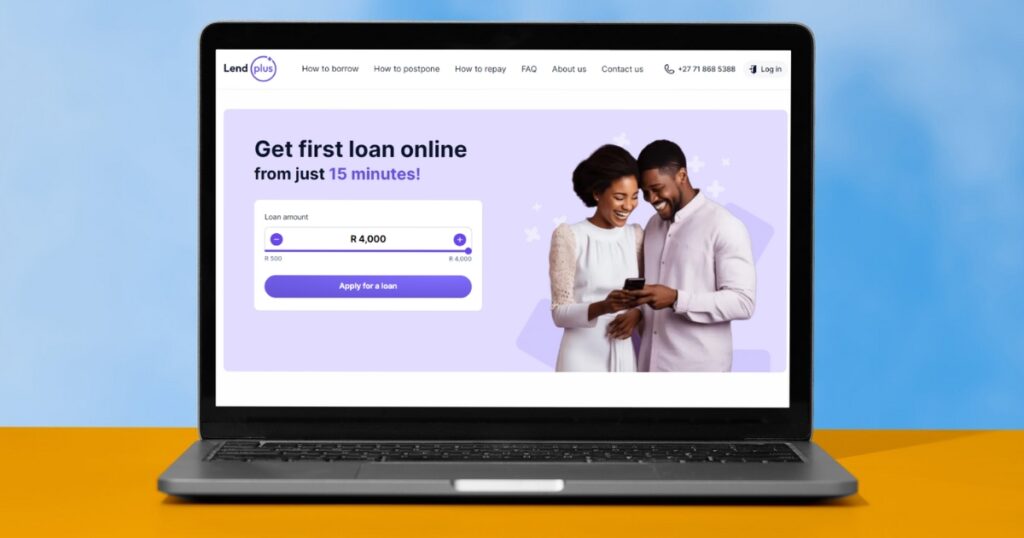

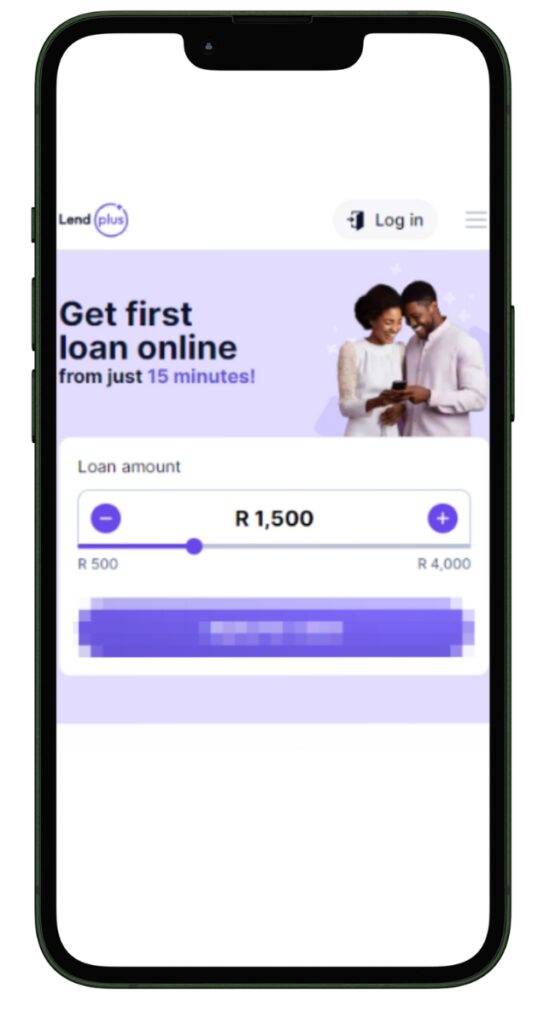

Step-by-Step Guide to Applying for a Loan with LendPlus

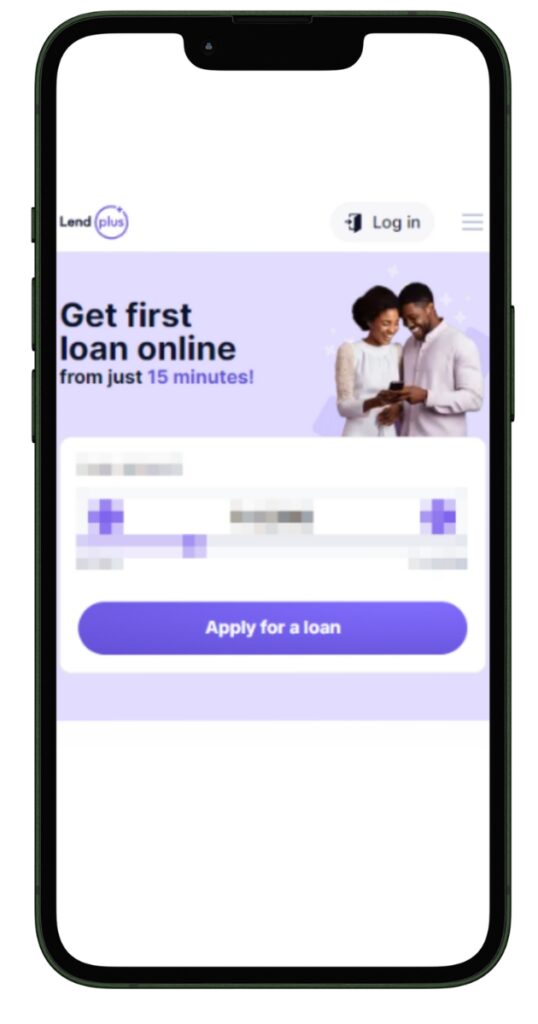

Step 1: Go to the LendPlus.co.za website

Step 2: Select Loan Amount

Step 3: Click “Apply for a loan”

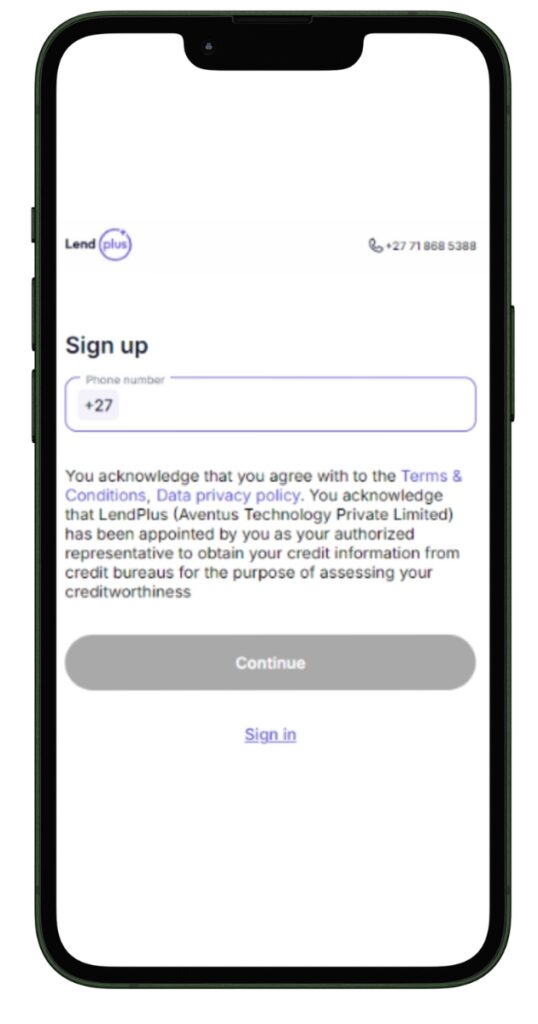

Step 4: Sign up by adding your phone number or Sign in

Step 5: LendPlus will review your application and typically respond within 30 minutes.

Step 6: If approved, review and accept the loan offer, including the repayment terms.

Step 7: Accept Loan Offer

Step 8: The loan amount will be disbursed into your bank account.

Eligibility Check

LendPlus offers a straightforward way to pre-check your eligibility before applying for a loan. Here are the available tools and methods:

- Online Calculator: provides an online loan calculator on their website. You can enter your desired loan amount and term to get an estimate of repayment amounts, helping you assess if the loan fits your budget.

- Initial Online Profile Setup: By setting up your online profile, you can enter preliminary information such as your income and financial status. This helps them gauge your likelihood of loan approval.

- Automated Credit Check: This lender performs a quick credit check during the application process to determine your creditworthiness and suitability for the loan product you are applying for.

- Customer Support: If you are unsure about your eligibility, they offers support via phone or email. You can discuss your situation with a representative who can provide guidance on your chances of approval based on their criteria.

How Much Money Can I Request from LendPlus?

Minimum and Maximum Amounts: You can request loan amounts ranging from R500 to R4 000. These amounts are tailored for short-term financial needs, making them a suitable choice for small, quick loans.

How LendPlus Creates Personalized Loan Offers

LendPlus uses the information provided during the application process, such as your income, financial history, and the desired loan amount and term, to craft a loan offer that meets your specific needs. This method ensures that the loan amount, interest rate, and repayment terms are customised to fit your financial situation, helping you manage your debt more effectively.

How Long Does It Take to Receive My Money from LendPlus?

Once your loan application is approved, they typically disburse the funds within 1 hour. The entire process, from application to receiving the money, can often be completed within a few hours, especially if all required documents are submitted promptly.

Factors Affecting Withdrawal Speed:

- Bank Processing Times: The speed of the transaction can be influenced by your bank’s processing times, particularly if the loan is approved outside regular banking hours or on weekends.

- Accuracy of Information: Providing complete and accurate information can speed up the verification process, reducing potential delays.

The LendPlus Loan Overview

| Aspect | Details |

|---|---|

| Financial Name | LendPlus, a division of Lendplus Technology (Pty) Ltd |

| Product | Personal and Short-term Loans |

| Minimum Age | 18+ years |

| Minimum Amount | R500 |

| Maximum Amount | R4 000 |

| Minimum Term | 5 days |

| Maximum Term | 41 days |

| APR | Variable; detailed rates not specified |

| Monthly Interest Rate | Not specified; depends on the loan amount and term |

| Early Settlement | Allowed; specifics not detailed |

| Repayment Flexibility | Tailored to individual borrower needs |

| NCR Accredited | Yes |

| Our Opinion | ✅ Quick application process |

| ✅ Flexible terms for various financial needs | |

| ⚠️ Limited to small, short-term financial solutions | |

| User Opinion | ✅ Appreciated for fast disbursement speeds |

| ⚠️ Critiques on higher rates for quick loans |

How Do I Repay My Loan from LendPlus?

Several convenient repayment options to accommodate various preferences:

- Debit Order Deduction: This is the most common method, where repayments are automatically deducted from your bank account on the agreed-upon date.

- Online Payment through OZOW: You can also repay your loan directly online using OZOW, which enables fast and secure payments.

Repayment plans are typically aligned with the loan term, ranging from 5 to 41 days, depending on the loan amount and your agreement with the credit provider.

Possible Fees and Penalties

- Late Payment Fees: If you miss a payment, a late fee may be charged. The amount will depend on your specific loan agreement.

- Early Settlement Fees: While you can repay your loan early, check if there are any fees for settling the loan before the end of the agreed term.

- Interest Rate: Interest rates can vary. It’s essential to review the loan terms carefully before accepting the offer to fully understand the borrowing costs.

Pros and Cons of Choosing LendPlus

Pros of LendPlus

- Quick Approval and Disbursement: Known for its swift loan approval process, with funds typically disbursed within an hour of approval. This makes it ideal for those who need immediate access to cash during emergencies.

- Fully Online Application Process: The entire application process is conducted online, eliminating the need for physical visits to a branch. This convenience is particularly advantageous for busy individuals or those in remote areas.

- Flexible Repayment Options: Offers various repayment options, including automatic debit orders and online payments through OZOW. This flexibility allows borrowers to select the method that best suits their financial situation.

- Transparency: Provides clear and upfront information about loan terms, fees, and repayment schedules. This transparency helps borrowers make informed decisions and avoid unexpected charges.

- No Collateral Required: Loans are unsecured, so you do not need to provide assets as collateral. This reduces the risk for borrowers who may not have significant assets to pledge.

Cons Pros of LendPlus

- High Interest Rates: The interest rates on LendPlus loans may be higher than those of traditional bank loans, making them more expensive, especially for larger loan amounts.

- Limited Loan Amounts: The maximum loan amount available from them is R4 000, which may not be sufficient for those needing larger sums for significant expenses.

- Short Loan Terms: With loan terms ranging from 5 to 41 days, this lender is geared towards short-term borrowing. This may not suit individuals seeking longer-term financing.

- Potential Fees: Although they are transparent about their fees, there are potential costs such as late payment penalties and possibly early settlement fees. These can increase the overall cost of borrowing if not managed carefully.

- Limited to South African Residents: Services are available only to South African residents, which limits accessibility for those outside the country.

Customer Service

LendPlusco.za places a strong emphasis on customer service, offering several channels to ensure you can get the assistance you need. Whether you have questions about the application process, need help with repayment, or have general inquiries, they provide multiple ways to reach out:

LendPlus Contact Channels

Phone number:

Office: +27 71 868 5388

Email: support@lendplus.co.za

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday: 08:00 – 13:00

Postal address:

LendPlus Technology (Pty) Ltd

V&A Waterfront, Spaces, Dock Road Junction

Cape Town 8001

South Africa

Online Reviews of LendPlus: What Customers Say

Many customers appreciate LendPlus for its fast, efficient, and fully online service, often receiving funds within an hour of applying, without the need for paperwork or branch visits. The clear communication of terms, conditions, and fees helps users make informed decisions, while flexible repayment options, including platforms like OZOW, add to the convenience.

I have Found this Company to be a step above the rest .They are super Efficient Do not hesitate to contact them for a Small Loan their services is excellent.

LendPlus has been so good to me, I’ve never encountered any problems with them. I’ve always had a smooth sailing journey with them.

On the downside, some customers find the interest rates high, especially for short-term loans, making borrowing costly if not repaid quickly. There have also been reports of delays in fund disbursement outside business hours or on weekends, and the maximum loan amount of R4 000 is seen as limiting for those needing larger sums.

I have been requesting for a reversal or a refund of a double debit on my account since the 29th of February 2025 till date they have not responded to my emails. I have numerous times with no luck.

A debit order went off my account which I didn’t apply and authorise. I sent many emails no feedback and when I call it says my number is not registered on there system.

Alternatives to LendPlus

If you want to explore other options, there are several alternative credit providers and comparison portals available in South Africa. Below are some of the top competitors and what they offer:

Comparison Table

Below is a side-by-side comparison of LendPlus with its top competitors:

| Feature | LendPlus | Wonga | FASTA | FinChoice | Capitec Bank | African Bank |

|---|---|---|---|---|---|---|

| Loan Amount | R500 – R4 000 | R500 – R8 000 | Up to R8 000 | R100 – R50 000 | Up to R250 000 | R2 000 – R250 000 |

| Loan Term | 5 – 41 days | 4 days – 6 months | Up to 3 months | Varies (short & long) | Up to 84 months | 3 – 72 months |

| Interest Rate | Varies, typically high | High | Competitive | Competitive | Competitive | Competitive |

| Application Process | Fully online | Fully online | Fully online | Fully online | Online/Branch/Mobile | Online/Branch/Mobile |

| Approval Time | Within 1 hour | Within 24 hours | Within 24 hours | Within hours | Same day | Same day |

| Collateral Required | No | No | No | No | No | No |

| Early Repayment | Allowed, terms vary | Allowed | Not Specified | Allowed | Allowed | Allowed |

| More Info | Wonga Review | FASTA Review | FinChoice Review | Capitec Bank Review | African Bank Review |

History and Background of LendPlus

LendPlus is a recent addition to the South African financial market, having been established in 2023. The company operates under Lendplus Technology (Pty) Ltd, which is registered and complies with the legal frameworks governing financial institutions in South Africa. Despite being new, they rapidly gained popularity by specialising in short-term loans that are easily accessible through a fully online platform. This focus on convenience and speed has enabled them to establish a niche in the competitive lending market.

Company’s Mission and Vision

LendPlus’s mission is to empower individuals by offering fast, reliable, and transparent financial solutions to address immediate financial needs. The company focuses on simplifying the borrowing process, making it accessible to a wider audience, especially those seeking quick cash without the complexity of traditional banking procedures.

This credit provider aims to become a leading provider of short-term loans in South Africa by consistently enhancing their services to better meet the evolving needs of their customers. This involves using technology to improve the customer experience, maintaining transparency in all transactions, and promoting financial inclusion by offering loans to those who may be underserved by traditional financial institutions.

Conclusion

LendPlus receives positive feedback for its speed, ease of use, and customer service. The platform is ideal for individuals needing quick access to small amounts of money. However, it may not be the best choice for those seeking larger loans or lower interest rates. The company’s dedication to transparency and customer empowerment enhances its position in the market, making it a reliable option for short-term lending needs in South Africa.

Frequently Asked Questions

The maximum loan amount available from is R4 000. This limit is intended for addressing short-term financial needs, particularly for small, urgent expenses.

After approval, they generally disburse funds within 1 hour. However, processing times may vary depending on your bank and the time of day.

To apply for a loan, you need a valid South African ID, your most recent 3 months’ bank statements, and a valid cell phone number. These documents are required to verify your identity and assess your financial situation.

Yes, early repayment is allowed with them. While early settlement is permitted, it is advisable to review the specific terms of your loan agreement to check for any associated fees or penalties.

They provides various repayment options, including automatic debit orders and online payments through OZOW. The repayment schedule typically matches the term of your loan, so it’s important to ensure that sufficient funds are available in your account on the due date to avoid late payment penalties.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 16 banks and find the right loan for you.