Lime [Lime24.co.za], a prominent online lender, offers a streamlined solution with its fast, easy-to-access loan services tailored for individuals facing urgent financial needs. Know the core features, benefits, and potential drawbacks of Lime loans, providing a comprehensive look at their application process, interest rates, repayment terms, and customer support. Whether you’re considering Lime for an emergency loan or simply exploring your options, this article will help you make an informed decision.

Lime offers short-term personal loans ranging from R500 to R8 000, with repayment periods of up to 37 days. If you’re looking for a fast and flexible loan solution to cover urgent expenses, keep reading to learn more about Lime and whether their services suit your financial needs.

Lime Loans: Quick Overview

Loan Amount: R500 – R8 000

Loan Term: 5 – 37 days

Interest Rate: APR between 28.9% – 39.8% (varies by profile)

Fees: Transparent fee structure; no hidden charges

Loan Types: Short-term personal loans

About Arcadia Finance

With Arcadia Finance, finding a loan is straightforward and user-friendly. Our service includes connecting you to various banks and lending institutions after completing a free application. You can expect loan proposals from up to 19 distinct lenders. We pride ourselves on partnering only with lenders who are accredited by the National Credit Regulator (NCR) in South Africa.

Lime Full Review

Experiences with Lime Loans

Navigating the financial landscape can be daunting, especially when unexpected expenses arise. Lime has emerged as a go-to solution for many South Africans in such situations. Users have praised the platform’s swift application process and the clarity of terms as standout features. The digital nature of Lime means no physical meetings, no unnecessary paperwork, and a relatively quick response time.

Who Can Apply for a Lime Loan?

They are open to a wide range of applicants. However, there are some basic requirements:

- Age: You must be 18 years or older.

- Residency: You should be a resident of South Africa.

- Identification: A valid SA ID number is required.

- Contact: A working cellphone number.

- Banking: Valid bank account details and bank statements from the last three months showing your income.

Their commitment to inclusivity, coupled with its digital efficiency, makes it a noteworthy option for those seeking quick and accessible financial solutions in South Africa.

Differences from Other Loan Providers

Lime has carved out a distinctive position in the crowded online lending market of South Africa. One of its standout features is its commitment to transparency. In contrast to some providers that may have hidden fees or charges catching borrowers off guard, this lender prides itself on offering clear terms. Right from the beginning, borrowers can view the total cost of their loan from their individual profile, eliminating any guesswork or unpleasant surprises.

Speed is another notable area where they excel. Once an application is approved, the money can be in the borrower’s account in a remarkably short time. This rapid processing can be a lifeline for those in urgent need of funds.

This company also places a strong emphasis on security – they ensure user data is protected to the highest standards. Their payment system aligns with the global requirements set by industry giants like Visa and Mastercard. Their operations adhere to the standards set by the National Credit Regulator and the legislations of the Republic of South Africa, ensuring they operate within the bounds of the law and uphold the rights of their borrowers.

Lime Loan

Lime has positioned itself as a go-to platform for many South Africans in need of quick and transparent financial solutions. But what exactly sets them apart from the myriad of other lenders in the market?

What Makes their Loan Unique?

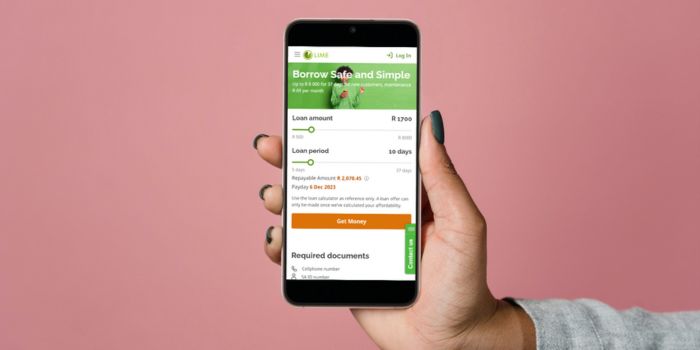

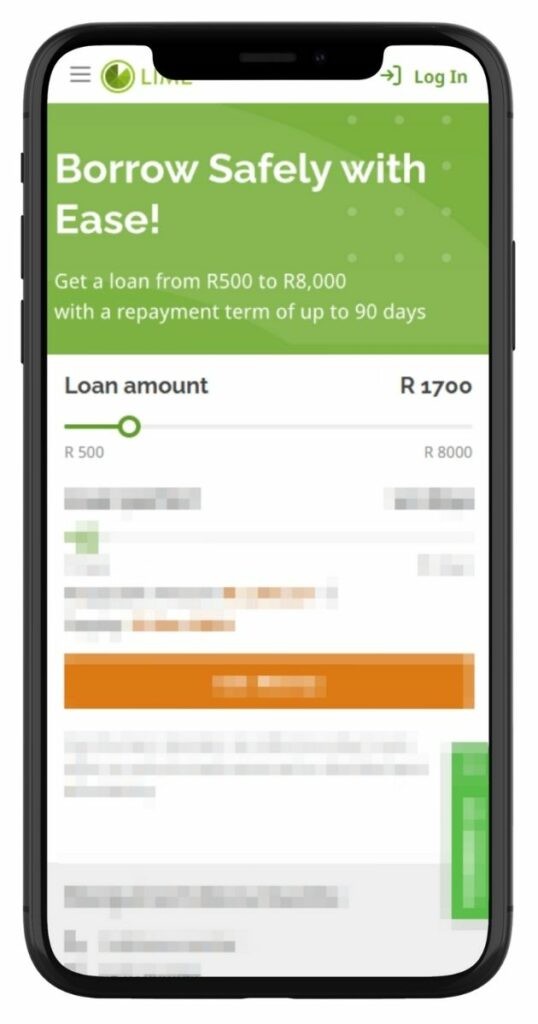

Its uniqueness stems from its user-friendly approach. First and foremost, they offer a straightforward loan calculator on their website. This tool allows potential borrowers to get a glimpse of their possible loan terms, even before applying. While it’s for reference only, it gives a clear idea of what to expect.

Another standout feature is the transparency this lender promises. There are no hidden fees, and users can select their loan conditions. The total cost is always visible from individual profiles, ensuring borrowers are never caught off guard with unexpected charges.

Lastly, they place a strong emphasis on security. They’ve taken measures to ensure user data is protected, aligning their operations with global standards and local South African legislations.

Types of Loans Offered by Lime

This lender offers a range of loan products including:

Short-Term Loans

These are loans designed to be repaid in a short period, typically up to 37 days. This company offers short-term loan amounts ranging from R 500 to R 8 000.

Such loans are ideal for: Covering unexpected expenses, Bridging the gap until the next payday, Handling small emergencies

Auto Loans

Auto loans are designed for individuals looking to purchase a vehicle.

They could offer such loans to help borrowers: Buy a new car, Upgrade their current vehicle, Refinance an existing auto loan

Personal Loans

While the exact details aren’t specified on the website, personal loans are generally larger amounts that can be repaid over a more extended period.

They can be used for: Consolidating debts, Making significant purchases, Funding home improvements

Who Are Lime Loans Best Suited For?

Lime loans are ideal for South Africans who:

- Need short-term personal loans for unexpected expenses

- Prefer a fully online application process with fast approval

- Are employed and can provide recent bank statements showing regular income

- Require loan amounts between R500 and R8 000

- Are comfortable with repayment periods of up to 37 days

Is Lime a Safe and Good Option?

Lime Loans is a legitimate and trusted online credit provider regulated by the National Credit Regulator (NCR). They offer short-term personal loans ranging from R500 to R8 000, with repayment terms of up to 37 days. The application process is straightforward and entirely online, requiring applicants to be South African residents aged 18 or older, with a valid SA ID number, a working cellphone number, an active bank account, and the latest three months’ bank statements showing income.

Lime Loans is committed to transparency, providing clear information on interest rates, repayment terms, and fees upfront. All applications undergo affordability checks to promote responsible lending. With fast processing times—often disbursing funds on the same day of approval—Lime Loans offers a practical option for those needing quick, short-term financial assistance outside of traditional banking channels.

Requirements for a Lime Loan

Lime has a set of requirements that every applicant must meet to ensure a smooth loan application process.

Documents and Information Needed

- Cellphone Number: This is crucial for communication purposes. They might send verification codes or updates regarding your loan application to this number.

- SA ID Number: A valid South African ID number is mandatory to verify your identity and ensure you’re eligible for a loan.

- Bank Account Details: They will need your bank account details to transfer the loan amount once approved. Additionally, they’ll use these details to set up repayment methods.

- Latest 3 Months Bank Statements: These statements should clearly show your income. This lender uses this information to assess your financial stability and determine your loan affordability.

Simulation of a Loan at Lime

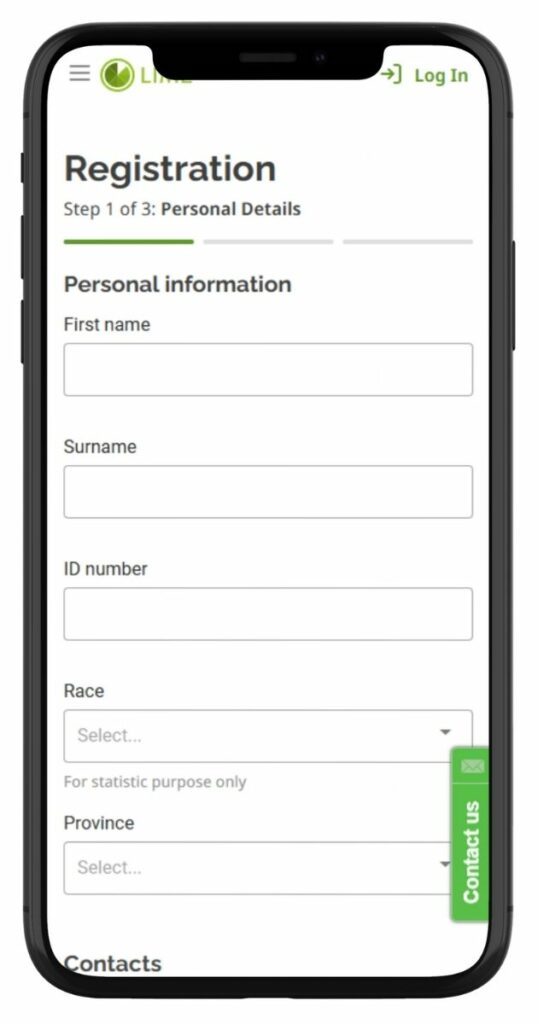

If you’re considering applying for a loan with Lime, it’s beneficial to understand the application process. Here’s a step-by-step guide to help you navigate through it:

Step 1. Start by visiting Lime24.co.za

Step 2. Adjust the loan amount slider (R500–R8000) and click to proceed.

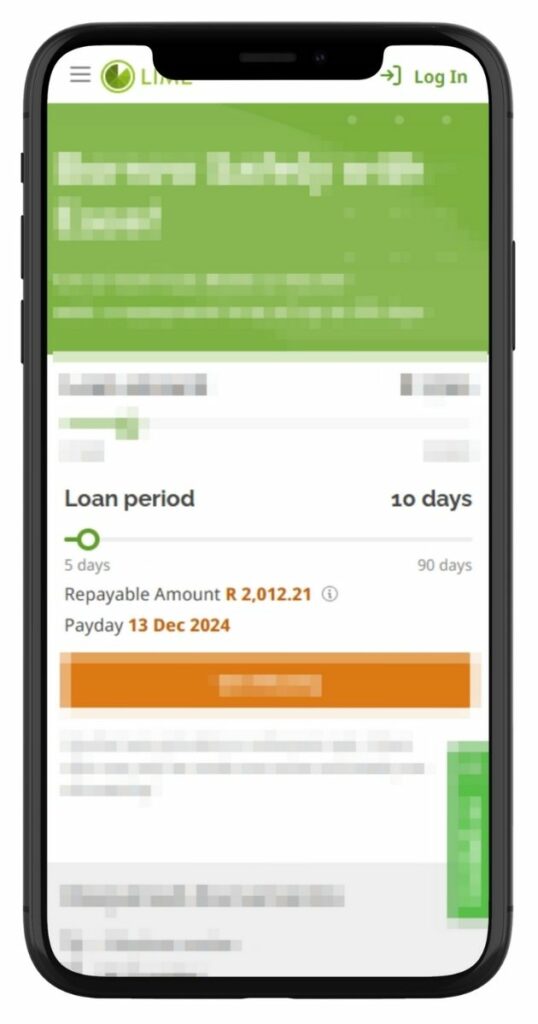

Step 3. Set the loan period (5–90 days) and view repayment details before continuing.

Step 4. Confirm loan terms and click “Get Money” to finalize the loan request.

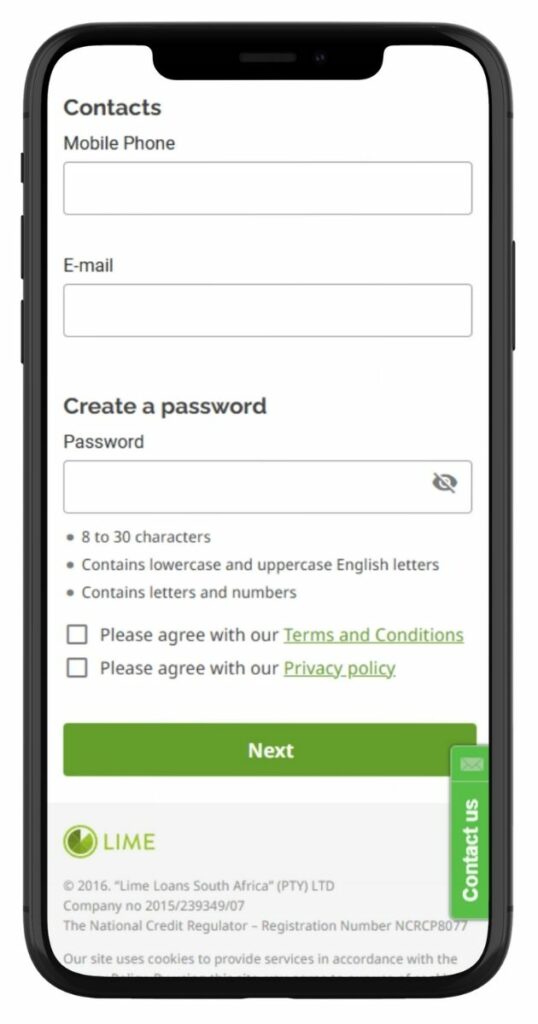

Step 5. Fill out personal information, including name, ID number, and province.

Step 6. Provide contact details, create a password, agree to terms, and click “Next.”

Step 6. Before finalizing the loan, ensure you thoroughly read the contract. Once you’re satisfied with the terms, sign the contract digitally.

Step 7. After the contract is signed, they will process the loan, and if approved, the funds will be transferred to your bank account.

Eligibility Check

On their platform, Lime provides a loan calculator. While this tool is primarily designed to give potential borrowers an idea of possible loan terms, it also serves as an indirect eligibility check. By inputting your desired loan amount and term, the calculator provides a breakdown of the loan, including the repayable amount. If the terms are favorable and align with your financial situation, it’s a good indication that you might be eligible for a their loan.

This lender has streamlined its loan application process, ensuring it’s user-friendly and transparent. By understanding the requirements and following the step-by-step guide, potential borrowers can navigate the process with ease and confidence.

Security and Privacy

How Lime Ensures the Security of Personal and Financial Information

Lime employs a multi-layered approach to data security. One of the standout features of their security protocol is their compliance with global standards. Their payment system, for instance, meets the stringent requirements set by major credit card companies like Visa and Mastercard. This ensures that any financial transaction made on their platform is secure and free from vulnerabilities.

They operate in alignment with the National Credit Regulator and the legislation of the Republic of South Africa. This alignment not only ensures that they adhere to local financial regulations but also that they maintain a high standard of data protection.

Privacy Policies and Data Handling Practices

Their commitment to user privacy is evident in their comprehensive privacy policy. This policy outlines how they collect, use, and safeguard user information. It provides clarity on the types of data they gather, the purposes for which it’s used, and the measures in place to protect it.

One of the key aspects of their data handling practice is transparency. They ensure that users are always informed about any data collection activity. They provide users with the option to control the data they share, giving them the autonomy to decide what information they’re comfortable providing.

How Much Money Can I Request from Lime?

Lime offers loans ranging from as little as R500, perfect for covering unexpected expenses or bridging the gap until your next payday. For those needing a larger financial boost, this lender provides loans of up to R8 000, making it a great option for tackling bigger expenses or planned investments.

How Lime Creates Personalized Loan Offers

The process begins when a potential borrower inputs their details and requirements into their system. They then assess this information, taking into account factors like income, financial stability, and loan repayment history. Based on this assessment, this lender generates a loan offer that aligns with the borrower’s financial situation. This ensures that the loan terms, including the interest rate and repayment period, are manageable for the borrower.

How Long Does It Take to Receive My Money from Lime?

Once you’ve decided to take out a loan with Lime, the waiting period to receive the funds is a crucial consideration.

Average Processing Times

This lender prides itself on its swift application processing. In many cases, once your application is approved, you can expect to receive the money in your bank account within a short timeframe. The exact duration can vary, but many users have reported receiving their funds on the same day of approval.

Factors Affecting Withdrawal Speed

While Lime aims to process loans swiftly, certain factors can affect the speed at which you receive your money:

- Banking Details Accuracy: Ensure that the bank account details provided are accurate. Any discrepancies can lead to delays.

- Time of Application: Applications made during business hours are likely to be processed faster than those made outside of these hours or during weekends.

- Document Verification: If Lime requires additional verification or documents, this can extend the processing time.

Lime Loan – Overview in Detail

| Name | Lime24 |

|---|---|

| Financial | Fintech Company, Branch of Lime Credit Group |

| Product | Short-Term Personal Loans |

| Minimum Age | 18 years |

| Minimum Amount | R500 |

| Maximum Amount | R8 000 |

| Minimum Term | 5 days |

| Maximum Term | 36 days |

| APR | 28.9% – 39.8% |

| Monthly Interest Rate | Not specified, varies based on loan amount and borrower profile |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Repayments are collected via debit orders, early repayment reduces interest payable |

| NCR Accredited | Yes |

| Our Opinion | ✅ Straightforward and fast online loan process ✅ Transparent costs with no hidden fees |

| User Opinion | ✅ Generally positive reviews for speed and efficiency ⚠️ High interest rates |

How Do I Repay My Loan from Lime24?

Lime offers multiple repayment options to cater to the diverse preferences of its users. Typically, the repayment is set up as a direct debit from the borrower’s bank account. This ensures that the repayment is made on the due date, eliminating the risk of forgetting or missing a payment. Borrowers can also log into their profile to view their repayment schedule, keeping them informed about upcoming due dates.

For those who prefer manual payments, this company provides options to make repayments via bank transfers or through other electronic payment methods. It’s essential to ensure that payments made this way are done before the due date to avoid any late fees.

Possible Fees and Penalties

While Lime is transparent about its loan terms and costs, borrowers should be aware of potential fees and penalties:

Late Payment Fees: If a repayment is missed or delayed, they may charge a late payment fee. This fee is to cover the administrative costs associated with managing late payments.

Early Repayment Fees: Some lenders charge fees for repaying a loan early, as it can affect the interest they earn. It’s advisable to check with them if any such fees apply.

What Customers Say About Lime

Many customers appreciate Lime’s swift application processing, highlighting that they received their funds promptly. The transparency of their offers, especially with no hidden fees, is another aspect that resonates positively with users.

However, like any service, there are mixed reviews. A few users have mentioned facing challenges with customer service, while others have pointed out discrepancies in the loan terms. It’s essential to remember that individual experiences can vary, and while many have had positive interactions with this company, it’s always a good idea to do thorough research and read multiple reviews before making a decision.

Since I started taking loans from Lime Loan, I have never been disappointed.

Once again, Lime loans is really great with offering fast and easy service.

I’ve called in 4 times and waited on calls for time exceeding 90 minutes each and hear you are caller number one, then 2 minutes later you’re caller number 5 then 3 then 1 then 5. I’ve sent multiple emails and still no response.

The funds have not been transfered to my account, it’s Sunday and I am still waiting.

Customer Service

Lime places a strong emphasis on ensuring that its customers have a smooth and hassle-free experience. Their customer service team is dedicated to assisting borrowers at every step of the loan process. Whether it’s a query about loan terms, repayment schedules, or any other concern, their team is equipped to provide timely and accurate responses.

Do You Have Further Questions?

If you have additional questions or need clarification on any aspect of their services, reaching out to their customer service is a good starting point. They offer multiple channels of communication, including email and phone support. Their website also features a comprehensive FAQ section, which addresses many common queries and concerns.

Contact Channels

Phone number:

Office: +27 10 442 6722

Email:

support@lime24.co.za

Postal address:

C505, Bridgewater 3, Century City, Cape Town, 7441, South Africa

Alternatives to Lime

While this lender offers a range of financial solutions, it’s always a good idea to explore alternatives to ensure you’re getting the best deal suited to your needs.

Comparison Table

To aid in the decision-making process, here’s a simple comparison table that outlines some of the key features of Lime and its alternatives:

| Feature | Lime | Wonga | Capfin | Dial Direct | MyMulah | Sunshine Loans |

|---|---|---|---|---|---|---|

| Loan Amount Range | R 500 – R 8 000 | Up to R 8 000 | Up to R 50 000 | Up to R150 000 | Up to R5 000 | R500 – R4 000 |

| Repayment Terms | Up to 37 days | Up to 6 months | Up to 24 months | 12 to 60 months | 1 day to 90 days | Up to 49 days |

| Interest Rates | Fixed per loan term | Fixed per loan term | Fixed per loan term | As low as 15% | From 5% up to 38% | 22.7% per annum, plus a flat fee of R195 |

| Application Process | Online, fast processing | Online, quick decision | Online & in-store, may require more documentation | Online | Online | Entirely online |

| More Info | Wonga Review | Capfin Review | Dial Direct Review | MyMulah Review | Sunshine Loan Review |

History and Background of Lime

Lime was established with the aim of providing South Africans with a transparent and efficient loan solution. Over the years, the company has grown, adapting to the changing financial landscape and the needs of its customers. Their journey from a startup to a reputable loan provider is a testament to their commitment to offering reliable financial solutions.

Company’s Mission and Vision

Lime’s mission is to simplify the loan process, making it accessible and understandable for everyone. They believe in transparency, ensuring that customers are always informed and never face unexpected surprises. Their vision is to be a leading loan provider in South Africa, recognized for their integrity, transparency, and customer-centric approach.

Pros and Cons

Like any service, Lime24 has its strengths and areas for improvement. Here’s a breakdown:

Pros of Lime Loans

- Transparent Terms: Lime24 is clear about its loan terms, ensuring customers are never caught off guard.

- Quick Processing: Many users appreciate the swift approval and disbursement process.

- User-Friendly Platform: Their online platform, complete with a loan calculator, makes the application process smooth.

Cons of Lime Loans

- Limited Loan Amount: With a maximum of R 8 000, some users might find the loan amount restrictive for larger financial needs.

- Short Repayment Period: A maximum repayment term of 37 days might not be suitable for everyone, especially those looking for longer-term loans.

Conclusion

Lime has positioned itself as a reliable loan provider in South Africa, particularly for those seeking short-term financial solutions. Their emphasis on transparency, quick processing, and user experience makes them a favorable choice for many. However, potential borrowers should consider the loan amount limitations and repayment terms to determine if this lender aligns with their specific needs. A balanced assessment of the advantages and disadvantages is crucial in making an informed decision when choosing a financial service provider.

Frequently Asked Questions

Once approved, many users receive their funds on the same day.

It’s advisable to check with them directly, as terms can vary.

This lender places a strong emphasis on data security, ensuring that user information is protected and aligns with global standards.

Terms and conditions apply, and it’s best to contact their customer service for specific queries related to loan extensions.

Loans offered are up to a maximum of R 8 000.