When searching for a loan, it’s important to choose a lender that matches your financial needs. Loan4Debt [Loan4debt.co.za], a South African-based lender, offers a range of loans designed to assist those managing debt or needing quick access to cash. Whether you’re seeking debt consolidation or a personal loan, this lender offers flexible and accessible options.

Loan4Debt – Loan Overview

| Name | Loan4Debt |

|---|---|

| Financial | Registered Credit Provider |

| Product | Short-Term Loans |

| Minimum age | >18 years |

| Minimum amount | R1,000 |

| Maximum amount | R1,000,000 |

| Minimum term | 30 days |

| Maximum term | 72 months |

| APR | 36% – 60% |

| Monthly Interest Rate | 3% – 5% |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Flexible, tailored to meet individual needs |

| NCR Accredited | Yes |

| Our Opinion | ✅ Quick approval process ✅ Online application available ⚠️ Higher interest rates on smaller amounts |

| User Opinion | ✅ Easy application process ⚠️ Requires stable income for approval |

What Makes the Loan4Debt Loan Unique?

What sets Loan4Debt apart is its focus on offering fast, accessible short-term loans specifically tailored to South African customers. Unlike many traditional lenders, Loan4Debt provides a straightforward online application process, allowing you to apply for a loan from the comfort of your home. This convenience, combined with a quick approval process, means that customers can access funds when needed, without long delays. Additionally, the lack of collateral requirements makes Loan4Debt a viable option for a wider range of individuals, including those who may not have assets to secure a loan.

Another notable feature is Loan4Debt’s emphasis on transparent terms and flexible repayment options. Customers can select a repayment plan that fits their financial situation, and early settlement of loans is permitted without penalties. This flexibility, along with clear and straightforward loan terms, ensures that customers know what to expect, helping them manage their finances more effectively. Whether addressing unexpected expenses or consolidating debt, Loan4Debt aims to provide a hassle-free borrowing experience.

Types of Loans Offered by Loan4Debt

Personal Loans

Personal loans from Loan4debt.co.za offer quick financial relief for various individual needs. These loans are typically unsecured, meaning no collateral is required. They can be used for a range of purposes, including covering emergency expenses, funding home improvements, or paying for unexpected medical bills. With flexible repayment options, these loans are ideal for those needing a short-term financial boost without lengthy approval processes.

Debt Consolidation Loans

Debt consolidation loans are designed to help individuals manage multiple debts by combining them into a single loan with one monthly payment. This can simplify your finances and often result in a lower overall interest rate, making debt management easier. Loan4Debt’s debt consolidation loans are particularly useful for those dealing with high-interest credit card debt or several personal loans, allowing you to regain control of your finances and reduce the stress of managing multiple payments.

Short-Term Loans

Short-term loans from Loan4Debt are aimed at those who need quick access to smaller amounts of money for urgent or unexpected expenses. These loans are ideal for covering costs such as car repairs, emergency travel, or utility bills. The loan amounts are smaller, and the repayment terms are shorter, usually ranging from 30 to 90 days. This makes them suitable for bridging financial gaps between paychecks or addressing immediate financial needs without long-term commitments.

Each of these loan types serves specific financial needs, allowing Loan4Debt to address a diverse range of customer requirements in South Africa.

Requirements for a Loan4Debt Loan

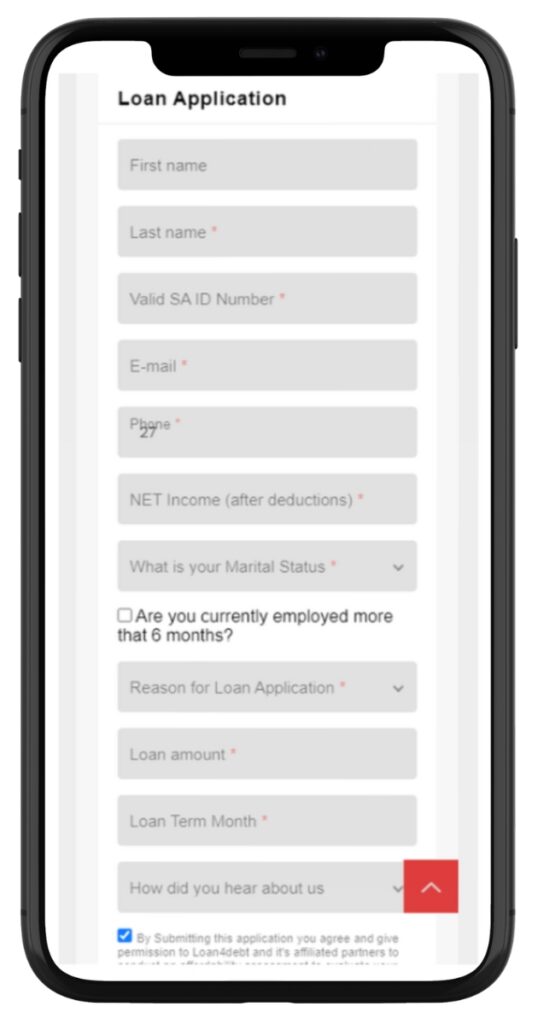

When applying for a loan with Loan4Debt, you need to meet certain requirements and provide specific documents. These ensure that you qualify for the loan and that the lender has enough information to assess your application accurately. Basic Requirements Include:

- Age: You must be at least 18 years old.

- Income: You need to have a stable and verifiable income to ensure you can meet the repayment obligations of the loan.

- Residency: You must be a South African citizen or have legal residency in South Africa.

- Bank Account: An active South African bank account is required for receiving the loan amount and making repayments.

Documents Needed

- Identity Document: A valid South African ID or passport.

- Proof of Income: Recent payslips or bank statements (typically the last three months) to verify your income.

- Proof of Address: A recent utility bill or lease agreement showing your current residential address.

- Bank Statements: Recent bank statements (usually from the last three months) to verify your financial situation.

These documents help Loan4Debt verify your identity, income, and ability to repay the loan. Having these ready before applying can speed up the application process and improve your chances of approval.

About Arcadia Finance

Arcadia Finance makes securing a loan simple and stress-free. With no fees and access to 19 reliable lenders, all adhering to NCR standards, your financial needs are covered.

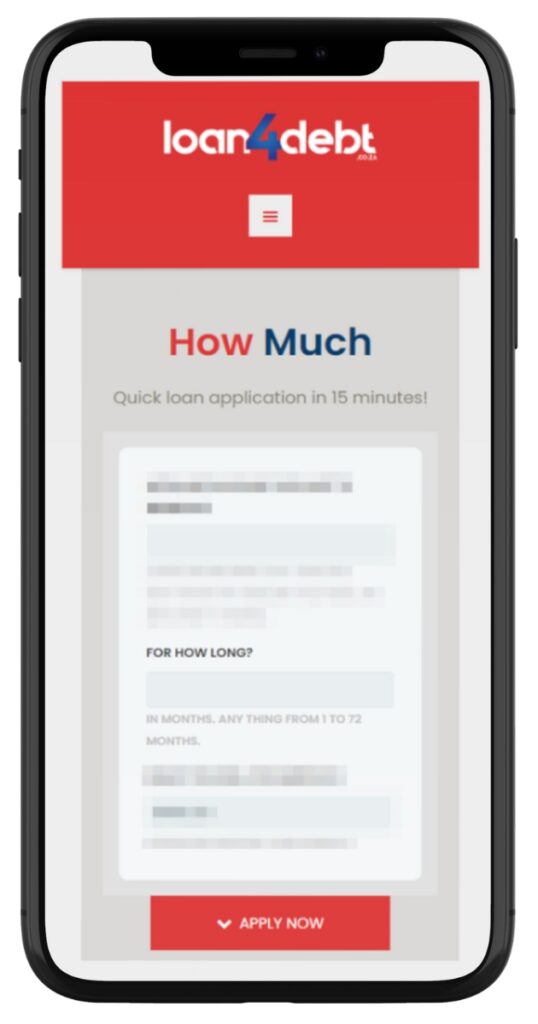

Step-by-Step Guide to Applying for a Loan at Loan4Debt

Step 1. Go to Loan4debt.co.za

Step 2. Enter the loan amount you need

Step 3. Input the loan term

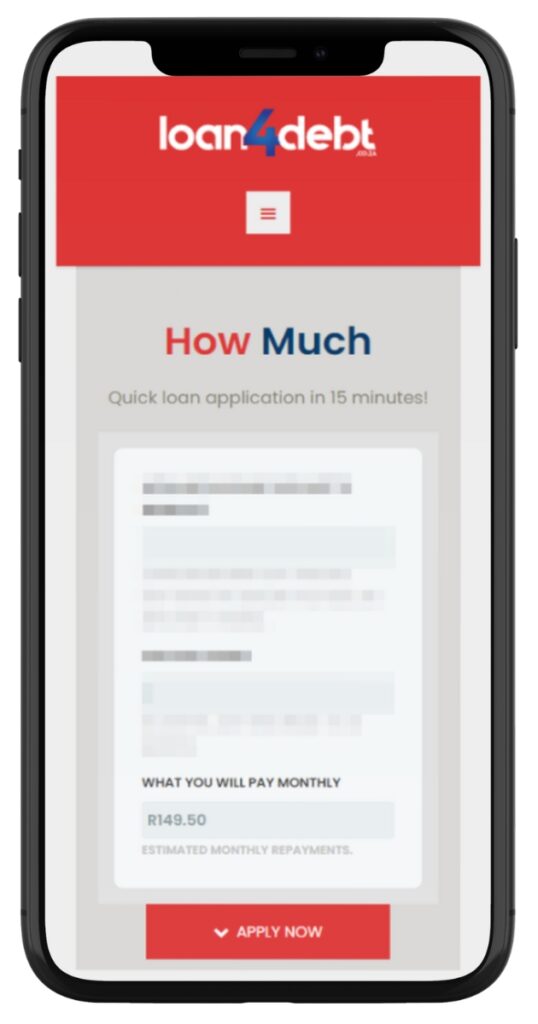

Step 4. Review the estimated monthly repayment amount

Step 5. Complete the online application form with your personal details.

Step 6. Upload the required documents (ID, proof of income, etc.).

Step 7. Send your application for processing.

Step 8. Wait for a response, typically within a short period.

Step 9. Once approved, the loan amount will be deposited into your bank account.

Step 10. Begin repaying the loan according to the agreed schedule.

Eligibility Check

Loan4Debt offers a straightforward and convenient way to check your eligibility for a loan. Here’s how you can pre-check your eligibility:

- Online Calculator: Use their online loan calculator to estimate the loan amount you may qualify for based on your income and repayment preferences.

- Pre-Approval Check: Some loan types may include a pre-approval tool, allowing you to assess your eligibility without impacting your credit score.

- Customer Support: Contact Loan4Debt’s customer service to discuss your financial situation and receive an informal assessment of your eligibility.

These methods help you determine if you meet the basic requirements before completing a full application, saving time and avoiding unnecessary credit checks.

How Much Money Can I Request from Loan4Debt?

Loan4debt.co.za offers short-term loans with flexible amounts based on your needs. The minimum loan amount you can request is R1,000, which is ideal for covering smaller, urgent expenses. Conversely, the maximum loan amount is R1,000,000, suitable for larger financial needs such as debt consolidation or significant purchases. These limits ensure that the loans remain manageable within short repayment periods.

Receive Offers

Loan4Debt provides personalised loan offers based on factors such as your financial situation, requested loan amount, and repayment capacity. During the application process, the system evaluates your income, credit history, and other financial obligations. This helps customise loan terms, including interest rates and repayment periods, to meet your specific needs. If you meet the basic requirements, you’ll receive a loan offer tailored to your profile, ensuring manageable repayments.

How Long Does it Take to Receive My Money from Loan4Debt?

Once your loan application is approved, Loan4Debt processes the funds promptly. On average, you can expect to receive the money within 24 to 48 hours after approval. The speed of this process depends on factors such as the time of application submission and how quickly the necessary documents are verified.

Factors Affecting Withdrawal Speed

- Time of Application: Submitting your application early in the day or during business hours can expedite processing.

- Document Verification: Providing complete and accurate documents ensures a quicker verification process.

- Bank Processing Times: The transfer speed may also depend on your bank’s processing times.

How Do I Repay My Loan from Loan4Debt?

Repayment Options and Plans: Loan4Debt offers flexible repayment options that fit your financial situation. You can choose from various repayment plans, typically spanning 30 to 72 months. Repayments can be made via direct debit from your bank account, ensuring timely payments without manual effort.

Possible Fees and Penalties: While Loan4Debt allows early settlement without penalties, late payments may incur fees. These penalties generally include additional interest charges or fixed late fees, depending on the loan agreement. To avoid these, it’s important to adhere to the agreed repayment schedule.

Pros and Cons of Choosing Loan4Debt

Pros

- Quick Access to Funds: Loan4Debt provides a fast and efficient application process, with funds typically available within 24 to 48 hours after approval.

- Flexible Repayment Options: Various repayment plans are available, allowing customers to select the option that best suits their financial situation.

- No Collateral Required: Loans are unsecured, meaning you don’t need to provide assets as security.

- Online Application: The entire loan process can be completed online, offering convenience for users who prefer a digital approach.

- Transparent Terms: Clear loan terms and the option to settle early without penalties help manage repayments more effectively.

Cons

- High-Interest Rates: Interest rates can be higher compared to other loan types, especially for smaller loan amounts.

- Limited Loan Amounts: The maximum loan amount is R50,000, which may not cover larger financial needs.

- Short-Term Focus: The loans are intended for short-term use, which may not suit those looking for longer repayment periods.

- Requires Stable Income: Approval relies on having a stable income, which could be a challenge for those with irregular earnings.

Customer Service

If you have additional questions or need assistance from Loan4Debt, their customer service team is available to help. You can contact them through the following methods:

- Phone: Call their direct helpline for immediate assistance.

- Email: Send your inquiries via email and expect a response within business hours.

- Online Chat: Some platforms may offer a live chat feature for quick support.

For specific queries about your loan application, repayment plans, or other details, reaching out to them directly through these contact methods is recommended.

Loan4Debt’s Contact Channels

Phone number:

Office: +27 87 654 4152

Cell: +27 63 665 0391 (WhatsApp available)

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: By appointment only

Postal address:

119 Booysens Reserve Rd, Theta, Johannesburg South, 2091, South Africa

Online Reviews of Loan4Debt

Customer reviews for Loan4debt.co.za typically present a blend of positive and negative experiences, reflecting the diverse nature of financial service feedback.

Positive Feedback

- Fast and Efficient Service: Many customers appreciate the quick approval process and the prompt availability of funds.

- User-Friendly Platform: The online application system is often praised for being simple and easy to use.

- Supportive Customer Service: Some users commend the customer support team for being helpful and responsive during the loan process.

Negative Feedback

- High-Interest Rates: Several customers note that the interest rates are higher than anticipated, which can lead to increased overall repayment amounts.

- Strict Repayment Terms: Some borrowers find the repayment plans to be inflexible, particularly when unexpected financial difficulties arise.

- Limited Loan Amounts: There are reviews mentioning that the maximum loan amounts may not be adequate for more substantial financial needs.

These reviews provide a balanced perspective on Loan4Debt’s services, highlighting its strengths while also noting areas where improvements could be made.

Alternatives to Loan4Debt

When exploring alternatives to Loan4Debt, consider these other credit providers and comparison tools available in South Africa:

- Wonga: Offers quick online loans with clear terms and competitive interest rates for short-term borrowing needs.

- Capitec Bank: Provides personal loans with flexible repayment options and generally lower interest rates, suitable for larger loan amounts.

- Lime Loans: Specialises in small, short-term loans with a simple online application process.

Comparison Table

| Criteria | Loan4Debt | Capitec Bank | Ackermans | Vodacom |

|---|---|---|---|---|

| Loan Amount | R1,000 – R1,000,000 | R1,000 – R250,000 | Up to R50,000 | Up to R250 000 |

| Interest Rate | 36% – 60% APR | 12.9% – 27.75% APR | Varies (based on credit profile) | Varies (based on credit profile) |

| Loan Term | 30 days – 72 months | 1 month – 84 months | Up to 12 months | Flexible terms |

| Application Process | Online & Phone | Online & In-branch | Online, SMS, or In-store | Online |

| Early Settlement | Allowed | Allowed | Allowed | Allowed |

| Repayment Flexibility | Limited | Flexible | Limited | Flexible |

| More Info | Capitec Bank Review | Ackermans Review | Vodacom Review |

History and Background of Loan4Debt

Loan4Debt was established to offer prompt and accessible financial solutions to South African consumers. Since its founding, the company has sought to address the need for quick, short-term loans, particularly for individuals requiring immediate financial support who might not have access to traditional banking services.

Loan4Debt’s goal is to provide clear, dependable, and speedy loan services, ensuring that customers’ financial needs are addressed with minimal difficulty. The company’s ambition is to become a leading provider of short-term financial solutions in South Africa, with a focus on customer satisfaction, ethical lending practices, and steady growth within the financial sector.

Conclusion

Loan4Debt offers a convenient and accessible option for South Africans seeking short-term financial assistance. With fast approval times and a simple application process, it caters to those in urgent need of funds. However, potential borrowers should carefully review the interest rates and repayment terms before agreeing to a loan. Overall, Loan4Debt performs well in terms of accessibility and speed but may not be ideal for those looking for lower interest rates.

Frequently Asked Questions

You can apply for a loan of up to R1,000,000 with Loan4Debt.

The approval process is generally quick, and you may receive funds within 24 hours of approval.

Repayment terms range from 30 days to 72 months, depending on the loan amount and agreement.

No, Loan4Debt allows for early repayment without any penalties.

Yes, Loan4Debt reviews applications from individuals with various credit scores. Approval may also depend on other factors such as income and job stability.