In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s an unforeseen medical expense, a car repair, or just bridging the gap until the next paycheck, many South Africans often find themselves in need of a quick financial boost. Enter MiPayDayLoans, an online lending platform that promises to provide swift and straightforward payday loans to those in need. In this review, we’ll delve deep into what MiPayDayLoans offers, how it stands out in the crowded loan market, and whether it’s the right choice for you.

Experiences with MiPayDayLoans Loan

Navigating the financial world can be daunting, especially when unexpected expenses arise. Many individuals have turned to MiPayDayLoans for a quick financial solution. The feedback has been largely positive, with users highlighting the platform’s user-friendly interface, swift loan approval process, and transparent terms and conditions. The ease with which loans are disbursed and the clarity in communication have made MiPayDayLoans a preferred choice for many South Africans in need of a payday loan.

Who can apply for a MiPayDayLoans Loan?

MiPayDayLoans has an inclusive approach, aiming to cater to a broad spectrum of South Africans. Whether you’re a salaried individual facing a month-end crunch or someone with an unexpected medical bill, MiPayDayLoans is open for applications. The primary requirement is that the applicant should be a South African resident with a valid ID number. However, like all responsible lenders, MiPayDayLoans does have certain criteria to ensure the financial safety of its borrowers.

Criteria for Potential Borrowers

To maintain the integrity of its lending process and ensure the well-being of its customers, MiPayDayLoans has set forth specific criteria for potential borrowers. Firstly, applicants must have a steady source of income, ensuring they can repay the loan without undue financial stress. Additionally, a credit check is performed to gauge the creditworthiness of the applicant. This doesn’t mean those with less-than-perfect credit scores are automatically disqualified, but it helps MiPayDayLoans tailor the loan terms to suit the borrower’s financial situation.

Differences from Other Loan Providers

In the crowded space of online lenders, MiPayDayLoans stands out for several reasons. Their commitment to serving underserved low-income households sets them apart. While many online lenders focus solely on profit, MiPayDayLoans emphasizes financial education and empowerment. Their transparent terms and conditions, coupled with a straightforward application process, make them a reliable choice. Their affiliation with WestPRO Finance, a registered and legal microfinance credit provider, adds an additional layer of trustworthiness to their operations. In a nutshell, MiPayDayLoans offers a blend of swift financial solutions with a touch of personal care, making them a distinct choice in the online lending market.

About Arcadia Finance

Streamline your loan sourcing experience with Arcadia Finance. Apply without any fees and investigate proposals from up to 19 diverse lenders. Each of our financial affiliates is credible and overseen by the National Credit Regulator, assuring compliance and trustworthiness in South Africa’s economic landscape.

MiPayDayLoans Loan

In the expansive realm of online lending, MiPayDayLoans has carved a niche for itself by providing tailored financial solutions to South Africans. However, what distinguishes the MiPayDayLoans loan from others? Let’s explore the unique features, advantages, and the range of loan products they offer.

What Makes the MiPayDayLoans Loan Unique?

MiPayDayLoans stands out as more than just another online lender. Their lending approach is grounded in a vision of inclusive growth, with the aim of benefiting underserved low-income households. This commitment to financial empowerment is reflected in their offerings, designed to be both accessible and educational. MiPayDayLoans operates with transparency, ensuring borrowers are well-informed about the terms and conditions of their loans. Their affiliation with WestPRO Finance, a reputable microfinance credit provider, reinforces their commitment to responsible lending.

Advantages of the MiPayDayLoans Loan Comparison

When comparing MiPayDayLoans to other lenders, several advantages become apparent. Firstly, their online platform is user-friendly, facilitating a smooth and hassle-free loan application process. The prompt approval and disbursement of loans mean that borrowers can access funds promptly when they need them the most. Additionally, MiPayDayLoans places a strong emphasis on financial education, ensuring borrowers are equipped with the knowledge to make informed financial decisions. This comprehensive approach to lending, combining quick financial solutions with an educational component, is what sets MiPayDayLoans apart.

Types of Loans Offered by MiPayDayLoans

MiPayDayLoans provides a variety of loan products tailored to meet the diverse needs of its clientele.

Different Loan Products Available

While the primary focus of MiPayDayLoans is on payday loans, designed to bridge the gap until the next paycheck, they may also offer other types of loans in collaboration with their parent company, WestPRO Finance. These loans are crafted to address specific financial needs, ensuring that borrowers have access to the right kind of financial assistance when they need it.

- Payday Loans: Ideal for individuals facing unexpected expenses before their next paycheck. Whether it’s a medical emergency, a utility bill, or any other unforeseen cost, a payday loan from MiPayDayLoans can provide the necessary financial relief.

- Personal Loans: Suitable for larger expenses that can’t be covered by a single paycheck. Whether it’s funding a vacation, consolidating debt, or making a significant purchase, a personal loan offers flexibility in terms of repayment.

- Home Loans and Auto Loans: While MiPayDayLoans primarily focuses on payday and personal loans, they might collaborate with WestPRO Finance to offer home or auto loans. These are long-term loans designed for significant life purchases, such as buying a house or a car.

Requirements for a MiPayDayLoans Loan

When considering a loan from MiPayDayLoans, it’s essential to be prepared with the necessary documents and information. This ensures a smooth application process and increases the likelihood of loan approval. Here’s a comprehensive overview of what you’ll need when applying for a loan with MiPayDayLoans.

Documents and Information Needed

To maintain the integrity of its lending process and ensure the safety and security of its borrowers, MiPayDayLoans requires certain documents and information from its applicants.

Proof of Identity: Submit a copy of your valid South African ID. This not only verifies your identity but also ensures that you are of legal age to enter into a loan agreement.

Proof of Income: Provide proof of income to demonstrate a steady source of earnings, indicating your ability to repay the loan. This can be in the form of recent payslips, bank statements, or any other document reliably showing your monthly income.

Contact Details: Furnish your contact details, including a current address, phone number, and email address. This allows MiPayDayLoans to communicate with you regarding your loan application, approval status, and any other related matters.

Additional Documentation (if requested): In some cases, MiPayDayLoans might request additional documentation or information to gain a clearer picture of your financial situation. This could include details of your monthly expenses, any existing debts, or other financial commitments.

Credit Check: As part of their commitment to responsible lending, MiPayDayLoans will perform a credit check. While this might sound intimidating, it’s a standard procedure that helps the lender gauge the creditworthiness of the applicant. It’s worth noting that a less-than-perfect credit score doesn’t automatically disqualify you. Instead, it helps MiPayDayLoans tailor the loan terms to better suit your financial situation.

Simulation of a Loan at MiPayDayLoans

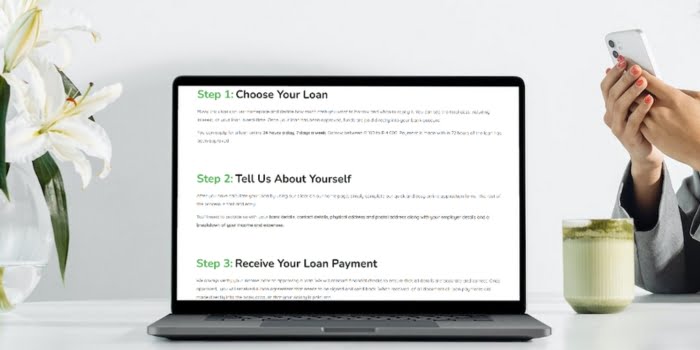

Navigating the loan application process can be a daunting task for many. However, with MiPayDayLoans, the procedure is streamlined and user-friendly. Here’s a step-by-step guide to help you understand how to apply for a loan with MiPayDayLoans.

Step-by-Step Guide to Applying for a Loan with MiPayDayLoans

- Visit the MiPayDayLoans Website: Start by accessing the official MiPayDayLoans website. This is your gateway to all the services they offer.

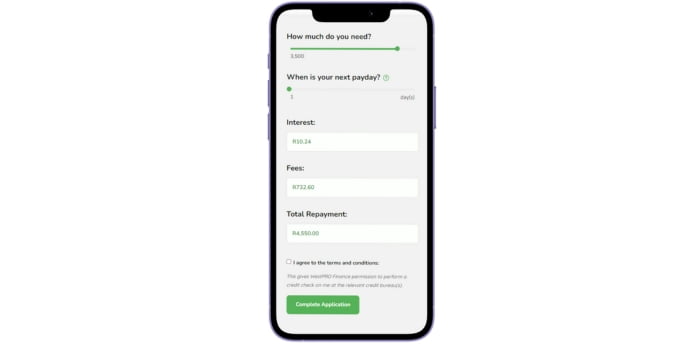

- Choose Your Loan Amount: On the homepage, you’ll find a loan calculator or a similar tool. Here, you can input the amount you wish to borrow. This tool will give you an estimate of the interest, fees, and total repayment amount.

- Provide Personal Details: After deciding on the loan amount, you’ll be prompted to provide personal information. This includes your full name, South African ID number, contact details, and other relevant information.

- Submit Proof of Income: To ensure you have the means to repay the loan, MiPayDayLoans will ask for proof of your income. This can be in the form of recent payslips or bank statements.

- Consent to a Credit Check: Before finalizing your application, you’ll need to give MiPayDayLoans permission to perform a credit check. This helps them assess your creditworthiness and tailor the loan terms accordingly.

- Review and Accept Terms and Conditions: Before submitting your application, take a moment to review the terms and conditions. Once you’re comfortable with the details, you can proceed.

- Wait for Approval: After submitting your application, MiPayDayLoans will review the provided information. If everything is in order, you’ll receive an approval notification, often within a short time frame.

- Receive Your Loan: Once approved, the loan amount will be disbursed to your provided bank account. The speed of this process can vary, but MiPayDayLoans prides itself on quick turnarounds.

Eligibility Check

Before diving into the application process, it’s wise to check if you meet MiPayDayLoans’ eligibility criteria. Here are the tools or methods offered by MiPayDayLoans to pre-check eligibility.

Tools or Methods Offered by MiPayDayLoans to Pre-Check Eligibility

MiPayDayLoans understands the importance of time and ensures that potential borrowers can quickly gauge their eligibility. They might offer an online eligibility checker on their website. By inputting basic information such as income details and the desired loan amount, this tool can provide a preliminary assessment of your loan eligibility. This not only saves time but also gives applicants a clearer picture of their borrowing potential before diving deep into the application process.

Security and Privacy at MiPayDayLoans

In the digital age, the security and privacy of personal and financial information are paramount. MiPayDayLoans recognizes the importance of this and has implemented robust measures to ensure that users’ data is protected at all times.

How MiPayDayLoans Ensures the Security of Personal and Financial Information

MiPayDayLoans employs state-of-the-art encryption technologies to safeguard the data transmitted between the user’s device and their servers. This means that any information you provide, be it personal details or financial records, is encrypted before transmission, making it nearly impossible for unauthorized parties to intercept or decipher.

In addition to encryption, MiPayDayLoans uses secure server infrastructure, often housed in data centers with advanced physical security measures. This ensures that the stored data remains protected from both digital threats, such as hacking attempts, and physical threats like theft or damage.

MiPayDayLoans maintains a strict policy of not sharing or selling user data to third parties for marketing purposes. Any third-party interactions, if at all, are solely for the purpose of enhancing the loan service, and all third parties are vetted rigorously to ensure they adhere to the same high standards of data protection.

Privacy Policies and Data Handling Practices

MiPayDayLoans is transparent about how they handle and use the data they collect. Their privacy policy, which is accessible on their website, provides detailed insights into their data handling practices.

Within this policy, MiPayDayLoans outlines the types of information they collect, how this information is used, and the circumstances under which it might be disclosed. For instance, while they collect data to assess loan eligibility, they also use it to improve their services, ensuring a better user experience.

MiPayDayLoans also emphasizes user control over their data. Users have the right to access, modify, or even delete their data. Any such requests are handled promptly, reflecting MiPayDayLoans’ commitment to user privacy.

In terms of data retention, MiPayDayLoans only keeps user data for as long as it’s necessary. Once the data has served its purpose, and there’s no legal or operational need to retain it, it’s securely deleted from their systems.

How Much Money Can I Request from MiPayDayLoans?

When considering a loan from MiPayDayLoans, it’s essential to know the range of amounts you can request. MiPayDayLoans offers online payday loans up to R4,000. However, the exact amount you can borrow will depend on various factors, including your income, credit history, and the specific loan product you choose.

Minimum and Maximum Amounts

MiPayDayLoans provides loans starting from smaller amounts, suitable for short-term needs, up to their maximum limit of R4,000. The flexibility in loan amounts ensures that borrowers can select an amount that aligns with their financial needs without over-borrowing.

Receive Offers

MiPayDayLoans takes pride in offering personalized loan solutions to its customers.

How MiPayDayLoans Creates Personalized Loan Offers

Instead of a one-size-fits-all approach, MiPayDayLoans evaluates each application individually. By assessing your income, credit score, and other relevant financial details, they tailor loan offers that match your repayment capacity. This personalized approach ensures that borrowers receive loan terms that are both favorable and manageable.

How Long Does It Take to Receive My Money from MiPayDayLoans?

One of the standout features of MiPayDayLoans is the speed of their loan processing.

Average Processing Times

On average, once your loan application is approved, MiPayDayLoans strives to disburse the funds swiftly, often within a short time frame. This rapid turnaround is especially beneficial for those in urgent need of funds.

Factors Affecting Withdrawal Speed

While MiPayDayLoans aims for quick disbursements, certain factors can influence the speed. These include the time of day the application is submitted, any additional documentation required, and the processing times of the bank where you hold your account.

How Do I Repay My Loan from MiPayDayLoans?

Repaying your loan is a straightforward process with MiPayDayLoans.

Repayment Options and Plans

MiPayDayLoans offers various repayment options to suit the diverse needs of its borrowers. Typically, repayments can be made through direct bank transfers, electronic payments, or even through physical branches if available. The repayment plan, including the tenure and installment amounts, will be clearly outlined in the loan agreement.

Possible Fees and Penalties

It’s crucial to be aware of any additional fees or penalties associated with the loan. MiPayDayLoans values transparency, ensuring that borrowers are informed about any potential charges upfront. While they strive to keep fees minimal, late repayments or defaults might incur penalties. It’s always advisable to read the loan agreement carefully and reach out to MiPayDayLoans for any clarifications.

Online Reviews of MiPayDayLoans

Many individuals turn to online payday loans when facing emergency cash needs, such as medical bills or unexpected expenses. Online lending networks, like MoneyMutual, connect borrowers with multiple lenders nationwide, allowing for a convenient online application process and quick funding. MoneyMutual, for instance, offers short-term loans up to R4,000 with a fast turnaround time. However, it’s crucial to be aware that payday loans often come with high interest rates, especially for those with bad credit.

Factors to Consider Before Opting for an Online Payday Loan: Before choosing an online payday loan, consider factors such as the interest rates, repayment terms, and any associated fees. Assess your own financial situation and determine if the loan is the most suitable solution for your needs. It’s important to be aware of the potential high costs associated with payday loans.

Comparison with Traditional Bank Loans: Online payday loans typically have higher interest rates compared to traditional bank loans. Traditional bank loans may offer lower interest rates and more favorable repayment terms, but they often involve a more extensive application and approval process. It’s essential to weigh the pros and cons based on your specific circumstances.

Alternative Financial Solutions: Explore alternative financial solutions that might be more beneficial than payday loans. Options could include negotiating payment plans with creditors, seeking assistance from local charities or community organizations, or considering a small personal loan from a credit union. It’s important to exhaust all available options and choose the one that best fits your financial situation.

Customer Service

When it comes to financial services, having a responsive and helpful customer service team is crucial. MiPayDayLoans understands this and has invested in ensuring that their customers have access to timely and accurate information. Whether you have questions about the loan application process, repayment terms, or any other aspect of their services, MiPayDayLoans’ customer service team is there to assist.

Do You Have Further Questions for MiPayDayLoans?

If you have more questions or need clarification on any aspect of MiPayDayLoans’ offerings, it’s recommended to reach out to their customer service directly. They can provide detailed information tailored to your specific situation, ensuring you make an informed decision.

Alternatives to MiPayDayLoans

While MiPayDayLoans offers a range of services, there are other credit comparison portals available. Some of these platforms might have different offers, terms, or features that could be more suitable for your needs. It’s always a good idea to explore multiple options before making a decision.

Comparison Table

| Features/Providers | MiPayDayLoans | Wonga | Cash Converters | Koodo | LendPlus |

|---|---|---|---|---|---|

| Maximum Loan Amount | R4000 (based on individual assessment) | Up to R4000 | Up to R4000 | Up to R5,000 | R500 to R4,000 |

| Loan Types Offered | Payday Loans | Short-Term Loans | Payday Loans | Payday Loans | Short-term Loans |

| Average Approval Time | Up to 72 hours | Within 24 hours | Within 24 hours | Within 24 hours | Within 1 hour |

| More Info | Wonga Review | Cash Converters Review | Koodo Review | LendPlus Review |

History and Background of MiPayDayLoans

MiPayDayLoans has emerged as a notable player in the online lending space, catering to the financial needs of many South Africans. Established by a team of financial experts passionate about providing accessible and transparent lending solutions, MiPayDayLoans has grown exponentially since its inception.

Brief History and Establishment of the Company

MiPayDayLoans was founded with the aim of bridging the financial gap many individuals face between paychecks. Recognizing the challenges that come with unexpected expenses, the founders sought to create a platform that offers swift and straightforward payday loans. Over the years, the company has expanded its services, continually adapting to the evolving needs of its clientele.

Company’s Mission and Vision

At the heart of MiPayDayLoans is a mission to provide financial solutions, services, and education to underserved low-income households. They believe in empowering individuals with the tools and knowledge to make informed financial decisions. Their vision is to be a leading online lender, known for its integrity, transparency, and commitment to customer well-being.

Pros and Cons of MiPayDayLoans

Here’s a balanced view of MiPayDayLoans, outlining both advantages and disadvantages:

Advantages

- User-Friendly Platform: MiPayDayLoans offers an intuitive online platform, making the loan application process seamless.

- Swift Approval and Disbursement: Recognizing the urgency of financial needs, they ensure quick loan approvals and disbursements.

- Transparent Terms: Borrowers are well-informed about the terms and conditions, ensuring there are no hidden surprises.

Disadvantages

- Limited Loan Amount: While MiPayDayLoans offers loans up to R4,000, some individuals might require larger amounts.

- Online-Only Presence: Being an online platform, those who prefer face-to-face interactions might find it less appealing.

Conclusion

MiPayDayLoans has successfully carved a niche for itself in the online lending space, providing customized financial solutions to a diverse range of South Africans. The company distinguishes itself through its commitment to transparency, quick service, and empowering customers with financial knowledge. Despite the inherent challenges and areas for improvement that any company may face, MiPayDayLoans’ steadfast dedication to its mission and vision is evident in its operations and the services it offers.

Frequently Asked Questions

MiPayDayLoans is an online lending platform that offers payday loans to South Africans, aiming to provide swift and straightforward financial solutions.

You can borrow up to R4,000 from MiPayDayLoans, though the exact amount may vary based on your financial situation and creditworthiness.

Once approved, MiPayDayLoans strives to disburse funds promptly, often within a short time frame.

Yes, MiPayDayLoans employs state-of-the-art encryption technologies and secure server infrastructure to ensure the safety and privacy of your data.

MiPayDayLoans offers various repayment options, including direct bank transfers and electronic payments. The specific repayment terms will be outlined in your loan agreement.