When unexpected expenses arise or financial assistance is needed quickly, MTN MoMo Qwikloans [Mtnmomo.co.za] offer a convenient solution for South Africans. Designed to provide immediate access to short-term credit, these loans are tailored for MTN MoMo users who require fast financial support without the hassle of lengthy applications. With their simple process, flexible loan amounts, and seamless integration with mobile wallets, MTN MoMo Qwikloans make borrowing straightforward and accessible.

MTN MoMo Qwikloans – Loan Overview

| Name | MTN MoMo Qwikloans |

|---|---|

| Financial | MTN’s Mobile Money Platform, MoMo, partnered with JUMO |

| Product | Qwikloan |

| Minimum age | 18 years |

| Minimum amount | R250 |

| Maximum amount | R10 000 |

| Minimum term | Variable, based on the loan agreement |

| Maximum term | Variable, based on the loan agreement |

| APR | Up to 10% |

| Monthly Interest Rate | Variable, significantly lower than traditional banks |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Tailored to meet specific requirements |

| NCR Accredited | Yes |

| Our Opinion | ✅ Efficient and user-friendly application process ✅ Flexible repayment options via MoMo wallet ⚠️ Limited to smaller, short-term loans |

| User Opinion | ✅ Convenient access to funds ⚠️ Interest rates may vary based on loan terms |

What Makes MTN MoMo Qwikloans Unique?

MTN MoMo Qwikloans stand out by offering a fast and mobile-friendly loan experience that caters to South Africans who need quick access to funds. Unlike traditional lenders that may require extensive documentation and long approval times, MTN MoMo Qwikloans operate entirely through Mtnmomo.co.za, making the process seamless for existing users. Borrowers can apply for loans directly from their mobile devices, with approval and disbursement often completed in minutes. This level of convenience ensures that users can address urgent financial needs without unnecessary delays, making it a practical choice for those prioritising speed and simplicity.

Another aspect that sets MTN MoMo Qwikloans apart is their integration with the MTN mobile wallet system, allowing users to manage both their loans and daily financial transactions in one place. This synergy between mobile banking and lending reduces the need for additional platforms, simplifying financial management for users. Furthermore, the service offers loan amounts and repayment terms that are flexible, ensuring borrowers can select options tailored to their circumstances. This unique blend of accessibility, speed, and mobile integration positions them as a standout option for individuals seeking immediate financial assistance.

About Arcadia Finance

Arcadia Finance makes borrowing simple and stress-free. Choose from 19 reliable lenders, each accredited by South Africa’s National Credit Regulator, with no application fees to worry about. Experience a hassle-free loan process tailored to your unique financial requirements.

Types of Loans Offered by MTN MoMo Qwikloans

MTN MoMo Qwikloans is designed to meet short-term financial needs with personal loans that are accessible to Mtnmomo.co.za users. While the platform does not offer specialised loans like home loans or auto loans, its flexible loan amounts and repayment terms make it suitable for a variety of purposes. Below is a breakdown of the primary loan type available and its potential uses:

Personal Loans

MTN MoMo Qwikloans exclusively provides personal loans, which are short-term loans designed for immediate financial requirements. Borrowers can access amounts tailored to their repayment capacity, ensuring manageable repayment terms. Potential uses include:

- Emergency Expenses: Ideal for covering unexpected costs such as medical bills, urgent repairs, or family emergencies.

- Household Needs: Can be used for purchasing groceries, paying utility bills, or covering school fees.

- Small Business Support: Useful for entrepreneurs who need quick funds for inventory purchases or operational expenses.

- Debt Consolidation: Provides an option to settle smaller debts and streamline repayments into a single loan.

These personal loans are highly flexible and accessible via Mtnmomo.co.za, ensuring users can address immediate needs without visiting a bank or filling out lengthy paperwork. The simplicity of the application process makes MTN MoMo Qwikloans a reliable choice for users seeking quick, small-scale loans tailored to their specific requirements.

Requirements for an MTN MoMo Qwikloan

To qualify for their Qwikloan, applicants must meet the following requirements:

- Be an MTN MoMo account holder with an active account.

- Have a valid South African ID or passport.

- Demonstrate consistent transactional activity on their platform.

- Maintain a positive credit and repayment history with MTN MoMo or other lenders.

No additional documents are typically required, as the service uses information linked to the applicant’s MoMo account to assess eligibility.

Simulation of a Loan at MTN MoMo

Applying for an MTN MoMo Qwikloan is straightforward:

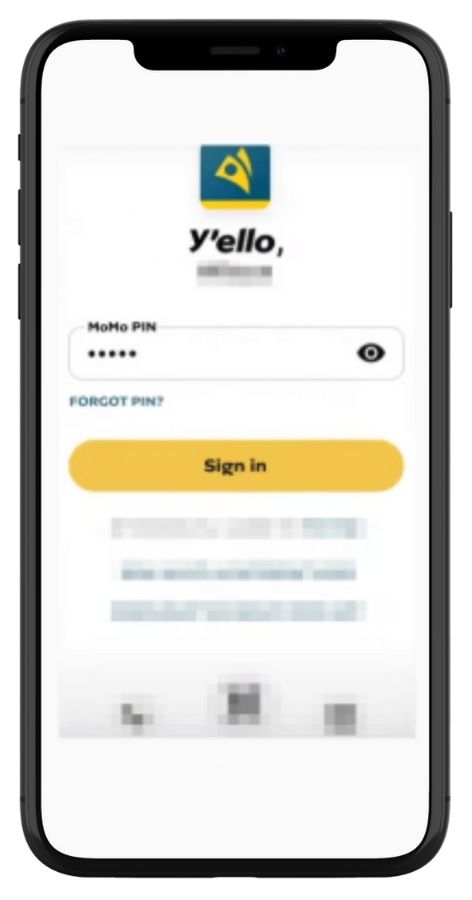

Step 1. Download their app.

Step 2. Enter your MoMo PIN and tapping “Sign in.”

Step 3. On the homepage, select the “Loans” option.

Step 4. Navigate to “Loans & advances” and select “Cash loans.”

Step 5. Choose the “Qwikloan” option.

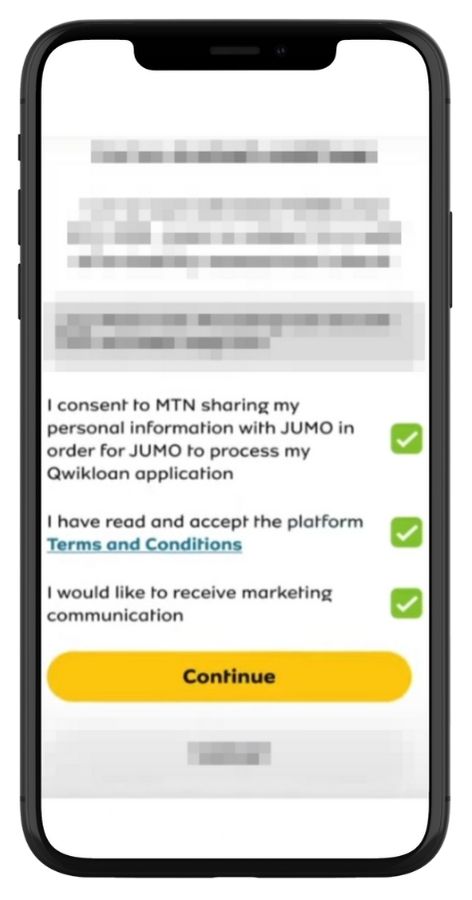

Step 6. Accept the terms and conditions then tap “Continue.”

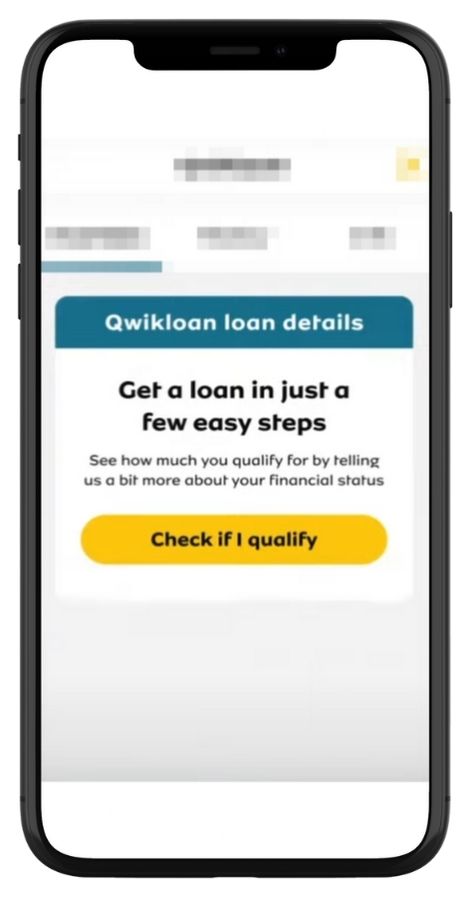

Step 7. Tap “Check if I qualify” to proceed with your loan application.

Step 8. Confirm your application.

Step 9. Receive the loan directly into your MoMo wallet if approved.

Eligibility Check

MTN MoMo offers a built-in eligibility tool within the MoMo platform. This tool assesses your borrowing capacity based on your transaction history and previous repayment behaviour. By using this feature, users can get an instant indication of whether they qualify for a Qwikloan and the amount they are eligible to borrow, ensuring transparency and saving time during the application process.

How Much Money Can I Request from MTN MoMo Qwikloans?

With MTN MoMo Qwikloans, borrowers can access loan amounts ranging from as low as R250 to a maximum of R10 000, depending on their financial profile and repayment history. The loan amounts are designed to provide short-term relief for small to moderate financial needs, ensuring that users can borrow within manageable limits. New borrowers typically qualify for smaller amounts initially, with access to higher loan limits increasing as they establish a reliable repayment record.

Receive Offers

MTN MoMo Qwikloans uses a personalised approach to determine the loan amount and terms offered to each borrower. The system evaluates factors such as the borrower’s transaction history on the MTN MoMo platform, repayment behaviour on previous loans, and the amount of income regularly flowing through their account. This data-driven method ensures that loan offers are tailored to each customer’s financial capacity, reducing the risk of over-borrowing and promoting responsible lending practices.

How Long Does It Take to Receive My Money from MTN MoMo Qwikloans?

One of the standout features of MTN MoMo Qwikloans is the speed of its processing time. Once an application is submitted and approved, funds are typically disbursed within minutes, making it an excellent option for urgent financial needs. The money is credited directly to the borrower’s MTN MoMo wallet, ready for immediate use. Factors affecting withdrawal speed include:

- Network Stability: Delays can occur due to technical issues or high system traffic.

- Eligibility Verification: If the borrower’s profile requires additional checks, it may take slightly longer to approve the loan.

- Repayment History: Customers with a strong repayment history are likely to experience faster approvals.

How Do I Repay My Loan from MTN MoMo Qwikloans?

Repaying an MTN MoMo Qwikloan is simple and fully integrated into the MoMo platform, offering convenience for borrowers. The system allows for automatic deductions, where the repayment amount is directly debited from the borrower’s MoMo wallet on the agreed repayment date. Alternatively, users can choose to manually settle their loans by transferring the required amount to their MoMo wallet before the due date. Loan terms typically require repayment within 30 days or another agreed short-term period, depending on the conditions set during the application process.

While the repayment process is straightforward, there are possible fees and penalties for late payments. Borrowers who miss their deadlines may face additional charges, increasing the overall cost of the loan. Interest may also accumulate on overdue amounts, making timely repayment crucial to avoiding extra expenses. However, they offer flexibility by not imposing penalties for early settlement, allowing users to pay off their loans ahead of schedule without incurring additional costs. This transparent and user-friendly approach ensures that borrowers can manage their loans effectively.

Pros and Cons of MTN MoMo Qwikloans

Pros

- Quick Access to Funds:They provide a fast application process, with approvals and disbursements often completed in minutes.

- Convenience: Loans are accessible directly from the mobile platform, eliminating the need for in-person visits or additional apps.

- Flexible Loan Amounts: Borrowers can choose loan amounts suited to their specific financial needs, ensuring they only borrow what they can afford to repay.

- No Extensive Documentation: The platform requires minimal paperwork, making it accessible to a wide range of customers, including those without traditional banking profiles.

- Transparent Process: Loan terms, including repayment amounts and interest rates, are clearly communicated, helping users understand their obligations upfront.

Cons

- Limited Loan Types: They only offer personal loans, making them unsuitable for users seeking specialised loans, such as home or vehicle financing.

- Short Repayment Periods: As a short-term loan product, repayment terms may be restrictive for borrowers needing longer periods to repay.

- MTN Network Restriction: Only MTN MoMo users can access the service, excluding customers on other mobile networks.

Customer Service

If you have further questions about MTN MoMo Qwikloans, the platform offers customer support to assist users with their queries. You can reach out via their app or contact the dedicated customer service team through their helpline.

Should you experience issues with your loan application or repayment, the customer service team is available to provide guidance and resolve concerns promptly.

MTN MoMo Qwikloans Contact Channels

Phone number:

Office: Dial 135 from an MTN line for general inquiries (free for MTN subscribers).

Cell: Dial 120151# to access the MoMo USSD portal (standard USSD rates apply).

Hours of operation:

Monday to Friday: 08:00 – 17:00

Postal address:

MTN Head Office, 216 14th Avenue, Fairlands, Johannesburg, South Africa.

Online Reviews of MTN MoMo Qwikloans

Customer feedback on MTN MoMo Qwikloans includes a mix of positive and negative experiences. Many users highlight the convenience of the service, praising the ease of applying for loans directly through their app, which eliminates the need for lengthy and complicated processes. Another commonly appreciated feature is the quick approval and disbursement of funds, particularly helpful during financial emergencies. Customers also value the transparency in loan terms and repayment schedules, which helps to minimise confusion.

On the other hand, some customers express dissatisfaction with certain aspects of the service. One common complaint is the limited loan options, as the platform does not offer specialised products such as home or vehicle financing. The dependency on the MTN MoMo network has also drawn criticism, as it excludes users on other mobile networks.

Alternatives to MTN MoMo Qwikloans

For those seeking alternatives, several other loan providers in South Africa offer similar services:

Comparison Table

| Feature | MTN MoMo Qwikloans | Wonga Loans | Capitec Personal Loans | Nedbank MobiMoney Loans | Standard Bank Instant Loans | Oloan |

|---|---|---|---|---|---|---|

| Loan Type | Short-term personal | Short-term personal | Personal loans | Short-term personal | Short-term and personal | Personal Loans |

| Application Process | Mobile-based | Online | In-branch or online | Mobile-based | Banking app | Online Application |

| Eligibility | MTN MoMo users only | Open to all | South African residents | Nedbank account holders | Standard Bank account holders | South African residents |

| Loan Amounts | Up to R10 000 | Up to R8 000 | Up to R500 000 | Up to R3 000 | Up to R300 000 | Up to R350 000 |

| Repayment Period | Short-term | Short-term | Up to 84 months | Short-term | Short-term | Up to 72 months |

| More Info | Wonga Loan Review | Capitec Loan Review | Nedbank Loan Review | Standard Bank Loan Review | Oloan Review |

History and Background of MTN MoMo

MTN MoMo, short for Mobile Money, is a financial service platform launched by MTN, one of Africa’s largest telecommunications providers. Established to enhance financial inclusion across South Africa, this company aims to provide accessible and user-friendly financial solutions to individuals who may not have access to traditional banking systems. The introduction of MTN MoMo Qwikloans reflects the company’s commitment to addressing the short-term financial needs of its users.

The company’s mission is to empower individuals and businesses by providing reliable and innovative financial services, ensuring that everyone, regardless of their location or banking status, can access essential financial tools. Their vision is to become a trusted financial partner, delivering simple, secure, and convenient services that improve the everyday lives of its users. By integrating financial services into its mobile platform, MTN MoMo continues to break barriers in financial accessibility.

Conclusion

MTN MoMo Qwikloans provide a practical and convenient solution for South Africans seeking quick financial assistance. The platform’s integration with MTN’s mobile services ensures a streamlined experience for users, offering quick approvals and simple loan management. While it has certain limitations, such as being restricted to MTN MoMo users and offering only short-term personal loans, the overall service remains a reliable option for those who value speed and accessibility. MTN MoMo Qwikloans score highly for convenience and user-friendliness, making them a strong contender for anyone seeking immediate financial support. However, potential borrowers should carefully review the terms and consider alternatives if their needs extend beyond the platform’s offerings.

Frequently Asked Questions

MTN MoMo Qwikloans are available to users who meet the eligibility criteria, including being an active user of the MTN MoMo platform.

Loan approvals and disbursements are typically completed within minutes, making the service ideal for urgent financial needs.

Repayment terms vary depending on the loan amount and user profile, but they are generally short-term and clearly outlined during the application process.

MTN MoMo Qwikloans are transparent about their fees, but borrowers should review the terms carefully to understand any applicable interest rates or penalties for late payments.

No, the service is exclusive to MTN MoMo users, meaning individuals on other mobile networks cannot access MTN MoMo Qwikloans.