MyLoan [Myloan.co.za] has established itself in the South African loan market by offering a user-friendly application process, adaptable loan amounts, and competitive interest rates. Whether you’re seeking immediate funds for an emergency or financial support for a larger project, their services are designed to cater to a variety of needs. By understanding the features and benefits of MyLoan, you can make an informed decision that aligns with your financial goals.

MyLoan provides access to loan amounts ranging from R5 000 to R250 000, with repayment terms of up to 72 months, depending on the lender. If you’re considering flexible loan options through an online broker, keep reading to see if MyLoan.co.za is the right fit for your financial needs.

MyLoan: Quick Overview

Loan Amount: R5 000 – R250 000

Loan Term: 1 – 72 months

Interest Rate: 20% – 27.5% APR (varies by lender and applicant profile)

Fees: No direct fees; lender-specific fees may apply

Loan Types: Personal loans, short-term loans, debt consolidation loans, educational loans

About Arcadia Finance

Get your loan with ease through Arcadia Finance. With no application fees and access to 19 reputable lenders, all adhering to South Africa’s National Credit Regulator standards, you can trust in a seamless process tailored to your financial situation.

MyLoan Full Review

What Makes the MyLoan Loan Unique?

MyLoan distinguishes itself in the South African loan market with its user-focused platform that simplifies the borrowing process. Rather than promoting a single financial product, they function as a broker, offering clients a range of loan options from various lenders. This approach allows borrowers to compare different financial products and secure the best rates and terms available, all through a single application. This streamlined process saves time and helps clients make well-informed financial decisions without the need to search extensively.

MyLoan’s flexibility and accessibility further set it apart. The platform supports a wide range of financial needs, offering loans from small, short-term amounts to larger sums up to R250 000. It caters to individuals with diverse credit histories, including those with less-than-perfect credit scores, which broadens its appeal. The online application process is quick and straightforward, taking just minutes to complete. By partnering with multiple lenders, it increases the chances of approval, making it easier for borrowers to find a loan that fits their needs, whether for urgent cash requirements or significant expenses.

Types of Loans Offered by MyLoan

MyLoan offers a range of loan types to meet the varied financial needs of its clients. Here’s an overview of the different loan products available through MyLoan:

Personal Loans

MyLoan’s personal loans are versatile and can be used for various purposes, making them a popular choice. They are ideal for consolidating debt, funding home renovations, or covering unexpected costs. With loan amounts available up to R250 000 and flexible repayment terms, these loans aim to provide immediate financial relief with manageable repayment plans.

Short-term Loans

MyLoan’s short-term loans are tailored for immediate, smaller financial needs and are typically repaid over a few months. These loans are suited for covering urgent expenses, such as medical bills or car repairs. The streamlined application process and rapid disbursement of funds ensure that borrowers can access the money they need without significant delays.

Debt Consolidation Loans

Debt consolidation loans are another important offering from MyLoan. These loans are particularly beneficial for individuals seeking to simplify their finances by combining multiple debts into a single loan with one monthly payment. This type of loan can help lower the overall interest rate on the borrower’s debt and streamline their financial obligations, making it easier to manage their finances.

Educational Loans

Educational loans are designed for students and parents looking to finance higher education. These loans can cover tuition fees, books, and other educational expenses, allowing borrowers to invest in their or their children’s education without immediate financial strain.

Who Is MyLoan Best For?

It is best suited for borrowers who:

- Want to compare multiple loan offers from different lenders

- Need access to personal loans ranging from R5 000 to R250 000

- Prefer a fast, fully online application process

- Are formally employed with a steady income

- May have a less-than-perfect credit history

- Are looking for unsecured loan options

- Need quick access to funds for emergencies or major expenses

Is MyLoan a Safe and Good Option?

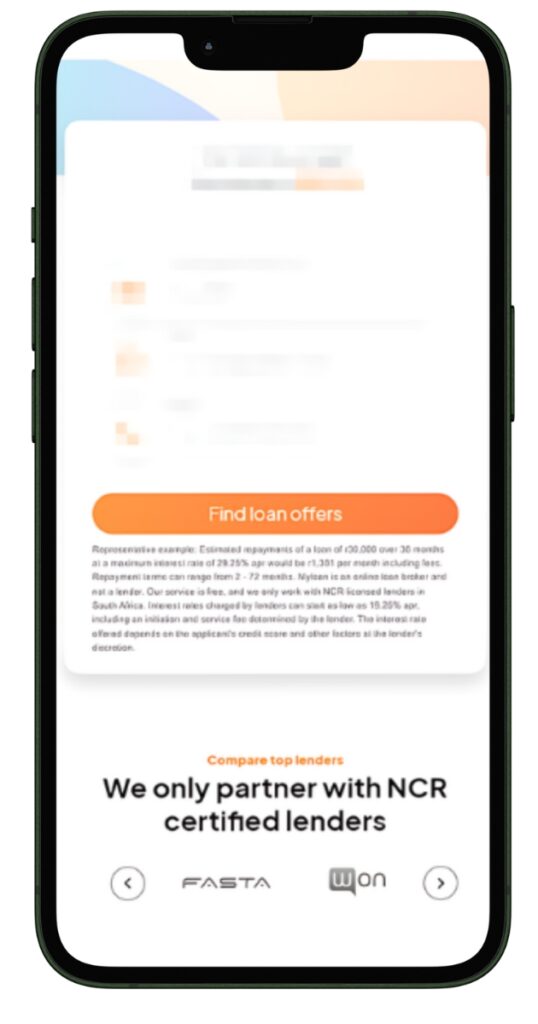

MyLoan.co.za is a registered online loan broker that connects South African borrowers with a range of NCR-accredited lenders offering unsecured personal loans. Through a secure and fully online application process, applicants can access loan amounts from R5 000 to R250 000, with repayment terms of up to 72 months, depending on the lender. The platform is designed for fast processing, with many users receiving loan offers on the same day.

Although final interest rates and fees depend on the lender, MyLoan remains transparent about its role as a broker and does not charge direct fees for using its comparison service. For individuals looking to compare loan options quickly and safely—especially those with varying credit backgrounds—this broker offers a practical and trustworthy way to find suitable financing.

Requirements for a MyLoan Loan

Applying for a loan through MyLoan involves a simple process, but applicants must provide specific documents and information to confirm eligibility and assist in the lending decision. Here’s what you’ll need:

- Full Name and Surname: As it appears on your official identification.

- South African ID Number: A valid South African ID to verify your identity and age.

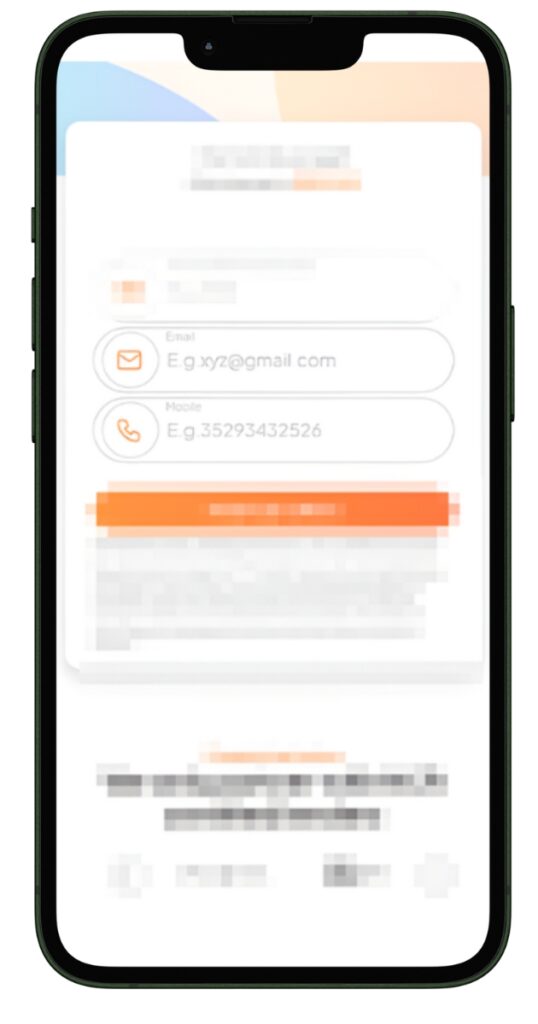

- Contact Information: A valid email address and mobile number for communication purposes.

- Proof of Income: Recent payslips or bank statements (usually for the last three months) to confirm stable income.

- Employment Information: Details about your current employer, job title, and length of employment.

- Bank Account Details: Information on an active bank account in your name for loan disbursement and repayments.

- Credit History Check: Broker will conduct a credit check to assess creditworthiness, which affects the loan amount and terms you may qualify for.

- Proof of Residence: A recent utility bill or similar document to verify your physical address.

- Purpose of the Loan: While not always required, specifying the purpose of the loan can help tailor the loan options to your needs.

Having these documents readily available can speed up the application process.

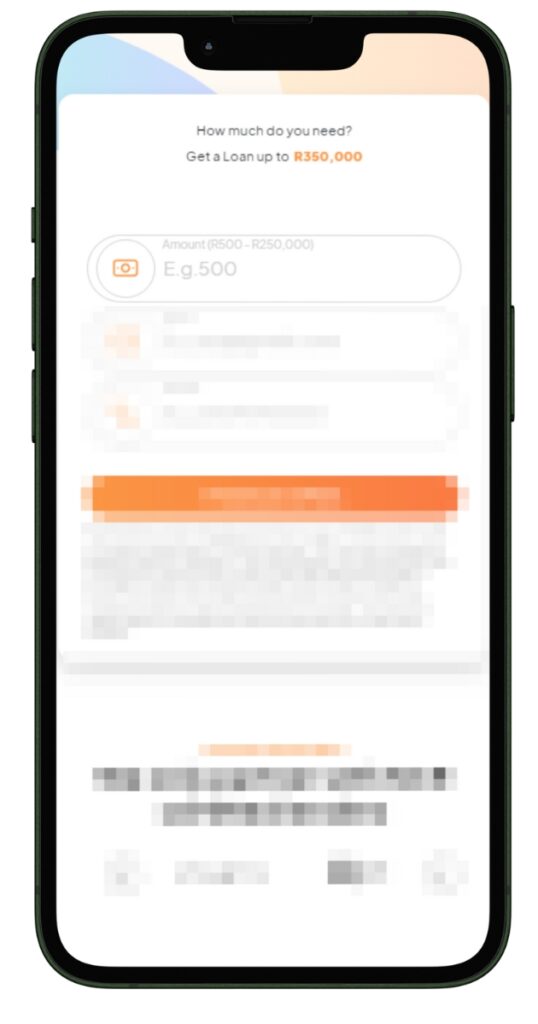

Step-by-Step Guide to Applying for a Loan with MyLoan

Step 1: Go to Myloan.co.za and click on the “Apply” button.

Step 2: Add your desired loan amount

Step 3: Input your email and mobile number

Step 4: Click “Find Loan Offers” to proceed

Step 5: When asked, attach necessary documents such as proof of income and ID.

Step 6: Allow MyLoan to perform a credit assessment.

Step 7: Receive and compare loan offers from various lenders.

Step 8: Select the most suitable loan offer and agree to the terms.

Step 9: Electronically sign the loan agreement.

Step 10: The loan amount will be deposited into your bank account.

Step 11: Arrange for loan repayment via debit order or manual payment.

Eligibility Check

MyLoan offers several tools and methods to help potential borrowers pre-check their eligibility before formally applying for a loan. These tools are designed to streamline the loan application process and reduce the chance of application rejection.

Eligibility Calculator: This broker provides an online calculator on their website. This tool allows applicants to gauge their potential eligibility by entering basic financial and personal information, such as income level, existing debts, and employment status.

Pre-Approval System: MyLoan.co.za’s platform offers a pre-approval process where preliminary information is reviewed to determine if the basic loan criteria are met. This process does not affect the applicant’s credit score, as it usually involves only a soft credit check.

These tools aim to save time for both borrowers and lenders by filtering out applications that may not meet the lender’s criteria from the beginning.

How Much Money Can I Request from MyLoan.ca.za?

MyLoan provides loan amounts ranging from a minimum of R5 000 to a maximum of R250 000. This range offers flexibility to address various financial needs, from minor emergencies to significant financial commitments.

How MyLoan Creates Personalized Loan Offers

MyLoan uses a combination of user-provided information and financial algorithms to assess your financial status and creditworthiness. Based on this analysis, it presents tailored loan offers from multiple lenders that match your needs and financial profile. This method ensures that borrowers receive competitive and appropriate loan options.

How Long Does It Take to Receive My Money from MyLoan?

Loan processing and disbursement generally take from a few hours to a few days after approval.

The processing time can vary depending on the completeness and accuracy of the information provided, the specific lender’s processing times, and whether additional verification or documentation is needed.

How Do I Repay My Loan from MyLoan?

MyLoan.co.za offers various repayment plans that can be customised according to the borrower’s pay cycle and financial capacity. Common options include monthly, fortnightly, or weekly repayments via direct debit from your bank account.

Possible Fees and Penalties: Late payment fees and other penalties may be incurred if repayments are not made on time. It’s important to review the specific terms and conditions of your loan agreement to understand all potential fees and penalties associated with your repayment plan.

MyLoan – Loan Overview

| Category | Detail |

|---|---|

| Name | MyLoan |

| Financial Type | Online Loan Broker |

| Product | Short-term Loans |

| Minimum Age | 18 years (typical minimum) |

| Minimum Amount | R5 000 |

| Maximum Amount | R250 000 |

| Minimum Term | 1 month |

| Maximum Term | 72 months |

| APR | 20% to 27.5% (varies by borrower profile) |

| Monthly Interest Rate | Typically starts from 20% |

| Early Settlement | Allowed; terms vary by lender |

| Repayment Flexibility | Customizable to borrower’s needs |

| NCR Accredited | Yes |

| Our Opinion | ✅ Efficient and fast application process |

| ✅ Flexible terms based on borrower’s needs | |

| User Opinion | ✅ Efficient and fast service |

| ✅ Good for managing diverse financial needs |

What Customers Say About MyLoan

Online reviews of MyLoan offer valuable insights into user experiences, highlighting both positive aspects and areas where some users have faced challenges.

It was so easy to apply and it was user friendly, I got helped in few hours and money was in my account.

MyLoan didn’t take much time after 24 hours my money was in, no fees, no ID documents or pay slip thanxs 2 MyLoan.

- Quick and Efficient Service: Many reviewers praise MyLoan for its fast processing times. Users appreciate the speed of application handling and the quick turnaround in receiving loan offers.

- Ease of Use: The platform is frequently lauded for its user-friendly interface. Customers find it easy to navigate, apply for loans, and compare offers all in one place.

- Helpful for Emergencies: Reviewers often highlight that MyLoan has been a valuable resource in financial emergencies, providing access to funds when most needed.

Pros of Choosing MyLoan

- Wide Range of Loan Options

MyLoan.co.za provides a variety of loan products, from short-term loans for immediate financial needs to larger loans up to R250 000. This flexibility caters to different financial situations, whether for emergency funding or substantial personal investments. - Competitive Interest Rates

By comparing offers from multiple lenders, they help borrowers secure competitive and often lower interest rates, which can significantly impact the overall cost of the loan. - Rapid Application Process

The online platform is designed for efficiency, allowing borrowers to complete applications in just a few minutes. This quick process is advantageous for those needing immediate financial assistance. - Accessibility for Individuals with Varied Credit Histories

Unlike traditional banks, they serve as individuals with diverse credit backgrounds, including those with poor credit ratings, thus broadening the pool of potential borrowers. - No Direct Fees Charged by MyLoan

As a broker, they do not charge direct fees for the application process, making it a cost-effective choice for securing loans.

Customer Service at MyLoan

MyLoan is committed to providing comprehensive customer support to assist with any queries or issues that may arise during or after the loan application process. Here’s how you can reach their customer service:

Online Support: MyLoan.co.za offers support through their website, which includes an FAQ section addressing common questions and issues related to loan applications, terms, and repayments.

Email Communication: For more detailed inquiries or specific issues, this broker provides a customer support email. This is useful for receiving responses regarding personal account matters or detailed explanations about loan terms.

Live Chat: They may offer a live chat feature on their platform for real-time problem-solving and guidance. This is particularly helpful for quick questions or immediate assistance.

Phone Support: While not all online platforms offer direct phone support, checking their official website for a contact number can provide direct access to customer service representatives for in-depth assistance and urgent matters.

Social Media: Engaging with MyLoan through social media platforms can also be an effective way to receive quick responses or updates about their services and any issues you may encounter.

Email Adress:

customersupport@MyLoan.co.za

Postal address:

MyLoan.co.za / Avica Group 7th Floor, Mandela Rhodes Place Corner Wale Street and Burg Street Cape Town, 8000

Alternatives to MyLoan

Here’s a side-by-side comparison of MyLoan with some of its top competitors in the South African loan comparison market, specifically focusing on key features that are important to borrowers:

| Feature | MyLoan | CompareLoans | Hippo | MyBanker | BetterLoans |

|---|---|---|---|---|---|

| Loan Amount Range | R5 000 to R250 000 | R2 000 to R300 000 | Up to R350 000 | Up to R250 000 | Up to R350 000 |

| Interest Rate | Starts from 20% | 6.55% to 60% p.a. | Varies, competitive rates | Low starting rates | Competitive rates |

| Loan Term Range | 1 to 72 months | 1 month to 84 months | Flexible, up to 6 years | 2 to 72 months | Flexible, varies by lender |

| Application Process | Online, fast | Online comparison, quick apply | Online with quick pre-qualification | Instant online comparison | Online with one application |

| Special Features | Brokering with multiple lenders | Comprehensive loan comparison | Detailed product comparisons | NCR-certified lenders only | Single application to multiple lenders |

| Fees | No direct fees, varies by lender | No hidden fees, varies | No hidden fees, transparent | No additional fees | Transparent fee structure |

History and Background of MyLoan

MyLoan, established in 2013, is a leading online loan broker in South Africa. Founded by a team of experienced financial professionals, the company aims to streamline the loan application process for South Africans seeking to achieve their financial goals. Over the years, they helped over 100,000 borrowers, building a reputation for efficient and customer-friendly service.

Their mission is to offer a straightforward way for individuals to compare loan offers from various lenders, enabling them to select the best options for their financial needs. MyLoan’s vision centres on accessibility and user convenience, ensuring that even those with poor credit scores have the opportunity to secure necessary funding.

Conclusion

MyLoan excels as an online loan broker in South Africa, offering a user-friendly platform that connects borrowers with a variety of lenders. Its comprehensive service includes the ability to compare multiple loan offers, which is particularly valuable for individuals with diverse financial needs, including those with less-than-perfect credit histories. Given its robust features, customer-friendly approach, and positive feedback on efficiency and convenience, this broker earns a strong recommendation. It stands out for its mission to make loans accessible and tailored to each user’s financial situation.

Frequently Asked Questions

MyLoan.co.za facilitates various loan types through its platform, with a primary focus on personal loans. These loans can be used for multiple purposes, including emergencies, debt consolidation, or major purchases.

Eligibility is determined based on factors such as the applicant’s credit score, income level, and other financial details. They connect borrowers with lenders who then review the application to assess eligibility.

They do not charge any fees for using its comparison service. However, the lenders you connect with may have their own fees, such as initiation or service fees.

The approval time can vary depending on the lender and the completeness of the application. This broker aims to facilitate a quick pre-approval process, often within the same day.

Early repayment is possible and depends on the terms set by the individual lender. Some lenders may allow early repayment without penalties, while others may impose a fee.